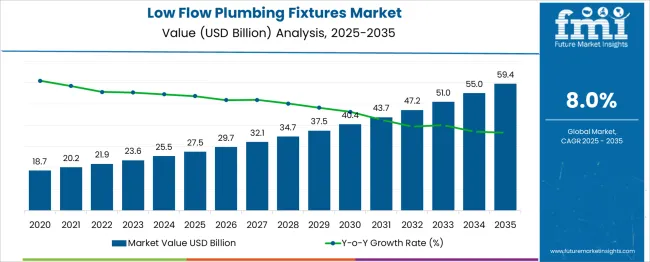

The Low Flow Plumbing Fixtures Market is estimated to be valued at USD 27.5 billion in 2025 and is projected to reach USD 59.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period. A rolling CAGR assessment across sub-periods reveals consistent momentum, supported by steady adoption of water-efficient technologies in residential, commercial, and industrial settings. From 2025 to 2028, the market expands from USD 27.5 billion to USD 34.7 billion, delivering a rolling CAGR of around 8.0%, reflecting balanced growth fueled by regulatory support and heightened consumer awareness.

The subsequent 2028 to 2031 phase shows an increase from USD 34.7 billion to USD 43.7 billion, translating to a rolling CAGR of approximately 8.0%, signaling stable market acceleration with product innovation and retrofitting demand contributing equally. In the final phase from 2031 to 2035, the value climbs from USD 43.7 billion to USD 59.4 billion, with a rolling CAGR near 8.0%, indicating sustained growth maturity rather than market saturation. The stability in CAGR across all rolling periods underscores that demand is being driven by long-term structural trends rather than short-lived spikes. This steady trajectory suggests predictable returns for manufacturers and suppliers that maintain technological differentiation and compliance with evolving efficiency standards.

| Metric | Value |

|---|---|

| Low Flow Plumbing Fixtures Market Estimated Value in (2025 E) | USD 27.5 billion |

| Low Flow Plumbing Fixtures Market Forecast Value in (2035 F) | USD 59.4 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The low flow plumbing fixtures market is expanding steadily, underpinned by rising regulatory mandates for water conservation, green building certifications, and growing consumer awareness of environmental sustainability. Increasing pressure on municipal water systems, especially in urban regions, has driven demand for fixtures that reduce water consumption without compromising performance. Policy frameworks such as the U.S.

EPA’s WaterSense program and LEED certifications have incentivized manufacturers and property developers to adopt water-efficient technologies. The remodeling of aging infrastructure in developed economies, alongside new construction in water-stressed geographies, has bolstered demand across residential and commercial segments.

Moreover, advances in aerator design and flow control technology have enabled low flow fixtures to meet user comfort expectations. As consumers prioritize cost-saving solutions amid rising utility bills, market adoption is further being accelerated through rebates and incentive programs offered by utilities and local governments.

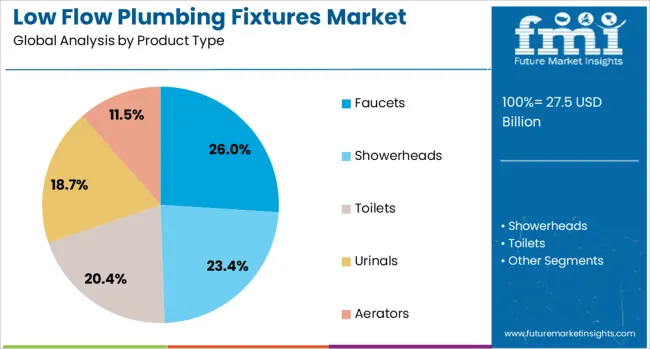

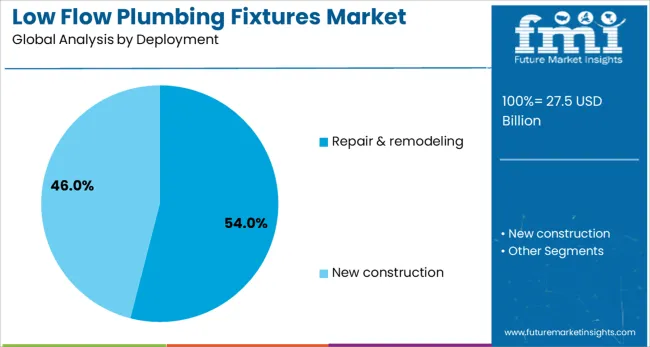

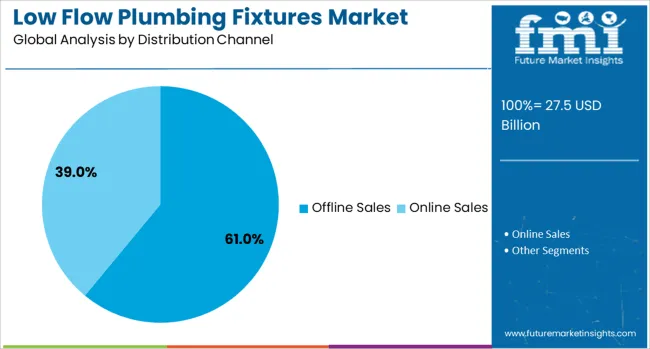

The low flow plumbing fixtures market is segmented by product type, deployment distribution channel, and geographic regions. By product type, the low flow plumbing fixtures market is divided into Faucets, Showerheads, Toilets, Urinals, Aerators, and Other fixtures. In terms of deployment, the low flow plumbing fixtures market is classified into Repair & remodeling, and new construction. The distribution channel of the low flow plumbing fixtures market is segmented into Offline Sales and Online Sales. Regionally, the low flow plumbing fixtures industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Faucets are anticipated to hold 26.00% of the total revenue share in the low flow plumbing fixtures market by 2025, emerging as the leading product type. Their dominance is being supported by widespread application in kitchens and bathrooms, where frequent water use demands efficient flow control.

Innovations in aerated stream delivery, sensor-based activation, and pressure-compensating designs have enabled faucets to reduce water usage while maintaining user experience significantly. Builders and architects are increasingly integrating low flow faucets into sustainable design specifications to meet building codes and environmental targets.

Growing consumer interest in modern fixtures with eco-friendly features, coupled with retrofitting initiatives in older homes, is further driving faucet installations. Additionally, their lower installation cost and compatibility with both residential and commercial projects have solidified their leading position in the product category.

The repair & remodeling segment is projected to contribute 54.00% of the total market revenue in 2025, making it the dominant deployment segment. This is being driven by rising investment in home improvement projects, particularly in mature housing markets across North America and Europe.

As homeowners seek to upgrade outdated plumbing systems with water-efficient alternatives, low flow fixtures are being increasingly adopted for their cost-saving and sustainability benefits. Incentives offered by local governments and utilities for replacing traditional fixtures have further supported retrofitting activity.

In commercial spaces, ongoing renovations to meet green building certifications and ESG goals have accelerated adoption. The flexibility of integrating low flow fixtures into existing plumbing frameworks without major structural changes enhances the appeal of the remodeling route over new construction.

Offline sales are expected to lead the distribution channel segment with 61.00% market share in 2025. This dominance is being reinforced by the preference for in-person consultation, hands-on product evaluation, and bundled installation services offered through physical retail stores and wholesale channels.

Plumbers, contractors, and facility managers continue to rely on offline suppliers for quick procurement, technical support, and after-sales service, particularly in large-scale or urgent renovation projects. Home improvement stores and plumbing supply distributors provide a tangible point of contact for brand comparison and demonstration, which influences purchasing decisions.

While online channels are growing, offline sales remain critical for complex or commercial installations where expert guidance and installation coordination are essential.

The market has been driven by the growing need for water conservation, enhanced plumbing efficiency, and compliance with regulatory standards that limit water consumption per use. These fixtures, which include low flow faucets, showerheads, toilets, and urinals, have been designed to minimize water usage while maintaining adequate pressure and performance. Adoption has been supported by government incentives, updated building codes, and rising installation in both residential and commercial properties. Manufacturers have focused on developing aerator technologies, pressure-compensating designs, and sensor-based controls to enhance performance. Increasing retrofitting projects, combined with new construction demands, have further expanded market potential.

In residential applications, low flow plumbing fixtures have been increasingly installed to comply with efficiency mandates and reduce household utility bills. Building codes in multiple regions have specified maximum flow rates for fixtures, prompting developers to standardize such products in new housing projects. Retrofitting older homes has been prioritized to replace outdated high-flow devices with compliant alternatives. Product designs have incorporated pressure-compensating mechanisms to deliver consistent performance regardless of water pressure fluctuations. Consumers have been drawn to cost savings on water and energy bills associated with reduced hot water consumption. Awareness campaigns have emphasized the environmental and economic benefits, increasing adoption rates. The integration of stylish finishes and advanced aerator technology has ensured that efficiency does not compromise comfort, making low flow fixtures a preferred choice among environmentally conscious homeowners and property managers.

Commercial buildings, hotels, educational institutions, and healthcare facilities have embraced low flow plumbing fixtures to reduce operational costs and meet sustainability certification requirements. Water usage in such environments has been significantly reduced through the use of low flow toilets, sensor-operated faucets, and metered urinals. Facility managers have preferred these solutions for their durability, lower maintenance requirements, and compliance with green building standards such as LEED. The hospitality sector has been a major adopter, integrating efficient showerheads and faucets without compromising guest experience. In large-scale installations, the cumulative savings in water and energy costs have justified upfront investments. These deployments have also aligned with corporate social responsibility initiatives, enhancing brand reputation while contributing to resource conservation goals. Integration with automated building management systems has provided real-time monitoring and leak detection, further optimizing efficiency.

Manufacturers have introduced innovations in aeration, spray patterns, and flow control to improve user experience while achieving low water consumption targets. Pressure-compensating valves have ensured consistent output even under variable supply conditions. Sensor-based and touchless technologies have reduced water waste by activating flow only when necessary, improving hygiene in high-traffic environments. Advanced materials and coatings have increased fixture longevity and resistance to mineral buildup. Hybrid designs combining low flow features with digital controls have allowed users to customize flow settings according to their needs. Water usage analytics integrated into smart plumbing systems have given facility managers actionable insights to optimize consumption. These advancements have addressed earlier consumer concerns regarding reduced water pressure, making modern low flow plumbing fixtures competitive with conventional models in both performance and aesthetics.

Despite favorable regulations and technology improvements, adoption in certain regions has been hindered by infrastructure constraints and retrofitting expenses. Older plumbing systems in some buildings have been incompatible with low flow fixtures, requiring additional modifications that increase installation costs. In areas with low water tariffs, financial savings have been less compelling for end users. Misinformation regarding performance and comfort has also slowed uptake in some residential segments. Limited awareness in rural and underdeveloped markets has restricted demand, while budget constraints in public institutions have delayed upgrades. Furthermore, variations in water pressure in certain locations have affected the performance of low flow devices without pressure-compensating features. Overcoming these barriers will require targeted awareness campaigns, supportive financing mechanisms, and product designs adaptable to diverse plumbing conditions.

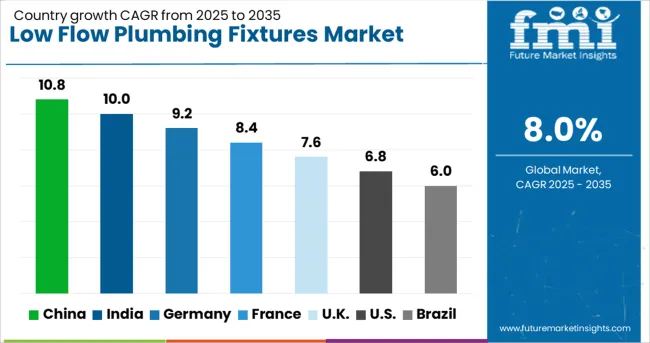

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The market is anticipated to grow at a CAGR of 8.0% from 2025 to 2035, supported by regulatory measures on water efficiency and increased usage of ecofriendly building materials. China, with a 10.8% CAGR, is expanding due to large scale residential and commercial construction integrating water saving technologies. India, growing at 10.0%, benefits from government initiatives to promote efficient water usage in urban and rural areas. Germany, at 9.2%, focuses on innovation in fixture designs and integration with smart home systems. The U.K., growing at 7.6%, experiences demand from retrofitting projects in older housing stock. The USA, with 6.8% growth, advances through building codes that mandate high efficiency fixtures in new developments. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is forecasted to grow at a CAGR of 10.8% from 2025 to 2035 in the low flow plumbing fixtures market, supported by government water conservation policies and urban infrastructure upgrades. Manufacturers are introducing advanced aerator designs and dual-flush systems to meet stricter water usage standards. Large-scale commercial projects and residential developments are increasingly specifying low flow faucets and showerheads to align with municipal efficiency targets. The hospitality sector is also adopting retrofitting programs to reduce utility costs. Growing public awareness regarding resource management is fostering adoption across both urban and semi-urban areas.

India is projected to record a CAGR of 10.0% in the low flow plumbing fixtures market, driven by integration of water efficiency norms into national and state-level building regulations. Affordable housing projects and large-scale smart city developments are implementing low flow fixtures to manage supply-demand imbalances in water distribution. Domestic manufacturers are introducing cost-effective models with improved durability to cater to mass adoption. Rising installation in educational institutions and healthcare facilities is contributing to consistent demand. Increased emphasis on groundwater preservation is influencing procurement choices in both public and private sectors.

Germany is anticipated to achieve a CAGR of 9.2% in the low flow plumbing fixtures market, supported by the adoption of precision-engineered components and performance certifications. The renovation of aging residential buildings is incorporating advanced aeration technologies to maintain water pressure while reducing consumption. Hospitality and retail chains are adopting low flow systems to comply with environmental responsibility goals. Plumbing fixture manufacturers are focusing on modular designs to facilitate faster installation and easy maintenance. Industry-wide collaborations with sustainability councils are promoting awareness campaigns that accelerate consumer transition toward efficient water usage.

The United Kingdom is expected to post a CAGR of 7.6% in the low flow plumbing fixtures market, aided by nationwide water conservation initiatives and consumer education programs. Plumbing retailers are partnering with utility companies to offer incentives and rebates for installing low flow products. Residential retrofits in water-stressed regions are increasing, with a focus on showerhead and faucet replacements. The hospitality sector is progressively upgrading guest facilities to achieve operational cost savings. Growth in eco-certified building projects is further reinforcing market demand.

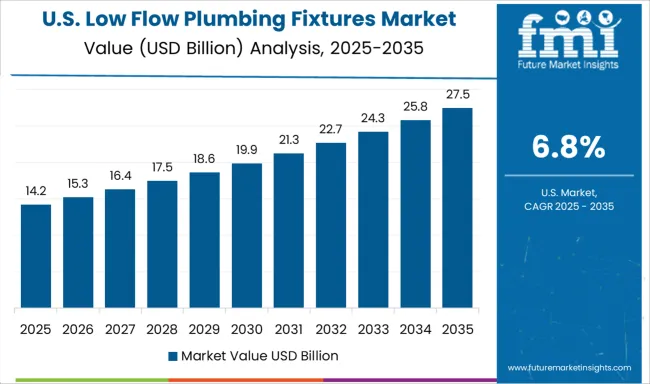

The United States is projected to grow at a CAGR of 6.8% in the low flow plumbing fixtures market, with emphasis on developing sensor-based and smart water management systems. Advanced designs that balance user comfort with reduced flow rates are gaining traction in both residential and commercial settings. Retrofitting initiatives in government buildings are promoting large-scale adoption, while the hospitality and healthcare sectors are integrating touchless and metered faucet systems. Rising consumer demand for sustainable home improvements is boosting retail sales channels.

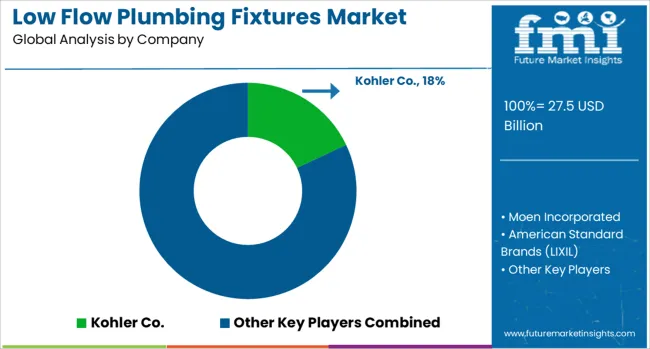

The market is growing steadily as water conservation regulations and efficiency standards drive adoption in both residential and commercial applications. These fixtures are engineered to reduce water consumption without compromising performance, supporting cost savings and environmental goals. Demand is being reinforced by urban infrastructure upgrades, green building certifications, and heightened consumer awareness about resource efficiency. The market landscape features established sanitaryware and faucet manufacturers with diversified portfolios targeting global and regional segments. Kohler Co. and Moen Incorporated offer a wide range of low flow faucets, showerheads, and toilets incorporating advanced aerator and pressure control technologies.

American Standard Brands, under LIXIL, integrates water-saving solutions into smart bathroom designs for large-scale housing and hospitality projects. Delta Faucet Company provides adjustable flow fixtures tailored to retrofit and new-build applications. Grohe AG and Hansgrohe SE focus on combining European design aesthetics with eco-performance engineering. Toto Ltd. remains prominent with high-efficiency toilets and integrated washlet systems known for water conservation. Competitive positioning is influenced by compliance with global water efficiency certifications, advancements in flow control mechanisms, and the development of durable, easy-to-install products. Companies that merge style, performance, and sustainability are well placed to capture market share as water scarcity challenges intensify worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 27.5 Billion |

| Product Type | Faucets, Showerheads, Toilets, Urinals, Aerators, and Other fixtures |

| Deployment | Repair & remodeling and New construction |

| Distribution Channel | Offline Sales and Online Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kohler Co., Moen Incorporated, American Standard Brands (LIXIL), Delta Faucet Company, Grohe AG, Hansgrohe SE, and Toto Ltd. |

| Additional Attributes | Dollar sales by fixture type and application segment, demand dynamics across residential housing, commercial buildings, and institutional facilities, regional trends in installation across North America, Europe, and Asia-Pacific, innovation in pressure-compensating aerators, dual-flush mechanisms, and water-efficient shower technology, environmental impact of reduced water consumption, material sourcing for manufacturing, and product longevity, and emerging use cases in green building certifications, retrofitting programs for water conservation, and integration with smart home water management systems. |

The global low flow plumbing fixtures market is estimated to be valued at USD 27.5 billion in 2025.

The market size for the low flow plumbing fixtures market is projected to reach USD 59.4 billion by 2035.

The low flow plumbing fixtures market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in low flow plumbing fixtures market are faucets, _bathroom faucets, _kitchen faucets, showerheads, _fixed showerheads, _handheld showerheads, toilets, _single-flush toilets, _dual-flush toilets, urinals, _standard urinals, _waterless urinals, aerators, _faucet aerators, _showerhead aerators, other fixtures, _bidets and _flow restrictors.

In terms of deployment, repair & remodeling segment to command 54.0% share in the low flow plumbing fixtures market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Alloy Steels Powder Market Size and Share Forecast Outlook 2025 to 2035

Low Alkali Cement Market Size and Share Forecast Outlook 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Components Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA