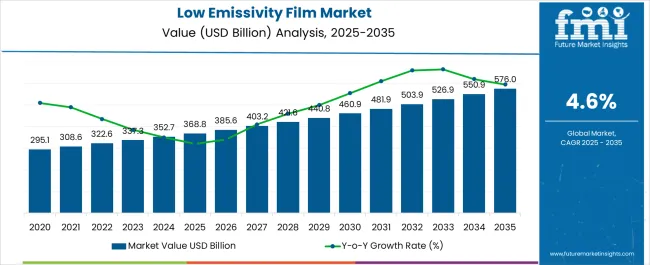

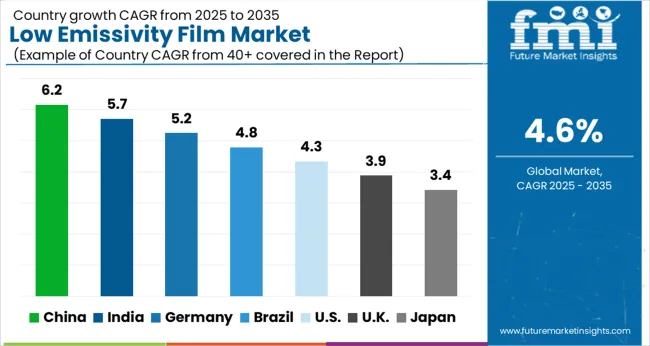

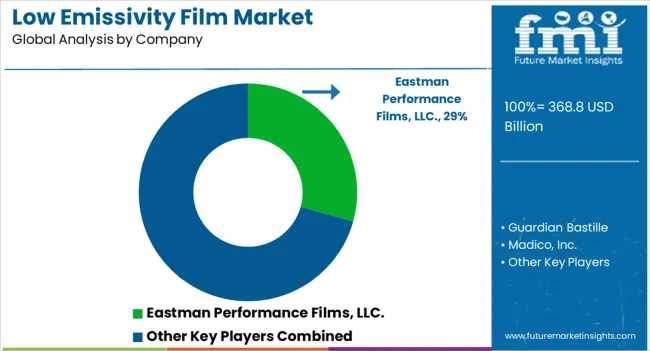

The Low Emissivity Film Market is estimated to be valued at USD 368.8 billion in 2025 and is projected to reach USD 576.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

| Metric | Value |

|---|---|

| Low Emissivity Film Market Estimated Value in (2025 E) | USD 368.8 billion |

| Low Emissivity Film Market Forecast Value in (2035 F) | USD 576.0 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The low emissivity film market is experiencing steady momentum supported by increasing demand for energy efficiency, sustainable construction practices, and advanced insulation technologies. Rising energy costs and stringent building codes have accelerated adoption across residential, commercial, and industrial applications.

Passive designs have gained particular traction as they offer year round benefits by reducing heat loss in colder climates and limiting solar heat gain in warmer regions. Technological improvements in coating methods, multilayer film structures, and optical clarity are enhancing performance while maintaining aesthetic appeal.

Growing investments in green buildings and the integration of energy efficient materials in food packaging and storage are expanding end use opportunities. The market outlook remains positive as low emissivity films continue to align with global priorities around carbon reduction, thermal performance, and energy conservation.

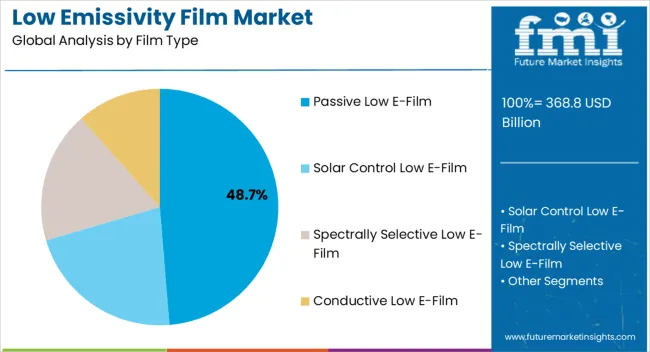

The passive low e-film type segment is expected to hold 48.70% of total market revenue by 2025 within the film type category, making it the leading segment. This dominance is attributed to its ability to provide effective insulation in colder climates by reflecting interior heat back into living spaces while allowing visible light to pass through.

Its relatively lower cost compared to active alternatives and compatibility with a wide range of window structures have further supported widespread adoption. Additionally, the passive design requires no external power source or activation, which reduces maintenance requirements and improves long term cost efficiency.

These combined benefits have reinforced the prominence of passive low e-film in the overall market.

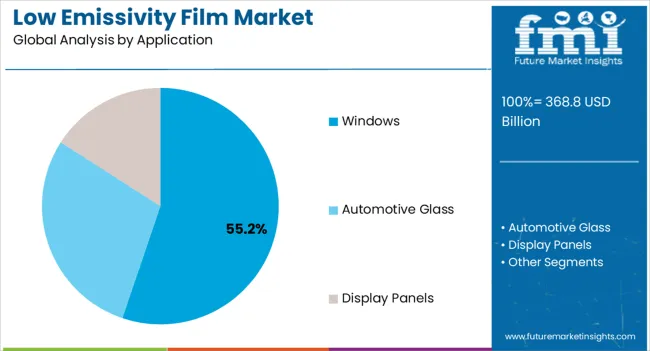

The windows segment is projected to account for 55.20% of market revenue by 2025 under the application category, positioning it as the dominant area of adoption. This share is supported by the increasing emphasis on energy efficient building envelopes where windows are a critical factor in heat gain and loss.

Low emissivity films applied to windows improve thermal comfort, reduce glare, and lower dependence on heating and cooling systems. The demand for retrofitting existing building stock with energy saving solutions has further propelled adoption in both residential and commercial construction.

The ability of these films to improve sustainability performance and meet regulatory energy efficiency standards has solidified the windows segment as the market leader.

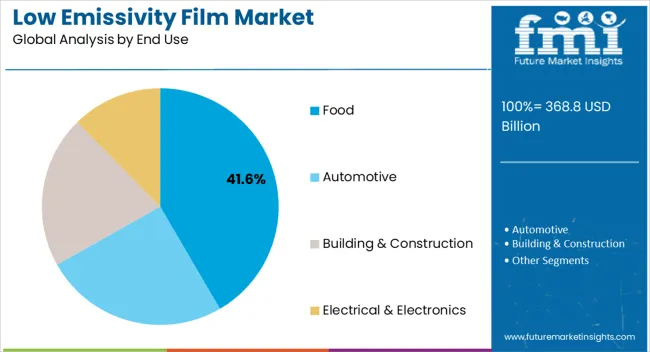

The food end use segment is expected to capture 41.60% of total revenue by 2025, making it the leading end use segment. This is being driven by the increasing requirement for thermal control in food packaging, storage, and transportation.

Low emissivity films are being utilized to preserve product quality by minimizing temperature fluctuations and reducing energy consumption in cold storage environments. Their application ensures extended shelf life, reduced spoilage, and improved energy efficiency in logistics chains.

With the food industry facing mounting pressure to cut energy usage while maintaining safety and freshness, the use of low emissivity films is expanding significantly. This strong alignment with operational efficiency and sustainability goals has established food as the foremost end use segment in the market.

From 2020 to 2025, the global Low Emissivity Film market experienced a CAGR of 3.6%, reaching a market size of USD 368.8 million in 2025.

Low-emissivity (low-E) films play a significant role in high heat absorbing multiple glass units, which can save a significant amount of heat energy in buildings. This remarkable advancement is regarded as one of the most significant developments in the flat glass sector in the last century.

The origins of low-E films in the 1960s, their commercialization in the 1970s, and, most importantly, subsequent developmental steps followed by, and in some cases actively co-designed by, market makers are portrayed.

According to the International Energy Agency (IEA) Paris, building accounts for approximately 30% of total energy consumption and 55% of total world power use. Several programme are being launched to create energy-efficient buildings in response to increased attempts to reduce individual energy consumption. Low-E glass demand is being driven by conscious efforts in the residential and commercial sectors to reduce energy usage.

From 2020 to 2025, with the entrance of new players, and the expansion of the market players in the new markets is driving the market growth. Also, the need for energy consumption and temperature control is increasing, resulting in boosting the market growth.

Looking ahead, the global low emissivity film industry is expected to rise at a CAGR of 4.8% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 536.6 million.

According to ENERGY.GOV Buildings account for more than 40% of total US energy consumption, with approximately 40% being attributed to the operation of heating, ventilation, and air-conditioning systems.

Saving fuel for cooling and heating buildings could make a significant contribution to sustainability. Low-emissivity films for building walls, which serve as the primary component of the thermal envelope. High reflectance in the infrared wavelength range (90%) and selectable reflectance in the visible light wavelength range for chosen colors.

These films can serve to reduce radiative heat exchange between the indoor and outdoor settings, saving energy for year-round cooling and heating while providing the desired visual impact. According to simulations, these coatings can assist minimize heat intake and loss by up to 257.6 MJ per installation wall area per year.

The market in Asia Pacific is expected to grow at the fastest rate during the forecast period, owing to rapid urbanization, smart cities, and skyscraper projects throughout the region, which are significant driving factors for market revenue growth during the forecast period.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 576 million |

| CAGR % 2025 to End of Forecast (2035) | 4.1% |

The low emissivity film industry in the China is expected to reach a market share of USD 576 million by 2035, expanding at a CAGR of 576%.

The market in China is expected to grow at the fastest rate during the forecast period, owing to rapid expansion in smart cities, urbanization, and skyscraper projects throughout the country, which are significant driving factors for market revenue growth during the forecast period.

The People's Republic of China (PRC) government has pledged to make renewable energy 20% of the energy mix by 2035 and to reduce carbon intensity by 17%.

| Country | USA |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 48.2 million |

| CAGR % 2025 to End of Forecast (2035) | 3.0% |

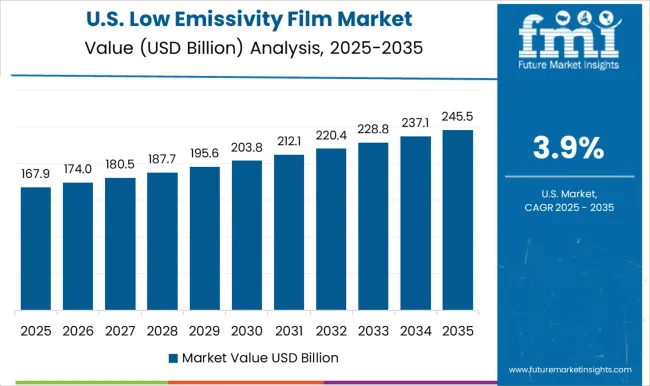

The low emissivity film industry in the USA is expected to reach a market share of USD 48.2 million, expanding at a CAGR of 3.0% during the forecast period.

Over the forecast period, the United States is anticipated consistent revenue growth. The growing use of UV filters and sophisticated thermal insulation technologies in green building regulations in the United States is driving revenue growth in the business.

Furthermore, the California Air Resources Board (CARB) legislation requiring the installation of low-E glass film on all new cars in order to improve fuel efficiency and reduce carbon emissions is propelling revenue growth in the country.

The solar control low E-Film segment is expected to dominate the low emissivity film industry with a CAGR of 4.4% from 2025 to 2035. Solar low e-film is an excellent choice for homes in any kind of weather.

They help keep heat outside on hot days and inside on cold days. This improves comfort by stabilizing temperature, reducing the cooling and heating system demands, and lowering energy expenses.

The automotive glass segment is expected to dominate the low emissivity film industry with a CAGR of 3.8% from 2025 to 2035. This film significantly enhances the energy efficiency of glass by lowering the quantity of solar radiation admitted into a structure through window apertures.

The goal of low-e films is to lower the quantity of solar radiation that enters a building from the infrared section of the solar spectrum while yet letting a high level of light in.

With the new entrants the low emissivity film industry is highly competitive, trying to gain market share. Key players in the low emissivity film market remain competitive by inventing and producing new solutions that satisfy changing client needs. The market players are focusing on research and development which can help to keep them updated with latest technologies and trends.

Key Strategies Adopted by the Players

Strategic Partnerships and Collaborations

For the development of companies, the market players are adopting partnership and collaboration, which can help them gain competitive advantage and get access to latest technologies and trends in the market.

Increasing Product Efficiency and Accuracy

The market players are adopting new strategies, which can help them in product innovation, increased efficiency and accuracy of these films. These market players are investing heavily in research and development for better growth in market.

Expansion into Emerging Markets

The major key players in market are expanding their operations in new emerging markets to increase customer base. In addition, they are collaborating with other companies for entering the market.

The global low emissivity film market is estimated to be valued at USD 368.8 billion in 2025.

The market size for the low emissivity film market is projected to reach USD 576.0 billion by 2035.

The low emissivity film market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in low emissivity film market are passive low e-film, solar control low e-film, spectrally selective low e-film and conductive low e-film.

In terms of application, windows segment to command 55.2% share in the low emissivity film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Components Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Low-Grade Glioma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA