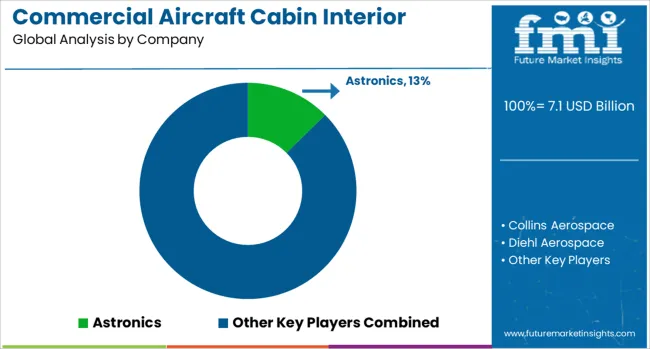

The Commercial Aircraft Cabin Interior Market is estimated to be valued at USD 7.1 billion in 2025 and is projected to reach USD 15.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Commercial Aircraft Cabin Interior Market Estimated Value in (2025 E) | USD 7.1 billion |

| Commercial Aircraft Cabin Interior Market Forecast Value in (2035 F) | USD 15.1 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The commercial aircraft cabin interior market is undergoing strong expansion, fueled by increasing air passenger traffic, modernization of aircraft fleets, and heightened emphasis on passenger comfort and safety. Airlines are actively investing in upgrading cabin aesthetics, ergonomics, and functional features to enhance in-flight experience and brand differentiation.

The trend toward lightweight and modular interiors is further accelerating demand for innovative cabin solutions that optimize fuel efficiency and maintenance turnaround times. Additionally, regulatory standards on fire safety, emissions, and crashworthiness are prompting manufacturers to develop advanced materials and smarter interior components.

As narrow-body aircraft dominate short-haul operations and low-cost carriers expand their global footprint, the need for high-performance, space-efficient cabin interiors continues to grow. The future outlook remains positive, with interior customization, digital integration, and sustainability expected to be central to product development and market competitiveness.

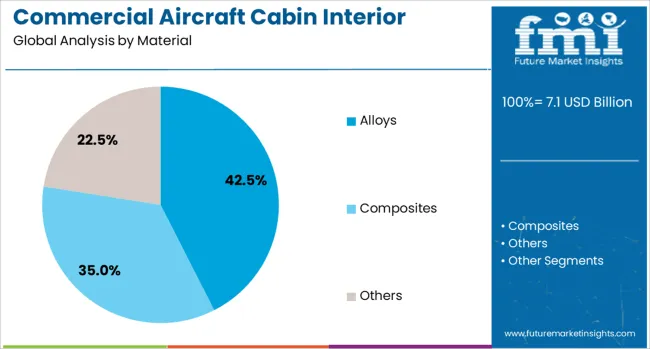

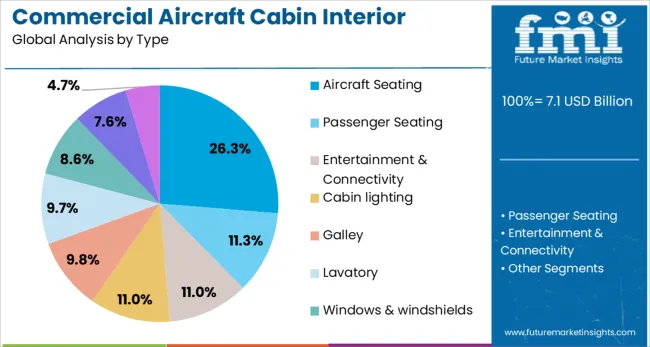

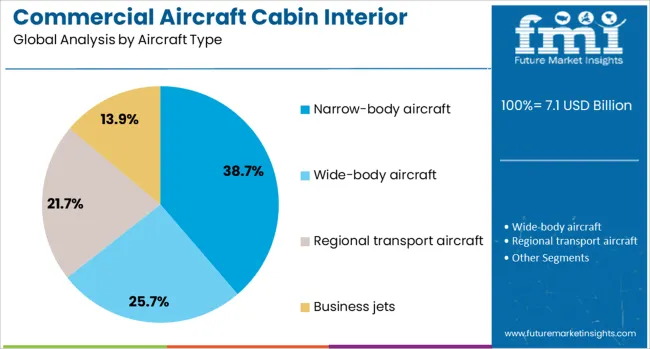

The commercial aircraft cabin interior market is segmented by material, type, and aircraft type and geographic regions. By material of the commercial aircraft cabin interior market is divided into Alloys, Composites, and Others. In terms of type of the commercial aircraft cabin interior market is classified into Aircraft Seating, Passenger Seating, Entertainment & Connectivity, Cabin lighting, Galley, Lavatory, Windows & windshields, Stowage Bins, and Interior Panels. Based on aircraft type of the commercial aircraft cabin interior market is segmented into Narrow-body aircraft, Wide-body aircraft, Regional transport aircraft, and Business jets. Regionally, the commercial aircraft cabin interior industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The alloys segment accounts for 42.5% of the material category in the commercial aircraft cabin interior market, reflecting its widespread adoption due to favorable strength-to-weight ratio, durability, and compliance with aviation safety regulations. Alloys, especially aluminum-based variants, are extensively used in structural and non-structural interior components including seat frames, galley fittings, and paneling systems.

The material’s corrosion resistance and machinability make it ideal for high-usage zones within aircraft cabins. Airlines and OEMs prioritize alloys for their cost-efficiency and lifecycle performance, particularly in retrofit programs and high-frequency aircraft. The demand for lightweight interiors that do not compromise mechanical integrity continues to support the dominance of this segment.

As aircraft manufacturers seek further fuel efficiency gains and cabin optimization, innovation in advanced alloy compositions is expected to drive sustained adoption across commercial fleets.

Aircraft seating leads the type category with a 26.3% market share, driven by its central role in influencing passenger comfort, cabin configuration, and airline revenue strategies. Seating components are subject to stringent regulatory, ergonomic, and weight standards, prompting continuous innovation in design and material use.

Airlines are increasingly opting for thinner, lighter, and more customizable seat structures to maximize passenger capacity without sacrificing comfort, especially in narrow-body and low-cost carrier fleets. The integration of in-seat entertainment, charging ports, and adjustable features further adds to the complexity and value of aircraft seating systems.

This segment is expected to witness sustained growth as premium economy layouts and long-haul comfort packages gain popularity. Continued advancements in seating ergonomics, modularity, and lightweight materials will be critical in maintaining this segment’s relevance amid evolving passenger expectations and airline business models.

The narrow-body aircraft segment holds a commanding 38.7% share within the aircraft type category, reflecting its dominance in global short- to medium-haul travel routes. These aircraft are heavily utilized by low-cost carriers and regional operators, making cabin interior efficiency and durability critical for operational profitability.

Cabin interiors in narrow-body fleets are increasingly being optimized for maximum seating capacity, weight reduction, and turnaround speed, driving demand for simplified yet robust interior components. Airlines prioritize cost-effective refurbishment and fast maintenance solutions, further enhancing market traction in this segment.

As global air traffic recovery favors domestic and regional routes, narrow-body aircraft remain the backbone of airline operations, fueling continuous investment in interior upgrades. The segment is poised for continued growth, supported by rising deliveries of next-generation models and strong aftermarket demand for cabin retrofits and enhancements.

Airlines are focusing on passenger comfort through ergonomic seating, modular layouts, and premium amenities while adopting lightweight materials for efficiency. Strict safety regulations and retrofitting initiatives are driving demand for fire-resistant materials, modular components, and operationally optimized cabin interiors.

Airlines have been prioritizing enhanced cabin comfort to improve passenger satisfaction and loyalty. Investments in ergonomic seating, noise-reduction materials, and customizable lighting have been accelerated to create a premium travel experience. The rise of long-haul travel has amplified the demand for upgraded in-flight amenities such as advanced entertainment systems, wireless connectivity, and modular seating solutions that allow reconfiguration for different classes. Lightweight and durable materials have been increasingly adopted to ensure fuel efficiency without compromising structural integrity. Premium economy and business class segments have been expanded, influencing interior design strategies toward space optimization and added privacy options. These trends reflect the competitive differentiation strategies pursued by carriers to attract frequent flyers and high-yield customers

Stringent aviation safety regulations have continued to shape interior design and material selection, pushing manufacturers to adopt fire-resistant materials, low-toxicity composites, and advanced certification processes. Airlines have been under pressure to meet evolving standards while minimizing maintenance costs, leading to a preference for modular and easily replaceable components. Enhanced overhead bin capacity and optimized galley configurations have been incorporated to improve operational efficiency during boarding and service processes. Cabin interior retrofitting programs have gained traction as operators extend aircraft service life and adapt existing fleets to new branding requirements. These developments have created steady opportunities for OEMs and aftermarket suppliers, particularly in seat refurbishments, lavatory redesigns, and premium cabin upgrades tailored for evolving passenger expectations.

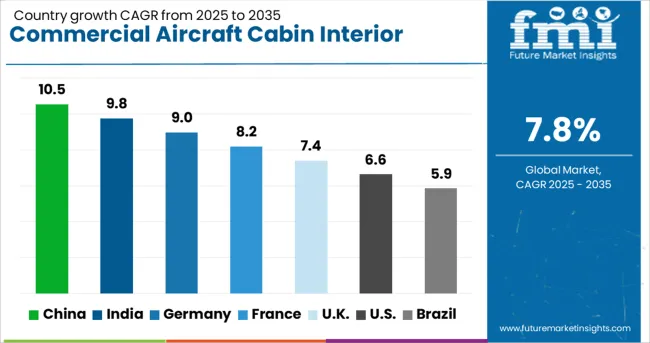

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

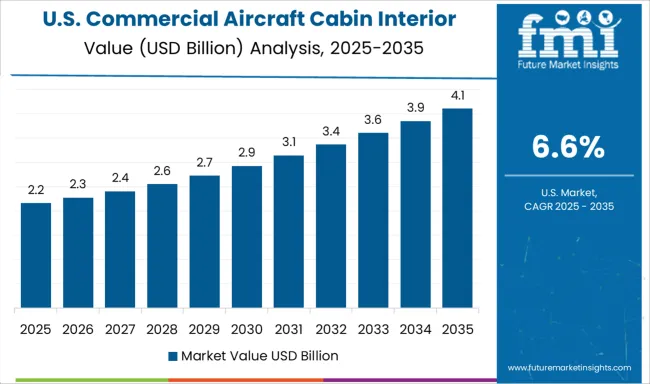

| USA | 6.6% |

| Brazil | 5.9% |

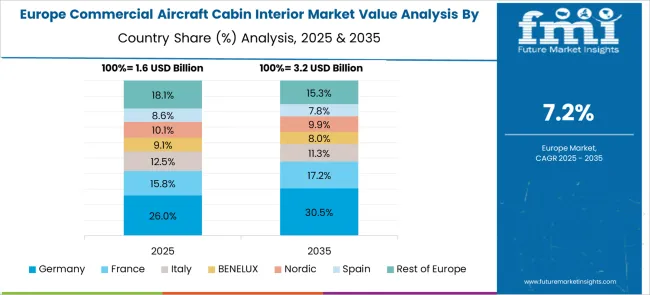

The commercial aircraft cabin interior market, projected to grow at a global CAGR of 7.8% from 2025 to 2035, shows strong variation in growth across leading economies. China leads with a CAGR of 10.5%, fueled by rapid fleet expansion, rising domestic air travel demand, and localization of cabin component manufacturing. India follows at 9.8%, driven by low-cost carrier dominance, modernization programs, and partnerships with global OEMs for interior upgrades. Germany records 9.0%, supported by technological leadership in premium cabin design, compliance with EASA standards, and a strong presence of aerospace supply chains. The UK posts 7.4%, benefiting from lightweight material adoption and refurbishment contracts, though tempered by Brexit-related supply challenges. The USA sees a 6.6% CAGR, driven by retrofit demand in existing fleets, focus on passenger comfort innovations, and replacement cycles for aging interiors. BRICS nations lead in volume-driven demand and fleet additions, while OECD economies emphasize advanced design, certification compliance, and integration of smart cabin technologies. The report covers in-depth analysis across 40+ countries, with five key markets summarized as reference points.

The CAGR for the UK Commercial Aircraft Cabin Interior Market during 2020-2024 is estimated at 5.9%, compared to the projected 7.4% for 2025–2035. The rise from 5.9% to 7.4% reflects the shift toward premium cabin configurations, retrofitting programs, and the adoption of lightweight composites in fleet upgrades. The demand surge is driven by recovery in long-haul travel, airline focus on passenger experience, and improved financing for cabin modernization. Competitive bidding for major airline contracts and integration of in-flight connectivity solutions added momentum. Supply chain localization initiatives further accelerated procurement cycles, supporting the double-digit order backlog in the UK.

The US market registered a CAGR of 5.2% in 2020-2024 and is forecasted to grow at 6.6% through 2025-2035, signaling a moderate recovery pattern. The increase stems from strategic fleet modernization, with emphasis on enhancing premium economy and first-class seating for high-yield routes. Airlines prioritized retrofits to meet FAA comfort standards and expand wireless entertainment options, influencing procurement of advanced seating and galley systems. Growth was constrained by supply chain volatility and deferred capex during 2020–2023, but improved post-2024 due to renewed air travel confidence and federal funding for aviation modernization initiatives.

Germany posted a CAGR of 6.8% during 2020–2024, rising to 9.0% in the 2025-2035 projection period. The growth jump is linked to OEM-driven investment in premium seating technology and sustainability-certified materials for Lufthansa and other European carriers. Demand consolidation occurred through airline alliances that adopted harmonized cabin standards. Retrofit demand for A320 and A350 families spiked as operators focused on weight reduction and fuel efficiency goals. Supply chain resilience improved with composite material plants in Bavaria and North Rhine-Westphalia scaling output for European programs.

China recorded a CAGR of 8.2% during 2020-2024 and is projected to escalate to 10.5% for 2025-2035, outpacing the global benchmark of 7.8%. Government-backed initiatives to expand domestic fleets, coupled with accelerated deliveries from COMAC, strengthened the market base. Interior system contracts surged with the localization of manufacturing under the Made in China 2025 program. Growth was influenced by rising demand for regional jets and extended-range narrow-body aircraft configured with high-density layouts. OEM partnerships with global suppliers ensured advanced cabin systems integration while maintaining pricing competitiveness for regional carriers.

India’s CAGR advanced from 8.7% during 2020–2024 to 9.8% in 2025-2035. This rise reflects increasing narrow-body fleet induction, driven by expanding domestic air traffic and regional connectivity schemes. Airlines focused on space-efficient seating and smart galleys to optimize operational economics. Import dependency during the early 2020s slowed upgrade cycles, but policy support for domestic aerospace clusters catalyzed cabin interior manufacturing capabilities from 2026 onward. Airlines’ preference for leasing rather than outright purchases also influenced retrofit demand across older aircraft. Emerging low-cost carriers adopted hybrid cabin configurations to balance capacity and passenger comfort.

In the commercial aircraft cabin interior market, leading players are focusing on passenger-centric designs, lightweight structures, and integrated connectivity systems to enhance travel experience and operational efficiency. Companies like Collins Aerospace, Safran, and Panasonic Avionics are spearheading developments in modular seating, advanced lighting systems, and in-flight entertainment solutions that align with evolving airline preferences for premium and economy classes. These firms are investing in digital upgrades and composite materials to ensure compliance with international safety norms while reducing overall maintenance costs. Emerging innovators such as Expliseat and Thompson Aero Seating are targeting niche applications like ultra-lightweight seating and bespoke premium cabin configurations. Firms like Gogo Business Aviation and Luminator Aerospace are strengthening in-flight connectivity and smart-cabin technologies, enabling real-time performance monitoring and improved passenger engagement. Partnerships between OEMs and interior solution providers are driving a wave of retrofitting programs across major airline fleets globally.

In April 2025, Astronics launched the SkyShow Server, a new in-cabin moving map platform supporting 4K visuals, designed for seamless retrofit and linefit integration.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.1 Billion |

| Material | Alloys, Composites, and Others |

| Type | Aircraft Seating, Passenger Seating, Entertainment & Connectivity, Cabin lighting, Galley, Lavatory, Windows & windshields, Stowage Bins, and Interior Panels |

| Aircraft Type | Narrow-body aircraft, Wide-body aircraft, Regional transport aircraft, and Business jets |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Astronics, Collins Aerospace, Diehl Aerospace, Expliseat, FACC, Gogo Business Aviation, Jamco, Luminator Aerospace, Panasonic Avionics, Recaro, Safran, Schott, STG Aerospace, Thales, and Thompson Aero Seating |

| Additional Attributes | Dollar sales, share, regional demand patterns, OEM vs aftermarket contribution, material preferences, retrofit growth rates, regulatory compliance costs, cabin class segmentation trends, and competitive positioning of key players to guide investment and product strategies. |

The global commercial aircraft cabin interior market is estimated to be valued at USD 7.1 billion in 2025.

The market size for the commercial aircraft cabin interior market is projected to reach USD 15.1 billion by 2035.

The commercial aircraft cabin interior market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in commercial aircraft cabin interior market are alloys, _aluminium alloy, _steel alloy, _others, composites, _carbon, _glass, _aramid (kevlar), _others and others.

In terms of type, aircraft seating segment to command 26.3% share in the commercial aircraft cabin interior market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA