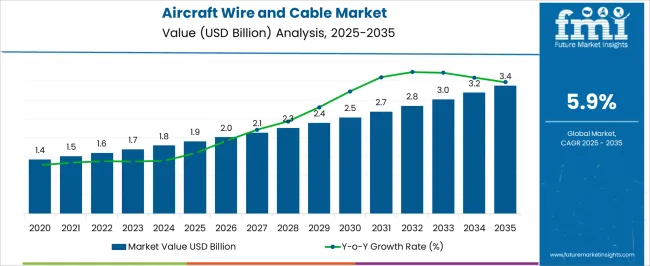

The aircraft wire and cable market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

The market’s cost structure is predominantly influenced by raw material expenditures, which include high-grade copper, aluminum, insulating polymers, and flame-retardant compounds. These materials account for a significant portion of production costs, as the quality and performance standards are stringent to ensure durability, weight efficiency, and safety under extreme operational conditions. Manufacturing costs contribute another substantial component, encompassing extrusion, stranding, braiding, and shielding processes, along with rigorous quality testing and certification. Technological integration, such as fiber-optic and high-voltage cabling, further adds to production complexity and cost.

Distribution and logistics account for additional expenses, particularly for customized or certified cables requiring specialized handling and traceability. The value chain begins with raw material suppliers, followed by component manufacturers, system integrators, and finally aerospace OEMs and maintenance providers. Margins are largely dependent on technical differentiation and compliance with aerospace standards. The cost distribution is skewed toward high-quality raw materials and precision manufacturing, while value generation is enhanced by certification, reliability, and long lifecycle performance, which collectively define the competitiveness of market players.

| Metric | Value |

|---|---|

| Aircraft Wire and Cable Market Estimated Value in (2025 E) | USD 1.9 billion |

| Aircraft Wire and Cable Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The aircraft wire and cable market is regarded as a crucial segment within aerospace electrical and avionics systems. It is estimated to account for 6.8% of aerospace electrical systems, reflecting its essential role in power distribution, signal transmission, and safety circuits. Within commercial aircraft components, a 4.3% share is observed, driven by integration in new generation airliners. Defense aircraft systems hold 5.1%, reflecting high performance, durability, and temperature resistant requirements. The avionics and instrumentation market contributes 3.7%, while the maintenance repair and overhaul sector accounts for 2.9%, supported by replacement cycles and retrofitting of legacy fleets.

Recent trends in the aircraft wire and cable market have been influenced by demand for lightweight, high performance, and fire resistant solutions. Breakthrough innovations include advanced composite insulated cables, halogen free flame retardant wires, and high temperature resistant designs. Key players have implemented strategies through collaborations with aerospace OEMs to develop modular wiring harnesses and standardized assemblies for faster integration. Efforts are also underway to improve signal integrity for high speed data buses and ensure electromagnetic compatibility. Regional focus on next generation aircraft and retrofitting programs is driving adoption, while manufacturers are investing in automation, predictive maintenance, and quality control technologies to enhance reliability and reduce life cycle costs.

The market is experiencing steady growth, supported by rising demand for advanced electrical systems in modern aircraft. The increasing complexity of avionics, communication systems, and power distribution networks has accelerated the adoption of high-performance wiring and cabling solutions. Manufacturers are focusing on lightweight yet durable materials to improve fuel efficiency while meeting stringent safety and performance standards.

The integration of advanced electronic systems in both commercial and defense aircraft is contributing to higher cable density and enhanced reliability requirements. Investments in new aircraft production, coupled with fleet modernization programs, are expanding opportunities for wire and cable suppliers.

The shift toward electric and hybrid propulsion systems is also increasing the need for specialized high-voltage wiring solutions Furthermore, advancements in insulation, shielding, and data transmission capabilities are positioning these products as critical components in next-generation aerospace designs, ensuring sustained market growth over the coming years.

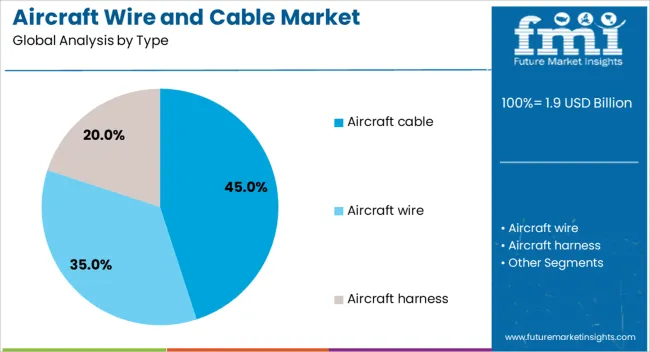

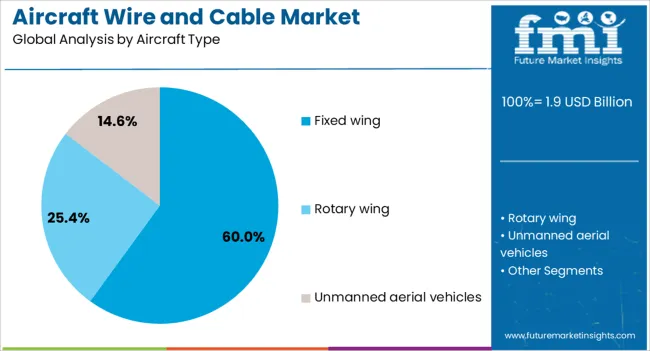

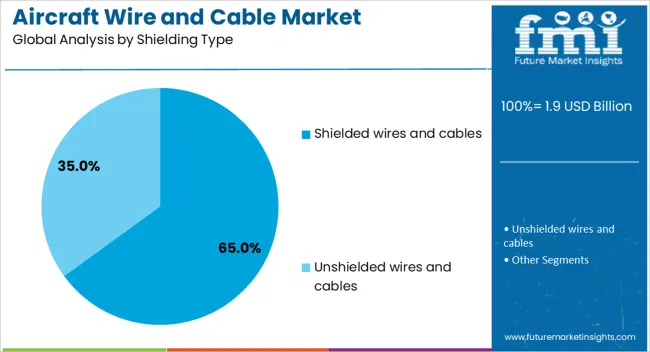

The aircraft wire and cable market is segmented by type, aircraft type, shielding type, application, and geographic regions. By type, aircraft wire and cable market is divided into aircraft cable, aircraft wire, and aircraft harness. In terms of aircraft type, aircraft wire and cable market is classified into fixed wing, rotary wing, and unmanned aerial vehicles. Based on shielding type, aircraft wire and cable market is segmented into shielded wires and cables and unshielded wires and cables. By application, aircraft wire and cable market is segmented into avionics, flight control systems, lighting systems, data transfer, power transfer, landing gear & braking systems, and others. Regionally, the aircraft wire and cable industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The aircraft cable type segment is projected to hold 45% of the aircraft wire and cable market revenue share in 2025, making it the leading type segment. Its dominance is attributed to the extensive use of high-strength and lightweight cables for power distribution, signal transmission, and control systems across aircraft platforms. Aircraft cables are being preferred due to their ability to withstand extreme environmental conditions, including high temperature fluctuations, vibration, and electromagnetic interference. The ongoing push for enhanced fuel efficiency has driven the demand for cables with reduced weight and improved performance characteristics. In addition, advancements in manufacturing processes have enabled the development of cables with superior insulation, durability, and flexibility, supporting reliable performance over extended operational life cycles Compliance with strict aviation safety regulations and the growing need for efficient electrical integration in modern aircraft have further reinforced the segment’s leading position.

The fixed wing aircraft type segment is expected to account for 60% of the market revenue share in 2025, securing its position as the dominant aircraft type segment. Growth in this segment is being driven by the high volume of commercial and military fixed wing aircraft production, coupled with increasing demand for advanced electrical and communication systems. Fixed wing aircraft require extensive wiring networks for avionics, navigation, control, and passenger systems, creating consistent demand for high-quality wire and cable solutions. The modernization of existing fleets, along with rising global air travel, has further boosted the need for wiring upgrades and replacements. Additionally, the integration of advanced technologies such as in-flight entertainment, real-time data communication, and enhanced safety systems has significantly increased wiring complexity The combination of regulatory compliance, operational reliability, and expanding aircraft production pipelines has ensured the continued market dominance of fixed wing platforms in wire and cable usage.

The shielded wires and cables shielding type segment is anticipated to hold 65% of the market revenue share in 2025, making it the leading shielding type segment. This leadership position is supported by the critical need for protection against electromagnetic and radio frequency interference in modern aircraft systems. Shielded wires and cables are essential for maintaining signal integrity and operational reliability in complex avionics, navigation, and communication networks. The increased adoption of advanced electronic systems has heightened the demand for robust shielding solutions that can operate under challenging aerospace conditions. Furthermore, innovations in shielding materials have improved performance while minimizing weight, meeting the aerospace industry’s dual objectives of safety and efficiency. Regulatory mandates for electromagnetic compatibility, along with the growing emphasis on preventing system malfunctions, have further reinforced the widespread use of shielded solutions As aircraft systems continue to evolve toward greater digitalization, the reliance on shielded wiring will remain a key growth driver for this segment.

The market has expanded significantly in response to growing demand for electrical systems in commercial, military, and business aviation. These components are critical for power transmission, signal integrity, avionics systems, lighting, and in-flight entertainment. Advanced wire and cable solutions, including lightweight, fire resistant, and high temperature tolerant materials, have been deployed to meet stringent aerospace standards. Growth has been reinforced by fleet expansion, increasing complexity of aircraft electrical architectures, and rising focus on weight reduction, safety, and system reliability in next generation aircraft platforms.

Lightweight wiring solutions have been prioritized in aircraft design to improve fuel efficiency and overall payload capacity. High performance cables with aluminum or copper conductors, combined with polyimide, Teflon, or cross-linked insulation, have been deployed to reduce mass without compromising electrical conductivity. Multi conductor bundles, shielded cables, and high temperature resistant coatings have been integrated to support avionics, power distribution, and communication systems. Weight reduction has been accompanied by enhanced durability, flame resistance, and resistance to vibration and thermal cycling, enabling compliance with stringent aviation safety and performance standards. These factors have driven widespread adoption in both commercial and military aircraft fleets.

The proliferation of advanced avionics systems, including navigation, communication, flight control, and cabin management, has increased the demand for sophisticated wiring harnesses. Electrical systems in modern aircraft are becoming more integrated and complex, requiring high reliability and minimal signal interference. Fiber optic cables and shielded twisted pairs have been increasingly used to meet these requirements. Redundancy, electromagnetic compatibility, and precise routing have become essential considerations in system design. Expansion of fly-by-wire systems, electronic flight controls, and in-flight entertainment networks has further reinforced the need for advanced aircraft cables that ensure consistent performance under challenging operational conditions.

Innovations in insulation and jacketing materials have improved resistance to fire, smoke, and toxic gas emissions in case of onboard incidents. Heat resistant polymers, halogen free compounds, and lightweight composites have been introduced to meet regulatory and certification standards. Cable designs that prevent moisture ingress, chemical degradation, and abrasion have enhanced operational reliability. Advanced manufacturing techniques, including precision extrusion, braiding, and testing protocols, have improved consistency and quality of finished products. These developments have allowed manufacturers to provide wiring solutions that balance mechanical strength, electrical performance, and compliance with international aerospace standards, supporting both OEM and aftermarket requirements.

Aircraft operators and maintenance providers have contributed to market growth through replacement, refurbishment, and retrofitting of aging wiring systems. As older aircraft are upgraded with new avionics or power distribution networks, specialized cables are installed to support modern functionality. Predictive maintenance using advanced inspection tools has extended cable lifespan and reduced operational disruptions. Availability of certified OEM and aftermarket cables ensures operational continuity, while regulatory oversight mandates adherence to installation and replacement protocols. The combination of new aircraft production, fleet modernization, and aftermarket servicing has maintained consistent demand, providing a sustained growth trajectory for aircraft wire and cable manufacturers globally.

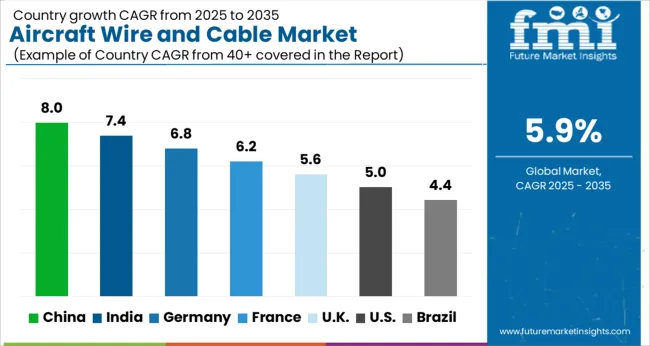

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

China led the market with a forecast CAGR of 8.0%, driven by expanding aerospace manufacturing and increased domestic airline fleet electrification. India followed at 7.4%, supported by growth in aircraft assembly and modernization programs. Germany recorded 6.8%, leveraging its expertise in aerospace engineering and advanced cabling solutions for commercial and defense aircraft. The United Kingdom grew at 5.6%, focusing on research and development of lightweight and high-performance wiring systems. The United States registered 5.0%, with demand sustained by retrofitting, maintenance, and upgrades of existing aircraft fleets. Collectively, these countries represent key regions advancing production, innovation, and technological adoption in aircraft wire and cable applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expanding at a CAGR of 8.0% in the market, driven by the growth of commercial aviation and modernization of military fleets. Domestic aircraft manufacturers are increasingly adopting lightweight, high-performance wiring solutions to improve fuel efficiency and reduce operational costs. Replacement and refurbishment of older aircraft fleets are providing steady aftermarket opportunities. The push for advanced avionics and in-flight entertainment systems is supporting demand for sophisticated cabling solutions. Research and development in high-temperature resistant and fire-retardant materials is gaining momentum. Overall, the focus on passenger safety, energy efficiency, and aircraft performance is bolstering the adoption of advanced wire and cable systems across commercial, defense, and business aviation segments in China.

India is witnessing a CAGR of 7.4% in the market, fueled by increasing domestic air travel and investments in aviation infrastructure. Airlines are focusing on operational efficiency and passenger comfort, leading to higher adoption of advanced wiring and cabling technologies. Indigenous aircraft manufacturing is boosting demand for fire-resistant and lightweight wire solutions. Replacement cycles for older fleets offer consistent aftermarket opportunities. The emphasis on energy efficiency and compliance with aviation safety standards is further driving market growth. Research into improved insulation materials and high-voltage cabling solutions is being prioritized by manufacturers. Overall, India is expected to witness steady growth across commercial, business, and defense aviation segments.

Germany is growing at a CAGR of 6.8% in the market, with demand supported by advanced commercial airline operations and high-end business aviation. Airlines and aircraft manufacturers are focusing on reducing weight and improving electrical system reliability. Fleet modernization and replacement programs drive stable aftermarket demand. European regulations emphasize safety, energy efficiency, and environmental compliance, further increasing the adoption of high-performance cabling solutions. Research into high-temperature, fire-retardant materials, and flexible wiring for complex aircraft designs is expanding. Germany’s well-established aerospace industry continues to innovate in cable manufacturing techniques, ensuring long-term growth opportunities across multiple aviation segments.

The United Kingdom is projected to grow at a CAGR of 5.6% in the market, supported by increasing aircraft production and fleet upgrades. Airlines are emphasizing safety, efficiency, and reliability, driving demand for advanced wiring solutions. Replacement and refurbishment activities offer consistent market opportunities. UK manufacturers are focusing on innovative insulation materials and durable cabling solutions to meet regulatory and operational requirements. Integration with modern avionics, electrical systems, and in-flight entertainment technologies is further boosting adoption. The market benefits from government and private investments in aerospace infrastructure and modernization programs.

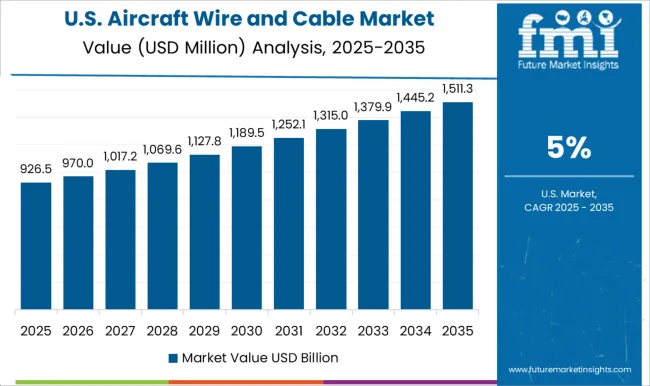

The United States is advancing at a CAGR of 5.0% in the market, influenced by robust commercial aviation, private jets, and defense applications. Airlines and manufacturers focus on lightweight, durable, and fire-resistant cabling solutions to reduce operational costs and improve efficiency. Replacement cycles and maintenance programs provide consistent opportunities for aftermarket suppliers. Research in high-performance materials and next-generation wiring technologies is enhancing reliability and system integration. The adoption of electric and hybrid aircraft systems is creating new demand for specialized cabling solutions. The US aerospace sector continues to drive innovation, making it a leading market for aircraft wire and cable solutions globally.

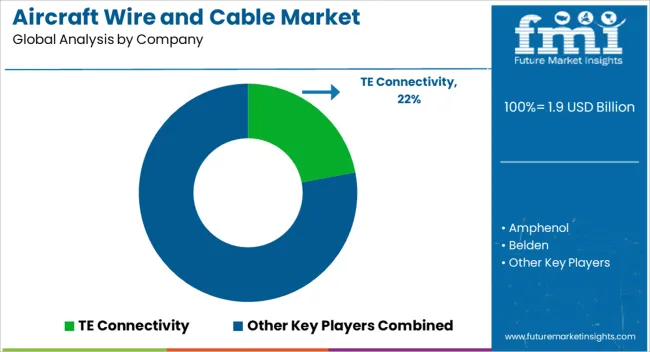

The market is characterized by a strong focus on high-performance, lightweight, and durable electrical interconnect solutions designed to withstand extreme aviation environments. TE Connectivity is a leading provider in this sector, offering a wide array of wiring harnesses, high-temperature cables, and fiber optic interconnects that support both commercial and military aircraft systems. Amphenol complements this offering with ruggedized connectors, shielded cables, and specialized interconnect solutions that meet stringent aerospace standards and electromagnetic compatibility requirements. Belden provides high-reliability cables for signal transmission, power distribution, and avionics integration, emphasizing durability under vibration, temperature fluctuations, and mechanical stress. Nexans plays a key role by delivering customized aerospace wiring solutions, including lightweight insulated wires and coaxial cables for both fixed-wing and rotorcraft applications.

Carlisle Interconnect focuses on engineered cable assemblies, harness solutions, and hybrid fiber-optic systems that optimize aircraft performance while reducing weight. Other regional and specialized suppliers contribute to the market by offering replacement cables, aftermarket solutions, and niche applications tailored for small aircraft and business jets. Collectively, these providers drive innovation in materials, insulation technologies, and manufacturing processes, enabling aircraft manufacturers to meet rising safety, efficiency, and regulatory demands. The market’s growth is underpinned by increasing aircraft production, electrification of onboard systems, and the need for enhanced signal integrity and reliability in complex aviation networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 billion |

| Type | Aircraft cable, Aircraft wire, and Aircraft harness |

| Aircraft Type | Fixed wing, Rotary wing, and Unmanned aerial vehicles |

| Shielding Type | Shielded wires and cables and Unshielded wires and cables |

| Application | Avionics, Flight control systems, Lighting systems, Data transfer, Power transfer, Landing gear & braking systems, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TE Connectivity, Amphenol, Belden, Nexans, Carlisle Interconnect, and Others |

| Additional Attributes | Dollar sales by wire and cable type and aircraft application, demand dynamics across commercial, military, and business aviation, regional trends in aircraft electrical systems adoption, innovation in lightweight materials, insulation, and signal integrity, environmental impact of manufacturing and end-of-life disposal, and emerging use cases in avionics, in-flight entertainment, and electric propulsion systems. |

The global aircraft wire and cable market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the aircraft wire and cable market is projected to reach USD 3.4 billion by 2035.

The aircraft wire and cable market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in aircraft wire and cable market are aircraft cable, _coaxial cables, _data cables, _power cables, _fiber optic cables, _rf cables, _others, aircraft wire and aircraft harness.

In terms of aircraft type, fixed wing segment to command 60.0% share in the aircraft wire and cable market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Micro Turbine Engines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft De-icing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA