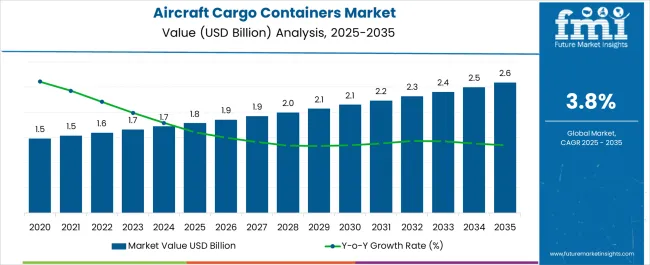

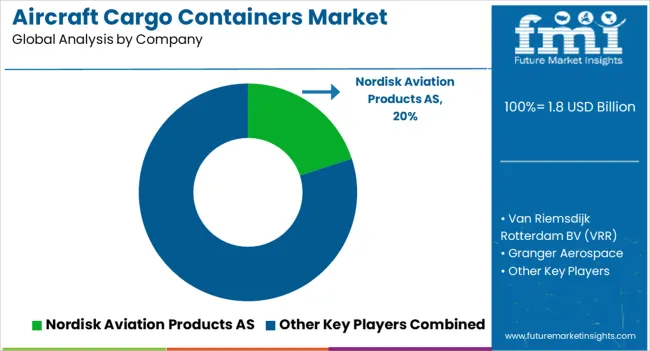

The Aircraft Cargo Containers Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

| Metric | Value |

|---|---|

| Aircraft Cargo Containers Market Estimated Value in (2025 E) | USD 1.8 billion |

| Aircraft Cargo Containers Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The Aircraft Cargo Containers market is experiencing robust expansion supported by the rapid growth in global air cargo volumes, rising e commerce penetration, and the increasing reliance on efficient aircraft cargo handling systems. The adoption of standardized containers is improving cargo security, streamlining logistics operations, and reducing turnaround times, which has strengthened their role in modern aviation.

Airlines and logistics operators are prioritizing lightweight, durable, and software monitored container systems that optimize load efficiency while complying with strict international aviation safety and environmental standards. As fleets expand to accommodate rising passenger and cargo traffic, container systems are being integrated with advanced materials and digital tracking capabilities.

Growing investment in aviation infrastructure and modernization of cargo facilities is also providing opportunities for wider container adoption The future outlook of the market is expected to remain favorable as both passenger and cargo aircraft fleets expand, supported by global trade recovery, rising demand for perishable goods transport, and the increasing need for faster and more reliable air freight services.

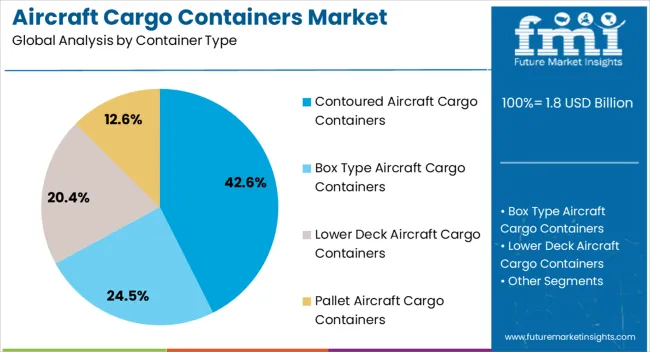

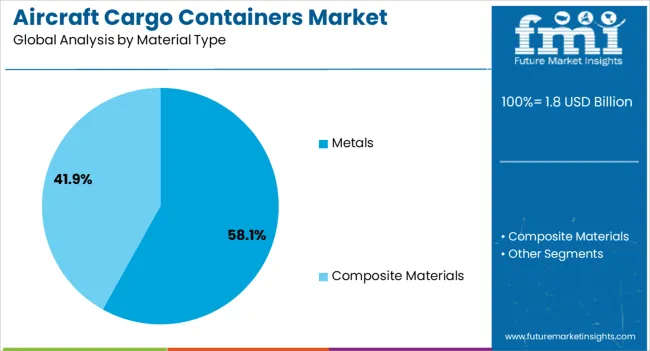

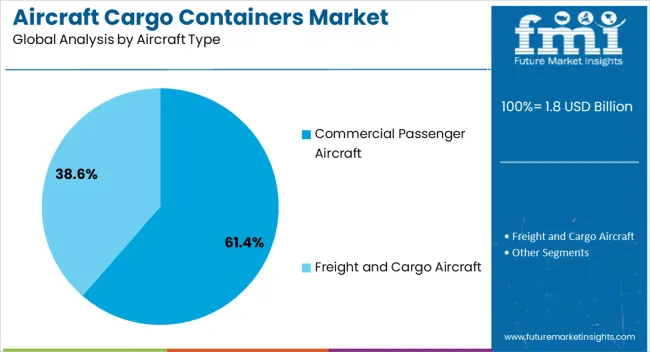

The aircraft cargo containers market is segmented by container type, material type, aircraft type, type, application, and geographic regions. By container type, aircraft cargo containers market is divided into Contoured Aircraft Cargo Containers, Box Type Aircraft Cargo Containers, Lower Deck Aircraft Cargo Containers, and Pallet Aircraft Cargo Containers. In terms of material type, aircraft cargo containers market is classified into Metals and Composite Materials. Based on aircraft type, aircraft cargo containers market is segmented into Commercial Passenger Aircraft and Freight and Cargo Aircraft. By type, aircraft cargo containers market is segmented into Non-refrigerated Aircraft Cargo Containers and Refrigerated Aircraft Cargo Containers. By application, aircraft cargo containers market is segmented into Lower and Cargo Deck and Upper Deck. Regionally, the aircraft cargo containers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Contoured Aircraft Cargo Containers segment is anticipated to hold 42.60% of the Aircraft Cargo Containers market revenue share in 2025, making it the leading container type. This growth is being attributed to the unique ability of contoured containers to maximize space utilization in aircraft lower deck compartments while maintaining structural strength and cargo security.

Airlines are adopting contoured containers widely because they allow optimal use of available cargo space in both widebody and narrowbody aircraft, thereby enhancing operational efficiency. Their design flexibility supports the carriage of diverse cargo, from general freight to temperature sensitive goods, without compromising safety standards.

The segment has further benefited from technological enhancements that make these containers lighter and more fuel efficient, which aligns with the industry’s focus on reducing operational costs and carbon emissions As aircraft utilization rates rise and operators focus on maximizing payload per flight, the demand for contoured cargo containers is expected to remain strong, reinforcing their dominant position in the market.

The Metals material type segment is projected to account for 58.10% of the Aircraft Cargo Containers market revenue share in 2025, positioning it as the largest material type. This leadership is being reinforced by the superior durability, strength, and proven safety profile of metal based containers, which continue to be widely used across global fleets. Metals such as aluminum alloys are preferred because they provide excellent resistance to impact, fire, and environmental stress while ensuring lightweight construction essential for aviation applications.

Airlines and cargo operators are prioritizing metal containers due to their longer service life, low maintenance requirements, and compliance with stringent aviation regulations. The material’s recyclability has also made it a sustainable option, aligning with the aviation industry’s growing focus on reducing environmental impact.

Despite the emergence of composite materials, the established reliability and cost effectiveness of metal containers have ensured their continued dominance With rising cargo traffic and the need for robust solutions, the metals segment is expected to retain its leadership over the forecast period.

The Commercial Passenger Aircraft segment is forecasted to capture 61.40% of the Aircraft Cargo Containers market revenue share in 2025, making it the leading aircraft type segment. This prominence is being driven by the increasing volume of cargo carried in the belly holds of passenger aircraft, which serve dual purposes of transporting passengers and freight. The growth of international air travel and rising passenger fleet expansion has significantly contributed to the use of cargo containers in these aircraft.

Airlines are leveraging cargo operations in passenger flights to generate additional revenue streams, particularly during fluctuating demand cycles, which has strengthened the role of containers in passenger fleets. The integration of advanced container systems in widebody passenger aircraft has supported efficient cargo management, while narrowbody aircraft are increasingly being utilized for regional cargo transport.

Enhanced global trade, coupled with growing demand for e commerce and perishable goods transportation, is expected to further drive the reliance on passenger aircraft belly cargo This segment’s dominant position is anticipated to persist as airlines continue optimizing fleet utilization for both passenger and cargo operations.

Aircraft Cargo Containers, a type of unit load device (ULD), are containers used for transport of cargo goods on aircrafts. Aircraft Cargo Containers simplify the transport of cargo by allowing different types of goods to be packed and kept into a single unit container.

Multiple such Aircraft Cargo Containers are used on commercial and cargo flights to load, transport and unload materials and products from one place to another. Aircraft Cargo Containers help cargo handlers across the entire chain, from origin to destination, to deal with large volumes of goods in an organized manner. Aircraft Cargo Containers thus help save time and efforts, improve efficiency of the process and ensure ease of process. Aircraft Cargo Containers also keep the goods being transported safe and protected from shocks, or falls during loading or unloading.

Aircraft Cargo Containers are expensive assets which require proper handling. Aircraft Cargo Containers can be made of metals, or other composite materials. Many manufacturers provide aircraft cargo containers with features that further improve ease of use, such as forklift pockets, cargo securing provisions, interior components such as shelves, compartments & drawers and drainage floor. Aircraft Cargo Containers are manufactured in a number of dimensions and specifications, with a general adherence to guidelines from international as well as regional aviation authorities. Standards for the design and manufacture of aircraft cargo containers are published by International Air Transport Association (IATA), and International Organization for Standardization (ISO), among others.

Considering these aspects of the Aircraft Cargo Containers, the study of the trends and forecasts of the Aircraft Cargo Containers market becomes an important read.

With increasing demand for international transport of goods and materials within small time-frames, demand for Aircraft Cargo Containers is expected to grow at a robust pace. The global industry air cargo industry has witnessed rapid growth in recent decades and currently operates as a key part of the international economy.

As per estimates of the International Air Transport Association, air cargo accounts for nearly 35% of the annual world merchandise movement and trade by value. The growth of digitalization, e-commerce solutions and exposure to global marketplace has led to increasing demand for air cargo transport, particularly for perishable products. At times, trade conflicts or natural calamities can also stimulate demand for Aircraft Cargo Containers. Recently, the gulf state of Qatar utilized air cargo services on a large scale to import goods from far away friendly countries, in view of a trade blockade imposed by its neighbors resulting from a diplomatic standoff.

Perishable food products and agricultural produce, along with medicines and some chemical products account for nearly one third of all the goods transported using air cargo. Thus the market for aircraft cargo containers will be driven by the growth in trade of these products. Also, manufacturers of aircraft cargo containers are focusing on providing lightweight and reliable containers as per demands of the air transport industry. Thus product innovation in terms of material, size and specification is a key trend in the market for Aircraft Cargo Containers.

The demand for Aircraft Cargo Containers is set to grow at a fast pace in the next five to ten years with increasing international trade, especially of perishable goods. Asia Pacific is expected to be a significant region for the Aircraft Cargo Containers market, as it is home to fast growing economies, many of whom are manufacturing driven, and form a key part of global product supply chains.

The use of temperature controlled Aircraft Cargo Containers, or refrigerated Aircraft Cargo Containers to transport fruits, vegetables, high value medicines etc. will also help drive market demand. Europe and North America continue to remain important markets for Aircraft Cargo Containers, with stable demand and high imports of various goods and materials, especially fresh food and agricultural products. China, India, US, Germany, UK, UAE are some of the key countries for the demand growth of Aircraft Cargo Containers market.

Examples of some of the market participants identified in the Aircraft Cargo Containers market include,

The research report on Aircraft Cargo Containers market presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application and industry.

The report on Aircraft Cargo Containers is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

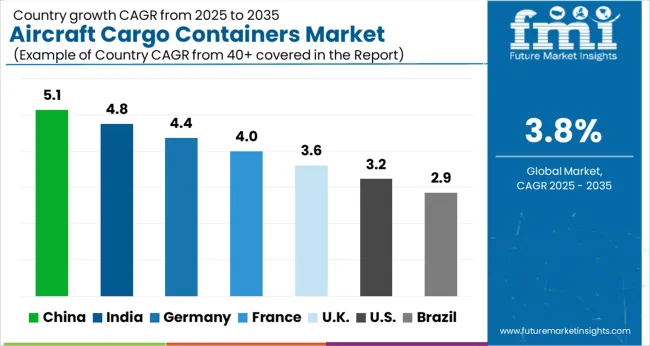

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

The Aircraft Cargo Containers Market is expected to register a CAGR of 3.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.1%, followed by India at 4.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 2.9%, yet still underscores a broadly positive trajectory for the global Aircraft Cargo Containers Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.4%. The USA Aircraft Cargo Containers Market is estimated to be valued at USD 668.6 million in 2025 and is anticipated to reach a valuation of USD 918.8 million by 2035. Sales are projected to rise at a CAGR of 3.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 82.2 million and USD 61.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Container Type | Contoured Aircraft Cargo Containers, Box Type Aircraft Cargo Containers, Lower Deck Aircraft Cargo Containers, and Pallet Aircraft Cargo Containers |

| Material Type | Metals and Composite Materials |

| Aircraft Type | Commercial Passenger Aircraft and Freight and Cargo Aircraft |

| Type | Non-refrigerated Aircraft Cargo Containers and Refrigerated Aircraft Cargo Containers |

| Application | Lower and Cargo Deck and Upper Deck |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nordisk Aviation Products AS, Van Riemsdijk Rotterdam BV (VRR), Granger Aerospace, Satco Inc, Zodiac AirCargo Equipment, Advanced Composite Structures, LLC (Cargo Composites), DokaSch GmbH, PalNet GmbH, Royal DSM N.V, and Air Cargo Containers LLC |

The global aircraft cargo containers market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the aircraft cargo containers market is projected to reach USD 2.6 billion by 2035.

The aircraft cargo containers market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in aircraft cargo containers market are contoured aircraft cargo containers, box type aircraft cargo containers, lower deck aircraft cargo containers and pallet aircraft cargo containers.

In terms of material type, metals segment to command 58.1% share in the aircraft cargo containers market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA