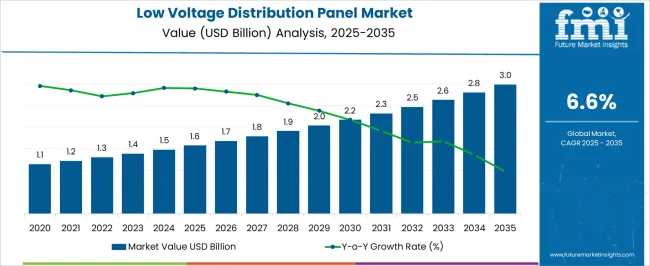

The low voltage distribution panel market is projected to grow from USD 1.6 billion in 2025 to USD 3.0 billion in 2035, reflecting a CAGR of 6.6%. This represents an absolute dollar opportunity of USD 1.4 billion over the decade. The market is expected to expand steadily, reaching USD 1.7 billion in 2026, USD 1.9 billion in 2029, USD 2.2 billion in 2031, and USD 2.8 billion in 2034. The consistent growth highlights increasing demand for low voltage distribution panels across electrical and industrial applications, offering manufacturers and investors the potential to capture incremental revenue throughout the ten-year period.

From an absolute dollar perspective, annual incremental growth starts at USD 0.1 billion in the early years and gradually increases to USD 0.2 billion in later years, culminating in USD 1.4 billion by 2035. Intermediate values, such as USD 1.5 billion in 2025, USD 2.0 billion in 2030, and USD 2.6 billion in 2033, demonstrate a predictable growth trajectory. This enables stakeholders to plan production, distribution, and market expansion effectively. Capturing this opportunity allows businesses to leverage both steady yearly growth and the cumulative USD 1.4 billion expansion in the low voltage distribution panel market over the decade.

| Metric | Value |

|---|---|

| Low Voltage Distribution Panel Market Estimated Value in (2025 E) | USD 1.6 billion |

| Low Voltage Distribution Panel Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

Continuing with the low voltage distribution panel market, a breakpoint analysis highlights key periods of accelerated growth. Between 2025 and 2027, the market grows from USD 1.6 billion to USD 1.7 billion, marking the early adoption phase where initial deployments establish market presence. Another critical breakpoint occurs around 2029–2031, as the market rises from USD 1.9 billion to USD 2.2 billion, representing a phase of stronger expansion and incremental revenue accumulation.

These stages are pivotal for manufacturers and investors to optimize production, manage supply chains, and capture increasing market share during key periods of market growth. The final major breakpoint is observed between 2033 and 2035, when the market increases from USD 2.8 billion to USD 3.0 billion, reflecting the largest absolute dollar growth in the later stage of the decade. Intermediate years, such as 2030–2032, show steady expansion from USD 2.0 billion to USD 2.6 billion, serving as bridging periods to sustain market momentum.

The low-voltage distribution panel market is experiencing steady expansion, driven by rising electricity demand, rapid infrastructure development, and the modernization of electrical distribution networks. Industry reports and utility sector updates have emphasized the growing role of these panels in ensuring safe, efficient, and reliable power distribution across residential, commercial, and industrial facilities.

Regulatory frameworks mandating safety compliance and energy efficiency in electrical installations have also influenced procurement patterns.

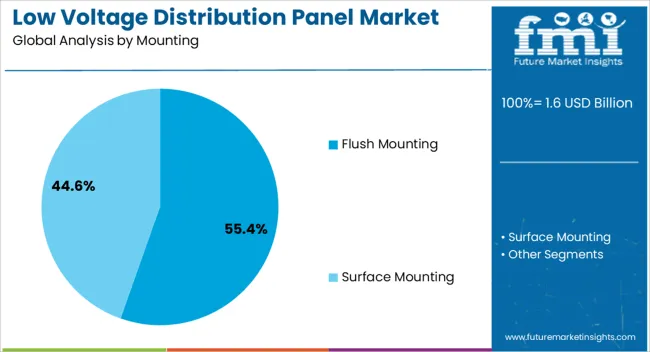

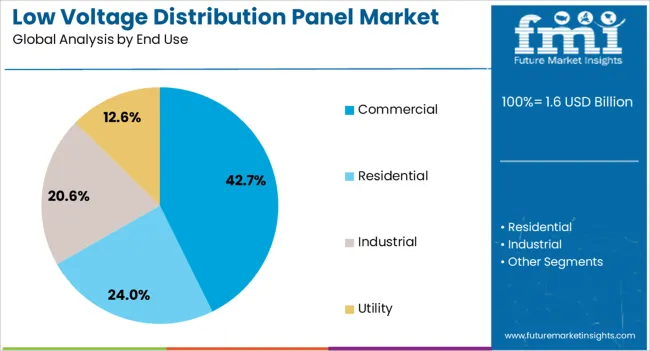

The low voltage distribution panel market is segmented by mounting, end use, and geographic regions. By mounting, low voltage distribution panel market is divided into Flush Mounting and Surface Mounting. In terms of end use, low voltage distribution panel market is classified into Commercial, Residential, Industrial, and Utility. Regionally, the low voltage distribution panel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The flush mounting segment is projected to account for 55.4% of the low voltage distribution panel market revenue in 2025, maintaining its lead due to its suitability for modern building designs and space optimization. Flush-mounted panels are preferred in urban and commercial environments where aesthetics, safety, and ease of access are critical. Electrical contractors and facility planners have favored this mounting style for its ability to integrate seamlessly into walls, minimizing visible infrastructure while protecting the panel from physical damage.

The adoption of flush mounting has also been supported by building codes and safety standards that prioritize organized, enclosed, and tamper-resistant installations. Additionally, growing use of flush-mounted panels in energy-efficient and smart buildings has reinforced demand, as these installations allow streamlined integration with automation and monitoring systems.

The combination of functional and visual advantages has solidified the segment’s dominant position in both new construction and retrofit projects.

The commercial segment is projected to contribute 42.7% of the low voltage distribution panel market revenue in 2025, sustaining its leadership due to increasing demand from office complexes, retail centers, healthcare facilities, and hospitality establishments. The segment’s growth is underpinned by rising commercial construction activity and the expansion of service-based industries requiring stable, uninterrupted power distribution.

Energy management priorities in the commercial sector have driven the adoption of panels equipped with advanced control features, metering capabilities, and integration with building management systems. Commercial operators have also invested in upgrading distribution panels to comply with evolving safety regulations and to support higher electrical loads from HVAC systems, lighting, and IT infrastructure.

Furthermore, the push toward green building certifications has encouraged the selection of energy-efficient and sustainable panel solutions. As commercial infrastructure projects continue to expand in both developed and emerging economies, this segment is expected to remain a key driver of market growth.

The low voltage distribution panel market is expanding as industries, commercial buildings, and residential projects increasingly require reliable power management solutions. These panels control, distribute, and protect electrical circuits operating at low voltages, ensuring safety, energy efficiency, and operational continuity. Europe and North America dominate adoption due to established electrical infrastructure, industrial modernization, and strict safety standards, while Asia Pacific shows rapid growth driven by urbanization, smart building adoption, and industrial expansion.

Manufacturers focus on modular design, compact layouts, and compliance with electrical codes, while material quality, component sourcing, and installation expertise influence adoption. Increasing demand for energy-efficient, safe, and flexible electrical distribution systems is driving investment in high-performance low voltage panels across multiple sectors.

Ensuring consistent performance and electrical safety is a primary concern for low voltage distribution panels. Variations in breaker quality, busbar conductivity, and insulation materials can affect protection levels, load handling, and operational reliability. Panels must prevent short circuits, overloads, and electrical hazards while maintaining stable distribution under varying loads. Manufacturers provide standardized testing, certifications, and detailed technical specifications to guarantee safety and reliability. Properly designed panels reduce downtime, protect connected equipment, and ensure compliance with local and international electrical standards. Suppliers delivering dependable, tested products gain preference from electrical contractors, industrial engineers, and facility managers, whereas inconsistent performance or component failure can result in safety risks, operational interruptions, and costly maintenance.

Low voltage distribution panels are increasingly designed for modularity, compact footprint, and ease of installation. Adjustable configurations, removable busbars, and standardized mounting systems simplify integration into new or retrofitted electrical setups. User-friendly interfaces, clear labeling, and accessible maintenance points improve operational efficiency. Manufacturers offering panels adaptable to diverse load requirements and building layouts enable faster deployment and minimize installation errors. Operational flexibility allows facilities to scale or modify electrical systems without significant downtime. Suppliers that provide installation guidance, pre-tested components, and compatible accessories enhance adoption. Streamlined design, coupled with accessible maintenance, ensures that panels perform effectively in both industrial and commercial applications while reducing labor costs and installation time.

Low voltage distribution panels are being increasingly applied in manufacturing plants, data centers, commercial complexes, hospitals, and residential projects. Growing electrification, smart building integration, and demand for reliable energy distribution drive market expansion. Industrial processes, HVAC systems, and critical equipment require panels capable of handling diverse loads with high safety margins. Suppliers offering customized or modular panels that can accommodate future expansion gain competitive advantage. Adoption is also rising in renewable energy integration, including solar and wind systems, where panels ensure proper load distribution and protection. Expanding applications across multiple sectors, coupled with rising urban and industrial infrastructure development, support long-term growth and widespread market penetration.

Market adoption is shaped by adherence to regional electrical safety codes, certifications, and material standards. Panels must comply with IEC, UL, or local guidelines for voltage ratings, insulation, and protection mechanisms. Supply chain stability for breakers, busbars, insulating materials, and control components affects manufacturing schedules and installation timelines. Competition exists between established global manufacturers and emerging local suppliers offering tailored solutions. Companies maintaining regulatory compliance, reliable component sourcing, and technical support gain preference in industrial and commercial projects. Conversely, inconsistent materials or non-compliance can result in installation delays, safety hazards, or regulatory penalties. Effective supply chain and certification management are critical for long-term adoption in the low voltage distribution market.

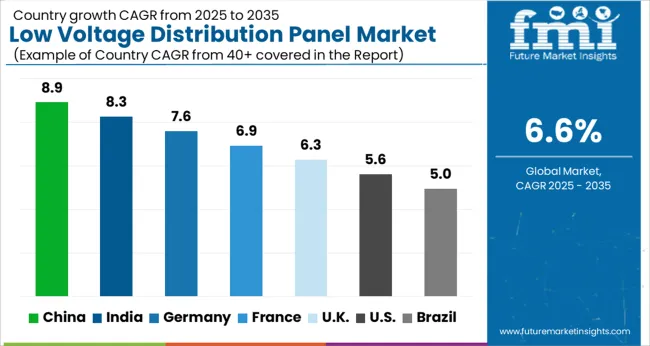

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

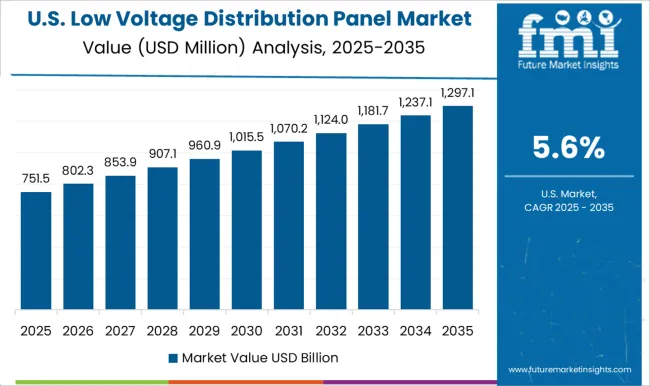

The global low voltage distribution panel market was projected to grow at a 6.6% CAGR through 2035, driven by demand in power distribution, industrial facilities, and commercial buildings. Among BRICS nations, China recorded 8.9% growth as large-scale production units were commissioned and compliance with electrical safety standards was enforced, while India at 8.3% growth saw expansion of manufacturing facilities to meet rising regional consumption. In the OECD region, Germany at 7.6% maintained significant output under strict industrial and electrical regulations, while the United Kingdom at 6.3% relied on moderate-scale operations for commercial and industrial applications. The USA, expanding at 5.6%, remained a mature market with steady demand across industrial, commercial, and utility sectors, supported by adherence to federal and state-level electrical safety and product standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The low voltage distribution panel market in China is growing at a CAGR of 8.9% due to increasing demand from industrial, commercial, and residential sectors. Companies are investing in panels to ensure reliable power distribution, improve safety, and manage electrical loads efficiently. Manufacturing industries, construction projects, and utility companies are major users of low voltage panels. Suppliers provide panels with features such as modular design, high load capacity, and compliance with electrical safety standards. Growth is also supported by government infrastructure projects, industrial expansion, and increasing adoption of smart building solutions. Businesses are focusing on panels that reduce downtime, improve operational efficiency, and allow easy maintenance. Manufacturers are offering solutions suitable for diverse applications including factories, office buildings, hospitals, and large residential complexes. Rising awareness about electrical safety and the need for reliable energy distribution continues to drive adoption across all sectors.

India is experiencing growth at a CAGR of 8.3% in the low voltage distribution panel market due to rising construction activity, industrial expansion, and modernization of power networks. Companies in manufacturing, commercial buildings, and infrastructure projects are investing in panels to ensure safe and efficient power distribution. Suppliers provide solutions that are modular, scalable, and compliant with national and international electrical standards. Growth is also supported by increasing urban development, expansion of industrial zones, and rising demand for energy management in large residential and commercial facilities. Manufacturers offer panels that are easy to install, maintain, and expand as per future electrical load requirements. Businesses are focusing on minimizing downtime, ensuring operational safety, and meeting regulatory requirements. Adoption of low voltage panels allows better management of electrical systems in industries, commercial complexes, hospitals, and educational institutions.

Germany is growing at a CAGR of 7.6% in the low voltage distribution panel market due to demand from industrial, commercial, and utility sectors. Companies prioritize panels that provide reliable power distribution, comply with safety regulations, and allow efficient load management. Industrial plants, commercial buildings, hospitals, and data centers are the primary users. Suppliers provide panels with modular design, high load capacity, and compatibility with monitoring systems. Growth is further supported by strict safety regulations, energy efficiency requirements, and the need to modernize aging electrical infrastructure. Manufacturers focus on solutions that reduce downtime, simplify maintenance, and improve operational efficiency. Businesses are adopting low voltage panels that allow for easy expansion and integration with automation and monitoring systems. Demand is increasing as companies seek safe, reliable, and efficient power distribution solutions for diverse applications.

The United Kingdom market is growing at a CAGR of 6.3% due to rising demand from industrial, commercial, and residential sectors. Companies are investing in low voltage distribution panels to manage electrical loads efficiently, maintain safety, and ensure reliable power supply. Construction projects, industrial facilities, and commercial buildings are key users of these panels. Suppliers provide modular, scalable, and high load capacity solutions that meet regulatory standards and improve operational efficiency. Businesses are focused on minimizing downtime, enabling easy maintenance, and allowing future expansion. Growth is supported by modernization of electrical systems, rising energy management requirements, and increasing investment in infrastructure. Manufacturers are offering panels suitable for diverse applications including factories, hospitals, educational institutions, and residential complexes. Adoption of low voltage panels helps improve energy distribution, reduce risks, and optimize performance in industrial and commercial facilities.

The United States market is expanding at a CAGR of 5.6% driven by demand from industrial, commercial, and residential sectors. Companies are adopting low voltage distribution panels to ensure safe and reliable power distribution, manage electrical loads, and improve energy efficiency. Industrial plants, office complexes, hospitals, and educational institutions are the primary users. Suppliers provide panels with modular design, high load capacity, and compliance with electrical standards. Growth is also supported by modernization of existing electrical systems, energy management initiatives, and infrastructure development. Manufacturers focus on panels that reduce downtime, allow easy maintenance, and provide options for future expansion. Adoption is increasing as businesses seek reliable and efficient electrical systems that ensure operational safety and optimize energy use. Low voltage panels are critical for safe and continuous power supply across multiple industrial and commercial applications.

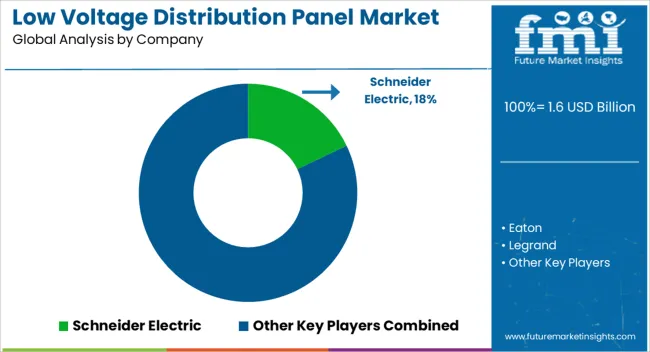

Schneider Electric, Eaton, and Legrand supply low voltage distribution panels for industrial, commercial, and residential applications, with brochures highlighting rated current, fault protection, and modular configuration. Siemens, ABB, and General Electric provide panels designed for critical power distribution, with datasheets detailing short-circuit rating, busbar design, and enclosure type. Larsen & Toubro Limited, NHP, and INDUSTRIAL ELECTRIC MFG focus on compact and customizable panels, with technical literature presenting mounting options, wiring layouts, and space optimization. ESL POWER SYSTEMS, INC., Hager Group, and Ags offer pre-fabricated and turnkey solutions, with brochures emphasizing panel protection features, integration with control systems, and compliance with IEC and ANSI standards. Meba Electric Co., Ltd., Norelco, EAMFCO, and alfanar Group provide high-performance panels for harsh environments, with datasheets highlighting thermal performance, ingress protection ratings, and corrosion resistance. Other regional suppliers compete with cost-effective or modular variants, with brochures emphasizing rapid deployment, standard compliance, and adaptability to small- and medium-scale facilities. Market strategies focus on safety, scalability, and operational reliability.

Leading suppliers such as Schneider Electric and Siemens emphasize modular construction, fault current management, and flexible busbar systems for varied load applications. Eaton and ABB differentiate through compact designs, high short-circuit ratings, and integrated metering options. Observed industry patterns indicate investment in intelligent panels with real-time monitoring, remote management, and predictive maintenance capabilities. Product roadmaps frequently include energy-efficient components, adaptable enclosures, and standardized modules to simplify installation and reduce lifecycle maintenance.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 Billion |

| Mounting | Flush Mounting and Surface Mounting |

| End Use | Commercial, Residential, Industrial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Schneider Electric, Eaton, Legrand, Siemens, ABB, General Electric, Larsen & Toubro Limited, NHP, INDUSTRIAL ELECTRIC MFG, ESL POWER SYSTEMS, INC., Hager Group, Ags, Meba Electric Co., Ltd, Norelco, EAMFCO, and alfanar Group |

| Additional Attributes | Dollar sales vary by panel type, including floor-mounted, wall-mounted, and modular panels; by application, such as commercial buildings, industrial facilities, residential complexes, and data centers; by end-use industry, spanning utilities, manufacturing, construction, and infrastructure; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising electricity demand, infrastructure development, and adoption of smart distribution solutions. |

The global low voltage distribution panel market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the low voltage distribution panel market is projected to reach USD 3.0 billion by 2035.

The low voltage distribution panel market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in low voltage distribution panel market are flush mounting and surface mounting.

In terms of end use, commercial segment to command 42.7% share in the low voltage distribution panel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Low-Grade Glioma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Low Power Wide Area Network (LPWAN) Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Content Kefir Market Size and Share Forecast Outlook 2025 to 2035

Low Profile Compact System Closures Market Size and Share Forecast Outlook 2025 to 2035

Low Flow Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Low Code Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA