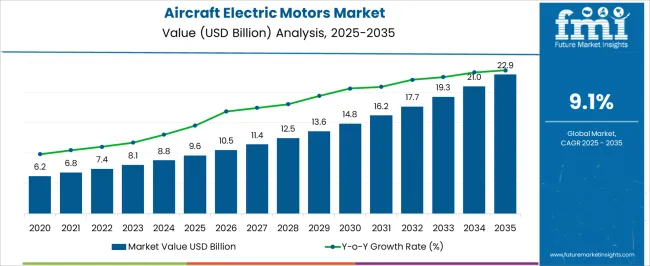

The aircraft electric motors market is estimated to be valued at USD 9.6 billion in 2025 and is projected to reach USD 22.9 billion by 2035, registering a compound annual growth rate (CAGR) of 9.1% over the forecast period.

The early stage of the curve from 2020 to 2025 shows expansion from USD 6.2 billion to USD 9.6 billion, driven by the shift toward hybrid propulsion systems and electric-driven actuators replacing hydraulic counterparts. Between 2026 and 2030, the trajectory becomes steeper, rising from USD 10.5 billion to USD 14.8 billion, capturing nearly 40% of the decade’s incremental gains. This reflects rising investment in regional electric aircraft projects, increased adoption of more electric aircraft architectures, and integration of high-performance motors with lightweight composite airframes.

The final phase from 2031 to 2035 takes the market from USD 16.2 billion to USD 22.9 billion, representing around 44% of the total growth, as full-scale commercial electric and hybrid-electric aircraft enter service and urban air mobility platforms incorporate advanced motor designs. The growth curve overall resembles an accelerating slope, starting moderately and intensifying into a steeper rise toward the forecast horizon, indicating momentum that gains pace as regulatory approval frameworks mature and commercial-scale adoption transforms the sector.

| Metric | Value |

|---|---|

| Aircraft Electric Motors Market Estimated Value in (2025 E) | USD 9.6 billion |

| Aircraft Electric Motors Market Forecast Value in (2035 F) | USD 22.9 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

The aircraft electric motors market occupies a significant position within the broader aerospace propulsion and systems domain, accounting for nearly 22–24% share of the overall aircraft electrification segment. This highlights the growing importance of electric propulsion systems in enabling fuel efficiency, reduced emissions, and quieter operations. Within the aircraft systems integration category, electric motors hold about 15–17% share, driven by their adoption in actuation systems, landing gear, and flight control mechanisms that traditionally relied on hydraulic or pneumatic solutions. In the electric and hybrid aircraft development sector, their share stands at approximately 18–20%, as they play a crucial role in powering auxiliary systems and supporting distributed propulsion designs. The defense and military aviation segment accounts for nearly 12–14% share, reflecting the shift toward lighter, more efficient electric-driven systems in unmanned aerial vehicles (UAVs) and next-generation aircraft platforms. Additionally, in the maintenance, repair, and overhaul (MRO) market, electric motors contribute about 8–10% share, owing to their reliability and extended lifecycle benefits compared to conventional systems. Growth is being propelled by rising demand for more efficient propulsion, advancements in high-power-density motor designs, and supportive regulatory frameworks promoting greener aviation technologies. Aircraft OEMs and component manufacturers are investing heavily in research, strategic partnerships, and scalable production to meet the expanding adoption of electric motors across both commercial and military applications, cementing their role as a cornerstone of future aviation systems.

The aircraft electric motors market is experiencing accelerated growth as the aviation sector undergoes a shift towards electrification to meet sustainability, efficiency, and regulatory requirements. Rising environmental concerns and the global push for reduced carbon emissions have led to increased adoption of electric propulsion systems and auxiliary power units in both commercial and defense aviation. Technological advancements in power electronics, thermal management, and lightweight materials are enabling electric motors to deliver higher performance with reduced energy consumption.

The integration of electric motors in various aircraft systems is also enhancing operational efficiency, lowering maintenance costs, and improving reliability. With the growth of urban air mobility and electric vertical take-off and landing aircraft development, demand for advanced electric motor solutions is expected to surge further.

Supportive government policies, investments from aerospace manufacturers, and strategic collaborations across the supply chain are creating strong momentum for the market This trend is expected to continue as the industry moves toward greener and more efficient aviation solutions.

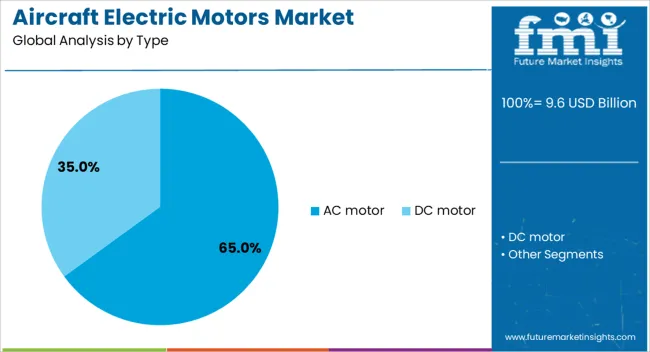

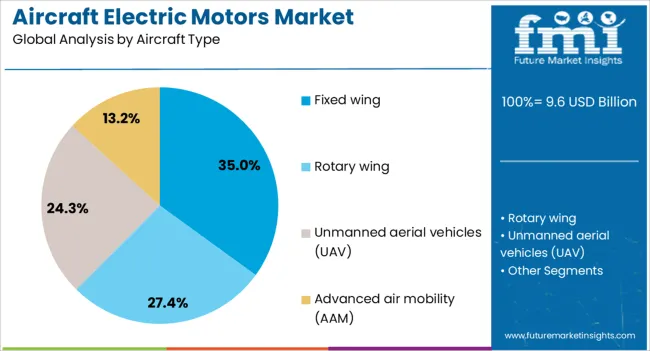

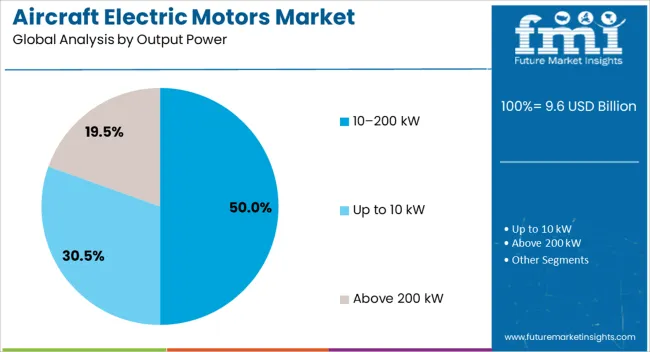

The aircraft electric motors market is segmented by type, aircraft type, output power, application, and geographic regions. By type, aircraft electric motors market is divided into AC motor and DC motor. In terms of aircraft type, aircraft electric motors market is classified into fixed wing, rotary wing, unmanned aerial vehicles (UAV), and advanced air mobility (AAM). Based on output power, aircraft electric motors market is segmented into 10–200 kW, Up to 10 kW, and Above 200 kW. By application, aircraft electric motors market is segmented into propulsion systems, flight control systems, environmental control systems, actuation systems, cabin interior systems, and others. Regionally, the aircraft electric motors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The AC motor type segment is projected to hold 65% of the market revenue share in 2025, making it the leading motor type. Growth in this segment has been driven by the ability of AC motors to deliver high efficiency, durability, and precise control, which are critical for various aircraft systems. Their capability to handle variable speeds and loads with minimal maintenance has made them suitable for propulsion, actuation, and auxiliary applications.

The compatibility of AC motors with advanced control systems and power electronics has enhanced their operational performance in modern aircraft. Additionally, improvements in motor winding design and insulation materials have increased efficiency while reducing weight, supporting fuel and energy savings.

The scalability of AC motor technology to meet diverse aircraft requirements has further strengthened its market dominance As aviation moves toward electrification, AC motors are expected to maintain their leading role due to their adaptability and proven reliability in high-demand aerospace environments.

The fixed wing aircraft type segment is estimated to account for 35% of the market revenue share in 2025, positioning it as a significant contributor. The segment’s growth is supported by the high adoption of electric motors in commercial airliners, business jets, and military aircraft. Electric motors are being increasingly used for flight control systems, environmental control units, and electric taxiing solutions in fixed wing platforms.

Enhanced efficiency, reduced mechanical complexity, and lower operational costs have contributed to the preference for electric solutions in this category. Ongoing advancements in battery technology and hybrid-electric propulsion systems are also enabling wider integration of electric motors in fixed wing designs.

The segment benefits from steady aircraft production rates, upgrades in existing fleets, and strong demand for next-generation, fuel-efficient aircraft As regulatory pressure for cleaner aviation intensifies, the role of electric motors in fixed wing applications is expected to expand further, reinforcing the segment’s market share.

The 10–200 kW output power segment is projected to hold 50% of the market revenue share in 2025, making it the dominant power category. This range has been recognized as the most suitable for a broad spectrum of aircraft applications, from propulsion in smaller aircraft to high-power auxiliary systems in larger platforms. The segment’s leadership is supported by its ability to balance power output with weight and efficiency requirements in aerospace operations.

Electric motors in this range provide sufficient thrust and torque while maintaining manageable thermal loads, which is essential for safe and reliable operation. The flexibility of the 10–200 kW range allows for its integration in both traditional fixed wing and emerging electric vertical take-off and landing aircraft.

Continuous improvements in motor efficiency, cooling systems, and lightweight construction have further solidified its dominance As demand for versatile, high-performance electric propulsion solutions grows, this power range is expected to remain at the forefront of market adoption.

Aircraft electric motors are gaining momentum across commercial, defense, and hybrid-electric aircraft sectors. With rising demand for efficiency and reliability, they are becoming integral to future aviation systems.

The adoption of aircraft electric motors is growing steadily as airlines and manufacturers emphasize efficiency, reliability, and performance improvements. Electric motors are increasingly being used to replace hydraulic and pneumatic systems, particularly in actuation, landing gear, and environmental control systems. Their ability to deliver lighter weight, greater precision, and lower maintenance has positioned them as a core enabler of next-generation aircraft design. Commercial aviation is witnessing heightened demand due to increasing air travel and fleet modernization, while hybrid-electric and electric aircraft programs further reinforce the role of electric motors. With governments promoting low-emission aviation and OEMs accelerating electrification programs, the market for aircraft electric motors is expanding at a faster pace.

Defense aviation is emerging as a significant consumer of aircraft electric motors, with demand driven by lightweight, compact, and durable designs suited for high-performance applications. Military aircraft are adopting electric motors for improved actuation systems, auxiliary power units, and energy-efficient subsystems that ensure higher reliability during critical missions. The rise in unmanned aerial vehicles (UAVs) has created a new growth avenue, as UAVs rely extensively on high-power-density motors for propulsion and control systems. Governments are expanding defense budgets to strengthen air capabilities, further accelerating procurement of advanced motors. The emphasis on longer endurance, reduced noise, and increased payload capacity in UAV platforms also boosts motor development.

Hybrid and fully electric aircraft development has intensified the demand for high-performance electric motors. These motors are central to distributed propulsion systems, energy storage integration, and next-generation regional mobility aircraft. Electric motors enable lower operating costs and higher efficiency, making them attractive to operators exploring alternative propulsion methods. Growth is supported by regulatory encouragement for reducing aviation emissions and by partnerships between OEMs, motor manufacturers, and energy solution providers. Regional and urban air mobility platforms, particularly electric vertical take-off and landing (eVTOL) aircraft, are driving innovation in compact, lightweight motor systems. This segment is expected to be a transformative force, influencing future aerospace design priorities globally.

The aircraft electric motors market is shaped significantly by supply chain stability, production scalability, and cost optimization efforts. The development of high-efficiency motors requires specialized raw materials such as rare earth magnets, creating vulnerability to pricing fluctuations. Manufacturers are increasingly focusing on diversifying supply sources and investing in local production to mitigate risks. Cost competitiveness is also critical, as airlines and defense agencies demand reliable solutions without escalating lifecycle expenses. OEM collaborations, joint ventures, and technology-sharing agreements are being used to ensure steady production and wider availability. Continuous advancements in motor efficiency, reliability, and design scalability are ensuring long-term adoption despite these challenges.

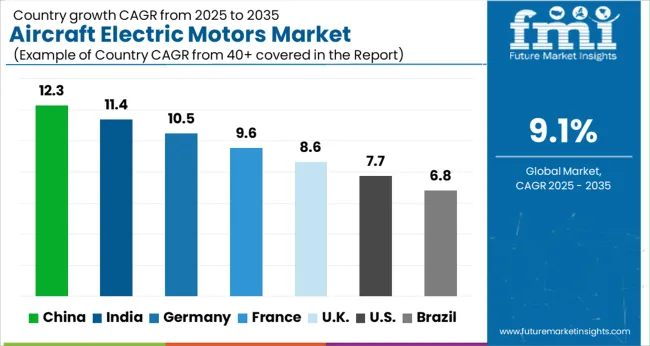

| Country | CAGR |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| France | 9.6% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

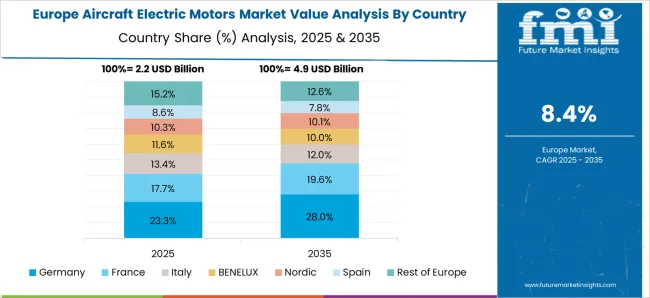

The aircraft electric motors market is projected to grow globally at a CAGR of 9.1% from 2025 to 2035, supported by growing demand for energy-efficient propulsion systems, hybrid-electric aircraft programs, and advancements in UAV technology. China leads with a CAGR of 12.3%, driven by its strong aerospace industry, significant investments in hybrid-electric aircraft, and increasing government-backed R&D in sustainable aviation technologies. India follows at 11.4%, influenced by rapid growth in aviation, urban air mobility programs, and the development of regional electric aircraft solutions. France records 9.6%, benefitting from large-scale aerospace projects and government policies to reduce aviation emissions. The United Kingdom grows at 8.6%, fueled by defense spending and the growing adoption of electric propulsion in urban air mobility platforms. The United States posts 7.7%, driven by rising electric aircraft development, military and commercial hybrid initiatives, and government funding for green aviation technologies. The analysis spans over 40 global markets, with these countries serving as benchmarks for investment strategies, technological advancements, and competitive positioning in the aircraft electric motors market.

China is projected to post a CAGR of 12.3% during 2025–2035, well above the global benchmark of 9.1%, supported by rapid adoption of electric propulsion technologies. During 2020–2024, CAGR stood at nearly 7.1%, driven by the initial integration of electric motors in auxiliary systems and limited pilot projects in hybrid aircraft. The subsequent rise reflects the government’s aggressive policies toward aviation electrification, investments in eVTOL platforms, and expansion of aerospace manufacturing clusters. Partnerships between domestic OEMs and international players are enhancing scalability, while rising passenger traffic is creating demand for energy-efficient aircraft. China is expected to remain the dominant hub for electric motor adoption in global aviation.

India is expected to record a CAGR of 11.4% between 2025–2035, exceeding the global average of 9.1%. In the earlier 2020–2024 phase, CAGR was about 6.5%, shaped by gradual modernization of the aviation industry and small-scale UAV programs. The leap in growth is attributed to government-backed regional connectivity programs, expansion of domestic aerospace manufacturing, and rapid investments in electric propulsion research. India’s focus on urban air mobility and UAVs for defense and civil purposes is strengthening demand. With growing collaboration between public and private entities, the Indian market is positioning itself as a rising center for aircraft electric motor deployment.

France is forecasted to grow at a CAGR of 9.6% during 2025–2035, compared to approximately 6.8% in 2020–2024. The early growth came from increased adoption in actuation systems and auxiliary applications within commercial aircraft. The improvement in later years reflects strong commitments by French aerospace leaders to electrify regional jets and expand hybrid propulsion platforms. Government funding and EU climate targets have provided additional stimulus, encouraging integration of electric motors in both defense and civilian projects. France’s aerospace ecosystem, backed by Airbus and major suppliers, continues to reinforce its strategic role in Europe’s push toward aviation electrification.

The United Kingdom is projected to post a CAGR of 8.6% during 2025–2035, up from nearly 5.9% in the 2020–2024 period, aligning closely with global momentum. Early growth was influenced by limited integration in civil aircraft and ongoing trials in hybrid propulsion systems. The increase reflects rising investments in defense aviation, government funding for green aviation programs, and accelerating interest in eVTOL aircraft. UK-based aerospace companies are investing in high-power-density electric motor technologies to support both domestic and export markets. The shift from moderate growth to a stronger trajectory highlights the country’s transition from experimental adoption to broader-scale deployment.

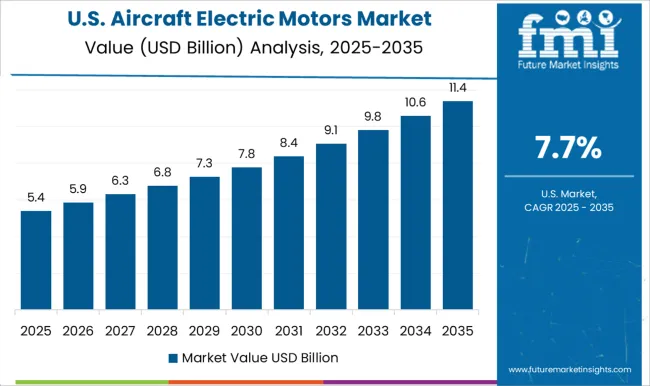

The United States is expected to post a CAGR of 7.7% during 2025–2035, up from about 5.2% in 2020–2024, driven by modernization of military fleets and advancements in hybrid-electric aircraft programs. The earlier growth was steady but modest, with adoption largely centered on auxiliary applications and UAV propulsion. The acceleration post-2025 is attributed to expanding defense contracts, NASA-supported electric aircraft initiatives, and the rising demand for regional hybrid-electric jets. Collaboration between aerospace OEMs, startups, and federal agencies is shaping a more competitive environment. Despite being slightly below global averages, the USA remains a leading innovation hub for electric aviation technologies.

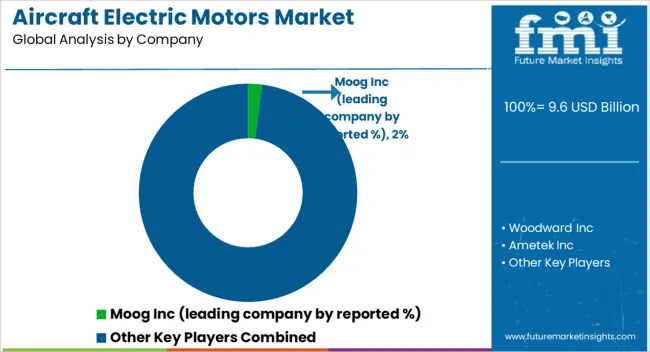

The aircraft electric motors market is defined by strong competition among established aerospace system integrators and specialized motor manufacturers, each focusing on efficiency, power density, and reliability to support both commercial and defense aviation. Moog Inc leads the market with its extensive portfolio of high-performance electric motors, positioning itself strongly in actuation systems, flight controls, and propulsion subsystems, supported by global aerospace contracts. Woodward Inc emphasizes precision motion control solutions, integrating electric motors into turbine and propulsion systems, with a reputation for reliability in both civil and military aviation. Ametek Inc provides a wide range of electric motors and electromechanical systems, catering to critical aerospace applications requiring lightweight and energy-efficient solutions. Rolls-Royce plc leverages its aerospace legacy to integrate electric propulsion motors into hybrid-electric and future all-electric aircraft programs, supported by significant R&D investment. Safran SA develops advanced motor systems with a focus on aircraft actuation, landing gear, and green propulsion technologies, benefiting from its wide aerospace portfolio. Kollmorgen contributes with specialized motors for aerospace and defense applications, emphasizing high torque density and durability. ElectroCraft Inc is recognized for compact, reliable electric motors suited for UAVs and auxiliary aircraft systems, while Maxon Motor AG provides precision-engineered miniature motors for avionics, actuation, and lightweight aviation applications. Other niche and regional players enhance competition by offering customized solutions for UAVs, experimental electric aircraft, and specific aerospace needs. Competitive strategies in this market focus on enhancing motor efficiency, reducing lifecycle costs, scaling hybrid-electric propulsion systems, and ensuring compliance with evolving aviation regulations. Partnerships with OEMs, investments in R&D for high-power-density solutions, and regional production capabilities remain central to maintaining leadership in the fast-evolving aircraft electrification landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.6 Billion |

| Type | AC motor and DC motor |

| Aircraft Type | Fixed wing, Rotary wing, Unmanned aerial vehicles (UAV), and Advanced air mobility (AAM) |

| Output Power | 10–200 kW, Up to 10 kW, and Above 200 kW |

| Application | Propulsion systems, Flight control systems, Environmental control systems, Actuation systems, Cabin interior systems, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Moog Inc (leading company by reported %), Woodward Inc, Ametek Inc, Rolls-Royce plc, Safran SA, Kollmorgen, ElectroCraft Inc, Maxon Motor AG, and Others |

| Additional Attributes | Dollar sales, share, demand in commercial, defense, and UAV sectors, propulsion trends, hybrid-electric adoption, regional growth hotspots, supply chain risks, pricing strategies, and competitive positioning. |

The global aircraft electric motors market is estimated to be valued at USD 9.6 billion in 2025.

The market size for the aircraft electric motors market is projected to reach USD 22.9 billion by 2035.

The aircraft electric motors market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in aircraft electric motors market are ac motor and dc motor.

In terms of aircraft type, fixed wing segment to command 35.0% share in the aircraft electric motors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Micro Turbine Engines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA