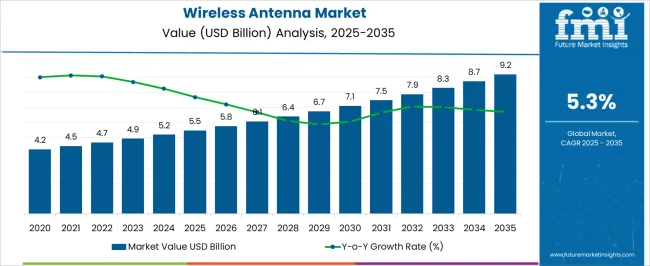

The Wireless Antenna Market is estimated to be valued at USD 5.5 billion in 2025 and is projected to reach USD 9.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Wireless Antenna Market Estimated Value in (2025 E) | USD 5.5 billion |

| Wireless Antenna Market Forecast Value in (2035 F) | USD 9.2 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The wireless antenna market is witnessing significant expansion, driven by surging data traffic, rapid 5G rollout, and widespread deployment of IoT-enabled devices. Continuous innovations in wireless communication standards and a rising shift toward high-frequency spectrum bands are pushing antenna designs toward higher performance, miniaturization, and adaptive configurations.

The need for robust indoor and outdoor connectivity across consumer, enterprise, and industrial networks is prompting integration of advanced antenna systems in routers, base stations, and IoT gateways. Investments in smart city infrastructure, vehicle-to-everything (V2X) communication, and low-latency networks are reinforcing demand for multi-functional and high-gain antennas.

Additionally, global regulatory support for spectrum reallocation and broadband expansion is enabling faster deployment of next-generation wireless infrastructure, opening new opportunities for advanced antenna technologies across sectors.

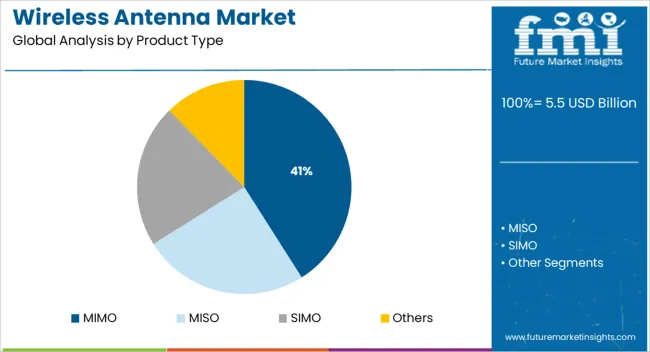

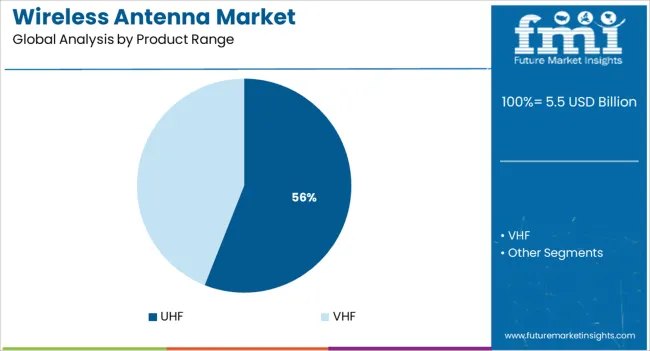

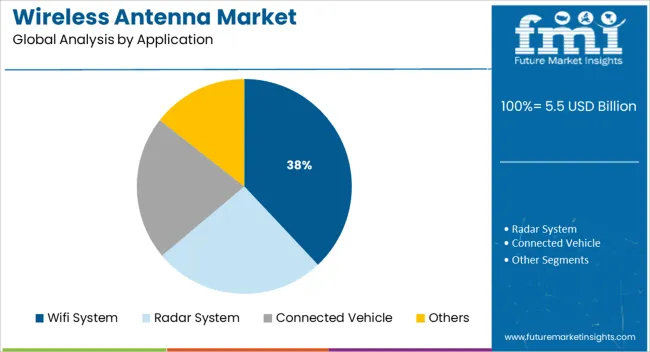

The market is segmented by Product Type, Product Range, and Application and region. By Product Type, the market is divided into MIMO, MISO, SIMO, and Others. In terms of Product Range, the market is classified into UHF and VHF. Based on Application, the market is segmented into Wifi System, Radar System, Connected Vehicle, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

MIMO (Multiple Input, Multiple Output) antennas are projected to contribute 41.0% of the total market revenue in 2025, positioning this product type as the leading segment. This dominance is being driven by their ability to enhance spectral efficiency, increase data throughput, and reduce latency across wireless networks.

MIMO technology supports simultaneous transmission and reception on multiple paths, which is crucial for 5G, LTE, and Wi-Fi 6 deployments. Its effectiveness in mitigating interference and improving signal reliability in dense environments makes it highly suitable for smart homes, enterprise WLANs, and telecom infrastructure.

As carriers and enterprises prioritize high-capacity, stable connectivity for video streaming, cloud access, and real-time communication, MIMO antenna systems are being widely adopted for their performance optimization and scalability benefits.

The UHF (Ultra High Frequency) range is expected to hold 56.0% of the wireless antenna market revenue by 2025, making it the dominant frequency band in use. This leadership is being influenced by UHF's favorable propagation characteristics, which include long-range signal transmission and effective penetration through buildings and obstacles.

Its applications span television broadcasting, RFID systems, cellular networks, and public safety communications. UHF antennas are also essential for IoT and M2M systems operating in the unlicensed ISM bands.

With increasing adoption of wireless surveillance, smart agriculture, and logistics automation, demand for reliable UHF-based communication systems is expanding. Furthermore, regulatory allocations for private LTE and industrial 5G are enhancing the utility of UHF spectrum in enterprise-grade wireless deployments.

Wi-Fi systems are forecast to generate 38.0% of the wireless antenna market revenue in 2025, securing their position as the leading application area. Growth in this segment is being propelled by rising global internet usage, widespread digital transformation, and expanding smart home ecosystems.

Wi-Fi antennas are central to delivering seamless connectivity across residential, commercial, and public environments, especially with increasing bandwidth demands from video conferencing, streaming, and IoT devices. Continued deployment of Wi-Fi 6 and preparations for Wi-Fi 7 are requiring advanced antenna configurations to support higher data rates, lower power consumption, and improved coverage.

Enterprise networks, education campuses, and hospitality venues are also prioritizing Wi-Fi solutions to support hybrid work and real-time applications. This sustained momentum is keeping Wi-Fi system integration at the forefront of wireless antenna applications.

Due to the availability of high-quality wireless communication infrastructure and a thriving smartphone industry with the presence of major smartphone players in the region, North America is a leading region in the wireless antenna market.

Additionally, it is anticipated that fast development and early adoption of cutting-edge technologies in a variety of industries would fuel market expansion during the forecast period. Deployment and the rapid development of technology have also helped this region's market function successfully. These factors, together with growing and active acceptance and the presence of multiple key market participants, have all contributed to this massive growth.

Owing to the increased demand for high-speed internet services and the resulting from the high adoption of advanced antenna designs, the USA has the biggest market share for wireless antennas. Due to the desire for a wireless communication network with a fast speed for homes and businesses, Canada has the second-largest market share.

Consumers from the United States and Canada have been discovered to spend a bigger percentage of their income on smartphone devices and network infrastructure. The region's requirement for wireless antennas is being fueled by the rising use of smartphones.

The region's sophisticated telecom infrastructure and associated components are being developed owing to the rising desire of this region to expedite the 5G network. However, both nations hold the greatest share of the wireless antenna market in North America as a result of the increasing industrial automation and the need for speedier internet services.

For commercial wide-body aircraft, a number of industry participants have unveiled second-generation hybrid in-flight connection antenna systems. When it comes to geosynchronous and non-geosynchronous satellite systems, they are the most capable and flexible options.

Wireless antennas such as Common data link radio, iCDL, CDL Portable Ground System, CDL Exportable Radio System, and Light Airborne Multipurpose Systems are provided by several businesses.

Some businesses run the USA and UK-based electronics businesses through the electronic systems segment, including electronic warfare systems, electro-optical sensors, commercial and military digital engines, flight controls, precision guidance and seeker solutions, next-generation military communication systems and data links, persistent surveillance capabilities, and hybrid electric drive systems.

Businesses in the wireless antenna market are expanding their capacity for production in order to provide solutions that incorporate sensing and signal processing components and are suited for mobile communication in long straight spaces like railroads. In order to obtain environmentally cognitive intelligence, businesses are also expanding the availability of moderately priced antennas paired with artificial intelligence (A.I.).

Numerous businesses provide a broad range of products, including base station antennas, FDD-LTE and TDD-LTE, variable tilt antennas, 4G antennas, and LTE antennas.

Some of them also include antennas that support 20, 40, and 80 MHz channels with 256 quadrature amplitude modulation, which are employed in wireless LAN systems and smart devices. Large market participants additionally provide different wireless antennas, such as omnidirectional, directional, indoor, and outdoor wall-mounted dual-band patch antennas.

International competitors in the wireless antenna market provide wireless antennas that support the integration of active and passive antenna capabilities in a way that reduces the complexity of tower tops and occupied towers while maintaining the performance of all technologies.

The demand for a wireless antenna is catching up due to the growing demand for devices that makes use of wireless technology for communication purposes, and this is supporting the growth of the global wireless antenna market.

Wireless antennas are transducers that transmit and receive radio signals in the form of radiofrequency (RF). These radio frequencies are transformed into electromagnetic waves by a wireless antenna and the other way around. Sales of wireless antennas are surging due to their growing applications. They are used in aviation, vehicles, radar systems, smartphones, and radar systems.

The wireless antenna market is expanding with the growing demand for devices that makes use of wireless technology for communication purpose. 3G and 4G networks which are known to be LTE wireless networks are also used for Wi-Fi networks. Wireless antennas deliver a cost-efficient and flexible structure which is more economical as compared to cable networks. As with any conventional network, even wireless network operations are fast.

With technological advances, there has been a swift and lucrative growth in the use of tablets, smartphones, and laptops; this has resulted in the demand for wireless antennas and the growth of the overall market.

Wireless antennas are used in several applications including WiMAX, Wi-Fi, RADAR systems, and cellular. Many advantages such as customized data pathways, error-free communication, co-channel interference prevention, and easy data flow are anticipated to promote the growth of the wireless antenna market.

Rising demand for vehicle connectivity innovations to improve the vehicles’ guidance and tracking system, safety by connecting the driver to the outside world, and growing usage of wireless antennas for electronic passenger car monitoring, has positively impacted the wireless antenna market.

The primary market driving factor that has a significant impact on the growth of the global wireless antenna market is the increasing use of wireless antenna in connectivity vehicles, this assists users to communicate with the outside world with enhanced features such as navigation and infotainment.

The demand for wireless antennas is surging due to the increasing use of this technology in mobile devices, this has additionally encouraged the growth of the global wireless antenna market. Furthermore, new market competitors in developing wireless antennas international market are also anticipated to promote market growth during the forecast period.

Besides the rising demand for wireless antennas in the vehicle navigation system, there is a surge in the application of wireless antennas for electronic passenger vehicle monitoring has also lucratively affected the global market of wireless antennas.

The growing trend of IoT, and expanding automotive industries are some of the other factors which are positively contributing towards the growth of this market. Furthermore, several technological advancements have resulted in novel types of antennas, and this too is projected to help the global wireless antenna market sustain its position.

The extensive use of wireless antennas in devices such as personal digital assistants (PDAs), laptops, and smartphones is accountable for the budding growth of the global market. These devices are furnished with internet and multimedia which demand faster communication systems. Therefore, the convenience of signal processing centres on wireless antennas promotes market growth.

The advancement of smart car sticks operates as another prominent growth factor of the global wireless antenna market. These antennas are incorporated in passenger and commercial vehicles for satellite-based navigation and to better the vehicle communication system.

Considerable growth in the IT industry and extensive research and development activities are anticipated to drive the global wireless antenna market further during the forecast period.

During the forthcoming years, the growing demand for data centres is one of the latest trends which will promote the global wireless antenna market. Big data analytics and cloud-based services have resulted in the growing need for data centres across the globe. Also, this growing demand for data centres is particularly more in emerging countries amongst big businesses, telecommunication organizations, government agencies, and communications service providers (CSPs). All these factors are anticipated to grow the demand for wireless antennas over the forecast period.

Apart from the market driving factors, wireless antennas for telecom networks are not very cost-efficient and this will hamper the growth of the global wireless antenna market during the forecast period. Moreover, the rising disputes amongst the countries and their impact on the trade agreement are predicted to pose a threat to the global market.

North America is dominating the global wireless antenna market owing to the increasing use of mobile phones, tablets, and other wireless devices. Of the global market share, North America accounted for 33.50% share of the overall wireless antenna market. This region is likely to hold its dominant market position during the forecast period owing to the rising rate of adoption of smart devices and other enhanced technologies such as IoT, especially in countries such as Canada and the United States.

The North American wireless antenna market will continue to grow exponentially due to higher smartphone penetration along with superior level 5G smart antenna demands. Owing to rising and active adoption, several primary market players are established in this region. Deployment and fast development of technology have also led to this region’s market performing effectively.

Besides North America, the Asia Pacific wireless antenna market is anticipated to lead the global market during the forecast period. This is because of robust financial growth in consumer electronic goods and a huge number of telecommunication industries in India and China.

Countries like India, China, and Japan have a growing demand for wireless antennas, and this is predicted to surge the market growth of the Asia Pacific wireless antenna market. Emerging countries in Asia Pacific deliver multiple opportunities cost-effectively for the growth of the market. Multiple start-ups and new market entrants are witnessed in this region as it is broadly untapped. Lastly, several governments of Asia Pacific allow several industrial and tax benefits for the wireless antenna market and thereby stirring the growth of the market further.

With time business models evolve, sometimes because of changes in the market and many a time due to the invention of new technology. This leads to the emergence of new and exciting trends. FMI closely monitors the start-up ecosystem from around the globe and presents multiple interesting new pieces of information which gain popularity.

WiGL Inc., based in the United States is a wireless-electric Grid Local Air Network, which is a novel technology that transmits focused energy through the air. The company focuses on assisting people to completely get rid of wires and cords. It's like getting electric power, in the same manner, the internet is received wirelessly.

Some of the key players in the wireless antenna market are AT&T, Cisco Systems, Inc., Bharti Airtel, Fractus Antennas S.L, AirNet Communications, Huawei Technologies Co., Ltd., Bouygues Telecom, Johanson Technology, Linx Technologies, Mobitel (Pvt) Ltd., Pulse Electronics, Taoglas, Ventev.

Market players have adopted strategies such as product approvals, product launches, market initiatives, and mergers and acquisitions.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.30% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2014 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Product Range, Application, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United States of America, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC Countries, South Africa |

| Key Companies Profiled | AT&T; Cisco Systems, Inc.; Bharti Airtel; Fractus Antennas S.L; AirNet Communications; Huawei Technologies Co., Ltd.; Bouygues Telecom; Johanson Technology; Linx Technologies; Mobitel (Pvt) Ltd.; Pulse Electronics; Taoglas; Ventev |

| Customization | Available Upon Request |

The global wireless antenna market is estimated to be valued at USD 5.5 billion in 2025.

The market size for the wireless antenna market is projected to reach USD 9.2 billion by 2035.

The wireless antenna market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in wireless antenna market are mimo, miso, simo and others.

In terms of product range, uhf segment to command 56.0% share in the wireless antenna market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Wireless HDMI Transmitter and Receiver Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wireless Testing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Printer Market Size and Share Forecast Outlook 2025 to 2035

Wireless Headphones Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA