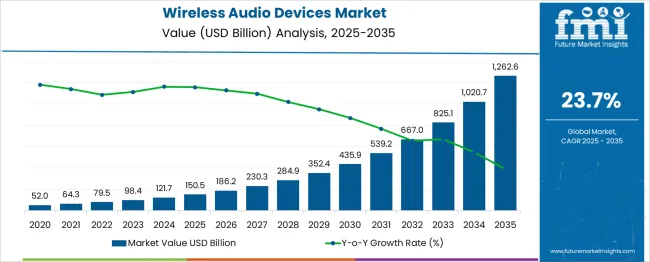

The global wireless audio devices market is forecasted to grow from USD 150.5 billion in 2025 to approximately USD 1,262.6 billion by 2035, recording an absolute increase of USD 1,112.1 billion over the forecast period. This translates into a total growth of 738.9%, with the market forecast to expand at a CAGR of 23.7% between 2025 and 2035. The overall market size is expected to grow by nearly 8.39X during the same period, supported by increasing adoption of wireless technology, rising demand for smart devices, and growing preference for portable audio solutions.

Between 2025 and 2030, the wireless audio devices market is projected to expand from USD 150.5 billion to USD 539.2 billion, resulting in a value increase of USD 388.7 billion, which represents 34.9% of the total forecast growth for the decade. This phase of growth will be shaped by rapid adoption of true wireless technology, increasing smartphone penetration, and growing consumer preference for cord-free audio experiences. Technology companies are expanding their wireless audio portfolios to address the growing demand for high-quality, feature-rich audio solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 150.5 billion |

| Forecast Value in (2035F) | USD 1,262.6 billion |

| Forecast CAGR (2025 to 2035) | 23.7% |

From 2030 to 2035, the market is forecast to grow from USD 539.2 billion to USD 1,262.6 billion, adding another USD 723.4 billion, which constitutes 65.1% of the overall ten-year expansion. This period is expected to be characterized by expansion of 5G networks, integration of AI-powered features, and development of advanced noise cancellation technologies. The growing adoption of immersive audio experiences and voice assistant integration will drive demand for premium wireless audio devices with enhanced connectivity and smart functionality.

Between 2020 and 2025, the wireless audio devices market experienced robust expansion, driven by the global shift towards remote work, increased content consumption, and accelerated adoption of wireless technology. The market developed as consumers recognized the convenience and freedom offered by wireless audio solutions, particularly during the pandemic period when traditional wired accessories became less practical for mobile lifestyles.

Market expansion is being supported by the increasing consumer preference for wireless connectivity and the corresponding demand for seamless audio experiences across multiple devices. Modern consumers are increasingly focused on convenience, portability, and freedom of movement, making wireless audio devices essential accessories for daily life. The elimination of headphone jacks from smartphones and the rise of streaming services have created a compelling need for high-quality wireless audio solutions.

The growing focus on active lifestyles and fitness activities is driving demand for wireless earbuds and headphones that can withstand physical activity while delivering superior sound quality. Consumer preference for multifunctional devices that combine audio playback with voice assistant capabilities, noise cancellation, and health monitoring features is creating opportunities for innovative product development. The rising influence of social media content creation and gaming is also contributing to increased demand for professional-grade wireless audio equipment.

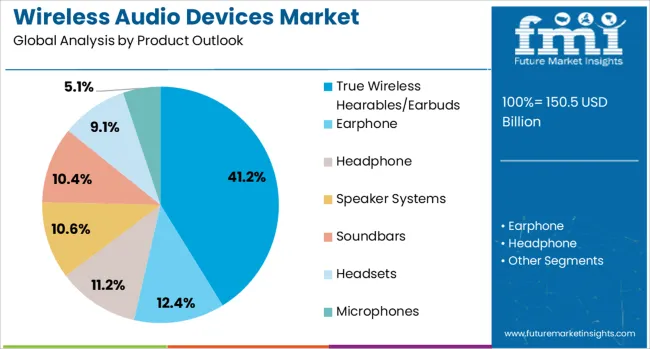

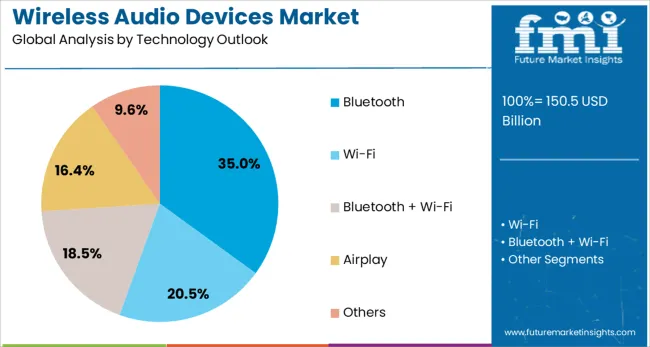

The market is segmented by product, technology, functionality, application, and region. By product type, the market is divided into true wireless hearables/earbuds, earphones, headphones, speaker systems, soundbars, headsets, and microphones. Based on technology, the market is categorized into Bluetooth, Wi-Fi, Bluetooth + Wi-Fi, AirPlay, and others. In terms of functionality, the market is segmented into smart devices and non-smart devices. By application, the market is classified into residential/individual, commercial, automotive, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

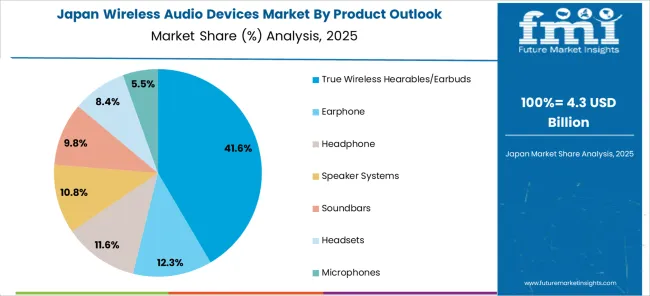

The true wireless hearables/earbuds segment is projected to account for 41.2% of the wireless audio devices market in 2025, reaffirming its position as the category's most popular product format. Consumers increasingly prefer the complete freedom and convenience offered by true wireless technology, which eliminates all cables and provides seamless connectivity with smartphones, tablets, and other devices. The compact form factor and advanced features like active noise cancellation, voice assistants, and health monitoring capabilities make these devices highly attractive.

This segment forms the foundation of most brand strategies, as it represents the fastest-growing and most innovative area of wireless audio technology. Continuous improvements in battery life, sound quality, and connectivity reliability continue to strengthen consumer adoption. With lifestyle trends favoring mobility, fitness, and multitasking, true wireless earbuds align perfectly with modern consumer needs, making them the central growth driver of the wireless audio market.

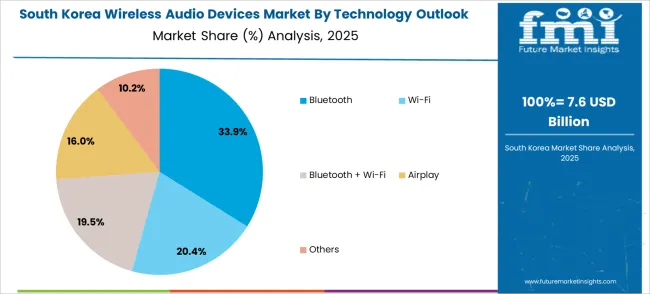

Bluetooth technology is projected to represent 35% of wireless audio device demand in 2025, underscoring its role as the dominant connectivity standard for personal audio devices. Consumers gravitate toward Bluetooth for its universal compatibility, ease of pairing, and reliable connection across various device ecosystems. The latest Bluetooth standards offer improved audio quality, lower latency, and enhanced power efficiency, making them ideal for high-performance audio applications.

The segment is supported by continuous technological advancement, with newer Bluetooth versions supporting high-resolution audio codecs and multi-device connectivity. Additionally, the widespread adoption of Bluetooth across smartphones, laptops, tablets, and smart home devices ensures broad compatibility and seamless user experiences. As device manufacturers prioritize interoperability and ease of use, Bluetooth-enabled wireless audio devices will continue to dominate market demand.

The smart devices functionality segment is forecasted to contribute 52% of the wireless audio devices market in 2025, reflecting the growing integration of artificial intelligence and voice assistant capabilities in audio products. Consumers are increasingly interested in devices that offer more than just audio playback, seeking features like voice control, smart home integration, health monitoring, and adaptive audio processing.

Smart functionality provides added value through features like automatic noise cancellation adjustment, personalized sound profiles, and seamless integration with virtual assistants like Siri, Google Assistant, and Alexa. This segment benefits from consumer willingness to pay premium prices for devices that enhance productivity, convenience, and lifestyle integration. With the continued expansion of smart home ecosystems and AI-powered services, smart wireless audio devices serve as critical connection points in the broader Internet of Things landscape.

The wireless audio devices market is advancing rapidly due to increasing smartphone adoption, growing streaming content consumption, and rising demand for portable entertainment solutions. However, the market faces challenges including battery life limitations, audio latency issues, and price sensitivity among budget-conscious consumers. Innovation in battery technology, audio codecs, and manufacturing processes continue to influence product development and market expansion patterns.

The global rollout of 5G networks is enabling new possibilities for wireless audio devices, including higher-quality streaming, lower latency communication, and enhanced real-time audio processing. 5G connectivity allows for more sophisticated features like real-time language translation, cloud-based audio processing, and seamless multi-device synchronization. These capabilities are driving demand for next-generation wireless audio devices that can leverage advanced network infrastructure.

Modern wireless audio device manufacturers are incorporating health monitoring capabilities such as heart rate sensing, activity tracking, and posture monitoring into their products. These features transform traditional audio accessories into comprehensive wellness devices, appealing to health-conscious consumers who value multi-functional products. Advanced sensors and AI algorithms enable personalized health insights while maintaining primary audio functionality.

| Countries | CAGR (2025-2035) |

|---|---|

| China | 32 % |

| India | 29.6% |

| Germany | 27.3% |

| France | 24.9% |

| UK | 22.5% |

| USA | 20.1% |

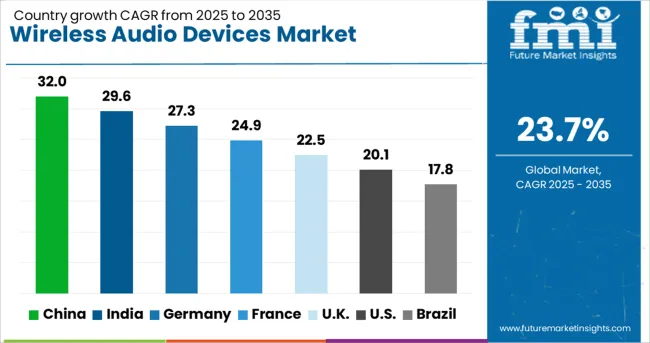

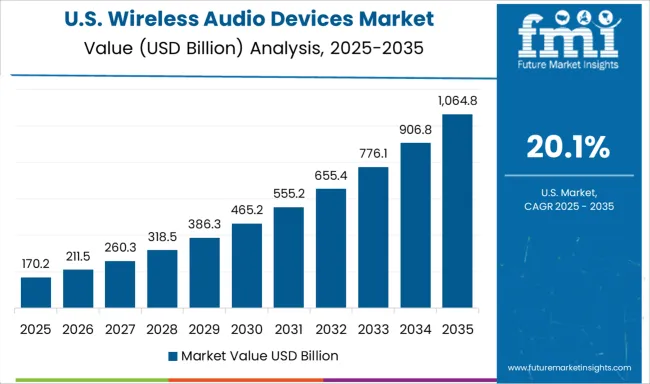

The wireless audio devices market is experiencing robust growth globally, with China leading at a 32 % CAGR through 2035, driven by massive manufacturing capabilities, strong domestic demand, and technological innovation in wireless connectivity. India follows at 29.6%, supported by rapid smartphone adoption, growing digital entertainment consumption, and increasing preference for wireless accessories. Germany shows strong growth at 27.3%, emphasizing premium audio quality and advanced engineering. France records 24.9%, focusing on design aesthetics and luxury positioning. The UK demonstrates 22.5% growth, prioritizing innovation and early adoption of new technologies. The USA shows 20.1% growth, driven by premium market segments and brand loyalty.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from wireless audio devices in China is projected to exhibit exceptional growth with a CAGR of 32 % through 2035, driven by the country's position as the global manufacturing hub for consumer electronics and its vast domestic market of tech-savvy consumers. The combination of local manufacturing capabilities, strong supply chain infrastructure, and rapidly evolving consumer preferences creates an ideal environment for wireless audio market expansion.

Revenue from wireless audio devices in India is expanding at a CAGR of 29.6%, supported by the country's massive young population, increasing smartphone penetration, and growing digital entertainment consumption. The market benefits from rising disposable income, expanding e-commerce infrastructure, and increasing preference for branded consumer electronics among middle-class consumers.

Demand for wireless audio devices in the USA is projected to grow at a CAGR of 20.1%, supported by strong consumer preference for premium brands, early adoption of new technologies, and integration with existing device ecosystems. American consumers consistently prioritize audio quality, brand reputation, and advanced features when selecting wireless audio products.

Revenue from wireless audio devices in Germany is projected to grow at a CAGR of 27.3% through 2035, driven by the country's strong focus on audio engineering, premium product positioning, and consumer preference for high-quality, durable electronics. German consumers consistently demand superior sound quality, robust build construction, and reliable performance.

Revenue from wireless audio devices in France is projected to grow at a CAGR of 24.9% through 2035, supported by consumer appreciation for design aesthetics, luxury positioning, and premium user experiences. French consumers value products that combine functional excellence with sophisticated design and brand prestige.

Revenue from wireless audio devices in the UK is projected to grow at a CAGR of 22.5% through 2035, supported by early technology adoption, strong e-commerce infrastructure, and consumer preference for innovative features. British consumers actively seek cutting-edge wireless audio solutions that integrate seamlessly with their digital lifestyles.

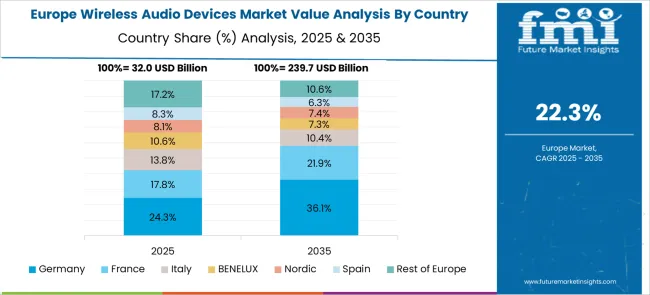

The European wireless audio devices market demonstrates sophisticated development across major economies with Germany leading through its precision audio engineering excellence and advanced manufacturing capabilities, supported by companies emphasizing premium sound quality, innovative connectivity solutions, and comprehensive wireless audio ecosystems while maintaining strict quality standards and environmental compliance protocols. The UK shows strength in technology adoption and innovation initiatives, with organizations specializing in cutting-edge wireless audio technologies and early adoption of smart connectivity features that meet rigorous performance standards.

France contributes through its design aesthetics and luxury positioning focus, delivering premium wireless audio solutions that combine sophisticated craftsmanship with modern connectivity technologies for enhanced user experiences. Sweden and Nordic countries focus on manufacturing practices and environmental responsibility in audio device production. Italy and Spain demonstrate growth in specialized lifestyle applications and fashion-forward audio accessories. The market benefits from stringent EU environmental regulations, established technology infrastructure, and growing consumer demand for premium wireless audio devices that provide superior sound quality and smart functionality.

The Japanese wireless audio devices market demonstrates steady growth driven by precision manufacturing focus, advanced audio technology development, and consumer preference for high-quality wireless solutions that ensure superior sound performance and reliability throughout personal entertainment experiences. Japanese organizations prioritize sophisticated acoustic engineering and comprehensive quality assurance systems, creating demand for wireless audio devices featuring advanced Bluetooth technology, premium materials, and integrated smart capabilities that align with Japanese manufacturing excellence standards.

The market emphasizes technological innovation in audio processing, battery optimization, and connectivity enhancement that reflects Japanese attention to detail in consumer electronics design and audio performance optimization. Growing investment in 5G infrastructure and smart device integration supports adoption of next-generation wireless audio systems with seamless connectivity, voice assistant integration, and advanced noise cancellation capabilities for enhanced user experiences. Japanese consumers focus on device reliability, consistent audio quality, and long-term performance value through premium technology integration.

The South Korean wireless audio devices market shows exceptional growth potential driven by expanding 5G network infrastructure, increasing adoption of smart device ecosystems, and growing demand for advanced wireless connectivity solutions requiring comprehensive integration and performance capabilities. The market benefits from South Korea's technological leadership in telecommunications and consumer electronics and increasing focus on digital lifestyle enhancement that drives investment in sophisticated audio technologies meeting international quality standards.

Korean consumers increasingly adopt true wireless earbuds, smart audio systems, and integrated entertainment platforms to improve lifestyle convenience and digital connectivity while ensuring cost-effectiveness requirements. Growing influence of Korean technology companies and consumer electronics innovation initiatives supports demand for advanced wireless audio platforms that ensure comprehensive functionality while maintaining user accessibility and environmental consciousness. The integration of AI-powered features and mobile applications creates opportunities for intelligent audio systems with personalized sound profiles and adaptive performance capabilities.

The wireless audio devices market is characterized by intense competition among global technology giants, specialized audio companies, and emerging direct-to-consumer brands. Companies are investing in advanced chip technology, battery optimization, noise cancellation algorithms, and ecosystem integration to deliver superior, seamless, and innovative wireless audio experiences. Product differentiation, brand positioning, and distribution channel expansion are central to strengthening market share and customer loyalty.

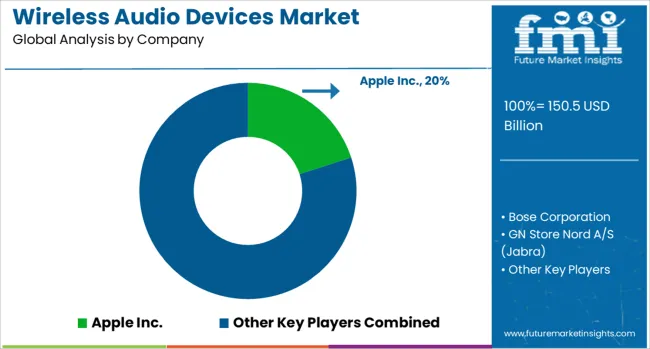

Apple Inc., USA - based, leads the market with 20.0% global value share, offering integrated wireless audio solutions with seamless iOS ecosystem connectivity and premium positioning. Bose Corporation provides industry-leading noise cancellation technology and professional-grade audio quality. GN Store Nord A/S (Jabra) delivers enterprise-focused wireless audio solutions with focus on business communication and professional applications. HARMAN International focuses on premium audio experiences with advanced connectivity features.

Logitech (Jaybird) specializes in sports and fitness-oriented wireless audio products with durable, weather-resistant designs. Samsung offers comprehensive wireless audio portfolios that integrate with Galaxy device ecosystems and smart home platforms. Skullcandy targets younger demographics with bold designs and lifestyle-focused marketing. Sennheiser electronic GmbH & Co. KG emphasizes audiophile-grade sound quality and professional audio applications. Sony Corporation and Xiaomi provide diverse product ranges across multiple price segments and global markets.

| Items | Values |

| Quantitative Units (2025) | USD 150.5 billion |

| Product | True wireless hearables/earbuds, Earphones, Headphones, Speaker systems, Soundbars, Headsets, Microphones |

| Technology | Bluetooth, Wi-Fi, Bluetooth + Wi-Fi, AirPlay, Others |

| Functionality | Smart devices, Non-smart devices |

| Application | Residential/individual, Commercial, Automotive, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Apple Inc., Bose Corporation, GN Store Nord A/S (Jabra), HARMAN International, Logitech (Jaybird), Samsung, Skullcandy, Sennheiser electronic GmbH & Co. KG, Sony Corporation, and Xiaomi |

| Additional Attributes | Dollar sales by connectivity type and price segment, regional demand trends, competitive landscape, consumer preferences for battery life versus audio quality, integration with smart home ecosystems, innovations in noise cancellation technology, voice assistant compatibility, and sustainable manufacturing practices |

United States

Canada

Mexico

Germany

United Kingdom

France

Italy

Spain

Nordic

BENELUX

Rest of Europe

China

Japan

South Korea

India

ASEAN

Australia & New Zealand

Rest of South Asia & Pacific

Brazil

Chile

Rest of Latin America

Kingdom of Saudi Arabia

Other GCC Countries

Turkiye

South Africa

Other African Union

Rest of Middle East & Africa

The global wireless audio devices market is estimated to be valued at USD 150.5 billion in 2025.

The market size for the wireless audio devices market is projected to reach USD 1,262.6 billion by 2035.

The wireless audio devices market is expected to grow at a 23.7% CAGR between 2025 and 2035.

The key product types in wireless audio devices market are true wireless hearables/earbuds, earphone, headphone, speaker systems, soundbars, headsets and microphones.

In terms of technology outlook, bluetooth segment to command 35.0% share in the wireless audio devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Wireless HDMI Transmitter and Receiver Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wireless Testing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Printer Market Size and Share Forecast Outlook 2025 to 2035

Wireless Headphones Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensors Market Size and Share Forecast Outlook 2025 to 2035

Wireless Display Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA