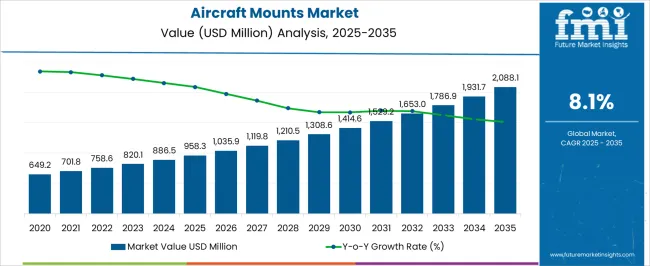

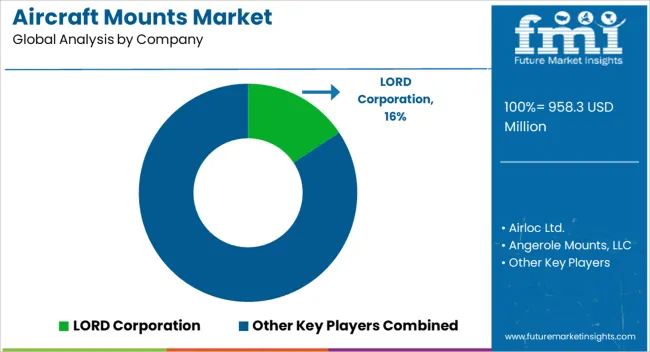

The aircraft mounts market is estimated to be valued at USD 958.3 million in 2025 and is projected to reach USD 2088.1 million by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period.

Year-on-Year (YoY) growth analysis reflects a consistent upward trend supported by rising aircraft production, increasing fleet modernization, and advancements in vibration control technologies. From 2025 to 2026, the market is expected to grow from USD 958.3 million to USD 1,035.9 million, reflecting a YoY increase of nearly 8.1%. Similarly, by 2027 the market expands further to USD 1,119.8 million, sustaining robust momentum. This steady progression is not only driven by demand in commercial aviation but also by military applications where reliable mounts play a critical role in performance and safety.

The industry’s growth is also anticipated to benefit from greater adoption of lightweight materials, enhancing both fuel efficiency and aircraft durability. Over the long term, the YoY pattern highlights resilience, with double-digit billion-dollar increments by the 2030s, ultimately surpassing the USD 2 billion milestone by 2035. Market participants are also likely to witness opportunities stemming from aftermarket services, OEM integration, and the adoption of mounts in next-generation aircraft platforms. As the aviation sector rebounds post-pandemic and governments invest in fleet upgrades, the market’s upward trajectory appears firmly supported by both technological evolution and expanding air travel demand.

The aircraft mounts market is strongly influenced by five interconnected parent markets that collectively define its growth outlook and demand evolution. The aerospace and defense market holds the largest share at 48%, as mounts are widely used in military jets, helicopters, and commercial aircraft to secure engines, avionics, and mission-critical components. Increasing fleet modernization and defense budgets further reinforce this segment.

The vibration control systems market contributes 22%, driven by the need for enhanced passenger comfort, noise reduction, and structural stability. Advanced vibration isolation technologies and lightweight mount materials are central to this growth. The aviation aftermarket services market accounts for 14%, as regular maintenance, repair, and replacement of mounts are essential to ensure airworthiness, safety compliance, and operational efficiency.

The aerospace components and systems integration market holds a 10% share, where aircraft mounts play a key role in seamless integration of new-generation engines, navigation systems, and advanced electronics into both civil and defense aircraft platforms.

Lastly, the space exploration and UAVs market contributes 6%, with demand rising from satellite launches, drones, and unmanned combat aerial vehicles requiring precision mounts for payload stabilization. With aerospace & defense and vibration control collectively capturing 70% of the share, the aircraft mounts market remains primarily driven by safety, performance, and compliance imperatives, while emerging opportunities in UAVs and space applications support diversification.

| Metric | Value |

|---|---|

| Aircraft Mounts Market Estimated Value in (2025 E) | USD 958.3 million |

| Aircraft Mounts Market Forecast Value in (2035 F) | USD 2088.1 million |

| Forecast CAGR (2025 to 2035) | 8.1% |

The aircraft mounts market is witnessing stable expansion supported by the rising global aircraft fleet, increasing passenger traffic, and sustained demand for vibration isolation and stability solutions in both commercial and defense aviation sectors. Market momentum is being reinforced by ongoing investments in fleet modernization, lightweight material integration, and advanced engineering designs that enhance operational efficiency and safety.

Regulatory compliance requirements related to noise reduction and structural integrity are driving the adoption of high-performance mounts across various aircraft platforms. Manufacturers are focusing on precision engineering, material optimization, and supply chain resilience to meet stringent aerospace standards.

Price volatility in raw materials and supply chain disruptions have prompted strategic sourcing initiatives and long-term supplier partnerships Over the forecast period, the sector is expected to benefit from the steady replacement cycle in mature markets, growing aircraft production in emerging economies, and the development of specialized mounts tailored for next-generation aircraft, ensuring sustained market growth and competitive positioning globally.

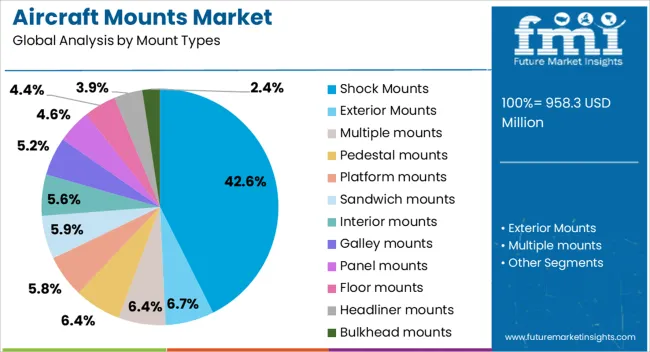

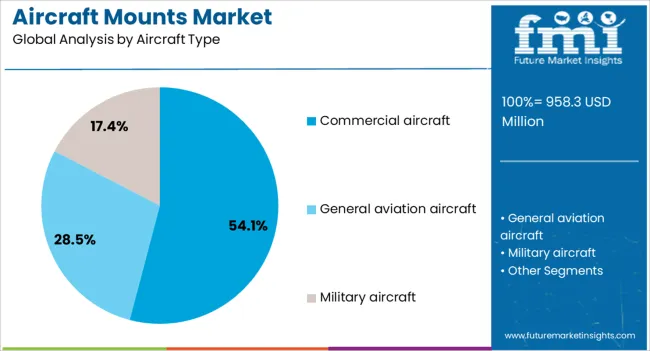

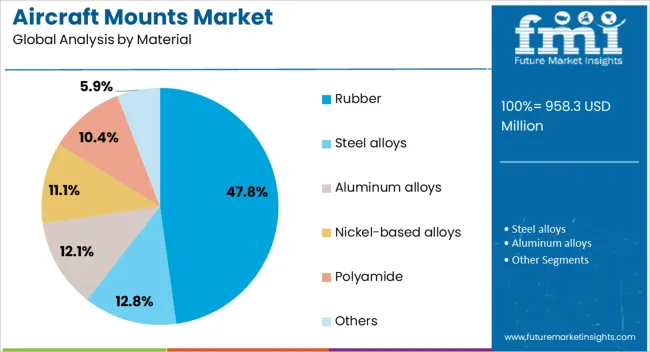

The aircraft mounts market is segmented by mount types, aircraft type, material, application, end-use, and geographic regions. By mount types, aircraft mounts market is divided into shock mounts, exterior mounts, multiple mounts, pedestal mounts, platform mounts, sandwich mounts, interior mounts, galley mounts, panel mounts, floor mounts, headliner mounts, and bulkhead mounts. In terms of aircraft type, aircraft mounts market is classified into commercial aircraft, general aviation aircraft, and military aircraft. Based on material, aircraft mounts market is segmented into rubber, steel alloys, aluminum alloys, nickel-based alloys, polyamide, and others. By application, aircraft mounts market is segmented into vibration/shock isolation, suspension, and engine mounts. By end-use, aircraft mounts market is segmented into OEM and replacement. Regionally, the aircraft mounts industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Shock mounts, holding 42.60% of the mount types category, have retained their dominance due to their critical role in reducing vibration transmission, safeguarding aircraft components, and enhancing passenger comfort. Their application spans across engines, avionics, and cabin interiors, where mechanical stability and noise reduction are paramount. Adoption levels have been sustained by advancements in elastomer technology and metal bonding techniques, which improve durability and performance under extreme temperature and pressure conditions. The segment’s market position has been reinforced by ongoing aircraft retrofitting programs and the rising production of new aircraft models equipped with advanced vibration isolation systems. Compliance with aerospace standards for safety and fatigue resistance has been a key driver for sustained use, while operational cost benefits from reduced maintenance requirements further support segment growth Looking ahead, innovations in composite-based shock mounts are expected to improve weight efficiency, ensuring the segment maintains its lead in the evolving aircraft mounts market.

The commercial aircraft category, commanding 54.10% of the aircraft type segment, continues to lead the market due to the high production volumes and ongoing fleet expansions by major airlines worldwide. Growth in this segment is supported by increasing passenger demand, particularly in Asia-Pacific and the Middle East, as well as by sustained investment in fuel-efficient aircraft models. Mount requirements in commercial fleets are driven by the need for enhanced cabin comfort, reduced noise, and improved structural resilience. Manufacturers have been focusing on integrating mounts that align with lightweight design philosophies while meeting stringent safety and performance regulations. The replacement and maintenance cycles for existing fleets further contribute to steady demand, as worn mounts are replaced to maintain operational standards Expansion of low-cost carrier networks and the entry of new aircraft programs are also expected to stimulate demand, ensuring the commercial aircraft segment’s continued dominance in the global market.

Rubber, with a 47.80% share in the material category, remains the preferred choice for aircraft mounts due to its superior vibration absorption, flexibility, and durability under dynamic loads. Its dominance is reinforced by its adaptability to various mount designs and its proven track record in meeting aerospace-grade performance requirements. Rubber mounts are extensively used across both commercial and defense platforms, benefiting from advancements in synthetic rubber formulations that enhance temperature resistance, reduce aging effects, and improve bonding with metal components. The segment’s strength is supported by its cost-effectiveness compared to alternative materials, while its ability to deliver consistent performance under cyclic stress conditions ensures continued adoption. Regulatory compliance regarding material safety and environmental performance has led to the use of specialized rubber compounds, further boosting reliability Ongoing innovations in rubber composite blends are expected to enhance weight reduction and operational longevity, securing the segment’s leading position within the aircraft mounts market.

The aircraft mounts market is driven by growing aerospace demand, strict safety compliance, lightweight material adoption, and aftermarket expansion. Together, these dynamics position mounts as critical enablers of safety, performance, and efficiency in modern aviation.

The aircraft mounts market is being fueled by the rising demand for commercial and defense aircraft worldwide. Growth in global passenger traffic, airline expansions, and military modernization programs are driving production volumes, which directly boost the requirement for mounts that reduce vibration, noise, and improve operational efficiency. Aircraft mounts are essential in ensuring smoother flight performance, structural integrity, and enhanced comfort for passengers. Additionally, the demand for lighter and more durable mounts is increasing due to rising aircraft fleet sizes and the need for fuel efficiency. The continuous procurement of aircraft from Boeing, Airbus, and defense authorities underscores the strong link between aerospace growth and mounts adoption.

Regulatory compliance is a critical dynamic shaping the aircraft mounts market. Aviation authorities such as the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency) impose stringent requirements on aircraft components, including mounts, to ensure reliability and passenger safety. These regulations influence material selection, vibration absorption capacity, and durability standards. Aircraft mounts must undergo rigorous testing before approval for use in commercial or defense aviation. Manufacturers are investing heavily in R&D to align with evolving safety requirements, leading to the adoption of advanced vibration isolation technologies. The emphasis on safety compliance increases product innovation and market entry barriers, ultimately defining competition and growth opportunities.

The growing shift toward lightweight aircraft components is significantly impacting the mounts market. Aircraft manufacturers are focusing on fuel efficiency and operational cost reduction, creating strong demand for mounts made from advanced composites and alloys. These materials not only reduce weight but also enhance vibration damping and structural strength. The rising trend of next-generation aircraft with improved efficiency standards has accelerated the integration of lightweight mounts. Furthermore, the adoption of additive manufacturing techniques in component design supports the development of custom-engineered mounts. This shift toward lightweight solutions not only helps meet airline demands for efficiency but also strengthens manufacturers’ positioning in the highly competitive aerospace supply chain.

Aftermarket services play an increasingly important role in the aircraft mounts market as global fleets expand and age. Airlines and defense operators are prioritizing maintenance, repair, and overhaul (MRO) activities to extend aircraft lifecycle and operational safety. Mounts are subject to wear and tear due to constant vibrations and mechanical stresses, creating a recurring demand for replacements and retrofits. The aftermarket segment benefits significantly from this trend, as operators seek reliable, cost-effective mount solutions to reduce downtime. Partnerships between mount manufacturers and MRO service providers are becoming more common, ensuring quicker service delivery and greater market reach. This dynamic reinforces aftermarket expansion as a consistent growth driver.

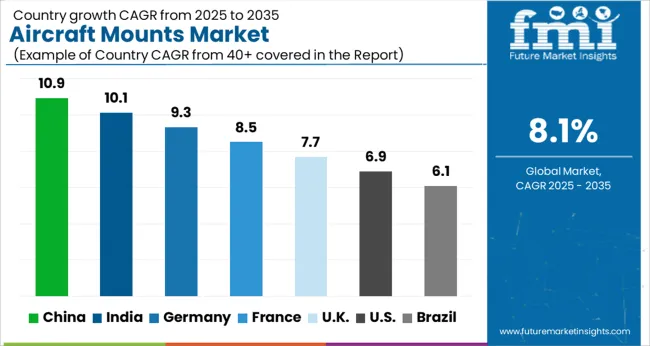

| Country | CAGR |

|---|---|

| China | 10.9% |

| India | 10.1% |

| Germany | 9.3% |

| France | 8.5% |

| UK | 7.7% |

| USA | 6.9% |

| Brazil | 6.1% |

The global aircraft mounts market is projected to expand at a CAGR of 8.1% between 2025 and 2035. China leads growth with a share of 10.9%, followed by India at 10.1% and Germany at 9.3%. France contributes 8.5%, while the UK and USA account for 7.7% and 6.9% respectively. Emerging economies such as China and India are strengthening their positions with expanding aerospace manufacturing, rising defense budgets, and investments in domestic aircraft programs.

Meanwhile, established aerospace hubs like Germany, France, the UK, and the USA emphasize advanced engineering, precision design, and regulatory compliance to maintain competitive strength. Growth is fueled by fleet expansions, aftermarket demand, and the pursuit of lightweight, high-durability mounting systems. The analysis spans over 40+ countries, with the leading markets shown below

The aircraft mounts market in China is projected to grow at a CAGR of 10.9% from 2025 to 2035, supported by large-scale investments in aerospace manufacturing, rising defense expenditure, and expansion of domestic aircraft programs. Local firms are enhancing their role in the supply chain, while collaborations with global aerospace leaders are strengthening production quality. Growing demand for both commercial and military aircraft is boosting the need for lightweight and high-durability mounts. Government initiatives to promote aviation infrastructure and aerospace exports further drive growth. The country’s manufacturing strength and engineering capabilities position it as a key hub for global aircraft component supply.

India’s aircraft mounts market is expected to grow at a CAGR of 10.1%, fueled by increasing air passenger traffic, defense modernization programs, and the “Make in India” initiative supporting domestic aerospace production. Rising procurement of commercial aircraft and indigenous fighter jet programs are boosting demand for advanced mounts. Local manufacturers are gradually strengthening capabilities by partnering with international suppliers, helping to bridge technology gaps. India’s expanding MRO (maintenance, repair, and overhaul) sector also plays a vital role, with mounts being a critical replacement component. This trend, coupled with policy-driven incentives, is creating new opportunities for both domestic and foreign players.

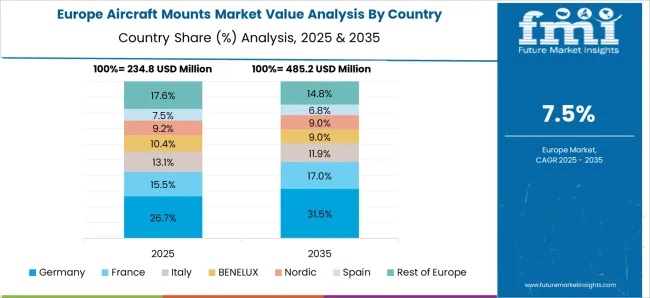

The aircraft mounts market in Germany is anticipated to grow at a CAGR of 9.3% between 2025 and 2035, driven by its role as a major hub for European aerospace innovation. With Airbus production facilities and a well-established supply chain, Germany continues to lead in precision engineering and high-quality aerospace components. Mounts designed for vibration reduction and durability are in high demand to meet strict European safety standards. Germany also benefits from a thriving defense industry and EU-funded aerospace research programs. Increasing focus on advanced materials and lightweight solutions further enhances competitiveness in global markets.

The aircraft mounts market in the UK is projected to grow at a CAGR of 7.7% through 2035, supported by a strong aerospace engineering base and partnerships with global aircraft manufacturers. The UK’s role in the supply chain for major aircraft programs, including defense and commercial fleets, ensures steady demand for mounts. Research institutions and aerospace clusters are advancing mount technologies with a focus on performance and compliance. Post-Brexit trade strategies are opening new opportunities for export markets, while domestic defense programs strengthen local procurement. The aftermarket demand for mounts in commercial aviation also provides consistent revenue.

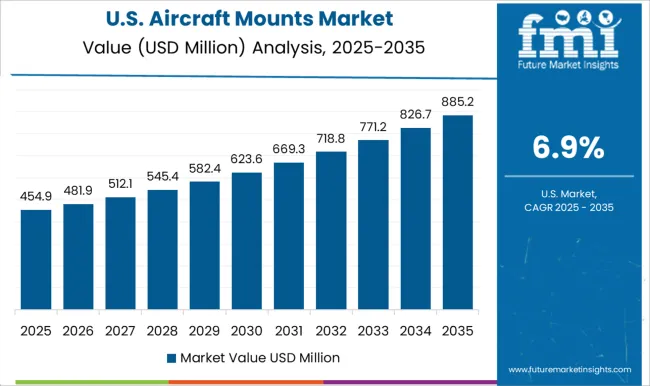

The aircraft mounts market in the USA is expected to expand at a CAGR of 6.9% from 2025 to 2035, driven by high military spending, commercial aircraft demand, and leadership in aerospace technology. The USA defense sector’s continuous procurement of advanced aircraft sustains steady demand for mounts with high durability and precision. Boeing and other leading OEMs play a central role in driving demand for both new aircraft and aftermarket services. The USA also leads in R&D for advanced materials, enabling production of mounts that meet rigorous performance standards. Domestic aftermarket services and global exports further strengthen the growth outlook.

Competition in the aircraft mounts market is defined by vibration isolation, durability, and compliance with stringent aerospace standards. LORD Corporation leads with decades of expertise in aerospace vibration control and strong OEM partnerships across defense and commercial aviation. Hutchinson Aerospace GmbH follows with advanced elastomeric solutions and a global presence in both airframe and engine mounts, emphasizing lightweight designs. Trelleborg Group leverages its material science leadership to provide highly customized mounts, focusing on noise reduction and extended service life for both OEM and aftermarket needs. GMT Rubber-Metal-Technic Ltd. and Butser Rubber specialize in precision-engineered rubber-to-metal components, supplying mounts with strong European manufacturing capabilities. Cadence Aerospace and Mayday Manufacturing strengthen the competitive ecosystem with machining and precision-engineered components that integrate seamlessly into broader aerospace systems.

Across suppliers, strategies center on improving lifecycle performance, weight reduction, and integration into modular aircraft systems. Differentiation drivers include elastomer composition, fatigue resistance, and aftermarket service capabilities. Many firms emphasize global certifications (AS9100, NADCAP) to ensure compliance with aerospace regulations, while partnerships with OEMs and MRO providers expand long-term contracts. Product brochures highlight load-bearing capacity, temperature resistance, and vibration dampening efficiency under extreme operating conditions.

Technical specifications emphasize fatigue life, modular design adaptability, and safety-critical reliability. Mount solutions for avionics, engines, fuselage, and cabin systems are marketed for their ability to extend aircraft longevity and reduce operational costs. Custom engineering services, rapid prototyping, and simulation-backed design validation are showcased as value-added offerings, reflecting a maturing and highly specialized supplier base aligned with global aerospace expansion.

| Item | Value |

|---|---|

| Quantitative Units | USD 958.3 million |

| Mount Types | Shock Mounts, Exterior Mounts, Multiple mounts, Pedestal mounts, Platform mounts, Sandwich mounts, Interior mounts, Galley mounts, Panel mounts, Floor mounts, Headliner mounts, and Bulkhead mounts |

| Aircraft Type | Commercial aircraft, General aviation aircraft, and Military aircraft |

| Material | Rubber, Steel alloys, Aluminum alloys, Nickel-based alloys, Polyamide, and Others |

| Application | Vibration/shock isolation, Suspension, and Engine mounts |

| End-use | OEM and Replacement |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LORD Corporation, Airloc Ltd., Anti Vibration Methods (Rubber) Co. Ltd., Avionics Support Group, Inc., Butser Rubber, Cadence Aerospace, GMT Rubber-Metal-Technic Ltd., Hutchinson Aerospace GmbH, Mayday Manufacturing, Meeker Aviation, MyGoFlight, RAM Mounts, Shock Tech, Inc., Singapore Aerospace Manufacturing Pte Ltd, The VMC Group, Trelleborg Group, and Vibrasystems Inc. |

| Additional Attributes | Dollar sales, share, demand by mount type (engine, interior, exterior), regional growth, OEM vs aftermarket trends, competitive strategies, regulatory impact, and supply chain risks. |

The global aircraft mounts market is estimated to be valued at USD 958.3 million in 2025.

The market size for the aircraft mounts market is projected to reach USD 2,088.1 million by 2035.

The aircraft mounts market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in aircraft mounts market are shock mounts, exterior mounts, multiple mounts, pedestal mounts, platform mounts, sandwich mounts, interior mounts, galley mounts, panel mounts, floor mounts, headliner mounts and bulkhead mounts.

In terms of aircraft type, commercial aircraft segment to command 54.1% share in the aircraft mounts market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA