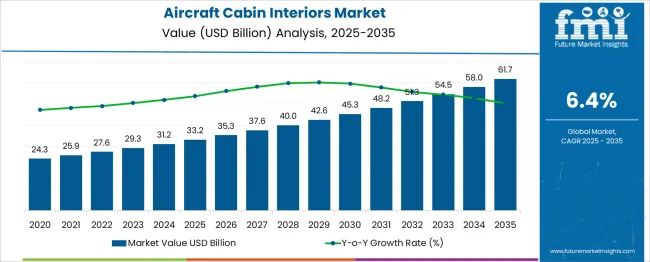

The aircraft cabin interiors market is forecasted to grow from USD 33.2 billion in 2025 to USD 61.7 billion by 2035, representing an absolute dollar opportunity of USD 28.5 billion. The Growth Contribution Index (GCI) analysis shows a steady and consistent increase in market value with key contributions from both volume and value growth. Between 2025 and 2030, the market grows from USD 33.2 billion to USD 45.3 billion, contributing USD 12.1 billion in growth, which accounts for approximately 42% of the total market growth. This early-stage growth is driven by the increasing demand for advanced cabin features such as better seating, lighting, and more efficient air conditioning systems, along with improved passenger comfort in response to rising consumer expectations. From 2030 to 2035, the market continues to expand from USD 45.3 billion to USD 61.7 billion, contributing USD 16.4 billion in growth, with a more pronounced 53% share of the overall market growth. This phase sees the rise in demand for smart, eco-friendly, and connected cabin technologies, such as noise reduction and advanced materials for weight reduction. The GCI highlights a larger contribution from the later years, driven by innovations in design, regulatory compliance, and the growing focus on enhancing passenger experience, underlining a shift toward more sophisticated cabin interior solutions.

| Metric | Value |

|---|---|

| Aircraft Cabin Interiors Market Estimated Value in (2025 E) | USD 33.2 billion |

| Aircraft Cabin Interiors Market Forecast Value in (2035 F) | USD 61.7 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The aircraft cabin interiors market is experiencing robust expansion as airlines pursue enhanced passenger comfort, fuel efficiency and brand differentiation. Investments in lightweight materials, modular designs and personalized cabin zones have been prioritized by carriers aiming to improve customer satisfaction and reduce operational costs. Collaboration between interior specialists, aerospace OEMs and certification bodies is enabling faster development of compliant solutions that align with in‑flight technology integration trends such as connectivity and smart lighting.

Fleet renewal programs among global carriers are fueling demand for next‑generation cabin components specially designed for narrow body and wide body aircraft. Sustainability pressures are leading to adoption of recyclable materials and energy‑efficient lighting systems.

Future opportunities are expected to stem from sustained retrofit cycles, emerging aftermarket services and growing interest in premium economy and business class cabin upgrades. Market competitiveness is being shaped by aerospace regulation alignment advanced engineering partnerships and increasing focus on passenger wellbeing.

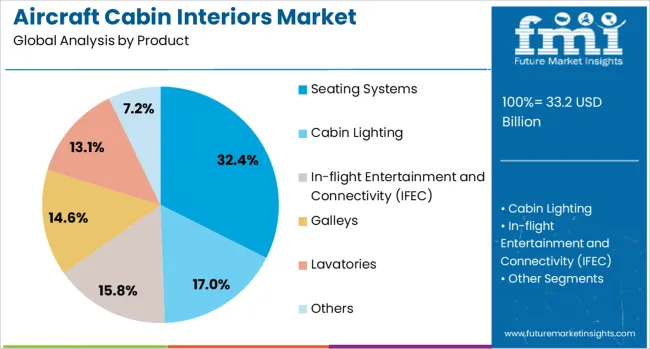

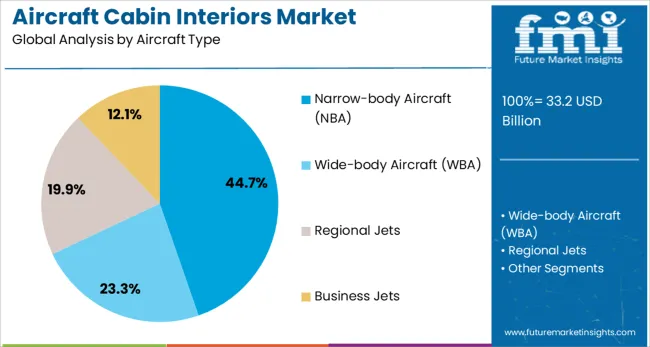

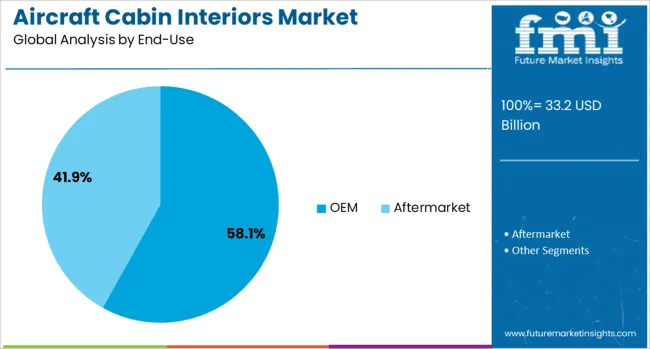

The aircraft cabin interiors market is segmented by product, aircraft type end-use, and geographic regions. By product the market is divided into Seating Systems, Cabin Lighting, In-flight Entertainment and Connectivity (IFEC), Galleys, Lavatories Others. In terms of aircraft type of the aircraft cabin interiors market is classified into Narrow-body Aircraft (NBA), Wide-body Aircraft (WBA), Regional Jets Business Jets. Based on end-use of the aircraft cabin interiors market is segmented into OEM and Aftermarket. Regionally, the aircraft cabin interiors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Seating systems are forecast to occupy 32.4% of the market share in 2025 making them the largest product category. This dominance is being driven by their direct impact on cabin weight reduction through advanced composite frame designs and lightweight upholstery innovations. Passenger demand for enhanced ergonomics and inflight entertainment systems is also fueling upgrades that support ancillary revenue opportunities.

Airlines are prioritizing comfort while optimizing seat density in economy classes and differentiating their premium cabins. The modular design of modern seating solutions allows easier fleet retrofitting and future proofing through quick component swaps.

Collaboration among OEMs, seat manufacturers, and maintenance providers has resulted in faster certification pathways and cost effective deployment across global fleets mainly in narrow‑body and regional aircraft. These trends have reinforced seating systems as the central investment area within cabin interior upgrades.

Narrow body aircraft are expected to represent 44.7% of total cabin interiors revenue in 2025 positioning them as the top aircraft type. Their appeal is grounded in high flight frequency on short to medium haul routes combined with operational efficiency that match low cost carrier and hybrid carrier business models.

Cabin interior investments in narrow body fleets are being prioritized for lightweight materials, efficient seat layouts and modular galleys and lavatories that support reduced turnaround time and lower fuel burn. Their increasing use in point to point international operations has accelerated retrofitting cycles in emerging markets.

Airlines have formed strategic alliances with interior specialists and OEMs to optimize cabin supply chains and reduce downtime. These factors have collectively reinforced the status of narrow body aircraft as the primary focus for cabin upgrades.

The OEM end use segment is projected to hold 58.1% of the Aircraft Cabin Interiors market revenue in 2025 making it the leading adoption route. By integrating cabin systems at the production line, OEMs benefit from streamlined certification and reduced part count which lowers overall aircraft weight.

Cabin interiors are increasingly being bundled with aircraft purchase packages allowing airlines to customize comfort, connectivity and branding features prior to delivery. OEM engagements with seat and cabin component suppliers are enabling enhanced logistics, just in time installation and lifecycle management.

Cost efficiencies from integrated manufacturing processes and economies of scale are leading airlines to commit to OEM fitted cabins rather than aftermarket retrofits. This trend is amplified by the demand for factory standard interiors that support predictive maintenance and enhanced passenger experience from day one.

The aircraft cabin interiors market is expanding due to rising consumer demand for enhanced in-flight comfort, entertainment, and convenience. As airlines and manufacturers focus on improving the passenger experience, innovations in seating, lighting, and entertainment systems are gaining traction. The increasing need for efficient and ergonomic designs to meet the diverse requirements of passengers and the airline industry is driving market growth. Although challenges such as high costs, complex certification processes, and maintenance concerns exist, there are significant opportunities in sustainable materials and smart technology integration to optimize cabin space and performance.

The growth of the aircraft cabin interiors market is driven by the increasing demand for better passenger comfort, convenience, and entertainment during flights. As airlines and aircraft manufacturers strive to differentiate their services and provide a superior in-flight experience, they are investing in high-quality, ergonomic, and technologically advanced cabin interiors. This includes innovations in seating arrangements, lighting systems, and on-board entertainment options to cater to the growing expectations of modern passengers. Furthermore, the demand for more spacious and comfortable cabins in premium classes, along with efficient use of space in economy class, is contributing to the market’s growth.

A significant challenge in the aircraft cabin interiors market is the high cost of advanced materials, design, and customization. While the demand for premium cabin interiors and innovative designs is increasing, the costs of materials such as high-quality seating, advanced lighting, and in-flight entertainment systems remain high. The aircraft interiors must comply with stringent safety regulations and certification processes set by aviation authorities. Meeting these regulatory standards, which include fire resistance, durability, and weight limits, adds complexity and delays to product development and design processes. These factors can increase the overall cost of aircraft cabin interior modifications, especially for smaller airlines.

The aircraft cabin interiors market presents significant opportunities through advancements in smart technologies and eco-friendly materials. Smart cabin systems that incorporate IoT, real-time data analytics, and AI-driven features, such as personalized lighting and seating adjustments, are increasingly being integrated into aircraft cabins to improve passenger experience and operational efficiency.The rising demand for environmentally friendly materials, such as lightweight composites and biodegradable textiles, presents opportunities for manufacturers to create cabins that are both comfortable and energy-efficient. As airlines and aircraft manufacturers focus on reducing their carbon footprint, these technologies and materials provide avenues for growth and innovation in the market.

A key trend in the aircraft cabin interiors market is the increasing demand for customizable and flexible cabin designs. Passengers now expect more personalized in-flight experiences, prompting airlines to offer more adaptable cabin configurations that can be modified based on passenger needs or flight duration. This includes customizable seating arrangements, modular layouts, and versatile lighting systems that can be adjusted for different moods and activities. Airlines are looking for designs that maximize cabin space, particularly in economy class, by integrating multi-functional features such as storage compartments and reclining mechanisms. As airlines and manufacturers work to meet these evolving demands, modular and customizable cabin interiors are becoming a prominent trend in the market.

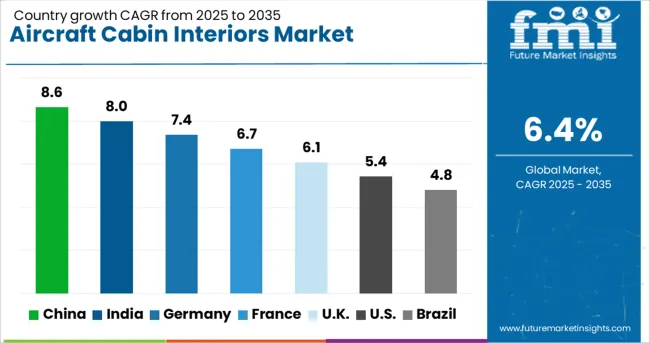

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

The aircraft cabin interiors market is projected to grow at a global CAGR of 6.4% from 2025 to 2035. China leads the market at 8.6%, followed by India at 8.0%, and France at 6.7%. The United Kingdom is expected to grow at 6.1%, while the United States is projected to grow at 5.4%. The strong growth in China and India is driven by the rapid expansion of the airline industry, increasing air travel demand, and growing investments in modernizing aircraft interiors. In OECD countries like France, the UK, and the USA, steady growth is supported by the rising demand for premium cabin experiences, innovative interior designs, and passenger comfort enhancements. The analysis spans 40+ countries, with the leading markets shown below.

China is projected to grow at a CAGR of 8.6% through 2035, leading the aircraft cabin interiors market. This growth is fueled by China’s rapid expansion in the aviation industry, with an increasing number of air passengers and a rising demand for modernized aircraft cabins. Chinese airlines are investing heavily in new aircraft and cabin refurbishments, offering enhanced passenger comfort and premium services. The growing middle class and the increasing number of international flights have significantly boosted demand for advanced cabin interiors. As China strengthens its position as a global aviation hub, the need for innovative, comfortable, and efficient cabin designs will continue to drive the market forward.

India is projected to grow at a CAGR of 8.0% through 2035, driven by the rapid growth of the aviation sector and increasing demand for upgraded passenger experiences. As more Indian airlines expand their fleets, there is a growing demand for advanced cabin interiors. Modernization initiatives in existing aircraft are further contributing to this market's expansion, with a strong focus on enhancing passenger comfort and providing premium in-flight experiences. With increasing disposable income and the growing middle class in India, passengers are demanding more comfort and luxury, accelerating the adoption of advanced cabin interior solutions.

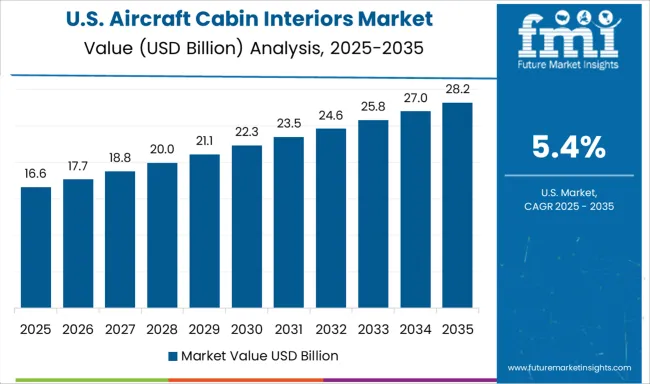

The United States is projected to grow at a CAGR of 5.4% through 2035, with demand for aircraft cabin interiors driven by rising air travel, a focus on improving passenger comfort, and growing investments in the refurbishment of older fleets. USA-based airlines are at the forefront of adopting premium cabin experiences, such as luxury seating, spacious interiors, and state-of-the-art entertainment systems. Airlines are increasingly focusing on eco-friendly materials and designs to improve the overall passenger experience. The adoption of new technologies and innovations in cabin interior design continues to grow, making air travel more comfortable and enjoyable for passengers.

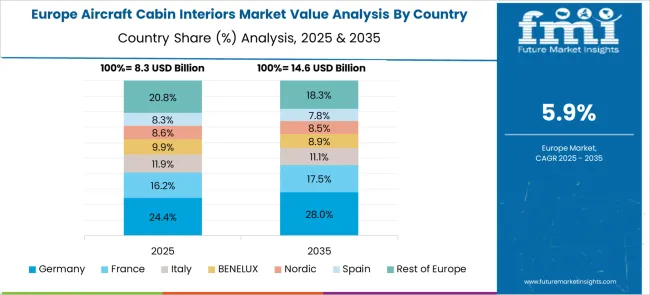

Germany is projected to grow at a CAGR of 6.7% through 2035, supported by the country’s position as a leader in the global aviation industry. As airlines increasingly prioritize passenger comfort, the demand for advanced aircraft cabin interiors is on the rise. Germany’s strong presence in the aerospace and aviation manufacturing sectors has encouraged significant investments in cabin interior innovations, from luxury seating and lighting to state-of-the-art entertainment systems. Additionally, the country’s focus on offering eco-friendly and energy-efficient cabin designs further drives demand for modern cabin interior solutions, meeting both passenger needs and regulatory requirements.

The United Kingdom is projected to grow at a CAGR of 6.1% through 2035, driven by rising air passenger demand and growing investment in aircraft upgrades. Airlines in the UK are focusing on providing an enhanced passenger experience through better cabin interiors, with a special emphasis on premium seating and in-flight entertainment. The growing demand for more comfortable and luxurious travel experiences continues to boost the market. Furthermore, the UK aviation industry is increasingly incorporating technological advancements, such as smart cabin systems and eco-friendly materials, into the designs of new aircraft and during fleet refurbishments.

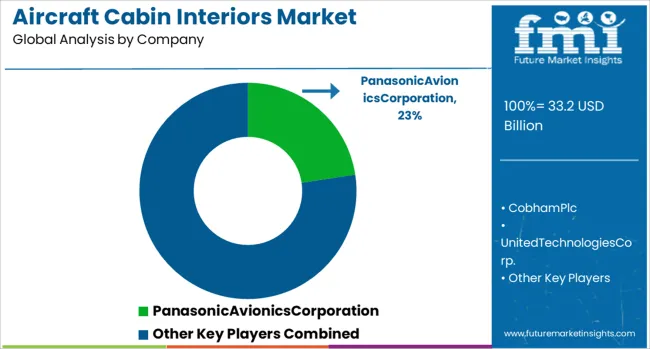

The aircraft cabin interiors market is driven by leading companies offering innovative solutions for passenger comfort, safety, and entertainment. Panasonic Avionics Corporation is a dominant player, providing advanced in-flight entertainment (IFE) systems, connectivity solutions, and cabin management systems that enhance passenger experience and airline efficiency. United Technologies Corporation (now part of Raytheon Technologies) is a significant player, offering a wide range of cabin interior solutions, including environmental control systems, seating, and safety equipment, all aimed at improving the overall passenger experience.

Zodiac Aerospace, now Safran, is known for its broad portfolio of aircraft cabin products, including seats, galleys, and in-flight entertainment systems, with a focus on innovation in design and passenger comfort. Diehl Stiftung & Co. KG offers advanced aircraft cabin solutions, including cabin lighting systems, modular seating, and integrated in-flight entertainment solutions, enhancing both passenger comfort and operational efficiency. The company is well-regarded for its contributions to the customization of cabin interiors for various aircraft models and configurations. Competitive differentiation in this market is driven by product quality, innovation in design, passenger comfort, and the ability to provide modular, customizable solutions for airlines. Barriers to entry include high capital investment, technological complexity, and strict regulatory standards. Strategic priorities include improving cabin space utilization, enhancing passenger experience with digital and connected technologies, and developing environmentally friendly solutions to meet sustainability goals in aviation.

Recent Development

| Item | Value |

|---|---|

| Quantitative Units | USD 33.2 Billion |

| Product | Seating Systems, Cabin Lighting, In-flight Entertainment and Connectivity (IFEC), Galleys, Lavatories, and Others |

| Aircraft Type | Narrow-body Aircraft (NBA), Wide-body Aircraft (WBA), Regional Jets, and Business Jets |

| End-Use | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | PanasonicAvionicsCorporation, CobhamPlc, UnitedTechnologiesCorp., ZodiacAerospace(Safran), and DiehlStiftung&Co.KG |

| Additional Attributes | Dollar sales by product type (seats, lighting systems, in-flight entertainment, galleys, lavatories) and end-use segments (commercial aircraft, private jets, government/military aircraft). Demand dynamics are driven by increasing passenger expectations for comfort, airlines' need for cost-efficient, high-performance cabin solutions, and regulatory mandates for safety and comfort. Regional trends show strong growth in North America and Europe, with increasing demand in Asia-Pacific driven by expanding air travel and the rise of low-cost carriers. |

The global aircraft cabin interiors market is estimated to be valued at USD 33.2 billion in 2025.

The market size for the aircraft cabin interiors market is projected to reach USD 61.7 billion by 2035.

The aircraft cabin interiors market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in aircraft cabin interiors market are seating systems, cabin lighting, in-flight entertainment and connectivity (ifec), galleys, lavatories and others.

In terms of aircraft type, narrow-body aircraft (nba) segment to command 44.7% share in the aircraft cabin interiors market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA