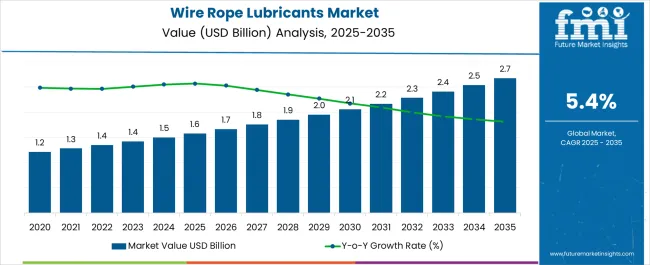

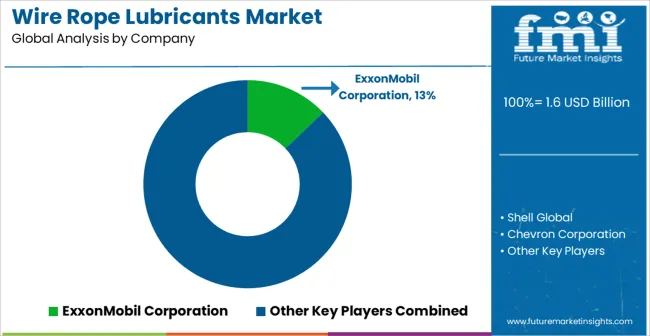

The Wire Rope Lubricants Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Wire Rope Lubricants Market Estimated Value in (2025 E) | USD 1.6 billion |

| Wire Rope Lubricants Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The Wire Rope Lubricants market is experiencing steady growth, supported by increasing demand across industries such as construction, oil and gas, mining, and marine. These lubricants play a critical role in reducing friction, minimizing wear, and extending the lifespan of wire ropes that are subjected to harsh environmental and mechanical conditions. The market is witnessing strong momentum due to rising adoption of biodegradable and advanced lubricant formulations that comply with environmental regulations while maintaining superior performance.

Increasing investments in heavy-duty infrastructure projects and industrial expansion are further fueling the need for reliable lubrication solutions. Additionally, growing emphasis on operational safety, equipment efficiency, and cost reduction is driving companies to adopt high-quality lubricants designed to withstand extreme loads and weather conditions.

Technological advancements, including synthetic blends and environmentally safe additives, are improving durability and sustainability of wire rope lubrication As industries continue to prioritize efficiency and regulatory compliance, the Wire Rope Lubricants market is expected to remain on a growth trajectory, driven by innovation, industrial expansion, and increasing focus on eco-friendly products.

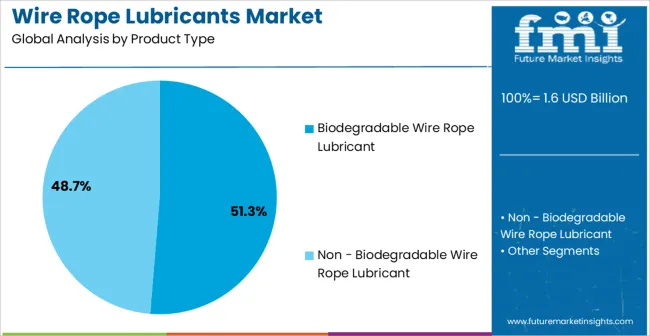

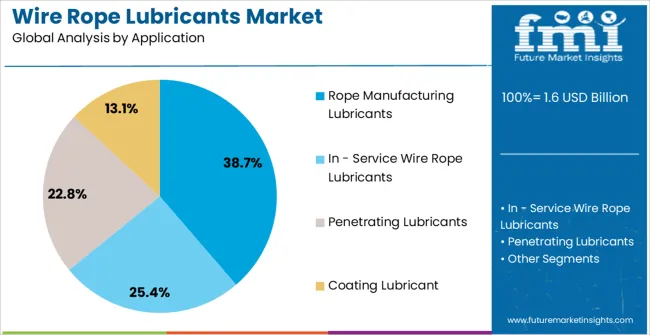

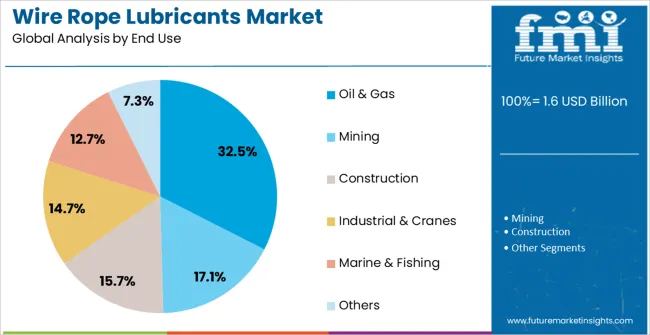

The wire rope lubricants market is segmented by product type, application, end use, and geographic regions. By product type, wire rope lubricants market is divided into Biodegradable Wire Rope Lubricant and Non - Biodegradable Wire Rope Lubricant. In terms of application, wire rope lubricants market is classified into Rope Manufacturing Lubricants, In - Service Wire Rope Lubricants, Penetrating Lubricants, and Coating Lubricant. Based on end use, wire rope lubricants market is segmented into Oil & Gas, Mining, Construction, Industrial & Cranes, Marine & Fishing, and Others. Regionally, the wire rope lubricants industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The biodegradable wire rope lubricant segment is projected to hold 51.3% of the market revenue share in 2025, making it the leading product type. Growth in this segment is being driven by the rising adoption of environmentally friendly lubricants that reduce ecological impact without compromising performance. Increasing regulatory pressure to reduce emissions and contamination in sensitive areas such as marine and offshore operations has accelerated demand for biodegradable formulations.

These lubricants provide excellent resistance to water washout, oxidation, and corrosion, ensuring prolonged rope life under challenging conditions. Industries such as shipping, construction, and oil and gas are adopting biodegradable solutions to comply with sustainability goals and reduce environmental risks. In addition to regulatory compliance, the operational benefits of reduced equipment downtime, enhanced safety, and improved rope performance are reinforcing market growth.

The ability of biodegradable lubricants to deliver both environmental responsibility and cost savings is strengthening their market leadership As industries continue to align with global sustainability standards, this segment is expected to maintain dominance in the coming years.

The rope manufacturing lubricants application segment is anticipated to account for 38.7% of the market revenue share in 2025, positioning it as the leading application area. Demand for these lubricants is being supported by the critical role they play in the production process, ensuring smooth wire drawing, improved strand bonding, and reduced friction during rope assembly. By enhancing the mechanical integrity of ropes, lubricants contribute to higher durability and better load-bearing capacity, which are vital in industries where wire ropes face constant stress.

Manufacturers are increasingly adopting advanced lubrication technologies to optimize production efficiency, reduce operational costs, and meet stringent quality standards. Additionally, the integration of environmentally friendly and high-performance lubricants in manufacturing processes is improving competitiveness in global markets.

Rope producers are prioritizing lubricants that extend product lifespan and reduce maintenance requirements for end users With the growing demand for high-strength, durable ropes in industrial, marine, and energy sectors, the rope manufacturing lubricants application segment is expected to remain a major growth driver in the market.

The oil and gas segment is expected to hold 32.5% of the market revenue share in 2025, making it the leading end-use industry. This dominance is being driven by the extensive use of wire ropes in drilling, lifting, anchoring, and subsea operations, where ropes are continuously exposed to extreme loads, saltwater, and harsh conditions. Reliable lubrication is essential for ensuring the operational efficiency, safety, and longevity of ropes in this sector.

The oil and gas industry faces strict safety and performance standards, prompting companies to adopt high-quality lubricants that minimize risks of equipment failure and downtime. Biodegradable and synthetic lubricants are gaining popularity due to their superior resistance to corrosion and ability to perform under high pressure. Increasing offshore exploration and expanding energy infrastructure projects are further boosting demand.

The segment’s reliance on durable and environmentally compliant lubrication solutions underscores its market leadership As oil and gas operations expand globally and prioritize sustainable practices, this end-use segment is expected to remain a key contributor to overall market growth.

Wire rope lubricants are designed for coating and protection of a wire rope from corrosion and they minimize the internal and external wear. The lifespan of a wire rope can be dramatically amplified when it is coated with a lubricant, i.e., lack of lubrication would result in reduction of longevity for wire ropes.

Wire rope lubricants find a wide range of applications in industrial fields, including mining, forestry, shipping, construction cranes, building elevators (lifts) and suspension bridges. These applications can be also be categorized based on consumption of lubricants. The lubricants used during the manufacturing of ropes come under category 1, whereas the lubricants used during the working conditions of wire ropes come under category 2.

Additionally, fatigue life of ropes can also be greatly extended by proper lubrication, when the wires can move freely to balance the stress distribution caused by drums or sheaves. The lubricant must reach the fiber cores or they will absorb moisture and encourage corrosion. Today, new legislative environmental guidelines are driving the users to give deliberation not only to the typical wire rope lubricants that lubricate and protect the wire ropes, but that are also considered as environment friendly.

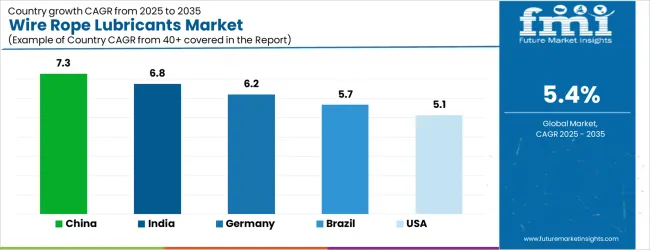

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| Brazil | 5.7% |

| USA | 5.1% |

| UK | 4.6% |

| Japan | 4.1% |

The Wire Rope Lubricants Market is expected to register a CAGR of 5.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.3%, followed by India at 6.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Wire Rope Lubricants Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.2%. The USA Wire Rope Lubricants Market is estimated to be valued at USD 566.0 million in 2025 and is anticipated to reach a valuation of USD 566.0 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 84.2 million and USD 43.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Product Type | Biodegradable Wire Rope Lubricant and Non - Biodegradable Wire Rope Lubricant |

| Application | Rope Manufacturing Lubricants, In - Service Wire Rope Lubricants, Penetrating Lubricants, and Coating Lubricant |

| End Use | Oil & Gas, Mining, Construction, Industrial & Cranes, Marine & Fishing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ExxonMobil Corporation, Shell Global, Chevron Corporation, BP plc, Klüber Lubrication, Lubrication Engineers, Inc., Castrol Limited, Total S.A., Fuchs Petrolub SE, Petro-Canada Lubricants Inc., Bel-Ray Company, LLC, Royal Manufacturing Co., and Whitmore Manufacturing, LLC |

The global wire rope lubricants market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the wire rope lubricants market is projected to reach USD 2.7 billion by 2035.

The wire rope lubricants market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in wire rope lubricants market are biodegradable wire rope lubricant and non - biodegradable wire rope lubricant.

In terms of application, rope manufacturing lubricants segment to command 38.7% share in the wire rope lubricants market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wire Rope Sling Market - Trends & Forecast 2025 to 2035

Europe Industrial Lubricants Market: Growth, Trends, and Forecast 2025 to 2035

Surface Contact Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

4-strand Fan-shaped Strand Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Demand for Surface Contact Wire Rope in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Surface Contact Wire Rope in USA Size and Share Forecast Outlook 2025 to 2035

Compacted Strand Surface Contact Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Wireless HDMI Transmitter and Receiver Market Size and Share Forecast Outlook 2025 to 2035

Wire and Cable Management Market Forecast Outlook 2025 to 2035

Wire Harness Tape Market Forecast and Outlook 2025 to 2035

Lubricants / Slip Agents Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wirewound Resistor Market Size and Share Forecast Outlook 2025 to 2035

Wire-cutting EDM Machines Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA