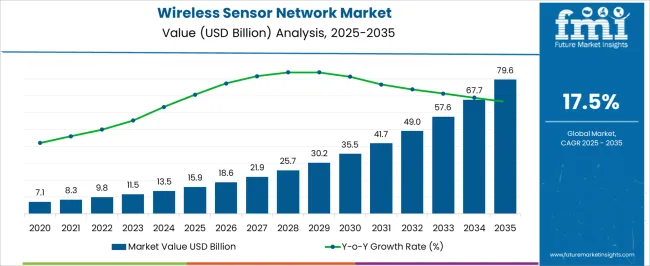

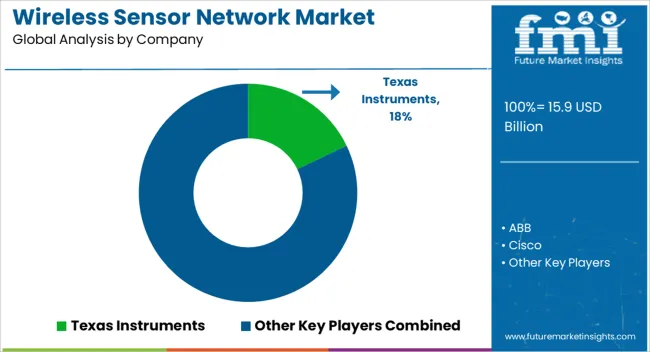

The wireless sensor network market is estimated to be valued at USD 15.9 billion in 2025 and is projected to reach USD 79.6 billion by 2035, registering a compound annual growth rate (CAGR) of 17.5% over the forecast period.

Between 2025 and 2030, the market will expand from USD 15.9 billion to USD 35.5 billion, reflecting sharp year-on-year gains. This steep rise underscores the growing adoption of wireless sensor technologies across industries such as healthcare, manufacturing, defense, energy, and smart infrastructure. The value progression from USD 18.6 billion in 2026 to USD 30.2 billion in 2029 highlights strong momentum, supported by the demand for real-time monitoring, automation, and efficient data collection. The curve during this stage demonstrates a fast upward slope, emphasizing the role of wireless sensor networks as foundational tools in next-generation connectivity. From 2030 to 2035, the market is expected to continue its rapid ascent, climbing from USD 35.5 billion to USD 79.6 billion.

This phase of growth reflects the increasing scale of deployments, with wireless sensors integrated into smart cities, energy grids, environmental monitoring systems, and industrial automation processes. Yearly increments such as from USD 41.7 billion in 2031 to USD 67.7 billion in 2034 illustrate a consistently accelerating curve. The shape of this trajectory suggests a market shifting from expansion into dominance, as wireless sensor networks become indispensable in managing critical operations and enabling predictive decision-making. The strong growth pattern signals a long-term opportunity for component manufacturers, integrators, and service providers to strengthen their presence in a rapidly evolving landscape.

| Metric | Value |

|---|---|

| Wireless Sensor Network Market Estimated Value in (2025 E) | USD 15.9 billion |

| Wireless Sensor Network Market Forecast Value in (2035 F) | USD 79.6 billion |

| Forecast CAGR (2025 to 2035) | 17.5% |

The wireless sensor network market secures a significant yet varied share across multiple technology-driven domains, reflecting its importance in enabling connectivity, data acquisition, and real-time monitoring. Within the Internet of Things (IoT) market, WSNs represent about 15%, as they provide the foundational architecture for communication between devices and systems. In the industrial automation and control systems market, their share is close to 12%, since they are widely deployed to optimize manufacturing, predictive maintenance, and process monitoring. Within the smart infrastructure and smart cities market, wireless sensor networks contribute nearly 14%, supporting applications such as energy management, traffic control, waste monitoring, and urban safety systems.

In the telecommunications and networking equipment market, their share is smaller at around 6%, as WSNs play a role in specialized networking but coexist with larger wireless technologies such as cellular and Wi-Fi. Finally, in the defense and security surveillance market, WSNs hold a share of about 9%, with adoption driven by battlefield awareness, border monitoring, and tactical systems that require distributed sensing. Collectively, these percentages emphasize that wireless sensor networks have their strongest positioning in IoT, industrial automation, and smart city initiatives, where data-driven decision-making and real-time monitoring are essential. Their more modest shares in telecom and defense indicate niche but strategic roles, underlining WSNs as a pivotal enabler of digital infrastructure and intelligent systems across both civilian and military applications.

The wireless sensor network (WSN) market is advancing rapidly, driven by the convergence of IoT, edge computing, and real-time data processing. The increasing need for automated monitoring, low-latency communication, and scalable sensor deployment is transforming industrial, urban, and environmental infrastructure.

Public and private investments in smart cities, precision agriculture, and industrial automation have created high-volume deployment opportunities for WSNs. Technological advances in energy-efficient communication protocols, miniaturized sensor design, and robust data encryption are enhancing system performance and longevity.

As demand for intelligent sensing continues across diverse sectors, the market is projected to see strong CAGR, especially with the integration of AI-driven analytics and 5G connectivity.

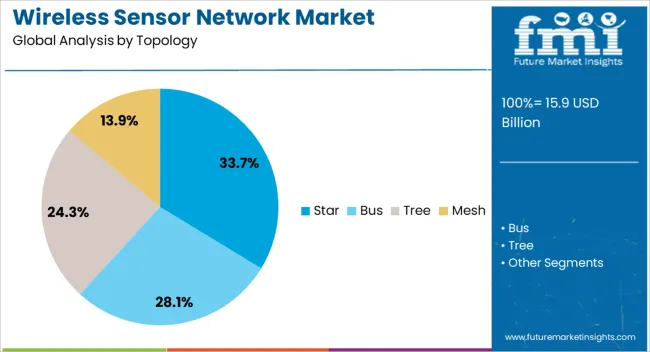

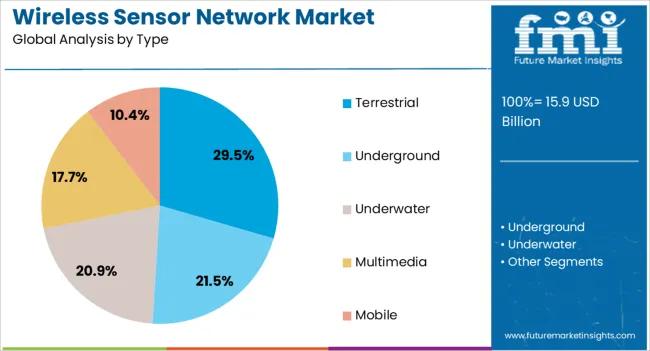

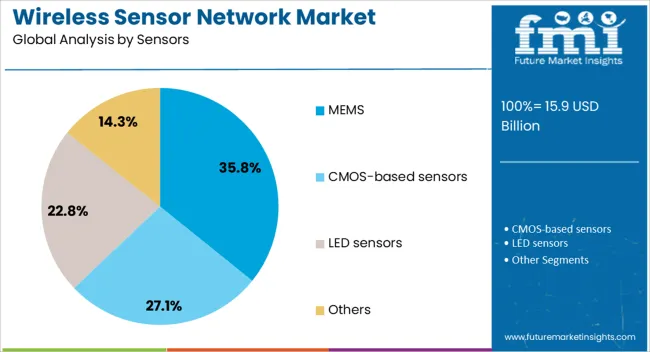

The wireless sensor network market is segmented by topology, type, sensors, technology, application, industry, and geographic regions. By topology, wireless sensor network market is divided into star, bus, tree, and mesh. In terms of type, wireless sensor network market is classified into terrestrial, underground, underwater, multimedia, and mobile. Based on sensors, wireless sensor network market is segmented into MEMS, CMOS-based sensors, LED sensors, and others. By technology, wireless sensor network market is segmented into ZigBee, wireless HART, Wi-Fi, IPv6, Bluetooth, Dash 7, and Z-Wave. By application, wireless sensor network market is segmented into industrial automation, home and building automation, military surveillance, smart transportation, patient monitoring, machine monitoring, and others. By industry, wireless sensor network market is segmented into healthcare, automotive, energy & utilities, IT & telecom, manufacturing, retail, aerospace & defense, and others. Regionally, the wireless sensor network industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Star topology is anticipated to command 33.70% of the wireless sensor network market by 2025, making it the dominant network structure. Its growth stems from the simplicity of design, ease of implementation, and minimal coordination overhead. In star configurations, all nodes connect directly to a central hub, streamlining data flow and reducing latency, which is ideal for low-power applications. This layout suits environments requiring high reliability and minimal reconfiguration, such as smart homes, healthcare monitoring, and asset tracking systems. The central control node also simplifies maintenance and upgrades, supporting rapid deployment and improved fault detection.

The terrestrial segment is projected to hold 29.50% of the total market share in 2025, leading among WSN types. This dominance is driven by terrestrial networks' compatibility with surface-based applications like industrial automation, structural health monitoring, and environmental sensing. They offer robust connectivity, ease of installation, and reliable power solutions through energy harvesting or fixed power sources. The ability to support dense sensor deployment in controlled or semi-controlled environments enhances data accuracy and consistency. Growing use in agriculture, smart grids, and civil infrastructure projects is propelling the adoption of terrestrial networks.

MEMS sensors are expected to account for 35.80% of the wireless sensor network market in 2025, leading the sensor category. Their rise is linked to their compact size, low power consumption, and multi-functionality, enabling precise monitoring of pressure, motion, vibration, and more. MEMS technology supports mass production at reduced costs, making it suitable for large-scale WSN deployments across sectors. Their integration in consumer electronics, automotive systems, and healthcare devices is enhancing the responsiveness and intelligence of sensor nodes. As applications demand more versatile and real-time sensing capabilities, MEMS sensors are becoming foundational to high-performance wireless networks.

The wireless sensor network market is expanding as industries adopt real-time monitoring to improve efficiency, safety, and asset utilization. Opportunities are growing in healthcare, smart infrastructure, and agriculture, while trends emphasize miniaturization, low-power designs, and AI-driven analytics. Challenges remain in network security, interoperability, and energy management. In my opinion, companies that focus on secure, energy-efficient, and scalable solutions will secure stronger positions, ensuring wireless sensor networks evolve into indispensable tools for digital transformation across industrial and service-based ecosystems worldwide.

Demand for wireless sensor networks has been reinforced by their ability to collect, process, and transmit real-time data across industries. Applications in manufacturing, healthcare, agriculture, and environmental monitoring are expanding rapidly, as organizations seek improved efficiency and predictive insights. These networks enable cost savings by reducing manual intervention and enhancing asset management. In my opinion, demand will continue to increase as businesses adopt data-driven decision-making, making wireless sensor networks critical enablers of efficiency, safety, and operational intelligence in both industrial and service sectors.

Opportunities are visible in smart cities, intelligent transportation, and healthcare monitoring, where wireless sensor networks enable automation and advanced diagnostics. Hospitals are adopting sensors for patient tracking and vital sign monitoring, while infrastructure projects integrate them for traffic management and energy efficiency. Growth in agriculture through soil and crop monitoring also contributes to rising adoption. I believe companies that provide scalable, energy-efficient, and secure solutions will capture significant opportunities, particularly as governments and private enterprises invest in digital transformation initiatives worldwide.

Trends in the wireless sensor network market highlight miniaturization, low-power consumption, and integration with cloud-based platforms. Energy harvesting and long-range communication protocols such as LoRaWAN are gaining traction, improving network efficiency and reducing maintenance costs. Another trend is the adoption of AI-driven analytics to derive actionable insights from sensor data. In my opinion, these trends indicate a clear transition toward intelligent, self-sustaining networks that not only collect data but also empower organizations with predictive capabilities and optimized resource management.

Challenges revolve around data security, interoperability, and reliability in large-scale deployments. Vulnerabilities in wireless networks expose critical infrastructure to cyber risks, creating hesitation among some adopters. Limited battery life and connectivity issues in remote areas add further barriers to widespread implementation. In my assessment, companies that enhance security protocols, improve interoperability standards, and innovate in energy-efficient designs will be best positioned to overcome these challenges and ensure wireless sensor networks achieve broader acceptance across sensitive and mission-critical applications.

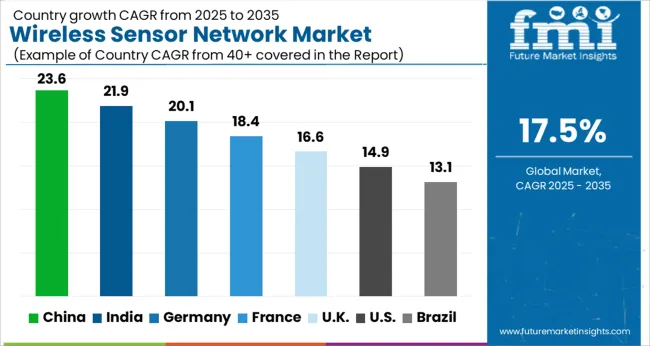

| Country | CAGR |

|---|---|

| China | 23.6% |

| India | 21.9% |

| Germany | 20.1% |

| France | 18.4% |

| UK | 16.6% |

| USA | 14.9% |

| Brazil | 13.1% |

The global wireless sensor network (WSN) market is projected to grow at a CAGR of 17.5% from 2025 to 2035. China leads with a growth rate of 23.6%, followed by India at 21.9%, and Germany at 20.1%. The United Kingdom records a growth rate of 16.6%, while the United States shows the slowest growth at 14.9%. Expansion is driven by adoption of IoT ecosystems, demand for real-time data monitoring, and integration of wireless sensor networks in industries such as manufacturing, energy, transportation, and healthcare. Emerging markets such as China and India are advancing rapidly due to smart city initiatives and industrial automation, while developed markets like the USA, UK, and Germany emphasize next-generation protocols, cybersecurity, and edge-computing integration. This report includes insights on 40+ countries; the top markets are shown here for reference.

The wireless sensor network market in China is projected to grow at a CAGR of 23.6%. Growth is fueled by the government’s strong investment in smart city projects, industrial automation, and large-scale deployment of connected infrastructure. Manufacturing hubs are adopting wireless sensors for predictive maintenance, process optimization, and quality assurance. WSN adoption is also expanding in energy, logistics, and healthcare applications. Domestic companies are collaborating with telecom providers to roll out next-gen connectivity standards, further accelerating integration of wireless sensor technologies.

The wireless sensor network market in India is expected to grow at a CAGR of 21.9%. Rising demand for IoT-enabled solutions in agriculture, logistics, and industrial automation is shaping adoption. Government initiatives such as Digital India and Smart Cities Mission are encouraging deployment of WSNs across urban and rural applications. The healthcare sector is also adopting sensor-based monitoring systems for telemedicine and patient management. Partnerships between startups, global firms, and telecom providers are enhancing WSN affordability and scalability in the Indian market.

The wireless sensor network market in Germany is projected to grow at a CAGR of 20.1%. Strong demand is coming from industrial automation, manufacturing, and energy sectors, supported by Germany’s advanced engineering ecosystem. WSNs are increasingly integrated into predictive maintenance, supply chain tracking, and smart grid systems. The German government’s emphasis on digital transformation and efficiency-driven solutions is creating favorable conditions for adoption. Collaborations between research institutions and industrial leaders are driving innovation in low-power, high-security sensor technologies.

The wireless sensor network market in the UK is projected to grow at a CAGR of 16.6%. Adoption is supported by growing deployment in healthcare, transportation, and utility sectors. Smart energy grids and connected transport systems are major drivers of growth. UK-based research institutes and startups are advancing applications of WSNs in environmental monitoring and industrial IoT. Strong regulatory support for cybersecurity and data privacy is also shaping the adoption of next-gen wireless sensor solutions across industries.

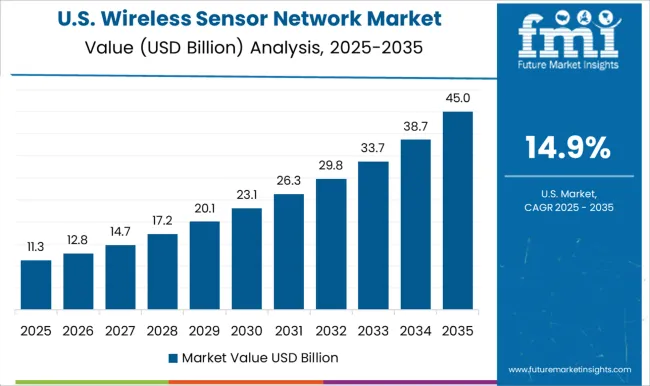

The wireless sensor network market in the USA is projected to grow at a CAGR of 14.9%. While slower than emerging economies, demand remains high due to adoption in defense, aerospace, healthcare, and manufacturing. Federal initiatives promoting digital infrastructure and smart energy systems are supporting growth. USA companies are leading innovation in edge computing and advanced sensor protocols, enabling greater efficiency and security. Partnerships between technology firms and enterprises are driving tailored WSN solutions for complex industrial and commercial needs.

Competition in the wireless sensor network segment is shaped by semiconductor strength, automation expertise, and connectivity platforms. Intel, Qualcomm, NXP Semiconductors, and STMicroelectronics dominate at the chip level, offering low-power processors, RF modules, and microcontrollers that enable sensor nodes. Texas Instruments anchors its position with scalable wireless ICs designed for industrial and IoT environments. On the systems side, Cisco and Siemens integrate these networks into broader automation and control infrastructures, while Honeywell and ABB deploy sensor networks across energy, industrial safety, and building automation. TE Connectivity rounds out the mix by providing rugged connectors and interconnect systems, ensuring reliability in harsh operating conditions. This ecosystem combines chipmakers, integrators, and application specialists, each competing to define how wireless sensor networks evolve across industries. Strategies focus on power efficiency, interoperability, and industrial scalability.

Semiconductor leaders emphasize energy harvesting, advanced transceivers, and secure protocols to extend sensor life cycles. Cisco and Siemens highlight integration with cloud platforms and digital twins, positioning networks as enablers of predictive maintenance and smart infrastructure. Honeywell and ABB stress vertical applications such as worker safety, utility grids, and chemical plant monitoring, promoting reliability and compliance advantages. TE Connectivity emphasizes durability, marketing sensor connectors with thermal and vibration resilience. Product brochures showcase node lifespans, latency performance, range capabilities, and compliance with standards like IEEE 802.15.4 and LoRaWAN. Visuals highlight mesh topologies, gateways, and real-world applications in factories, cities, and energy grids. Messaging underscores benefits such as cost reduction, real-time monitoring, and enhanced decision-making. By blending technical clarity with industry relevance, brochures position wireless sensor networks as foundational technologies for scalable, connected environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.9 billion |

| Topology | Star, Bus, Tree, and Mesh |

| Type | Terrestrial, Underground, Underwater, Multimedia, and Mobile |

| Sensors | MEMS, CMOS-based sensors, LED sensors, and Others |

| Technology | ZigBee, Wireless HART, Wi-Fi, IPv6, Bluetooth, Dash 7, and Z-Wave |

| Application | Industrial automation, Home and building automation, Military surveillance, Smart transportation, Patient monitoring, Machine monitoring, and Others |

| Industry | Healthcare, Automotive, Energy & utilities, IT & telecom, Manufacturing, Retail, Aerospace & defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Texas Instruments, ABB, Cisco, Honeywell, Intel, NXP Semiconductors, Qualcomm, Siemens, STMicroelectronics, and TE Connectivity |

| Additional Attributes | Dollar sales by product type (hardware, software, services), Dollar sales by application (industrial, environmental monitoring, healthcare, smart cities), Trends in low-power communication and IoT integration, Use in predictive maintenance, precision agriculture, and patient monitoring, Growth in demand for scalable connectivity solutions, Regional deployment clusters across North America, Europe, and Asia-Pacific. |

The global wireless sensor network market is estimated to be valued at USD 15.9 billion in 2025.

The market size for the wireless sensor network market is projected to reach USD 79.6 billion by 2035.

The wireless sensor network market is expected to grow at a 17.5% CAGR between 2025 and 2035.

The key product types in wireless sensor network market are star, bus, tree and mesh.

In terms of type, terrestrial segment to command 29.5% share in the wireless sensor network market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wireless Testing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Printer Market Size and Share Forecast Outlook 2025 to 2035

Wireless Headphones Market Size and Share Forecast Outlook 2025 to 2035

Wireless Display Market Size and Share Forecast Outlook 2025 to 2035

Wireless Paging Systems Market Size and Share Forecast Outlook 2025 to 2035

Wireless Patient Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Wireless Earphone Market Size and Share Forecast Outlook 2025 to 2035

Wireless Ev Charging Market Size and Share Forecast Outlook 2025 to 2035

Wireless Telecommunication Services Market Trends – Growth & Forecast through 2035

Wireless Charging ICs Market Size and Share Forecast Outlook 2025 to 2035

Wireless Antenna Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA