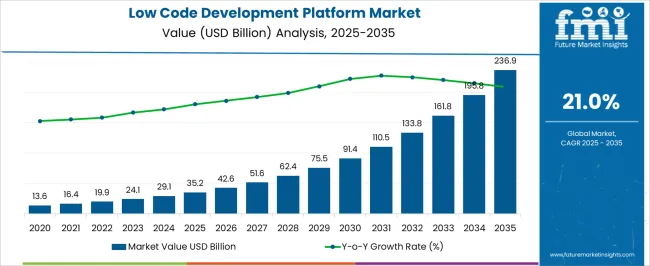

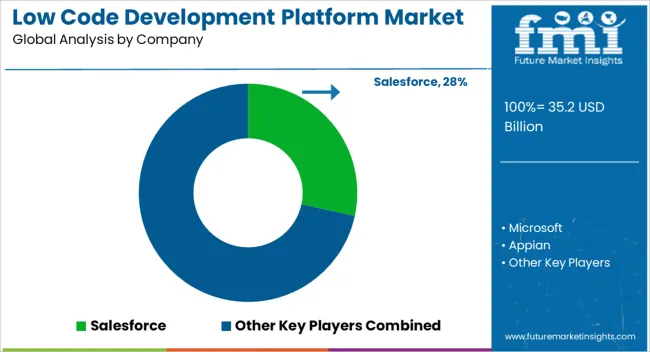

The Low Code Development Platform Market is estimated to be valued at USD 35.2 billion in 2025 and is projected to reach USD 236.9 billion by 2035, registering a compound annual growth rate (CAGR) of 21.0% over the forecast period.

| Metric | Value |

|---|---|

| Low Code Development Platform Market Estimated Value in (2025 E) | USD 35.2 billion |

| Low Code Development Platform Market Forecast Value in (2035 F) | USD 236.9 billion |

| Forecast CAGR (2025 to 2035) | 21.0% |

The low code development platform market is experiencing accelerated growth as businesses increasingly seek to enhance software delivery speed, reduce development costs, and minimize dependence on traditional coding expertise. The convergence of business process automation demands, talent shortages in software engineering, and the growing adoption of digital transformation initiatives has intensified reliance on low code tools.

These platforms allow both technical and non technical users to build and modify applications through visual interfaces, reducing the time to market and enabling rapid prototyping. The growing need for agility in enterprise operations and integration with emerging technologies such as artificial intelligence and robotic process automation has further expanded the utility of low code platforms.

With organizations prioritizing adaptability, cross departmental collaboration, and custom workflow automation, the market outlook remains favorable across industries ranging from banking to healthcare and education.

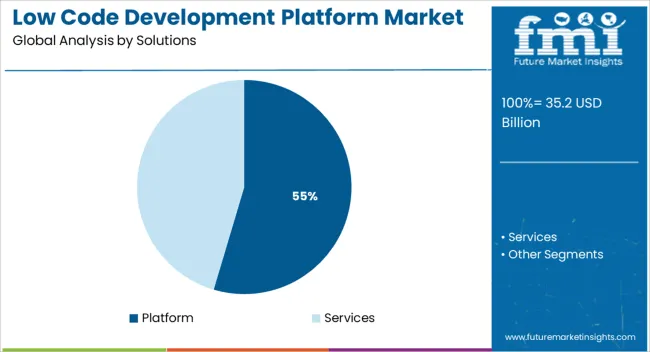

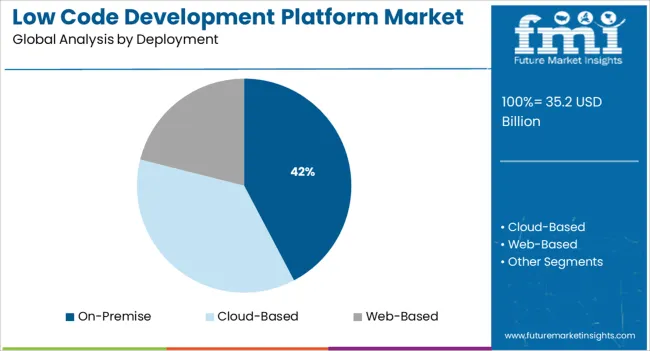

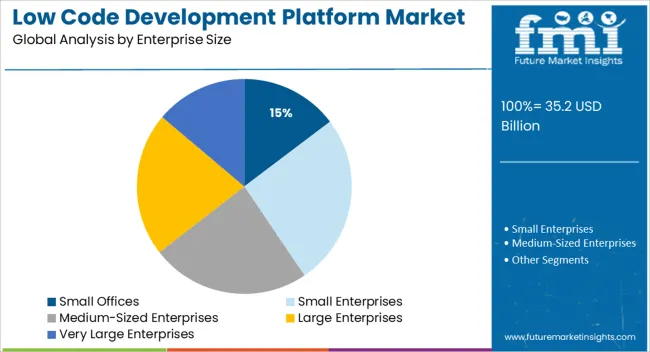

The market is segmented by Solutions, Deployment, Enterprise Size, and Industry and region. By Solutions, the market is divided into Platform and Services. In terms of Deployment, the market is classified into On-Premise, Cloud-Based, and Web-Based. Based on Enterprise Size, the market is segmented into Small Offices, Small Enterprises, Medium-Sized Enterprises, Large Enterprises, and Very Large Enterprises. By Industry, the market is divided into Services, Distribution Services, Public Sector, Finance, Manufacturing and Resources, and Infrastructure. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The platform segment is projected to account for 54.60% of total market revenue by 2025 within the solutions category, establishing itself as the dominant offering. This is attributed to its broad functionality which supports end to end application lifecycle management including design, development, integration, and deployment.

Platforms offer modular architecture, reusable components, and drag and drop features that empower citizen developers and accelerate delivery cycles. Enterprises have increasingly adopted platform solutions to address the rising complexity of IT systems and to standardize development across departments.

The ability to scale applications efficiently while maintaining governance and security protocols has reinforced the platform’s leadership in the solutions segment.

The on premise deployment model is expected to contribute 42.30% of total revenue by 2025 within the deployment category, marking it as a key delivery preference. This dominance is being driven by sectors with stringent data control requirements such as finance, defense, and healthcare.

Organizations have favored on premise deployment to ensure compliance with internal security protocols and regulatory mandates. It also allows for greater customization, performance optimization, and reduced latency in critical workflows.

Businesses with legacy systems or highly specialized infrastructure have continued to invest in on premise platforms to maintain operational continuity and minimize integration challenges. As a result, the segment retains its relevance particularly in security sensitive and compliance driven environments.

The small offices segment is projected to account for 14.70% of total market revenue by 2025 within the enterprise size category. This share is influenced by the growing accessibility of low code tools and their ability to offer cost effective digital solutions without requiring extensive IT infrastructure.

Small offices have increasingly turned to these platforms to streamline internal processes, develop lightweight customer engagement apps, and automate repetitive administrative tasks. The intuitive interface and scalability of low code platforms allow small enterprises to adapt quickly to changing business needs without incurring heavy development expenses.

This segment has gained momentum as more small offices prioritize digital readiness and look to leverage affordable tools that support agility, innovation, and productivity.

Intervention of AI technologies are stimulating market growth

The incorporation of AI is expanding across all industries. Strategically, businesses have emphasized AI in their initiatives to transform business. The idea of low-code artificial intelligence is revolutionary in terms of AI technology for software and application development. The platform attracts investment from many businesses due to its wide application and potential advantages. Businesses can profit from improved data analytics, user experience, cost savings, quick development, and more. As a result, it is projected that the market for low-code development platforms would continue to increase due to the growing trend of low-code AI.

Numerous market opportunities are created by the low-code applications in the healthcare sector

A minimal code development platform is used in the healthcare sector to speed up the data integration process, increase workflow effectiveness, and improve the patient experience. By allowing healthcare professionals to study patient histories and provide better care, low code development cloud technology can greatly help in integrating patient data across several systems, supporting industry growth.

The development of mobile-friendly apps that can support virtual consultations is made easier by low-code application platforms. These platforms also offer a secure network for encrypted communication. As a result, the benefits of low code development technology are hastening the market's growth in the healthcare sector.

By lowering the entrance hurdle for those without a background in programming, low-code, and no-code platforms are revolutionizing the development of apps and software. Users can build specialized solutions for their business needs using a simple interface with drag-and-drop capabilities.

Enterprises employ technologies like robotic process automation (RPA), artificial intelligence (AI), and low-code application platforms to boost productivity, reduce costs, and improve workflow (LCAP). With the latter, staff members can build custom applications that enable data collection, management, and interchange between businesses.

Low-code platforms are becoming an important part of existing web-based platforms in many organizations, allowing them to improve their strategy while reducing cost and complexity. Mendix on IBM Cloud, App Maker on Google Cloud Platforms, and PowerApps on Microsoft are some well-known low-code platforms from major web-based service providers.

According to the analysis, small enterprises account for 26.4% of the low code development platform market.

This can be attributed to rising consumer demand for high-quality digital applications, which puts pressure on small businesses to develop applications quickly and improve time to value. As a result, small enterprises are becoming more interested in low-code development platforms, which enable non-IT employees to create applications quickly and at a low cost. These platforms are typically available as subscription services, allowing them to pay only for the services that they use.

Due to the growing need to digitize services like origination, customer onboarding, self-servicing, and back-office operations, the services segment accounted for a sizable revenue share of over 29.3% in 2024. They are becoming more interested in low-code development platforms in order to enhance customer experiences, cut costs, increase company agility, and shorten time to market.

North America dominates the global low-code development platform market, accounting for nearly 32.6% of revenue in 2024. The significant presence of several prominent regional organizations primarily focused on the development of innovative products and services is driving the market growth. Both the United States and Canada have strong economies and are anticipated to be major contributors to the expansion of the low-code development platform market.

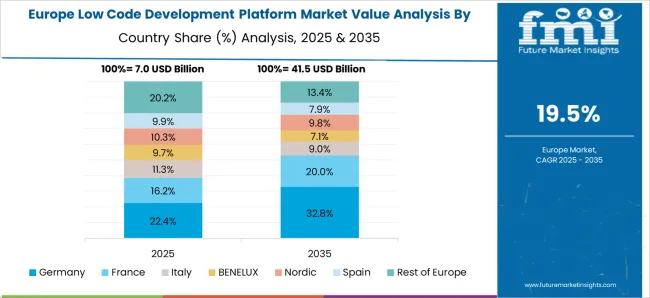

The increased emphasis on BFSI, retail, healthcare, and education for efficient application development is expected to drive growth in Europe. The United Kingdom and Germany are expected to demonstrate potential opportunities for regional business development. Brexit and the Covid outbreak in the United Kingdom are critical market growth considerations.

With the increasing incorporation of low-code platforms in the region, particularly in China, Asia Pacific is expected to record the highest CAGR of more than 26.8%. Several local vendors across all major verticals are utilizing these platforms to speed up application delivery, expand developer task forces, reduce operating costs, and boost innovation.

To keep up with the ever-advancing technologies, industries all over the world are jumping on the digital transformation bandwagon. As more and more people buy and sell on the internet, the e-commerce industry is undergoing a transformation.

While other industries suffered during the 2020 pandemic, e-commerce businesses thrived as people were confined to their homes with only their electronic devices. This has, however, resulted in e-commerce market saturation, with businesses struggling to find a competitive advantage.

E-commerce businesses are constantly looking for ways to increase sales while remaining cost-effective. Low-code and no-code platforms have proven to be useful tools for managing the e-commerce ecosystem on a budget. These technologies are becoming increasingly popular in the digital ecosystem.

The low-code development platform industry is moderately fragmented, with a large number of participants, a considerable legislative framework worldwide, and smaller vendors collectively controlling a big portion of the market. Market players with substantial financial resources are actively engaged in strategic M&A activities, while smaller businesses focus on product innovation methods to increase market share.

Digital Transformation

Recent experiences, particularly those related to the pandemic, show that the demand for new technological solutions is increasing among organizations across industries. To put it another way, digital transformation has become critical. And its primary goal is to enable non-technical people to build apps or websites in a short period of time.

Low-code and no-code tools appear to be the best option for small and medium-sized businesses outside of IT. It is especially relevant for users who want to achieve their business objectives quickly, efficiently, and affordably by utilizing modern technology.

As the application becomes more progressive, a suitable level of technical background will be required. This means that time is required to educate and become acquainted with the low-code software. As a result, there is an increased demand for low-code specialists.

As an example of an application complexification process, consider the SQL language. It was designed to be an approachable solution for everyone to help with database management. However, it evolved into its own programming language over time. A typical user cannot comprehend or write complex SQL queries. They must learn SQL in order to comprehend the database's structure.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 28.4% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | By Deployment, By Solution, By Enterprise Size, By Industry, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East & Africa; Oceania |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Salesforce; Appian; Mendix; Microsoft; Pegasystems; Zoho; OutSystems; Oracle Corporation; ServiceNow; TrackVia; and K2. |

| Customization & Pricing | Available upon Request |

The global low code development platform market is estimated to be valued at USD 35.2 billion in 2025.

The market size for the low code development platform market is projected to reach USD 236.9 billion by 2035.

The low code development platform market is expected to grow at a 21.0% CAGR between 2025 and 2035.

The key product types in low code development platform market are platform and services.

In terms of deployment, on-premise segment to command 42.3% share in the low code development platform market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Components Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA