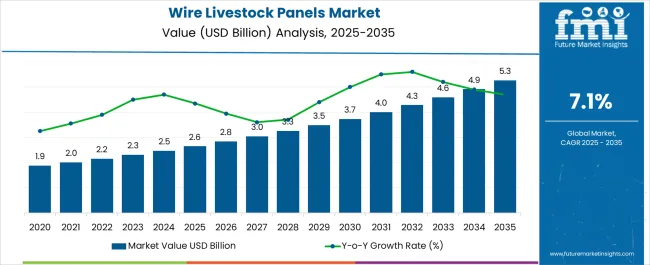

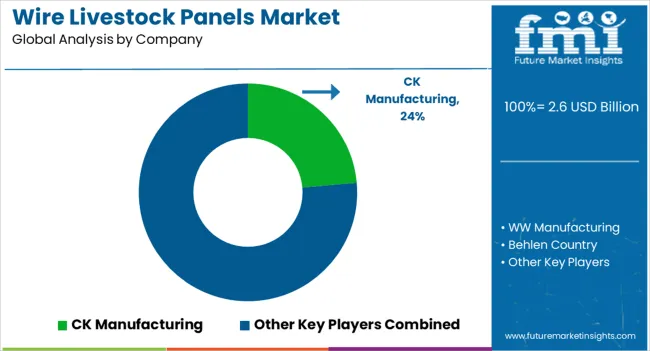

The Wire Livestock Panels Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

| Metric | Value |

|---|---|

| Wire Livestock Panels Market Estimated Value in (2025 E) | USD 2.6 billion |

| Wire Livestock Panels Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The wire livestock panels market is gaining momentum as demand for durable, cost effective, and easy to install fencing solutions increases across agricultural and livestock management sectors. Rising herd sizes, expansion of ranching activities, and the need for efficient containment solutions are driving adoption.

Farmers and ranchers are prioritizing products that balance affordability with strength and longevity, which has boosted the market for galvanized and heavy duty wire panel structures. Technological improvements in welding and coating have further enhanced durability against environmental stressors, reducing maintenance costs.

Regulatory emphasis on animal safety and biosecurity is also contributing to adoption. Looking ahead, the market outlook remains positive as livestock production continues to expand, with greater reliance on standardized, scalable, and sustainable panel systems for both small and large scale operations.

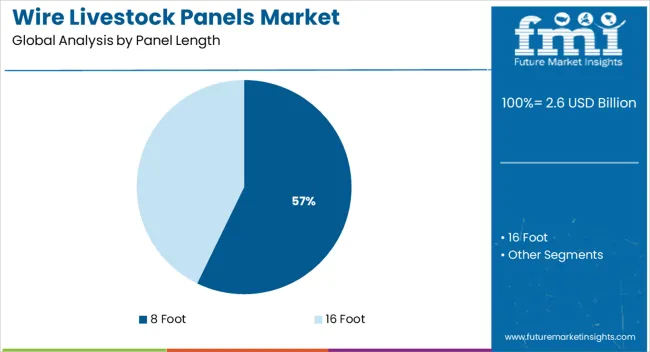

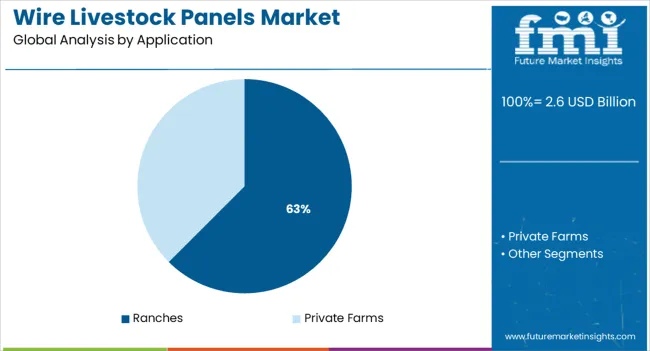

The market is segmented by Panel Length, Application, and Sales Channel and region. By Panel Length, the market is divided into 8 Foot and 16 Foot. In terms of Application, the market is classified into Ranches and Private Farms. Based on Sales Channel, the market is segmented into Direct Sales and Retail Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 8 Foot panel length segment is projected to hold 57.20% of total revenue by 2025 within the panel length category, making it the leading sub segment. Its dominance is supported by versatility, ease of handling, and suitability for a wide range of livestock management practices.

The balanced size allows for efficient installation and transportation while maintaining durability and strength.

Its cost effectiveness and adaptability across both small farms and large ranching operations have reinforced its leadership position.

The ranches application segment is expected to account for 62.50% of overall market revenue by 2025, positioning it as the most prominent application area. This growth is driven by the high concentration of livestock populations in ranch settings, where large scale containment and movement management are critical.

Ranchers increasingly rely on wire panels for perimeter fencing, feeding areas, and animal segregation, making them integral to operations.

The emphasis on reducing losses, ensuring animal safety, and simplifying management practices has bolstered the dominance of this application.

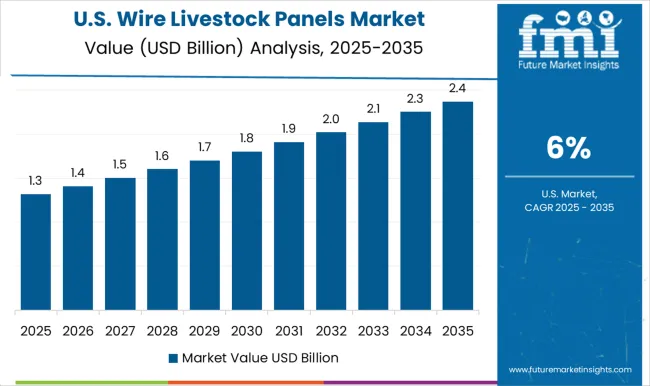

The market has evolved over time in response to changes in the agriculture industry, advances in technology and manufacturing processes, and shifts in consumer demand. Therefore, when compared to the 6.4% CAGR recorded between 2020 and 2025, the wire livestock panels market is predicted to expand at a 7.1% CAGR between 2025 and 2035.

| Short Term (2025 to 2029) | Factors such as increasing livestock production and rising demand for meat and dairy products are expected to drive market growth. |

|---|---|

| Medium Term (2029 to 2035) | The adoption of wire livestock panels for enclosures, pens, and fencing is likely to grow as the industry is becoming more focused on efficiency and cost-effectiveness, as well as animal welfare and safety. |

| Long Term (2035 to 2035) | Innovations in materials, designs, and manufacturing techniques are anticipated to make wire livestock panels more durable, versatile, and affordable over time. This is projected to result in market growth. |

These factors are anticipated to support about a 2X increase in the wire livestock panels market between 2025 and 2035. The market is projected to be worth USD 5.3 billion by the end of 2035, according to FMI analysts.

The global market is anticipated to expand significantly during the forecast period as a result of various key aspects that have been identified. Along with factors influencing the market's expansion, FMI analysts looked at potential threats, tempting opportunities, and restricting factors that may have an impact on the sales of wire livestock panels.

| Drivers |

|

|---|---|

| Restraints |

|

| Opportunities |

|

| Threats |

|

8 Foot Wire Livestock Panels: The New Standard for Animal Containment

Farmers prefer using 8 foot wire livestock panels since they offer several advantages such as:

Farmers and ranchers also adopt 8 foot panels since they can cover a larger area, making it more efficient for enclosing pastures or pens. These panels allow for easy installation and transportation. Furthermore, these panels are often more widely available and easier to find at agro stores. All of these factors make them a convenient choice for farmers and ranchers which are likely to increase the adoption of 8 foot wire livestock panels.

Ranchers’ Secret Weapon: Wire Livestock Panels for Strong and Durable Animal Enclosures

Even though both ranches and private farms use wire livestock panels, it is worth noting that wire livestock panels are more commonly used by ranchers. Wire livestock panels are practical, durable, and cost-effective solutions for ranches looking to contain and manage their animals. Ranches and large commercial farms tend to have a huge livestock population, typically perform larger operations and need to enclose a larger area.

These panels are also relatively lightweight, which makes them easy to move and reposition as needed. This is useful for ranches that need to regularly rotate grazing areas or move animals from one pen to other. Another reason ranches use wire panels is that they are relatively easier to install and can be configured in various ways to suit the needs of the ranch. This makes them an adaptable and flexible option for creating pens, corrals, and other enclosures for different types of livestock.

| Country | United States |

|---|---|

| Market Share (2025) | 30.8% |

| Market Value (2025) | USD 664.5 million |

| Country | Germany |

|---|---|

| Market Share (2025) | 16.1% |

| Market Value (2025) | USD 346.6 million |

| Country | United Kingdom |

|---|---|

| Market Share (2025) | 9.8% |

| Market Value (2025) | USD 211.3 million |

| Country | China |

|---|---|

| Market Share (2025) | 8.5% |

| Market Value (2025) | USD 182.65 million |

| Country | Japan |

|---|---|

| Market Share (2025) | 4.4% |

| Market Value (2025) | USD 94.5 million |

| Country | India |

|---|---|

| Market Share (2025) | 4.0% |

| Market Value (2025) | USD 85.8 million |

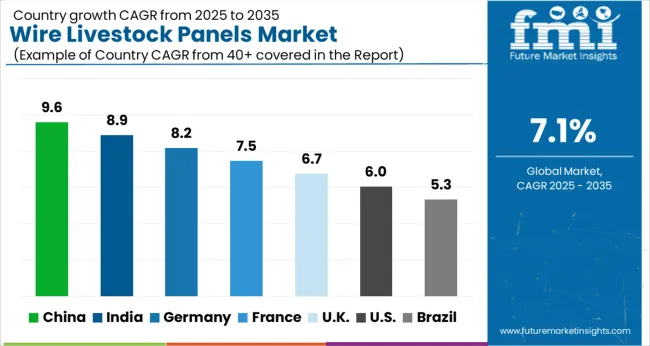

North America dominate the global market and the United States holds the predominant share of the market. The United States livestock panels market is a growing one, driven by increasing demand for sustainable and cost-effective fencing solutions for farms and ranches. The market growth can be attributed to the increasing popularity of hobby farms and small-scale agriculture, as well as the need for improved animal containment and protection.

The increasing demand for organic and locally sourced food products has led to a rise in small-scale farming operations, which in turn has driven demand for wire livestock panels. Many farmers and ranchers in the country are now using advanced technology such as GPS and remote monitoring systems to improve the efficiency and productivity of their operations.

The market is highly competitive in the United States, with numerous manufacturers and suppliers offering a wide range of products to meet the demand. Certain leading manufacturers of wire livestock panels in the country include Behlen Country, Cattle Panels, Red Brand and OK Brand.

In the United Kingdom, the market is driven by the growing demand for sustainable and efficient farming practices. In recent years, there has been a growing trend of farmers in the country moving away from traditional wooden fences. Moreover, the demand for these panels is increasing among small and medium-sized farms as these are cheaper than wooden fences. Therefore, with growing awareness among farmers about the benefits of wire livestock panels, the United Kingdom wire livestock panels market is expected to continue to grow in the future.

The market is also characterized by a high degree of innovation and product development. Many companies are investing in research and development to improve the strength, durability and design of their wire livestock panels. This has led to the introduction of new and improved products in the market, such as panels with increased strength and corrosion resistance. Hence, the market in the United Kingdom is projected to reach USD 5.3 million by 2035, exhibiting a CAGR of 7.6%.

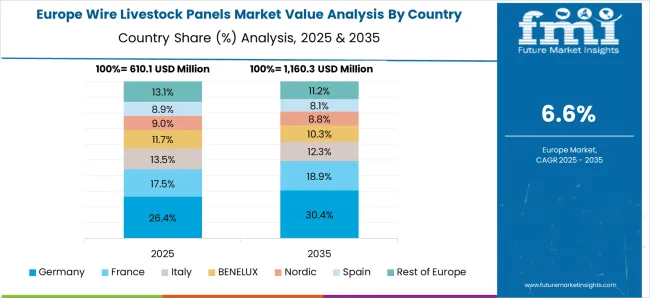

The German wire livestock panels market is experiencing significant growth owing to the demand for advanced farming tools and solutions. The German government also plays a role in the growth of the wire livestock panels industry. The government provides subsidies and grants for farmers who want to invest in sustainable and modern farming equipment and infrastructure. This has led to more farmers investing in wire livestock panels as an alternative to traditional wooden fences.

Germany has several large commercial farms and wire livestock panels are ideal solutions for these farms. The market is also expected to benefit from the growing global trend towards large-scale industrial farming. As the demand for food products increases, more farmers are turning to industrial farming methods to increase productivity.

The Chinese wire livestock panels market is projected to surpass USD 317.7 million by 2035, registering a CAGR of 5.7%. The wire livestock panels industry in China has numerous opportunities for growth as the government is promoting modern agriculture technologies and equipment. The government initiatives aim to improve the efficiency and productivity of the country’s agricultural sector.

Another significant reason why the market is growing is the rapidly expanding livestock industry in China. As the country’s economy continues to grow, there is a growing demand for high-quality animal products like meat and milk from consumers. To meet this demand, farmers are under increasing pressure to ensure that the animals are kept in a comfortable and safe environment.

The wire livestock panel industry in Japan is relatively small compared to other countries. However, it’s been steadily growing in recent years. The key factor driving the Japanese wire livestock panels market is the growth of the livestock industry. Since the land in Japan is not suitable for agriculture, livestock farming is a common practice here. Moreover, as the population continues to grow, the number of small-scale farms has been increasing. This in turn is likely to increase the demand for wire livestock panels.

The market in Japan is also driven by the country’s efforts to increase its self-sufficiency in food production. Under its new plan for Sustainable Food Systems, the government has promised to meet several sustainability goals by the year 2050. A least 30% improvement in productivity in the food production industry is also included in this plan. This is likely to increase the number of livestock farms, which in turn is expected to drive product adoption.

Indian wire livestock panels market is growing predominantly in terms of CAGR as more farmers turn to the efficient method of managing their livestock. The market has the potential to play a key role in improving the efficiency of India’s livestock farming industry. Moreover, like other developing countries of the Asia Pacific region, India also has an increasing demand for meat and dairy products.

The population of the country is growing significantly, which in turn additionally increases the demand for animal products. This is expected to increase the size of the livestock industry. This in turn is anticipated to increase the adoption of wire livestock panels in the country. FMI analysts predict that the market in India is estimated to be valued at USD 191.2 million by 2035, exhibiting a CAGR of 8.3%.

Start-ups in the wire livestock panels sector are likely to notice new prospects in the market throughout the forecast period. This is due to farmers' and ranchers' increased demand as a consequence of their search for more inexpensive alternatives to traditional fence systems.

AgriFence - This start-up offers a wide range of wire livestock panels including hog panels, horse panels and cattle panels. They also provide custom panel fabrication services.

Livestock Secure - It offers a broad range of panels, gates, and other livestock equipment including feeders, waterers, and shelters. They also offer custom fabrication services to meet specific needs.

Top Manufacturers and their Recent Significant Developments in the Market

Manufacturers of wire livestock panels invest money in research and development to create inventive wire panel designs that are suitable for the requirements of specific animals. This includes panels that may be customized with different widths, heights, and other options. Several manufacturers are currently offering wireless systems that enable farmers to monitor and control the panels from a distance.

Priefert Manufacturing is a company that specializes in the production of livestock equipment, including chutes, arenas, fencing, panels and other related products. The company is known for producing high-quality, durable equipment that is widely used by farmers, ranchers and other livestock professionals. They also offer a wide range of accessories and replacement parts for their products.

MJE Livestock Equipment produces the top livestock equipment by scrutinizing each stage of the manufacturing process to assure quality. It has developed economies at every station in its shop, starting with superior materials, to keep prices down without compromising quality. Products made by the company are made to last, from fabrication to welding to painting. In addition to the fence panels, MJE Livestock Equipment also manufactures gates, feeders, waterers, and mineral feeders.

In September 2025, MJE Livestock Equipment officially announced a significant expansion of its Dealer Network. Through these alliances, MJE Livestock Equipment will be accessible to farmers and ranchers throughout the United States.

The global wire livestock panels market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the wire livestock panels market is projected to reach USD 5.3 billion by 2035.

The wire livestock panels market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in wire livestock panels market are 8 foot and 16 foot.

In terms of application, ranches segment to command 62.5% share in the wire livestock panels market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Wireless HDMI Transmitter and Receiver Market Size and Share Forecast Outlook 2025 to 2035

Wire and Cable Management Market Forecast Outlook 2025 to 2035

Wire Harness Tape Market Forecast and Outlook 2025 to 2035

Wire Rope Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Wirewound Resistor Market Size and Share Forecast Outlook 2025 to 2035

Wire-cutting EDM Machines Market Size and Share Forecast Outlook 2025 to 2035

Wireless Video - 2.4/5GHz Market Size and Share Forecast Outlook 2025 to 2035

Wireless Polysomnography Market Size and Share Forecast Outlook 2025 to 2035

Wireless Audio Devices Market Size and Share Forecast Outlook 2025 to 2035

Wireless Communication Technologies In Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Wireless Mesh Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Wireless Sensor Network Market Size and Share Forecast Outlook 2025 to 2035

Wire Harness Market Size and Share Forecast Outlook 2025 to 2035

Wireless Power Transmission Market Size and Share Forecast Outlook 2025 to 2035

Wireless Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA