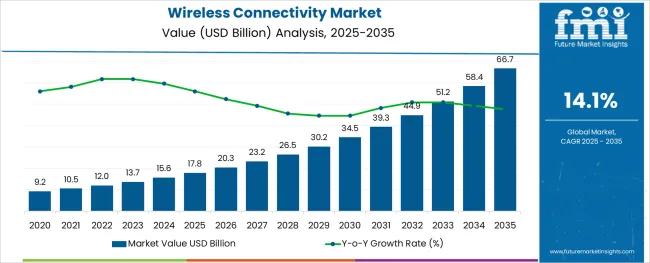

The Wireless Connectivity Market is estimated to be valued at USD 17.8 billion in 2025 and is projected to reach USD 66.7 billion by 2035, registering a compound annual growth rate (CAGR) of 14.1% over the forecast period.

The wireless connectivity market is expanding rapidly, fueled by the growing need for seamless and high-speed communication across a wide range of devices. Increasing adoption of smart home technologies, wearable devices, and mobile gadgets has led to greater demand for reliable wireless solutions. Industry developments have focused on enhancing bandwidth, reducing latency, and improving energy efficiency to support the expanding ecosystem of connected devices.

Consumers and businesses alike are driving the need for stable and scalable wireless networks, which enable greater mobility and flexibility in device usage. Furthermore, advancements in wireless protocols and standards have improved interoperability and security.

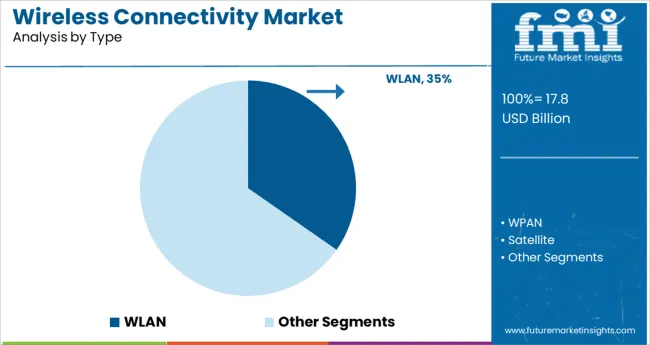

As digital transformation accelerates, the wireless connectivity market is poised for continued growth, driven by innovations that cater to evolving consumer and industrial requirements. Segmental growth is expected to be led by WLAN technology due to its widespread use and the consumer electronics sector as the primary end user.

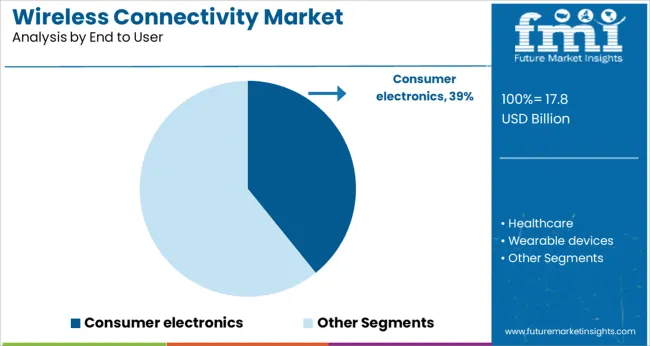

The market is segmented by Type and End to User and region. By Type, the market is divided into WLAN, WPAN, Satellite, LPWAN, and Cellular M2M. In terms of End to User, the market is classified into Consumer electronics, Healthcare, Wearable devices, Transportation and automotives, Building automation, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The WLAN segment is expected to hold 34.7% of the wireless connectivity market revenue in 2025, maintaining its position as the dominant technology type. WLAN has been widely adopted for its ability to provide robust and flexible wireless networking solutions in residential and commercial environments. The growing deployment of Wi-Fi enabled devices such as smartphones, laptops, smart TVs, and IoT gadgets has significantly increased WLAN usage.

Its capacity to deliver high-speed internet access and support multiple devices simultaneously makes it a preferred choice for home and office connectivity. Additionally, ongoing improvements in WLAN standards have enhanced data throughput and network reliability.

As users demand seamless streaming, gaming, and smart home integration, the WLAN segment is expected to retain its leading market share.

The consumer electronics segment is projected to account for 39.2% of the wireless connectivity market revenue in 2025, holding the top position among end users. Growth in this segment has been driven by the proliferation of connected devices including smartphones, tablets, smart speakers, and wearable technology.

Consumer demand for wireless solutions that offer convenience, mobility, and high performance has fueled the integration of wireless connectivity in nearly all electronic gadgets. Retail expansion and increasing internet penetration have also supported the adoption of connected consumer electronics globally.

Furthermore, the rising popularity of smart home ecosystems and personal entertainment devices has intensified the reliance on wireless networks. With continuous innovation in device capabilities and connectivity standards, the consumer electronics segment is expected to maintain its dominance in the wireless connectivity market.

Growing adoption of wireless technology, like Bluetooth, Wi-Fi, and GPS is as well expanding the growth scope of the wireless connectivity market. Wireless systems usually decrease the burden of bulky cables, thus slashing the cost of installation and operation across various business enterprises.

The arrival of 5G is as well expected to improve the growth prospect for the wireless connectivity industry. Several agencies across the globe are persistently working towards improving the 5G infrastructure across respective economies. For instance, the Federal Communications Commission, 2024 made a priority-based announcement to ensure the wireless industry has the tools it requires to uphold USA leadership in commercial 5G enactment.

Besides, the growing adoption of wireless sensors in smart homes and offices is another factor driving the demand for wireless connectivity. Developments in various wireless connectivity technologies such as ZigBee, BLE, Z-Wave, and EnOcean are encouraging the rapid deployment of wireless sensors in domestic and industrial spaces. These sensors are extensively used in several applications ranging from homes to office buildings, while high-end precision sensors are utilized in several industries and laboratories. Therefore, the increasing demand for affordable smart wireless sensors is likely to drive the growth of the market for BLE chipset/devices as these devices can be paired with Smart Ready devices.

The demand for wireless technologies is propelled by countless developments in the wireless communications industry, such as imminent long-term evolution (LTE), improved adoption of smart devices, higher mobility, and explosive development in mobile data traffic. Novel wireless technologies request more spectrum and more energy. LTE and 5G are the fastest-growing mobile technologies and would continue to evolve in the future.

With the mounting number of connected devices, the need for high-speed internet connectivity has become one of the most imperative parameters in digitally progressive workplaces. With 3G becoming the absolute wireless broadband technology and 4G rapidly increasing its prospects across numerous applications, the industry concentration has shifted toward the advancement of the 5G technology. It is estimated to become the next stage of development across the highly dynamic broadband industry. As pondered by leading network providers, the 5G network infrastructure would support release connectivity of ≥1 Gbps in the coming years.

Sensors and other peripherals are substantial power consumers. The energy consumption rate for sensors in a wireless sensor network varies based on the protocols the sensors utilize for communication. While technologies such as ultra-low-power processors, tiny mobile sensors, and wireless networking are available, there is a necessity for competent power management and optical power consumption in IoT devices.

Connectivity load is another grave issue since several devices need to be connected at the same time. For instance, an average smart home may comprise 50-100 connected appliances, lights, thermostats, and other devices, respectively with their power necessities. Devices such as smart meters are also used to make the line power efficient. As a recurrent manual spare of the batteries of thousands of sensors, actuators, and other connected devices within IoT systems is not viable, the key snag is the power management of devices using wireless technologies, such as Wi-Fi.

Consumer Electronics to catch Service Providers’ Eyes in the Forthcoming Future

Owing to growing automation and increasing implementation of technology in gadgets like ACs. Smart TVs, etc to make them easily accessible is bolstering demand for consumer electronics. Besides, swelling sales of netbooks, media tablets, and other “always connected” consumer and industrial electronics products mean equally robust performance in markets for wireless connectivity ICs. Future Market Insights forecasts that shipments of wireless connectivity chipsets will reach a total of approximately three billion units by the end of 2035, a 13.5% shipment increase compared to 2024.

This trend is likely to continue in the coming years, backed by the increasing adoption of smart gadgets among fitness enthusiasts and millennials. Bluetooth upheld its lead among all wireless connectivity chipset categories. Wi-Fi connectivity bags second place with approximately 38% market share. They are likely to attain the highest growth rate among connectivity chipsets, with a 13.5% CAGR between 2025 and 2035.

For technology applications, the swelling demand for Wi-Fi-enabled mobile and consumer electronics gadgets is a principal engine driving market growth. Nowadays almost every netbook, media tablet, and gaming console have Wi-Fi embedded, and in 2024 shipments of Wi-Fi-enabled consumer devices showed an increase of about 15% compared to 2020.

WPAN-based Chipsets likely to capture the Largest Share

The wireless personal area network connectivity technology is based on the IEEE 802.15.4 standard. WPAN is a small area and low bandwidth networking technology that allows transmission within a very short range, which is nearly 10 meters. Tools supporting WPAN comprise Bluetooth, ultra-wideband (UWB), ZigBee, Z-Wave, and Thread. ZigBee is used to create personal area networks with small and low-power digital radios. It has a communication distance of 10-100 meters. ZigBee runs at a frequency of 2.4 GHz. It is ideal for applications that require long battery life, secure networking, sturdiness, and a low data transfer rate.

The development of the market for WPAN-enabled chipsets is encouraged by the advent of the 5th generation of Bluetooth wireless technology. Bluetooth 5 is touted to be 2X faster for low-power applications than the previous version, Bluetooth 4.0. The launch of Bluetooth 5 was a significant milestone in the development not only of the standard in general but also for the arrival of services based on Bluetooth beacons. For users, smartphones and tablets that support the standard of Bluetooth 5.0 have been announced in the market.

A recently published report by Future Market Insights states that the WPAN segment is estimated to expand at a CAGR of 13.6% throughout the forecast period.

Future Market Insights reported that the USA market for wireless connectivity is expected to acquire USD 66.7 Billion by 2035, and is prophesied to rise at a 13.9% CAGR over the forecast period owing to the increasing adoption of WSN, especially in the military and defense divisions. Besides, the presence of prominent companies will encourage growth in the country.

Another prominent reason for the progressive market growth is the robust demand for improving in-building network connectivity in the country. The United States has a large number of subscribers owning more than one connected device; the aspects such as growing automation, increasing adoption of the Internet of Things (IoT) platform, increasing cellular M2M connections, and rising demand for on-demand video services would propel the wireless connectivity market growth.

Early implementation of new technologies, such as machine-to-machine interaction, and IoT-enabled devices, along with the presence of key industrial players, would lead to high growth in the USA wireless connectivity market.

Prominent player Nokia is expanding its industrial connectivity edge-centric solution portfolio with the Digital Automation Cloud Wi-Fi Solution in the United States and other regions. The company is offering new solutions like Wi-Fi 6, and 6E for connecting non-business critical use cases and private 4.9G/LTE and 5G to support critical Industry 4.0 applications.

China held the largest customer base in 2024, backed by the digital technologies adoption which has greater potential for transformation. Since the IoT market is experiencing healthy growth, the wireless connectivity chip market in APAC is likely to expand at a significant rate stimulated by the largest concentration of the global population in China & India. Henceforth, the amount of new M2M connections per year, the demand for smart consumer devices, and the necessity for the industrial revolution are higher in this country.

Rendering to the fact of a large population base, coupled with linked issues such as those of healthcare and energy management, the wireless connectivity technologies seem to uphold more prospects to enhance the standard of living and transform the industrial sector in China. Moreover, capital investments by the Chinese government in the development and modernization of businesses have augmented the penetration rate of IoT-connected devices, which include connectivity ICs. For instance, In July 2025, the Chinese government-backed institute Purple Mountain Laboratories achieved a 6G-level wireless transmission up to a speed of 206.66.7 gigabits per second for the first time in a lab environment.

Future Market Insights forecast that the Chinese Market for Wireless Connectivity is estimated to reach USD 66.7 Billion by 2035, following a CAGR of 13.4% throughout the forecast period.

| Countries | Expected CAGR |

|---|---|

| USA | 13.9% |

| UK | 12.8% |

| China | 13.4% |

| Japan | 12.3% |

| South Korea | 11.6% |

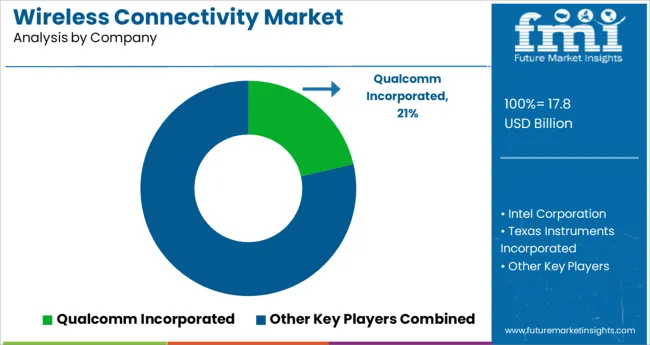

Players in the global Wireless Connectivity market are adopting various strategies to strengthen their position in the market. Acquisitions, partnerships, and agreements are some of the most adopted strategies. A notable development in the market is:

| Report Attributes | Details |

|---|---|

| Growth Rate | 14.1% CAGR from 2025 to 2035 |

| Market Value for 2025 | USD 17.8 billion |

| Market Value for 2035 | USD 66.7 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | billion for Value |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type, End-User, Region |

| Regions Covered | North America; Europe; The Asia Pacific; Latin America; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, France, The UK, Italy, BENELUX, Nordics, Russia, China, Japan, South Korea, GCC, South Africa, Turkey |

| Key Companies Profiled | Intel Corporation; Texas Instruments Incorporated; Qualcomm Incorporated; Broadcom; STMicroelectronics N.V.,; NXP Semiconductors N.V.; Microchip Technology Inc.; MediaTek Inc.; Cypress Semiconductor Corporation; Renesas Electronics Corporation; EnOcean; Nexcom International Co., Ltd.; Skyworks Solutions, Inc.; Murata Manufacturing Co., Ltd.; Marvell Technology Group; Nordic Semiconductor; Expressiveif Systems; CEVA, Inc.; Quantenna Communications, Inc.; Peraso Technologies, Inc.; Panasonic Corporation; BehrTech; Element 14; Dialog Semiconductor; Silicon Labs |

| Report Customization & Pricing | Available upon Request |

The global wireless connectivity market is estimated to be valued at USD 17.8 billion in 2025.

It is projected to reach USD 66.7 billion by 2035.

The market is expected to grow at a 14.1% CAGR between 2025 and 2035.

The key product types are wlan, wpan, satellite, lpwan and cellular m2m.

consumer electronics segment is expected to dominate with a 39.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Wireless HDMI Transmitter and Receiver Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wireless Testing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Printer Market Size and Share Forecast Outlook 2025 to 2035

Wireless Headphones Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA