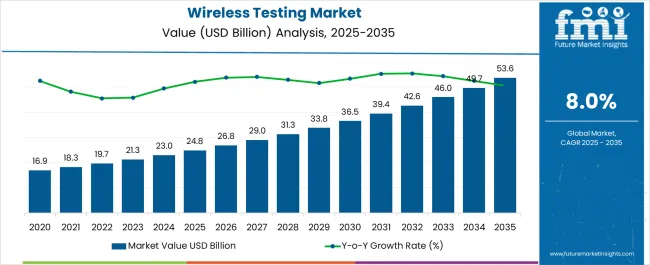

The Wireless Testing Market is estimated to be valued at USD 24.8 billion in 2025 and is projected to reach USD 53.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period. The wireless testing market is projected to generate an incremental gain of USD 11.7 billion over the first five years, which accounts for 42.3% of the total incremental growth over the 10-year forecast period.

This growth is driven by the increasing demand for wireless communication devices, 5G deployment, and the need for advanced testing solutions to meet evolving industry standards. Wireless testing is critical to ensuring device performance, signal integrity, and compliance with regulatory requirements across telecommunications, automotive, and IoT sectors.

The second half (2030–2035) will contribute USD 15.1 billion, representing 57.7% of the total growth, reflecting stronger momentum driven by the growing adoption of 5G, IoT, and other wireless technologies. Annual increments will rise from USD 1.1 billion in the early years to USD 1.9 billion by 2035, as global demand for wireless communication devices continues to surge. Manufacturers focusing on providing scalable, high-speed, and cost-effective testing solutions will capture the largest share of this USD 26.8 billion opportunity.

| Metric | Value |

|---|---|

| Wireless Testing Market Estimated Value in (2025 E) | USD 24.8 billion |

| Wireless Testing Market Forecast Value in (2035 F) | USD 53.6 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The wireless testing market is experiencing sustained growth driven by the rapid evolution of wireless communication standards, increasing complexity in device connectivity, and rising demand for seamless user experiences across digital ecosystems. Advancements in wireless technologies such as 5G, Wi Fi 6, and ultra wideband are compelling manufacturers to adopt more robust testing protocols to ensure performance, compliance, and interoperability.

This demand is further amplified by the proliferation of connected devices across sectors including automotive, consumer electronics, healthcare, and industrial automation. The focus on faster data transfer rates, low latency, and network reliability has reinforced investment in wireless testing infrastructure.

As global certification and regulatory compliance standards become more stringent, the need for accurate and scalable testing solutions is becoming a critical success factor for device manufacturers. Looking ahead, the market is expected to witness consistent growth as wireless innovation and consumer expectations continue to advance in parallel.

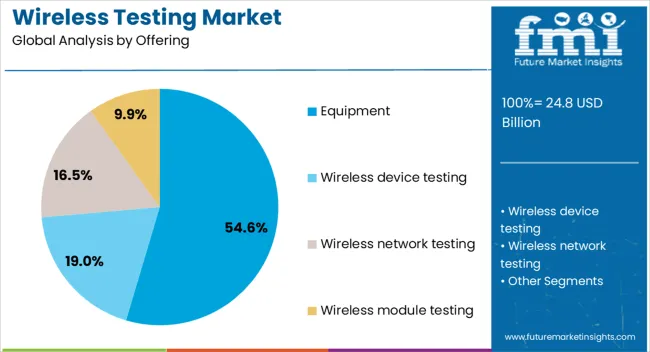

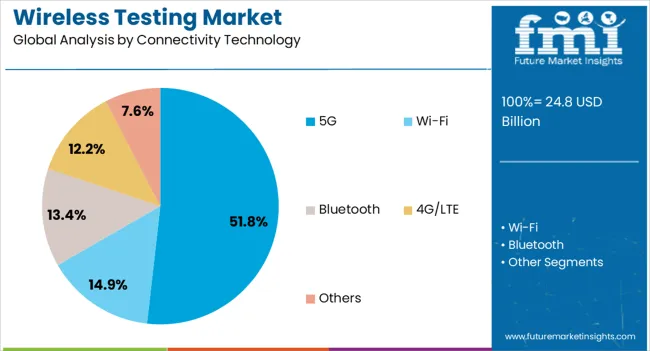

The wireless testing market is segmented by offering, connectivity technologyapplication, and geographic regions. By offering of the wireless testing market is divided into Equipment, Wireless device testing, Wireless network testing, Wireless module testing, Wireless IC testing, and Services. In terms of connectivity technology of the wireless testing market is classified into 5G, Wi-Fi, Bluetooth, 4G/LTE, and Others.

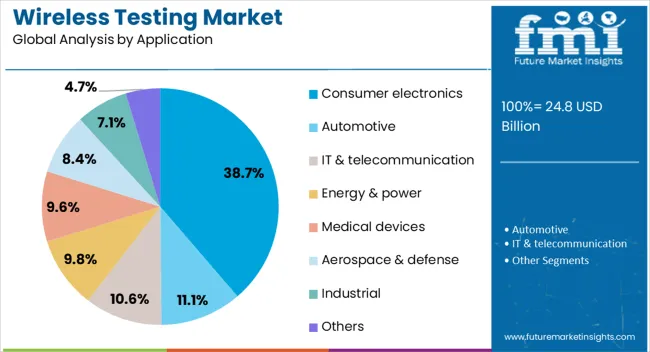

Based on application of the wireless testing market is segmented into Consumer electronics, Automotive, IT & telecommunication, Energy & power, Medical devices, Aerospace & defense, Industrial, and Others. Regionally, the wireless testing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The equipment segment is anticipated to account for 54.60% of total market revenue by 2025 under the offering category, making it the dominant contributor. This leadership is attributed to the rising complexity of wireless protocols and the need for high precision testing instruments that can validate diverse connectivity standards.

Equipment used in wireless testing provides detailed measurements of signal strength, latency, interference, and throughput, which are essential for ensuring device quality and network reliability. Manufacturers across various industries are investing in advanced testing setups to support both pre compliance and certification stages.

The increasing rollout of new wireless technologies has further driven demand for modular, multi standard equipment capable of testing a wide range of frequency bands and use cases. As a result, the equipment segment continues to play a foundational role in the expansion and quality assurance of the wireless ecosystem.

The 5G segment is projected to contribute 51.80% of market revenue by 2025 within the connectivity technology category, making it the leading sub segment. This is driven by the global commercialization of 5G networks and the corresponding surge in 5G enabled devices across consumer, industrial, and enterprise domains.

The complexity of 5G architecture, including support for mmWave frequencies, massive MIMO, and ultra low latency use cases, has necessitated rigorous testing protocols. Test solutions are required to address both standalone and non standalone deployments, ensuring device compatibility and network efficiency.

Furthermore, telecom operators and OEMs are expanding investments in 5G trials and infrastructure validation, strengthening the demand for specialized testing services and equipment. As 5G continues to redefine connectivity standards worldwide, its impact on wireless testing remains substantial and sustained.

The consumer electronics segment is expected to hold 38.70% of total market revenue by 2025 under the application category, positioning it as the top segment. This dominance is attributed to the increasing volume and diversity of connected devices such as smartphones, wearables, smart home products, and tablets.

These devices require multi standard wireless capability, creating a need for extensive testing to ensure consistent performance across Bluetooth, Wi Fi, 5G, and other technologies. End users demand low latency, high reliability, and seamless interoperability, all of which are enabled through comprehensive wireless testing protocols.

As consumer electronics companies race to innovate and shorten product development cycles, testing has become an integral step in maintaining brand reputation and meeting international quality benchmarks. This continued emphasis on user experience and network optimization has positioned consumer electronics as the primary driver of wireless testing market growth.

The wireless testing market is driven by increasing demand for reliable communication testing solutions and opportunities from the expansion of 5G and IoT applications. Emerging trends such as automation and remote testing solutions are reshaping the market. However, challenges like high equipment costs and regulatory compliance remain significant obstacles. By 2025, overcoming these challenges through cost-effective solutions and streamlining compliance will be key to supporting continued market growth and the adoption of advanced wireless testing technologies.

The wireless testing market is experiencing growth due to the increasing demand for reliable wireless communication testing solutions. As the number of connected devices and wireless networks rises, industries across telecommunications, automotive, and consumer electronics need to ensure that their wireless communication systems perform optimally. Wireless testing solutions are critical in identifying and solving network issues, ensuring that these systems operate efficiently. By 2025, the market is expected to continue expanding as businesses and manufacturers prioritize robust testing systems for their wireless infrastructures.

Opportunities in the wireless testing market are growing with the ongoing expansion of 5G networks and the increasing adoption of IoT applications. The rollout of 5G technology demands comprehensive testing to ensure network reliability and performance, especially in high-traffic areas. Additionally, as the Internet of Things (IoT) continues to grow, with more connected devices across various industries, wireless testing is essential to maintain network efficiency. By 2025, the expansion of 5G and IoT applications will significantly drive the need for advanced wireless testing tools and solutions.

Emerging trends in the wireless testing market include the increasing adoption of automation and remote wireless testing solutions. These technologies allow businesses to conduct tests without on-site presence, improving efficiency and reducing operational costs. With the growing complexity of wireless networks, automated testing systems can perform multiple tests simultaneously, ensuring better coverage and faster results. By 2025, remote wireless testing solutions are expected to become more prevalent, offering businesses flexible, scalable, and cost-effective ways to ensure the performance of their wireless systems.

Despite growth, the wireless testing market faces challenges such as high equipment costs and the need for regulatory compliance. Wireless testing equipment, especially advanced tools for 5G and IoT testing, can be expensive, limiting accessibility for smaller companies or those with tight budgets. Additionally, strict regulatory standards in different regions can complicate the testing process, requiring businesses to invest in tools that meet various certifications and compliance criteria. By 2025, addressing these challenges will be crucial for ensuring that wireless testing solutions remain affordable and accessible for businesses of all sizes.

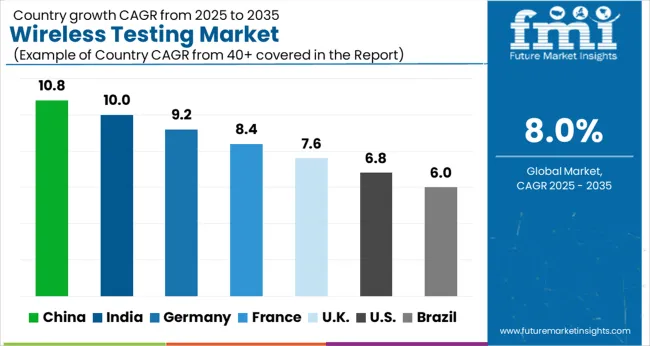

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The global wireless testing market is projected to grow at an 8% CAGR from 2025 to 2035. China leads with a growth rate of 10.8%, followed by India at 10%, and France at 8.4%. The United Kingdom records a growth rate of 7.6%, while the United States shows the slowest growth at 6.8%. These varying growth rates are driven by factors such as the increasing demand for wireless communication systems, the growing adoption of 5G technologies, and the need for testing solutions to support the development of next-generation wireless devices. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, technological advancements, and large-scale investments in telecom infrastructure, while more mature markets like the USA and the UK see steady growth driven by the adoption of 5G, IoT, and increased focus on testing solutions for complex wireless networks. This report includes insights on 40+ countries; the top markets are shown here for reference.

The wireless testing market in China is growing rapidly, with a projected CAGR of 10.8%. China’s expanding telecom infrastructure, combined with the rising demand for wireless communication systems, including 5G, IoT, and smart devices, is driving significant market growth. The country’s growing investments in technology and innovation, along with government policies promoting 5G and telecommunications, further contribute to the rising demand for wireless testing solutions. Additionally, China’s leadership in manufacturing and the development of cutting-edge wireless technologies, including 5G networks and smart city infrastructure, accelerates the need for advanced wireless testing systems.

The wireless testing market in India is projected to grow at a CAGR of 10%. India’s growing demand for telecom services, increasing adoption of smartphones, and expanding wireless networks are driving the adoption of wireless testing solutions. The country’s significant investments in 5G technology and telecom infrastructure development are contributing to the growing need for testing solutions to ensure network quality and efficiency. Additionally, India’s rapidly expanding mobile data consumption and the growing IoT ecosystem are accelerating the demand for advanced wireless testing services. As India continues to invest in digital infrastructure, the market for wireless testing will expand significantly.

The wireless testing market in France is projected to grow at a CAGR of 8.4%. France’s focus on 5G network rollouts, IoT integration, and telecom infrastructure advancements is driving steady market growth. The country’s emphasis on improving mobile communication networks and ensuring network quality, reliability, and security is contributing to the increasing demand for wireless testing solutions. Additionally, France’s growing technology ecosystem, supported by government policies promoting digital infrastructure, smart cities, and innovative wireless communication technologies, further accelerates the market demand for wireless testing services. The increasing use of connected devices and the expansion of digital services in France support the need for efficient wireless network testing solutions.

The wireless testing market in the United Kingdom is projected to grow at a CAGR of 7.6%. The UK demand for wireless testing solutions is driven by the country’s ongoing 5G deployment, mobile network expansion, and the increasing number of IoT applications. The country’s strong emphasis on digital infrastructure development and the rollout of advanced wireless networks are fueling the need for efficient testing services to ensure network reliability and performance. Additionally, the UK focus on regulatory compliance for telecommunications, data security, and network efficiency further accelerates the demand for wireless testing technologies.

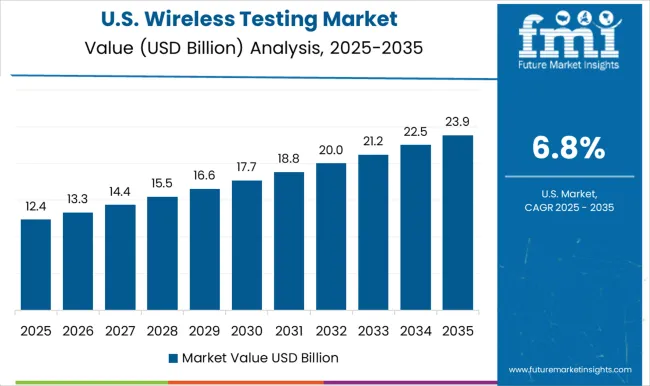

The wireless testing market in the United States is expected to grow at a CAGR of 6.8%. The USA market remains steady, driven by the increasing demand for wireless communication solutions, including 5G, IoT, and smart devices. The country’s focus on expanding telecom infrastructure, ensuring high network performance, and promoting network security is driving the need for advanced wireless testing solutions. Additionally, the growing adoption of connected devices, advancements in IoT, and investments in next-generation wireless technologies further contribute to the rising demand for wireless testing services. The USA regulatory environment supporting telecommunications and data privacy continues to accelerate the market growth.

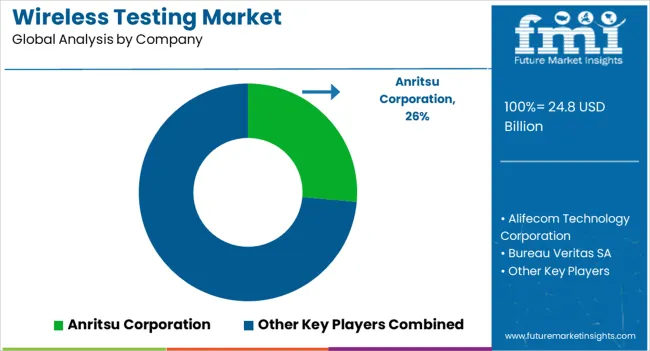

The wireless testing market is dominated by Keysight Technologies, which leads with its advanced wireless testing solutions that cater to the growing demand for efficient, high-quality wireless communication systems. Keysight’s dominance is supported by its strong innovation in RF testing, software, and hardware solutions, providing critical tools for network operators and equipment manufacturers.

Key players such as Rohde & Schwarz, Viavi Solutions Inc., and Anritsu Corporation maintain significant market shares by offering comprehensive wireless testing systems that cover various communication standards such as 5G, Wi-Fi, and IoT. These companies focus on delivering high-precision, scalable testing equipment for a wide range of wireless devices and networks.

Emerging players like Bureau Veritas SA, DEKRA SE, and Intertek Group plc are expanding their market presence by offering specialized testing solutions for industries such as automotive, healthcare, and telecommunications. Their strategies include improving testing accuracy, enhancing product certifications, and focusing on testing for emerging wireless technologies. Market growth is driven by the rapid adoption of 5G technology, the rising complexity of wireless communication systems, and the increasing demand for high-performance, low-latency wireless networks. Innovations in testing methodologies, automation, and AI-based testing are expected to continue shaping competitive dynamics and drive further growth in the global wireless testing market.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.8 Billion |

| Offering | Equipment, Wireless device testing, Wireless network testing, Wireless module testing, Wireless IC testing, and Services |

| Connectivity Technology | 5G, Wi-Fi, Bluetooth, 4G/LTE, and Others |

| Application | Consumer electronics, Automotive, IT & telecommunication, Energy & power, Medical devices, Aerospace & defense, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Anritsu Corporation, Alifecom Technology Corporation, Bureau Veritas SA, Cisco Systems, Inc., DEKRA SE, Intertek Group plc, Keysight Technologies, Rohde & Schwarz, SGS SA, and Viavi Solutions Inc. |

| Additional Attributes | Dollar sales by testing type and application, demand dynamics across telecommunications, consumer electronics, and automotive sectors, regional trends in wireless testing adoption, innovation in 5G and IoT device testing technologies, impact of regulatory standards on compliance and performance, and emerging use cases in network optimization and autonomous systems testing. |

The global wireless testing market is estimated to be valued at USD 24.8 billion in 2025.

The market size for the wireless testing market is projected to reach USD 53.6 billion by 2035.

The wireless testing market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in wireless testing market are equipment, wireless device testing, _oscilloscopes, _signal generators, _spectrum analyzers, _network analyzers, _over-the-air (ota) testers, _electromagnetic interference (emi) testers, _others, wireless network testing, _network testers, _network scanners, _others, wireless module testing, wireless ic testing, services, _professional and _managed.

In terms of connectivity technology, 5g segment to command 51.8% share in the wireless testing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Wireless HDMI Transmitter and Receiver Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Printer Market Size and Share Forecast Outlook 2025 to 2035

Wireless Headphones Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensors Market Size and Share Forecast Outlook 2025 to 2035

Wireless Display Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA