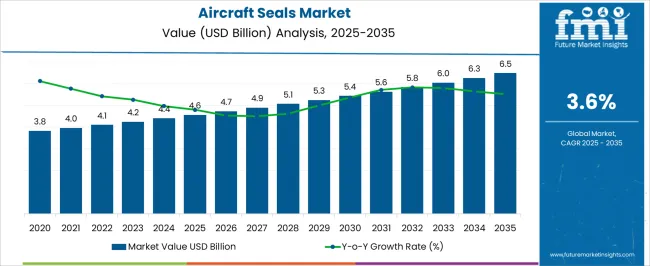

The aircraft seals market is estimated to be valued at USD 4.6 billion in 2025 and is projected to reach USD 6.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

Growth during this phase is relatively modest, averaging around 4% annually, reflecting steady demand for sealing solutions in maintenance cycles, retrofit activities, and limited production increases of new aircraft programs. This block highlights the importance of consistent aftermarket demand in stabilizing value creation. Between 2026 and 2030, the market advances from USD 4.7 billion to USD 5.6 billion, adding nearly USD 0.9 billion. Growth in this period slightly outpaces the earlier block, supported by recovery in global air travel, higher aircraft utilization rates, and replacement needs for advanced sealing materials capable of handling temperature extremes, pressure variations, and fluid resistance.

This stage demonstrates a shift from stability-driven expansion to incremental innovation-based adoption. From 2031 to 2035, the market increases further from USD 5.8 billion to USD 6.5 billion, adding USD 0.7 billion. While the absolute contribution is smaller than the prior block, it signals maturity, with growth driven primarily by next-generation aircraft platforms and composite-friendly sealing technologies.

| Metric | Value |

|---|---|

| Aircraft Seals Market Estimated Value in (2025 E) | USD 4.6 billion |

| Aircraft Seals Market Forecast Value in (2035 F) | USD 6.5 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The aircraft seals market occupies a specific role across several broader aviation sectors, contributing measurable shares that emphasize both its technical importance and commercial scope. Within the aerospace components market, aircraft seals account for nearly 4 to 5%, positioned alongside bearings, actuators, and fasteners that collectively ensure airworthiness. Their share is more evident in the aircraft maintenance, repair, and overhaul (MRO) market, where seals contribute about 6 to 7%, reflecting high replacement frequency due to wear from pressure cycles, thermal exposure, and fuel contact. In the aircraft manufacturing market, seals represent close to 3 to 4%, integrated directly into fuselage assemblies, engine housings, and hydraulic systems during OEM production runs.

Their impact strengthens within the aviation safety and reliability market, where they command almost 8 to 9%, underscoring their importance in preventing fluid leakage, maintaining cabin pressure, and ensuring system reliability in both civil and defense aircraft. Lastly, in the defense and military aviation market, aircraft seals hold about 2 to 3%, demanded for specialized military-grade applications in combat jets, helicopters, and UAV platforms that require durability in extreme conditions.Their commercial presence is anchored not by volume dominance, but by technical indispensability across manufacturing, maintenance, and mission-critical aviation systems.

The market is experiencing sustained growth as aerospace manufacturers and operators prioritize advanced sealing solutions that enhance performance, safety, and operational efficiency. Demand is being driven by the increasing production of next-generation aircraft, the expansion of global air travel, and the rising need for maintenance, repair, and overhaul services. Technological advancements in materials science have enabled the development of seals that offer superior resistance to extreme temperatures, pressures, and chemical exposure.

These innovations are critical for modern aircraft that operate under stringent safety and environmental standards. The shift toward lightweight and fuel-efficient designs has also accelerated the adoption of specialized seals that meet rigorous durability and weight reduction criteria.

With growing investments in commercial, military, and general aviation sectors, coupled with the integration of advanced manufacturing processes, the market is set to expand further The ability of high-performance seals to extend service life and reduce maintenance downtime positions them as an indispensable component in the evolving aerospace industry.

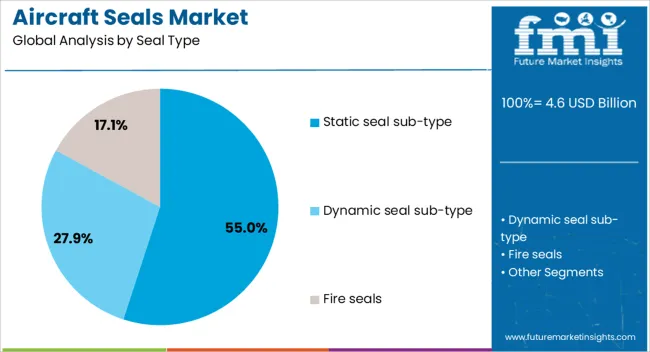

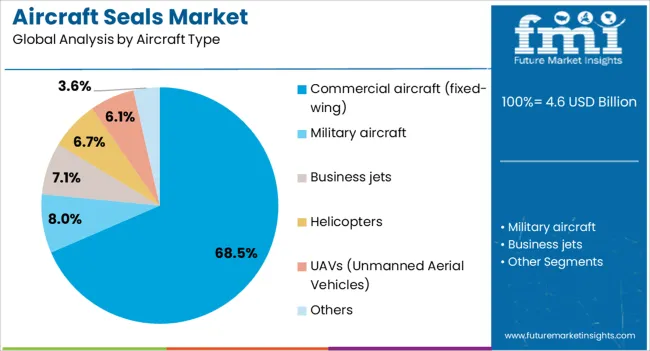

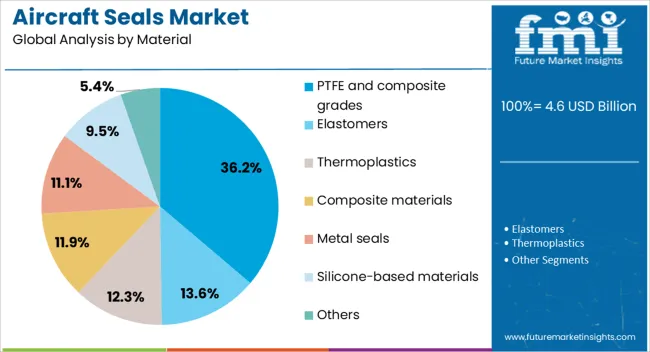

The aircraft seals market is segmented by seal type, aircraft type, material, application, end use, and geographic regions. By seal type, aircraft seals market is divided into static seal sub-type, dynamic seal sub-type, and fire seals. In terms of aircraft type, aircraft seals market is classified into commercial aircraft (fixed-wing), military aircraft, business jets, helicopters, UAVs (Unmanned Aerial Vehicles), and others. Based on material, aircraft seals market is segmented into PTFE and composite grades, elastomers, thermoplastics, composite materials, metal seals, silicone-based materials, and others. By application, aircraft seals market is segmented into engine & nacelle. By end use, aircraft seals market is segmented into OEM (Original Equipment Manufacturer) and MRO (Maintenance, Repair, and Overhaul). Regionally, the aircraft seals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The static seal sub-type is projected to hold 55% of the aircraft seals market revenue share in 2025, establishing it as the leading seal type. Growth in this segment has been attributed to the reliability and durability of static seals in preventing fluid or gas leakage in fixed contact areas. Their design provides consistent performance under high pressure and temperature variations, which is essential for critical aerospace systems. The widespread use of static seals in engines, landing gear, and hydraulic systems has reinforced their market dominance. Advances in precision manufacturing and material engineering have further enhanced their sealing efficiency and lifespan, reducing maintenance requirements. As aircraft manufacturers focus on improving operational safety and minimizing unplanned downtime, static seals have become a preferred choice due to their robust performance characteristics The adaptability of these seals to a variety of aerospace applications, combined with their proven track record in long-term reliability, has ensured their continued leadership in the seal type category.

The commercial aircraft (fixed-wing) segment is expected to account for 68.50% of the market revenue share in 2025, making it the dominant aircraft type. This leadership has been supported by the rising global demand for passenger and cargo transport, which has led to increased production rates of commercial aircraft. Seals used in fixed-wing aircraft must meet stringent regulatory and performance standards, ensuring safety and efficiency in both short-haul and long-haul operations. The expansion of airline fleets, coupled with the introduction of fuel-efficient and next-generation aircraft models, has significantly increased seal consumption in this segment. Maintenance, repair, and overhaul activities for commercial fleets have also contributed to steady demand. The ability of seals to withstand extreme environmental conditions, from high-altitude pressures to rapid temperature fluctuations, has reinforced their critical role in the segment Ongoing technological advancements in seal design and material performance are expected to sustain the dominance of the commercial fixed-wing category.

The PTFE and composite grades material segment is projected to secure 36.20% of the market revenue share in 2025, emerging as a key material category. The growth of this segment has been driven by the exceptional chemical resistance, low friction properties, and high temperature tolerance of PTFE-based seals. These characteristics are essential for ensuring consistent performance in demanding aerospace applications, including hydraulic systems, engines, and fuel handling systems. Composite grades, which combine PTFE with reinforcing fillers, offer enhanced wear resistance and mechanical strength, further extending service life. The adoption of these materials has been reinforced by the industry’s focus on reducing weight without compromising durability, aligning with broader efficiency and sustainability goals. As aircraft designs evolve to incorporate more advanced systems and operate in increasingly challenging environments, PTFE and composite seals have proven their ability to meet stringent operational requirements Their contribution to reducing maintenance intervals and improving reliability continues to strengthen their market position.

The chalcogenide glasses market is expanding, fueled by applications in infrared imaging, sensing, and photonics. Their role in defense, aerospace, medical imaging, and communication systems highlights their importance in advanced optical technologies. However, high manufacturing costs, processing difficulties, and raw material constraints remain key obstacles. Opportunities are emerging from fiber optics, nonlinear applications, and integration into automotive and industrial systems. Material innovations and regional adoption trends are reshaping the market, positioning chalcogenide glasses as a vital enabler of next-generation imaging, communication, and sensing technologies across multiple industries.

The chalcogenide glasses market is gaining momentum due to their unique optical properties, particularly in infrared transmission. These glasses are widely used in thermal imaging, night vision devices, spectroscopy, and optical sensors. Their ability to transmit infrared light makes them indispensable in defense, security, and aerospace applications, where precision and reliability are critical. Beyond defense, medical imaging and chemical sensing are emerging as important sectors driving adoption. Their compatibility with fiber-drawing processes also allows integration into specialized communication systems. As industries increasingly demand materials that can withstand challenging environments while maintaining optical performance, chalcogenide glasses are being positioned as a preferred choice. Their role in enabling advanced imaging, sensing, and monitoring technologies is expected to keep expanding as innovation pushes the boundaries of optical engineering across multiple high-tech industries.

Chalcogenide glasses face hurdles stemming from high production costs and technical challenges in processing. These glasses require carefully controlled conditions during synthesis to maintain purity and avoid structural defects, which increases manufacturing expenses. Their relatively soft mechanical nature makes them more prone to damage during handling and machining compared to traditional optical materials, adding further costs in polishing and shaping. Limited scalability in mass production restricts availability, while environmental sensitivity of certain compositions complicates storage and long-term durability. Furthermore, sourcing of raw materials such as selenium or tellurium can be inconsistent, leading to supply uncertainties. These limitations often prevent their widespread adoption in cost-sensitive industries, confining usage mainly to specialized sectors where performance advantages outweigh financial barriers. Overcoming these challenges through process optimization and material engineering remains a key priority for producers.

New opportunities for chalcogenide glasses are arising with the growth of emerging technologies requiring advanced optical performance. Their integration into mid-infrared photonics is paving the way for next-generation sensors and communication systems, especially in areas such as environmental monitoring and industrial process control. Advances in fiber optics are broadening applications in high-speed data transmission, with chalcogenide-based fibers supporting wavelengths beyond the range of conventional silica. Their nonlinear optical properties are also being leveraged for ultrafast lasers and signal processing systems. The rise of autonomous vehicles and advanced driver-assistance systems is creating additional potential, as thermal imaging and LiDAR demand high-performance optics. Collaborative R&D between research institutions and industry players is expanding the design space of chalcogenide materials, unlocking opportunities that align with broader technology shifts across photonics, communications, and sensing applications.

A notable trend shaping the chalcogenide glasses market is the emphasis on material innovation and region-specific adoption. Manufacturers are investing in new compositions that enhance durability, thermal stability, and optical performance, broadening the scope of applications. Integration with nanostructures and coatings is improving resilience, allowing for deployment in more demanding operational environments. Regionally, defense-driven demand dominates in North America and Europe, while Asia is witnessing growing adoption in consumer electronics and automotive imaging. Strategic collaborations between defense contractors, research labs, and optical firms are fueling innovation pipelines. Increasing interest from medical and environmental monitoring industries is also diversifying applications. The combination of advanced R&D efforts and growing cross-industry partnerships is expected to shape the trajectory of chalcogenide glasses, making them central to future innovations in optics and photonics technologies worldwide.

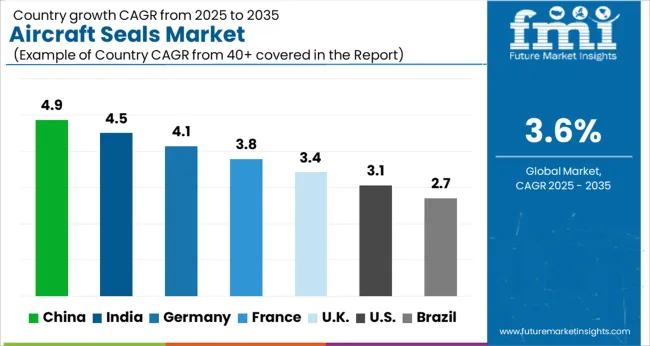

| Country | CAGR |

|---|---|

| China | 4.9% |

| India | 4.5% |

| Germany | 4.1% |

| France | 3.8% |

| UK | 3.4% |

| USA | 3.1% |

| Brazil | 2.7% |

The aircraft seals market is expected to grow at a global CAGR of 3.6% between 2025 and 2035. China leads with 4.9%, followed by India at 4.5% and Germany at 4.1%, while the UK posts 3.4% and the USA records 3.1%. China secures the highest growth premium at +1.3% above baseline, supported by domestic fleet expansion and indigenous aircraft programs. India maintains strength with defense aviation and MRO-driven demand, while Germany benefits from its aerospace ecosystem and innovation. The UK and USA show slower growth but retain importance through global supply chains, advanced manufacturing, and extensive MRO networks. The analysis includes over 40+ countries, with the leading markets detailed below.

The aircraft seals market in China is projected to grow at a CAGR of 4.9% from 2025 to 2035, the highest among the profiled countries. The expansion is driven by China’s fast-growing commercial aviation sector, rising aircraft fleet size, and the government’s strong focus on aerospace manufacturing under local industrial programs. Aircraft seals are essential for hydraulic systems, engines, landing gear, and fuselage components, ensuring reliability and safety in high-performance operations. Local suppliers are scaling up to meet demand, but advanced sealing technologies are still imported from international aerospace firms. The rapid increase in domestic air travel, coupled with military modernization projects, is fueling adoption.

The aircraft seals market in India is expected to grow at a CAGR of 4.5% between 2025 and 2035. Growth is supported by the country’s expanding defense aviation programs and the rapid growth of commercial airlines. The demand for high-performance seals is rising in engines, landing gear, and hydraulic systems, where durability is critical. India’s aviation manufacturing ecosystem is evolving under “Make in India” initiatives, with local firms collaborating with global aerospace suppliers to develop advanced components. Civil aviation growth, particularly low-cost carriers, adds consistent demand for maintenance and replacement seals.The expansion of MRO (Maintenance, Repair, and Overhaul) facilities across India is generating recurring demand for aircraft seals in replacement cycles.

The aircraft seals market in Germany is forecast to expand at a CAGR of 4.1% through 2035. Germany’s strong aerospace ecosystem, supported by Airbus and multiple Tier-1 suppliers, ensures steady demand for advanced sealing solutions. Aircraft seals are crucial for hydraulic systems, engines, fuel tanks, and fuselage components, where reliability is non-negotiable. The focus on next-generation aircraft and lightweight materials is driving innovation in sealing technology, particularly with elastomeric and composite-based seals. Germany’s MRO sector, serving both European and international airlines, contributes significantly to recurring demand. Research collaborations between aerospace firms and technical institutes are fostering development of high-performance seals designed for efficiency and extended service life.

The aircraft seals market in the United Kingdom is projected to grow at a CAGR of 3.4% between 2025 and 2035. Growth is shaped by the country’s role as a major aerospace hub, supplying components for both defense and civil aviation programs. Demand is concentrated in engine seals, hydraulic seals, and fuselage sealing systems, where high reliability is essential. UK aerospace firms are engaged in global supply chains, particularly in advanced sealing materials designed to withstand extreme operating conditions. The MRO industry plays a key role, as frequent maintenance of aircraft fleets sustains replacement demand for seals. Challenges include reliance on imported raw materials and competitive pricing pressures, but opportunities exist in supplying seals for electric and hybrid aircraft programs.

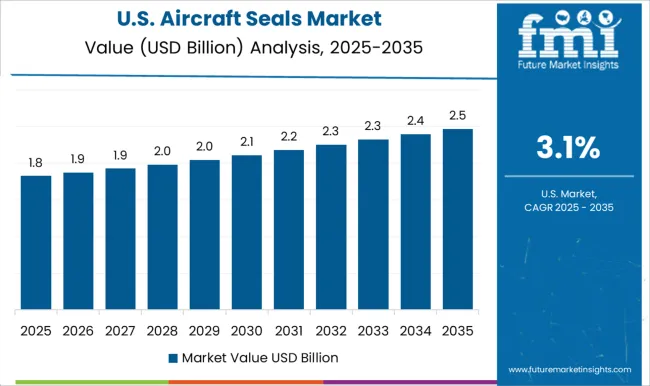

The aircraft seals market in the United States is forecasted to grow at a CAGR of 3.1%, the slowest among the profiled regions. However, the USA remains the largest global market in absolute value, due to its vast aerospace manufacturing base, strong defense programs, and high commercial fleet size. Seals are indispensable in aircraft engines, landing gear, hydraulic systems, and fuselage structures, ensuring performance and safety. American OEMs, including Boeing and defense contractors, rely on advanced sealing technologies designed for longer service life and minimal maintenance. The USA MRO sector generates significant recurring demand, as fleet operators require constant replacement of seals. Innovation is focused on seals with enhanced chemical resistance, lightweight elastomers, and higher temperature tolerance.

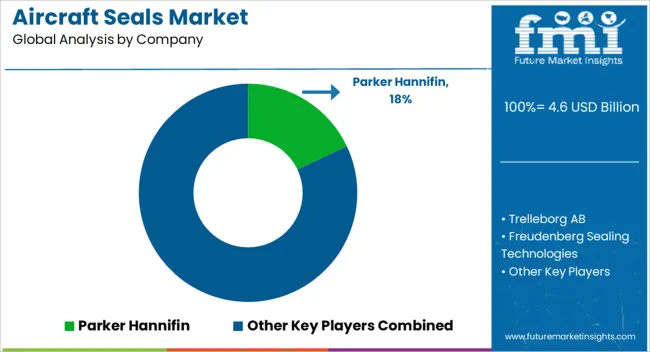

Competition in aircraft seals is decided by qualification depth, material pedigree, and lifecycle coverage. Platform content is pursued across engines, nacelles, airframes, landing gear, and cabin systems, where interchangeability and documentation control influence awards. Parker Hannifin is positioned around integrated sealing systems for fuel, hydraulic, and pneumatic circuits, supported by compound libraries and aerospace approvals. Trelleborg AB competes through airframe and engine sealing portfolios that stress fire resistance, low friction, and fluid compatibility. Freudenberg Sealing Technologies is focused on elastomer and thermoplastic solutions that balance wear, compression set, and weight. Hutchinson SA supplies sealing, thermal, and acoustic components that are qualified for harsh vibration and temperature cycles. SKF Group extends its bearing heritage into rotary and static sealing for actuators and gearboxes.

Eaton participates where seals are embedded within fluid conveyance, valves, pumps, and connectors, giving a systems pathway into line fit and spares. Other major suppliers address niche geometries and spring energized PTFE designs for extreme chemistries. Strategy has centered on dual channel growth, with OEM line fit used to lock bill of material positions and PMA or distributor routes used to capture maintenance and retrofit volumes. Regional service hubs, kitting, and vendor managed inventory are promoted to cut turn times. Material science is commercialized through families of FKM, FFKM, fluorosilicone, HNBR, and PTFE blends that meet flammability and toxicity limits, fluid resistance targets, and low leak requirements. Qualification programs, first article inspection, and change control are emphasized to protect approvals. Digital catalogs, part cross references, and configurators are used to simplify engineer selection. Product brochure content is precise.

Static seals, O rings, gaskets, and fire barrier seals for doors, windows, nacelles, and thrust reversers are listed. Dynamic lip seals, u cups, rod and piston seals, and spring energized PTFE elements for actuators and pumps are offered. Back up rings, wear rings, and scraper rings are shown for landing gear and flight control hardware. Datasheets highlight compound families, media resistance to Skydrol and fuels, wide temperature ranges, low outgassing, surface finish guidance, and standard aerospace drawings with AS9100 quality notes.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.6 billion |

| Seal Type | Static seal sub-type, Dynamic seal sub-type, and Fire seals |

| Aircraft Type | Commercial aircraft (fixed-wing), Military aircraft, Business jets, Helicopters, UAVs (Unmanned Aerial Vehicles), and Others |

| Material | PTFE and composite grades, Elastomers, Thermoplastics, Composite materials, Metal seals, Silicone-based materials, and Others |

| Application | Engine & nacelle |

| End Use | OEM (Original Equipment Manufacturer) and MRO (Maintenance, Repair, and Overhaul) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Parker Hannifin, Trelleborg AB, Freudenberg Sealing Technologies, Hutchinson SA, SKF Group, and Eaton / Other major suppliers |

| Additional Attributes | Dollar sales by product type include dynamic seals (rotary, actuator, hydraulic), static seals (O-rings, gaskets), and specialty designs for fire protection and EMI shielding, with segmentation by application across engines, landing gear, flight controls, and fluid systems. Dollar sales by end use span commercial aviation, defense platforms, and business jets. Demand dynamics have been shaped by new aircraft production, aftermarket MRO cycles, and longer replacement intervals supported by advanced materials. Regional trends show North America as the anchor due to Boeing and tier suppliers, Europe led by Airbus programs, and Asia Pacific advancing with indigenous aircraft development and growing MRO hubs. |

The global aircraft seals market is estimated to be valued at USD 4.6 billion in 2025.

The market size for the aircraft seals market is projected to reach USD 6.5 billion by 2035.

The aircraft seals market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in aircraft seals market are static seal sub-type, _o-rings & gaskets (static), _other seals (static), dynamic seal sub-type, _contact seals, _clearance seals, _others (dynamic) and fire seals.

In terms of aircraft type, commercial aircraft (fixed-wing) segment to command 68.5% share in the aircraft seals market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA