The Wire Harness Market is estimated to be valued at USD 103.3 billion in 2025 and is projected to reach USD 152.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period. This growth is supported by a steady CAGR of 4%, driven by increasing demand for wire harnesses in automotive, electronics, aerospace, and industrial applications. In the first five-year phase (2025–2030), the market is expected to grow from USD 103.3 billion to USD 123.3 billion, adding USD 20 billion, which accounts for 40.3% of the total incremental growth, driven by advancements in electric vehicles, automation, and industrial connectivity.

The second phase (2030–2035) will contribute USD 29.6 billion, representing 59.7% of the total growth, reflecting stronger momentum driven by the electrification of transportation, smart technologies in manufacturing, and more integrated systems in consumer electronics. Annual increments rise from USD 3.5 billion in early years to USD 6 billion by 2035, driven by innovations in wire harness designs, material optimization, and regulatory requirements for safety and sustainability. Manufacturers focusing on high-performance, eco-friendly materials will capture the largest share of this USD 49.6 billion opportunity.

| Metric | Value |

|---|---|

| Wire Harness Market Estimated Value in (2025 E) | USD 103.3 billion |

| Wire Harness Market Forecast Value in (2035 F) | USD 152.9 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The Wire Harness market is experiencing steady expansion, supported by growing demand for efficient power distribution and signal transmission in automotive, industrial, and heavy machinery applications. The current market environment is being influenced by the rising complexity of electrical systems in modern vehicles and machinery, which is increasing the need for advanced wire harness configurations.

The transition toward smart mobility, vehicle electrification, and increased automation across industrial operations is shaping future growth prospects. Strong momentum from global vehicle production and stringent regulatory norms regarding safety and emissions are further reinforcing the adoption of optimized wiring solutions.

Additionally, ongoing innovation in lightweight and heat-resistant materials, along with the need for space-saving and modular wiring systems, is expected to support long-term market potential. With technological upgrades becoming more frequent and wiring infrastructure playing a critical role in operational efficiency, the wire harness market is expected to maintain its upward trajectory across multiple end-use sectors.

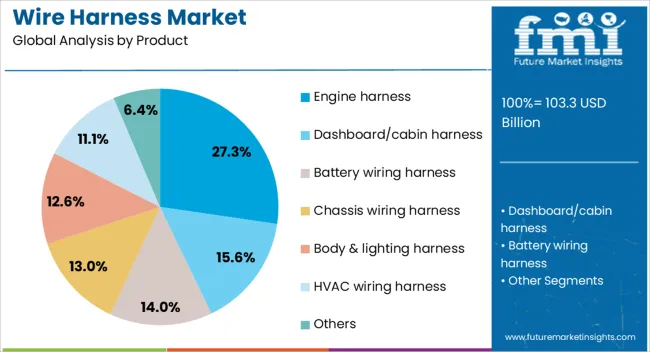

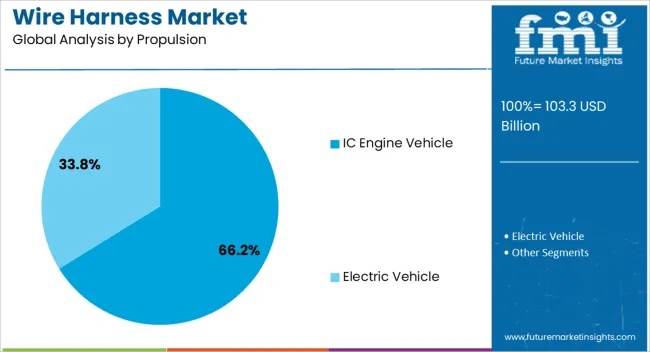

The wire harness market is segmented by product, material, propulsion, transmission, end user, and geographic regions. The wire harness market is divided into several products, including Engine harness, Dashboard/cabin harness, Battery wiring harness, Chassis wiring harness, Body & lighting harness, HVAC wiring harness, and Others. The wire harness market is classified into two main materials: Metallic and Optical Fiber. The wire harness market is segmented into IC Engine Vehicle and Electric Vehicle. The transmission of the wire harness market is segmented into Electric Wiring and Data Transmission.

The end users of the wire harness market are segmented into Automotive, Aerospace & defense, Telecommunication, Power & Energy, Construction equipment, Agricultural equipment, Medical equipment, and Others. Regionally, the wire harness industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The engine harness segment is projected to contribute 27.3% of the total revenue share in the wire harness market in 2025, emerging as the leading product category. This dominance is being attributed to its critical function in managing the electrical circuits that control engine performance, emissions, and efficiency. The growing integration of electronic control units in internal combustion engine architectures has significantly increased the demand for reliable and heat-resistant engine harness systems.

Advanced sensors, actuators, and control modules depend on robust connectivity, making engine harnesses indispensable for modern powertrains. Their ability to support multiple functions while withstanding harsh operating environments has reinforced their adoption.

Additionally, with global vehicle production showing steady growth and manufacturers focusing on optimizing fuel efficiency and compliance, the demand for precision-engineered engine harnesses is expected to remain strong. The increasing use of modular and standardized harness platforms is also contributing to the segment’s sustained relevance across diverse vehicle categories.

The metallic material segment is expected to dominate the wire harness market with an 81.6% revenue share in 2025. This strong position is being maintained due to the superior conductivity, durability, and mechanical strength offered by metallic materials such as copper and aluminum. These characteristics make metallic wire harnesses highly suitable for both high and low voltage applications, where reliable signal transmission and power distribution are critical.

Despite the emergence of alternative materials, the long-standing industry preference for metallic conductors continues to influence procurement strategies. Their compatibility with existing manufacturing processes, as well as resistance to environmental and thermal stresses, supports their continued use across automotive and industrial sectors.

Moreover, the ability to process metallic materials into complex wiring architectures without compromising performance has reinforced their application in increasingly compact and electrified systems. As performance expectations grow, the reliability and efficiency of metallic wire harnesses are expected to drive continued dominance in the material segment.

The IC engine vehicle segment is estimated to hold 66.2% of the wire harness market revenue in 2025, leading the propulsion-based segmentation. This leadership is being driven by the sustained global production of internal combustion engine vehicles, particularly in regions where electrification is progressing at a moderate pace.

The reliance of IC engine platforms on complex electrical systems for emissions control, engine diagnostics, and fuel injection systems has continued to support high wire harness demand. Additionally, tightening emissions regulations have led to the incorporation of more electronic components, sensors, and control units, all of which require dependable wiring frameworks.

While electric vehicles are gaining market share, IC engine vehicles continue to account for the majority of global vehicle output, especially in commercial, off-road, and low-infrastructure regions. The widespread availability of standardized wire harness designs for IC engine configurations has also contributed to manufacturing efficiency, thereby supporting this segment’s sustained revenue contribution.

The wire harness market is driven by growing demand for reliable power distribution, with opportunities in expanding automotive and electric vehicle markets. Trends in lightweight and flexible designs are reshaping the market, while challenges related to raw material costs and design complexity remain. By 2025, overcoming these barriers through cost-effective materials and streamlined design processes will be essential for sustaining market growth.

The wire harness market is experiencing significant growth due to the increasing demand for reliable power distribution systems in industries like automotive, electronics, and aerospace. Wire harnesses are essential for connecting and transmitting electrical signals in complex systems. As industries move toward more advanced machinery, automated vehicles, and electronic devices, the need for high-quality wire harnesses is expected to rise. By 2025, the market will continue expanding, driven by these advancements in technology and increased demand for efficiency.

Opportunities in the wire harness market are growing with the expansion of the automotive and electric vehicle markets. As electric vehicles (EVs) become more widespread, the need for advanced wire harnesses to support electrical systems in EVs is increasing. Additionally, the rise of autonomous vehicles and advanced automotive features is driving demand for more complex wiring solutions. By 2025, these opportunities will create significant growth for manufacturers supplying wire harnesses in these rapidly growing sectors.

Emerging trends in the wire harness market include the increasing demand for lightweight and flexible wire harnesses. As industries look to reduce weight and improve performance, particularly in the automotive and aerospace sectors, lightweight wire harnesses are becoming more popular. Flexible wire harness designs are also gaining traction as they allow for easier integration into smaller spaces and complex configurations. By 2025, these trends will dominate the market as companies strive for efficiency in power distribution and system design.

Despite growth, challenges such as rising raw material costs and increasing design complexity persist in the wire harness market. The cost of copper, a primary raw material used in wire harnesses, has been rising, impacting production costs. Additionally, the complexity of modern electronic systems requires more intricate and expensive wire harness designs, which can drive up costs. By 2025, addressing these challenges through more cost-effective material sourcing and design standardization will be crucial for continued market growth.

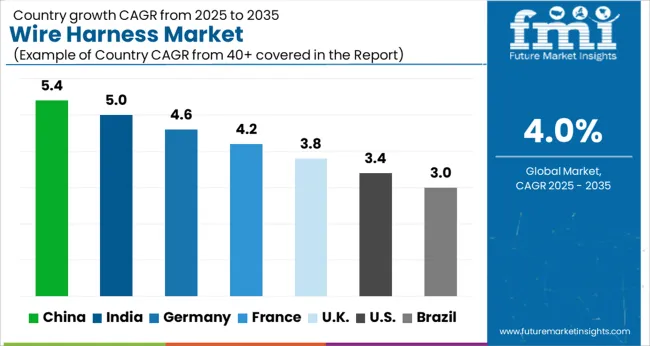

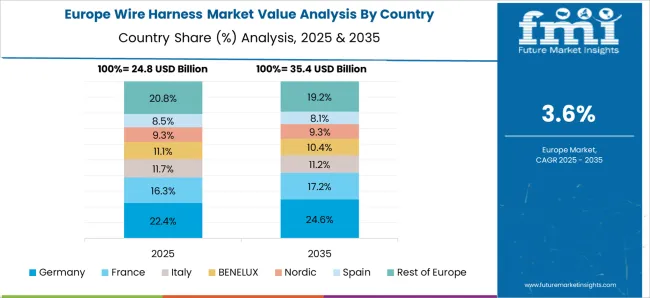

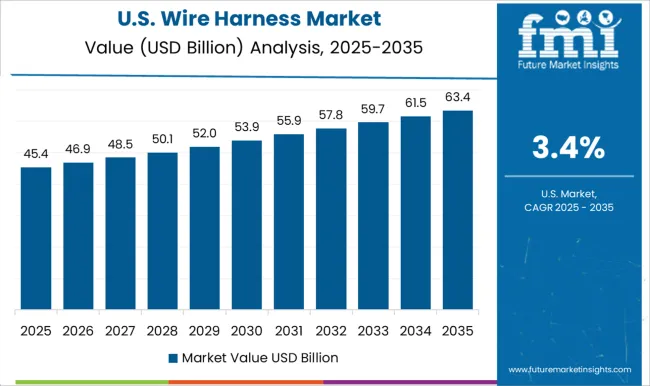

The global wire harness market is projected to grow at a 4% CAGR from 2025 to 2035. China leads with a growth rate of 5.4%, followed by India at 5%, and France at 4.2%. The United Kingdom records a growth rate of 3.8%, while the United States shows the slowest growth at 3.4%. These varying growth rates are driven by factors such as the increasing demand for wire harnesses in automotive, industrial, and electronics applications, the rise in electric vehicle (EV) production, and technological advancements in manufacturing processes. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, increased automotive production, and the growing adoption of electric mobility, while more mature markets like the USA and the UK see steady growth driven by advancements in manufacturing technologies and demand for specialized wire harness solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The wire harness market in China is growing rapidly, with a projected CAGR of 5.4%. The country’s expanding automotive industry, driven by the rising demand for electric vehicles (EVs) and the need for more advanced wire harness systems in electric mobility, is a key factor driving market growth. China’s growing industrial base and increasing consumer demand for electronics, home appliances, and other electrical equipment are further contributing to the market expansion. Additionally, China’s focus on upgrading its manufacturing technologies and automation in the wire harness production process accelerates the demand for high-quality and efficient wire harness solutions.

The wire harness market in India is projected to grow at a CAGR of 5%. India’s rapidly growing automotive sector, driven by rising domestic demand and exports, is fueling the demand for wire harness solutions. The growing adoption of electric vehicles (EVs) and hybrid vehicles, coupled with the increasing focus on automotive safety and innovation, is further driving market growth. Additionally, India’s expanding electronics industry, increased infrastructure development, and rising consumer demand for electrical products are contributing to the growing adoption of wire harnesses in various industrial applications.

The wire harness market in France is projected to grow at a CAGR of 4.2%. France’s strong automotive and industrial sectors, along with increasing demand for wire harnesses in automotive applications, including electric and hybrid vehicles, are key drivers of market growth. The country’s emphasis on sustainability, regulatory standards for electric mobility, and energy-efficient systems further accelerate the demand for wire harness solutions. Additionally, France’s growing electronics sector, coupled with advancements in manufacturing technologies, contributes to the steady growth of the wire harness market.

The wire harness market in the United Kingdom is projected to grow at a CAGR of 3.8%. The UK market is driven by increasing demand for wire harnesses in the automotive sector, particularly for electric and autonomous vehicles. Additionally, the country’s growing focus on sustainability, energy-efficient systems, and automotive safety features further contributes to the demand for wire harness solutions. The UK also benefits from technological advancements in manufacturing processes and innovations in wire harness design, contributing to steady market growth.

The wire harness market in the United States is expected to grow at a CAGR of 3.4%. The USA market remains steady, driven by the increasing demand for wire harnesses in automotive, aerospace, and industrial applications. The growing adoption of electric and hybrid vehicles, along with the rise in automation and smart technologies in manufacturing, is contributing to market growth. Additionally, the USA market benefits from advancements in manufacturing processes, innovations in product designs, and government regulations supporting the adoption of energy-efficient systems.

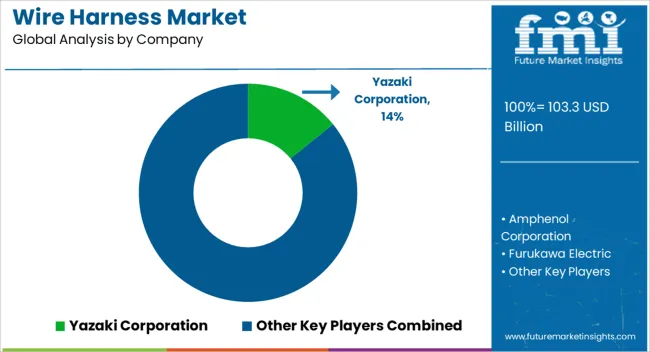

The wire harness market is dominated by Yazaki Corporation, which leads with its extensive portfolio of wire harness solutions for automotive, industrial, and consumer electronics applications. Yazaki’s dominance is supported by its strong global presence, innovative technology, and commitment to providing high-quality, efficient wire harnesses that meet the needs of modern electrical systems. Key players such as Amphenol Corporation, Furukawa Electric, and Sumitomo Electric Industries maintain significant market shares by offering durable, reliable, and customizable wire harnesses that support industries such as automotive, aerospace, and electronics. These companies focus on ensuring high performance, optimizing space, and reducing weight in complex electrical systems. Emerging players like Kromberg & Schubert, Manitou Group Gear, and PKC Group (Motherson) are expanding their market presence by offering specialized wire harness solutions for niche applications such as heavy machinery, electric vehicles, and renewable energy sectors. Their strategies include enhancing product quality, improving manufacturing efficiency, and focusing on sustainable materials and production methods. Market growth is driven by increasing demand for wire harnesses in electric and autonomous vehicles, growing industrial automation, and the need for lightweight, energy-efficient solutions. Innovations in smart wire harnesses, eco-friendly materials, and integration with advanced electronics are expected to continue shaping competitive dynamics and drive further growth in the global wire harness market.

| Item | Value |

|---|---|

| Quantitative Units | USD 103.3 Billion |

| Product | Engine harness, Dashboard/cabin harness, Battery wiring harness, Chassis wiring harness, Body & lighting harness, HVAC wiring harness, and Others |

| Material | Metallic and Optical Fiber |

| Propulsion | IC Engine Vehicle and Electric Vehicle |

| Transmission | Electric Wiring and Data Transmission |

| End User | Automotive, Aerospace & defense, Telecommunication, Power & Energy, Construction equipment, Agricultural equipment, Medical equipment, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Yazaki Corporation, Amphenol Corporation, Furukawa Electric, Kromberg & Schubert, Lear Corporation, Leoni AG, Manitou Group Gear, PKC Group (Motherson), Sumitomo Electric Industries, and TE Connectivity |

| Additional Attributes | Dollar sales by harness type and application, demand dynamics across automotive, aerospace, and industrial sectors, regional trends in wire harness adoption, innovation in lightweight and high-performance materials, impact of regulatory standards on safety and performance, and emerging use cases in electric vehicles and smart manufacturing systems. |

The global wire harness market is estimated to be valued at USD 103.3 billion in 2025.

The market size for the wire harness market is projected to reach USD 152.9 billion by 2035.

The wire harness market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in wire harness market are engine harness, dashboard/cabin harness, battery wiring harness, chassis wiring harness, body & lighting harness, hvac wiring harness and others.

In terms of material, metallic segment to command 81.6% share in the wire harness market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wire Harness Tape Market Insights – Trends & Future Outlook 2024-2034

Wire Rope Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wirewound Resistor Market Size and Share Forecast Outlook 2025 to 2035

Wire-cutting EDM Machines Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Wire Livestock Panels Market Size and Share Forecast Outlook 2025 to 2035

Wireless Testing Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Bank Market Size and Share Forecast Outlook 2025 to 2035

Wireless Battery Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Wireless Printer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA