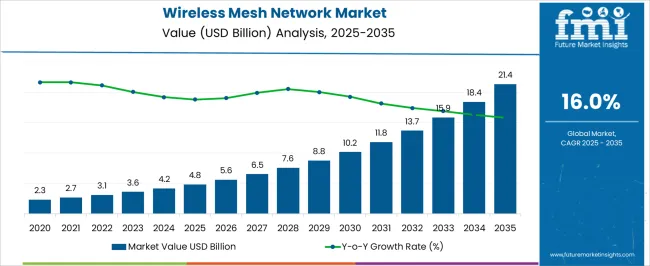

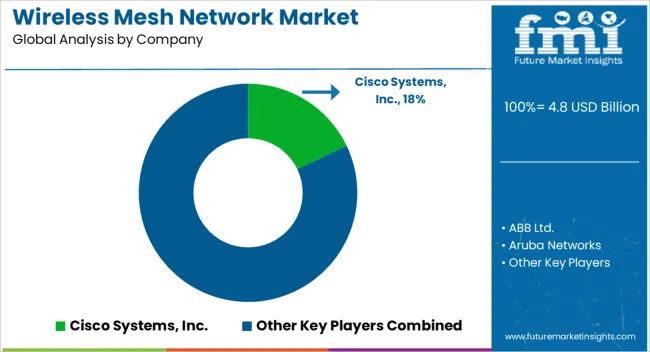

The wireless mesh network market is estimated to be valued at USD 4.8 billion in 2025 and is projected to reach USD 21.4 billion by 2035, registering a compound annual growth rate (CAGR) of 16.0% over the forecast period. Steady adoption is anticipated across enterprise, industrial, and smart infrastructure applications, where seamless connectivity, network reliability, and scalability are increasingly prioritized. The market growth is being driven by the demand for decentralized and self-healing network architectures that support robust communication, uninterrupted data transmission, and efficient resource allocation in complex network environments.

By 2035, the wireless mesh network market is projected to more than quadruple in size, emphasizing its role in modern networking strategies and infrastructure deployments. The strong growth pattern indicates that industries and enterprises are increasingly relying on mesh solutions to enhance network coverage, reduce downtime, and support high-density communication requirements.

Providers offering high-performance, secure, and adaptable wireless mesh technologies are likely to capture significant market share. The trajectory suggests that the market will continue to attract investments and strategic adoption, establishing wireless mesh networks as a foundational element in robust digital communication ecosystems and high-demand operational frameworks.

| Metric | Value |

|---|---|

| Wireless Mesh Network Market Estimated Value in (2025 E) | USD 4.8 billion |

| Wireless Mesh Network Market Forecast Value in (2035 F) | USD 21.4 billion |

| Forecast CAGR (2025 to 2035) | 16.0% |

The wireless mesh network market is a specialized segment within the broader wireless networking market, where it currently holds approximately 4-5% share, driven by its ability to provide flexible, scalable, and reliable network connectivity in challenging environments. Within the Internet of Things (IoT) market, wireless mesh networks account for around 3-4% share, as they enable seamless communication between connected devices, sensors, and controllers, particularly in industrial, agricultural, and smart home applications.

In the telecommunications and communication equipment market, the segment represents roughly a 2-3% share, serving as a crucial solution for extending network coverage in urban, rural, and remote areas without relying on traditional infrastructure. The smart city infrastructure market contributes about a 5-6% share, as wireless mesh networks facilitate intelligent traffic management, public safety monitoring, and energy-efficient utilities by connecting diverse devices across urban landscapes.

The wireless mesh network market is witnessing strong growth, fueled by the expanding deployment of smart infrastructure, increased bandwidth demands, and the shift toward decentralized connectivity. These networks offer enhanced reliability, self-healing capabilities, and flexible scalability, which make them ideal for both consumer and industrial applications.

Governments and enterprises are adopting mesh architectures to support large-scale IoT rollouts, public Wi-Fi zones, and remote monitoring systems. Additionally, the growing need for seamless, low-latency communication in real-time applications is positioning mesh networks as a preferred alternative to traditional topologies.

Technological advancements in node processing power and dynamic routing algorithms are expected to accelerate adoption in urban, rural, and enterprise environments.

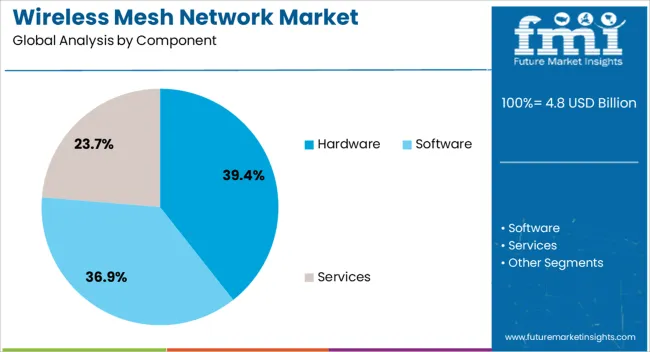

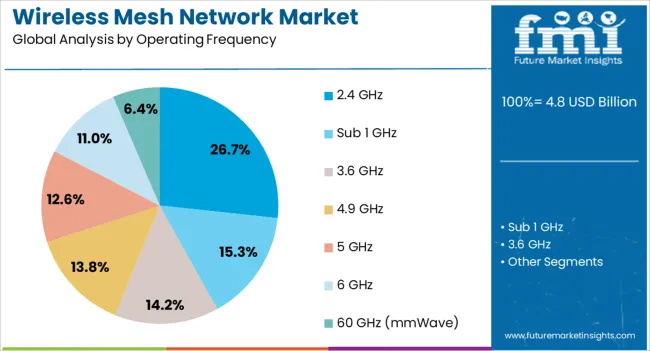

The wireless mesh network market is segmented by component, operating frequency, application, end-user, and geographic regions. By component, the wireless mesh network market is divided into Hardware, Software, and Services. In terms of operating frequency, the wireless mesh network market is classified into 2.4 GHz, Sub 1 GHz, 3.6 GHz, 4.9 GHz, 5 GHz, 6 GHz, and 60 GHz (mmWave).

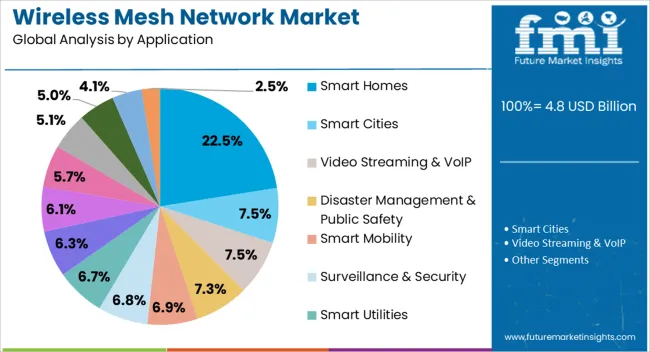

Based on application, the wireless mesh network market is segmented into Smart Homes, Smart Cities, Video Streaming & VoIP, Disaster Management & Public Safety, Smart Mobility, Surveillance & Security, Smart Utilities, Industrial IoT, Healthcare, Education, Retail, Hospitality, Agriculture, and Others. By end-user, the wireless mesh network market is segmented into Residential, Commercial, Industrial, Government & Defense, Transportation & Logistics, and Others. Regionally, the wireless mesh network industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Hardware is projected to lead with 39.4% market share by 2025 in the wireless mesh network space, reflecting its critical role in enabling reliable and secure connectivity. Routers, gateways, and access points form the physical backbone of mesh networks and are increasingly designed with built-in redundancy and enhanced signal processing.

The demand for high-performance, ruggedized hardware is particularly strong in industrial and smart city deployments where environmental and operational reliability is essential.

Innovations in multi-band support and energy-efficient hardware design are also helping drive replacement cycles and broader adoption.

The 2.4 GHz band is expected to dominate with a 26.70% share of the wireless mesh network market by 2025. This frequency range offers wider coverage and better penetration through walls and obstructions, making it ideal for residential and medium-scale commercial deployments.

Its broad compatibility with legacy Wi-Fi devices and lower cost of implementation have made it a preferred choice for cost-sensitive installations.

Despite increasing congestion in the band, ongoing enhancements in interference mitigation and channel optimization have kept it relevant in smart home and campus networks.

Smart homes are anticipated to contribute 22.50% of the total market share by 2025, becoming the leading application area for wireless mesh networks. The segment is growing due to rising consumer demand for connected lighting, security systems, and energy management tools that require seamless in-home communication.

Mesh networks ensure consistent coverage throughout multi-floor buildings and eliminate connectivity blind spots common in single-router setups.

The increase in IoT-enabled household devices and voice-controlled ecosystems further enhances the need for reliable, self-healing wireless infrastructure, making mesh networks a foundational element in the evolution of connected living spaces.

The wireless mesh network market is expanding with growing demand from smart cities, industrial automation, and IoT applications. Opportunities lie in smart infrastructure integration and turnkey IoT solutions, while trends highlight AI-driven self-healing networks. Challenges include cybersecurity risks and spectrum management complexities. Overall, market growth is driven by the need for reliable, scalable, and intelligent wireless networks that support urban, industrial, and enterprise connectivity across global deployments.

The wireless mesh network market is being driven by growing adoption in smart cities, industrial automation, and enterprise networking. The increasing need for seamless, reliable, and self-healing network connectivity is supporting the deployment of mesh networks in urban infrastructure, utilities, and manufacturing facilities. These networks enable efficient communication across large areas with minimal wiring, improving operational efficiency and reducing maintenance costs. Rising demand for IoT devices, smart lighting, and connected sensors is further fueling the adoption of scalable and resilient wireless mesh solutions globally.

Significant opportunities exist in integrating wireless mesh networks with IoT platforms and smart infrastructure solutions. Applications in smart homes, industrial IoT, and city-wide monitoring systems require high network reliability, low latency, and adaptive routing, which mesh networks provide. Vendors offering turnkey solutions with cloud-based management, analytics, and security features are well-positioned to capture these opportunities. Expansion of connected devices and digital transformation initiatives across healthcare, transportation, and energy sectors further enhances market potential for advanced wireless mesh network solutions.

A prominent trend is the development of AI-driven, self-healing wireless mesh networks. Intelligent routing algorithms and adaptive signal management optimize network performance, reduce downtime, and enhance reliability in dynamic environments. The integration of network analytics enables predictive maintenance and real-time monitoring of connectivity. Additionally, hybrid mesh solutions combining Wi-Fi, LTE, and 5G technologies are gaining traction, offering improved coverage and bandwidth. These trends reflect the market’s focus on intelligent, resilient, and performance-optimized wireless communication systems for enterprise and urban applications.

The wireless mesh network market faces challenges related to cybersecurity and spectrum management. Mesh networks are susceptible to hacking, unauthorized access, and data breaches, necessitating robust encryption and security protocols. Limited spectrum availability, interference from other wireless technologies, and regulatory constraints can impact network performance.

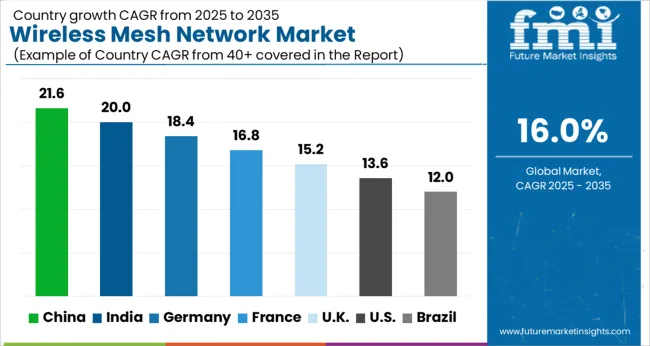

| Country | CAGR |

|---|---|

| China | 21.6% |

| India | 20.0% |

| Germany | 18.4% |

| France | 16.8% |

| UK | 15.2% |

| USA | 13.6% |

| Brazil | 12.0% |

The global wireless mesh network market is projected to grow at a CAGR of 16% from 2025 to 2035. China leads with a growth rate of 21.6%, followed by India at 20% and Germany at 18.4%. The United Kingdom records a growth rate of 15.2%, while the United States shows the slowest growth at 13.6%. Expansion is supported by the increasing need for reliable, scalable, and high-performance wireless communication systems across industrial, commercial, and smart city applications. Emerging markets like China and India are benefiting from rapid urban infrastructure growth, rising IoT adoption, and government-backed connectivity initiatives, while developed countries such as the USA, UK, and Germany focus on upgrading legacy networks and implementing advanced wireless technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The wireless mesh network market in China is growing at 21.6% CAGR, the highest among leading nations. Expansion is driven by rapid smart city development, industrial IoT adoption, and large-scale urban connectivity projects. Manufacturers are deploying scalable, high-performance wireless mesh solutions to enhance communication reliability and network efficiency. Adoption in transportation, public safety, and commercial sectors further accelerates growth. Government policies promoting digital infrastructure and smart city initiatives reinforce market expansion.

The wireless mesh network market in India is advancing at 20% CAGR, fueled by rapid urbanization, industrial automation, and government initiatives for digital connectivity. Adoption of scalable and reliable mesh network solutions is increasing in commercial, healthcare, and smart city applications. Manufacturers are focusing on cost-effective, high-performance products tailored for dense urban and industrial environments. Expansion of 5G networks and IoT adoption further supports market growth.

The wireless mesh network market in Germany is growing at 18.4% CAGR, supported by industrial IoT, smart manufacturing, and urban connectivity projects. Manufacturers are introducing high-performance, scalable, and secure mesh network solutions for factories, transportation hubs, and public utilities. Retrofit of existing networks and integration with automation and monitoring systems contribute to steady growth. Emphasis on energy efficiency and reliable communication further strengthens adoption.

The wireless mesh network market in the United Kingdom is expanding at 15.2% CAGR, influenced by smart city initiatives, IoT deployment, and industrial automation. Adoption of secure, high-performance, and energy-efficient mesh networks is increasing across transportation, healthcare, and commercial sectors. Upgrades of legacy networks and integration with smart infrastructure further drive market demand. Manufacturers focus on scalable solutions to support urban and industrial connectivity.

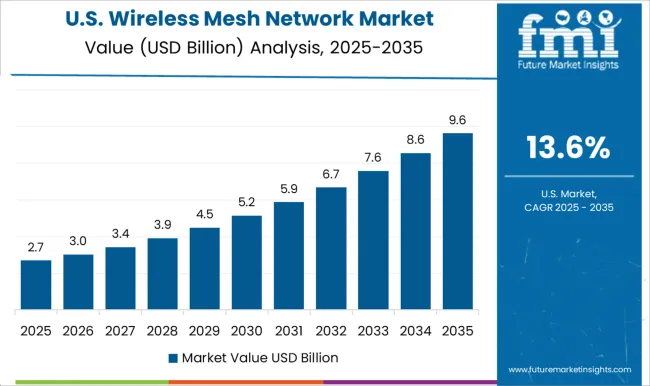

The wireless mesh network market in the United States is growing at 13.6% CAGR, the slowest among leading nations. Growth is driven by industrial IoT, smart buildings, and commercial connectivity requirements. Adoption of scalable, secure, and high-performance mesh networks supports efficiency in transportation, manufacturing, and public safety applications. Retrofit of aging networks and integration with smart infrastructure continues to expand market penetration. Manufacturers emphasize reliable solutions for dense urban and industrial environments.

Leading suppliers in the wireless mesh network market, such as Cisco Systems, ABB Ltd., and Aruba Networks, are competing by offering robust, scalable solutions for industrial, commercial, and smart city applications. Cisco emphasizes enterprise-grade mesh networks with high reliability, security, and centralized management, presenting brochures that highlight seamless connectivity and reduced downtime. ABB focuses on industrial automation and critical infrastructure, promoting wireless mesh solutions that ensure real-time data transmission and resilient network performance.

Aruba Networks markets flexible and easy-to-deploy mesh networks for commercial and campus environments, emphasizing user experience and simplified management. Other players, including Cambium Networks, Ltd. and Concentris Systems LLC, differentiate through cost-effective, high-performance solutions designed for rural, remote, and large-scale outdoor deployments. Cambium Networks emphasizes low-latency, long-range connectivity, while Concentris Systems highlights secure and customizable mesh network configurations for specific industry needs. Product brochures consistently focus on network reliability, scalability, and integration with existing IT infrastructure. Market competition is driven by the ability to provide secure, resilient, and easily managed wireless networks, with companies positioning their solutions as critical enablers for industrial IoT, smart cities, and large enterprise connectivity.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 Billion |

| Component | Hardware, Software, and Services |

| Operating Frequency | 2.4 GHz, Sub 1 GHz, 3.6 GHz, 4.9 GHz, 5 GHz, 6 GHz, and 60 GHz (mmWave) |

| Application | Smart Homes, Smart Cities, Video Streaming & VoIP, Disaster Management & Public Safety, Smart Mobility, Surveillance & Security, Smart Utilities, Industrial IoT, Healthcare, Education, Retail, Hospitality, Agriculture, and Others |

| End-User | Residential, Commercial, Industrial, Government & Defense, Transportation & Logistics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco Systems, Inc., ABB Ltd., Aruba Networks, Cambium Networks, Ltd., and Concentris Systems LLC |

| Additional Attributes | Dollar sales by network type (full mesh, partial mesh) and application (industrial, residential, commercial) are key metrics. Trends include growing demand for reliable, scalable, and low-latency wireless connectivity, adoption in IoT and smart city applications, and integration with existing network infrastructures. Regional adoption, technological advancements, and security considerations are driving market growth. |

The global wireless mesh network market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the wireless mesh network market is projected to reach USD 21.4 billion by 2035.

The wireless mesh network market is expected to grow at a 16.0% CAGR between 2025 and 2035.

The key product types in wireless mesh network market are hardware, mesh wi-fi appliances, routers, gateways, extenders, software, mesh network platforms, management and security software, services, network planning & consulting, deployment & provisioning, network security, network analytics, support and maintenance, network testing and network optimization.

In terms of operating frequency, 2.4 GHz segment to command 26.7% share in the wireless mesh network market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wireless Testing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Printer Market Size and Share Forecast Outlook 2025 to 2035

Wireless Headphones Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensors Market Size and Share Forecast Outlook 2025 to 2035

Wireless Display Market Size and Share Forecast Outlook 2025 to 2035

Wireless Paging Systems Market Size and Share Forecast Outlook 2025 to 2035

Wireless Patient Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Wireless Earphone Market Size and Share Forecast Outlook 2025 to 2035

Wireless Ev Charging Market Size and Share Forecast Outlook 2025 to 2035

Wireless Telecommunication Services Market Trends – Growth & Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA