The Low Voltage Motor Market is expected to flourish due to heightened industrial automation, rising utilization of energy-efficient electric motors, and increasing manufacturing infrastructure worldwide. Low voltage motors usually below 1,000 volts are necessary for different applications including HVAC, pumps, compressors, conveyors and machine tools. So, as industries modernize and pursue greater productivity, less downtime, and lower energy costs, the uptake of high-efficiency motor systems is on the rise.

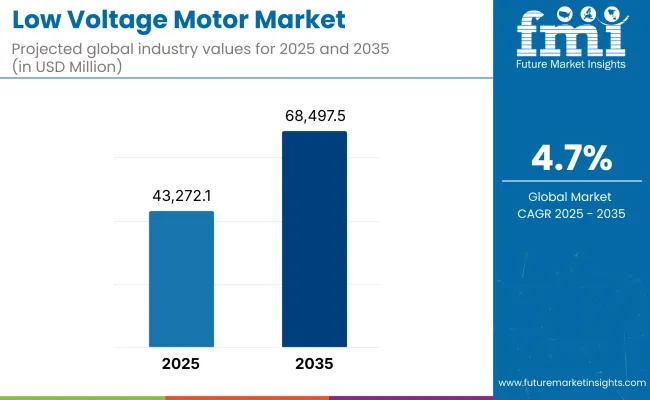

The market was valued at USD 43,272.1 Million which is expected to reach USD 68,497.5 Million by 2035, at a CAGR 4.7% over the forecast period. This growth is supported by regulatory regulations to promote energy conservation, an increase in investments in smart factory automation, and the transition to Industry 4.0.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 43,272.1 Million |

| Market Value (2035F) | USD 68,497.5 Million |

| CAGR (2025 to 2035) | 4.7% |

Growing emphasis on reducing carbon footprint, combined with advances in motor design, IoT-based monitoring, and integration with digital control systems, is further boosting the adoption across developed and emerging economies. In addition, the rising demand for low maintenance and durable motors for mission-critical operations is driving demand in industrial as well as commercial sector.

North America continues to be a prime market as a result ofhigh levels of industrial automation, increasing use of energy efficient technologies and government driven energy saving programs. The United States leads market growth by implementing advanced manufacturing infrastructure and enforcing the value of technology through regulatory efforts, such as the USA Department of Energy’s Motor Challenge. Furthermore, the use of low voltage motors in HVAC applications, oil & gas operations, and commercial buildings also helps to drive the demand in the region.

In Europe, the low voltage motor market is driven by stringent energy efficiency standards like the European Union’s Ecodesign Directive. Germany, France and Italy are among those at the forefront of industrial automation and green manufacturing. Increasing Demand of IE3 and IE4 Efficiency Class Motors Along With Retrofitting of Incoming Equipment Segments is Boosting the Growth of Market.

The region is also emphasizing sustainability, which is promoting electric motor solutions across water treatment, automotive and renewable energy.

The Asia-Pacific is the fastest-growing region owing to rapid industrialization and infrastructure development, along with rising demand for automation in nations such as China, India, and South Korea. Most of this growth comes from China (the biggest contributor), fuelled by local industrial motor production and great investments on smart factories and process automation.

Make in India movement and a greater manufacturing base in the country are also driving motor adoption in India. Increasing energy demand and electricity prices are pushing businesses throughout the region to invest in energy-efficient motor technologies.

Challenge

Cost Sensitivity and Complexity of Upgrading Legacy Systems

Premium-efficiency motors are more expensive upfront, which makes them a harder sell to SMEs, one of the biggest barriers to uptake in the market. Further, adapting contemporary low voltage motors for legacy systems often necessitates complex retrofitting, leading to higher operational complexity and interruptions. In particular, lack of awareness on long-term energy and cost savings also hinders the adoption, especially in developing parts of the world.

Opportunity

Integration with Digital Platforms and Industrial IoT

As smart manufacturing begins to take hold, opportunities to integrate low voltage motors with IIoT and AI-based monitoring systems are increasing. It lends itself to real-time diagnostics, predictive maintenance, and remote operation, leading to greater productivity and energy optimization.

The availability of VFDs and motor control systems enables further customization, with energy-efficient designs that benefit not only the manufacturer but also the customer. Manufacturers who capitalize on the evolving demand landscape by investing in smart, connected and service-based motor solutions stand to benefit.

The global carbon disulfide market grew at a consistent rate from 2020 to 2024, driven by strong demand from the textile, agricultural, and chemical industries. Rayon and cellophane manufacturing dominated, particularly as demand began to grow with packaging and apparel industries.

Moreover, the usage of the compound in the synthesis of agricultural pesticides, especially dithiocarbamates, further intensified its significance in crop protection. But carbon disulfide's environmental toxicity and occupational hazards have limited its wider use. Its market penetration was also hampered during this period by regulatory scrutiny and health-related limitations in multiple countries.

The market is moderate during the period from 2025 to 2035 with improvements in production efficiency and safer protocols of material handling further driving the growth. Manufacturers will probably turn to sustainable production methods to reduce carbon disulfide's environmental footprint.

End Use Industry Demand: The pharmaceutical segment and fine chemical synthesis are also going to witness an increased demand and provide a new path of growth. On the other side, the growing demand for biodegradable and environmentally friendly materials is predicted to support the consumption of carbon disulfide in the eco-friendly production of viscose rayon and regenerated cellulose films. However, with environmental regulations tightening and the industry slowly shifting towards less risky chemical alternatives, market players could see higher compliance loads hitting their balance sheets in time.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Industry Applications | Predominantly used in textile (rayon production), agriculture (pesticides), and chemical manufacturing. |

| Regulatory Environment | Faced challenges due to environmental and health concerns, leading to stringent regulations. |

| Technological Integration | Limited advancements in production processes, with a focus on traditional manufacturing methods. |

| Market Expansion | Growth concentrated in regions with established textile and agricultural industries. |

| Consumer Preferences | Demand driven by traditional applications in textiles and agriculture. |

| Market Shift | 2025 to 2035 |

|---|---|

| Industry Applications | Diversification into pharmaceuticals and eco-friendly product manufacturing. |

| Regulatory Environment | Anticipated implementation of stricter environmental policies promoting safer usage and handling. |

| Technological Integration | Adoption of innovative and sustainable production technologies to reduce environmental impact. |

| Market Expansion | Expansion into emerging markets driven by industrialization and demand for sustainable products. |

| Consumer Preferences | Shift towards eco-friendly and biodegradable products, influencing market demand. |

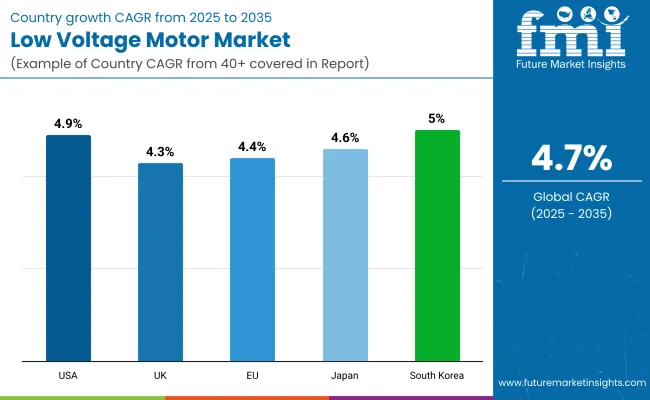

The United States Low Voltage Motor Market is and will grow at a CAGR of 4.9% CAGR during the forecasted period. Low voltage motors are used extensively in the country’s industrial ecosystem covering HVAC, water treatment, oil & gas as well as manufacturing for energy efficiency and automation. Zero-Incompatible rated motors - IE2, IE3 and IE4 Motor Systems have made the replacement of the traditional motor an easy task following the government initiatives towards the adoption of the energy-efficient Motor Systems.

Furthermore, ongoing investments toward infrastructure modernization and industrial automation are further fueling demand from industries such as smart factories and sustainable construction. With that said, domestic manufacturers also focus on research & development activity to improve the design of compact and integrated motor systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

From 2025 to 2035, the Low Voltage Motor Market in the United Kingdom is expected to increase at a CAGR of 4.3%. The increasing emphasis on energy optimization across urban and industrial sectors is directing market growth. With the UK government targeting net-zero emissions by2030, industries are being encouraged to install premium-efficiency motors, especially in HVAC and other public infrastructure.

Low voltage motors are also integral to automation in the UK dimension's food processing and logistics industries. Collaboration between universities and industrial automation companies is also fostering innovation in technologies and performance monitoring for electric drives.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

The Low Voltage Motor Market in Europe will grow at a CAGR of 4.4% during the forecast period. Even though the EU is moving towards the mandatory adoption of high-efficiency motors, it remains far from being a homogenous player on the international stage, as Germany, France and Italy lead the way. IE3 efficiency standards have become mandatory as part of regulatory policies such as the Ecodesign Directive throughout the EU, which promotes replacement demand for old motors.

Low voltage motors are essential for that industrial base in the area, especially automotive, metal processing, and packaging, to be able to run around-the-clock reliable operations. The implementation of EU-funded energy-efficiency programs and digital twin technologies are also influencing trends of future adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| Europe | 4.4% |

Japan Low Voltage Motor Market is expected to witness a substantial growth rate of 4.6% during the forecast period, i.e., 2025-2035. Japanese manufacturing sectors- electronics, robotics and automotive, require high-precision low voltage motors that are compact in design, and offer high-performance. The country’s focus on industrial automation and integration of robotics is driving the acceptance of variable frequency drive (VFD)-compatible low voltage motors.

Japan’s Ministry of Economy, Trade and Industry (METI) energy efficiency regulations have also contributed to the momentum toward premium-efficiency motors. The demand from smart HVAC systems and commercial buildings is also increasing as Japan continues to replace its aging infrastructure with smart technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The Low Voltage Motor Market in South Korea is expected to grow at a CAGR of 5.0% over the next decade. High-tech manufacturing facilities coupled with a rapidly growing smart infrastructure ecosystem are driving the need and adoption of the market.

Low voltage motors are used in conveyor belts, compressors, and robotics systems in sectors as varied as electronics, shipbuilding, and automated warehousing to enhance energy savings and make maintenance more cost effective. National energy conservation regulations are also pushing local industries to switch to IE3 and IE4 compliant motors.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

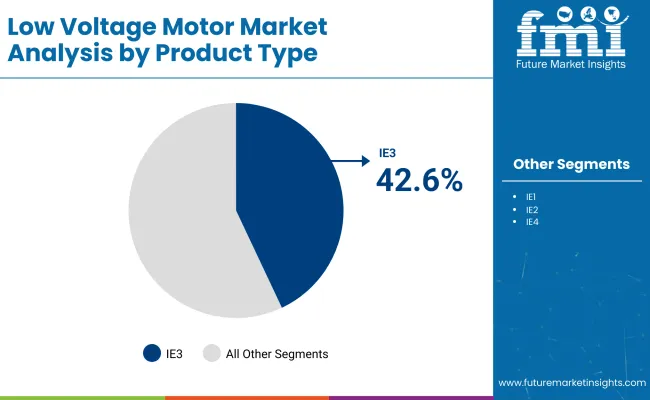

| By Product Type | Market Share (2025) |

|---|---|

| IE3 Low-Voltage Motors | 42.6% |

IE3 low-voltage motors are prevailing in the market on account of higher energy efficiency and increasing compliance requirements framed by global authorities on energy. IE3 : An exactly type of motor, which has a premium efficiency standard, works in such a way that it meets the needs of the industries, thus they can meet the power, economics and cost performance factor. These Motors consume lower power without losing torque which is why it has a great value in the industrial sector as it can perform numerous applications.

With movies banning refrigerants with high global warming potential and drafting regulations to soothe the flame-drawing energy-cost consumers, businesses are not waiting too long to comply with the energy-efficiency standards by switching to IE3 motors to prevent fines and achieve better operational savings in the long run. The motors work dependably in tough environments, from compressors and conveyors to pumps and fans, allowing manufacturers to keep processes running nonstop while also reducing energy costs.

Energy savings is emerging as a key competitive advantage, leading OEMs and plant managers to adopt IE3 low-voltage motors to optimize lifecycle costs. This move, aided by government incentives, makes these motors the choice of both new and retrofitting legacy systems. With global industrial activity on the rise and demand for energy-efficient, sustainable motor solutions expected to remain strong, the adoption of IE3 motors is going to go on fuelling further increases.

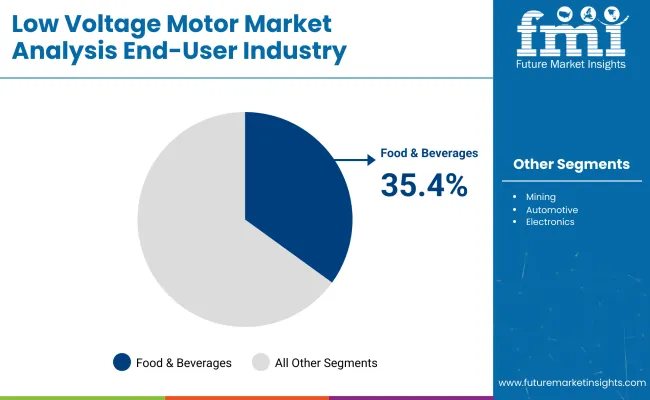

| By End-User Industry | Market Share (2025) |

|---|---|

| Food & Beverages | 35.4% |

Proliferation of automation coupled with hygiene needs in the food & beverages sector has made it the leading end-user industry in low voltage motor market. Motors are essential in processing and packaging lines to drive equipment for conveying, mixing, cooling, bottling and labeling operations. Low-voltage motors are generally used in these systems due to their small size, quiet operation, and energy-saving ability.

For manufacturers in the food industry, washdowns, moisture and temperature changes are the enemies of good equipment, which is why the motors used in food processing have to be tough. Low-voltage motors especially those with IP-rated enclosures that are designed for particular applications can meet these needs while adhering to regulatory standards around food safety and preventing cross-contamination. As food production worldwide ramps up and supply chains get further mechanized, strong, low-maintenance motors become absolutely essential.

Demand for Automation Due to automation trends especially in dairy, bakery, beverage, and processed food segments, intelligent motor systems that provide diagnostics, and remote monitoring capabilities closer to break-even point continue to drive the demand. Low-voltage motors can also help achieve energy management goals, allowing food processors to reduce operating costs while maintaining productivity and safety.

Rising industrial automation, a growing adoption of energy-efficient motors, and infrastructure development in the manufacturing, HVAC, and power generation sectors are driving the growth of the Low Voltage Motor Market. Manufacturers are also investing into compact and energy efficient motors, adhering to IE3 and IE4 efficiency standards, among other things, growing their global footprint and aftermarket service capabilities. The global electric motor market is highly fragmented in nature owing to the presence of multinational corporations and regional manufacturers that provide various motor types such as asynchronous, synchronous, and brushless DC motors for different end-use applications.

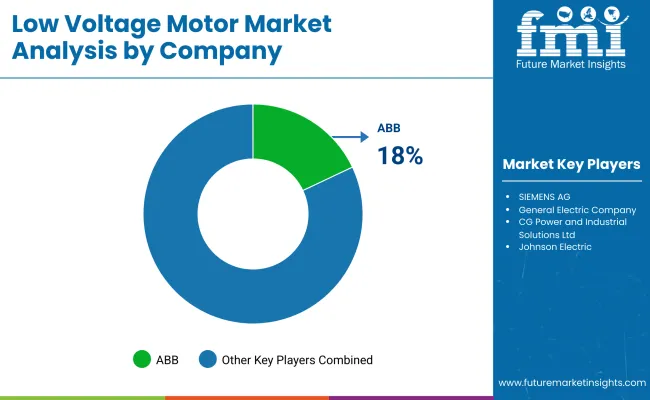

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ABB | 18-22% |

| SIEMENS AG | 14-18% |

| General Electric Company | 10-14% |

| CG Power and Industrial Solutions Ltd. | 8-12% |

| Johnson Electric | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| ABB | In 2024, launched ultra-premium IE5 low voltage motors targeting high-efficiency applications. |

| SIEMENS AG | In 2025, expanded its Simotics motor range with digital twin integration for real-time monitoring. |

| General Electric Company | In 2024, introduced low-voltage motors optimized for renewable energy and smart grids. |

| CG Power and Industrial Solutions Ltd. | In 2025, increased exports of low-voltage motors across MEA and Southeast Asia. |

| Johnson Electric | In 2024, released compact low-voltage motors for automotive and HVAC markets. |

Key Company Insights

ABB (18-22%)

ABB dominates the market with high-efficiency IE5-rated motors, offering advanced control and digital monitoring features.

SIEMENS AG (14-18%)

SIEMENS delivers integrated motor solutions using smart technologies and simulation tools, enabling predictive maintenance.

General Electric Company (10-14%)

GE specializes in industrial-scale low-voltage motors tailored for specifications with sustainability, grid compatibility, and reliability in mind.

CG Power and Industrial Solutions Ltd. (8-12%)

CG Power is focused on emerging markets with durable, energy-efficient low-voltage motors optimized for extreme environments.

Johnson Electric (6-10%)

Johnson Electric specializes in miniature and precision low-voltage motors for automotive, medical, and industrial OEMs.

Other Key Players (30-40% Combined)

Several global and regional motor manufacturers contribute significantly to the market with product specialization and regional customization:

The overall market size for the Low Voltage Motor Market was USD 43,272.1 Million in 2025.

The Low Voltage Motor Market is expected to reach USD 68,497.5 Million in 2035.

The demand is driven by increasing adoption of industrial automation, stringent energy efficiency regulations, growing deployment in electric vehicles, and rising applications in HVAC systems and home appliances.

The top 5 countries driving market growth are the USA, UK, Europe, Japan, and South Korea.

The IE3 Low-Voltage Motors segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Voltage Motor Control Center Market Growth – Trends & Forecast (2024-2034)

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Low-Grade Glioma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Low Power Wide Area Network (LPWAN) Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Content Kefir Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA