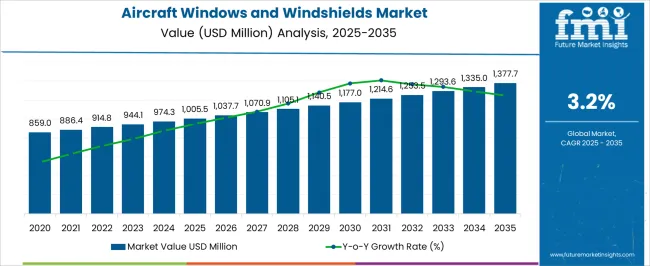

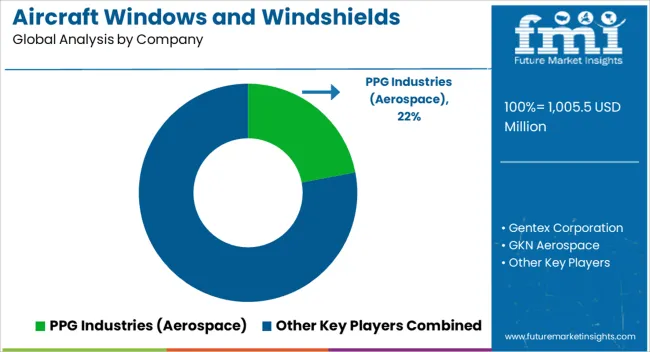

The aircraft windows and windshields market is estimated to be valued at USD 1005.5 million in 2025 and is projected to reach USD 1377.7 million by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

The gradual increase in market value over the forecast period reflects incremental adoption of advanced glazing technologies, composite laminates, and enhanced coatings designed to improve optical clarity, impact resistance, and environmental performance in commercial and military aircraft. Contribution analysis by technology indicates that laminated glass and acrylic-based windows constitute the foundational segment, offering high reliability and cost efficiency, and capturing the majority of the market share initially. Over the decade, polycarbonate and hybrid composite glazing technologies are expected to gain relevance due to their lightweight characteristics, superior impact tolerance, and integration with anti-fog, UV-resistant, and electromagnetic shielding layers.

Incremental contributions from smart glazing technologies, including electrochromic and variable opacity solutions, are anticipated in premium and next-generation aircraft, although their adoption is limited by higher costs and certification requirements. The growth trajectory is primarily influenced by technological upgrades, retrofitting cycles, and regulatory mandates for passenger safety and energy efficiency. The traditional laminated and acrylic technologies maintain a dominant contribution, while advanced composite and smart glazing technologies increasingly supplement the market, shaping future technology-driven value.

| Metric | Value |

|---|---|

| Aircraft Windows and Windshields Market Estimated Value in (2025 E) | USD 1005.5 million |

| Aircraft Windows and Windshields Market Forecast Value in (2035 F) | USD 1377.7 million |

| Forecast CAGR (2025 to 2035) | 3.2% |

The aircraft windows and windshields market is considered a critical subsegment of aerospace manufacturing with direct influence on safety, visibility, and passenger comfort. It is estimated to hold 2.7% of the aircraft components and parts market, reflecting the precision engineering and durability required. Within aerospace materials, a 1.9% share is assessed, driven by use of advanced composites, laminates, and polycarbonate solutions. The aviation maintenance repair and overhaul sector sees a 1.2% contribution, largely from replacement cycles. In commercial aviation equipment, the market holds a 2.1% share, while in defense aircraft systems it accounts for 0.9%, given specialized requirements.

Recent industry trends in this market have been shaped by the growing emphasis on lightweight, durable, and impact resistant materials. Key breakthroughs include the integration of electrochromic smart windows for adjustable transparency and glare reduction. Leading companies have also advanced bird strike resistant laminates and coatings that improve UV and thermal management. Strategic moves have involved collaborations between glass manufacturers and aerospace OEMs to develop multi-layer structures with higher fatigue resistance. Efforts are also being directed toward improving maintenance efficiency through modular windshield designs. These ground breaking strategies highlight how innovation continues to strengthen reliability, safety, and operational efficiency in aviation.

The market is experiencing strong growth as aviation manufacturers and operators prioritize passenger comfort, safety, and operational efficiency. Advancements in material technology, including the use of lightweight and impact-resistant composites, are enabling windows and windshields to meet stringent regulatory standards while contributing to overall fuel efficiency. Increasing global air traffic, driven by both commercial and business aviation, has led to higher demand for aircraft production and subsequent procurement of advanced window and windshield systems.

Technological improvements in coating and lamination processes are enhancing optical clarity, UV protection, and resistance to environmental stresses, further boosting adoption rates. Additionally, the rising focus on cabin aesthetics and passenger experience is influencing aircraft designs that integrate larger and more durable windows.

The growing investments in fleet modernization and the replacement of aging aircraft are expected to provide sustained growth opportunities As aerospace OEMs continue to innovate, the market is anticipated to benefit from long-term demand across multiple aircraft categories and regions.

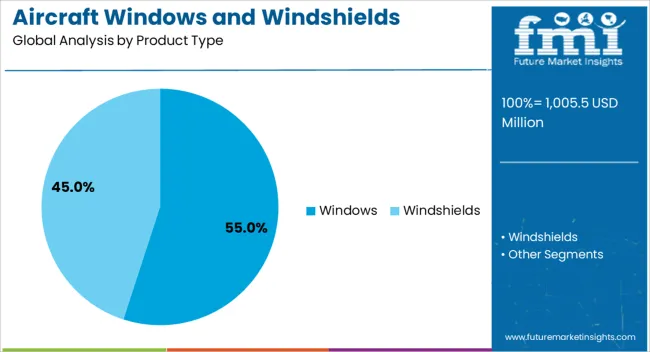

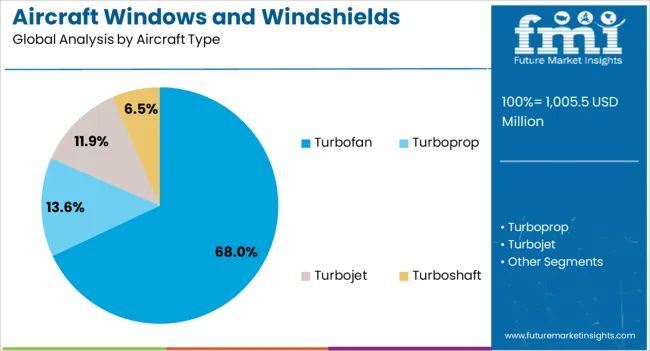

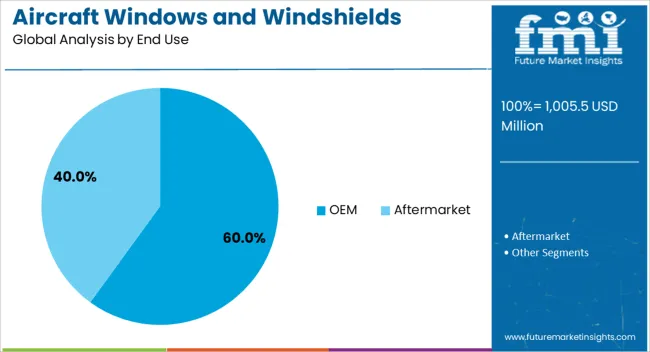

The aircraft windows and windshields market is segmented by product type, aircraft type, end use, and geographic regions. By product type, aircraft windows and windshields market is divided into windows and windshields. In terms of aircraft type, aircraft windows and windshields market is classified into turbofan, turboprop, turbojet, and turboshaft. Based on end use, aircraft windows and windshields market is segmented into OEM and aftermarket. Regionally, the aircraft windows and windshields industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The windows segment is projected to hold 55% of the aircraft windows and windshields market revenue share in 2025, making it the leading product type. Growth in this segment has been supported by rising demand for enhanced passenger visibility and cabin ambiance, which has led to the development of larger, structurally advanced window designs. The use of lightweight, high-strength materials has allowed manufacturers to produce windows that meet stringent safety standards while contributing to improved aircraft fuel efficiency. The segment has further benefited from advances in electrochromic and UV-filtering technologies, enabling customizable light transmission and improved passenger comfort. Additionally, the requirement for regular maintenance and replacement due to wear, impact damage, or regulatory compliance has sustained consistent aftermarket demand. The strong presence of windows in both narrow-body and wide-body aircraft categories has reinforced the segment’s dominance Continued focus on design innovation and operational durability is expected to maintain the windows segment as a primary contributor to market revenue.

The turbofan aircraft type segment is anticipated to account for 68% of the market revenue share in 2025, positioning it as the dominant aircraft type. The widespread adoption of turbofan engines in commercial aviation has driven higher production volumes of narrow-body and wide-body aircraft, each requiring multiple windows and windshields. Turbofan-powered aircraft are favored for their fuel efficiency, range, and operational cost advantages, which has encouraged airlines to expand and modernize their fleets. The segment’s growth has been further supported by the rising number of long-haul and medium-haul routes, increasing demand for aircraft with advanced cabin designs and passenger amenities. Integration of advanced materials and manufacturing processes has enhanced the durability and optical performance of windows and windshields for turbofan aircraft As global passenger traffic continues to rise and fleet expansion accelerates, the demand for windows and windshields specifically designed for turbofan aircraft is expected to remain strong in both OEM and aftermarket channels.

The OEM segment is expected to command 60% of the market revenue share in 2025, making it the leading end-use category. Growth in this segment has been driven by the steady increase in aircraft manufacturing to meet rising global passenger and cargo transport demands. Aircraft manufacturers are incorporating advanced windows and windshields directly during production, ensuring compliance with the latest safety and performance standards. The segment has also benefited from the trend toward fleet modernization, with new aircraft being equipped with state-of-the-art materials that enhance visibility, reduce weight, and improve structural integrity. OEM demand is further supported by strong order backlogs among major aircraft producers, which provide a consistent pipeline for component suppliers. The integration of innovative technologies, such as smart tinting and improved impact resistance, during initial assembly has made OEM installations a preferred choice for operators seeking long-term reliability As aircraft deliveries continue to increase, OEM demand for windows and windshields is projected to maintain its market leadership.

The market has expanded due to increasing emphasis on passenger safety, cabin comfort, and aircraft performance. These components are critical in maintaining pressurization, reducing noise, and protecting passengers from external environmental factors. Advanced materials such as acrylics, polycarbonates, laminated glass, and coated composites have been used to balance transparency, strength, and resistance to UV and impact. Growth has been driven by rising air travel demand, fleet expansion in commercial aviation, and the introduction of next generation business jets and regional aircraft. Maintenance, repair, and replacement services have further reinforced market activity globally.

Aircraft windows and windshields have been designed to comply with stringent aviation safety regulations and certification standards. Materials must withstand bird strikes, hail, and high altitude pressure differentials while maintaining optical clarity. Multi-layer laminated glass, acrylic, and polycarbonate composites have been adopted to meet these requirements. Advanced coatings have been applied for UV filtration, anti-fogging, and scratch resistance. Regulatory oversight from aviation authorities has required rigorous testing, including thermal cycling, impact resistance, and durability under extreme conditions. Compliance with these safety and performance standards has driven widespread adoption of reinforced materials and advanced manufacturing processes across commercial and business aircraft sectors.

Innovations in glazing and lamination technologies have enabled lighter, stronger, and more transparent aircraft windows and windshields. Heated windshields reduce ice formation, while scratch resistant coatings improve longevity and reduce maintenance cycles. Bonding techniques and edge sealing have improved structural integrity, reducing the risk of delamination. Curved acrylic and polycarbonate layers have allowed design flexibility while maintaining aerodynamic efficiency. Smart coatings and electrochromic tints have been introduced to allow variable shading, reducing glare and improving passenger comfort. These technological advancements have reinforced both operational performance and in cabin experience, supporting adoption across commercial and private aircraft fleets.

The market for aircraft windows and windshields has been strengthened by ongoing demand for repair, refurbishment, and replacement across aging fleets. Airlines and maintenance providers have focused on reducing aircraft downtime through modular window replacement and certified refurbishing processes. Supply of OEM and aftermarket components has ensured availability of high quality parts, reducing operational delays. Predictive maintenance using inspection tools and nondestructive testing has increased lifespan and reliability of installed components. These aftermarket activities have provided a continuous revenue stream for manufacturers and service providers, complementing new aircraft installations and contributing to steady market growth.

Airline operators have increasingly demanded lightweight materials for windows and windshields to enhance fuel efficiency and reduce overall aircraft weight. High performance composites, thin multilayer laminates, and advanced acrylics have been engineered to replace heavier traditional glass solutions without compromising safety. Weight optimization has contributed to lower fuel consumption, reduced emissions, and improved payload capacity. In parallel, material advancements have allowed retention of optical quality and impact resistance, supporting both operational and regulatory requirements. The focus on weight and efficiency has directed investment into advanced material R&D and adoption strategies across the commercial and private aviation sectors, reinforcing long term market expansion.

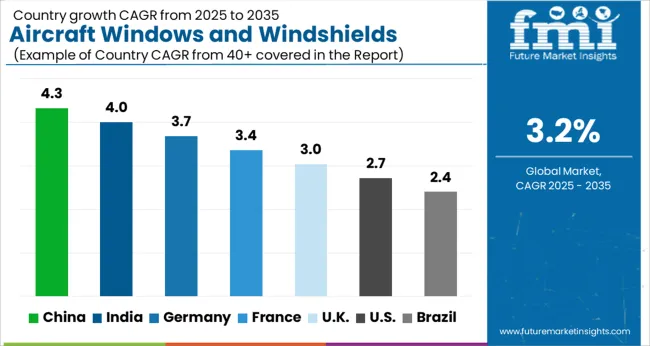

| Country | CAGR |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| France | 3.4% |

| UK | 3.0% |

| USA | 2.7% |

| Brazil | 2.4% |

China maintained the leading growth in the market with a forecast CAGR of 4.3%, supported by expanding commercial and regional aircraft production. India followed at 4.0%, driven by increasing adoption in domestic airline fleets and aerospace manufacturing initiatives. Germany recorded 3.7%, where strong aerospace engineering capabilities and integration of advanced materials contributed to steady development. The United Kingdom grew at 3.0%, benefiting from specialized aircraft components manufacturing and refurbishment programs. The United States registered 2.7%, with demand sustained by maintenance, repair, and modernization of existing aircraft fleets. These countries together reflect a mix of production, technological advancement, and fleet expansion shaping the global market trajectory. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expanding at a CAGR of 4.3% in the market, driven by rapid growth in commercial and business aviation sectors. Airlines are increasingly upgrading fleets with modern windows and windshields that improve passenger comfort, reduce weight, and enhance durability. Domestic aircraft manufacturers are investing in advanced glazing technologies and lightweight composites. Maintenance, repair, and overhaul activities are contributing to steady replacement demand. Rising emphasis on energy efficiency and aerodynamics in new aircraft designs is further supporting market expansion. With government initiatives to support aviation infrastructure and increasing air travel, China is expected to be a significant contributor to the global demand for aircraft windows and windshields.

India is witnessing a CAGR of 4.0% in the market, supported by expansion in domestic and regional air travel. Airlines are focusing on passenger comfort and operational efficiency, driving demand for innovative windshield and window solutions. Indigenous aircraft manufacturers are introducing lightweight composites to meet performance and regulatory requirements. Maintenance and replacement cycles are providing steady opportunities for aftermarket players. Government policies to promote aviation growth and airport modernization are further contributing to market development. Increased focus on energy efficiency, safety, and aerodynamics is enhancing the adoption of technologically advanced window and windshield systems across commercial and private aviation segments.

Germany is growing at a CAGR of 3.7% in the market, with demand fueled by commercial airline upgrades and business aviation requirements. European manufacturers emphasize safety, durability, and energy efficiency, making advanced window solutions a key priority. Replacement and refurbishment cycles for existing fleets ensure steady aftermarket opportunities. Research in transparent composites and advanced coatings is enhancing scratch resistance and visibility while reducing weight. Integration of aerodynamic and thermal efficiency features is further supporting adoption. Germany’s established aerospace industry and focus on innovative materials continue to drive demand for high-performance aircraft windows and windshields.

The United Kingdom is projected to grow at a CAGR of 3.0% in the market, with airline modernization and private jet expansions as key drivers. Lightweight and energy-efficient window systems are gaining traction due to operational cost reduction efforts. Maintenance and replacement demand remain steady as commercial airlines and defense operators upgrade aging fleets. UK manufacturers focus on durability and compliance with strict aviation safety standards. Technological advancements such as reinforced composites and anti-fog coatings are influencing the adoption of next-generation aircraft window and windshield solutions. The market is expected to benefit from continued investments in aviation infrastructure and fleet expansions.

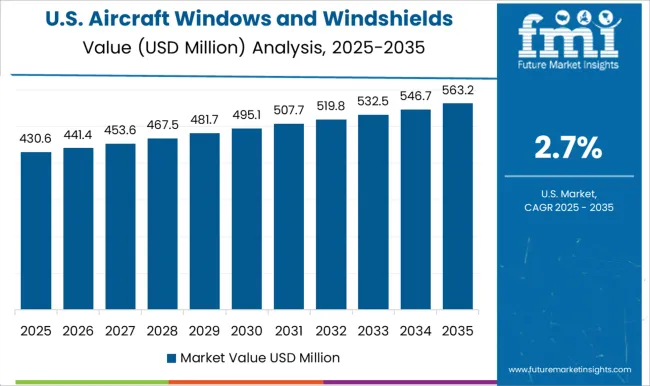

The United States is advancing at a CAGR of 2.7% in the market, influenced by strong commercial and business aviation segments. Airlines and private operators prioritize lightweight and durable glazing for fuel efficiency and passenger comfort. Replacement cycles and maintenance activities provide stable demand for aftermarket suppliers. Research in reinforced composites, UV-resistant coatings, and scratch-resistant treatments is enhancing product longevity. Integration with modern cockpit and cabin technologies is further encouraging adoption. The US aerospace sector’s innovation-driven approach ensures the country remains a leading market for aircraft windows and windshields, with opportunities in both new aircraft production and fleet retrofits.

The market is dominated by established aerospace glass manufacturers and specialized component suppliers that focus on safety, optical clarity, and durability. PPG Industries (Aerospace) stands out as a leading provider with a broad portfolio encompassing laminated and tempered glass, acrylic, and polycarbonate solutions for both commercial and military aircraft. Gentex Corporation complements the market by offering advanced cockpit windows, electrochromic dimming technologies, and integrated sensor solutions that enhance pilot visibility and passenger safety. GKN Aerospace and Nordam Group are critical players, delivering engineered window assemblies that combine structural integrity with lightweight materials for fuel efficiency and regulatory compliance. Lee Aerospace and Triumph Group contribute through custom glazing solutions, focusing on retrofitting and OEM contracts for commercial and defense aircraft programs.

Saint-Gobain Sully, along with Kopp Glass, provides specialty laminated glass and coated windshield solutions designed for extreme environmental resistance, scratch protection, and optical performance. AIP Aerospace and TBM Glass add value through niche offerings tailored to business jets and smaller aircraft segments, emphasizing rapid delivery and customizable sizes. Collectively, these providers drive innovation in glazing materials, surface treatments, and assembly techniques, supporting the aerospace industry's ongoing demand for durable, high-performance, and lightweight window and windshield solutions. The competitive landscape is further strengthened by other regional suppliers who cater to replacement, aftermarket, and specialized applications, ensuring continuity of supply across the global aviation market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1005.5 million |

| Product Type | Windows and Windshields |

| Aircraft Type | Turbofan, Turboprop, Turbojet, and Turboshaft |

| End Use | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | PPG Industries (Aerospace), Gentex Corporation, GKN Aerospace, Nordam Group, Lee Aerospace, Triumph Group, Saint-Gobain Sully / Saint-Gobain, Kopp Glass, AIP Aerospace, TBM Glass, and Other suppliers |

| Additional Attributes | Dollar sales by window and windshield type and aircraft category, demand dynamics across commercial, business, and military aviation, regional trends in aircraft modernization and retrofitting, innovation in transparency, impact resistance, and lightweight materials, environmental impact of manufacturing and end-of-life disposal, and emerging use cases in enhanced passenger safety and advanced avionics integration. |

The global aircraft windows and windshields market is estimated to be valued at USD 1,005.5 million in 2025.

The market size for the aircraft windows and windshields market is projected to reach USD 1,377.7 million by 2035.

The aircraft windows and windshields market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in aircraft windows and windshields market are windows, _windows (cockpit), _windows (cabin), windshields, _pilot windshields, _co-pilot windshields and _canopies / special transparencies.

In terms of aircraft type, turbofan segment to command 68.0% share in the aircraft windows and windshields market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Micro Turbine Engines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft De-icing Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Window Frame Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA