The global wire rope sling market will register sustained growth between 2025 and 2035 after growing in the construction, oil & gas, marine, and mining sectors. Wire rope slings are an essential lifting equipment employed in the lifting of heavy loads under harsh environments, where strength, toughness, and safety come first.

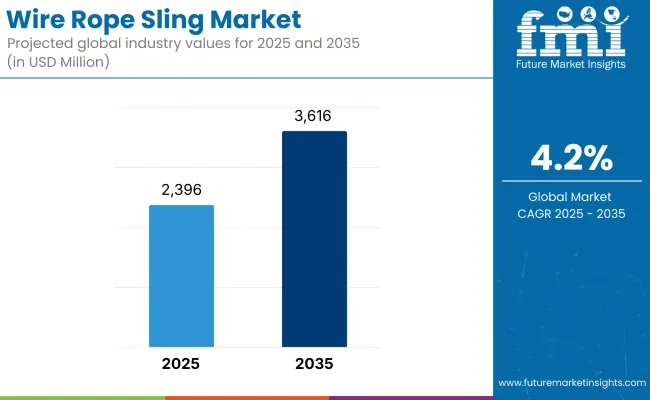

As infrastructure development in the emerging countries is increasing and protection laws for industry across the world are becoming stricter, the requirement for high-performance wire rope sling will increase. The market is expected to be USD 2,396 million in 2025 and USD 3,616 million in 2035 and will advance at a CAGR of 4.2% during the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 2,396 million |

| Projected Market Size in 2035 | USD 3,616 million |

| CAGR (2025 to 2035) | 4.2% |

Growing investment in megaprojects, renewable energy facilities, and urbanization is fueling wire rope sling market growth directly. Furthermore, galvanizing, coating, and heat-resistance development of wire rope is offering better reliable performance in high-stress applications, enabling end-users to gain maximum service life and reduce operating downtime.

North America is also a major region with ongoing demand in construction, shipbuilding, and oil & gas. America is investing heavily in rebuilt aging infrastructure, offshore drilled platforms, and logistics centers with heavy-load lifting facilities. Traceable load-rated certified slings and the inspection process are being addressed as a consequence of OSHA compliance by contractors.

Europe is experiencing steady growth, particularly in Germany, the UK, and Scandinavia, with offshore wind farms and green power showing good performance. Wire rope slings are more being used in marine work and wind turbine installation than ever before. Europe is also marked by intense concern about environmentally friendly manufacturing processes, which have resulted in innovations in wire materials that can be recycled and are corrosion resistant.

Asia-Pacific is the rapidly changing market for wire rope slings due to urbanization, giant-sized mines and giant-sized expansion in seaports. India, China, Indonesia, and Vietnam are all drivers of growth and growing industrialization and huge investment in transport infrastructure and property. Domestic manufacturers are also gearing to supply domestic as well as export markets and investment in more advanced test and certificate systems.

Corrosion, Safety Compliance, and Counterfeit Products

Among the key challenges is corrosion and wear in harsh environments, which affects lifting safety. Misuse or breakdown in regular inspection also risks workplaces. Another challenge is easy availability of low-quality or counterfeit wire rope slings, particularly in cost-sensitive markets, whose use leads to poor-quality equipment failure with disastrous implications. Compliance with safety standards such as EN 13414 and ASME B30.9 remains vital.

Smart Slings, NDT Monitoring, and Private Fabrication

Smart slings equipped with load sensors, RFID tags, and non-destructive test (NDT) monitoring systems present great opportunity for enhanced safety and asset positioning. Also, industry-specific design fashions in slings by industry or use-flame-resistant slings for refinery or ultra-flexible slings for crane assembly-present opportunities in specialty markets. Electronic record platforms for certification and inspection history for slings also facilitate compliance for large fleets.

2020 to 2024 wire rope sling market trends were interrupted by COVID-19 disturbances in oil & gas sector and construction. Nevertheless, post-pandemic recuperation allowed for greater infrastructure spending, especially in North America and Asia. Greater use of polymer-coated and stainless-steel core wire ropes, intended for heavy loads for outdoor use, also dominated the market.

During the period of 2025 to 2035, the industry will be moving in the direction of digital integration of lifting equipment with slings providing real-time information to operators and safety boards. Green technology such as bio-based lubricants and wire rope core recycling will become the standard as sustainability will emerge as a buying driver.

As industries give increased importance to culture of safety, certified training courses and regular sling audits will be the new normal, further adding to the continued consistent market growth.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with OSHA, ISO 7531, and ASME B30.9 safety standards for rigging. |

| Consumer Trends | Demand driven by construction, oil & gas, and heavy manufacturing sectors. |

| Industry Adoption | Standard across crane, shipbuilding, and logging operations for heavy lifting. |

| Supply Chain and Sourcing | Sourcing of galvanized steel and stainless rope from bulk producers in China and India. |

| Market Competition | Dominated by Crosby, Gunnebo, and Bridon-Bekaert with large-scale industrial portfolios. |

| Market Growth Drivers | Fueled by global infrastructure projects and logistics sector expansion. |

| Sustainability and Environmental Impact | Limited focus on lifecycle emissions or recyclability of slings. |

| Integration of Smart Technologies | Basic use of load rating tags and manual inspection schedules. |

| Advancements in Equipment Design | Relied on traditional hand-spliced or swaged end fittings. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Introduction of smart compliance mandates requiring traceability tagging, fatigue detection sensors, and real-time inspection records. |

| Consumer Trends | Shift toward slings with embedded load monitoring chips and RFID-enabled tracking for preventive maintenance and asset lifecycle control. |

| Industry Adoption | Expansion into offshore wind energy, modular construction, and smart shipyard automation demanding higher endurance and corrosion resistance. |

| Supply Chain and Sourcing | Shift to regionally forged, fatigue-resistant wire ropes with eco-coated surfaces and robotic assembly processes for consistency. |

| Market Competition | Entry of specialized firms offering AI-inspected slings, magnetic core detection systems, and customizable multi-leg assemblies. |

| Market Growth Drivers | Driven by digital rigging audits, offshore renewable energy growth, and rising safety norms in mining and defense applications. |

| Sustainability and Environmental Impact | Focus on recyclable rope cores, bio-lubricated strand coatings, and carbon-footprint tracking during installation and retrieval. |

| Integration of Smart Technologies | Rise of IoT-integrated slings with real-time stress monitoring, remote fault alerts, and digital twin integration in smart construction. |

| Advancements in Equipment Design | Innovations in high-tension rotary swaging, precision forged sockets, and automatic damage visualization via embedded sensors. |

In the USA, wire rope slings remain integral to construction, defense logistics, and port operations. However, demand is evolving toward high-durability slings equipped with smart wear sensors. Engineering firms are working with local fabricators to deploy RFID-tagged slings that alert riggers when maximum load cycles are reached. The USA Navy’s fleet support programs are also integrating corrosion-proof wire slings for onboard operations.

| Country | CAGR (2025 to 2035) |

|---|---|

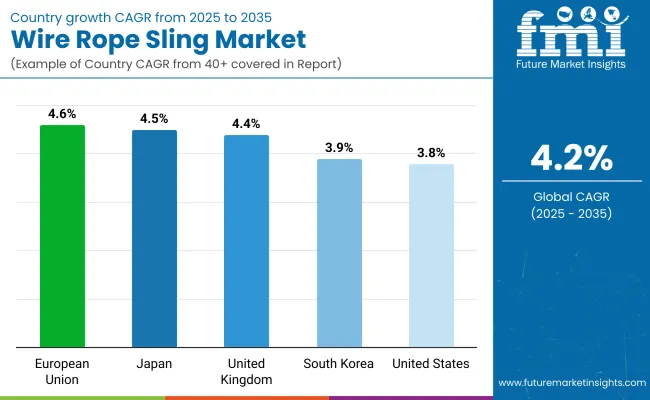

| USA | 3.8% |

The UK market is experiencing renewed investment in offshore rigging systems as part of wind energy infrastructure. Operators are replacing standard slings with high-performance galvanized versions featuring UV-resistant coatings and load-count sensors. Smart rigging compliance under the UK Health and Safety Executive (HSE) is pushing adoption of sensor-integrated lifting systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.4% |

EU countries like Germany, the Netherlands, and Norway are advancing the adoption of digitally certifiable wire rope slings for nuclear, offshore, and heavy mechanical engineering sectors. Sling manufacturers are now integrating digitally stamped QR codes that tie each sling to a cloud-based rigging log. The EU’s Green Deal goals are pushing demand for recyclable wire cores and environmentally neutral protective coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

Japan’s automation-heavy port and shipyard sectors are upgrading to precision-manufactured wire rope slings with magnetic rope inspection systems. Leading steelmakers and rigging firms are co-developing slings with built-in torque monitors to support autonomous cranes and gantry systems. Earthquake-resistant infrastructure projects are also fueling demand for ultra-flexible, multi-layered rope designs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

South Korea’s wire rope sling market is rising in sync with its smart industrial port upgrades and shipbuilding resurgence. Firms are switching to AI-tested slings with wear rate predictors and machine-readable lifespan indicators. Shipbuilders are integrating custom-built, temperature-resistant slings for LNG carrier assembly and heavy-deck loadouts.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.9% |

| By Design | Market Share (2025) |

|---|---|

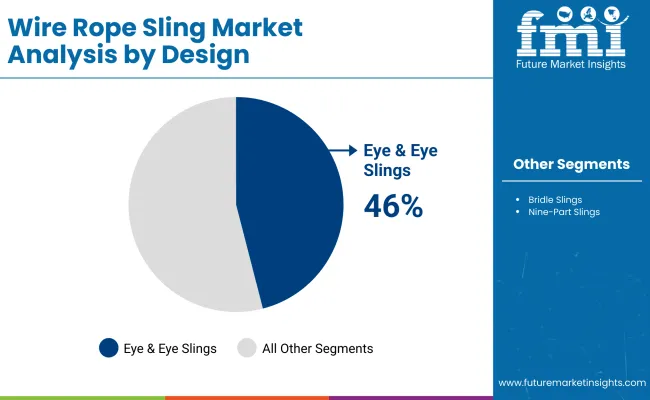

| Eye & Eye Slings | 46% |

Eye & eye slings are forecast to account for the largest share of the wire rope sling market in 2025, at 46% of total demand. Their simple design and versatility make them popular applications for general-purpose lifting, rigging, and load securing.

For example, building construction companies across Southeast Asia employ eye & eye slings in crane operation for the hoisting of precast concrete and steel beams due to their handy feature of being choked, basketed, or used in vertical configurations. Their handyness and easy inspecting characteristic make them a go-to choice in high-demand work areas.

| By End-User | Market Share (2025) |

|---|---|

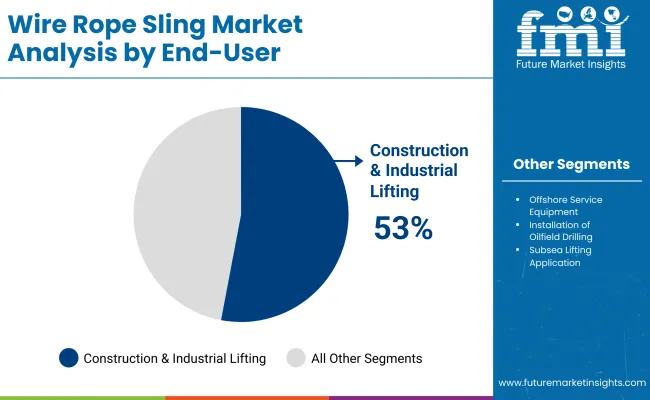

| Construction & Industrial Lifting | 53% |

Construction and industrial lifting applications will drive end-user demand, accounting for 53% of wire rope sling demand in 2025. High-duty and durable lifting devices are required for heavy equipment and fabricated pieces and construction materials to transport around these industries.

A good example is large Middle East infrastructure projects where contractors utilized wire rope slings to lift oversized bundles of rebar and prefabricated units under harsh climatic conditions. As industrial ventures of mega scale and urbanization are increasing all around the globe, the demand for reliable lifting equipment like wire rope slings continues to increase in pace within this sector.

Wire rope sling market is experiencing steady growth as there is increasing demand within industries such as construction, manufacturing, and oil & gas. All these industries rely on wire rope slings owing to their strength, dependability, and usability in heavy-duty applications in lifting.

Technological advancements, including the application of synthetic slings and customized solutions, are also boosting market growth. The market is led by several key players competing along the parameters of product innovation, distribution networks, and customized solutions to gain a competitive advantage.

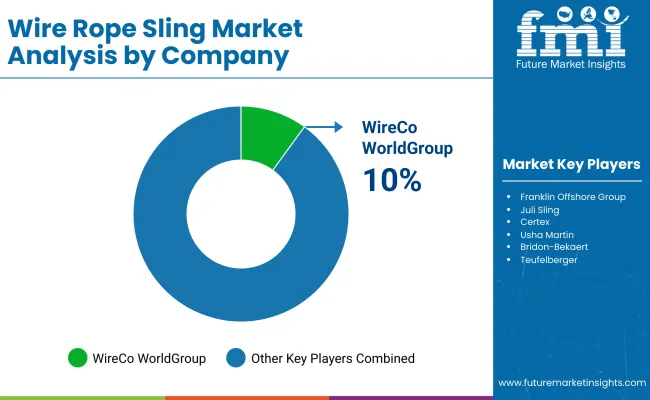

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| WireCo WorldGroup | 10-15% |

| Franklin Offshore Group | 8-12% |

| Juli Sling | 5-10% |

| Certex (part of Axel Johnson International) | 5-10% |

| Usha Martin | 4-8% |

| Other Companies (combined) | 50-60% |

| Company Name | Key Offerings/Activities |

|---|---|

| WireCo WorldGroup | In 2024, launched a new line of high-performance wire rope slings with enhanced load capacities. In 2025, expanded manufacturing facilities in Asia to meet growing regional demand. |

| Franklin Offshore Group | In 2024, developed customized wire rope sling solutions for offshore oil & gas applications. In 2025, partnered with renewable energy companies to supply slings for wind turbine installations. |

| Juli Sling | In 2024, introduced eco-friendly coatings for wire rope slings to improve corrosion resistance. In 2025, implemented IoT-enabled tracking systems for real-time monitoring of sling usage and wear. |

| Certex | In 2024, expanded its product portfolio to include synthetic slings alongside traditional wire rope offerings. In 2025, established a training program for clients on safe sling usage and maintenance. |

| Usha Martin | In 2024, launched a series of wire rope slings designed specifically for the construction industry. In 2025, increased export activities to penetrate emerging markets in Africa and Latin America. |

Key Company Insights

WireCo WorldGroup (10-15%)

WireCo leads the market with its high-performance wire rope slings, raising load capacities steadily and adding manufacturing capacity, particularly in Asia, to address expanding regional demand.

Franklin Offshore Group (8-12%)

With experience in offshore applications, Franklin Offshore offers customized sling solutions for the oil & gas sector and is moving into renewable energy projects, including wind turbine installations.

Juli Sling (5-10%)

Juli Sling places emphasis on sustainability by using green coatings to provide corrosion resistance and using IoT-based tracking devices to track sling use and wear in real-time.

Certex (5-10%)

Certex expands its product range with the introduction of synthetic slings and emphasizes customer education through comprehensive training modules on proper use and maintenance of slings.

Usha Martin (4-8%)

Usha Martin is focusing on the construction industry with tailor-made wire rope slings and is making a serious attempt to establish international presence by expanding exports to new economies in Africa and Latin America.

Other Key Players (50-60% Combined)

The overall market size for the wire rope sling market was approximately USD 2,396 million in 2025.

The wire rope sling market is projected to reach around USD 3,616 million by 2035.

The increasing demand from construction and infrastructure projects, as well as the expansion of the marine industry, fuels the wire rope sling market during the forecast period.

The top 5 countries driving the development of the wire rope sling market are the United States, China, India, Germany, and Japan.

On the basis of design, the nine-part slings segment is expected to command a significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wire and Cable Management Market Forecast Outlook 2025 to 2035

Wire Harness Tape Market Forecast and Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wirewound Resistor Market Size and Share Forecast Outlook 2025 to 2035

Wire-cutting EDM Machines Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Wire Harness Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wire Livestock Panels Market Size and Share Forecast Outlook 2025 to 2035

Wireless Testing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA