The aircraft de-icing market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period. The market trajectory indicates steady expansion, yet the growth distribution is uneven, influenced by regional aviation traffic volumes, climate conditions, and regulatory frameworks for winter operations. Asia-Pacific, driven by rapid airport expansions, increasing fleet sizes, and rising passenger air travel, is expected to account for the highest incremental growth, benefiting from infrastructure investments and the modernization of ground handling services.

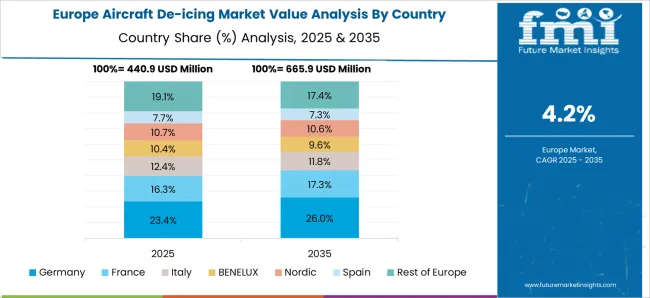

The region’s market progression from USD 1.8 billion in 2025 to an estimated USD 2.8 billion by 2035 reflects a significant adoption rate of advanced de-icing technologies to maintain operational safety in diverse climatic zones. Europe maintains moderate growth due to well-established aviation infrastructure and strict environmental and operational regulations. Demand in Europe is driven by the need to comply with stringent de-icing fluid usage and chemical management standards, resulting in a steady but slower growth pattern compared to Asia-Pacific.

North America, with a mature aviation sector, shows incremental adoption primarily focused on technology upgrades and efficiency improvements rather than fleet expansion. The regional growth imbalance underscores Asia-Pacific as the primary growth engine, Europe sustaining moderate demand through regulatory compliance, and North America showing stable, incremental expansion.

| Metric | Value |

|---|---|

| Aircraft De-icing Market Estimated Value in (2025 E) | USD 1.8 billion |

| Aircraft De-icing Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The aircraft de-icing market represents a specialized segment within the global aviation and ground support equipment industry, emphasizing operational safety, regulatory compliance, and efficiency in winter conditions. Within the broader ground support and airport services sector, it accounts for about 4.7%, driven by demand from commercial airlines, cargo operators, and regional airports. In the de-icing fluids and chemicals segment, its share is approximately 5.2%, reflecting the adoption of propylene glycol, ethylene glycol, and advanced additive formulations.

Across the airport operations and ground handling equipment market, it contributes around 3.9%, supporting on-time performance, passenger safety, and aircraft maintenance schedules. Within the aviation safety and regulatory compliance category, it represents 3.5%, highlighting the need for certified solutions in cold climates. In the overall aviation support and services ecosystem, the market contributes about 4.1%, emphasizing reliability, environmental considerations, and operational effectiveness. Recent developments in the aircraft de-icing market have focused on fluid innovation, automation, and environmental impact reduction. Groundbreaking trends include biodegradable and low-toxicity de-icing fluids, high-efficiency spray systems, and heated fluid recirculation technologies.

Key players are collaborating with airport operators, aircraft manufacturers, and chemical suppliers to optimize application methods and reduce glycol runoff. Adoption of remote monitoring, automated de-icing vehicles, and integrated ground operations management systems is gaining traction. The regulatory compliance, eco-friendly formulations, and predictive weather response technologies are shaping service standards. These advancements demonstrate how safety, efficiency, and sustainability are guiding the market.

The aircraft de-icing market is witnessing steady expansion, supported by the increasing frequency of air travel in cold-weather regions and the rising emphasis on flight safety standards. Stringent regulatory requirements from aviation authorities have reinforced the need for timely and effective de-icing operations, ensuring operational efficiency and minimizing flight delays.

The market’s current growth is further driven by the expansion of airport infrastructure in regions prone to snow and ice accumulation, coupled with technological advancements in de-icing methods and materials. Sustainability considerations are influencing product development, with a shift toward eco-friendly fluids and optimized application techniques to reduce environmental impact.

Long-term growth prospects are anchored in the growing global aircraft fleet size and heightened preparedness for extreme weather events, ensuring continuous demand for both products and services. As climate variability intensifies, the strategic importance of de-icing within airline operations is expected to solidify, positioning the market for sustained adoption across commercial, military, and private aviation sectors.

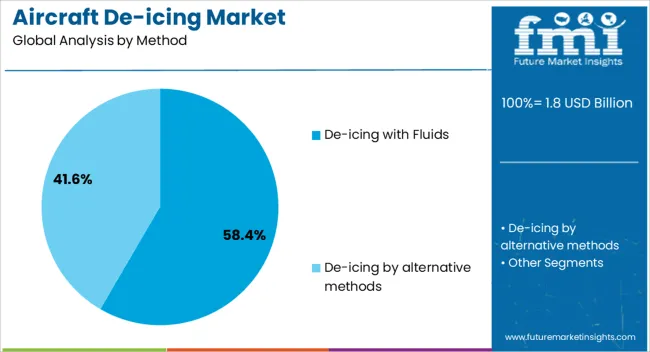

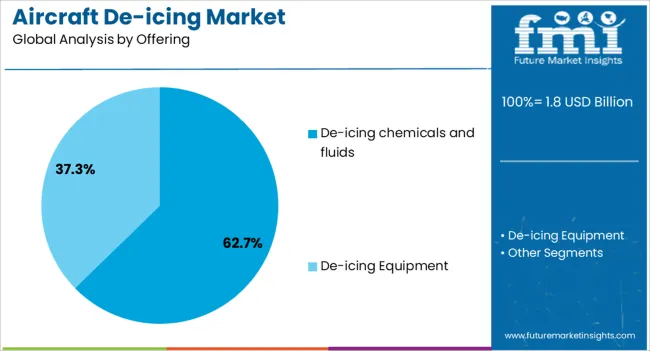

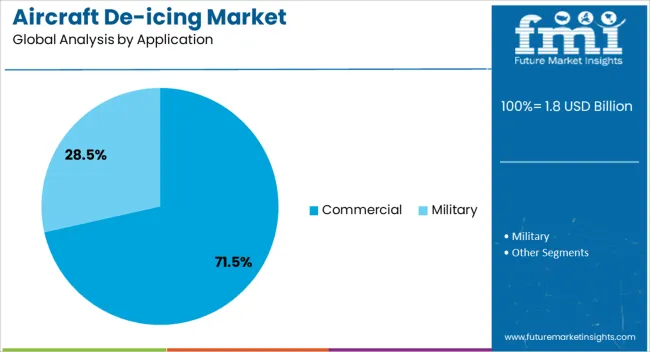

The aircraft de-icing market is segmented by method, offering, application, and geographic regions. By method, aircraft de-icing market is divided into De-icing with Fluids and De-icing by alternative methods. In terms of offering, aircraft de-icing market is classified into De-icing chemicals and fluids and De-icing Equipment. Based on application, aircraft de-icing market is segmented into Commercial and Military. Regionally, the aircraft de-icing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The de-icing with fluids segment holds the largest share in the method category, accounting for approximately 58.4% of the aircraft de-icing market. Its dominance is attributed to its proven efficiency, quick application, and compatibility with a wide range of aircraft types.

This method remains the industry standard due to its ability to rapidly remove frost, ice, and snow while preventing reformation during short ground delays. Growth in this segment is reinforced by the availability of advanced glycol-based and alternative eco-friendly formulations that meet stringent safety and environmental standards.

Operational flexibility, cost-effectiveness, and the ease of integrating this method into existing airport ground handling processes further contribute to its high adoption rate. With continued innovation in fluid formulations and dispensing systems, de-icing with fluids is expected to retain its leading position in the foreseeable future.

De-icing chemicals and fluids represent the leading offering in the aircraft de-icing market, commanding a share of approximately 62.7%. This segment’s leadership is supported by the continuous requirement for high-performance chemical solutions capable of operating under extreme weather conditions. The use of specialized formulations, including Type I and Type IV fluids, enables effective ice removal and protection, ensuring compliance with international aviation safety protocols.

Demand is further bolstered by the expansion of airport operations in colder regions and the need for large-volume procurement during peak winter months. The segment benefits from ongoing R&D initiatives aimed at enhancing biodegradability, lowering toxicity, and improving operational efficiency.

Strategic supplier partnerships and long-term contracts with airlines also underpin market stability. As aviation activity increases globally and weather patterns become more unpredictable, de-icing chemicals and fluids are expected to remain a critical and high-demand offering within the market.

The commercial segment dominates the application category, holding a substantial 71.5% share of the aircraft de-icing market. Its strong position is driven by the large volume of scheduled passenger and cargo flights requiring frequent and reliable de-icing services. Commercial aviation’s operational schedules demand minimal downtime, making effective de-icing essential for maintaining punctuality and safety standards.

The growth of international and regional airline networks in cold-weather regions has significantly increased the demand for de-icing services within this segment. Furthermore, high passenger traffic and expanding airport capacities in countries experiencing severe winters contribute to sustained market demand.

Investments in advanced de-icing equipment and automated application systems tailored for commercial fleets further enhance operational efficiency. Given the increasing size of the global commercial aircraft fleet and the industry’s prioritization of safety, the commercial segment is expected to maintain its dominant market share throughout the forecast period.

The market has been experiencing significant growth due to the increasing emphasis on aviation safety and operational reliability in cold weather conditions. De-icing solutions, including chemical fluids, mechanical equipment, and thermal systems, are used to remove ice and snow from critical aircraft surfaces such as wings, fuselage, and control surfaces. Demand is driven by the expansion of commercial and regional air traffic, stricter regulatory requirements for winter operations, and the need to minimize flight delays caused by ice accumulation. Technological improvements in environmentally friendly de-icing fluids, automated systems, and rapid-response equipment have enhanced efficiency and reduced operational downtime.

Safety regulations and compliance requirements have been primary factors driving the adoption of aircraft de-icing solutions. Aviation authorities mandate strict adherence to operational procedures for aircraft exposed to snow, ice, and frost conditions. De-icing operations are critical to maintaining lift, control, and overall aircraft performance during takeoff and landing. Automated de-icing vehicles and precision fluid application systems are being deployed to ensure uniform coverage and reduce human error. Environmentally compliant de-icing fluids that minimize chemical runoff are increasingly preferred to meet ecological standards. Routine monitoring, testing, and reporting procedures have strengthened operational reliability. Airlines and airport operators prioritize certified equipment and trained personnel to comply with regional and international safety protocols, reinforcing the role of de-icing technologies as an essential component of aviation safety and operational continuity.

Technological innovation has played a pivotal role in improving the efficiency and effectiveness of aircraft de-icing solutions. Advanced spray systems, heated trucks, and automated control technologies enable rapid ice removal while minimizing chemical usage. Sensors, remote monitoring, and predictive analytics have enhanced operational planning by identifying aircraft requiring de-icing and optimizing resource deployment. Fluid formulation advancements have improved freeze point performance, reduced viscosity, and enhanced biodegradability, supporting both environmental and operational objectives. Mechanically assisted de-icing equipment, including rotary brushes and pneumatic devices, provides additional safety options in extreme conditions. Integration with airport ground management systems allows coordinated de-icing schedules, minimizing delays and congestion on runways. These technological improvements have strengthened the reliability, speed, and environmental performance of de-icing operations globally.

Environmental sustainability has become a critical driver in the aircraft de-icing market. Traditional glycol-based fluids can pose environmental hazards due to chemical runoff into soil and water bodies. In response, biodegradable and low-toxicity formulations have been developed to reduce ecological impact while maintaining freezing point suppression and anti-icing properties. Airports are increasingly adopting fluid recovery systems and recycling processes to limit waste and contamination. Regulatory guidelines and environmental monitoring programs encourage operators to optimize fluid usage and adopt greener alternatives. These developments have increased the adoption of sustainable de-icing solutions across commercial and regional airports. As environmental awareness grows, investment in eco-friendly technologies, training, and infrastructure continues to influence market expansion and stakeholder decision-making.

Expansion and modernization of airport infrastructure have significantly influenced the demand for aircraft de-icing solutions. Growing air travel volumes necessitate larger operational areas, including aprons, taxiways, and de-icing pads equipped with automated systems. New terminal construction and regional airport development have created opportunities for installation of advanced de-icing equipment and fluid storage facilities. Integration of de-icing systems with ground handling operations ensures minimal delays and efficient resource utilization. Airlines operating in cold climate regions, where frost and snow are frequent, are prioritizing investments in de-icing infrastructure to maintain schedule adherence. The growth of airport networks, particularly in emerging economies, has reinforced the market for aircraft de-icing technologies, ensuring sustained adoption and modernization of operational practices.

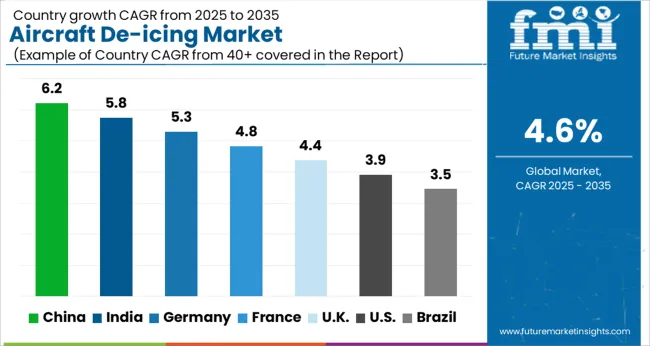

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

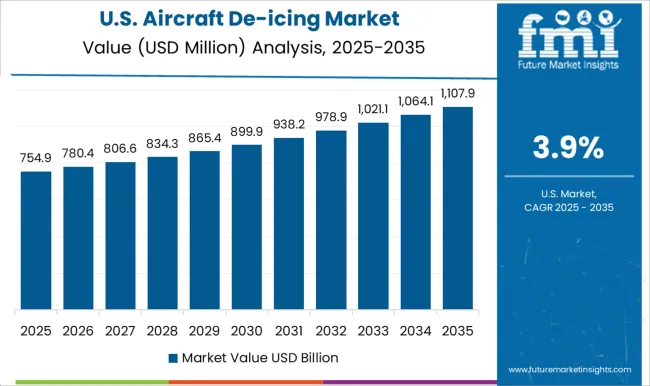

| USA | 3.9% |

| Brazil | 3.5% |

The market is projected to grow at a CAGR of 4.6% from 2025 to 2035, reflecting the aviation sector’s focus on operational safety and efficiency. China leads with 6.2%, driven by rapid expansion of commercial aviation and adoption of advanced de-icing technologies. India follows at 5.8%, supported by increasing air traffic and modernization of airport facilities. Germany registers 5.3%, reflecting stringent safety regulations and investment in cutting-edge de-icing solutions. The UK holds 4.4%, influenced by regulatory compliance and technological upgrades at airports. The USA records 3.9%, propelled by established aviation infrastructure and continuous innovation in de-icing chemicals and equipment. Market growth is influenced by extreme weather preparedness, technological adoption, and regulatory mandates. This report includes insights on 40+ countries; the top markets are shown here for reference.

China recorded a 6.2% CAGR, driven by expansion of commercial aviation, regional airports, and rising cold weather operations. Airlines and airport authorities prioritized deployment of advanced de-icing fluids, automated spray systems, and mobile de-icing equipment to ensure operational safety and minimize flight delays. Domestic equipment manufacturers collaborated with international technology providers to introduce eco-friendly and high performance de-icing solutions. Competitive strategies included service contracts, on-site training, and maintenance support for airline operators. Investments in weather monitoring and predictive maintenance systems supported timely de-icing operations. Increasing passenger traffic, airport infrastructure upgrades, and emphasis on operational safety reinforced consistent demand across both domestic and international airports.

India demonstrated a 5.8% CAGR, supported by growing domestic and international air traffic, expansion of regional airports, and enhanced safety regulations. Airlines invested in advanced de-icing equipment, high performance glycol based fluids, and automated spray systems. Demand was highest in northern regions and hilly airports experiencing winter conditions. Collaborative projects with global technology providers facilitated adoption of best practices and training for airport staff. Competitive strategies focused on maintenance contracts, supply chain efficiency, and localized production of de-icing fluids. Government regulations on aviation safety and operational continuity during cold weather periods further drove market adoption.

Germany advanced at a 5.3% CAGR, shaped by mature aviation infrastructure, high air traffic, and strict regulatory safety standards. Airports and airlines prioritized efficient de-icing solutions, including heated spray systems, glycol based fluids, and eco-friendly alternatives. Competitive advantage was achieved through fast response services, predictive maintenance, and compliance with European aviation safety regulations. Airport operators emphasized integrated weather monitoring systems to schedule de-icing operations efficiently. Collaboration with international de-icing solution providers ensured adoption of advanced technologies. Seasonal demand during winter months further reinforced equipment and fluid procurement, while operational efficiency and reliability remained key selection criteria for airline operators.

The United Kingdom expanded at a 4.4% CAGR, driven by airport infrastructure expansion, operational safety requirements, and seasonal weather conditions. Airlines and ground service providers adopted automated de-icing equipment and eco-friendly glycol fluids. Competitive strategies emphasized maintenance services, rapid response during peak winter months, and compliance with UK aviation safety standards. Partnerships between airports and de-icing solution manufacturers enabled timely equipment deployment and staff training. Increasing passenger traffic and regional connectivity projects reinforced adoption of reliable and efficient de-icing solutions. Integration with digital monitoring and forecasting systems further enhanced operational efficiency and minimized disruptions due to icy conditions.

The United States grew at a 3.9% CAGR, influenced by high passenger traffic, cold weather operations, and regulatory compliance requirements. Airlines and airports prioritized automated de-icing systems, glycol based fluids, and mobile spray units to ensure timely operations. Competitive strategies included long term service contracts, predictive maintenance, and regional supply networks to minimize operational disruptions. Collaboration with international solution providers enabled adoption of advanced and environmentally friendly technologies. Peak winter demand reinforced procurement of fluids and equipment. Manufacturers emphasized reliability, operational efficiency, and safety compliance to cater to diverse airports, ranging from major hubs to regional airfields with seasonal cold weather conditions.

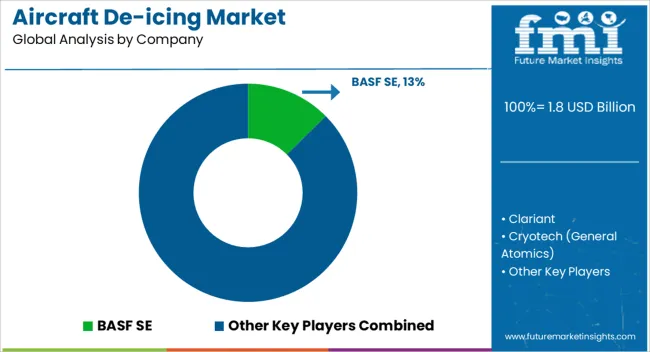

The market has been shaped by chemical innovators and specialized ground support equipment providers. BASF SE, Clariant, and DuPont de Nemours have focused on formulating high performance de-icing fluids, emphasizing low environmental impact, corrosion resistance, and efficient ice removal. Cryotech (General Atomics) and Kilfrost Limited have concentrated on technologically advanced glycols and additives, ensuring operational reliability in extreme cold conditions.

Global Ground Support LLC and Ground Support Specialists have strengthened positions through turnkey solutions integrating equipment and chemical supply. Regional and niche players including Inland Technologies, Oshkosh Aerotech (JBT Corporation), Tronair, Textron Ground Support Equipment, and Vestergaard Company have differentiated by offering equipment optimized for rapid fluid application, mobility, and operational safety. Product brochures highlight automated sprayers, heated nozzles, and environmentally friendly chemical options.

Emphasis is placed on minimizing aircraft downtime, reducing fluid consumption, and meeting international aviation safety standards. BASF and DuPont highlight product performance under varying weather conditions, while Kilfrost and Cryotech promote compatibility with multiple aircraft types. Competition revolves around chemical efficiency, environmental compliance, and operational reliability. Tronair and Textron focus on equipment ergonomics and ease of handling, while Vestergaard and Oshkosh emphasize integrated ground support solutions.

Brochures communicate fluid performance metrics, system durability, and operational convenience, positioning each player as a dependable partner for airlines and airport authorities. The market is increasingly driven by innovation, safety, and sustainability rather than price alone, with product literature serving as a critical tool to project technical credibility and performance assurance.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Method | De-icing with Fluids and De-icing by alternative methods |

| Offering | De-icing chemicals and fluids and De-icing Equipment |

| Application | Commercial and Military |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Clariant, Cryotech (General Atomics), DuPont de Nemours Inc, Global Ground Support LLC, Ground Support Specialists, Inland Technologies International Limited, Kilfrost Limited, Oshkosh Aerotech LLC (JBT Corporation), Textron Ground Support Equipment Inc., Tronair Inc., and Vestergaard Company |

| Additional Attributes | Dollar sales by de-icing method and aircraft type, demand dynamics across commercial, cargo, and military aviation, regional trends in cold-weather operations, innovation in fluid formulations, application systems, and environmental compliance, environmental impact of chemical runoff and energy use, and emerging use cases in automated de-icing systems, remote airfields, and rapid turnaround operations. |

The global aircraft de-icing market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the aircraft de-icing market is projected to reach USD 2.8 billion by 2035.

The aircraft de-icing market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in aircraft de-icing market are de-icing with fluids and de-icing by alternative methods.

In terms of offering, de-icing chemicals and fluids segment to command 62.7% share in the aircraft de-icing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA