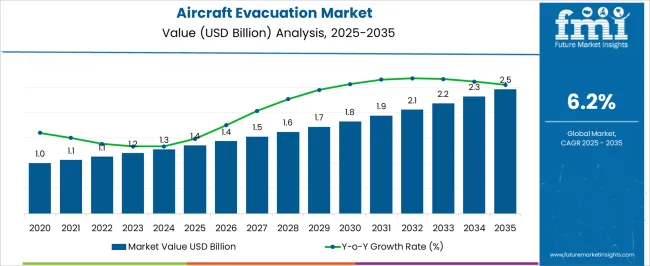

The aircraft evacuation market is forecasted to expand from USD 1.4 billion in 2025 to USD 2.5 billion by 2035, reflecting a CAGR of 6.2%. This steady growth trajectory is driven by increasing regulatory requirements, enhanced airline safety standards, and rising adoption of advanced evacuation technologies in both commercial and defense aircraft. Year-on-Year growth highlights a gradual but consistent pace of market expansion as airlines and manufacturers focus on passenger safety and compliance. From 2025 to 2027, the market rises from USD 1.4 billion to USD 1.5 billion, marking early adoption of modern evacuation slides, modular emergency systems, and retrofits in existing fleets.

Growth during this phase is supported by investments from major aircraft OEMs such as Boeing, Airbus, and Embraer, as well as enhanced safety training programs for cabin crews. Between 2028 and 2031, revenues climb from USD 1.6 billion to USD 1.9 billion, with YoY growth ranging between 5–6%. Momentum in this period is fueled by technological innovations in lightweight, automated, and inflatable evacuation systems, coupled with regulatory updates that mandate faster egress times and improved reliability. The final stretch from 2032 to 2035 shows further acceleration, with the market reaching USD 2.5 billion.

| Metric | Value |

|---|---|

| Aircraft Evacuation Market Estimated Value in (2025 E) | USD 1.4 billion |

| Aircraft Evacuation Market Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

Five interconnected parent markets strongly influence the aircraft evacuation market, each contributing to overall demand and safety compliance. The commercial aviation market holds the largest share at 40%, as airlines operating passenger aircraft require evacuation slides, life rafts, and emergency systems to meet stringent safety regulations and ensure passenger protection.

The defense and military aircraft market contributes 25%, with transport planes, fighter jets, and military helicopters deploying advanced evacuation solutions to safeguard personnel during emergencies and combat operations. The helicopter and rotorcraft market accounts for 15%, driven by both civil and military applications requiring rapid egress and survival equipment in challenging environments.

The aerospace component and safety systems market holds a 12% share, providing slides, chutes, life rafts, and other safety solutions that are integral to aircraft evacuation infrastructure. The MRO market represents 8%, ensuring that evacuation systems are regularly inspected, certified, and upgraded to maintain operational reliability. Commercial aviation, defense, and helicopters account for 80% of overall demand, highlighting that regulatory compliance, personnel safety, and mission-critical operations are the primary growth drivers, while component providers and MRO services support continuous adoption and innovation globally.

The aircraft evacuation market is gaining momentum due to tightening safety regulations, fleet modernization efforts, and an increase in commercial and defense aviation activities worldwide. Airlines and aircraft manufacturers are prioritizing the integration of advanced evacuation systems to ensure compliance with international airworthiness mandates.

Innovations in materials, compact deployment systems, and reliability under diverse environmental conditions are driving product advancements. Additionally, the growth in OEM collaborations with evacuation system providers is fostering faster adoption across new-generation aircraft.

As air travel continues its post-pandemic rebound, supported by rising passenger volumes and defense investments, the demand for high-performance evacuation solutions is expected to expand significantly.

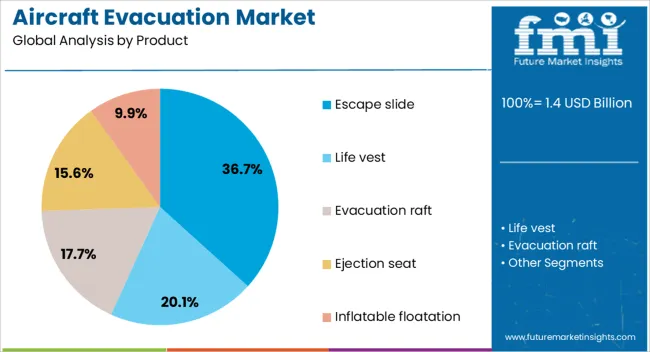

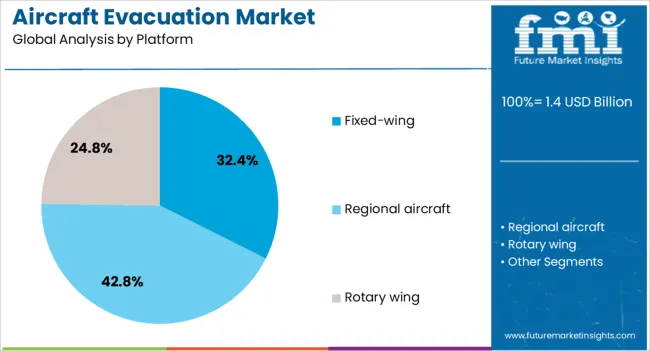

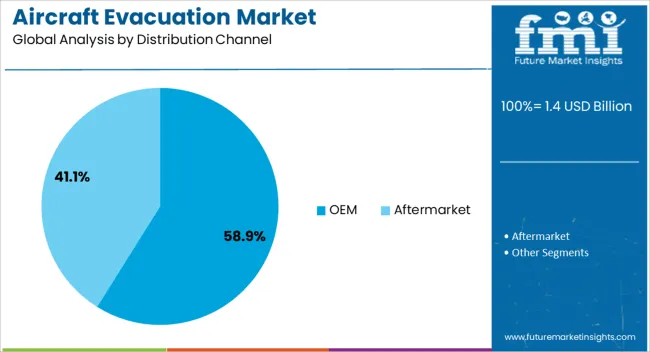

The aircraft evacuation market is segmented by product, platform, distribution channel, and geographic regions. By product, the aircraft evacuation market is divided into Escape slides, Life vests, Evacuation rafts, Ejection seats, and Inflatable floatation. In terms of platform, the aircraft evacuation market is classified into Fixed-wing, Regional aircraft, and rotary-wing. Based on distribution channel, aircraft evacuation market is segmented into OEM and Aftermarket.

Regionally, the aircraft evacuation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Escape slides are anticipated to account for 36.70% of the total market share in the aircraft evacuation sector by 2025, making them the leading product type. Their dominance is supported by mandatory installation on most commercial aircraft and recurring replacement cycles driven by wear, regulatory upgrades, or damage.

Escape slides have evolved with lighter, fire-resistant materials and enhanced inflation mechanisms, improving both deployment time and passenger safety during emergencies. As aircraft OEMs increasingly adopt modular, space-saving solutions, escape slide designs have been optimized for better integration with modern aircraft doors and fuselage structures.

This product's irreplaceable role in aviation safety makes it a cornerstone of evacuation equipment portfolios globally.

The fixed-wing aircraft segment is projected to lead the platform category with a 32.40% share in 2025. This leadership is driven by the sheer volume of commercial fixed-wing aircraft in operation and on order, particularly narrow-body and wide-body jets.

Regulatory mandates across civil aviation authorities require all large fixed-wing aircraft to be equipped with reliable evacuation systems. Additionally, defense and cargo transport aircraft are increasingly investing in modernized safety systems, including rapid-deployment slides and ramps.

Ongoing expansion of airline fleets, especially in Asia-Pacific and the Middle East, reinforces the need for robust evacuation solutions tailored to fixed-wing platforms.

The OEM channel is expected to dominate the aircraft evacuation market with a 58.90% share in 2025. This segment’s strength lies in the seamless integration of evacuation systems during the aircraft assembly process, ensuring compliance from delivery.

Aircraft manufacturers prioritize long-term contracts with evacuation system suppliers to streamline supply chains and reduce lead times. OEM integration also ensures alignment with specific aircraft configurations, enhancing operational efficiency and regulatory conformance.

The ongoing production of new aircraft, including next-generation fuel-efficient models, is expected to sustain OEM demand, making this channel the central pillar of evacuation system distribution.

The aircraft evacuation market is growing as airlines, aircraft manufacturers, and regulatory bodies prioritize passenger safety and rapid egress during emergencies. Demand is driven by the need for compliant evacuation slides, rafts, and emergency systems across commercial, business, and military aircraft. Challenges include high development and certification costs, complex installation requirements, and stringent regulatory standards. Opportunities exist in advanced materials, modular slide systems, and digitally monitored deployment mechanisms. Trends highlight lightweight composite materials, rapid inflation technologies, and integration with aircraft monitoring systems.

Airlines and aircraft manufacturers are increasingly focusing on systems that ensure rapid and safe passenger evacuation during emergencies. Demand is driven by commercial aviation growth, stricter aviation safety regulations, and the requirement for compliance with international safety standards. Modern aircraft designs require lightweight, high-strength evacuation slides, life rafts, and emergency exit solutions that can be deployed quickly under diverse conditions. Passenger comfort, ease of use, and reliability under extreme weather or operational scenarios are critical factors. With increasing fleet sizes and the expansion of regional and low-cost carriers, reliable evacuation systems are considered essential for operational readiness, passenger confidence, and regulatory approval, driving market adoption across multiple aircraft segments.

Constraints in the aircraft evacuation market include high research and development costs for lightweight and high-strength materials, rigorous certification requirements, and complex integration with aircraft interiors. Production and installation require adherence to international aviation safety standards such as FAA, EASA, and ICAO regulations. Supply chain limitations for specialized composites, high-pressure gas systems, and inflation mechanisms can affect lead times. Maintenance, inspection, and replacement protocols increase lifecycle costs for airlines. Intellectual property protections and proprietary design technologies can restrict sourcing options. Buyers increasingly favor suppliers offering certified, tested, and easily serviceable evacuation systems with predictable delivery timelines to meet stringent operational and regulatory requirements.

Opportunities exist in lightweight composites, flame-retardant fabrics, and modular evacuation solutions adaptable to multiple aircraft models. Advanced rapid-inflation technologies and slide systems that reduce deployment time enhance passenger safety and operational efficiency. Military and business aircraft segments require specialized evacuation systems for crew and personnel, expanding the addressable market. Integration with digital monitoring systems enables real-time deployment tracking and predictive maintenance. Regional airline expansion in Asia-Pacific, Europe, and North America presents additional opportunities. Suppliers that provide modular, tested, and lightweight evacuation solutions with comprehensive service support are positioned to capture growth driven by safety mandates and fleet modernization programs.

The market is trending toward evacuation systems with integrated digital monitoring for deployment status, predictive maintenance, and real-time alerts. Lightweight, durable composite materials and compact designs improve aircraft fuel efficiency while meeting regulatory standards. Rapid inflation technologies, including gas and hybrid systems, enable quick passenger egress under extreme conditions. Partnerships between evacuation system manufacturers, aircraft OEMs, and safety regulators are enhancing innovation, certification, and operational reliability. Increased focus on passenger safety metrics and adherence to international standards is shaping product design and development. Suppliers offering certified, reliable, and technologically advanced evacuation solutions are best positioned to meet evolving airline safety requirements and global market demand.

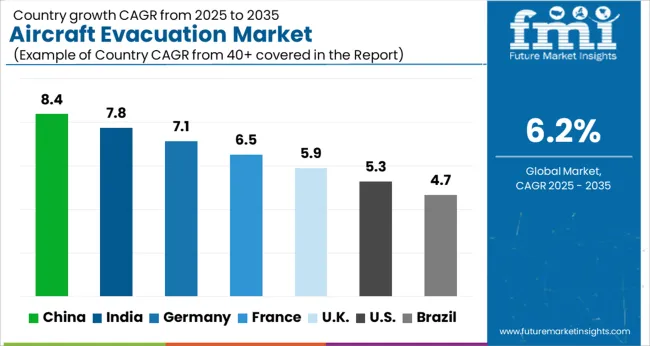

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The global aircraft evacuation market is projected to grow at a CAGR of 6.2% from 2025 to 2035. China leads at 8.4%, followed by India at 7.8%, France at 6.5%, the UK at 5.9%, and the USA at 5.3%. Growth is driven by commercial airline fleet expansion, defense modernization, and increasing focus on passenger and crew safety. Demand for lightweight, modular, and automated evacuation systems is rising, supported by regulatory compliance, international collaborations, and R&D investments. Asia, particularly China and India, exhibits rapid adoption due to expanding aviation infrastructure, while Europe and North America focus on certified, high-performance solutions for civil and military applications. The analysis spans over 40+ countries, with the leading markets shown below.

The aircraft evacuation market in China is projected to grow at a CAGR of 8.4% from 2025 to 2035, driven by rapid expansion of commercial aviation, regional airlines, and defense modernization programs. The country is investing in advanced evacuation systems for passenger and military aircraft, including slides, rafts, and emergency egress solutions. Domestic manufacturers are enhancing production capabilities while integrating high-strength, lightweight materials to improve safety and performance. Aviation authorities are enforcing stricter safety regulations and conducting frequent certification programs, creating consistent demand for compliant systems. Partnerships with international suppliers enable technology transfer and design innovation, while training programs for crew and ground personnel support operational readiness.

The aircraft evacuation market in India is expected to expand at a CAGR of 7.8% from 2025 to 2035, fueled by the growth of domestic and regional airlines and defense aviation upgrades. The Indian Air Force, Navy, and Coast Guard are investing in advanced emergency evacuation systems, including rapid-deploy slides, life rafts, and modular egress kits. Civil aviation authorities are implementing updated safety mandates, driving airlines to upgrade existing aircraft evacuation solutions. Domestic manufacturers are collaborating with international suppliers to develop cost-effective, lightweight, and highly reliable equipment. Airports and private airline operators are focusing on evacuation drills and training to comply with national safety standards.

The aircraft evacuation market in France is projected to grow at a CAGR of 6.5% from 2025 to 2035, supported by civil aviation safety regulations, defense modernization programs, and private airline fleet upgrades. French manufacturers focus on integrating durable materials, compact designs, and automated deployment systems in aircraft evacuation slides and life rafts. Airlines prioritize systems that meet EASA and ICAO certification standards for passenger and cargo planes. The defense sector continues to adopt evacuation solutions for military transport, reconnaissance, and surveillance aircraft. Partnerships with European and North American suppliers facilitate technology improvements and operational efficiency. Training programs for cabin crew and ground personnel enhance compliance and emergency preparedness.

The UK aircraft evacuation market is expected to grow at a CAGR of 5.9% from 2025 to 2035, led by civil and military aviation upgrades, as well as private airline fleet expansions. Airlines are focusing on reliable, lightweight, and space-efficient evacuation slides, rafts, and emergency kits. Military and defense forces are implementing specialized evacuation systems for transport, surveillance, and training aircraft. Compliance with the UK Civil Aviation Authority and European aviation safety regulations ensures that all new equipment meets stringent standards. Suppliers are increasingly offering modular, easy-to-maintain systems, while training programs for cabin crew and personnel improve safety readiness. Collaboration with international manufacturers and R&D investments enhance product performance and reliability, ensuring robust growth in both commercial and defense segments.

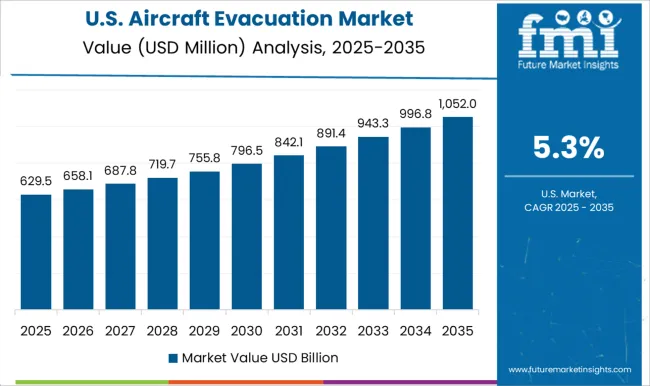

The USA aircraft evacuation market is projected to grow at a CAGR of 5.3% from 2025 to 2035, driven by large commercial airline fleets, defense modernization, and increasing passenger traffic. The Department of Defense, Coast Guard, and commercial airlines are adopting advanced evacuation solutions including automated slides, life rafts, and emergency escape kits. Manufacturers are focusing on high-strength, lightweight materials, automated deployment, and modular designs to improve safety and operational efficiency. Training programs for crew, pilots, and ground personnel ensure operational readiness, while public-private partnerships accelerate innovation in evacuation technology. Increased air travel and fleet expansion of low-cost carriers and regional airlines support steady growth in both civil and military segments.

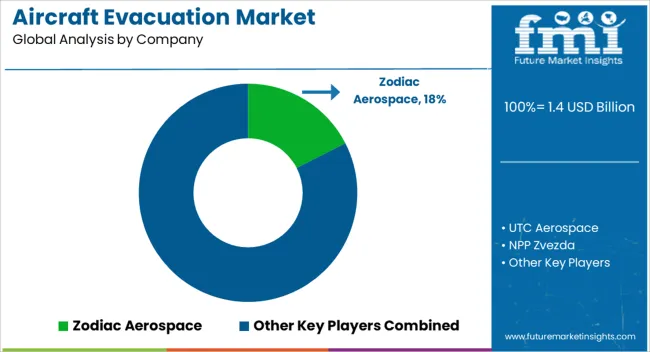

Competition in the aircraft evacuation market is defined by reliability, certification compliance, and rapid deployment. Zodiac Aerospace and UTC Aerospace lead with certified emergency slides, life rafts, and integrated evacuation systems for commercial aircraft, emphasizing ease of installation, durability, and minimal maintenance requirements. Survitec Group and Martin Baker compete through survival equipment, crew escape systems, and egress solutions designed for both commercial and military aviation. Trelleborg and Switlik differentiate with specialized flotation devices and life rafts optimized for maritime evacuations and overwater operations. Regional and mid-tier players such as NPP Zvezda, EAM Worldwide, and DART Aerospace provide modular evacuation kits, portable slides, and helicopter egress systems tailored to niche civilian and defense applications. Strategies emphasize compliance with FAA, EASA, and ICAO standards, lightweight materials, corrosion resistance, and rapid deployment testing.

Retrofits and lifecycle service agreements are marketed to airlines and defense operators seeking to reduce downtime while maintaining regulatory certification. Risk mitigation, durability testing, and performance under extreme environmental conditions are promoted to strengthen market trust. Product brochure content is precise and technical. Emergency slides for doors and overwing exits, life rafts, helicopter egress systems, and modular evacuation kits are described with deployment time, inflation method, load capacity, and operational temperature range. Materials, durability ratings, and storage dimensions are highlighted. Accessories such as repair kits, inflation devices, and maintenance tools are detailed. Certification data, testing reports, and compliance with international aviation standards are included to reinforce credibility. Crew training modules, installation manuals, and operational guides are presented alongside products to ensure readiness. Brochures emphasize safety performance, reliability under stress, and ease of use, reflecting a market focused on passenger protection, rapid evacuation, and regulatory assurance.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Product | Escape slide, Life vest, Evacuation raft, Ejection seat, and Inflatable floatation |

| Platform | Fixed-wing, Regional aircraft, and Rotary wing |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zodiac Aerospace, UTC Aerospace, NPP Zvezda, EAM Worldwide, DART Aerospace, Switlik, Trelleborg, Survitec Group, and Martin Baker |

| Additional Attributes | Dollar sales by product type (aircraft slides, life rafts, evacuation seats, egress systems), aircraft type (commercial, military, rotorcraft, general aviation), and application (passenger evacuation, crew safety, emergency training). Demand dynamics are driven by stringent aviation safety regulations, fleet modernization programs, and rising focus on passenger and crew safety. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, supported by expanding commercial airline fleets, defense aircraft upgrades, and regulatory mandates for evacuation system certification. |

The global aircraft evacuation market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the aircraft evacuation market is projected to reach USD 2.5 billion by 2035.

The aircraft evacuation market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in aircraft evacuation market are escape slide, life vest, evacuation raft, ejection seat and inflatable floatation.

In terms of platform, fixed-wing segment to command 32.4% share in the aircraft evacuation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Evacuation Slide Market

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA