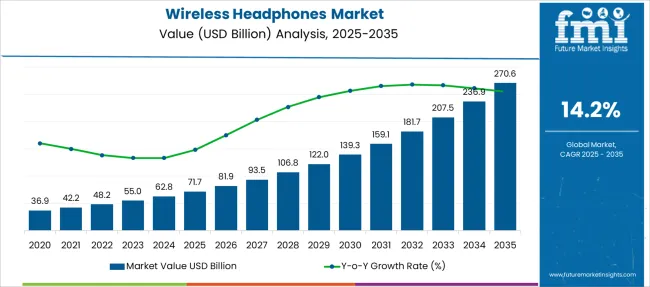

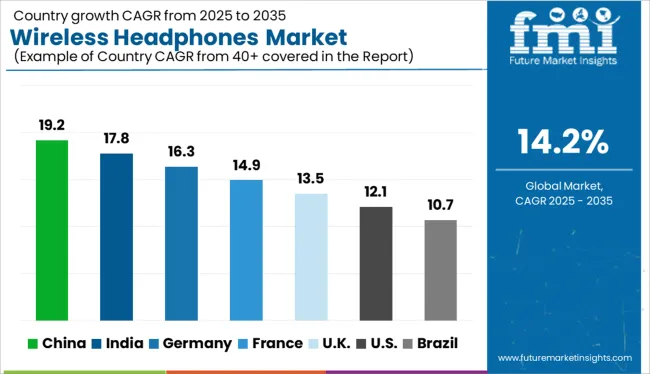

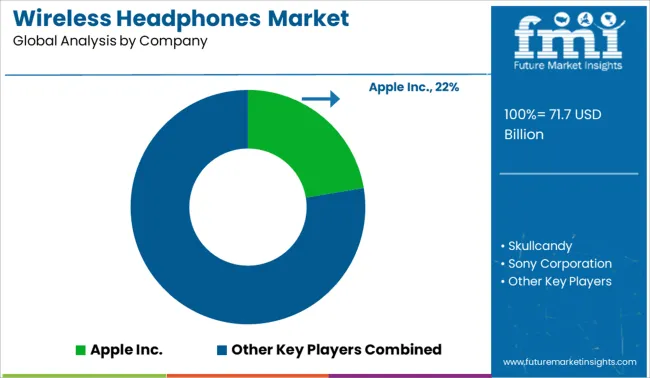

The Wireless Headphones Market is estimated to be valued at USD 71.7 billion in 2025 and is projected to reach USD 270.6 billion by 2035, registering a compound annual growth rate (CAGR) of 14.2% over the forecast period.

| Metric | Value |

|---|---|

| Wireless Headphones Market Estimated Value in (2025 E) | USD 71.7 billion |

| Wireless Headphones Market Forecast Value in (2035 F) | USD 270.6 billion |

| Forecast CAGR (2025 to 2035) | 14.2% |

The wireless headphones market is witnessing strong growth, propelled by rapid adoption of smart devices, rising consumer preference for cable-free audio, and technological innovations in battery life and sound quality. The shift toward remote work, virtual meetings, and fitness-oriented lifestyles has boosted demand for portable and ergonomic audio solutions.

Manufacturers are leveraging advancements in active noise cancellation, low-latency transmission, and voice assistant integration to differentiate products. Consumer expectations around seamless connectivity, audio fidelity, and stylish designs have led to accelerated product development across multiple price points.

Increasing penetration of e-commerce platforms and aggressive digital marketing campaigns have further widened the reach of brands. Continued demand from music streaming, gaming, and online content consumption is expected to support sustained momentum in the years ahead.

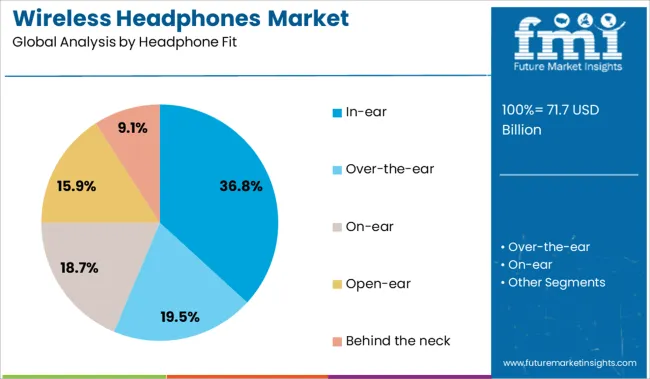

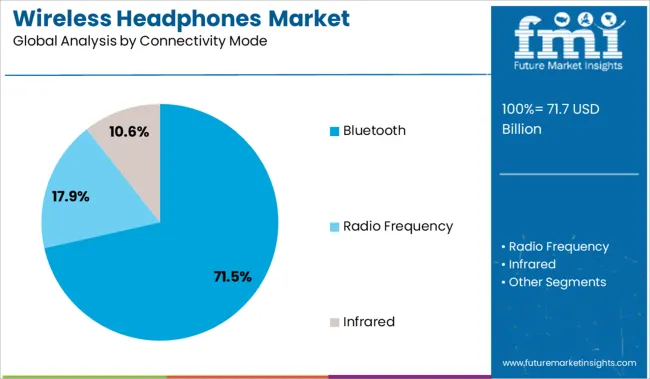

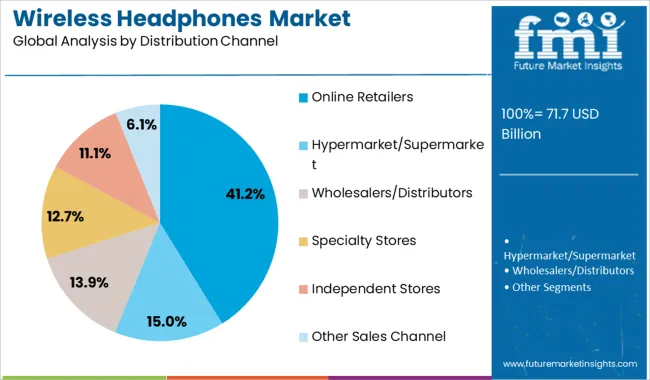

The market is segmented by Headphone Fit, Connectivity Mode, and Distribution Channel and region. By Headphone Fit, the market is divided into In-ear, Over-the-ear, On-ear, Open-ear, and Behind the neck. In terms of Connectivity Mode, the market is classified into Bluetooth, Radio Frequency, and Infrared. Based on Distribution Channel, the market is segmented into Online Retailers, Hypermarket/Supermarket, Wholesalers/Distributors, Specialty Stores, Independent Stores, and Other Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

In-ear headphones are projected to account for 36.8% of total revenue in the wireless headphones market in 2025, making them the leading fit type. Their dominance has been driven by compact design, improved comfort, and enhanced noise isolation capabilities that cater to both casual and active users.

Increased demand for on-the-go listening solutions in urban and fitness-driven environments has supported widespread adoption. In-ear models are typically more affordable and easier to store, making them attractive to a broader demographic.

Additionally, their compatibility with true wireless stereo (TWS) platforms and integration with charging cases have boosted product appeal across various market segments. As audio brands focus on lightweight materials, biometric sensors, and extended battery life, in-ear headphones continue to maintain leadership in versatility and user convenience.

Bluetooth connectivity is expected to contribute 71.5% of the total market revenue by 2025, securing its place as the dominant wireless mode. The prevalence of Bluetooth-enabled smartphones, tablets, and laptops has facilitated widespread interoperability, eliminating the need for proprietary transmitters or dongles.

Successive generations of Bluetooth technology have delivered enhanced transmission stability, reduced power consumption, and lower latency, improving both user experience and device longevity. The standardization of Bluetooth audio protocols has enabled smoother pairing and multipoint connectivity, which has become a key expectation among multitasking consumers.

Manufacturers have capitalized on these advancements to offer feature-rich wireless headphones compatible with a wide range of operating systems and audio platforms. As consumer ecosystems become increasingly wireless, Bluetooth remains the foundation of connectivity across entry-level and premium headphone segments.

Online retailers are forecast to account for 41.2% of market revenue by 2025, establishing them as the leading distribution channel in the wireless headphones market. This trend has been influenced by expanding digital infrastructure, increased internet penetration, and the convenience of doorstep delivery.

E-commerce platforms enable consumers to compare features, read reviews, and access exclusive offers factors that significantly influence purchase decisions. The COVID-19 pandemic accelerated the shift toward online shopping, and this behavioral change has persisted with the normalization of digital buying habits.

Brands and third-party sellers have optimized their presence across major platforms, offering virtual try-on features, easy return policies, and bundling options. The ability to reach tier-2 and tier-3 cities without physical retail presence has further extended the reach of online channels, cementing their status as a primary mode of headphone distribution.

Mobile phones and smartphones are becoming necessary all over the world. Everyone has a smartphone. There are multiple applications and services that have entertainment and music streaming. YouTube, Spotify, Netflix, etc. are commonly found applications on smartphones.

As these entertainment services are increasing, people are binge-watching shows and listening to music in their free time or traveling. While listening to music or watching movies, headphones allow complete privacy and convenience to the user.

People are purchasing expensive and premium headphones, as they offer better sound quality along with some additional features. An increase in disposable income is a reason that people are investing in premium quality wireless headphones.

Manufacturers are focusing on making these headphones more stylish, comfortable, and affordable to increase sales. Music enthusiasts are demanding high-quality and clear sound-providing headphones, resulting in more research and proper designing of the products.

Smart technologies are used in making these headphones more complex and take the market higher. Also, many smartphone manufacturers are removing the headphone jack from devices, making Bluetooth connectivity the only option for headphones.

Wireless headphones mainly operate on batteries. These batteries can deplete pretty quickly if used continuously. Wireless headphones with low battery capacity have to be charged regularly after a few uses, which is not convenient. These batteries also lose efficiency as they get older.

More features, modern looks, and comfort are things that customers are continuously requesting. For the products to be properly designed and manufactured, all of these qualities require research, raising production costs, and, eventually, selling prices.

Customers with modest incomes will eventually stop buying these goods as the prices rise and switch to moderately priced, low-quality wireless headphones.

Another restraint to the market is counterfeit products. There are many popular brands which are providing premium quality wireless headphones. Counterfeit manufacturers can copy the product design and sell these products at lower prices.

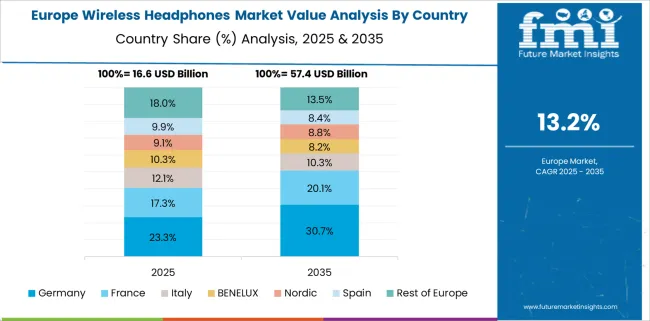

Germany is observing a rise in sales of wireless headphones and earphones. Wireless earphones are popular as they are small and can be used quickly, wireless headphones are still having increasing demand among customers. due to their comfort, sound quality, and longer battery life, wireless headphones are preferred by German customers.

India is an emerging market for wireless headphones. As India is a developing country, people are having a significant rise in income and are spending money on premium products. Customers are looking for good quality products with stylish designs. Popular brands like Sony, and JBL along with local manufacturers like Boat and MiVi are dominating the market. online purchases of wireless headphones are common in Indian cities.

Some key players in the Wireless Headphones market are Skullcandy, Sony Corporation, Sennheiser electronic GmbH & Co. KG, Apple Inc., Jabra, V-MODA LLC, Master & Dynamic., Bang & Olufsen, Harman International Industries Inc., Bose Corporation, AfterShokz, JLab Audio, Wicked Audio Inc. and others. These are popular and well-known brands all over the world.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 14.2% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical Data Available for | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative units | Revenue in USD Billion, volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors and trends, pricing analysis |

| Segments Covered | Headphone Fit, Connectivity Mode, Distribution Channel, Region |

| Country scope | USA, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, India, Thailand, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, United Arab Emirates, South Africa |

| Key Companies Profiled | Skullcandy; Sony Corporation; Sennheiser electronic GmbH & Co; Apple Inc.; Jabra; V-MODA LLC; Master & Dynamic.; Bang & Olufsen; Harman International Industries Inc.; Bose Corporation; AfterShokz; JLab Audio; Wicked Audio Inc.; Others |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global wireless headphones market is estimated to be valued at USD 71.7 billion in 2025.

The market size for the wireless headphones market is projected to reach USD 270.6 billion by 2035.

The wireless headphones market is expected to grow at a 14.2% CAGR between 2025 and 2035.

The key product types in wireless headphones market are in-ear, over-the-ear, on-ear, open-ear and behind the neck.

In terms of connectivity mode, bluetooth segment to command 71.5% share in the wireless headphones market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Wireless HDMI Transmitter and Receiver Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wireless Testing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Printer Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensors Market Size and Share Forecast Outlook 2025 to 2035

Wireless Display Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA