The wire and cable market holds a specialized share within several larger industries. In the electrical equipment market, it accounts for approximately 25-30%, driven by the high demand for wires and cables used in electrical distribution and power generation systems. Within the telecommunications equipment market, the share of wire and cables is around 10-12%, as these components are essential for communication systems, including data transmission and internet infrastructure. In the construction market, the share is about 12-15%, as wires and cables are crucial for residential, commercial, and industrial construction projects, including electrical wiring, lighting, and HVAC systems. In the automotive market, the share of wire and cables is approximately 5-7%, reflecting their growing use in automotive applications for electrical systems, vehicle lighting, and infotainment. In the energy and power market, the share is around 8-10%, driven by the increasing need for cables in energy distribution and renewable energy projects, such as wind and solar farms. Despite its smaller share in some sectors, the wire and cable market continues to expand due to increasing demand for reliable infrastructure, technological advancements, and the growing focus on renewable energy and electric vehicles.

| Metric | Value |

|---|---|

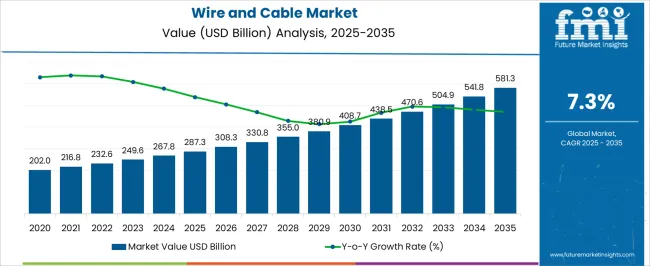

| Wire and Cable Market Estimated Value in (2025 E) | USD 287.3 billion |

| Wire and Cable Market Forecast Value in (2035 F) | USD 581.3 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The wire and cable market is witnessing steady expansion due to accelerated investments in energy infrastructure, modernization of grid systems, and sustained demand from construction and industrial sectors. Electrification initiatives across emerging economies, growing integration of renewable power sources, and urban infrastructure upgrades have collectively elevated the demand for reliable and efficient cabling systems.

Technological advancements in insulation materials, fire resistance, and energy efficiency are driving the adoption of specialized cables across utilities, transportation, and data communication applications. Additionally, government mandates focused on safety and energy optimization are reinforcing product innovation and compliance.

The proliferation of smart grids and data centers, along with increasing rollout of EV charging infrastructure and 5G networks, is expected to sustain market momentum through the next decade. Strong collaborations between manufacturers, utility providers, and EPC contractors continue to shape the procurement and deployment ecosystem for wire and cable solutions.

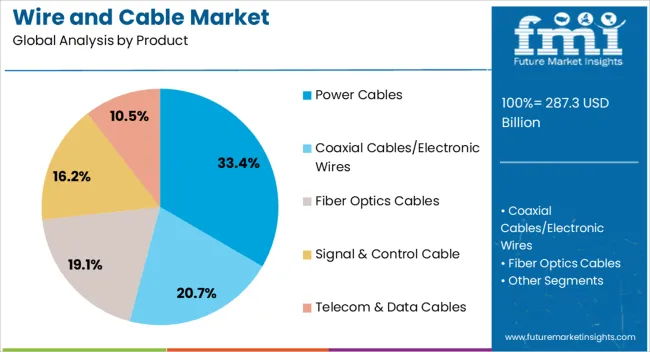

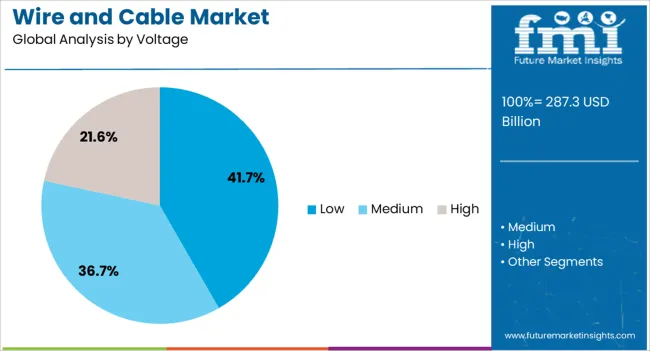

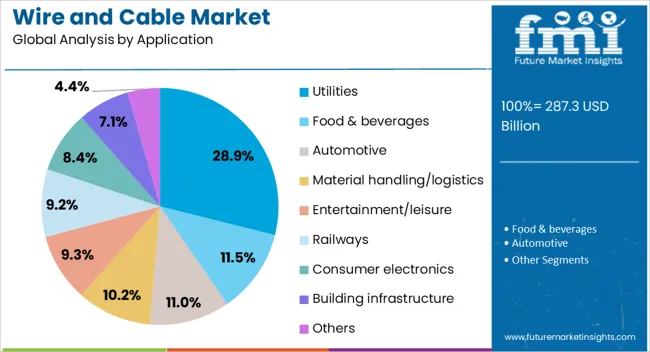

The wire and cable market is segmented by product, voltage, application, and region. By product, it is divided into power cables, coaxial cables/electronic wires, fiber optic cables, signal and control cables, and telecom and data cables. In terms of voltage, the market is classified into low, medium, and high. Based on application, it is segmented into utilities, food and beverages, automotive, material handling and logistics, entertainment and leisure, railways, consumer electronics, building infrastructure, and others. Regionally, the wire and cable industry is categorized into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Power cables are projected to hold 33.40% of the overall market revenue in 2025, positioning this segment as the most dominant within the product category. The leading position is being driven by widespread applications in power generation, transmission, and distribution projects globally.

Infrastructure expansion in residential, industrial, and commercial sectors has heightened the need for efficient medium- and high-voltage energy transfer, which is well-served by power cables. Their durability, high current carrying capacity, and compatibility with underground and overhead installations have reinforced their role in large-scale grid modernization and electrification programs.

Furthermore, technological improvements in XLPE insulation and fire-retardant jackets are making power cables more suitable for mission-critical and environmentally challenging environments.

Low voltage cables are expected to contribute 41.70% of the total revenue in the market by 2025, emerging as the dominant voltage class. This segment’s lead is being influenced by the growing demand for low-voltage distribution in commercial buildings, residential complexes, and industrial automation setups.

The increasing number of smart buildings and energy-efficient construction projects has driven the need for safe, flexible, and cost-effective low voltage wiring. Enhanced focus on fire safety standards, especially in densely populated regions, has accelerated the transition toward certified low voltage solutions.

Additionally, the segment benefits from rising usage in solar rooftops, electric vehicles, and small-scale renewable energy systems, where operational voltages remain under 1kV.

The utilities sector is expected to account for 28.90% of the wire and cable market revenue in 2025, making it the largest application segment. The segment’s prominence stems from large-scale investments in power transmission and distribution infrastructure, aimed at improving grid reliability and minimizing energy losses.

Expansion of rural electrification programs, substation upgrades, and smart grid rollouts have elevated the requirement for specialized cabling systems in utility networks. Cables used in this sector must meet stringent operational and safety standards, including thermal endurance, water resistance, and electromagnetic shielding.

As electricity demand continues to rise with urbanization and industrialization, utility providers are prioritizing long-life, low-maintenance cable systems to reduce total cost of ownership.

The wire and cable market is growing due to increasing demand in power transmission, construction, and telecommunications sectors. The rising need for electricity, renewable energy systems, and communication networks is driving market growth. Technological advancements in cable materials and manufacturing processes are improving efficiency, performance, and durability. While challenges like raw material price fluctuations and environmental regulations exist, opportunities are emerging from infrastructure development, demand for high-performance cables, and advancements in smart grid technologies. The market also sees potential in the growing adoption of electric vehicles (EVs) and renewable energy systems.

The wire and cable market is driven by the growing demand for power transmission, telecommunications, and infrastructure development. With urbanization and industrialization, the need for efficient power distribution systems is increasing, requiring reliable cables for electricity transmission. The global demand for telecommunications services, including internet and data services, is also driving the market for cables, especially high-speed, fiber-optic cables. In addition, the expansion of renewable energy systems, including solar and wind energy, requires advanced cables to transmit electricity efficiently. The rising adoption of electric vehicles (EVs) is another key factor, as the need for charging infrastructure and specialized cables grows. These factors are significantly contributing to the overall growth of the wire and cable market.

A significant challenge for the wire and cable market is the volatility in raw material prices, particularly copper and aluminum, which are essential in cable manufacturing. Fluctuations in these prices due to supply chain disruptions, geopolitical factors, and mining costs impact the overall production costs and profitability of manufacturers. Additionally, stricter environmental regulations regarding the use of certain materials, such as PVC and lead, are adding complexity to production processes. The need for eco-friendly alternatives and the development of cables with reduced environmental impact creates challenges in terms of research, development, and compliance with global standards. Manufacturers are working to overcome these hurdles by innovating in material sourcing and improving production efficiency.

The wire and cable market presents several growth opportunities, particularly in the renewable energy sector. As global efforts to transition to cleaner energy sources increase, the demand for cables that support solar, wind, and other renewable energy systems is on the rise. Additionally, the growing adoption of electric vehicles (EVs) is creating a significant need for specialized cables for charging stations and battery systems. The increasing use of smart technologies, including smart grids, is also providing opportunities for high-performance cables with advanced capabilities for data transmission and energy management. As infrastructure continues to expand in emerging markets, the demand for reliable and efficient wire and cable solutions is set to increase, presenting long-term growth potential.

A key trend in the wire and cable market is the increasing adoption of smart grid technology, which requires advanced, high-performance cables capable of transmitting data and electricity efficiently. This trend is driving innovation in cable materials, including fiber-optic cables and cables designed for high-speed communication.There is a rising demand for eco-friendly cables made from recyclable materials, such as halogen-free compounds, in response to stricter environmental regulations and consumer preference for sustainable products. The growth of electric vehicles (EVs) is also influencing the design of specialized cables for charging infrastructure. Manufacturers are focusing on creating more durable, energy-efficient, and environmentally responsible solutions to meet the evolving needs of the market.

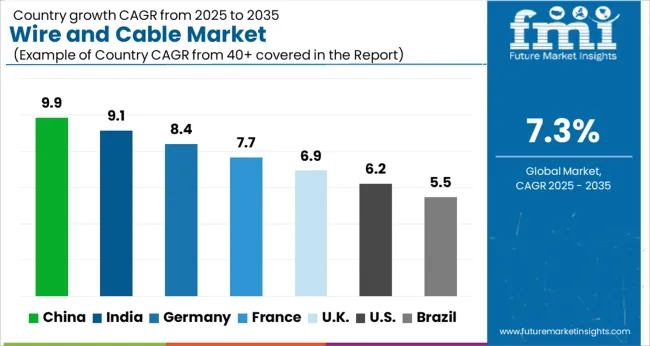

The wire and cable market is projected to grow at a global CAGR of 7.3% from 2025 to 2035, with China leading at 9.9%, followed by India at 9.1%, and Germany at 8.4%. The United Kingdom shows 6.9%, while the United States records 6.2%. The market growth is driven by the expansion of the telecommunications, construction, and energy sectors, with strong demand for high-performance cables in emerging economies like China and India. In OECD countries such as Germany, the UK, and the USA, steady growth is fueled by infrastructure development and the ongoing shift to renewable energy sources. The analysis spans over 40+ countries, with the top markets shown below.

China is projected to grow at a CAGR of 9.9% through 2035, driven by rapid industrialization, urbanization, and the increasing demand for electrical infrastructure. The country’s booming construction, telecommunications, and energy sectors are major contributors to the demand for wires and cables, particularly in the development of smart cities and renewable energy projects. China’s ongoing push for infrastructure expansion, along with government-led initiatives to modernize power grids and enhance telecommunications, continues to drive the market. The country’s role as a global manufacturing hub and its dominance in the electric vehicle sector further supports demand for specialized cables.

India is projected to grow at a CAGR of 9.1% through 2035, with significant demand for wires and cables driven by the country’s growing infrastructure and industrial expansion. The need for electrical wiring in new urban developments, residential projects, and industrial applications is expanding rapidly. India’s focus on renewable energy and electrification of rural areas further boosts the demand for power cables. The government’s focus on infrastructure, including the construction of smart cities, urban housing projects, and transportation systems, continues to create a solid foundation for the wire and cable market. Additionally, India’s growing adoption of electric vehicles is increasing the need for specialized cables in charging infrastructure.

Germany is projected to grow at a CAGR of 8.4% through 2035, with demand for wire and cable solutions primarily driven by the country’s leadership in the automotive and energy sectors. The ongoing transition to renewable energy and energy-efficient infrastructure in Germany, supported by government incentives and regulations, is expected to boost demand for cables in the power transmission and distribution sectors. Germany’s strong industrial base and the push toward electric mobility are also key growth factors, leading to an increase in the demand for cables in both energy and telecommunications infrastructure. As Germany’s industrial sector grows and modernizes, so too does the need for high-quality, high-performance wire and cable solutions.

The United Kingdom is projected to grow at a CAGR of 6.9% through 2035, with steady growth driven by the continued demand for energy infrastructure and telecommunications cables. The shift towards renewable energy, along with government commitments to reduce carbon emissions, is driving investment in energy grids and power distribution systems, contributing to the increased demand for cables. Additionally, the UK’s expanding focus on electric mobility and green technologies is driving the need for cables in the automotive and infrastructure sectors. As the country strengthens its energy security and invests in sustainable infrastructure, the wire and cable market will continue to benefit from these trends.

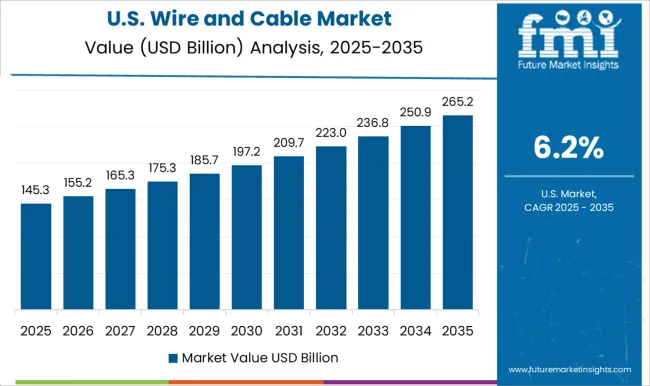

The United States is projected to grow at a CAGR of 6.2% through 2035, driven by strong demand for wires and cables in infrastructure development, renewable energy projects, and telecommunications. The USA is investing heavily in modernizing its power grid and expanding energy distribution systems, creating substantial demand for power cables. The increasing adoption of electric vehicles and the growing construction of EV charging stations further contribute to the market's growth. The demand for high-performance cables in commercial, industrial, and residential buildings, along with the integration of smart technologies in infrastructure, will continue to support growth in the USA

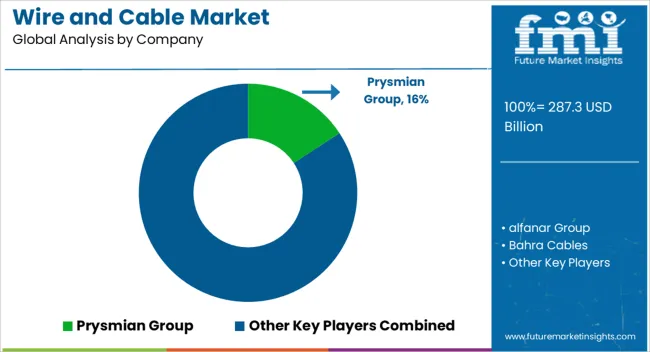

In the wire and cable market, competition centers on quality, production capacity, regional expansion, and product diversification. Prysmian Group and Nexans lead with global reach, offering a wide range of products from low-voltage cables to high-performance solutions for power, telecommunications, and industrial applications.

Strategy in the market is driven by technological advancements, regional partnerships, and product specialization. Brugg Kabel AG and HELUKABEL are differentiating through their focus on high-end industrial cables, emphasizing customizations for specific industries like automation, robotics, and renewable energy.

Product brochures from these companies showcase their diverse solutions. Prysmian highlights cables for energy transmission, smart grids, and fiber optics. Nexans emphasizes renewable energy cables and industrial solutions. alfanar and Elsewedy Electric promote power and industrial cables, while Ducab and Riyadh Cables highlight products for heavy-duty industrial use and energy infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product | Power Cables, Coaxial Cables/Electronic Wires, Fiber Optics Cables, Signal & Control Cable, and Telecom & Data Cables |

| Voltage | Low, Medium, and High |

| Application | Utilities, Food & beverages, Automotive, Material handling/logistics, Entertainment/leisure, Railways, Consumer electronics, Building infrastructure, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Prysmian Group, alfanar Group, Bahra Cables, BELDEN, Brugg Kabel AG, Ducab, Elsewedy Electric, Federal Cables, Fujikura, HELUKABEL MiddleEast, Jeddah Cables, KEI Industries, Midal Cables, Naficon, Nexans, NIBE Industrier AB, NKT A/S, Power Plus Cables, Riyadh Cables, Saudi Cable Company, Sumitomo Electric Industries, and ZTT |

The global wire and cable market is estimated to be valued at USD 287.3 billion in 2025.

The market size for the wire and cable market is projected to reach USD 581.3 billion by 2035.

The wire and cable market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in wire and cable market are power cables, coaxial cables/electronic wires, fiber optics cables, signal & control cable and telecom & data cables.

In terms of voltage, low segment to command 41.7% share in the wire and cable market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wire and Cable Management Market Forecast Outlook 2025 to 2035

Industry Share Analysis for Wire and Cable Plastics Companies

Wire Compounds and Cable Compounds Market Growth - Trends & Forecast 2025 to 2035

Aircraft Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Insulated Wires & Cables Market Growth – Trends & Forecast 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Commercial Wire And Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Wire And Cable Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Wireless EEG Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Wireless Refrigerant Charging Scale Market Size and Share Forecast Outlook 2025 to 2035

Wireless Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Wireless HDMI Transmitter and Receiver Market Size and Share Forecast Outlook 2025 to 2035

Wire Harness Tape Market Forecast and Outlook 2025 to 2035

Cable Line Fault Indicator Market Size and Share Forecast Outlook 2025 to 2035

Cable Tray Market Size and Share Forecast Outlook 2025 to 2035

Cable Granulator Market Size and Share Forecast Outlook 2025 to 2035

Wire Rope Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Cable Distribution Cabinets Market Size and Share Forecast Outlook 2025 to 2035

Wireless Access Point Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA