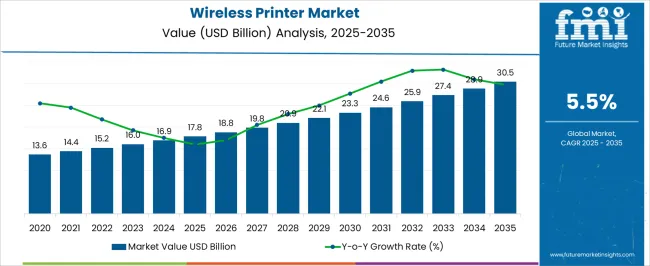

The Wireless Printer Market is estimated to be valued at USD 17.8 billion in 2025 and is projected to reach USD 30.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. The data indicates a consistent year-on-year increase, with the market rising by roughly USD 1.0 to 1.2 billion annually. Breaking down the timeline, the market grows from USD 17.8 billion in 2025 to USD 20.9 billion by 2028, marking the first breakpoint where the value crosses the USD 20 billion threshold.

This initial phase shows moderate but steady demand as wireless printing technology gains broader adoption across businesses and homes. Between 2029 and 2032, the market advances from USD 22.1 billion to USD 25.9 billion, representing a second breakpoint zone. Here, growth remains stable, supported by continuous technological improvements, such as enhanced connectivity and integration with smart devices, further fueling market expansion.

The final segment, from 2033 to 2035, sees the market moving from USD 27.4 billion to USD 30.5 billion, breaking through the USD 30 billion mark. This phase indicates sustained momentum with expanding usage in enterprise and consumer sectors, although growth increments slightly taper compared to earlier years. The Wireless Printer Market growth curve suggests smooth progression without sharp accelerations or stagnation points, indicating a mature yet steadily expanding industry environment.

| Metric | Value |

|---|---|

| Wireless Printer Market Estimated Value in (2025 E) | USD 17.8 billion |

| Wireless Printer Market Forecast Value in (2035 F) | USD 30.5 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The wireless printer market is undergoing a strong transformation, supported by increased digitization across offices, homes, and educational environments. Demand for compact, remotely accessible devices has accelerated due to hybrid work models, remote education, and small business automation.

Advancements in mobile printing, cloud integration, and secure wireless protocols are influencing adoption across both enterprise and individual users. A rise in demand for minimal-cabling infrastructure and scalable print environments is reinforcing the shift away from traditional wired systems.

Additionally, manufacturers are focusing on energy-efficient designs and multi-device compatibility to address modern user expectations. The future outlook is expected to benefit from integration with smart home ecosystems, AI-enabled print queue management, and cloud-based diagnostics, which are transforming the way printing hardware is deployed and managed.

The wireless printer market is segmented by product type, functionality, connectivity, application, price, distribution channel, and geographic regions. By product type, the wireless printer market is divided into Inkjet printers, Laser printers, 3D printers, and Others (thermal printers, dye-sublimation printers, portable/mobile printers, etc.). In terms of functionality, the wireless printer market is classified into Multi-function printers and Single-function printers.

The wireless printer market is segmented based on connectivity into Wi-Fi, Bluetooth, Cloud printing, and Others (near field communication (NFC) enabled printer, Air print, etc.). The wireless printer market is segmented into Commercial, Industrial, and Residential.

The wireless printer market is segmented by price into Medium, Low, and High. The distribution channel of the wireless printer market is segmented into Offline and Online. Regionally, the wireless printer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

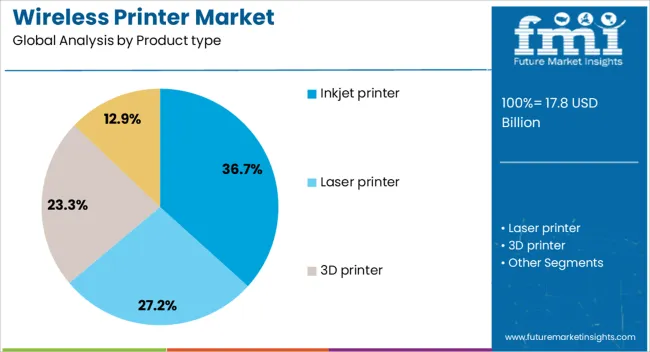

Inkjet printers are expected to account for 36.7% of the wireless printer market revenue in 2025, making them the leading product type. This segment’s leadership is driven by the balance of affordability, high-resolution print output, and compact form factor that inkjet models offer.

Their dominance in home and small business environments has been reinforced by support for color printing, photo-quality output, and versatile media handling. Continuous improvements in cartridge yield, ink efficiency, and wireless pairing technologies have further extended their relevance.

Additionally, ease of maintenance and compatibility with various operating systems and mobile platforms have strengthened inkjet printers’ position in both personal and professional use cases.

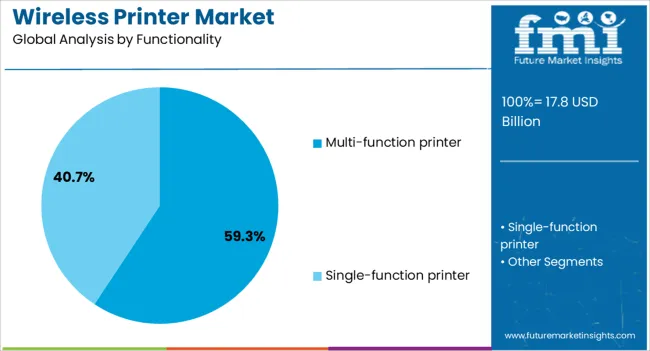

Multi-function printers are projected to hold 59.3% of the total market revenue in 2025, positioning them as the dominant functionality type. This growth is being driven by user demand for space-saving devices that consolidate printing, scanning, copying, and faxing functions into a single unit.

Enterprises, schools, and remote work setups are increasingly investing in multi-functional systems to reduce hardware costs while improving operational efficiency. Enhanced wireless connectivity, mobile scanning apps, and integration with cloud storage solutions have made these printers indispensable in digitized workflows.

The convenience of centralized document handling and ongoing innovations in document security and OCR capabilities have further bolstered their adoption.

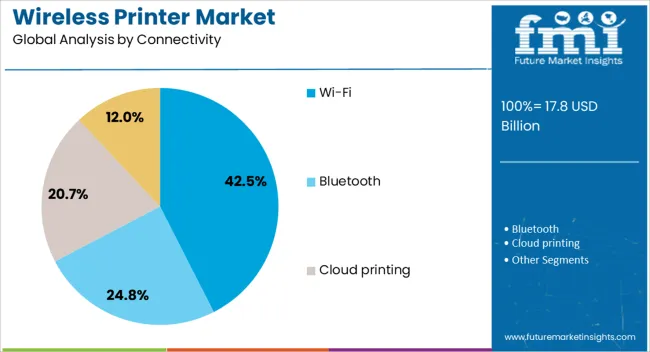

Wi-Fi-enabled printers are forecast to contribute 42.5% of the overall market revenue in 2025, emerging as the leading connectivity segment. This preference is attributed to the widespread use of wireless networks in homes and offices, offering flexibility in device placement and multi-user access without physical cabling.

Seamless integration with smartphones, tablets, laptops, and cloud platforms has made Wi-Fi the most user-friendly option, especially for mobile-first users. Enhanced security protocols such as WPA3 and support for enterprise-grade authentication have resolved early concerns about data protection.

With the continued shift toward remote and decentralized working environments, Wi-Fi connectivity remains essential for productivity, convenience, and integration with collaborative digital platforms.

The market has experienced substantial growth, driven by the increasing demand for convenient and flexible printing solutions across residential, commercial, and educational sectors. Wireless printers enable seamless connectivity through Wi-Fi, Bluetooth, and cloud services, allowing multiple devices to print without physical cables. Rising adoption of mobile and remote work environments has accelerated market demand. Advances in printing technologies, such as inkjet and laser, combined with features like duplex printing, high resolution, and energy efficiency, have enhanced the user experience. The concerns about data security, network compatibility, and initial device costs continue to influence purchasing decisions.

The expansion of mobile devices and remote work setups has significantly increased the need for wireless printers that provide convenience and flexibility. Employees and students require printing capabilities from various devices, including laptops, tablets, and smartphones, often from different locations within homes or offices. Wireless connectivity eliminates the need for physical connections, simplifying setup and enabling multiple users to share a single printer. This trend is especially pronounced in small to medium-sized businesses and educational institutions adapting to hybrid work and learning models. The ability to print remotely via cloud services further enhances productivity, positioning wireless printers as essential office equipment.

Recent technological advancements have improved wireless printers’ performance, usability, and energy consumption. Integration of features such as automatic duplex printing, higher resolution output, and faster print speeds caters to diverse user needs. Compatibility with multiple wireless protocols and operating systems increases accessibility and reduces connectivity issues. Smart features, including touchscreen controls, mobile app integration, and voice command support, have simplified operation. Additionally, eco-friendly technologies that reduce ink and power usage address growing environmental concerns. These innovations contribute to better user experiences, lower operational costs, and increased adoption across residential and professional markets.

As wireless printers connect to networks and cloud platforms, data security has become a critical consideration. Potential vulnerabilities can expose sensitive documents and network access to cyber threats. Users and organizations prioritize printers with robust encryption, secure login protocols, and regular firmware updates. Compliance with data protection regulations further shapes purchasing preferences, particularly among corporate and government clients. Manufacturers are investing in enhanced security features such as secure print release, user authentication, and network firewall integration. Addressing these security challenges is vital to building customer trust and expanding market penetration in an increasingly connected environment.

While wireless printers offer numerous benefits, the market faces challenges related to device cost and intense competition. Entry-level models with limited features target budget-conscious consumers but may not meet all user requirements. Conversely, high-end printers with advanced functionalities often carry higher price tags, potentially limiting accessibility for small businesses and individual users. The presence of numerous manufacturers and rapid product innovation leads to frequent price reductions and promotional offers, benefiting consumers but pressuring profit margins. To remain competitive, companies focus on developing cost-effective, versatile printers with scalable features and strong after-sales support, fostering sustained market growth.

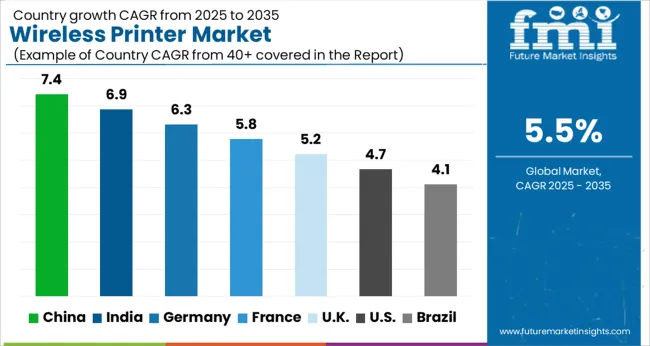

The market is projected to grow at a CAGR of 5.5% from 2025 to 2035, driven by increasing demand for smart office solutions, remote printing capabilities, and advances in wireless connectivity. China leads with a 7.4% CAGR, supported by large-scale manufacturing and growing adoption in corporate and home offices. India follows at 6.9%, fueled by expanding digital infrastructure and rising small business usage.

Germany, growing at 6.3%, benefits from innovation in printing technology and eco-friendly solutions. The UK, at 5.2%, experiences steady demand in educational and business sectors. The USA, with a 4.7% CAGR, reflects growth influenced by integration of wireless and cloud printing services. This report includes insights on 40+ countries; the top markets are shown here for reference.

Wireless printer sales in China are expected to grow at a CAGR of 7.4% from 2025 to 2035, fueled by increasing adoption of smart offices and home-based work environments. Major technology firms such as Lenovo and Huawei are integrating wireless connectivity features in multifunction devices to support seamless printing across mobile and desktop platforms. The rise of cloud-based document management systems is also contributing to higher demand. Government initiatives to digitize administrative processes accelerate deployment in public sector offices. The competitive landscape includes both domestic manufacturers and international brands offering cost-effective wireless printing solutions tailored to Chinese consumers.

The wireless printer industry in India is forecast to expand at a CAGR of 6.9% through 2035, driven by growing digitization in education, SMBs, and government offices. Companies such as HP India and Canon India focus on affordable wireless printing solutions adapted for small business and home use. Increasing penetration of smartphones and tablets further encourages mobile printing capabilities. E-commerce growth has improved accessibility to wireless printer devices nationwide. Rising awareness about paperless workflows and smart office technologies supports market momentum.

Sales of wireless printing equipment in Germany are expected to grow at a CAGR of 6.3% over the next decade, supported by the country’s emphasis on Industry 4.0 and smart office integration. Leading technology providers such as Brother and Epson invest in developing wireless-enabled printers with advanced security features. Demand from corporate offices and educational institutions remains significant. Environmental regulations encourage low-energy and duplex wireless printers. Integration with cloud-based document solutions enhances user convenience and market appeal.

The United Kingdom wireless printer market is projected to grow at a CAGR of 5.2% between 2025 and 2035, with growth supported by rising remote work adoption and small business digitization. Market leaders and new entrants focus on compact, wireless, and user-friendly devices that fit home office setups. Increasing reliance on mobile devices for printing and scanning boosts demand. Integration with virtual collaboration tools is a growing trend. Government initiatives promoting digital workplaces add further momentum.

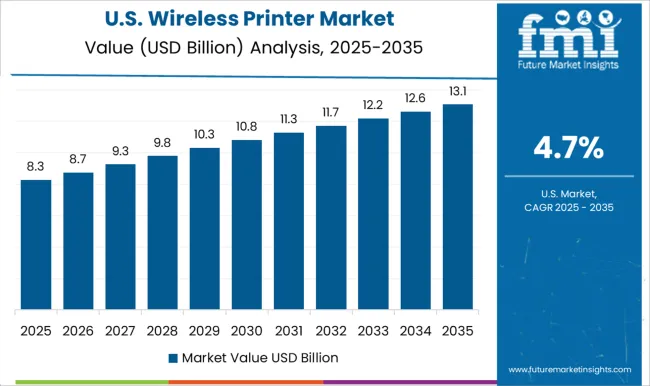

In the United States, wireless printer sales are forecast to expand at a CAGR of 4.7% during 2025 to 2035, driven by office modernization and growth in cloud computing services. Key suppliers such as Xerox and HP focus on enhancing wireless connectivity, security, and multifunction capabilities. Demand from healthcare, education, and corporate sectors remains robust. Growth in home office setups post-pandemic supports consumer wireless printer adoption. Advanced features such as wireless direct printing and integration with digital workflows are increasingly prioritized.

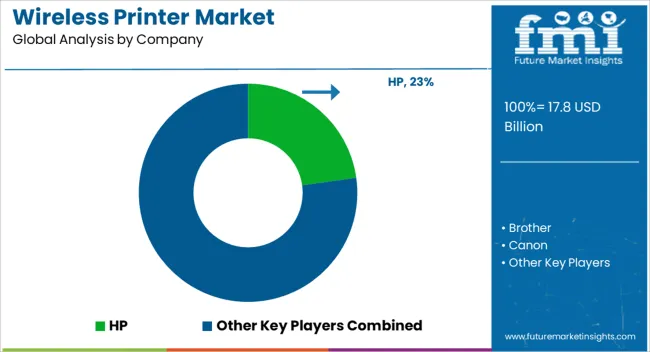

The market is dominated by renowned global brands offering a wide range of printing solutions designed for homes, offices, and specialized business applications. HP leads the sector with innovative wireless printing technologies that provide seamless connectivity, high-quality output, and user-friendly interfaces. Brother and Canon are key competitors focusing on versatile devices that combine reliability with advanced features such as mobile printing and cloud integration.

Epson and Fujifilm deliver high-resolution printing systems that cater to both general consumers and professional photographers, emphasizing color accuracy and efficiency. Konica Minolta and Kyocera specialize in robust wireless printers designed for high-volume office environments, combining durability with energy-saving features. Lexmark, Oki, and Ricoh provide tailored wireless solutions suited for enterprise needs, integrating secure printing and network management capabilities.

Roland and Sharp contribute with niche products targeting commercial printing and specialized industries. Toshiba and Xerox maintain strong market presence by offering scalable wireless printing solutions that support large workflows and enterprise IT infrastructures. The market is driven by the increasing demand for convenience, flexible connectivity options including Wi-Fi Direct and Bluetooth, and integration with mobile and cloud services.

Manufacturers continually enhance product portfolios through technology upgrades and strategic partnerships. Entry barriers include the need for advanced R&D, manufacturing excellence, and established distribution channels. Leading providers capitalize on these factors to sustain competitive advantage in a rapidly evolving market.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.8 Billion |

| Product type | Inkjet printer, Laser printer, 3D printer, and Others (thermal printer, dye-sublimation printer, portable/mobile printer, etc.) |

| Functionality | Multi-function printer and Single-function printer |

| Connectivity | Wi-Fi, Bluetooth, Cloud printing, and Others (near field communication (NFC) enabled printer, Air print, etc.) |

| Application | Commercial, Industrial, and Residential |

| Price | Medium, Low, and High |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | HP, Brother, Canon, Dell, Epson, Fujifilm, Konica Minolta, Kyocera, Lexmark, Oki, Ricoh, Roland, Sharp, Toshiba, and Xerox |

| Additional Attributes | Dollar sales by printer type and end-use sector, demand dynamics across home offices, corporate environments, and educational institutions, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in mobile connectivity, energy-efficient printing technologies, and cloud integration, environmental impact of consumable waste, energy consumption, and device recycling, and emerging use cases in remote printing solutions, IoT-enabled office ecosystems, and personalized printing services. |

The global wireless printer market is estimated to be valued at USD 17.8 billion in 2025.

The market size for the wireless printer market is projected to reach USD 30.5 billion by 2035.

The wireless printer market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in wireless printer market are inkjet printer, laser printer, 3D printer and others (thermal printer, dye-sublimation printer, portable/mobile printer, etc.).

In terms of functionality, multi-function printer segment to command 59.3% share in the wireless printer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Wireless HDMI Transmitter and Receiver Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wireless Testing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Headphones Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensors Market Size and Share Forecast Outlook 2025 to 2035

Wireless Display Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA