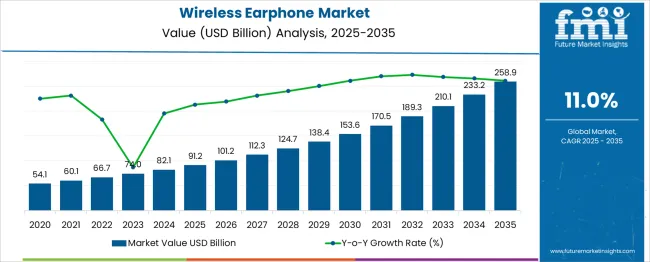

The Wireless Earphone Market is estimated to be valued at USD 91.2 billion in 2025 and is projected to reach USD 258.9 billion by 2035, registering a compound annual growth rate (CAGR) of 11.0% over the forecast period. The market is expected to increase from USD 91.2 billion in 2025 to USD 258.9 billion by 2035, driven by a CAGR of 11.0%. The data suggests a smooth, upward-sloping curve without significant fluctuations, indicating balanced and predictable growth dynamics. From 2025 to 2028, the market value grows from USD 91.2 billion to USD 124.7 billion, reflecting a gradual increase with annual increments ranging between USD 10.0 billion and USD 12.4 billion.

This early phase suggests stable adoption with moderate year-on-year expansion. The period from 2028 to 2032 shows sustained acceleration, with market values rising from USD 124.7 billion to USD 170.5 billion. Annual increases in this phase reach around USD 14.0 billion, reflecting growing consumer demand and technology integration.

Between 2032 and 2035, the growth curve continues its upward trajectory, expanding from USD 170.5 billion to USD 258.9 billion. The yearly increments rise further, nearing USD 23.0 billion by the final forecast years, highlighting increased market penetration and product diversification. The growth curve for the Wireless Earphone Market is smooth and convex, representing healthy, compounding expansion driven by steady demand and continuous innovation in wireless audio technology.

| Metric | Value |

|---|---|

| Wireless Earphone Market Estimated Value in (2025 E) | USD 91.2 billion |

| Wireless Earphone Market Forecast Value in (2035 F) | USD 258.9 billion |

| Forecast CAGR (2025 to 2035) | 11.0% |

The wireless earphone market is witnessing substantial growth, driven by increasing demand for mobility, integration with smart devices, and enhanced audio technology. Advancements in Bluetooth protocols, miniaturization of audio components, and consumer preference for tangle-free experiences have fueled mass adoption across fitness, lifestyle, and professional use cases.

Rising smartphone penetration, growing streaming content consumption, and a shift toward work-from-anywhere models have strengthened market dynamics. Regulatory pressure for standardizing USB-C and low-energy connectivity is pushing manufacturers toward platform-universal, battery-efficient designs.

Further support comes from brand-led innovation around spatial audio, active noise cancellation, and biometric integration, creating new avenues for product differentiation. Continued expansion is expected through bundled offerings, direct-to-consumer channels, and the premiumization of mid-range audio accessories.

The wireless earphone market is segmented by type, connectivity, battery life, application, pricing, distribution channel, and geographic regions. The wireless earphone market is divided into In-ear and On-ear. In terms of connectivity, the wireless earphone market is classified into Bluetooth, Wi-Fi, and NFC. Based on battery life, the wireless earphone market is segmented into 12 to 24 Hours, up to 12 Hours, and above 24 Hours. The wireless earphone market is segmented into Music & Entertainment, Gaming, Fitness & Sports, and Others (Virtual Meetings & Communication). The wireless earphone market is segmented into Medium, Low, and High. The distribution channel of the wireless earphone market is segmented into Online, Company Websites, E-commerce, Offline, Supermarket/Hypermarket, Specialty Store, and Others (Mega Retail Store). Regionally, the wireless earphone industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

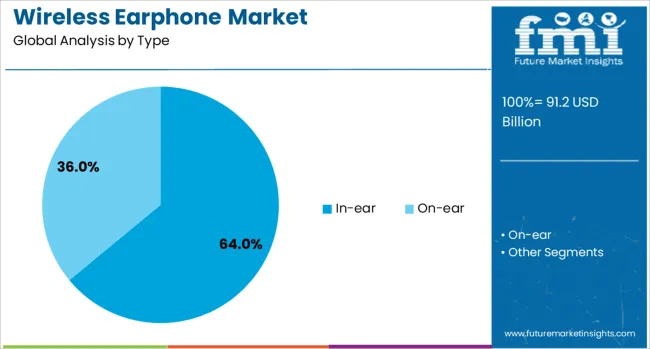

In-ear models are projected to account for 64.0% of the market revenue in 2025, making them the dominant earphone type. Their popularity is being driven by compact form factors, ergonomic comfort, and enhanced noise isolation suitable for both leisure and on-the-go use.

The ability to integrate advanced features such as touch controls, voice assistants, and adaptive sound profiles has reinforced their value proposition among users across age groups. In-ear devices also benefit from efficient power management and secure fit, making them ideal for active lifestyles and extended usage.

Their dominance is further supported by extensive compatibility across device ecosystems and strong retail availability across both premium and value segments.

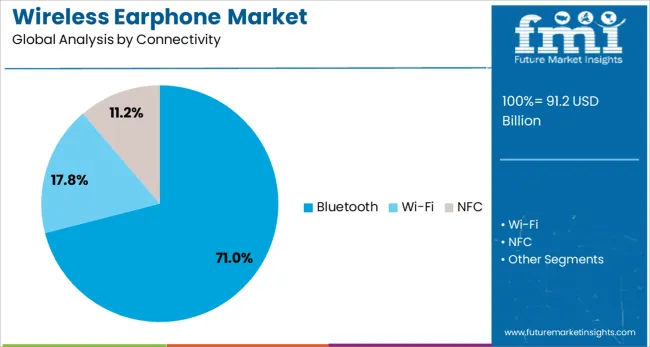

Bluetooth-based connectivity is expected to represent 71.0% of total market share in 2025, reflecting its leadership as the core wireless standard. Growth in this segment is being driven by continuous advancements in transmission speed, latency reduction, and power efficiency.

The widespread adoption of smartphones without headphone jacks has accelerated reliance on Bluetooth-enabled audio accessories. Integration of newer Bluetooth versions like 5.2 and beyond has enabled support for dual-device pairing, low-latency gaming, and higher-quality codecs, improving the user experience across price tiers.

Additionally, Bluetooth’s interoperability across platforms and wearables has cemented its role as the preferred wireless protocol for manufacturers and consumers alike.

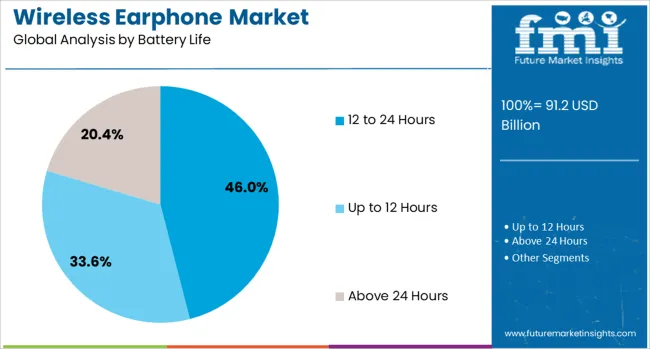

The battery life category of 12 to 24 hours is anticipated to account for 46.0% of market revenue in 2025, leading the battery life segment. This range offers a balanced solution between performance and portability, aligning with the lifestyle needs of commuters, students, and hybrid workers.

Increased battery efficiency from low-power chipsets and software optimization has enabled manufacturers to deliver extended playtime without increasing weight or compromising design aesthetics. Consumers have shown a strong preference for earphones that can last through a full day of intermittent use, including media consumption, calls, and virtual meetings.

The adoption of fast-charging capabilities and wireless charging cases within this segment has further improved convenience, reinforcing its popularity in both mid-range and premium categories.

The wireless earphone market has experienced significant growth due to increasing consumer demand for convenience, portability, and enhanced audio experiences. Advancements in Bluetooth technology and battery life have enabled longer usage durations and better connectivity, facilitating widespread adoption. Integration of voice assistants and active noise cancellation features has further increased product appeal. The rise of smartphones without headphone jacks and the trend toward wearable devices have driven market expansion. Manufacturers have focused on ergonomic designs and waterproofing to improve user comfort and durability.

Improvements in Bluetooth protocols, such as Bluetooth 5.0 and beyond, have enhanced wireless earphone performance by increasing data transmission rates and reducing latency. These advancements have allowed for higher fidelity audio streaming, improved synchronization between audio and video, and more stable connections over extended ranges. Features that reduce energy consumption have extended battery life, enabling longer listening times without frequent charging. Multipoint connectivity has been incorporated to allow simultaneous pairing with multiple devices, increasing convenience. Enhanced codec support, including aptX and AAC, has optimized audio compression and decoding. These technological innovations have collectively elevated user experience, making wireless earphones suitable for diverse applications, including gaming, fitness, and professional use.

The integration of smart features such as voice assistants, touch controls, and sensors has expanded the functionality of wireless earphones. Users have been able to interact hands-free with devices through voice commands, facilitating calls, music playback, and information retrieval. Touch-sensitive panels and gesture controls have simplified navigation without physical buttons, enhancing usability. Sensors capable of detecting in-ear presence have enabled automatic play/pause functions, improving convenience and battery efficiency. Health-monitoring sensors, including heart rate monitors and motion trackers, have been incorporated in select models to support fitness and wellness applications. These smart capabilities have contributed to the positioning of wireless earphones as multifunctional wearable devices in consumer electronics portfolios.

Wireless earphones have been increasingly adopted across various lifestyle segments, including casual listening, sports, and professional environments. Fitness enthusiasts have preferred sweat-resistant and secure-fitting models designed to withstand rigorous physical activity. Noise cancellation features have made these earphones suitable for use in noisy urban settings, public transport, and offices. The rise of remote work and virtual meetings has boosted demand for clear audio communication solutions. Gaming applications have benefited from low-latency wireless earphones that provide immersive sound experiences. Additionally, the emergence of true wireless stereo (TWS) designs has offered compact, cord-free convenience favored by younger consumers. This diversification of use cases has driven steady market growth and product innovation.

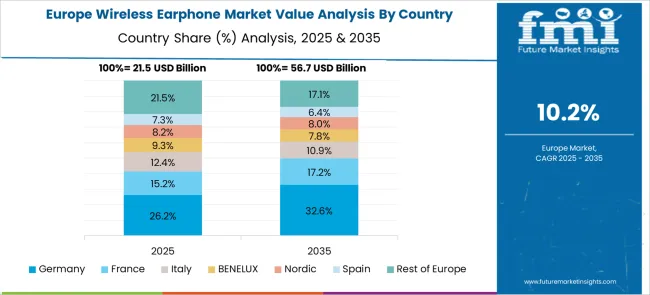

Regional adoption of wireless earphones has been influenced by smartphone penetration, internet accessibility, and consumer spending patterns. Asia-Pacific has emerged as a dominant market due to large populations, increasing disposable income, and rapid urbanization. North America and Europe have demonstrated strong demand driven by tech-savvy consumers and early adoption of wireless technologies. Distribution channels have evolved with e-commerce platforms playing a critical role in reaching wider audiences, alongside traditional retail outlets and brand-exclusive stores. Partnerships with mobile device manufacturers and telecom operators have facilitated bundled offerings and promotions. Regional variations in consumer preferences have led to localized product features and marketing strategies, supporting broader market penetration and competitive dynamics.

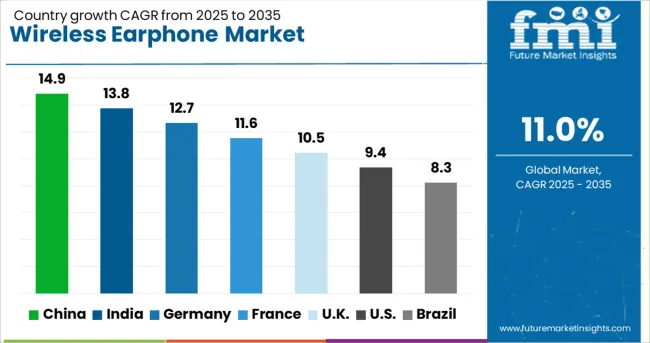

| Country | CAGR |

|---|---|

| China | 14.9% |

| India | 13.8% |

| Germany | 12.7% |

| France | 11.6% |

| UK | 10.5% |

| USA | 9.4% |

| Brazil | 8.3% |

The wireless earphone market is projected to grow at a CAGR of 11.0% between 2025 and 2035, driven by rising consumer demand for portable audio devices, advancements in Bluetooth technology, and increasing smartphone penetration. China leads with a 14.9% CAGR, supported by large-scale electronics manufacturing and expanding domestic and export markets. India follows at 13.8%, fueled by growing youth population and rising disposable incomes. Germany, at 12.7%, benefits from high consumer electronics adoption and premium audio device demand. The UK, projected at 10.5%, sees growth from lifestyle trends and increasing use of wireless accessories. The USA, at 9.4%, reflects steady uptake among tech-savvy consumers and integration with smart devices. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 14.9% between 2025 and 2035, fueled by rising consumer interest in smart audio devices and increasing integration with AI assistants. Domestic brands such as Xiaomi, Huawei, and QCY are enhancing product offerings with noise-canceling features and longer battery life. E-commerce platforms have accelerated market penetration, particularly in tier-2 and tier-3 cities. Innovative marketing strategies, including collaborations with music streaming services, have helped brands gain customer loyalty. Additionally, manufacturing scale advantages allow competitive pricing, stimulating demand. The rise of wireless audio in fitness and gaming sectors has diversified applications beyond traditional mobile use.

India’s wireless earphone market is projected to grow at a CAGR of 13.8%, driven by expanding smartphone penetration and affordable device availability. Brands like boAt, Realme, and Noise have captured significant market share by focusing on budget-conscious consumers while improving audio quality. Increasing use of online retail channels and localized marketing campaigns have supported rapid adoption in both metropolitan and semi-urban regions. The youth demographic’s preference for wireless audio during remote learning and outdoor activities has expanded the user base. Rising interest in gaming accessories has also contributed to diversification.

Germany is expected to record a CAGR of 12.7% in wireless earphones through 2035, backed by high consumer expectations for audio fidelity and ergonomic design. Premium brands like Sennheiser and Beyerdynamic dominate the market with offerings focused on sound clarity and durability. The corporate sector has increasingly adopted wireless headsets for remote conferencing, supporting steady market growth. Retail partnerships and offline distribution channels remain important despite growing e-commerce activity. Sustainability concerns have led to innovations in recyclable packaging and longer product lifecycles.

The United Kingdom is anticipated to achieve a CAGR of 10.5%, driven by growing consumer preference for wireless convenience and smart features. Leading brands such as Bose and Sony have introduced models with enhanced voice assistant integration and multi-device connectivity. Consumer interest in health tracking and fitness-oriented earbuds has expanded segment diversity. The market is influenced by rising disposable technology spending and frequent model refreshes. Retailers have promoted bundle offers with smartphones, further stimulating purchases. Awareness campaigns highlighting wireless safety and device hygiene have become prevalent.

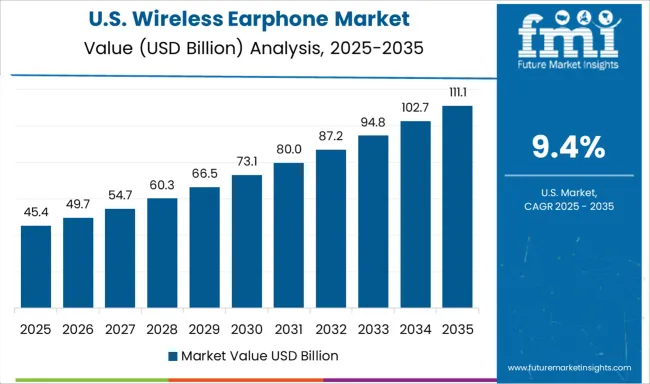

The United States wireless earphone market is forecast to grow at a CAGR of 9.4%, influenced by technology innovations and brand loyalty. Apple’s AirPods continue to dominate with widespread ecosystem integration, complemented by offerings from Beats and JBL. Wireless earphones are popular among commuters and fitness enthusiasts seeking portability and sound quality. Smart features such as spatial audio and adaptive EQ have differentiated product lines. Market growth is supported by regular firmware updates and strong after-sales services. Subscription models for premium audio content are also increasing earphone usage duration.

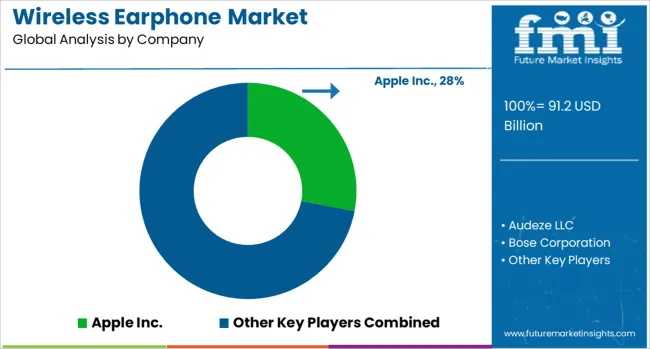

The wireless earphone market features a blend of premium audio brands and consumer electronics giants competing to deliver superior sound quality, comfort, and smart features. Apple Inc. dominates with its AirPods lineup, leveraging seamless integration within its ecosystem and advanced chip technology for noise cancellation and voice assistance.

Bose Corporation and SONY Corporation offer premium models focused on superior active noise cancellation and rich audio performance, catering to audiophiles and frequent travelers. Jabra and Plantronics, Inc. specialize in wireless earphones optimized for professional use, combining clear voice transmission with durable designs suited for extended wear. Samsung Electronics Co., Ltd. integrates advanced features such as adaptive sound and health monitoring in its Galaxy Buds series, targeting Android users and ecosystem loyalty.

Sennheiser Electronic and Audeze LLC focus on audiophile-grade sound fidelity, appealing to niche consumers prioritizing sound accuracy. Brands like Skullcandy Inc., House of Marley, Marshall Group, Master & Dynamic, and JAYS Headphones emphasize distinctive design aesthetics and lifestyle branding, appealing to younger demographics.

Noise and Sonova provide competitive options with value-driven features targeting emerging markets and hearing assistance segments respectively. Key competitive factors include battery life, wireless connectivity standards, voice assistant integration, and ergonomic design. Providers investing in proprietary chipsets and ecosystem compatibility maintain advantages as consumer demand evolves toward multifunctional, high-fidelity wireless earphones.

| Item | Value |

|---|---|

| Quantitative Units | USD 91.2 Billion |

| Type | In-ear and On-ear |

| Connectivity | Bluetooth, Wi-Fi, and NFC |

| Battery Life | 12 to 24 Hours, Up to 12 Hours, and Above 24 Hours |

| Application | Music & Entertainment, Gaming, Fitness & Sports, and Others (Virtual Meetings & Communication) |

| Price | Medium, Low, and High |

| Distribution Channel | Online, Company Websites, E-commerce, Offline, Supermarket/Hypermarket, Specialty Store, and Others (Mega Retail Store) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Apple Inc., Audeze LLC, Bose Corporation, House of Marley, Jabra, JAYS Headphones, Marshall Group, Master & Dynamic, Noise, Plantronics, Inc., Samsung Electronics Co., Ltd., Sennheiser Electronic, Skullcandy Inc., Sonova, and SONY Corporation |

| Additional Attributes | Dollar sales by product type and distribution channel, demand dynamics across true wireless, neckband, and sport wireless earphones, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in noise cancellation, battery life enhancement, and voice assistant integration, environmental impact of battery disposal and electronic waste, and emerging use cases in fitness tracking, augmented reality audio, and smart home connectivity. |

The global wireless earphone market is estimated to be valued at USD 91.2 billion in 2025.

The market size for the wireless earphone market is projected to reach USD 258.9 billion by 2035.

The wireless earphone market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in wireless earphone market are in-ear and on-ear.

In terms of connectivity, bluetooth segment to command 71.0% share in the wireless earphone market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Wireless HDMI Transmitter and Receiver Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wireless Testing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Printer Market Size and Share Forecast Outlook 2025 to 2035

Wireless Headphones Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA