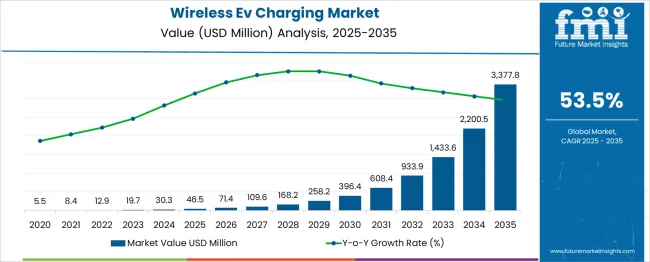

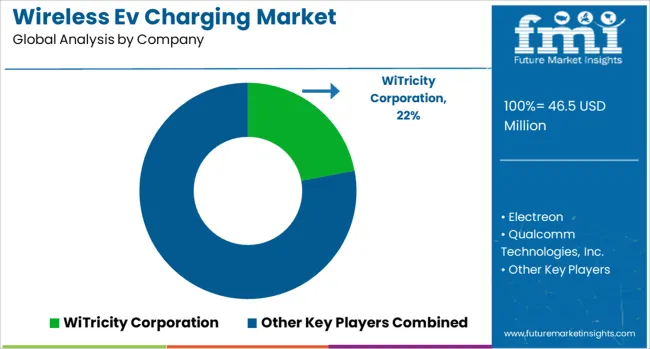

The wireless EV charging Market is estimated to be valued at USD 46.5 million in 2025 and is projected to reach USD 3377.8 million by 2035, registering a compound annual growth rate (CAGR) of 53.5% over the forecast period. Between 2025 and 2030, the market expands nearly tenfold, reaching USD 396.4 million. Growth milestones include USD 71.4 million in 2026, USD 109.6 million in 2027, USD 168.2 million in 2028, and USD 258.2 million in 2029. This sharp rise creates a window of opportunity for early-stage players and established charging infrastructure providers.

Firms offering scalable, vehicle-agnostic solutions with compact installation footprints are poised to capture early market leadership. Collaborations with EV manufacturers, parking operators, and fleet managers will further strengthen the position. Market share may erode for companies lacking interoperability, high-efficiency charging modules, or backward compatibility with existing vehicle models. Long installation times, bulky components, or safety certification gaps may further hinder adoption. From 2025 to 2030, competitive advantage will favor those with strong intellectual property, tested pilot deployments, and OEM collaborations. Vendors that meet regulatory standards, while also focusing on cost reduction and performance reliability, are likely to command dominant positions. Lagging on these fronts could lead to quick displacement in this fast-moving segment.

The wireless EV charging market is a fast-emerging segment within the broader electric vehicle infrastructure industry. It enables EVs to charge without physical plugs, using inductive or resonant magnetic technology. As of 2024, the global market is valued at around USD 30 million, with strong growth expected over the next decade. Stationary wireless charging, such as garage floor pads or parking lot systems, makes up about 95% of current installations. Dynamic charging, which powers vehicles while driving over embedded coils in roads, represents a smaller share (~5%) but is expanding quickly, especially for commercial fleets and public transport. In terms of technology, inductive systems lead with about 60% market share, while resonant systems offer more flexibility in alignment and are gaining adoption.

Europe leads regionally with roughly 35% of market share, followed by Asia-Pacific (30%) and North America (25%). Key companies include WiTricity, Qualcomm Halo, Continental AG, and Bosch, which are partnering with automakers and cities to roll out infrastructure. Growing demand for convenience, automation, and smart city compatibility is pushing wireless EV charging from a niche innovation toward mainstream adoption in residential, commercial, and fleet applications.

| Metric | Value |

|---|---|

| Wireless Ev Charging Market Estimated Value in (2025 E) | USD 46.5 million |

| Wireless Ev Charging Market Forecast Value in (2035 F) | USD 3377.8 million |

| Forecast CAGR (2025 to 2035) | 53.5% |

The wireless EV charging market is gaining momentum as governments, automakers, and infrastructure developers increasingly prioritize seamless, contactless charging solutions. Advancements in inductive power transfer, interoperability standards, and system efficiency have positioned wireless charging as a strategic enabler for smart mobility ecosystems. The market is being driven by the rising adoption of electric vehicles and the growing need to overcome limitations associated with plug-in infrastructure.

Stationary systems have gained early traction, but evolving interest in dynamic in-road charging technologies continues to signal long-term potential. In urban commercial hubs and fleet operations, demand for wireless charging is accelerating due to the reduced maintenance, minimal driver intervention, and real-time energy management capabilities.

The market outlook remains strong, supported by ongoing public-private partnerships, pilot deployments in smart cities, and investments in integrated mobility solutions. As EV penetration deepens and user experience becomes a competitive differentiator, wireless charging is expected to evolve from an emerging innovation into a mainstream component of the global EV infrastructure landscape..

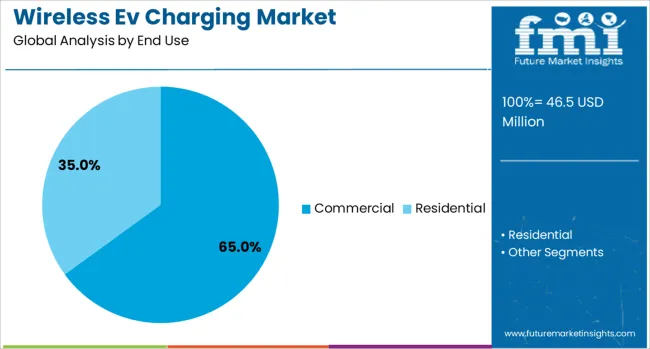

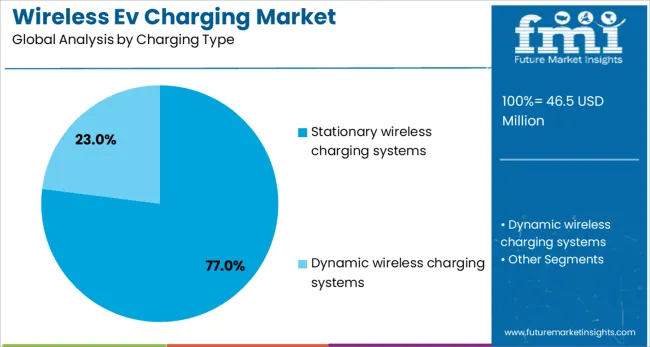

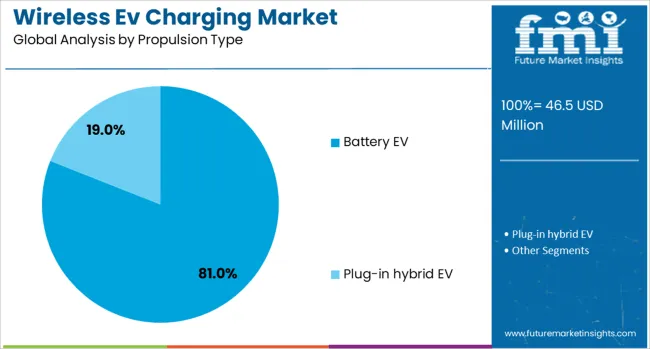

The wireless EV charging market is segmented by end use, charging type, and propulsion type and geographic regions. By end use, the wireless EV charging market is divided into Commercial and Residential. In terms of charging type, the wireless EV charging market is classified into Stationary wireless charging systems and Dynamic wireless charging systems. Based on the propulsion type, the wireless EV charging market is segmented into Battery EV and Plug-in hybrid EV. Regionally, the wireless EV charging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The commercial segment is projected to account for 65% of the Wireless EV Charging market revenue share in 2025, making it the leading end use category. This dominance has been attributed to the increasing electrification of fleet vehicles, public transportation systems, and logistics networks that require efficient and scalable charging solutions. Commercial operators have favored wireless systems due to their ability to reduce downtime, minimize human error, and support high-frequency usage cycles without physical wear on connectors.

The ease of integration into depots, taxi stands, bus terminals, and last-mile hubs has enabled widespread deployment in urban zones. Additionally, wireless infrastructure aligns well with automated fleet management strategies and can be centrally monitored for predictive maintenance and energy optimization.

Government incentives and regulatory frameworks encouraging zero-emission fleets have further catalyzed the transition toward wireless charging in commercial applications. The segment’s continued growth is being reinforced by strategic collaborations between automakers, utility providers, and commercial fleet owners aiming to scale wireless deployments across cities and regions..

Stationary wireless charging systems are expected to hold a dominant 77% share of the Wireless EV Charging market revenue in 2025. This segment’s leadership has been driven by its technological maturity, safety, and compatibility with a wide range of EV models. These systems have been deployed across private garages, parking lots, and fleet hubs due to their stable infrastructure, ease of use, and reliable charging performance.

The preference for stationary systems has grown as municipalities and enterprises seek low-maintenance, durable charging solutions that can be retrofitted into existing facilities without complex civil work. The ability to deliver consistent energy transfer without manual plugging has proven valuable in reducing operational friction and improving user satisfaction.

As standardization initiatives continue to align OEMs and infrastructure providers, stationary systems have gained favor for their faster path to commercialization. With strong cost-efficiency, compliance readiness, and integration capabilities, stationary wireless charging systems are expected to maintain their market lead over dynamic alternatives in the near to mid-term..

Battery electric vehicles are anticipated to account for 81% of the Wireless EV Charging market revenue share in 2025, solidifying their position as the leading propulsion type. This growth has been fueled by the increasing adoption of BEVs across both consumer and commercial segments, as automakers expand their electric portfolios and governments mandate stricter emission norms. BEVs have been more compatible with wireless charging solutions due to their relatively larger onboard battery capacities and longer charging cycles, which align well with inductive transfer systems.

The integration of wireless modules into BEV platforms has also been streamlined by automakers, accelerating commercial readiness. Additionally, BEV users have shown higher receptivity toward contactless charging as a value-added convenience that enhances usability and reduces plug-related mechanical failures.

Infrastructure developers have increasingly tailored wireless solutions specifically for BEV configurations, further reinforcing their adoption. As BEVs continue to dominate new vehicle registrations in the zero-emission category, their compatibility and readiness for wireless charging are expected to drive sustained segment leadership..

The wireless EV charging market is gaining traction as electric mobility evolves toward hands‑free charging and grid integration. Advances in inductive and resonant charging technologies enable seamless plug‑free energy transfer at home, in parking areas, and via embedded roadways. Fleet operators, public transit agencies, and smart cities are piloting dynamic charging solutions to reduce downtime and range anxiety.

Growth is reinforced by collaboration between automakers, infrastructure developers, and standard bodies working on universal protocols and interoperability frameworks. Regional investment and urban policy support infrastructure rollout, especially in commercial and municipal contexts. Rising demand for user convenience, automation, and electric vehicle cost optimization positions wireless charging as an essential feature in next‑generation EV ecosystems.

Recent technological innovations are critical to the deployment of wireless EV charging systems. Improvements in inductive and resonant power transfer guided by standards such as J2954 have increased efficiency and safety while reducing alignment constraints. Higher power systems now approach fast charging capabilities with medium and high output designs suitable for residential, fleet depot, and public infrastructure settings. Alignment systems and feedback protocols help drivers center vehicles over charging pads. Innovations in dynamic wireless charging allow vehicles to receive power while in motion, through road-embedded coils, reducing reliance on large battery packs and enabling continuous grid support. As onboard and ground modules evolve with improved thermal and electromagnetic compatibility, system integration becomes easier. These advancements pave the way for robust, user‑friendly solutions suitable across diverse vehicle types and operational environments.

Integration with smart city infrastructure presents a major opportunity for wireless EV charging. Municipal governments are embedding charging pads beneath roads, bus stops, and transit depots to support dynamic and stationary charging for fleets and shared mobility services. Public transit agencies are installing inductive systems at high-use locations to charge buses with minimal infrastructure footprint. These deployments align with wider smart city goals such as grid resilience and emissions reduction. Intelligent transport corridors equipped with wireless charging reduce idle vehicle downtime and extend operational hours. Retail and parking operators are also incorporating stationary wireless pads to offer seamless, cable-free charging experiences. As urban design modernizes, wireless charging becomes a future-facing feature in connected mobility ecosystems spanning fleet, autonomous vehicles, and last‑mile delivery solutions.

Despite strong promise, wireless EV charging adoption faces challenges due to high implementation costs and technical complexity. Installing inductive pads, especially embedded in roads, requires civil engineering work, grid integration, and precise alignment mechanisms. Consumer vehicles must accommodate receiver coils, alignment sensors, and communication modules, increasing the cost of onboard systems and package design complexity. Efficiency losses compared to wired charging, although narrowing, still concern cost-sensitive segments. Lack of standardization across protocols or OEM implementations causes compatibility and interoperability hurdles. Consumer education remains limited, and trust in seamless operation is still forming. Fleet and city operators often delay deployment pending clear return-on-investment data. Until hardware and infrastructure costs decline and standards become widely adopted, deployment may remain focused on commercial and premium segments.

Efforts to define global interoperability standards such as SAE J2954 for inductive EV charging and ISO 15118 for plug-and-charge protocols provide essential guidance for market expansion. These frameworks define power transfer classes, alignment methods, and secure communication interfaces between the vehicle and charging pads. Emerging protocols enable automatic, app-free authentication and bidirectional vehicle-to-grid integration. Collaboration between OEMs and charging providers around shared public key infrastructures supports scalable roaming and secure data flow across networks. Acceptance of standardized modules simplifies retrofit and fleet deployment, enhancing reliability and trust. Regulatory bodies in major regions mandate compliance with certified protocols to ensure safety and compatibility. As technology matures under standard frameworks, adoption accelerates via reduced cross-device friction and enhanced functionality in hands‑free charging scenarios.

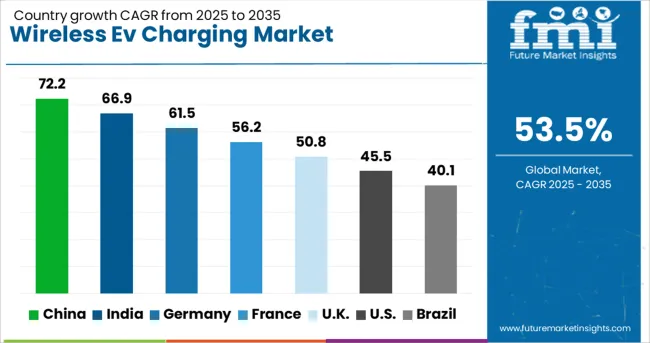

| Country | CAGR |

|---|---|

| China | 72.2% |

| India | 66.9% |

| Germany | 61.5% |

| France | 56.2% |

| U.K. | 50.8% |

| U.S. | 45.5% |

| Brazil | 40.1% |

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| U.K. | 3.7% |

| U.S. | 3.3% |

| Brazil | 2.9% |

The wireless EV charging market is expected to surge at a CAGR of 53.5% through 2035, revolutionizing electric mobility by eliminating plug-in hassles and enabling seamless charging experiences. China leads with a remarkable 72.2% growth, driven by strong government support, smart city initiatives, and integration with autonomous vehicle infrastructure. India, at 66.9%, is experiencing rapid adoption fueled by urbanization, a rising EV ecosystem, and efforts to reduce fossil fuel dependence. Germany’s 61.5% growth stems from technological innovation, supportive regulations, and automaker-led infrastructure expansion. The U.K., with a 50.8% growth rate, is witnessing public-private collaborations to build wireless charging corridors. The U.S., at 45.5%, shows steady growth powered by pilot projects, federal incentives, and increasing investments in sustainable transport. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China has recorded a CAGR of 72.2 %in the wireless EV charging market, driven by expanding electric vehicle adoption and infrastructure upgrades in major metropolitan areas. Municipal governments and private operators are installing wireless pads in public parking zones, commercial buildings, and smart roads. Domestic automakers are collaborating with technology providers to integrate compatible receivers into passenger and light-duty vehicles. The push for convenient, cable-free charging aligns with the growing popularity of autonomous and shared mobility fleets. Urban pilot programs are being scaled across cities like Shanghai and Shenzhen to test dynamic charging under real-time traffic. Equipment suppliers are offering scalable platforms for both stationary and in-motion charging.

India has achieved a CAGR of 66.9% in the wireless EV charging market, supported by government-led electric mobility initiatives and the need for safer, user-friendly solutions in dense urban centers. Key EV manufacturers are developing small-format cars and two-wheelers pre-fitted with wireless charging modules. Trials in Delhi and Bengaluru have demonstrated promising results for commercial fleet operations. Charging solution vendors are focused on affordability, durability, and compatibility with existing EV architectures. University-led research programs and public-private partnerships are also pushing the development of inductive charging for buses and last-mile delivery vehicles. Municipal agencies are evaluating retrofitting options for high-traffic zones.

Germany has posted a CAGR of 61.5 % in the wireless EV charging market, with growth fueled by automotive R&D efforts and evolving urban transport models. Leading carmakers are investing in inductive charging R&D to match increasing demand for residential and commercial EV infrastructure. The integration of wireless systems in carports, office lots, and taxi hubs has gained traction. Cities such as Berlin and Munich are trialing dynamic charging lanes for public buses and logistics vehicles. Regulatory bodies are developing new safety and efficiency standards to align with rapid hardware rollouts. Startups and legacy suppliers are jointly testing smart energy management features to minimize grid strain.

The United Kingdom has recorded a CAGR of 50.8% in the wireless EV charging market, largely influenced by a strong policy focus on clean transport and smart city design. Trials in cities such as Nottingham and London have explored wireless options for residential streets and public fleet depots. Automakers and energy firms are working together to offer turnkey charging solutions with minimal installation disruption. Cableless systems are being prioritized for disabled-friendly charging access and densely packed parking areas. Local councils are piloting the integration of these systems into zoning plans and urban redevelopment projects. EV charging networks are beginning to offer wireless as a premium add-on service.

The United States has posted a CAGR of 45.5% in the wireless EV charging market, supported by increased EV adoption and a growing interest in hands-free charging infrastructure. Fleet operators and ride-hailing services are experimenting with wireless pads in depots and airports. Commercial real estate developers are integrating wireless solutions into building plans to future-proof assets. Research hubs across California and Michigan are testing dynamic charging on highways for heavy-duty EVs. Partnerships between automotive firms and utility providers aim to synchronize wireless charging with grid stability. Standards development is also a key area of focus, with industry bodies defining protocols for interoperability.

The wireless EV charging market is rapidly emerging as a transformative solution for convenient, cable-free energy transfer in electric vehicles. By utilizing inductive or resonant magnetic coupling, these systems allow EVs to charge simply by parking over a pad, eliminating the need for physical connectors. This innovation is particularly attractive for autonomous vehicles, public transit fleets, and premium consumer EVs. As cities and automakers focus on smart infrastructure and user-centric mobility, wireless charging is moving from pilot projects to commercial viability.

WiTricity Corporation is a pioneer in magnetic resonance-based wireless power transfer and holds a leading position through its robust IP portfolio and collaborations with major OEMs like Hyundai, Toyota, and BMW. The company’s Halo™ system has been tested for high-efficiency, high-power wireless charging at various parking and fleet depots. Electreon, an Israeli startup, is pushing the frontier with dynamic (in-motion) wireless charging roads, deploying infrastructure in Europe and the U.S. to power buses and trucks while in transit, potentially transforming range and charging logistics.

Qualcomm Technologies, Inc., through its Halo technology (now licensed by WiTricity), laid early groundwork in the sector with trials in Formula E and public streets. HEVO Inc. and Mojo Mobility, Inc. are key innovators in stationary charging systems, focusing on safety certifications, grid integration, and interoperability with multiple vehicle platforms. As wireless charging aligns with the future of autonomous mobility and urban electrification, players offering standardized, high-efficiency, and scalable solutions are poised to dominate this next-gen charging ecosystem.

WiTricity licenses magnetic resonance wireless EV charging to automakers like BMW and Hyundai and helped develop the SAE J2954 standard. Siemens invested USD 25 million in WiTricity in 2022 to support commercialization. Electreon operates dynamic in-road charging pilots in Sweden and Detroit, enabling EVs to charge while driving over embedded coils.

| Item | Value |

|---|---|

| Quantitative Units | USD 46.5 Million |

| End Use | Commercial and Residential |

| Charging Type | Stationary wireless charging systems and Dynamic wireless charging systems |

| Propulsion Type | Battery EV and Plug-in hybrid EV |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | WiTricity Corporation, Electreon, Qualcomm Technologies, Inc., HEVO Inc., and Mojo Mobility, Inc. |

| Additional Attributes | Dollar sales by wireless EV charging type include stationary inductive, resonant magnetic, and dynamic in-road systems, applied in passenger vehicles, commercial fleets, and public transport sectors across North America, Europe, and Asia-Pacific. Demand is driven by EV adoption growth, smart city development, and the need for seamless, cable-free charging. Innovation focuses on dynamic charging lanes, IoT integration, vehicle-to-grid (V2G) technology, and automatic charging alignment. Costs depend on charging power level, installation type, material components, and grid connectivity infrastructure. |

The global wireless ev charging market is estimated to be valued at USD 46.5 million in 2025.

The market size for the wireless ev charging market is projected to reach USD 3,377.8 million by 2035.

The wireless ev charging market is expected to grow at a 53.5% CAGR between 2025 and 2035.

The key product types in wireless ev charging market are commercial and residential.

In terms of charging type, stationary wireless charging systems segment to command 77.0% share in the wireless ev charging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Wireless HDMI Transmitter and Receiver Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wireless Testing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Printer Market Size and Share Forecast Outlook 2025 to 2035

Wireless Headphones Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensors Market Size and Share Forecast Outlook 2025 to 2035

Wireless Display Market Size and Share Forecast Outlook 2025 to 2035

Wireless Paging Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA