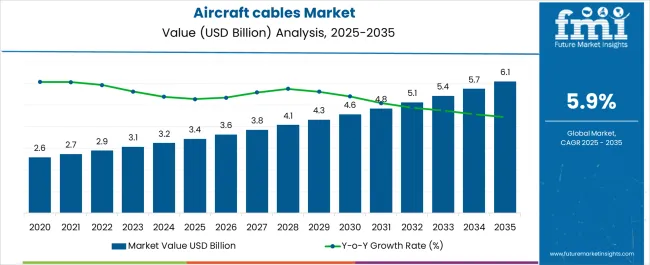

The Aircraft cables Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 6.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Aircraft cables Market Estimated Value in (2025 E) | USD 3.4 billion |

| Aircraft cables Market Forecast Value in (2035 F) | USD 6.1 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The Aircraft Cables market is experiencing robust expansion supported by the increasing production and modernization of aircraft fleets across both commercial and defense sectors. Rising passenger air traffic has led to higher demand for new aircraft, while ongoing fleet replacement initiatives are fueling the integration of advanced cable systems designed for greater durability and efficiency.

Aircraft cables play a pivotal role in ensuring reliable performance in communication, power transmission, and control systems, making them indispensable in modern aviation. The market outlook is further reinforced by the rapid adoption of lightweight and high-performance cable solutions that support fuel efficiency and compliance with stringent safety regulations.

Growing investments in next-generation aircraft programs and maintenance, repair, and overhaul activities are creating additional growth opportunities The emphasis on electrification and digitalization in aviation systems is expected to further drive demand for advanced cable technologies, positioning the market on a steady upward trajectory in the coming years.

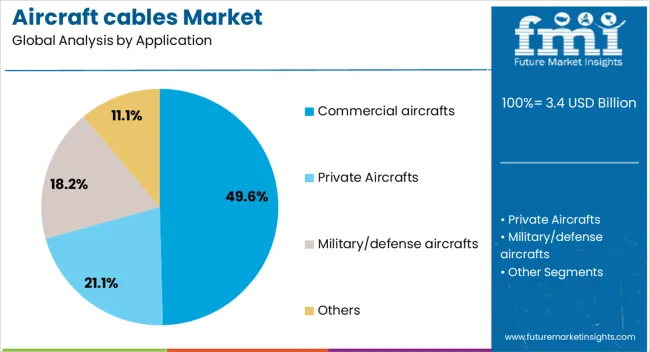

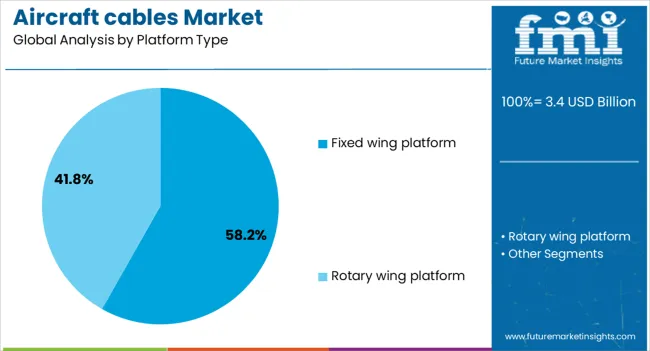

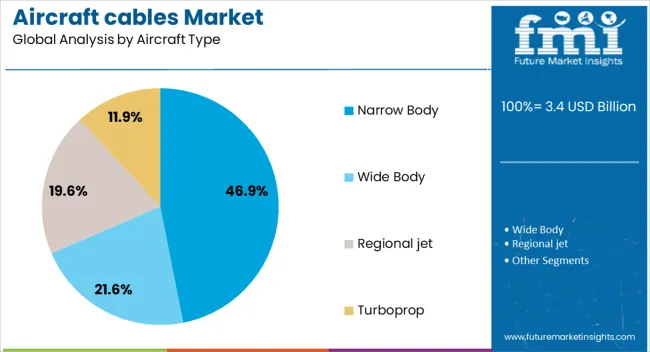

The aircraft cables market is segmented by application, platform type, aircraft type, material type, product type, sales channel, end use, and geographic regions. By application, aircraft cables market is divided into Commercial aircrafts, Private Aircrafts, Military/defense aircrafts, and Others. In terms of platform type, aircraft cables market is classified into Fixed wing platform and Rotary wing platform. Based on aircraft type, aircraft cables market is segmented into Narrow Body, Wide Body, Regional jet, and Turboprop. By material type, aircraft cables market is segmented into Stainless steel, Galvanized steel, ETFE (Ethylene tetrafluoroethylene), Polyimide, and PTFE Composites.

By product type, aircraft cables market is segmented into Power cables, Special cables, Data bus cables, and Fire resistant cables/engine cables. By sales channel, aircraft cables market is segmented into OEM and Aftermarket. By end use, aircraft cables market is segmented into Flight control system, Power supply, Data Transfer, Lighting, Avionics, and Engine cables. Regionally, the aircraft cables industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The application segment of commercial aircrafts is projected to account for 49.60% of the total Aircraft Cables market revenue in 2025, making it the leading category. This leadership position is being supported by the continuous rise in global air passenger traffic, which has directly increased the production and procurement of commercial aircrafts.

The demand for reliable and advanced cable systems has been strengthened as airlines modernize their fleets to improve safety, efficiency, and passenger experience. Commercial aircraft operations require robust cable installations that can withstand varying environmental and operational stresses, making them critical for flight safety and compliance with international standards.

Fleet expansion in emerging markets, alongside the replacement of aging aircraft in mature economies, has further supported this segment’s growth Additionally, the increasing emphasis on fuel efficiency and the integration of digital technologies in commercial aviation systems have accelerated the adoption of lightweight and high-performance cable solutions, ensuring the dominance of this segment.

The platform type segment of fixed wing aircraft is expected to capture 58.20% of the Aircraft Cables market revenue in 2025, positioning it as the most prominent platform category. Growth in this segment has been driven by the dominance of fixed wing aircraft in both civil and defense aviation operations.

The wide use of fixed wing aircraft for passenger transportation, cargo movement, and military missions has created consistent demand for reliable cable systems that ensure seamless performance of power, communication, and control networks. The ability of fixed wing aircraft to operate on longer routes and carry larger payloads has heightened the need for advanced cable assemblies capable of handling higher levels of electrical and electronic integration.

Upgrades to avionics and increasing adoption of electric and hybrid propulsion systems have further enhanced the role of cables in fixed wing platforms As global airline fleets continue to expand and defense procurement remains steady, fixed wing platforms are expected to sustain their leadership in cable utilization.

The aircraft type segment of narrow body aircraft is anticipated to hold 46.90% of the Aircraft Cables market revenue in 2025, making it the leading category within aircraft type. This position is being maintained due to the widespread use of narrow body aircraft in short and medium haul routes, which continue to dominate commercial aviation traffic globally.

Rising passenger demand for affordable air travel has resulted in a surge in orders for narrow body aircraft, strengthening the requirement for advanced cable systems across these fleets. Airlines favor narrow body aircraft for their fuel efficiency and operational flexibility, further contributing to the growth of this segment.

The increasing integration of digital flight systems, advanced communication technologies, and in-flight connectivity solutions in narrow body aircraft has created higher reliance on sophisticated cable installations With low-cost carriers expanding their networks and airlines focusing on fleet modernization programs, the narrow body aircraft segment is expected to remain the largest consumer of aircraft cables, ensuring consistent revenue contribution.

The need for more sophisticated avionics, increased data processing requirement, higher resolution displays and the expansion of Inflight entertainment systems is expected to drive the need for aircraft cables. Wires and cables are becoming critical components in the data-centric architecture of modern aircrafts. There has been increase in deployment of advanced communication systems. The growing need for lighting fast data transfer throughout the aircraft for the efficient technological functioning.

Specialized cables that transfer data at high rate is therefore of immense importance in the aircraft industry thus aircraft cables plays important role in the global market. There has been a need for cables up gradation in a number of defense and commercial aircrafts still in service. The growing MRO budget is projected to have positive impact on the aircraft cables market. The deployment of advanced computers and displays and other electronics in aircrafts, especially defense aircrafts is expected to create traction in the aircraft cables market.

Aircraft cables Market Drivers

The improved airline operating cost structure is also projected to boost the demand for aircraft cables. The up cycle in aircraft orders and production is in turn expected to drive the demand for aircraft cables

The avionics manufacturers have shown increase in interests for innovation and deploying new and advanced technologies in the aircrafts. In-flight entertainment systems and on board servers in the cabin are expected to generate significant demand for aircraft cables. The increase in number of passengers travelling by airplanes has led to rise in number of aircrafts needed.

There has also been a need for aircraft cables for the aircrafts which are still in service today for cable and wires upgrade. The growing MRO budget for the aircrafts maintenance, repair and overhaul is also expected to generate significant demand for aircraft cables.

One of the major challenge faced by the global aircraft cables market is the increasing penetration of wireless and cable less technologies in the aviation industry. This will in turn impact the demand for aircraft cables in a negative aspect. Moreover, there has been increase in aircraft backlogs is also expected to impact the demand for aircraft cables in the long run.

The programs for the production of new airframes will lead to reduction of cables to reduce weight and further improve the fuel efficiency is projected to restrain the market growth for aircraft cables.

In order to win an edge over the other players in the market, the manufacturers are focusing on deploying customized solutions and are also offering products and services in an integrated package.

There has also been increase in deployment of aircraft cables at high temperature areas such as engine, where there has been a need for highly temperature resistant cables.

In terms of regional perspective, the global aircraft cables market is anticipated to be dominated by North America and Europe region owing to the increase in MRO budget thus the need of up gradation in the existing aircrafts. There has also been growing demand for aircraft cables in the defense aircrafts due to the highly advanced data connection systems.

Asia Pacific is expected to register a sound growth in the global aircraft cables market. The increasing aircraft fleet in the region is projected to drive the demand. Middle East and Africa is projected to hold significant share in the global aircraft cables market. Latin America is projected to be a low volume high growth region. Japan is expected to witness moderate demand for aircraft cables.

Some of the market participants identified across the value chain of global Aircraft cables market are:

The research report aircraft cables presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. Aircraft cables also contains projections using a suitable set of assumptions and methodologies. The research report aircraft cables provides analysis and information according to market segments such as geographies, application, and industry.

The report aircraft cables is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report aircraft cables provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report aircraft cables also maps the qualitative impact of various market factors on aircraft cables market segments and geographies.

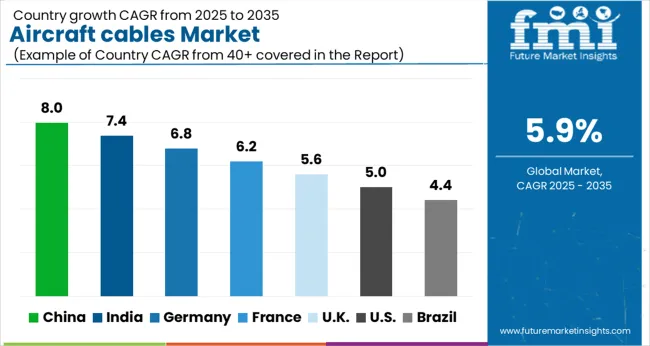

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The Aircraft cables Market is expected to register a CAGR of 5.9% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.0%, followed by India at 7.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.4%, yet still underscores a broadly positive trajectory for the global Aircraft cables Market.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.8%. The USA Aircraft cables Market is estimated to be valued at USD 1.2 billion in 2025 and is anticipated to reach a valuation of USD 1.9 billion by 2035. Sales are projected to rise at a CAGR of 5.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 175.6 million and USD 91.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Application | Commercial aircrafts, Private Aircrafts, Military/defense aircrafts, and Others |

| Platform Type | Fixed wing platform and Rotary wing platform |

| Aircraft Type | Narrow Body, Wide Body, Regional jet, and Turboprop |

| Material Type | Stainless steel, Galvanized steel, ETFE (Ethylene tetrafluoroethylene), Polyimide, and PTFE Composites |

| Product Type | Power cables, Special cables, Data bus cables, and Fire resistant cables/engine cables |

| Sales Channel | OEM and Aftermarket |

| End Use | Flight control system, Power supply, Data Transfer, Lighting, Avionics, and Engine cables |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nexans S.A., Tyler Madison, Inc., Carlisle Interconnect Technologies, TE Connectivity, Sea Wire and Cable Inc., Habia Cable AB, Amphenol Corporation, Radiall, Rockwell Collins, Inc., and A.E. Petsche Company |

The global aircraft cables market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the aircraft cables market is projected to reach USD 6.1 billion by 2035.

The aircraft cables market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in aircraft cables market are commercial aircrafts, private aircrafts, military/defense aircrafts and others.

In terms of platform type, fixed wing platform segment to command 58.2% share in the aircraft cables market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA