The Commercial Wire And Cable Market is estimated to be valued at USD 108.2 billion in 2025 and is projected to reach USD 220.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period. The commercial wire and cable market is projected to generate an absolute gain of USD 112.6 billion and a growth multiplier of 2.04x over the decade. Supported by a CAGR of 7.4%, this growth is driven by increasing demand for high-performance wires and cables in various sectors, including telecommunications, energy, and construction.

During the first five years (2025-2030), the market will expand from USD 108.2 billion to USD 154.5 billion, adding USD 46.3 billion, which accounts for 41.2% of the total incremental growth, with a 5-year multiplier of 1.43x. The second phase (2030-2035) will contribute USD 66.3 billion, representing 58.8% of the total growth, reflecting stronger momentum due to ongoing urbanization, infrastructural development, and the expansion of 5G, electric vehicles, and renewable energy systems.

Annual increments rise from USD 3.8 billion in early years to USD 6.3 billion by 2035, signaling accelerated growth driven by technological advancements and infrastructure upgrades. Manufacturers focusing on energy-efficient, sustainable, and high-performance wire and cable solutions will capture the largest share of this USD 112.6 billion opportunity.

| Metric | Value |

|---|---|

| Commercial Wire And Cable Market Estimated Value in (2025 E) | USD 108.2 billion |

| Commercial Wire And Cable Market Forecast Value in (2035 F) | USD 220.8 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The commercial wire and cable market is experiencing steady growth driven by expanding industrial automation, infrastructure modernization, and digital connectivity requirements. Increasing reliance on connected systems in commercial and industrial environments is elevating the demand for high performance cables that ensure uninterrupted power and data transmission.

Developments in smart logistics, facility management, and building automation have further heightened the need for reliable and efficient cabling solutions. Regulatory emphasis on energy efficiency and fire safety standards is also pushing manufacturers to innovate in insulation materials and cable design.

As businesses scale up their operational footprints, investment in advanced cabling infrastructure continues to grow, positioning the market for sustained momentum across key industrial corridors.

The commercial wire and cable market is segmented by product, voltage, application, and geographic regions. By product, the commercial wire and cable market is segmented into Coaxial Cables/Electronic Wires, Fiber Optic Cables, Signal & Control Cables, Telecom & Data Cables, and Others. In terms of voltage, the commercial wire and cable market is classified into Low Voltage and Medium Voltage.

Based on application, the commercial wire and cable market is segmented into Material Handling/Logistics, Entertainment/Leisure, Consumer Electronics, Building Infrastructure, and Others. Regionally, the commercial wire and cable industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The coaxial cables and electronic wires segment is expected to contribute 48.60% of the total market revenue by 2025, making it the dominant segment under the product category. This growth is attributed to the increasing deployment of data and signal transmission infrastructure across commercial facilities.

These cable types are valued for their shielding capabilities, signal integrity, and adaptability in both communication and control systems. Their extensive use in security systems, data centers, and control equipment supports broad applicability in modern commercial operations.

The consistent need for stable connectivity and real-time communication has reinforced the adoption of coaxial and electronic wire formats, allowing them to lead in the product segment.

The low voltage segment is projected to account for 56.30% of the overall market revenue by 2025 within the voltage category, making it the most significant segment. The widespread use of low-voltage cables in commercial lighting, building management systems, and low-power machinery is a key factor driving this growth.

These cables offer high flexibility, ease of installation, and compliance with safety standards which are critical for commercial use cases. As energy-efficient systems and smart building solutions become more mainstream, low-voltage cabling continues to gain traction due to its reliability and adaptability.

The segment’s strength lies in its capacity to support operational efficiency without compromising safety or cost control.

The material handling and logistics segment is anticipated to hold 41.70% of the total market revenue by 2025 under the application category, making it the leading segment. Growth in this area is being propelled by increased automation in warehouses, distribution centers, and industrial transport systems.

Commercial wire and cable solutions are integral to powering conveyor belts, automated guided vehicles, robotic arms, and inventory tracking systems. The emphasis on real-time operations, reduced manual intervention, and higher throughput has intensified the need for robust cabling infrastructure in logistics operations.

As supply chain modernization accelerates across regions, the material handling and logistics segment continues to lead demand in the commercial wire and cable market.

The commercial wire and cable market is propelled by the increasing demand for electrical infrastructure in the commercial sector, with substantial opportunities arising from the expansion of renewable energy and power sectors. Emerging trends in smart wiring solutions and energy efficiency are reshaping the market. However, challenges like fluctuating raw material prices and supply chain disruptions continue to pose risks. By 2025, overcoming these obstacles will be vital for ensuring continued growth and a steady supply of commercial wire and cable products to meet rising demand.

The commercial wire and cable market is driven by the rising demand for electrical infrastructure in various commercial sectors, including office buildings, industrial complexes, and retail establishments. As construction projects increase and existing buildings undergo renovations, the need for reliable wiring and cabling solutions is growing. Wire and cables are essential for electrical distribution, lighting systems, and communication networks. By 2025, the market is expected to continue its upward trajectory due to the expansion of commercial real estate and infrastructure projects in emerging regions.

Opportunities in the commercial wire and cable market are increasing with the expansion of renewable energy and power sectors. As the global shift toward renewable energy accelerates, the demand for efficient electrical systems to support wind, solar, and hydropower projects is rising. Commercial buildings and facilities are increasingly adopting energy-efficient solutions, requiring advanced wiring and cabling systems to support renewable energy sources. By 2025, the growth of clean energy installations, along with the need to modernize the power grid, will significantly boost demand for commercial wire and cable products.

Emerging trends in the commercial wire and cable market include the adoption of smart wiring solutions aimed at enhancing energy efficiency. With the growing demand for automation and integrated building systems, smart wiring is becoming a critical element in commercial buildings. These wiring solutions enable the optimization of energy use, improved safety, and easier maintenance. By 2025, the market will see increased investment in smart cables and integrated solutions that align with the push for energy-efficient and automated commercial infrastructures.

Despite growth, the commercial wire and cable market faces challenges from fluctuating raw material prices and supply chain disruptions. The cost of materials such as copper, aluminum, and plastic can vary significantly, impacting production costs and product pricing. Additionally, supply chain disruptions, including delays and shortages of key materials, can hinder the timely delivery of wire and cable products. By 2025, addressing these challenges through diversified sourcing strategies and more resilient supply chains will be crucial for sustaining growth and meeting market demand.

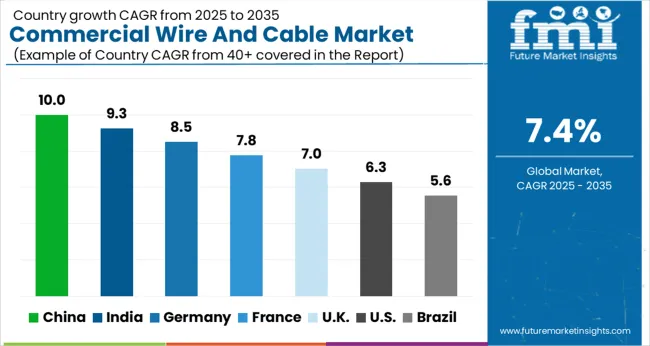

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

The global commercial wire and cable market is projected to grow at a 7.4% CAGR from 2025 to 2035. China leads with a growth rate of 10%, followed by India at 9.3%, and France at 7.8%. The United Kingdom records a growth rate of 7%, while the United States shows the slowest growth at 6.3%. These varying growth rates are driven by increasing demand for energy-efficient and high-performance wire and cable solutions in sectors like telecommunications, construction, and energy. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, infrastructure development, and rising urbanization, while more mature markets like the USA and the UK see steady growth driven by technological advancements, sustainability efforts, and the need for reliable and safe infrastructure. This report includes insights on 40+ countries; the top markets are shown here for reference.

The commercial wire and cable market in China is growing rapidly, with a projected CAGR of 10%. China’s expanding industrial base, coupled with a rising demand for high-performance wires and cables in construction, telecommunications, and energy sectors, is driving significant market growth. The country’s investments in infrastructure development, including smart cities and urban expansion, further contribute to the demand for commercial wire and cable solutions. Additionally, China’s focus on energy-efficient solutions and its strong regulatory frameworks promoting sustainable energy infrastructure continue to boost the market for advanced wire and cable technologies.

The commercial wire and cable market in India is projected to grow at a CAGR of 9.3%. India’s rapid urbanization, infrastructure development, and increasing demand for energy-efficient solutions are key drivers of market growth. The expanding construction and telecommunications sectors, along with growing investments in power generation and distribution infrastructure, continue to boost the demand for high-quality commercial wire and cable products. The government’s focus on renewable energy projects and the expansion of smart grid systems further accelerates the adoption of commercial wire and cable technologies, contributing to the market’s expansion.

The commercial wire and cable market in France is projected to grow at a CAGR of 7.8%. France’s demand for wire and cable products is driven by the growing need for energy-efficient solutions, smart infrastructure, and renewable energy projects. The country’s strong regulatory focus on sustainability and environmental impact, particularly in the energy and construction sectors, accelerates the adoption of advanced commercial wire and cable technologies. Additionally, the ongoing modernization of the country’s electrical grids, along with the push for smart cities, further supports market expansion. The increasing demand for telecom infrastructure and the rising number of construction projects contribute to steady market growth.

The commercial wire and cable market in the United Kingdom is projected to grow at a CAGR of 7%. The UK increasing focus on sustainable infrastructure, energy efficiency, and telecommunications growth is driving demand for commercial wire and cable solutions. The country’s strong regulatory framework for environmental protection, coupled with investments in renewable energy and the electrification of transportation, further supports the adoption of wire and cable technologies. The UK market also benefits from the growing trend of smart homes, energy-efficient buildings, and advancements in construction techniques, all of which contribute to the steady demand for commercial wire and cable products.

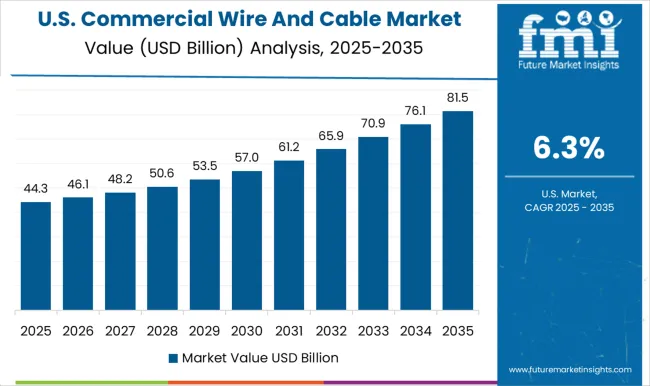

The commercial wire and cable market in the United States is expected to grow at a CAGR of 6.3%. The USA market is driven by increasing demand for reliable and high-performance wire and cable solutions in sectors such as energy, telecommunications, and construction. The country’s focus on modernizing infrastructure, expanding renewable energy projects, and improving energy efficiency continues to contribute to the steady growth of the market. The ongoing shift towards smart cities, smart homes, and the adoption of next-generation communication technologies further accelerates the need for advanced wire and cable products. Additionally, regulatory support for clean energy solutions and sustainability initiatives boosts market demand.

The commercial wire and cable market is dominated by Prysmian Group, which leads with its comprehensive range of high-quality cables used in a variety of applications, including energy distribution, telecommunications, and construction. Prysmian’s dominance is supported by its strong global presence, extensive product portfolio, and commitment to providing reliable and energy-efficient solutions.

Key players such as Belden Inc., Sumitomo Electric Industries, Ltd., and Southwire Company LLC maintain significant market shares by offering durable, flexible, and innovative wire and cable products designed to meet the growing demand for industrial automation, infrastructure development, and energy transmission. These companies focus on delivering cost-effective and environmentally sustainable solutions for various commercial sectors. Emerging players like KEI Industries Limited, Polycab, and NKT A/S are expanding their market presence by offering specialized wire and cable solutions tailored for niche applications such as high-voltage transmission, renewable energy projects, and smart buildings. Their strategies include enhancing product durability, improving system efficiency, and focusing on new technologies such as fiber-optic cables and smart grid integration.

Market growth is driven by the increasing demand for advanced electrical systems, the rise in infrastructure projects, and the growing focus on renewable energy sources. Innovations in cable design, energy-efficient solutions, and smart monitoring systems are expected to continue shaping the competitive landscape and drive further growth in the global commercial wire and cable market.

| Item | Value |

|---|---|

| Quantitative Units | USD 108.2 Billion |

| Product | Coaxial Cables/Electronic Wires, Fiber Optics Cables, Signal & Control Cable, Telecom & Data Cables, and Others |

| Voltage | Low Voltage and Medium Voltage |

| Application | Material Handling/Logistics, Entertainment/Leisure, Consumer Electronics, Building Infrastructure, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bergen Cable Technology, Belden Inc., FURUKAWA ELECTRIC CO., LTD., Havell India Ltd., KEI Industries Limited, Klaus Faber AG, LS Cables, Leoni Cables, NKT A/S, Polycab, Prysmian Group, RR Kabel, Riyadh Cables, Sumitomo Electric Industries, Ltd., Southwire Company LLC, Top Cables, Thermo Cables, and ZM Cables |

| Additional Attributes | Dollar sales by wire and cable type and application, demand dynamics across construction, telecommunications, and industrial sectors, regional trends in commercial wire and cable adoption, innovation in energy-efficient and high-performance materials, impact of regulatory standards on safety and environmental concerns, and emerging use cases in smart grid systems and renewable energy projects. |

The global commercial wire and cable market is estimated to be valued at USD 108.2 billion in 2025.

The market size for the commercial wire and cable market is projected to reach USD 220.8 billion by 2035.

The commercial wire and cable market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in commercial wire and cable market are coaxial cables/electronic wires, fiber optics cables, signal & control cable, telecom & data cables and others.

In terms of voltage, low voltage segment to command 56.3% share in the commercial wire and cable market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA