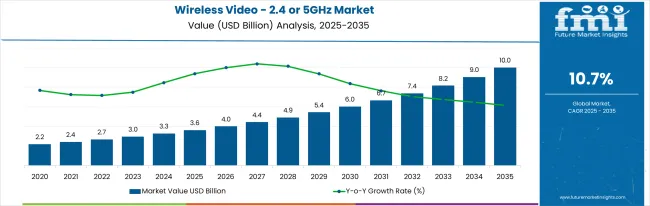

The Wireless Video - 2.4/5GHz Market is estimated to be valued at USD 3.6 billion in 2025 and is projected to reach USD 10.0 billion by 2035, registering a compound annual growth rate (CAGR) of 10.7% over the forecast period.

| Metric | Value |

|---|---|

| Wireless Video - 2.4/5GHz Market Estimated Value in (2025E) | USD 3.6 billion |

| Wireless Video - 2.4/5GHz Market Forecast Value in (2035F) | USD 10.0 billion |

| Forecast CAGR (2025 to 2035) | 10.7% |

The Wireless Video 2.4/5GHz market is experiencing significant growth, driven by the increasing demand for high-quality, low-latency video transmission in consumer electronics, security surveillance, and professional broadcasting. Adoption is being fueled by the proliferation of wireless-enabled devices and the need for flexible connectivity solutions that eliminate the constraints of wired installations. Advancements in wireless protocols, signal processing, and interference mitigation technologies have enhanced video quality, range, and reliability, enabling real-time streaming for critical applications.

The dual-band 2.4/5GHz spectrum supports simultaneous data transmission and reduced congestion, which has become essential in both residential and commercial environments. Increasing investments in smart home solutions, remote monitoring systems, and video communication infrastructure are further driving adoption.

Regulatory support for unlicensed spectrum usage, along with growing awareness of wireless video advantages such as scalability and mobility, continues to shape the market As technology continues to evolve, the market is expected to witness sustained expansion, driven by innovations in receiver design, signal optimization, and integration with intelligent video management systems.

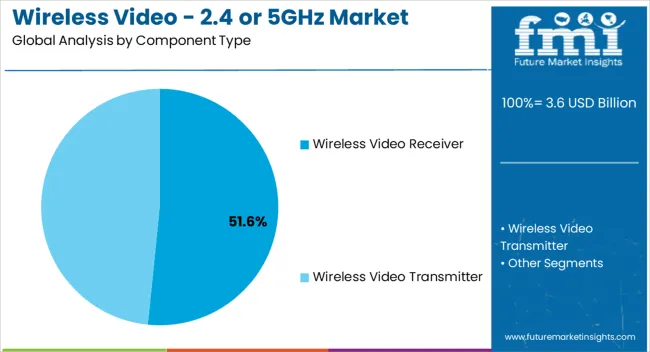

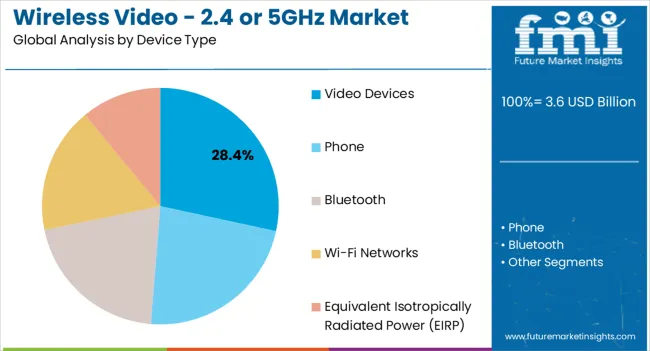

The wireless video - 2.4/5ghz market is segmented by component type, device type, and geographic regions. By component type, wireless video - 2.4/5ghz market is divided into Wireless Video Receiver and Wireless Video Transmitter. In terms of device type, wireless video - 2.4/5ghz market is classified into Video Devices, Phone, Bluetooth, Wi-Fi Networks, and Equivalent Isotropically Radiated Power (EIRP). Regionally, the wireless video - 2.4/5ghz industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wireless video receiver segment is projected to hold 51.6% of the market revenue in 2025, establishing it as the leading component type. Growth in this segment is being driven by the increasing need for reliable reception and processing of high-definition video signals across multiple applications. Wireless video receivers enable seamless transmission from cameras, drones, and other video sources to monitoring and recording systems without signal degradation.

Advanced features such as interference reduction, error correction, and dual-band compatibility enhance performance and reliability. Integration with both consumer and professional video devices further accelerates adoption. The flexibility provided by these receivers reduces infrastructure costs, simplifies deployment, and supports scalable network expansion.

Manufacturers are focusing on improving receiver sensitivity, connectivity range, and real-time data handling to meet the growing demand for high-performance video systems As wireless solutions continue to replace traditional wired setups, the wireless video receiver segment is expected to maintain its market dominance, driven by technological innovation and increasing demand for efficient video transmission.

The video devices segment is anticipated to account for 28.4% of the market revenue in 2025, making it the leading device type category. Growth is being driven by the rising deployment of wireless-enabled video equipment in residential, commercial, and industrial applications. Devices such as cameras, monitors, and video capture units rely on wireless transmission for enhanced mobility, real-time monitoring, and operational efficiency.

Integration with advanced receiver systems and dual-band 2.4/5GHz technology ensures low latency and high-quality video delivery. The adoption of smart home systems, remote surveillance, and collaborative video communication platforms is further boosting demand.

The ability to quickly install and reposition devices without relying on wired connections provides significant operational flexibility As consumer and enterprise reliance on video-enabled workflows increases, the video devices segment is expected to remain a key growth driver, supported by continuous advancements in wireless connectivity, device miniaturization, and interoperability with emerging video management platforms.

A wireless video transmits up to 1080p video from an HDMI source. These include Blu-ray (2D and 3D), cable/satellite, and gaming systems. Most wireless video transmit IR signals, so that one can control the source that’s attached to the transmitter (cable box) while someone is away from the television.

The currently manufactured wireless products handle all current and near-future HD video signals. A 2.4 GHz wireless frequency range is capable to reach farther than the 5GHz frequency due to the basic characteristics of waves which attenuate much faster at higher frequencies.

Wireless video have features such as uncompressed video & audio transmission, support resolutions up to 1080p60, 300' distance with 1ms latency, user license-free 5 GHz frequency, 3G-SDI input & loop, 3G-SDI output, video output via USB 3.0 grab engine, internal antennas, stream broadcast quality HD video, deliver to platforms and RTMP addresses, accepts any HDMI camera source.

Bluetooth configuration via tablet/phone, two hour internal lithium-ion battery, record to SD card via built-in SD port, max bandwidth via teradek sharelink to name a few.

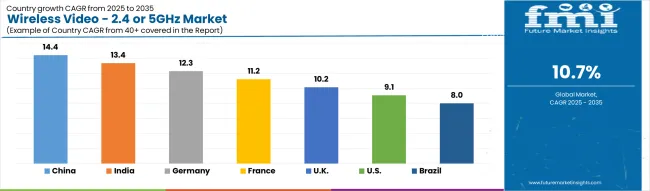

| Country | CAGR |

|---|---|

| China | 14.4% |

| India | 13.4% |

| Germany | 12.3% |

| France | 11.2% |

| UK | 10.2% |

| USA | 9.1% |

| Brazil | 8.0% |

The Wireless Video - 2.4/5GHz Market is expected to register a CAGR of 10.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 14.4%, followed by India at 13.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 8.0%, yet still underscores a broadly positive trajectory for the global Wireless Video - 2.4/5GHz Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 12.3%. The USA Wireless Video - 2.4/5GHz Market is estimated to be valued at USD 1.3 billion in 2025 and is anticipated to reach a valuation of USD 3.0 billion by 2035. Sales are projected to rise at a CAGR of 9.1% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 198.4 million and USD 107.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.6 Billion |

| Component Type | Wireless Video Receiver and Wireless Video Transmitter |

| Device Type | Video Devices, Phone, Bluetooth, Wi-Fi Networks, and Equivalent Isotropically Radiated Power (EIRP) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

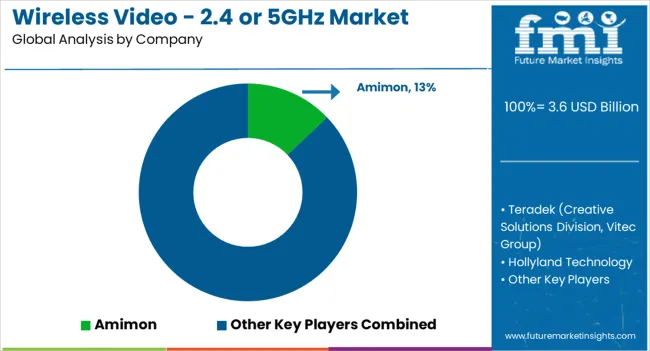

| Key Companies Profiled | Amimon, Teradek (Creative Solutions Division, Vitec Group), Hollyland Technology, DVEO, IDX System Technology, Zaxcom, Paralinx (Creative Solutions Division, Vitec Group), Broadcast Wireless Systems, Vislink Technologies, Cinegy, Barco, Wireless Video Systems, Cobham (now part of CAES), Dejero, and TVU Networks |

The global wireless video - 2.4/5ghz market is estimated to be valued at USD 3.6 billion in 2025.

The market size for the wireless video - 2.4/5ghz market is projected to reach USD 10.0 billion by 2035.

The wireless video - 2.4/5ghz market is expected to grow at a 10.7% CAGR between 2025 and 2035.

The key product types in wireless video - 2.4/5ghz market are wireless video receiver and wireless video transmitter.

In terms of device type, video devices segment to command 28.4% share in the wireless video - 2.4/5ghz market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Video on Demand (VoD) Service Market Size and Share Forecast Outlook 2025 to 2035

Wireless HDMI Transmitter and Receiver Market Size and Share Forecast Outlook 2025 to 2035

Video Processing Platform Market Size and Share Forecast Outlook 2025 to 2035

Video Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Video Game Market Size and Share Forecast Outlook 2025 to 2035

Video As A Sensor Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Video Encoders Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Video Conferencing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA