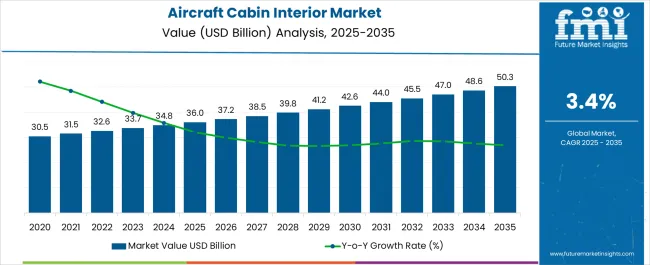

The global aircraft cabin interior market is expected to grow from USD 36 billion in 2025 to approximately USD 50.3 billion by 2035, recording an absolute increase of USD 22.2 billion over the forecast period. This translates into a total growth of 60.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.4% between 2025 and 2035. The overall market size is expected to grow by nearly 1.6X during the same period, supported by rising demand for passenger comfort, sustainable cabin materials, and digitally integrated interior solutions.

Between 2025 and 2030, the aircraft cabin interior market is forecast to grow from USD 36.5 billion to USD 46.1 billion, contributing USD 9.6 billion, or 43.2% of total forecast growth. Rising adoption of premium seating configurations, advanced lighting solutions, and smart cabin technologies will drive demand. Airlines will prioritize passenger comfort enhancements alongside fuel-efficient interior components, while retrofit programs continue to gain traction as carriers upgrade existing fleets to meet evolving passenger expectations.

From 2030 to 2035, the aircraft cabin interior market is projected to expand from USD 46.1 billion to USD 58.7 billion, adding USD 12.6 billion, or 56.8% of decade-long growth. This phase will be fueled by next-generation aircraft deliveries, adoption of sustainable interior materials, and integration of digitally connected passenger systems. Airlines will increasingly invest in AI-powered cabin optimization, biometric recognition, and recyclable interior components, positioning cabin innovation as a core driver of operational efficiency and passenger satisfaction.

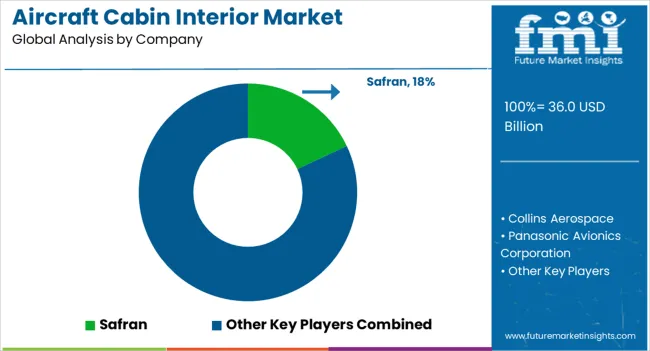

Between 2020 and 2025, the aircraft cabin interior market expanded from USD 28.4 billion to USD 36.5 billion, supported by post-pandemic recovery in global air travel and rising passenger expectations for enhanced onboard experiences. Growth was driven by leading aerospace suppliers such as Safran, Collins Aerospace, and Panasonic Avionics, focusing on weight reduction, comfort, and advanced in-flight entertainment systems. Sustainable materials, modular seating, and energy-efficient lighting emerged as key differentiators, while service-led offerings like retrofits and maintenance accounted for a growing share of revenues.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 36 billion |

| Projected Value (2035F) | USD 50.3 billion |

| CAGR (2025 to 2035) | 3.4% |

Market expansion is being supported by the rising global air passenger traffic and increasing airline focus on passenger experience differentiation. Airlines are investing heavily in cabin upgrades to attract customers and improve brand loyalty through enhanced comfort, entertainment, and connectivity options. The transition to fuel-efficient aircraft and regulatory requirements for improved safety standards further support market expansion.

Aircraft cabin interiors featuring lightweight materials, ergonomic seating designs, and advanced entertainment systems are gaining traction for their ability to improve passenger satisfaction while reducing operational costs. Their integration with wireless connectivity, mood lighting, and personalized service platforms enhances the overall travel experience. Sustainability initiatives promoting recyclable cabin materials and energy-efficient systems also contribute to strong global market growth across commercial aviation segments.

The market is segmented by product type, material type, aircraft type, application, sales channel, and region. By product type, the market is divided into sidewalls/liners, carts, overhead bins, seats (business, premium, first, and economy), interior panels (floor, ceiling, and side), crew resting compartment, lavatory compartment, monuments, passenger windows, aircraft windshield, interior lights, and galley. By material type, the market is categorized into metals (aluminum alloys, titanium alloys, steel alloys, and magnesium alloys) and non-metals (composites, plastics & polymers, textiles & upholstery materials, and foams). By aircraft type, the market is segmented into narrow body aircraft, wide body aircraft, and large body aircraft. By application, the market is classified into seating system, galley structure, cabin & structure, and equipment & system. By sales channel, the market is divided into OEM and aftermarket. Regionally, the market is divided into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and Middle East & Africa.

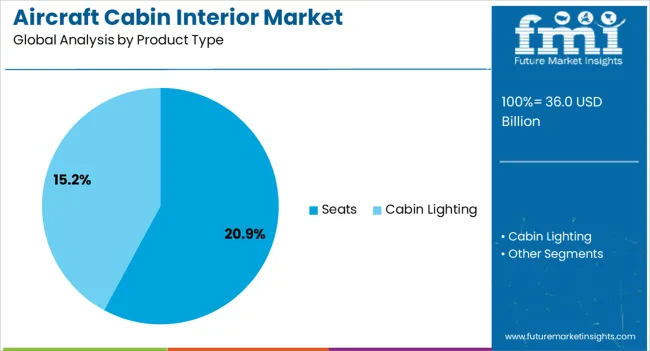

Seats are projected to account for 20.9% of the aircraft cabin interior market in 2025, supported by their critical role in passenger comfort and airline revenue optimization. Modern aircraft seating systems incorporate lightweight materials, ergonomic designs, and space-efficient configurations that maximize passenger capacity while maintaining comfort standards. Airlines prioritize seating upgrades to differentiate their service offerings and improve customer satisfaction scores.

Rising passenger expectations for comfort during longer flights has accelerated investment in premium seating solutions across economy, business, and first-class cabins. Innovations in seat-back entertainment integration, adjustable lumbar support, and convertible configurations enhance the value proposition. The segment's compatibility with various aircraft types and retrofit applications reinforces its market leadership position.

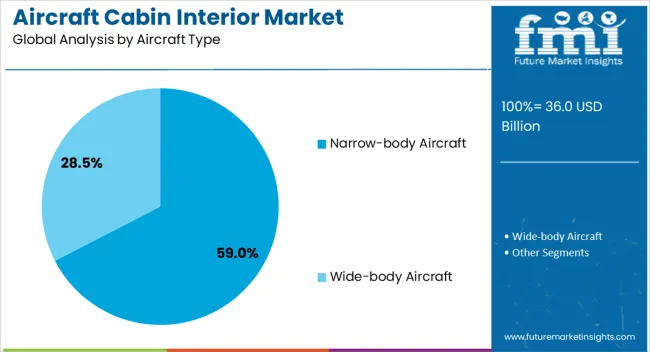

Narrow-body aircraft are expected to capture 59.0% of demand in 2025, as these aircraft represent the largest segment of global commercial aviation fleets. Single-aisle aircraft such as the Airbus A320 family and Boeing 737 series dominate short to medium-haul routes, requiring frequent cabin interior updates to maintain passenger appeal and regulatory compliance.

The segment benefits from high aircraft delivery rates and retrofit cycles driven by intense competition among airlines on popular domestic and regional international routes. Narrow-body aircraft cabin interiors must balance passenger comfort with quick turnaround requirements, driving demand for durable, easily maintainable interior components. Cost-effective interior solutions for this aircraft category ensure strong market demand.

The aircraft cabin interior market is growing as airlines invest in passenger experience enhancements to maintain competitive advantages and comply with evolving safety regulations. Rising air travel demand and aircraft fleet modernization support strong market expansion. However, high retrofit costs and long certification processes limit adoption speed. Trends in sustainable materials, smart cabin technologies, and personalized passenger services are driving market transformation.

Aircraft cabin interiors are increasingly upgraded to meet rising passenger expectations for comfort, connectivity, and entertainment during flights. Airlines recognize that superior cabin experiences directly impact customer loyalty, pricing power, and brand differentiation in highly competitive markets. Fleet modernization programs replacing aging aircraft with new-generation models incorporate advanced interior systems as standard equipment. Regulatory requirements for improved accessibility, safety features, and environmental standards also mandate interior upgrades across existing fleets.

Adoption is hindered by substantial costs associated with cabin interior retrofits, including component procurement, installation, and aircraft downtime during modification periods. Complex certification processes required by aviation authorities add time and expense to interior upgrade projects. Weight restrictions on aircraft limit material choices and design options, potentially compromising desired features. Airline financial constraints, particularly following industry disruptions, delay discretionary cabin enhancement investments despite passenger demand for improved experiences.

Key trends include adoption of recyclable, bio-based, and lightweight materials that reduce environmental impact while maintaining safety and durability standards. Smart cabin technologies incorporating IoT sensors, AI-powered systems, and predictive maintenance capabilities are enhancing operational efficiency and passenger services. Personalization features such as adjustable lighting, climate control, and entertainment preferences are becoming standard across cabin classes. Wireless connectivity integration, touchless interfaces, and health-monitoring systems represent growing areas of innovation responding to evolving passenger preferences and operational requirements.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.3% |

| Japan | 6.0% |

| India | 4.3% |

| Brazil | 2.8% |

| China | 2.6% |

| Germany | 1.9% |

| United States | 1.6% |

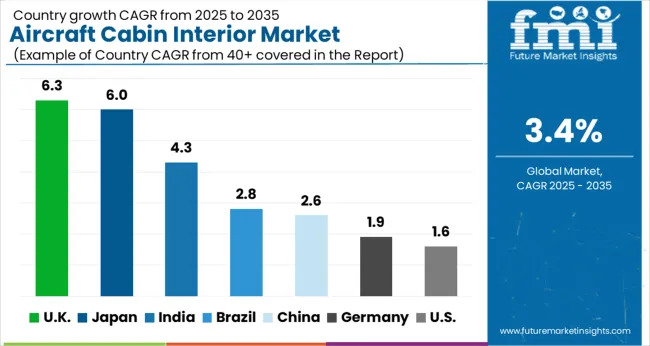

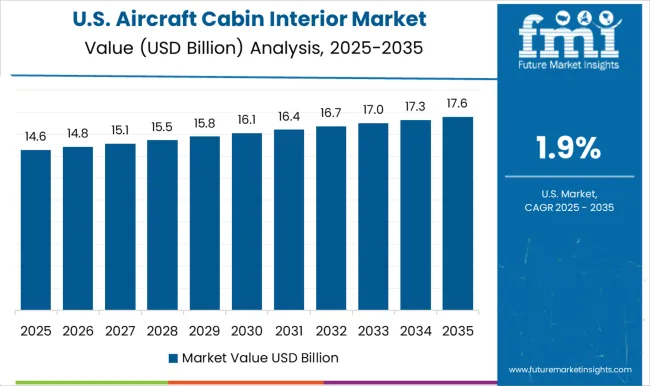

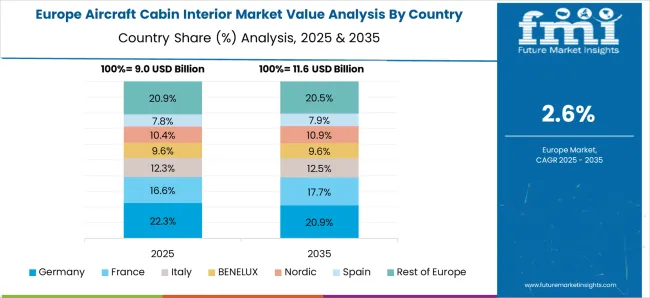

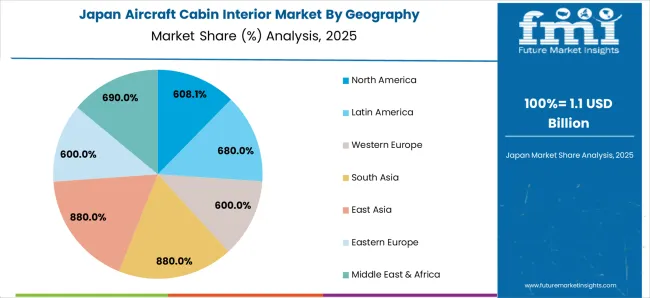

The aircraft cabin interior market is growing rapidly, with United Kingdom leading at a CAGR of 6.3%, driven by strong investments from British Airways and Virgin Atlantic to enhance premium cabin experiences and maintain global competitiveness. Japan follows with 6.0% CAGR, supported by its reputation for exceptional service standards and precision engineering, which sustain demand for advanced cabin technologies. India records robust momentum at 4.3% CAGR, reflecting fast expansion of domestic airlines, government aviation policies, and rising middle-class travel demand. Brazil and China exhibit moderate growth at 2.8% and 2.6% CAGRs respectively, where airlines balance capacity expansion with cost-effective interior solutions. The United States and Germany present the slowest growth at 1.6% and 1.9% CAGRs, though they remain vital markets with advanced aerospace industries, mature airline networks, and technological innovation driving steady demand for upgrades.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from aircraft cabin interior in the USA is projected to grow at a CAGR of 1.9% from 2025 to 2035, supported by major airline fleet renewal programs and increasing passenger traffic on domestic routes. American carriers are investing heavily in premium cabin configurations to compete effectively on transcontinental and international services. The market benefits from strong aerospace manufacturing infrastructure and advanced technology development capabilities. Major airlines are prioritizing passenger experience enhancements through upgraded seating, entertainment systems, and connectivity solutions to maintain market leadership positions.

Revenue from aircraft cabin interior in Germany is expected to expand at a CAGR of 1.9% from 2025 to 2035, driven by Lufthansa Group's extensive fleet operations and the country's position as a major European aviation hub. German airlines emphasize engineering excellence and passenger comfort in cabin interior selections, supporting demand for high-quality components and systems. The market benefits from strong domestic aerospace manufacturing capabilities and export-oriented production facilities serving global airline customers. Regulatory compliance with European aviation standards and environmental requirements shapes interior material and technology choices.

Demand for aircraft cabin interior in Japan is forecast to grow at a CAGR of 6% from 2025 to 2035, supported by major carriers Japan Airlines and ANA investing in premium passenger experiences for domestic and international operations. Japanese airlines are known for exceptional service standards, driving demand for sophisticated cabin interior technologies and amenities. The market emphasizes space optimization, passenger convenience features, and attention to detail in interior design and functionality. Strong domestic aerospace component manufacturing supports both local airline requirements and export opportunities.

Demand for aircraft cabin interior in the UK is projected to expand at a CAGR of 6.3% from 2025 to 2035, driven by British Airways and Virgin Atlantic's premium service positioning and London's status as a major international aviation gateway. British carriers invest significantly in cabin interior differentiation to compete on competitive transatlantic and European routes. The market benefits from established aerospace manufacturing capabilities and close integration with European supply chains. Brexit-related regulatory changes and environmental commitments influence interior technology and material selection decisions.

Demand for aircraft cabin interior in China is expected to grow at a CAGR of 2.6% from 2025 to 2035, reflecting rapid expansion of domestic airlines and increasing international route development. Chinese carriers are investing heavily in modern cabin interior systems to compete with established international airlines and meet growing passenger expectations. The market benefits from government support for aviation sector development and domestic manufacturing capabilities. Strong domestic air travel demand and expanding international connectivity drive consistent interior upgrade and retrofit programs.

Revenue from aircraft cabin interior in Brazil is forecast to expand at a CAGR of 2.8% from 2025 to 2035, supported by major carriers such as Latam Airlines and Gol Linhas Aéreas serving extensive domestic and regional international route networks. Brazilian airlines focus on cost-effective cabin interior solutions that maintain passenger comfort while supporting efficient operations. The market benefits from Embraer's domestic aircraft manufacturing capabilities and established aerospace supply chain relationships. Economic conditions and currency fluctuations influence airline investment decisions regarding cabin interior upgrades and retrofits.

Revenue from aircraft cabin interior in India is projected to expand at a CAGR of 4.3% from 2025 to 2035, supported by rapid expansion of domestic airlines, increasing air travel penetration, and government initiatives promoting aviation sector development. Indian carriers are investing in modern cabin interior systems to compete effectively and meet rising passenger expectations for comfort and entertainment. The market benefits from growing middle-class population, expanding route connectivity, and favorable government policies supporting airline operations. International airline partnerships and aircraft leasing arrangements facilitate access to advanced interior technologies and financing options.

The aircraft cabin interior market is moderately concentrated, with established aerospace suppliers, specialized interior manufacturers, and technology providers competing across commercial aviation, business aviation, and cargo aircraft segments. Global leaders such as Safran, Collins Aerospace, and Panasonic Avionics Corporation hold significant market share, driven by comprehensive product portfolios, advanced technology capabilities, and established airline relationships. Their strategies increasingly emphasize passenger experience enhancement, operational efficiency, and sustainability commitments through innovative materials and systems.

Established players including Honeywell International Inc. and HAECO Group are supporting adoption of integrated cabin interior solutions featuring advanced connectivity, passenger comfort systems, and maintenance-friendly designs. These companies are especially active in retrofit markets and airline modernization programs, offering comprehensive upgrade packages that combine multiple interior systems for enhanced passenger experiences and operational benefits.

Specialized regional providers focus on customized interior solutions for specific airline requirements and aircraft types. Their strengths lie in flexible design capabilities, rapid response to airline specifications, and cost-effective solutions for emerging market carriers, enabling airlines to differentiate service offerings while managing capital expenditure requirements effectively.

| Item | Value |

|---|---|

| Quantitative Units | USD 36 billion |

| Product Type | Sidewalls/Liners, Carts, Overhead Bins, Seats (Business, Premium, First, And Economy), Interior Panels (Floor, Ceiling, And Side), Crew Resting Compartment, Lavatory Compartment, Monuments, Passenger Windows, Aircraft Windshield, Interior Lights, and Galley |

| Aircraft Type | narrow body aircraft, wide body aircraft, and large body aircraft |

| End-Use | OEM and Aftermarket |

| Regions Covered | North America, Western Europe, Eastern Europe, South Asia, East Asia, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Safran, Collins Aerospace, Panasonic Avionics Corporation, Honeywell International Inc., HAECO Group |

The global aircraft cabin interior market is estimated to be valued at USD 36.0 billion in 2025.

The market size for the aircraft cabin interior market is projected to reach USD 50.3 billion by 2035.

The aircraft cabin interior market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in aircraft cabin interior market are north america, latin america, western europe, south asia, east asia, eastern europe and middle east & africa.

In terms of product type, seats segment to command 20.9% share in the aircraft cabin interior market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interiors Market Size and Share Forecast Outlook 2025 to 2035

Commercial Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA