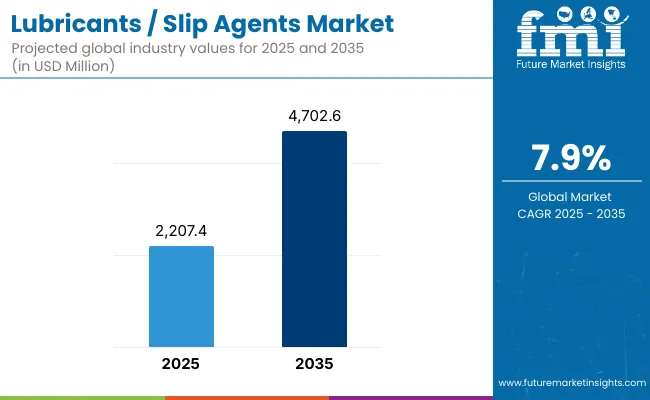

The Global Lubricants / Slip Agents Market is expected to record a valuation of USD 2,207.4 million in 2025 and USD 4,702.6 million in 2035, reflecting an absolute increase of USD 2,495.2 million, which equals a 2.1X growth over the decade. The overall expansion represents a CAGR of 7.9%, signaling consistent acceleration in the demand for slip-enhancing ingredients across skincare, color cosmetics, hair care, and sunscreen formulations.

Global Lubricants / Slip Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Global Lubricants / Slip Agents Market Estimated Value (2025E) | USD 2,207.4 million |

| Global Lubricants / Slip Agents Market Forecast Value (2035F) | USD 4,702.6 million |

| Forecast CAGR (2025 to 2035) | 7.90% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,207.4 million to USD 3,221.9 million, adding USD 1,014.5 million, which accounts for 40.6% of total decade growth. This initial phase records steady adoption of silicone-based and ester-modified slip agents, driven by the growing integration of sensorial and functional additives in mass personal care and dermocosmetic formulations.

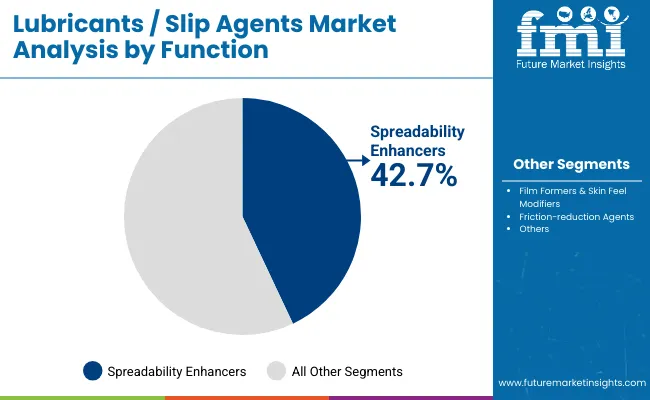

The demand for spreadability enhancers dominates during this period, supported by global brands emphasizing smooth texture, hydration balance, and light sensory feel in creams, serums, and foundations.

The second half from 2030 to 2035 contributes USD 1,480.7 million, equal to 59.4% of the total decade growth, as the market expands from USD 3,221.9 million to USD 4,702.6 million. This acceleration is powered by premium skincare and hybrid cosmetic formulations that utilize multi-functional slip agents combining film-forming, friction-reduction, and sensorial balance properties. Rapid product innovation in polyether-modified silicones and natural ester derivatives reinforces market advancement, particularly in Asia-Pacific and Europe.

Evolving consumer preferences toward lightweight, eco-conscious, and touch-optimized formulations add depth to this growth phase. Software-like customization in formulation blending and ingredient compatibility platforms are enabling manufacturers to develop tailored slip agents, enhancing recurring demand from formulators and brand R&D units.

From 2020 to 2024, the Global Lubricants / Slip Agents Market expanded from approximately USD 1,740 million to USD 2,207.4 million, largely driven by the rising penetration of silicone and hydrocarbon-based slip additives in personal care emulsions and cosmetic bases.

During this period, the competitive landscape was dominated by chemical manufacturers controlling nearly 70% of the market revenue, with leaders such as Dow, Wacker Chemie, and Shin-Etsu focusing on purity, rheological stability, and high compatibility with emulsifiers and active agents. Differentiation primarily centered around viscosity profiles, sensorial enhancement, and durability in diverse formulations, while natural ester blends began gaining acceptance in clean-label and sustainable beauty formulations. Service-linked partnerships between ingredient suppliers and beauty R&D labs remained limited, contributing less than 10% of the total market value.

By 2025, the market value for lubricants and slip agents will reach USD 2,207.4 million, and the revenue mix will begin shifting toward high-performance and multifunctional chemistries. Traditional silicone suppliers face competition from innovators focusing on renewable, polyether-modified, and bio-based systems that enhance spreadability and sensory properties without compromising sustainability.

Key suppliers such as Evonik, Croda, and Clariant are developing next-generation slip modifiers that merge hydration, film formation, and friction reduction, aligning with premium skincare and dermocosmetic trends. The competitive advantage is progressively moving away from simple silicone chemistry toward integrated sensorial engineering, environmental compliance, and hybrid formulation adaptability.

Emerging entrants, especially in East Asia, are leveraging local production and cost optimization to serve regional brands with tailored silicone-ester hybrid blends. These localized supply models, combined with global distribution networks, are reshaping pricing, availability, and formulation standards. Meanwhile, premium markets such as Japan, the U.S., and Germany are adopting multi-layer sensorial agents that improve texture transition and tactile quality, making slip agents integral to product differentiation in luxury skincare.

The market is expanding due to the increasing formulation complexity and consumer preference for superior tactile experiences in personal care and cosmetic applications. Advances in silicone-based chemistry have enabled consistent film formation, uniform pigment dispersion, and longer wear-time for color cosmetics. Moreover, improvements in polyether-modified silicones and ester blends have improved compatibility with natural oils, bioactives, and emulsifiers, resulting in enhanced product stability and feel.

The demand for spreadability enhancers and film-forming slip agents is accelerating across skincare and sun care products as manufacturers emphasize lightweight application, non-greasy texture, and smoother finish. In hair care and styling, slip agents improve combability, shine, and static control, strengthening their role in conditioner and serum formulations.

Innovation in emulsion concentrate forms and powder dispersions has expanded product versatility, while the growing adoption of biodegradable and non-volatile silicone alternatives is aligning the market with clean beauty standards. With increased focus on multi-functionality and sensorial performance, lubricants and slip agents are transitioning from supporting ingredients to core sensory-engineering components in product development pipelines.

The segment growth is strongly led by silicone-based chemistries, liquid physical forms, and spreadability enhancer functions due to their widespread use in premium skincare and dermocosmetic products. The integration of natural ester and hybrid silicone systems into formulations is expected to strengthen during 2030 to 2035, as global brands adopt eco-optimized ingredient sourcing and sustainable formulation design.

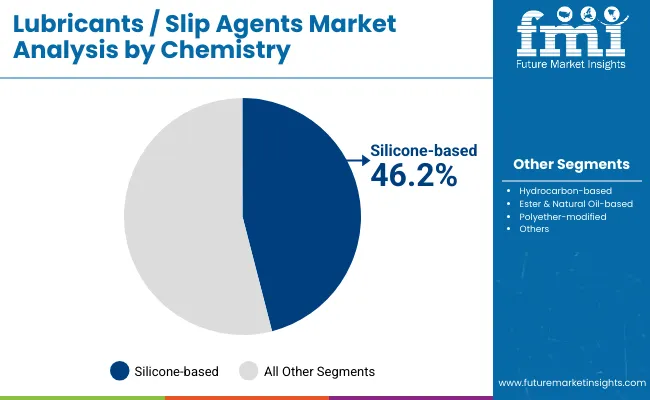

The Global Lubricants / Slip Agents Market demonstrates a balanced yet clearly defined segmentation structure across chemistry, function, physical form, application, and end use, reflecting the evolving sensorial and formulation demands of the personal care industry. Silicone-based agents dominate with a 46.2% share in 2025, driven by their superior spreading, film-forming, and tactile enhancement properties, making them indispensable in skincare and color cosmetic formulations.

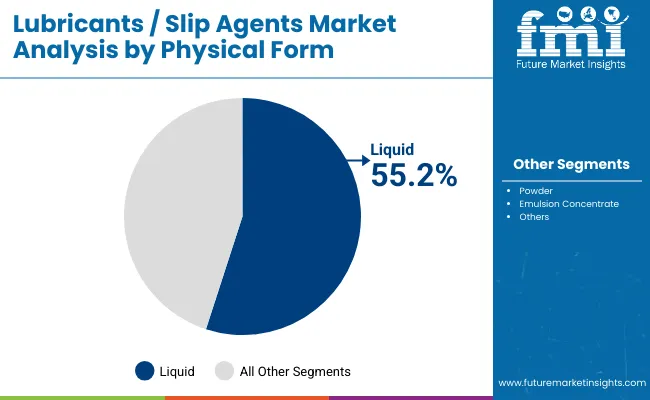

Within the function segment, spreadability enhancers lead with 42.7% share, owing to their role in improving texture uniformity, application smoothness, and product stability. The liquid form segment accounts for 55.2% of the market, benefiting from its high compatibility with emulsions, oils, and actives, which ensures efficient formulation performance and sensory refinement.

In terms of application, skin creams, lotions, and color cosmetics collectively generate the majority of consumption, supported by the growing premiumization of beauty and dermocosmetic products. End-use segmentation further highlights that while mass personal care continues to anchor volume, premium skincare and dermocosmetic categories are gaining rapid momentum as consumers seek multi-functional, non-greasy, and texture-optimized formulations.

Regionally, East Asia and South Asia & Pacific are emerging as the fastest-growing markets, led by robust manufacturing ecosystems and surging local brand innovation, while Europe and North America remain strongholds for high-performance, regulatory-compliant, and sensorially differentiated slip agents.

| Chemistry | Value Share % 2025 |

|---|---|

| Silicone-based | 46.2% |

| Others | 53.8% |

The silicone-based segment is projected to contribute 46.2% of the Global Lubricants / Slip Agents Market revenue in 2025, maintaining its position as the dominant chemistry category throughout the forecast period. This dominance is driven by the superior spreading efficiency, smooth texture, and compatibility that silicone-based slip agents offer across personal care and cosmetic formulations. These chemistries enhance tactile properties and film formation, improving the application feel and finish of skincare, color cosmetic, and sunscreen products.

Silicone-based slip agents continue to be preferred due to their low surface tension, volatility control, and durable sensory attributes, which allow formulators to create lightweight and long-lasting products. The segment’s growth is also supported by the ongoing innovation in polyether-modified silicones, which provide the dual benefits of hydrophilicity and enhanced dispersion of actives in emulsions. As sustainable beauty trends evolve, manufacturers are developing biodegradable and low-cyclic silicone variants, ensuring regulatory compliance and broadening end-user adoption.

The silicone-based chemistry segment is expected to retain its leadership in the global market as the core functional backbone of next-generation slip systems. While ester and natural oil-based agents are gaining traction, silicone-based chemistries will remain indispensable for premium sensorial performance and formulation stability across both mass and dermocosmetic categories.

| Function | Value Share % 2025 |

|---|---|

| Spreadability enhancers | 42.7% |

| Others | 57.3% |

The spreadability enhancer segment is forecasted to hold 42.7% of the Global Lubricants / Slip Agents Market in 2025, driven by its vital role in ensuring uniform application, even coverage, and superior sensory finish across cosmetic and skincare formulations. These agents facilitate effortless glide and uniform product layering, improving the user experience while optimizing the delivery of active ingredients.

Their adoption is particularly high in skin creams, color cosmetics, and sunscreen formulations, where the demand for light and silky touch textures continues to rise. The ability of spreadability enhancers to balance viscosity, oil phase compatibility, and non-greasy sensory effects has made them essential in high-performance formulations. Rapid innovation in silicone-ester hybrids and polyether-modified agents has further enhanced spreading efficiency while meeting regulatory and clean-beauty standards.

The segment’s expansion is reinforced by the growing use of multifunctional slip systems that combine spreading, film formation, and sensory enhancement in a single ingredient. With premium beauty brands prioritizing texture differentiation as a key marketing driver, spreadability enhancers will continue to dominate as the functional cornerstone of the global market, particularly in Asia-Pacific and Europe where sensorial appeal is a major purchase factor.

| Physical Form | Value Share % 2025 |

|---|---|

| Liquid | 55.2% |

| Others | 44.8% |

The liquid form segment is projected to contribute 55.2% of the Global Lubricants / Slip Agents Market revenue in 2025, maintaining its lead as the most widely adopted form across both skincare and haircare applications. This dominance is attributed to the ease of formulation, homogeneous blending, and high solubility of liquid slip agents in diverse oil and emulsion systems.

Liquid slip agents are favored for their consistency and process adaptability, making them suitable for large-scale manufacturing and small-batch formulations alike. They enhance compatibility with other actives, pigments, and emulsifiers, enabling smoother, stable end products. As brands increasingly focus on texture refinement and feel optimization, liquid slip agents have become indispensable in premium skincare serums, conditioning formulations, and high-spread foundation systems.

The growth of this segment is also fueled by technological advances in liquid silicone derivatives and bio-based ester blends, which improve viscosity control and provide enhanced skin conditioning effects. As the market transitions toward eco-responsible and multifunctional liquid systems, their role in formulation design and performance consistency will remain central. The liquid form segment will continue to act as the foundation of sensorial engineering, ensuring stable emulsions, soft-touch feel, and prolonged wearability in both mass and luxury personal care markets.

Shift Toward Sensorial Optimization and Multi-Functional Formulation Design

A key driver for the Global Lubricants / Slip Agents Market is the accelerating shift among personal care and cosmetic formulators toward sensorial optimization and multi-functional product design. Slip agents are no longer viewed as secondary ingredients but as core sensorial engineering components that define product touch, glide, and finish. Brands are investing in slip systems that combine spreadability, friction reduction, and film-forming performance in a single solution.

This is particularly evident in premium skincare and hybrid makeup products, where consumers expect seamless absorption, matte yet soft finishes, and compatibility with bioactive complexes. The demand for polyether-modified and silicone-ester hybrid chemistries is rising as formulators look for greater formulation flexibility and active delivery efficiency. By enabling smoother sensory transitions and stable emulsification, these multi-role slip agents are now essential to texture differentiation strategies across both mass and dermocosmetic lines.

Expansion of Silicone Innovation in Asia-Pacific and the Rise of Localized Manufacturing Hubs

A second major growth driver is the rapid localization of silicone-based ingredient manufacturing in East Asia and South Asia, which is fundamentally reshaping supply chain economics and adoption patterns. Previously dominated by European and USA suppliers, the silicone derivatives space is witnessing strategic expansions by Shin-Etsu, KCC Beauty, and Wacker Chemie, along with growing regional capacity additions in China and India.

Localized production reduces import dependency, improves lead times, and enables cost-efficient adaptation of slip agents to local formulation needs, such as heat and humidity resistance or fast-absorbing textures preferred in tropical climates.

This regional innovation dynamic is also driving collaborations between global players and Asian cosmetic brands to co-develop region-specific slip systems, aligning with both performance and sustainability goals.

Regulatory Scrutiny and Phase-Out of Volatile Silicones (D4, D5, D6)

The most significant restraint for the market stems from tightening regulatory frameworks on volatile cyclic silicones (D4, D5, and D6) across Europe, North America, and selective Asian markets. These materials, widely used for their superior spreadability and dry-touch sensory feel, are under restriction due to their potential environmental persistence and bioaccumulation risks.

Regulatory agencies such as the European Chemicals Agency (ECHA) and USA EPA are enforcing limits and mandatory labelling for certain silicone categories, compelling manufacturers to reformulate using compliant, low-volatile, or biodegradable alternatives.

While this transition fosters innovation in polyether-modified and natural ester systems, it also imposes R&D costs, certification delays, and supply chain adjustments, temporarily affecting market growth and consistency across regions.

Raw Material Price Volatility and Limited Feedstock Diversification

Another key restraint arises from fluctuations in raw material pricing, particularly for silicone monomers, synthetic esters, and petroleum-based hydrocarbons. Dependence on petrochemical feedstocks and the absence of large-scale natural oil-based alternatives expose producers to cost volatility and margin pressures.

The limited diversification of raw material sources, especially for high-purity silicones, constrains small and mid-sized producers that rely on external suppliers. Additionally, the complex synthesis and purification processes for cosmetic-grade slip agents often require precision-controlled environments, further elevating operational costs.

The result is a growing price-performance imbalance, especially in cost-sensitive markets where mass personal care formulations dominate, slowing adoption of premium slip systems in emerging economies.

Emergence of Bio-Based and Hybrid Silicone Alternatives in Clean Beauty Formulations

A defining trend shaping the market is the rise of bio-based and hybrid silicone alternatives that align with the clean beauty movement. As brands aim for sustainability without sacrificing sensorial appeal, ingredient innovators are introducing esterified silicones, natural oil-modified slip agents, and sugar-derived emollient systems that replicate the tactile smoothness and volatility profile of traditional silicones.

Companies like Evonik, Croda, and Clariant are actively expanding their “green silicone” portfolios that combine the performance of dimethicones with the biodegradability of natural esters. These innovations cater to premium and dermocosmetic categories, especially in Europe and Japan, where regulatory compliance and environmental messaging have become strong consumer purchase drivers. Over 2025 to 2035, hybrid slip agents will form the foundation of next-generation sensorial frameworks in skincare and sun care applications.

Digitalization of Formulation and Ingredient Performance Mapping

Another transformative trend is the digitalization of formulation processes, where AI-driven simulation tools and cloud-based ingredient databases are enabling precise slip agent selection and performance mapping. Major players such as Dow and BASF are integrating digital formulation platforms that allow real-time prediction of sensory outcomes (spread rate, tactile finish, film uniformity) based on slip agent combinations.

This technology-led approach shortens R&D cycles and promotes rapid customization of product texture according to demographic and climatic factors. The convergence of digital chemistry, machine learning, and data-driven sensory evaluation is expected to revolutionize how slip agents are formulated, tested, and scaled.

As brands increasingly focus on consumer sensory profiling and regional texture preferences, digital-enabled formulation ecosystems will become a critical differentiator across the global lubricants and slip agents market.

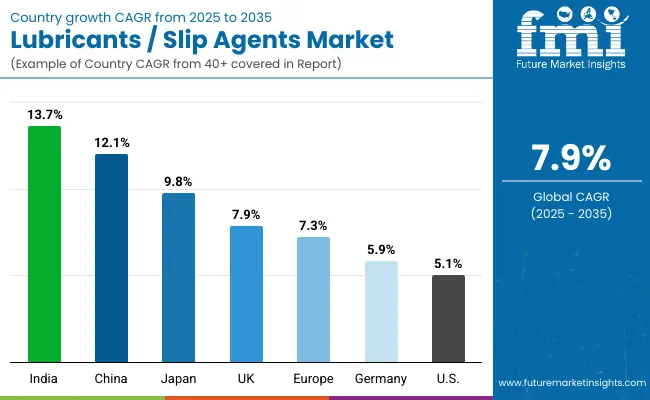

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 12.1% |

| USA | 5.1% |

| India | 13.7% |

| UK | 7.9% |

| Germany | 5.9% |

| Japan | 9.8% |

| Europe | 7.3% |

The Global Lubricants / Slip Agents Market shows a distinct regional performance pattern, with Asia-Pacific emerging as the fastest-growing hub for production, innovation, and consumption between 2025 and 2035. India (13.7% CAGR) and China (12.1% CAGR) lead global expansion, driven by rapid growth in personal care manufacturing, rising domestic brand activity, and increasing consumer preference for high-performance skincare and cosmetic textures. India’s growth is supported by an expanding local formulation base and higher inclusion of silicone and ester-modified slip agents in affordable beauty products.

In China, the surge is linked to aggressive capacity expansions by silicone producers and partnerships between global suppliers and domestic formulators developing multifunctional sensorial ingredients for hybrid beauty and sun care. Japan (9.8% CAGR) also contributes strongly due to continuous technological advancements in polyether-modified silicones and its influence on tactile formulation standards adopted across East Asia. Collectively, the Asian region is becoming the key global innovation center for clean, lightweight, and humidity-adapted slip agents, balancing both functional and regulatory needs.

In contrast, mature markets in North America and Europe exhibit moderate yet stable growth trajectories. The USA market (5.1% CAGR) is characterized by steady demand for premium silicone systems used in dermocosmetic and hybrid skincare formulations, supported by leading players like Dow and Momentive focusing on advanced sensorial chemistries and digital formulation tools.

In Europe, where the average CAGR stands at 7.3%, growth is reinforced by the regulatory-driven shift toward biodegradable and low-volatile silicone alternatives. Germany (5.9% CAGR) and the U.K. (7.9% CAGR) continue to serve as hubs for R&D and sustainable formulation development, leveraging strong cosmetic innovation ecosystems and environmentally conscious consumer bases.

European markets, while slower in volume growth compared to Asia, are steering the global transition toward eco-compliant slip systems and driving collaboration between chemical suppliers and luxury cosmetic brands to redefine next-generation sensorial benchmarks.

| Year | USA Lubricants / Slip Agents Market (USD Million) |

|---|---|

| 2025 | 458.29 |

| 2026 | 488.51 |

| 2027 | 520.72 |

| 2028 | 555.06 |

| 2029 | 591.65 |

| 2030 | 630.66 |

| 2031 | 672.25 |

| 2032 | 716.57 |

| 2033 | 763.82 |

| 2034 | 814.18 |

| 2035 | 867.86 |

The Global Lubricants / Slip Agents Market in the United States is projected to grow at a CAGR of 5.1% from 2025 to 2035, driven by sustained demand across premium skincare, hybrid cosmetics, and advanced hair care formulations. The USA remains a hub for formulation innovation, where chemical suppliers and beauty brands increasingly collaborate to co-develop next-generation sensorial systems.

Growth is led by the expansion of silicone-based and polyether-modified slip agents, which continue to dominate due to their ability to enhance spreadability, tactile balance, and film uniformity in high-performance products. The dermocosmetic and hybrid skincare categories-bridging pharmaceutical-grade efficacy with consumer sensory appeal-have emerged as major consumers of these agents.

Increasing investments by players such as Dow, Momentive, and Wacker Chemie in advanced emulsion technologies and clean-silicone formulations are supporting strong domestic adoption. In addition, the rising consumer preference for multifunctional beauty and sustainable sensorial solutions is pushing formulators to design slip systems that balance biodegradability with high-performance smoothness and texture delivery.

The Global Lubricants / Slip Agents Market in the United Kingdom is forecasted to grow at a CAGR of 7.9% during 2025 to 2035, supported by the nation’s strong innovation ecosystem in cosmetic chemistry and clean beauty formulation. The U.K. market benefits from advanced formulation capabilities, well-developed testing infrastructure, and growing partnerships between ingredient suppliers and luxury skincare brands. Slip agents are increasingly being tailored for eco-certified and hybrid cosmetic formulations, combining high sensorial performance with environmental compliance.

Ester and natural oil-based lubricants are gaining momentum due to strong consumer inclination toward biodegradable and plant-derived ingredients. Moreover, the country’s leading beauty labs and contract manufacturers are expanding the use of polyether-modified silicones that deliver ultra-smooth application and improve active dispersion. The regulatory emphasis on volatile silicone restriction (D4/D5) has accelerated the adoption of innovative non-volatile systems. The integration of digital formulation tools and sensorial analytics by U.K. formulators is also supporting the optimization of slip and texture balance for climate-adapted, premium products.

India is witnessing rapid growth in the Global Lubricants / Slip Agents Market, which is expected to expand at a CAGR of 13.7% through 2035, the highest globally. The surge is primarily driven by the localization of personal care manufacturing, the rise of indigenous cosmetic brands, and increasing adoption of sensorially advanced yet cost-efficient formulations.

Domestic manufacturers are increasingly incorporating silicone-based and ester-derived slip agents into skincare, sunscreen, and hair styling products to achieve premium feel without increasing formulation costs. Tier-2 and tier-3 cities are contributing significantly, with MSME producers adopting pre-formulated emulsion concentrates that improve spreadability and product texture.

Additionally, Indian R&D labs are investing in natural ester and oil-derived slip systems aligned with Ayurveda-inspired clean beauty trends. The government’s “Make in India” initiative and tariff reductions on silicone intermediates are further supporting local production and downstream formulation innovation.

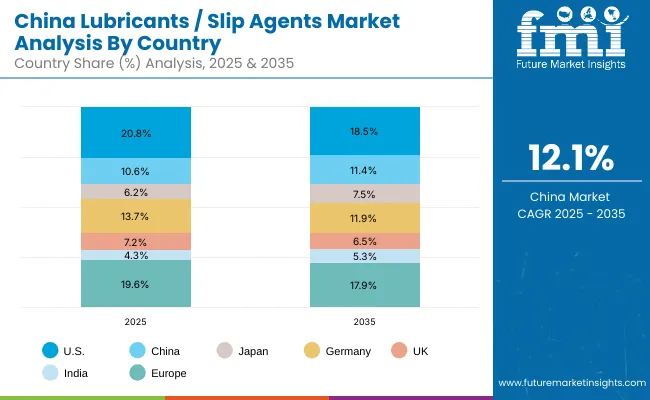

The Global Lubricants / Slip Agents Market in China is projected to grow at a CAGR of 12.1%, making it one of the most dynamic and competitive markets globally. Growth is underpinned by massive production scalability, aggressive domestic R&D investment, and the integration of sensorial additives into mainstream and luxury beauty formulations.

China’s rapid industrial expansion in silicone derivatives and polyether-modified systems is reshaping supply chains, making high-performance slip agents more accessible to local brands. The growing emphasis on texture innovation, active dispersion, and skin feel balance in products like tone-up creams, sunscreens, and foundations is boosting demand.

Furthermore, China’s government-backed sustainability programs have incentivized green chemistry in cosmetics, leading to strong adoption of bio-based ester slip agents. Domestic suppliers are also competing with global leaders by offering cost-effective multifunctional systems compatible with hybrid formulations.

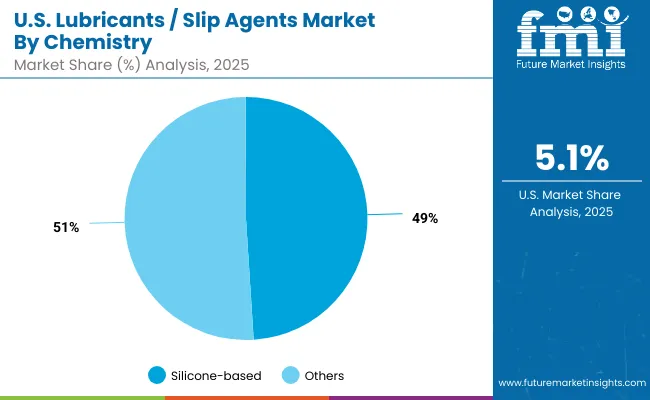

| USA By Chemistry | Value Share % 2025 |

|---|---|

| Silicone-based | 49.1% |

| Others | 50.9% |

The Global Lubricants / Slip Agents Market in the United States is valued at USD 458.3 million in 2025, representing one of the most mature yet innovation-driven segments of the global landscape. Silicone-based agents dominate with a 49.1% share, reflecting the long-standing reliance of USA formulators on high-purity silicones for premium skincare, hybrid cosmetics, and dermocosmetic applications.

The USA market’s direction is shaped by clean formulation initiatives, increasing use of low-volatile silicone blends, and the integration of polyether-modified agents that combine superior spreadability with environmental compliance. A gradual transition is visible toward sustainable and multifunctional sensorial systems, with formulators seeking to balance tactile performance, volatility control, and biodegradability.

A key growth catalyst is the integration of AI-driven formulation software and sensorial databases, enabling brands to fine-tune slip characteristics for varying skin types and climates. Companies such as Dow and Momentive are leveraging data-backed formulation modeling and hybrid silicone development to meet the rising demand for “smart sensorial” personal care products.

The adoption of hybrid silicone-ester systems in sunscreen, anti-aging serums, and clean beauty lines is expanding rapidly. Regulatory compliance, consumer preference for non-greasy, breathable finishes, and the emphasis on texture differentiation continue to position the United States as a critical innovation hub in the global slip agents ecosystem.

| China By Function | Value Share % 2025 |

|---|---|

| Spreadability enhancers | 39.2% |

| Others | 60.8% |

The Global Lubricants / Slip Agents Market in China is estimated at USD 234.2 million in 2025 and is forecasted to expand at an impressive CAGR of 12.1% through 2035, marking it as one of the most dynamic regional markets worldwide.

Spreadability enhancers dominate the functional segmentation with a 39.2% share, reflecting the strong consumer preference for lightweight, fast-absorbing, and matte-finish products suited to humid climates. The Chinese market’s growth is powered by rapid expansion in personal care manufacturing, strong R&D investment in silicone and natural ester chemistries, and robust domestic production of polyether-modified slip agents.

The widespread adoption of slip systems in skin-brightening creams, tone-up sunscreens, and hybrid foundation-serum formulations has elevated China’s role from a manufacturing base to an innovation-led consumer market. Local players such as KCC Beauty and regional subsidiaries of Shin-Etsu and Wacker Chemie are partnering with cosmetic OEMs to create cost-efficient, multifunctional slip systems optimized for mass and premium beauty lines.

Additionally, China’s strong regulatory push for green chemistry and biodegradable ingredients is accelerating the shift toward ester-based and plant-derived slip agents. As smart manufacturing expands, cloud-integrated formulation labs and AI-based quality control systems are expected to dominate R&D workflows by 2030, further reinforcing China’s competitive advantage in sensorial technology and scale.

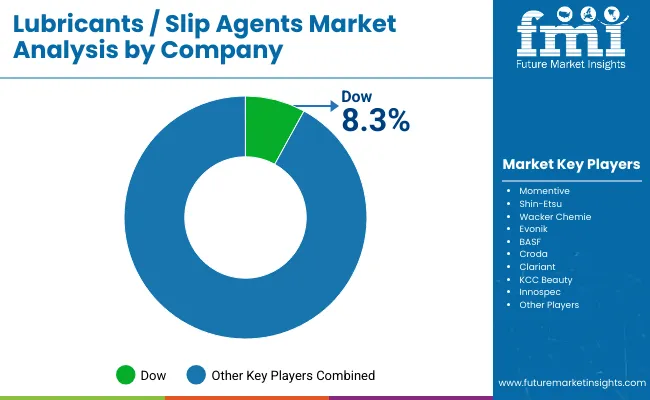

| Company | Global Value Share 2025 |

|---|---|

| Dow | 8.3% |

| Others | 91.7% |

The Global Lubricants / Slip Agents Market is moderately consolidated, with a mix of global chemical majors, mid-sized specialty players, and formulation-driven innovators competing for share across regions. Dow leads globally with an 8.3% value share, leveraging its comprehensive silicone-based portfolio and deep partnerships with personal care formulators across the United States, Europe, and Asia.

Momentive, Shin-Etsu, and Wacker Chemie closely follow, focusing on high-performance silicone fluids, polyether-modified derivatives, and emulsion concentrates that deliver multi-sensory enhancement and surface uniformity. Evonik and BASF have strengthened their presence through biodegradable ester and hybrid systems, aligning with the clean beauty transition in Europe and North America.

Mid-tier players such as Croda, Clariant, and Innospec are differentiating through bio-based sensorial engineering, combining natural feedstocks with silicone alternatives to achieve similar tactile smoothness while reducing environmental impact. Emerging Asian manufacturers, particularly KCC Beauty in South Korea and local producers in China, are reshaping the competitive balance through cost-effective hybrid slip systems that rival global formulations in both texture and performance.

The competitive environment is shifting away from chemistry alone toward integrated sensorial ecosystems, where performance analytics, regulatory compliance, and climate-adapted formulation design define differentiation. Increasing adoption of AI-powered R&D, digital formulation mapping, and cloud-based testing platforms is enabling suppliers to co-create products with beauty brands in real time. This convergence of chemistry and data science is establishing a new benchmark for innovation in the Global Lubricants / Slip Agents Market, where the leaders are those who deliver sensorial precision, sustainability, and scalability across every formulation tier.

Key Developments in Global Lubricants / Slip Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Chemistry | Silicone-based, Hydrocarbon-based, Ester & Natural Oil-based, Polyether-modified |

| Function | Spreadability enhancers, Film formers & skin feel modifiers, Friction-reduction agents |

| Physical Form | Liquid, Powder, Emulsion concentrate |

| Application | Skin creams & lotions, Color cosmetics, Hair conditioners & styling, Sunscreen formulations |

| End Use | Mass personal care, Premium skincare & color cosmetics, Dermocosmetic |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, India, Japan, Germany, United Kingdom, France, Brazil, South Korea, Indonesia |

| Key Companies Profiled | Dow, Momentive, Shin-Etsu, Wacker Chemie, Evonik, BASF, Croda, Clariant, KCC Beauty, Innospec |

| Additional Attributes | Dollar sales by chemistry and function, adoption trends in premium skincare and hybrid beauty, rising demand for polyether-modified and silicone-ester hybrids, shift toward low-volatile and biodegradable formulations, expansion of dermocosmetic applications, regional focus on clean beauty and sensorial optimization, integration of digital formulation tools, and sustainability-driven ingredient innovation across major regions. |

The Global Lubricants / Slip Agents Market is estimated to be valued at USD 2,207.4 million in 2025.

The market size for the Global Lubricants / Slip Agents Market is projected to reach USD 4,702.6 million by 2035.

The Global Lubricants / Slip Agents Market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key chemistries in the Global Lubricants / Slip Agents Market are silicone-based, hydrocarbon-based, ester & natural oil-based, and polyether-modified slip agents.

In terms of function, spreadability enhancers are expected to command 42.7% share of the Global Lubricants / Slip Agents Market in 2025.

The East Asia and South Asia & Pacific regions will witness the highest growth, led by expanding personal care manufacturing in China and India, and rapid adoption of sensorially advanced, sustainable formulation technologies.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Anti-Slip Agents Manufacturers

Slip Lid Can Market Size and Share Forecast Outlook 2025 to 2035

Slip Cover Cans Market Size and Share Forecast Outlook 2025 to 2035

Slip Tip Syringe Market Size and Share Forecast Outlook 2025 to 2035

Slipcases Market Size and Share Forecast Outlook 2025 to 2035

Slip Resistant Shoes Market Insights - Trends & Forecast 2025 to 2035

Slip-on Shoes Market Trends - Demand & Forecast 2025 to 2035

Slip Sheets Market Insights – Growth & Demand 2025 to 2035

Slippery Elm Market Analysis by Form, Application, Packaging, Distribution Channel and Region through 2035

Competitive Landscape of Slip Tip Syringe Providers

Lubricants for Cement Industry Market

Anti-Slip Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in Anti-Slip Coated Paper Sector

Anti-Slip Floor Tape Market Trends – Growth & Forecast 2024-2034

Pallet Slip Sheet Market Trends, Growth and Forecast from 2024 to 2034

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA