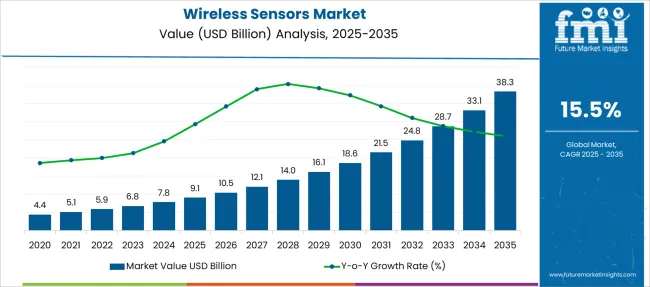

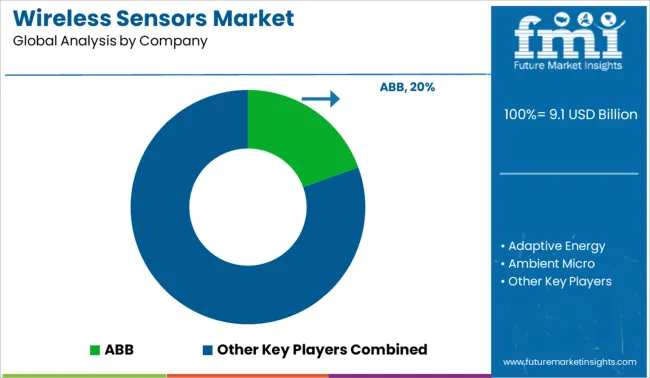

The Wireless Sensors Market is estimated to be valued at USD 9.1 billion in 2025 and is projected to reach USD 38.3 billion by 2035, registering a compound annual growth rate (CAGR) of 15.5% over the forecast period.

| Metric | Value |

|---|---|

| Wireless Sensors Market Estimated Value in (2025 E) | USD 9.1 billion |

| Wireless Sensors Market Forecast Value in (2035 F) | USD 38.3 billion |

| Forecast CAGR (2025 to 2035) | 15.5% |

The wireless sensors market is growing steadily, driven by the increasing adoption of smart technologies across industries aiming to enhance automation and data collection. There is rising demand for wireless sensor networks that can provide real-time monitoring and improve operational efficiency in complex environments.

Advances in sensor accuracy, miniaturization, and energy efficiency have expanded the use of wireless sensors across multiple applications. Industrial sectors are investing in smart factory initiatives where wireless sensors help monitor equipment health and environmental conditions, supporting predictive maintenance and reducing downtime.

Connectivity solutions have also evolved, offering robust and secure data transmission options. The market is expected to benefit from further technological innovations and expanding industrial IoT implementations. Segmental growth is anticipated to be led by temperature sensors as the primary product, the industrial sector as the leading end-user, and Bluetooth as the preferred connectivity type.

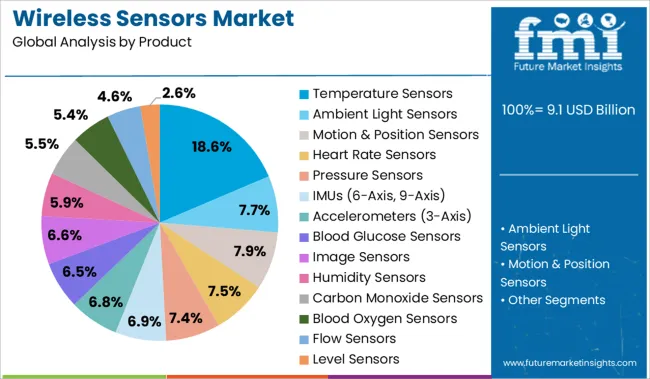

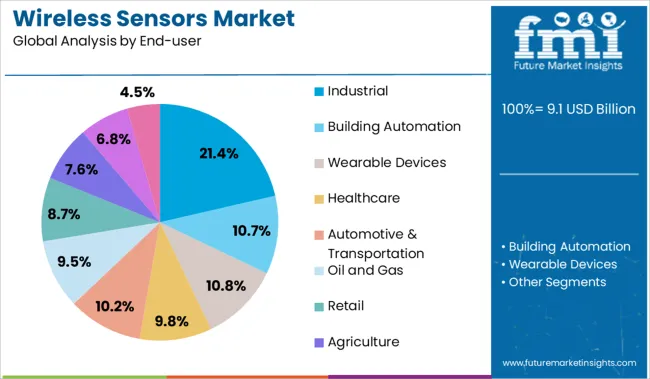

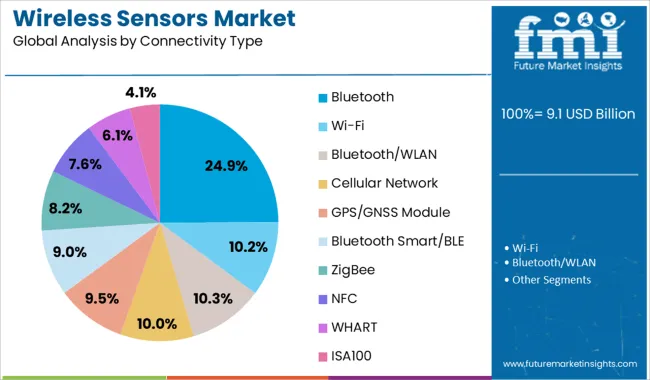

The market is segmented by Product, End-user, and Connectivity Type and region. By Product, the market is divided into Temperature Sensors, Ambient Light Sensors, Motion & Position Sensors, Heart Rate Sensors, Pressure Sensors, IMUs (6-Axis, 9-Axis), Accelerometers (3-Axis), Blood Glucose Sensors, Image Sensors, Humidity Sensors, Carbon Monoxide Sensors, Blood Oxygen Sensors, Flow Sensors, Level Sensors, Chemical Sensors, ECG Sensors, and Others (MRR, Ultrasonic Sensors, Vehicle Detection Sensors, Pedestrian Presence Sensors, Speed Sensors, Soil Moisture Sensors). In terms of End-user, the market is classified into Industrial, Building Automation, Wearable Devices, Healthcare, Automotive & Transportation, Oil and Gas, Retail, Agriculture, Aerospace & Defense, and BFSI. Based on Connectivity Type, the market is segmented into Bluetooth, Wi-Fi, Bluetooth/WLAN, Cellular Network, GPS/GNSS Module, Bluetooth Smart/BLE, ZigBee, NFC, WHART, and ISA100. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The temperature sensors segment is projected to account for 18.6% of the wireless sensors market revenue in 2025, positioning it as the leading product type. Its growth is attributed to the critical role temperature monitoring plays in industrial processes and environmental control. Temperature sensors enable accurate and continuous data collection without the need for wired connections, facilitating flexible deployment in harsh or hard-to-access environments.

Their integration into automation systems has improved process control and safety standards. The segment benefits from advances in sensor technology that provide higher precision and longer battery life.

As industries increasingly rely on real-time monitoring to optimize operations, the temperature sensors segment is expected to maintain strong demand.

The industrial segment is projected to represent 21.4% of the wireless sensors market revenue in 2025, making it the leading end-user category. Growth has been driven by the adoption of wireless sensors for equipment monitoring, environmental sensing, and process optimization in manufacturing and production facilities.

Industrial operators prioritize wireless solutions for their scalability and ability to reduce installation and maintenance costs. Additionally, growing interest in Industry 4.0 initiatives and smart factories has propelled the integration of wireless sensors into industrial IoT frameworks.

The segment’s expansion is supported by increasing investments in digital transformation and data analytics. With the industrial sector focused on enhancing operational efficiency and safety, wireless sensors are expected to play an essential role in its continued development.

The Bluetooth connectivity segment is projected to hold 24.9% of the wireless sensors market revenue in 2025, establishing itself as the leading connectivity option. Bluetooth is favored for its low power consumption, ease of integration, and widespread compatibility with a range of devices.

Its use enables reliable short-range communication in industrial and commercial settings, supporting sensor networks that require flexibility and scalability. Advances in Bluetooth technology have improved data transmission speeds and security features, making it suitable for mission-critical applications.

Additionally, Bluetooth’s presence in consumer electronics has helped accelerate adoption in industrial and smart environment applications. As connectivity demands grow and new Bluetooth standards emerge, this segment is expected to sustain its market leadership.

Increasing sales of IoT-connected devices such as wearables, smart speakers, and others are expected to drive demand for wireless sensors. Besides this, stringent government norms pertaining to workforce safety across industries such as mining, oil & gas, and energy transmission will boost the adoption of wireless sensors.

These sensors enable individuals to monitor and control the facility remotely. Wireless sensors are reliable components that are efficient, safe, and flexible, having the ability to monitor the usage, performance, and failure of machinery and other equipment autonomously.

High adoption of IoT in the building and construction sector will influence the wireless sensors demand outlook across various countries. Rising establishment of smart cities, buildings, and factories will fuel sales of wireless sensors as they are high precision, small in size, use less power, and control ambient parameters.

Wireless sensors are cost-effective as they have a low installation cost and cause minimal disruption to the interiors of the facility or the workforce. The installation of wireless systems needs no wiring or structural changes at the site.

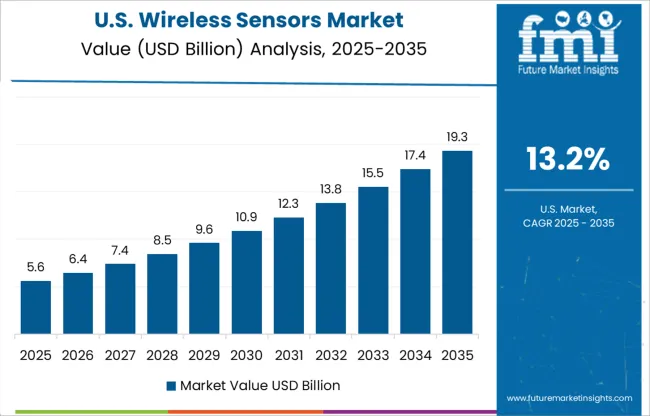

Rising focus on energy conservation in the USA and Canada is expected to augment growth in the North America wireless sensors market over the forecast period. Energy conservation is vital for minimizing the environmental impact and carbon footprint.

Wireless sensors are used in the energy sector to accurately measure stationary and portable weather conditions, wind energy systems, weather stations, building design aerodynamics, and high-altitude weather research balloons.

They are also being utilized to monitor automotive emissions, water pollution devices, and smokestack mercury sampling. Further, sales of zero power wireless sensors are gaining momentum as they are required in energy processing low power management to monitor the output power and conserve energy.

Rapid advancements in low power and reliable wireless sensors will boost the adoption of wireless sensors in wired electrical infrastructure. Backed by the aforementioned factors, demand for wireless sensors across North America will account for 24.8% of the total wireless sensors market share in 2025.

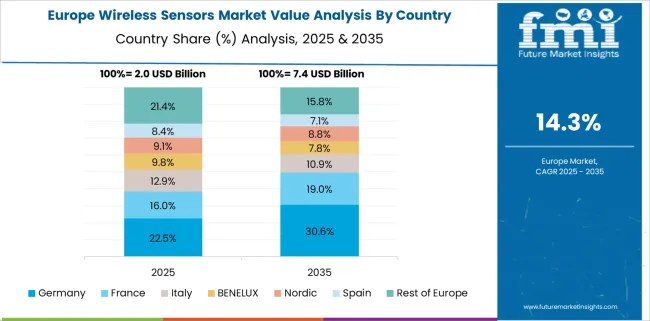

As per FMI, total sales of wireless sensors in Europe are forecast to account for 21.7% of the global wireless sensors market share in 2025. Rising demand for wireless sensors in the healthcare sector in countries such as Germany, France, and Switzerland is expected to augment the growth in the market.

In addition to this, the presence of some of the key wireless sensor manufacturers across Europe will bode well for the market. For instance, in May 2024, Advantech launched an innovative certified wireless module for sensor-cloud connectivity for IoT. It is in a compact industry-standard form and does not require programming. Applications include cold chain and refrigerator monitoring, asset tracking, smart agriculture, smart street lighting, and smart waste management.

Amid rapid technological advancements in IoT, artificial intelligence (AI), and machine learning (ML), many players are aiming to improve their offerings to keep up with the growing demand. Innovation, creativity, and effective connectivity are some of the key areas of focus among emerging wireless sensor brands.

Key wireless sensor manufacturers are investing in collaborations and partnerships with other service providers to launch application-specific wireless sensors. Through this, players are aiming to gain a competitive edge in the global wireless sensors market. Some recent developments include:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 15.50% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025-2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Type, End User, Connectivity, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; APEJ; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | ABB; Adaptive Energy; Ambient Micro; Apprion; Aruba Networks; Atmel; BAE Systems; BSC Computer; Cardiomems; Chevron; Cymbet; Dust Networks; ELTAV; Ember; Emerson; Enocean; Gastronics; Greenpeak; Microstrain |

| Customization | Available Upon Request |

The global wireless sensors market is estimated to be valued at USD 9.1 billion in 2025.

The market size for the wireless sensors market is projected to reach USD 38.3 billion by 2035.

The wireless sensors market is expected to grow at a 15.5% CAGR between 2025 and 2035.

The key product types in wireless sensors market are temperature sensors, ambient light sensors, motion & position sensors, heart rate sensors, pressure sensors, imus (6-axis, 9-axis), accelerometers (3-axis), blood glucose sensors, image sensors, humidity sensors, carbon monoxide sensors, blood oxygen sensors, flow sensors, level sensors, chemical sensors, ecg sensors and others (mrr, ultrasonic sensors, vehicle detection sensors, pedestrian presence sensors, speed sensors, soil moisture sensors).

In terms of end-user, industrial segment to command 21.4% share in the wireless sensors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wireless Flow Sensors Market Analysis & Forecast by Technology, Application, and Region Through 2035

Wireless Brain Sensors Market

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Wireless HDMI Transmitter and Receiver Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wireless Testing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Printer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA