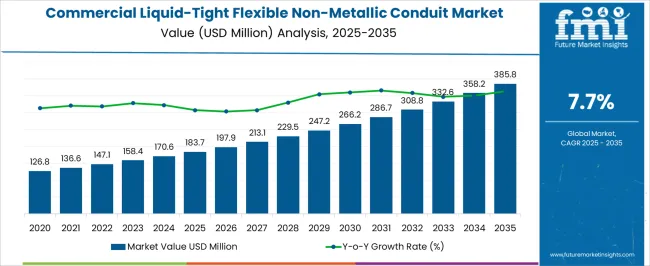

The commercial liquid-tight flexible non-metallic conduit industry is projected to expand from USD 183.7 million in 2025 to USD 385.8 million in 2035, advancing at a CAGR of 7.7%. The absolute dollar opportunity over the decade is estimated at more than USD 200 million, highlighting the rising preference for flexible wiring protection in commercial construction and industrial facilities. Analysts argue that this opportunity reflects increased focus on safety, cost efficiency, and adaptability in electrical infrastructure.

The consistent expansion path shows that buyers value non-metallic conduits for their corrosion resistance, lightweight handling, and installation flexibility across diverse building applications. By 2035, the market is forecasted to nearly double in size, creating significant incremental revenue streams for suppliers and distributors. The absolute dollar opportunity is considered strong evidence of evolving demand, where modern construction projects and retrofits are increasingly adopting liquid-tight conduits for dependable wiring protection. Industry observers note that this expansion favors manufacturers investing in extended product ranges, UL certifications, and regional distribution partnerships. The opportunity is viewed not as cyclical but as structural, with steady gains reinforcing the conduit’s long-term role in commercial safety standards and infrastructure planning. This makes it a category with pronounced growth resilience.

| Metric | Value |

|---|---|

| Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Estimated Value in (2025 E) | USD 183.7 million |

| Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Forecast Value in (2035 F) | USD 385.8 million |

| Forecast CAGR (2025 to 2035) | 7.7% |

The commercial liquid-tight flexible non-metallic conduit segment is estimated to contribute nearly 14% of the electrical conduit market, about 11% of the commercial building wiring market, close to 10% of the cable management systems market, nearly 7% of the construction materials market, and around 6% of the industrial electrical equipment market. Collectively, this equals an aggregated share of approximately 48% across its parent categories.

This proportion underscores the importance of liquid-tight non-metallic conduit as a trusted solution for protecting electrical wiring in environments exposed to moisture, oil, or mechanical stress. Its role has been reinforced in commercial infrastructure projects, where durability, safety, and ease of installation remain decisive procurement factors. Industry analysts regard this conduit type as more than a protective covering, positioning it as an enabler of long-term wiring reliability that reduces maintenance costs and enhances safety compliance. Demand has been shaped by the expansion of office complexes, retail facilities, and institutional projects where electrical systems require flexible and resilient protection. Its integration has also extended into industrial facilities, though its strongest foothold remains within commercial building applications. As a result, commercial liquid-tight flexible non-metallic conduit is viewed as a strategic category that influences specification standards, contractor preferences, and supply chain priorities across the wider electrical and construction ecosystem, ensuring its significant standing within its parent markets.

The market is experiencing strong growth driven by the increasing need for reliable and adaptable electrical wiring protection in commercial and industrial environments. The market is benefiting from rising construction activities, modernization of existing infrastructure, and the integration of advanced electrical systems that require robust conduit solutions.

Demand is being reinforced by the emphasis on safety standards, resistance to moisture and chemicals, and flexibility in installation. The future outlook remains positive as more commercial projects adopt non-metallic liquid-tight conduits to improve efficiency and reduce maintenance costs.

Increasing adoption in sectors such as retail, hospitality, healthcare, and manufacturing is contributing to sustained demand. Advancements in conduit materials that enhance durability and performance are expected to open new opportunities, while the trend toward eco-friendly and easy-to-install solutions continues to influence buyer preferences.

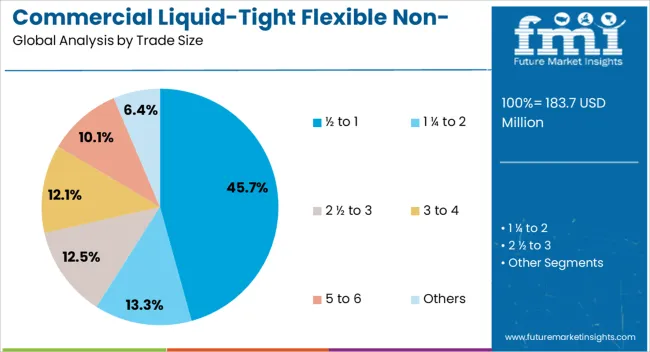

The commercial liquid-tight flexible non-metallic conduit market is segmented by trade size, and geographic regions. By trade size, commercial liquid-tight flexible non-metallic conduit market is divided into ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others. Regionally, the commercial liquid-tight flexible non-metallic conduit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ½ to 1 trade size segment is projected to hold 45.7% of the overall Commercial Liquid-Tight Flexible Non-Metallic Conduit market revenue in 2025, making it the leading size category. This dominance is being driven by its suitability for a wide range of commercial electrical installations, offering the right balance between capacity and ease of handling.

Its versatility in accommodating various wiring types and fitting within tight installation spaces has supported widespread adoption across different commercial settings. The segment’s growth has been reinforced by its compatibility with standard connectors and fittings, allowing efficient integration into existing electrical systems. The ability to provide strong protection against moisture, dust, and mechanical damage while maintaining flexibility has made this trade size highly preferred by contractors and engineers As commercial infrastructure projects continue to expand, the demand for conduit sizes that combine performance, ease of installation, and cost-effectiveness is expected to keep this segment at the forefront of the market.

The commercial liquid-tight flexible non-metallic conduit market is projected to expand as demand grows for safe, adaptable, and cost-effective wiring protection systems. Adoption is being driven by commercial construction, retrofitting projects, and safety regulations across electrical installations. Opportunities are opening through growth in data centers, retail facilities, and industrial complexes requiring flexible conduit systems. Trends emphasize lightweight designs, halogen-free materials, and compatibility with advanced cabling. Challenges such as price sensitivity, competition from metallic conduits, and compliance with varying regional standards continue to shape the direction of the industry.

Demand for commercial liquid-tight flexible non-metallic conduits has been reinforced by expanding commercial construction and increased retrofitting of old buildings. Contractors favor these conduits for their corrosion resistance, ease of installation, and flexibility in routing cables through tight spaces. Opinions suggest that commercial facilities such as shopping malls, office complexes, and hospitals are increasingly adopting non-metallic conduits to ensure safe and reliable electrical wiring. Fire safety and electrical codes have accelerated demand for liquid-tight solutions that provide added protection against moisture and mechanical damage. Retrofitting of older infrastructure, especially in developed regions, has created additional demand for lightweight conduits that are easier to install compared to metallic alternatives. This surge in demand reflects how regulatory compliance, convenience, and adaptability are reinforcing the role of non-metallic conduits in modern commercial projects.

Opportunities in the commercial liquid-tight flexible non-metallic conduit market are being shaped by rapid growth in data centers, retail facilities, and industrial complexes. Data centers, with their extensive cabling requirements, present strong opportunities for conduit suppliers offering scalable and heat-resistant solutions. Retail facilities and hospitality sectors are also adopting conduits for their flexibility in layout modifications and integration with lighting systems. Opinions highlight that the strongest opportunities lie in partnerships with electrical contractors and builders for long-term supply contracts. Expansion in developing regions with rising commercial construction investments is also opening avenues for growth. Customization opportunities, such as conduits designed with halogen-free properties and improved chemical resistance, provide a pathway for differentiation. These opportunities indicate that suppliers who innovate in product features while maintaining compliance are well positioned to capture sustained growth.

Trends in the commercial liquid-tight flexible non-metallic conduit market highlight advancements in safety, material innovation, and installation efficiency. Halogen-free conduits are trending as fire safety standards grow stricter, particularly in high-occupancy commercial buildings. Lightweight and flexible designs are being preferred by contractors seeking faster installations and reduced labor costs. Opinions suggest that compatibility with advanced cabling for smart building systems has become a major trend, reinforcing the need for conduits that protect sensitive wiring. Pre-fabricated conduit assemblies are gaining traction, streamlining installation in large commercial projects. Growth of energy-efficient building designs has also influenced trends, as conduits supporting flexible integration with upgraded electrical systems are increasingly adopted. Collectively, these trends illustrate how product innovation and compliance-driven features are reshaping market demand, positioning liquid-tight non-metallic conduits as indispensable components in modern electrical installations.

Challenges in the commercial liquid-tight flexible non-metallic conduit market revolve around price sensitivity, competition from metallic alternatives, and compliance complexities. Metallic conduits often compete strongly in heavy-duty applications, limiting adoption in certain industrial settings. High sensitivity to raw material prices, particularly plastics and polymers, creates volatility in production costs. Opinions emphasize that regional regulatory variations complicate product standardization, forcing manufacturers to adapt specifications for different markets. Smaller players often face barriers in meeting certification requirements, restricting their competitiveness. Resistance from contractors accustomed to traditional metallic conduits adds further challenges. These factors underscore the structural constraints limiting the broader penetration of non-metallic conduits. Without consistent cost management and stronger awareness campaigns, adoption may remain concentrated in select commercial segments, leaving potential growth opportunities underutilized.

| Countries | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| UK | 7.3% |

| USA | 6.5% |

| Brazil | 5.8% |

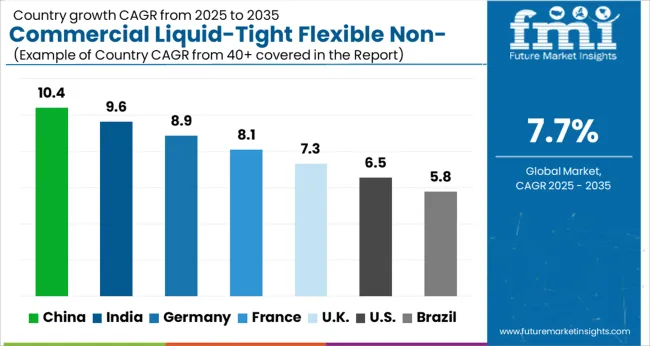

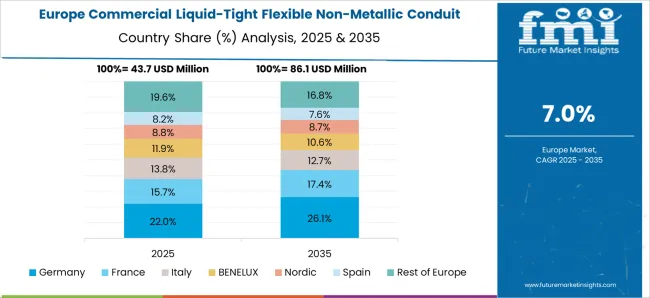

The global commercial liquid tight flexible non metallic conduit market is projected to expand at a CAGR of 7.7% between 2025 and 2035. China leads with 10.4%, followed by India at 9.6% and Germany at 8.9%. The United Kingdom is forecast at 7.3%, while the United States records 6.5%. Growth is shaped by rising demand for safe electrical wiring protection in commercial buildings, infrastructure expansion, and stricter compliance with safety standards. Asian markets register faster adoption due to large scale construction and industrial activity, while European regions emphasize regulatory compliance and premium conduit systems. The USA records slower but steady growth, supported by retrofitting projects, integration with energy efficient buildings, and demand from data centers. This report includes insights on 40+ countries; the top markets are shown here for reference.

The commercial liquid tight flexible non metallic conduit market in China is projected to grow at a CAGR of 10.4%. Expansion is propelled by large scale urban development, rapid construction of commercial facilities, and integration of advanced wiring systems into smart buildings. Domestic manufacturers expand production capacity to serve both domestic and export markets, offering conduits with enhanced flame resistance and durability. Government backed safety regulations reinforce adoption across commercial complexes, healthcare facilities, and educational institutions. With a strong base of construction activity, China secures its leadership in the global market.

The commercial liquid tight flexible non metallic conduit market in India is expected to grow at a CAGR of 9.6%. Growth is influenced by rising demand for safer electrical wiring in urban buildings, industrial parks, and institutional facilities. Government backed infrastructure programs and foreign investment in commercial real estate provide long term expansion opportunities. Domestic manufacturers adopt advanced materials to improve UV and chemical resistance in conduit systems. India’s rapid electrification and demand for organized construction strengthen adoption, making it a key growth driver in the Asia Pacific region.

The commercial liquid tight flexible non metallic conduit market in Germany is projected to grow at a CAGR of 8.9%. Expansion is supported by the country’s strong industrial base, stringent electrical safety regulations, and adoption in high tech facilities. German firms prioritize premium conduit systems that comply with EU fire safety and performance standards. Demand is reinforced by growth in data centers, healthcare facilities, and automotive manufacturing plants. Technological collaborations and emphasis on quality certifications ensure continued leadership in the European market.

The commercial liquid tight flexible non metallic conduit market in the UK is expected to expand at a CAGR of 7.3%. Growth is driven by demand for safer electrical systems in commercial refurbishments and public infrastructure upgrades. Adoption of conduits is reinforced by regulatory compliance, particularly in fire safety and wiring protection standards. Demand also rises from commercial retail complexes, hospitality projects, and educational institutions. Imports play a significant role in supply, with distributors focusing on certified high performance conduits. Though moderate compared to Asia, steady modernization of infrastructure supports consistent growth.

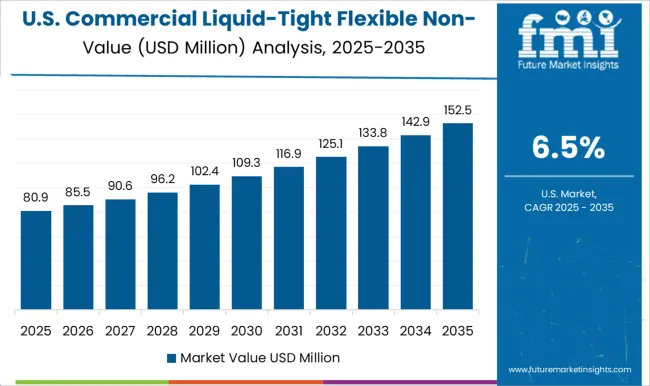

The commercial liquid tight flexible non metallic conduit market in the US is projected to grow at a CAGR of 6.5%. Market growth is steady, reflecting maturity but supported by retrofitting of commercial buildings and rising demand from data centers. Emphasis on energy efficient buildings and compliance with NEC standards encourages adoption of liquid tight conduits for wiring safety. OEMs focus on material innovation, such as halogen free and recyclable compounds, to enhance product positioning. While the USA grows slower than Asia and Europe, its market remains significant due to consistent infrastructure upgrades and commercial modernization.

Leading manufacturers are adopting multiple strategic initiatives to strengthen their market position and meet the rising demand for flexible, durable wiring solutions. Companies are focusing on product innovation, developing conduits with enhanced flexibility, corrosion resistance, and flame-retardant properties to address the evolving requirements of industrial and commercial installations.

Geographic expansion into emerging markets, particularly in regions with rapid urbanization and infrastructure growth, allows firms to tap into new customer bases and increase market share. Strategic partnerships and collaborations with construction companies, electrical contractors, and distributors are leveraged to expand distribution networks and ensure widespread product availability. Additionally, adherence to industry standards and safety regulations ensures that products meet quality and compliance requirements, building trust with customers and regulators.

| Item | Value |

|---|---|

| Quantitative Units | USD 183.7 Million |

| Trade Size | ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Eaton, ABB, Atkore, Anamet Electrical, Inc., Dura-Line Corporation, Electri-Flex Company, Hangzhou EVT Electrical Co., Ltd., Hangzhou Topele Imp. & Exp. Co.,Ltd, Hubbell, IPEX USA LLC., Kaiphone Technology Co. Ltd., Legrand, Shanghai Weyer Electric Co., Ltd., Southwire Company, LLC., Techno Flex, Thomas & Betts Corporation, and Zhejiang Flexible Technology Co., Ltd. |

| Additional Attributes | Dollar sales by conduit type (PVC, polypropylene, polyurethane), Dollar sales by application (commercial buildings, data centers, healthcare facilities, retail outlets), Trends in flexible wiring protection for high-moisture and corrosive environments, Role of conduits in meeting electrical safety codes and fire resistance standards, Growth in demand from retrofit projects and smart building infrastructure, Regional installation patterns across North America, Europe, and Asia Pacific. |

The global commercial liquid-tight flexible non-metallic conduit market is estimated to be valued at USD 183.7 million in 2025.

The market size for the commercial liquid-tight flexible non-metallic conduit market is projected to reach USD 385.8 million by 2035.

The commercial liquid-tight flexible non-metallic conduit market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in commercial liquid-tight flexible non-metallic conduit market are ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of , segment to command 0.0% share in the commercial liquid-tight flexible non-metallic conduit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA