The global wire compounds and cable compounds market is poised for steady growth as industries increasingly rely on high-performance materials to meet rising demands for reliable, durable, and efficient cabling solutions. These compounds, which include materials like PVC, XLPE, and EPDM, are critical for insulation, jacketing, and sheathing in a wide range of applications, from power transmission and telecommunications to automotive wiring and industrial automation.

As the global economy becomes more electrified and connected, the need for advanced wire and cable compounds that ensure safety, flexibility, and long service life is driving the market. Furthermore, the shift toward renewable energy projects, electric vehicles, and smart infrastructure is spurring innovation in low-smoke, halogen-free, and recyclable compound formulations, further supporting growth through 2035.

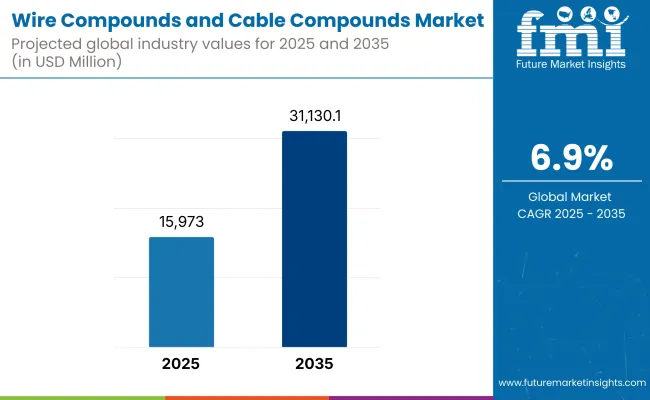

In 2025, the global wire compounds and cable compounds market was estimated at approximately USD 15,973 Million. By 2035, it is projected to grow to around USD 31,130.1 Million, reflecting a compound annual growth rate (CAGR) of 6.9%.

The North American region holds a major wire and cable compounds market share, owing to matured energy infrastructure, burgeoning adoption of renewable energy projects and substantial demand for high-performance commodities in industrial and automotive applications. Investments in smart grids and electric vehicle charging networks in both the United States and Canada are on the rise, which further necessitate advanced compounds that guarantee durability, dependability, and environmental compatibility.

Another important market is Europe, which has stringent environmental regulations, focus on sustainability and a solid manufacturing infrastructure. Germany, France, and the United Kingdom are leading the pack, as they are the most proactive adopters of halogen-free and low-smoke compounds, especially in applications with a high demand for safety standards. Continued efforts in the region on renewable energy integration, electric mobility, and efficient data transmission infrastructure, leads to a stable demand for wire and cable compounds.

The wire & cable compounds market is anticipated to witness sound pillar growth rate majorly fueled via way of means of the fastest-developing Asia-Pacific market, boasting speedy urbanization, swiftly-developing commercial sectors & rising investments in renewable power & telecommunications infrastructure.

CRU is expecting the largest growth in demand from the power utilities but also from automotive manufacturing sector and electronics industries in countries like Japan, China, and India. Asia-Pacific is expected to act as a potential enabler of global market growth due to improving infrastructure and growing adoption of sustainable and high-performance compounds in this region.

Fluctuating Raw Material Prices, Regulatory Compliance, and Environmental Concerns

Prices of raw materials such as polyvinyl chloride (PVC), polyethylene (PE), and thermoplastic elastomers (TPE) [, among others used in wire and cable compounds, are predominantly sourced from petrochemicals, following the prices of crude oil. As stringent safety standards require manufacturers to produce low-smoke, halogen-free, flame-retardant and recyclable compounds, regulatory compliance is another major challenge for the market which increases the production cost from the high cost of biodegradable raw materials and processing.

Moreover, environmental issues such as plastic waste, non-biodegradable insulation materials, and high energy consumption in wire manufacturing are urging manufacturers to use sustainable and bio-based cable compounds, which also adds a layer of complexity to supply chain logistics.

Growth in EV Charging Infrastructure, Renewable Energy Expansion, and Smart Cable Materials

However, the wire and cable compounds market is expected to witness significant growth opportunities due to the growing development of electric vehicle (EV) charging networks, development of renewable energy projects, and smart material innovations. The global transition to electrification in transportation as well as modernization of smart grid is driving demand for high-performance, weather-resistant and heat-resistant cable compounds in EV charging stations, wind farms, and solar power plants.

AI powered predictive maintenance, and Nanotech based self-healing cable insulators are also being explored to develop longer-lasting cables in the domains of telecom, aerospace, industrial automated systems and similar areas. Moreover, the demand for halogen-free, biodegradable, and recyclable insulation materials encourages the use of environmentally friendly cable compounds in accordance with worldwide sustainability objectives.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with RoHS, REACH, UL, and IEC safety standards for flame-retardant, low-smoke cable compounds. |

| Consumer Trends | Demand for low-smoke, halogen-free, and fire-resistant cable compounds in industrial and residential applications. |

| Industry Adoption | High use in power transmission, automotive wiring, and telecommunication cables. |

| Supply Chain and Sourcing | Dependence on petrochemical-based polymers such as PVC, PE, and cross-linked polyethylene (XLPE). |

| Market Competition | Dominated by cable compound manufacturers, polymer producers, and electrical component suppliers. |

| Market Growth Drivers | Growth fueled by urbanization, smart city projects, and high-speed data transmission demands. |

| Sustainability and Environmental Impact | Moderate adoption of recyclable insulation materials and eco-friendly manufacturing processes. |

| Integration of Smart Technologies | Early adoption of self-monitoring cables, AI-based cable failure prediction, and IoT-enabled transmission lines. |

| Advancements in Cable Compound Materials | Development of low-smoke, flame-retardant, and UV-resistant polymer compounds. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter carbon-neutral cable production mandates, AI-driven material safety tracking, and global sustainability laws. |

| Consumer Trends | Growth in smart cable materials, AI-powered fault detection, and high-durability polymer-based insulation. |

| Industry Adoption | Expansion into AI-optimized smart grids, self-repairing cable coatings, and 6G-ready fiber optic cable insulation. |

| Supply Chain and Sourcing | Shift toward biodegradable, recyclable, and AI-optimized material sourcing for sustainable cable compounds. |

| Market Competition | Entry of AI-driven polymer chemistry firms, sustainable cable material startups, and next-gen nanocomposite insulation developers. |

| Market Growth Drivers | Accelerated by EV infrastructure expansion, AI-assisted grid maintenance, and nanotechnology-enhanced power cables. |

| Sustainability and Environmental Impact | Large-scale shift toward fully biodegradable wire insulation, zero-emission cable production, and AI-driven waste reduction in wire manufacturing. |

| Integration of Smart Technologies | Expansion into AI-driven real-time fault detection, blockchain-based supply chain transparency, and smart-grid-ready insulation materials. |

| Advancements in Cable Compound Materials | Evolution toward self-healing insulation coatings, conductive polymer-based shielding, and ultra-lightweight nanocomposite wiring solutions. |

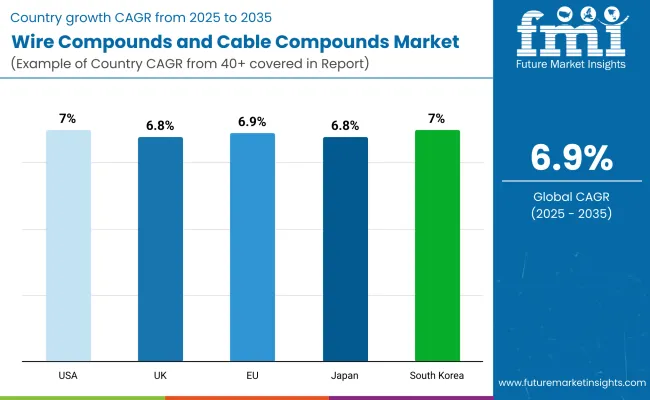

The market for wire compounds and cable compounds in the USA is expanding globally, driven by rising demand from the end-user industries such as power transmission, automotive, and telecommunication. Market growth is driven by the increased deployment of smart grid technology, renewable energy infrastructure, and electric vehicles (EVs). Moreover, the transition from halogen to less hazardous materials is bolstered by technical developments in flame-retardant and halogen-free compounds.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.0% |

The United Kingdom market for wire compounds and cable compounds is also witnessing growth due to increasing investments in fiber optic communication, offshore wind farms and green energy infrastructure. Increasing adoption of low-smoke and zero-halogen (LSZH) compounds for flame-resistive cabling is expected to fuel market demand. Moreover, government programs encouraging the use of sustainable and recyclable wire materials also drive the wire market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

The wire compounds and cable compounds market in the European Union is experiencing steady growth as industries move toward the use of high-performance polymer-based cable insulation and sheathing materials. Growing demand for disparate cables to support electric vehicle charging infrastructure, 5G telecom deployments, and solar and wind power transmission are driving demand. Moreover, the expansion of the market also is boosted by EU regulations, which are focused on fire safety and environmental-friendly wire compounds.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.9% |

The Japan market for wire compounds and cable compounds is expected to dominate the demand of wire and cable compounds in various end use industries and the market is growing with a moderate rate owing to wide use of high-voltage cable insulation technology, miniaturization of electronic wiring and automotive lightweight materials. Hence the necessity for wire coatings that are resistant to high temperatures and corrosion is increasing. Government policies promoting next-generation mobility and 6G communication networks are also guiding that so-called use case.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.8% |

In South Korea, demand from semiconductor manufacturing, EV battery systems, and 5G infrastructure projects is spurring growth in the Wire Compounds and Cable Compounds market. Market growth is driven by the replacement of conventional cables with halogen-free, weather-resistant, conventional cable compounds for smart cities and intelligent transportation systems. Moreover, government initiatives in support of environmentally-safe polymers' production for use in wire coatings, provide boost to industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.0% |

The wire compounds & cable compounds market is expected to witness steady growth as the industries need high-performance, fire-retardant, and durable insulation materials to use for power transmission, building & construction, telecommunication, and automotive applications. These additives improve electrical conductivity, insulation, and mechanical properties, thereby making them appropriate for the efficient and safe manufacturing of cables.

Manufacturers are shifting to flame-retardant, green, and high-temperature-resistant wire and cable compounds due to the growth of the renewable energy sector, demand for smart grids, and the development of urban infrastructure. The market is divided as per Type (Halogenated Polymers, Non-Halogenated Polymers, etc.) and End-Use (Construction, Power, Communications, Automotive, Others).

The Non-Halogenated Polymers segment is the largest segment due to the global trend towards low-smoke and fire-resistant insulation materials driving growth in the industry. Examples are non-halogenated compounds such as polyolefins, thermoplastic elastomers, silicones, etc which have shown better flame retardancy, toxicity, and sustainability than existing halogenated alternatives.

Tightening ignore standards, growing awareness of toxic emissions, and increased in demand for recyclable wire insulation materials, compel manufacturers to invest in non-halogenated compounds exhibiting improved dielectric strength, heat resistance, and permanence. These materials find use in renewable energy transmission, smart buildings, and next-generation electric vehicle (EV) wiring systems.

The Halogenated Polymers segment is experiencing considerable demand, especially across industrial and heavy-duty power cable applications. Halogenated compounds such as polyvinyl chloride (PVC) and fluoropolymers exhibit high thermal stability, moisture resistance, and very good insulating properties, making them well-suited for power transmission applications in high-voltage and underground lines.

Due to the advancements in PVC formulations, expanding usage of fluoropolymer-based insulation in harsh environments, and under the tracks for long-lasting industrial power cables, the demand for halogenated wire compounds continues in certain high-performance applications.

Based on application, the wire compounds and cable compounds market are segmented into Telecom, Automotive, and Power, its largest segment because of the efficient electricity transmission, distribution, and grid stability requires high-quality insulation materials. The increasing integration of renewable energy resources, expanding smart grids, and powering working, cables compound with high-performance, fire-resistance, and durability properties are increasingly in the needs.

The market has observed increased investments in energy infrastructure projects, greater emphasis on generally accepted energy efficiency practices, and regulatory mandates for fire-safe wiring solutions, prompting manufacturers to focus on next generation cable insulation solutions for power generation, transmission and distribution networks.

Additionally, we see significant demand for demand in the Communication segment further accelerated by the entry of fiber-optic networks, 5G infrastructure, & high-speed broadband connectivity. On the other hand, use of advanced wire and cable compounds helps to maintain optimum signal integrity, improve shielding against electromagnetic interference (EMI), and thereby increasing long-term durability, thus making them a vital part for telecom and data transmission.

Developments such as the rising use of fiber-optic cables, rising deployment of IoT-enabled connectivity solutions, and growing need for high-bandwidth communication networks are spurring demand for advanced, lightweight, and flame-retardant cable insulation solutions across the telecoms industry.

The growth factor of these wire compounds and cable compounds in the market is primarily due to the increasing need for high-performance electrical insulation materials, flame retardant properties, and desirable conductivity in some sectors such as power, automobile, telecommunications, and industrial.

The increasing use of AI-driven material formulation, sustainability programs for cable manufacture, and the burgeoning infrastructure to match the pace of renewable generation are driving growth. The functionalities in cable management systems evolve through HFFR compounds, XLPE, and AI-enabled polymer formulation.

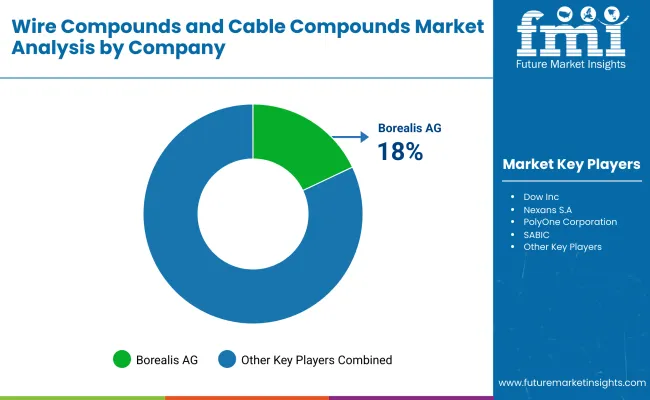

Market Share Analysis by Key Players & Wire & Cable Compound Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Borealis AG | 18-22% |

| Dow Inc. | 12-16% |

| Nexans S.A. | 10-14% |

| PolyOne Corporation | 8-12% |

| SABIC (Saudi Basic Industries Corporation) | 5-9% |

| Other Wire & Cable Compound Manufacturers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Borealis AG | Develops AI-optimized XLPE insulation, halogen-free flame-retardant (HFFR) compounds, and advanced polyolefins for power cables. |

| Dow Inc. | Specializes in thermoplastic elastomer (TPE) compounds, AI-assisted insulation material innovation, and low-smoke zero-halogen (LSZH) formulations. |

| Nexans S.A. | Provides high-performance polymeric compounds for energy cables, AI-enhanced material efficiency, and sustainable cable solutions. |

| PolyOne Corporation | Focuses on customized thermoplastic compounds, AI-powered flame-retardant materials, and electrical insulation coatings. |

| SABIC (Saudi Basic Industries Corporation) | Offers AI-driven polymer compound development, sustainable cable sheathing solutions, and high-voltage insulation materials. |

Key Market Insights

Borealis AG (18-22%)

Borealis leads the wire compounds and cable compounds market, offering AI-powered XLPE insulation, flame-retardant polymer compounds, and sustainable energy cable solutions.

Dow Inc. (12-16%)

Dow specializes in thermoplastic elastomers and LSZH compounds, ensuring AI-enhanced insulation material innovation and environmental compliance.

Nexans S.A. (10-14%)

Nexans provides polymeric compounds for power and telecom cables, optimizing AI-driven material efficiency and performance enhancements.

PolyOne Corporation (8-12%)

PolyOne focuses on custom thermoplastic cable compounds, integrating AI-assisted fire-resistant material advancements and high-performance insulation.

SABIC (5-9%)

SABIC develops AI-driven polymer formulations for cable sheathing and high-voltage applications, ensuring low environmental impact and superior material durability.

Other Key Players (30-40% Combined)

Several polymer manufacturers, specialty chemical firms, and cable technology companies contribute to next-generation wire and cable compound innovations, AI-powered material advancements, and sustainable insulation solutions. These include:

The overall market size for the wire compounds and cable compounds market was USD 15,973 Million in 2025.

The wire compounds and cable compounds market is expected to reach USD 31,130.1 Million in 2035.

Growth is driven by the rising demand for power transmission infrastructure, increasing use in automotive and industrial applications, advancements in insulation and jacketing materials, and expanding adoption of renewable energy projects.

The top 5 countries driving the development of the wire compounds and cable compounds market are the U.S., China, Germany, Japan, and India.

Non-Halogenated Polymers and Power Sector are expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wire Insulation & Jacketing Compounds Market

Compounds Market Size and Share Forecast Outlook 2025 to 2035

Wire and Cable Management Market Forecast Outlook 2025 to 2035

Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Wire and Cable Plastics Companies

Flavor Compounds Market Size and Share Forecast Outlook 2025 to 2035

Purging Compounds Market

Platinum Compounds Market Size and Share Forecast Outlook 2025 to 2035

Bioactive Compounds In Coffee Market

Anti-seize Compounds Market Size & Growth 2025 to 2035

Bulk Molding Compounds Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Insulated Wires & Cables Market Growth – Trends & Forecast 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Commercial Wire And Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Wire And Cable Market Size and Share Forecast Outlook 2025 to 2035

Chemical Hardener Compounds Market Size and Share Forecast Outlook 2025 to 2035

Medium Voltage Wire and Cable Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Flavoring Compounds Market Size and Share Forecast Outlook 2025 to 2035

Quaternary Ammonium Compounds Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA