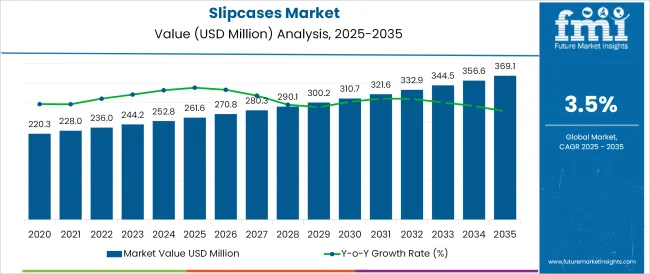

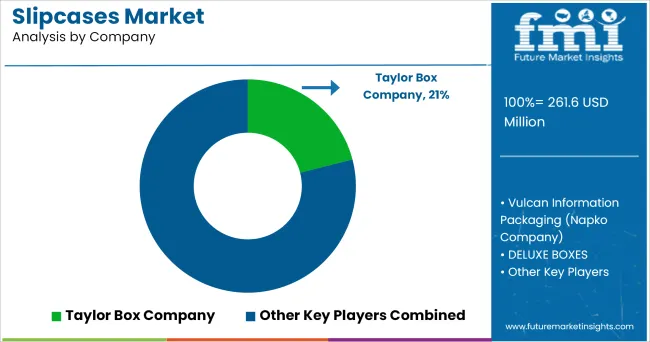

The Slipcases Market is estimated to be valued at USD 261.6 million in 2025 and is projected to reach USD 369.1 million by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

The slipcases market is experiencing stable growth, fueled by rising demand for protective and aesthetically appealing packaging solutions in the publishing, luxury, and archival storage sectors. Increasing consumer preference for premium presentation in book sets, limited editions, and collector’s items is reinforcing the relevance of slipcase packaging.

Enhanced durability, design flexibility, and branding potential have positioned slipcases as a preferred option among publishers, gift brands, and luxury goods manufacturers. Sustainable material trends and growing investments in recycled paperboard and biodegradable finishes are also supporting market expansion.

With e-commerce growth elevating the importance of tamper-resistant and visually distinctive packaging, slipcases are being adopted not only as protective containers but also as marketing tools. The integration of specialty coatings, foil stamping, and embossing features has further enhanced their appeal in high-value product categories.

As personalization and small-batch customization continue to trend upward, the slipcase market is expected to gain traction among independent publishers and boutique design studios.

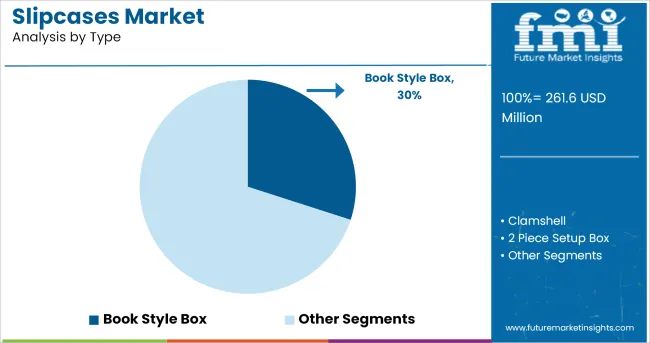

The market is segmented by Type and Application and region. By Type, the market is divided into Book Style Box, Clamshell, 2 Piece Setup Box, 3 Piece Setup Box, and V-Notch and V-Grooved.

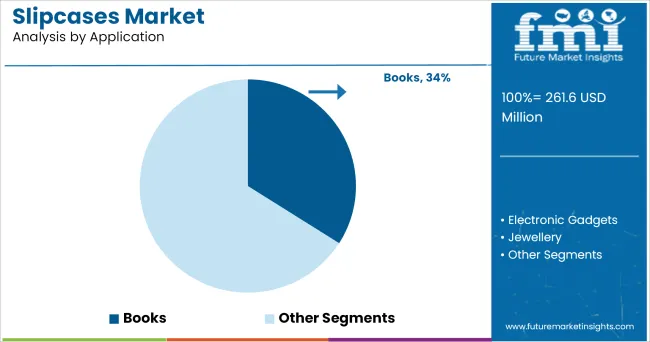

In terms of Application, the market is classified into Books, Electronic Gadgets, Jewellery, DVDs, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Book style box slipcases are projected to account for 30.0% of total market revenue in 2025, making it the leading segment by type. This dominance is being driven by the box’s durable structure and hinged opening format, which offers enhanced protection and ease of use for both consumers and retailers.

Book style boxes allow for intricate design elements, such as magnetic closures and internal compartments, making them ideal for high-value packaging in books, media collections, and commemorative sets. The ability to customize surface treatments ranging from soft-touch laminates to textured wraps has elevated their adoption in premium product categories.

Their compatibility with digital and offset printing enables visually compelling packaging that aligns with branding strategies. As publishers and luxury brands seek packaging formats that balance function, protection, and aesthetics, book style slipcases have emerged as the segment of choice for long-term storage and elevated shelf presence.

Books are projected to contribute 34.0% of revenue to the slipcases market in 2025, establishing this as the leading application segment. The dominance of this segment is supported by the continued value placed on physical books as collectible and display-worthy items, especially in the context of special editions, box sets, and literary anniversaries.

Slipcases used in the book segment offer added protection from dust, light, and wear, extending the longevity and perceived value of printed works. Their role in enhancing gift appeal, facilitating shelf organization, and differentiating product lines has further driven adoption among publishers and retailers.

Demand has also increased as small presses and independent authors seek customized, short-run packaging formats to appeal to niche readerships. As physical book sales regain momentum in select regions and collectors seek archival-grade presentation, slipcases remain a preferred packaging solution in the publishing ecosystem.

The premium grade packaging has assured the product's safety thus inviting usage of slipcases by the end users. This packaging solutions are used to add elegance and style to different products such as books, digital tablets, magazines, and other precious products. Innovations in packaging methods resulting in sustainable packaging has proved to be a value added proposition for the end users in selling their finished products reaping sound profits.

This is believed to be the key growth factor of the slipcases market. Additionally, the rapid growth and penetration of retail market consisting of gift based articles and routine based consumer goods is anticipated to increase the demand for the slipcases.

Favourable traits such as light in weight and variety of customized aesthetics in addition to protection of products. The associated economic cost has also acted in adoption of the product to a profound extent. Furthermore their sustainable future is also proving to be optimistic for the market growth in form of biodegradable, and recyclable products.

This boxes are significantly used for packaging of valuable items for gifting. The idea of designating days to raise awareness or commemorate certain events is gaining traction.

These days of commemorating and celebrating successes or achievements, as well as dedicating a day of appreciation to it, have allowed gifting firms all over the world to increase the demand. The growth of e-commerce based goods sector is also said to propel the market growth.

Also using this boxes for are being extensively used for storing antiques, valuable books & literature, scriptures and others.

The slipcases market growth too has been understood to experience the same with the rebound likely to be slower than the threshold rate, as consumers are likely to be more hesitant to return to luxury packaging, travel, and the hospitality industry in the early quarters, but scenario will improve by next few quarters.

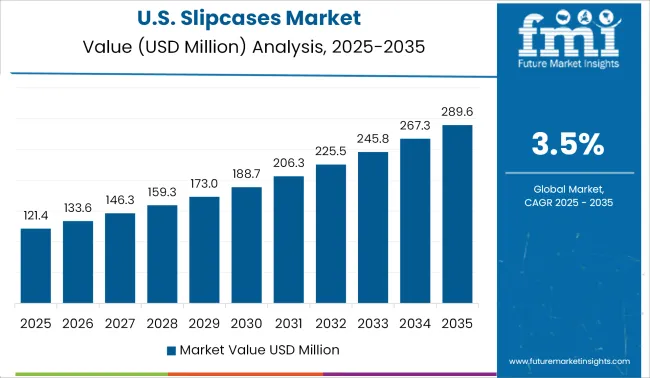

USA market is expected to dominate the regional market as a result of increasing investment in R&D to provide manufacturers with sustainable packaging options, a rise in the number of product launches in the fashion and cosmetic sectors coupled with rising investments by luxury product manufacturers in sustainable development.

The Asia Pacific region accounted for prominent share in the global market owing to high industrial growth indices in countries including India, Japan, China, Australia, South Korea, and Indonesia have boosted their spending on luxury packaging. Furthermore, these countries have easy access to raw resources and low-cost labour.

According to data from Statista Luxury packaging industry in Asia Pacific was valued at USD 252.8 Million in 2024 and will expand to USD 261.6 Million by 2025 driven by sustainable and bio-degradable packaging. This will impact the regional market growth to a significant extent.

Some of the leading manufacturers and suppliers of Slipcases include

This are niche products and usually sold through online or retails sales outlet. Prominent share of manufacturers provide custom solution and options making market more competitive.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global slipcases market is estimated to be valued at USD 261.6 million in 2025.

The market size for the slipcases market is projected to reach USD 369.1 million by 2035.

The slipcases market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in slipcases market are book style box, clamshell, 2 piece setup box, 3 piece setup box and v-notch and v-grooved.

In terms of application, books segment to command 34.0% share in the slipcases market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA