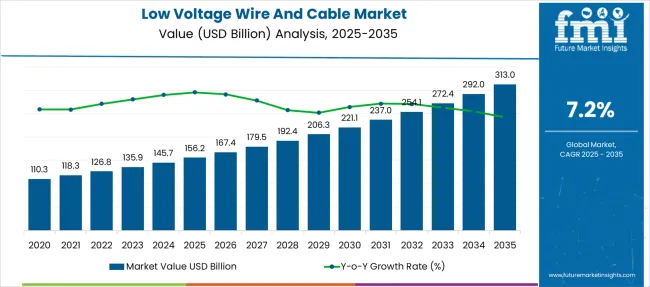

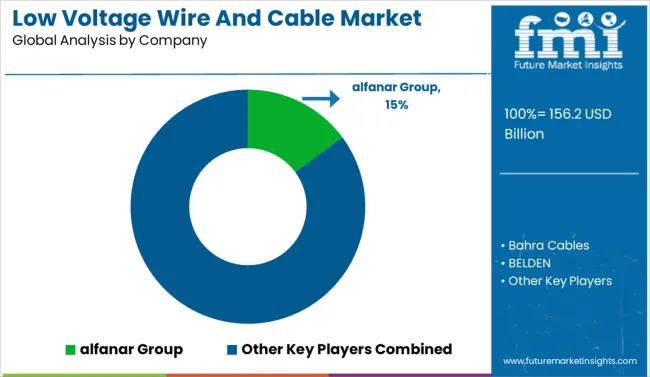

The Low Voltage Wire And Cable Market is estimated to be valued at USD 156.2 billion in 2025 and is projected to reach USD 313.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period. Based on the 5-year growth block analysis, the low voltage wire and cable market shows consistent and strengthening growth across each block. From 2020 to 2025, the market grew from 110.3 billion to 156.2 billion USD, an increase of 45.9 billion. The next block from 2025 to 2030 adds 64.9 billion USD, reaching 221.1 billion.

The final block from 2030 to 2035 experiences the sharpest increase, rising by 91.9 billion USD to reach 313.0 billion. This acceleration across blocks indicates growing demand and investment in the sector, especially beyond 2030, possibly driven by increasing electrification, infrastructure expansion, and renewable energy integration.

Analyzing the acceleration and deceleration pattern, the year-on-year growth rate begins to climb from 2025, peaking around 2027, and then gradually declines after 2028. There is a slight rebound in growth rate around 2031 and 2032, followed by a continued downward trend through 2035. This suggests an early phase of rapid growth transitioning into a more stable, mature phase. The market is still expanding in absolute terms. The pace of growth is slowing in later years, indicating a shift from high-growth to steady-growth dynamics that typically characterize a maturing industry.

| Metric | Value |

|---|---|

| Low Voltage Wire And Cable Market Estimated Value in (2025 E) | USD 156.2 billion |

| Low Voltage Wire And Cable Market Forecast Value in (2035 F) | USD 313.0 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The low voltage wire and cable market accounts for about 18 to 20% of the overall electrical equipment and components market, as wiring is essential for all electrical installations across industries. Within the massive construction and infrastructure market, low voltage wiring represents roughly 2 to 3% of total construction costs, translating to around 25 to 30% of the electrical materials used in buildings and infrastructure projects.

In the renewable energy market, low voltage cables make up about 10 to 15% of the total value, given their importance in connecting solar panels, wind turbines, and energy storage systems. In the automotive and electric vehicle market, low voltage wiring harnesses currently represent around 8 to 10% of the market’s value, with this share expected to rise as electric vehicle adoption accelerates.

Rising automation in manufacturing, growing digital infrastructure, and the integration of smart systems have amplified the need for robust low voltage cabling solutions. Emphasis on energy efficiency, safety compliance, and compact design has encouraged the adoption of high-quality insulation and durable conductor materials. The market outlook remains optimistic as governments worldwide continue investing in infrastructure upgrades, particularly in urban power distribution and factory automation.

Additionally, ongoing developments in renewable energy systems and EV charging infrastructure are expected to further reinforce the need for dependable low voltage wiring. As industries shift toward Industry 4.0 and smart facility models, the role of advanced low voltage cables in maintaining operational stability and minimizing downtime will continue to drive consistent growth.

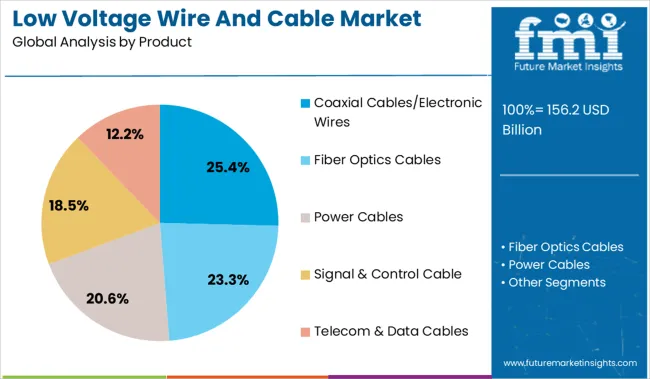

The coaxial cables/electronic wires segment holds a 25.4% share within the product category, supported by their essential function in signal transmission and data connectivity across low voltage environments. These cables are widely used in electronic systems, telecommunications, surveillance, and entertainment networks due to their reliability and interference resistance.

As industries and commercial facilities invest in digital infrastructure and automated control systems, demand for coaxial and electronic wires has seen sustained growth. The segment has also benefited from advancements in shielding technology and miniaturization, making these cables more efficient and adaptable to compact, high-performance equipment.

Their application in both internal system wiring and external signal transmission contributes to their widespread adoption. With the rising emphasis on reliable communication and equipment synchronization in industrial automation and building management systems, the segment is projected to remain a vital part of the low voltage cable ecosystem.

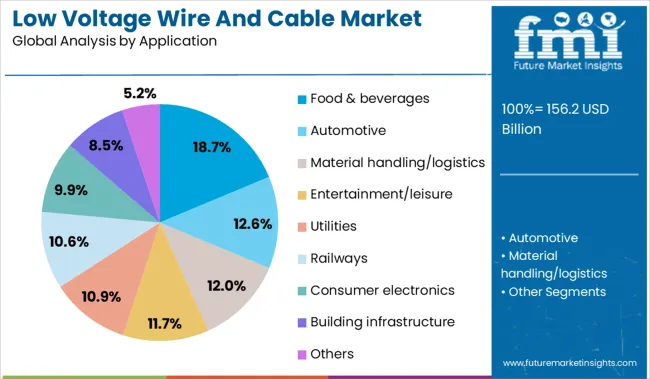

The food and beverages segment accounts for 18.7% of the application share in the low voltage wire and cable market, highlighting its growing reliance on automation and hygiene-compliant electrical systems. Processing plants, packaging units, and cold storage facilities within this sector increasingly demand specialized wiring solutions that support consistent power delivery while withstanding harsh environmental conditions such as moisture, extreme temperatures, and chemical exposure.

The segment has seen increased investment in advanced machinery and robotics, all of which require secure low voltage connectivity to function efficiently. Additionally, regulatory standards concerning food safety and operational reliability are prompting manufacturers to adopt cables that meet stringent insulation and durability specifications.

As the industry embraces Industry 4.0 practices and expands production capacity to meet evolving consumer demands, the requirement for specialized low voltage wires and cables is expected to rise, solidifying the segment’s contribution to market expansion.

The low voltage wire and cable market is seeing strong opportunities through integration with prefabricated construction. From 2024 to 2025, modular projects adopted pre-engineered wiring assemblies to streamline installation and reduce onsite labor. This shift positions cable suppliers offering standardized, panel-ready solutions as key partners in accelerating construction timelines and improving build quality across residential and commercial sectors.

Heavy investments in electrical infrastructure have been identified as the primary factor fueling growth in the low-voltage wire and cable market. In 2024, industrial automation programmes were supported by expanded deployment of control cables and signal wiring in new factory setups and renewable energy links. By 2025, utility companies were found to be upgrading grid feeder lines and metering circuits, prompting procurement of large volumes of insulated conductor products. These procurement trends confirm that rising infrastructure spending rather than short-term demand spikes is establishing wire and cable as core system components, with manufacturers of quality, flame-rated cable assemblies positioned to capture sustained market growth.

By 2024, modular building systems were being observed to incorporate factory-installed low-voltage wiring harnesses into prefabricated wall and ceiling panels, simplifying onsite labor requirements and reducing installation errors. By 2025, large-scale residential and commercial modular projects were being executed with integrated plug-and-play cable assemblies that supported lighting, security, and HVAC control systems out of the box.

These deployments demonstrate that low-voltage cable can evolve from raw material to a pre-engineered building component. Manufacturers offering standardized, panel-ready wiring kits are thus being positioned to serve the growing prefabrication sector, capturing demand for efficiency, quality control, and improved construction cycle timelines.

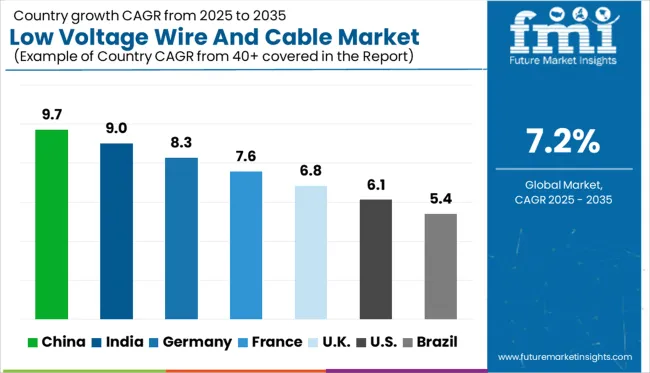

| Countries | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

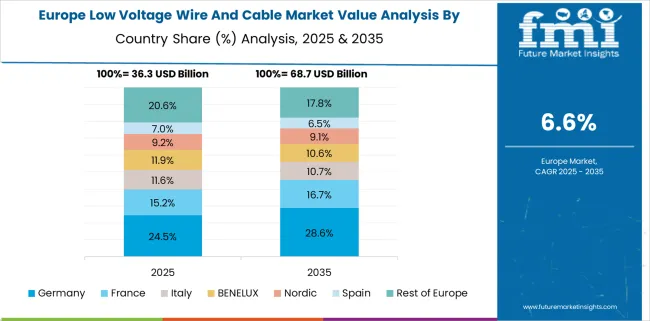

The global low voltage wire and cable market is projected to grow at a CAGR of 7.2% from 2025 to 2035. China leads with 9.7%, followed by India at 9.0% and Germany at 8.3%. France posts 7.6%, while the United Kingdom records 6.8%. Growth in China and India is driven by smart infrastructure projects, rapid urban electrification, and renewable energy integration.

Germany’s progress is anchored in EU-compliant safety standards and industrial automation upgrades. France advances with building retrofits and LSZH cable adoption, while the UK focuses on EV charging networks, housing electrification, and smart building technologies despite regulatory challenges.

China is projected to lead the low voltage wire and cable market with a CAGR of 9.7%, driven by large-scale infrastructure projects, rapid commercial construction, and grid modernization initiatives. Demand for fire-resistant and halogen-free cables is rising due to stringent building codes.

The adoption of smart building systems and renewable integration further accelerates the use of advanced low-voltage cables in residential and industrial settings. Domestic manufacturers are focusing on high-capacity production and cost-efficient polymer formulations to meet both domestic and export needs.

India is expected to grow at a 9.0% CAGR in the low voltage wire and cable market, supported by smart city projects, power distribution expansion, and residential electrification. Rapid adoption of energy-efficient systems in commercial buildings is boosting demand for low-smoke, flame-retardant cables.

Government schemes for rural electrification and renewable energy integration are driving procurement for robust LV networks. Domestic cable makers are focusing on IS-certified flexible and armored cable variants for diverse installations.

Germany is forecast to grow its low voltage wire and cable market at 8.3% CAGR, with demand driven by sustainable building codes and automation in industrial environments. LV cables with halogen-free and recyclable insulation dominate procurement to align with EU green standards. Applications span building electrification, data centers, and electric mobility infrastructure. Manufacturers are also focusing on lightweight, high-flexibility designs for modular construction projects.

France is projected to expand at a 7.6% CAGR, fueled by commercial building retrofits, renewable power expansion, and digital infrastructure upgrades. Demand for LSZH (Low Smoke Zero Halogen) cables is increasing across telecom hubs and urban residential projects. The adoption of prefabricated wiring solutions for rapid construction projects is on the rise. Government regulations under energy transition programs encourage fire-safe and eco-friendly cable systems.

The UK market is expected to grow at 6.8%, driven by electrification in housing projects, public sector retrofits, and green energy initiatives. Demand for low-voltage wiring in EV charging, home automation, and data transmission is increasing. Installers prefer flexible, shielded cables for confined urban spaces. However, rising material costs and regulatory complexities in heritage building retrofits present challenges for rapid expansion.

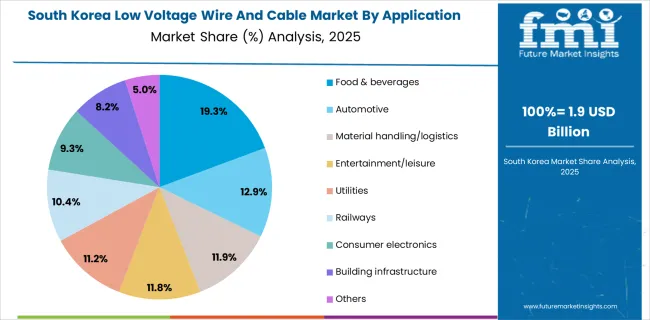

In 2025, South Korea’s low voltage wire and cable market is valued at approximately USD 1.9 billion, highlighting a moderately sized yet diverse sector. The market’s largest application is in food and beverages, commanding 19.3% of market share, reflecting South Korea’s strong food processing industry.

The automotive sector, accounting for 12.9%, and material handling/logistics at 11.9%, emphasize the country’s robust automotive manufacturing and efficient supply chain infrastructure. Entertainment/leisure and utilities collectively make up nearly 23%, indicating growing investments in consumer and essential services. Other sectors like railways (10.4%) and consumer electronics (9.3%) also contribute significantly. This diversified application mix suggests a balanced market that is both industrially and commercially driven, supporting steady growth despite economic fluctuations.

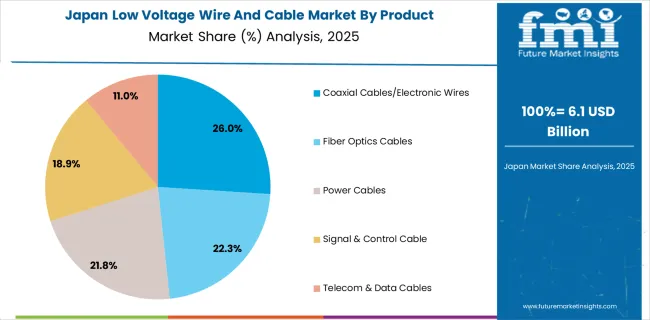

Japan’s low voltage wire and cable market, valued at USD 6.1 billion in 2025, is notably larger than South Korea’s, reflecting Japan’s advanced industrial base and infrastructure. The market is led by coaxial cables/electronic wires at 26%, underscoring Japan’s dominance in electronics and communications. Fiber optics cables (22.3%) and power cables (21.8%) together comprise nearly half the market, revealing substantial investments in telecommunication infrastructure and power distribution networks.

Signal and control cables (18.9%) and telecom & data cables (11%) also represent key product segments, driven by Japan’s focus on automation and data connectivity. This product-driven composition highlights Japan’s technological sophistication, with emphasis on high-performance, reliable cables to support complex industrial, telecom, and energy systems.

The low voltage cable market is moderately consolidated with key companies holding a dominant position through their integrated manufacturing operations, wide product portfolio, and strong supply capabilities for residential, commercial, and industrial projects.

Dominant player status is held exclusively by Alfanar Group. Key players include Bahra Cables, BELDEN, Brugg Kabel AG, Ducab, Elsewedy Electric, Federal Cables, Fujikura Ltd., HELUKABEL Middle East, Jeddah Cables, and KEI Industries Limited, each providing certified low-voltage cable solutions for power transmission, control systems, and building infrastructure, supported by regional manufacturing and compliance with international standards.

Emerging players are currently limited in this market due to the capital-intensive nature of production and the dominance of established suppliers in large-scale utility and construction projects. Grid expansion programs, smart building installations, and regulatory focus on safe and efficient energy distribution networks drive market demand.

Recent Industry Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 156.2 Billion |

| Product | Coaxial Cables/Electronic Wires, Fiber Optics Cables, Power Cables, Signal & Control Cable, and Telecom & Data Cables |

| Application | Food & beverages, Automotive, Material handling/logistics, Entertainment/leisure, Utilities, Railways, Consumer electronics, Building infrastructure, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | alfanar Group, Bahra Cables, BELDEN, Brugg Kabel AG, Ducab, Elsewedy Electric, Federal Cables, Fujikura Ltd., HELUKABEL MiddleEast, Jeddah Cables, and KEI Industries Limited |

| Additional Attributes | Dollar sales by cable type (single-core, multi-core, shielded, unshielded), regional demand trends, competitive landscape, buyer preferences for fire-resistant and eco-friendly insulation, integration with smart grids and buildings, innovations in halogen-free and IoT-compatible wiring. |

The global low voltage wire and cable market is estimated to be valued at USD 156.2 billion in 2025.

The market size for the low voltage wire and cable market is projected to reach USD 313.0 billion by 2035.

The low voltage wire and cable market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in low voltage wire and cable market are coaxial cables/electronic wires, fiber optics cables, power cables, signal & control cable and telecom & data cables.

In terms of application, food & beverages segment to command 18.7% share in the low voltage wire and cable market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Low-Grade Glioma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Low Power Wide Area Network (LPWAN) Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Content Kefir Market Size and Share Forecast Outlook 2025 to 2035

Low Profile Compact System Closures Market Size and Share Forecast Outlook 2025 to 2035

Low Flow Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA