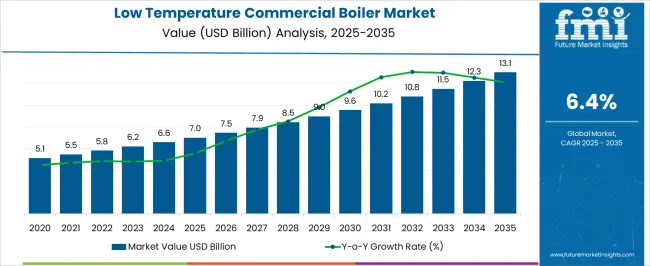

The low temperature commercial boiler market is projected to grow from USD 7.0 billion in 2025 to USD 13.1 billion by 2035, reflecting a CAGR of 6.4%. During the early adoption phase (2020–2024), the market gradually expanded as commercial facilities began transitioning to efficient boiler systems to meet heating requirements.

By 2025, the adoption of low-temperature solutions will become more consistent across offices, institutions, and service industries. This phase marks the transition from selective usage to broader deployment, with manufacturers scaling capacity and improving availability in regional markets to meet rising demand. From 2025 to 2030, the scaling phase sees strong adoption, with the market expanding steadily from USD 7.0 billion as usage grows across small and large commercial buildings.

By 2030, low temperature commercial boilers become increasingly common in retrofits and new installations, reflecting wider market confidence. Between 2030 and 2035, the consolidation phase emerges as the market reaches USD 13.1 billion. Leading suppliers streamline their product portfolios, strengthen partnerships with distributors, and focus on reliability and operational cost efficiency. The result is a mature market structure defined by stable growth, strong competition, and widespread integration into commercial heating systems globally.

| Metric | Value |

|---|---|

| Low Temperature Commercial Boiler Market Estimated Value in (2025 E) | USD 7.0 billion |

| Low Temperature Commercial Boiler Market Forecast Value in (2035 F) | USD 13.1 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The low temperature commercial boiler market is an important sub-segment of the broader commercial heating equipment industry. In 2025, low temperature systems account for around 21% of the total commercial boiler market, which includes conventional and high-efficiency models. The broader commercial heating equipment sector, covering boilers, furnaces, and heat pumps, is expected to grow at a CAGR of about 5% from 2025 to 2035, while low temperature commercial boilers outperform this trend with a CAGR of 6.4%, underscoring their rising relevance in the parent industry. Within the commercial boiler segment, low temperature systems hold approximately 30% share in 2025, with conventional boilers representing the majority.

By 2030, as adoption accelerates, the share of low temperature units is expected to rise to 34%, reflecting steady replacement of older models and wider use in new commercial facilities. Between 2030 and 2035, consolidation within the industry drives standardization, helping low temperature commercial boilers secure around 37% share of the commercial boiler market by 2035.

The low temperature commercial boiler market is witnessing steady expansion, supported by increasing demand for energy-efficient heating systems across commercial and institutional infrastructures. Stricter environmental regulations, combined with the need to reduce greenhouse gas emissions, are encouraging the replacement of conventional high-temperature boilers with low-temperature models that operate at optimal thermal efficiency.

Advancements in heat exchanger technology, enhanced control systems, and compatibility with hybrid and renewable energy sources are further reinforcing market growth. The adoption rate is being boosted by government incentives and compliance requirements that favor lower operating temperatures to minimize energy wastage.

Demand is particularly strong in sectors such as hospitality, healthcare, education, and office buildings, where consistent yet efficient heat supply is essential. The long-term outlook remains positive as technological innovation, lifecycle cost benefits, and retrofitting potential align with global decarbonization goals, making low temperature commercial boilers an integral component in sustainable heating solutions for the future.

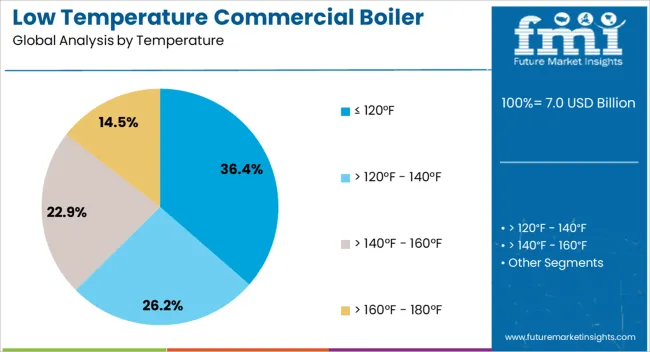

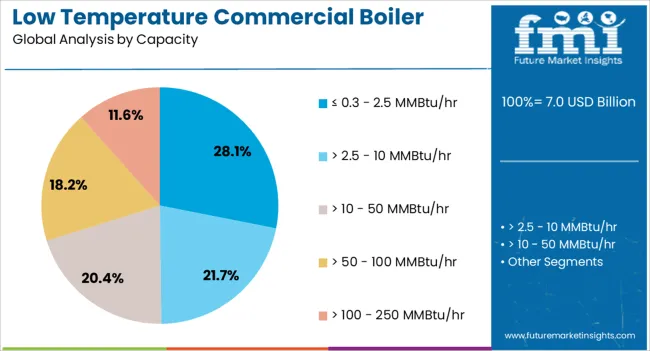

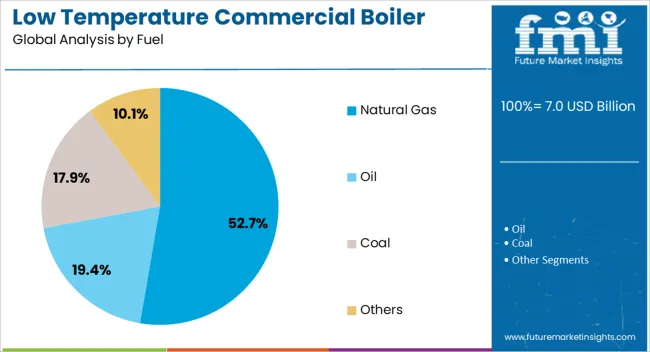

The low temperature commercial boiler market is segmented by temperature, capacity, fuel, technology, application, and geographic regions. By temperature, low temperature commercial boiler market is divided into ≤ 120°F, > 120°F - 140°F, > 140°F - 160°F, and > 160°F - 180°F. In terms of capacity, low temperature commercial boiler market is classified into ≤ 0.3 - 2.5 MMBtu/hr, > 2.5 - 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, and > 100 - 250 MMBtu/hr. Based on fuel, low temperature commercial boiler market is segmented into Natural Gas, Oil, Coal, and Others. By technology, low temperature commercial boiler market is segmented into Condensing and Non-Condensing. By application, low temperature commercial boiler market is segmented into Offices, Healthcare Facilities, Educational Institutions, Lodgings, Retail Stores, and Others. Regionally, the low temperature commercial boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤ 120°F segment leads the market within the temperature category, accounting for approximately 36.4% of total share. This dominance is attributed to its ability to deliver consistent thermal performance while maximizing condensing efficiency, which results in lower energy consumption and reduced operating costs. The segment’s growth has been reinforced by its suitability for modern building heating systems, especially those utilizing radiant floor heating and low-temperature radiators.

Regulatory standards promoting efficiency optimization have further encouraged adoption of boilers in this temperature range. Additionally, the ≤ 120°F configuration reduces thermal stress on system components, extending service life and minimizing maintenance requirements.

Its compatibility with renewable energy-assisted systems and ability to meet stringent emissions targets make it a preferred choice for environmentally conscious projects. With continued investment in commercial energy retrofits and a shift towards low-carbon infrastructure, this temperature range is expected to sustain its leadership position over the forecast period.

The ≤ 0.3 - 2.5 MMBtu/hr capacity segment holds a significant 28.1% share in the market, reflecting its alignment with the heating requirements of small to mid-sized commercial facilities. The segment benefits from its balance of operational flexibility and cost efficiency, making it suitable for applications such as schools, healthcare centers, and small office complexes.

The compact footprint and ease of installation associated with this capacity range have supported its widespread use in both new construction and retrofitting projects. Demand is further reinforced by the segment’s ability to achieve high efficiency ratings while maintaining compliance with evolving emissions standards.

These boilers offer scalability, allowing for modular configurations that can adapt to fluctuating heating loads, thereby enhancing overall system efficiency. With growing emphasis on lifecycle cost savings and operational reliability, the ≤ 0.3 - 2.5 MMBtu/hr capacity segment is anticipated to maintain steady growth momentum in the coming years.

The natural gas segment dominates the fuel category with a substantial 52.7% market share, driven by the fuel’s cost-effectiveness, wide availability, and relatively lower carbon footprint compared to other fossil fuels. Natural gas-fired low temperature boilers are favored for their high thermal efficiency, reduced emissions, and compatibility with advanced condensing technologies.

This segment’s leadership is reinforced by supportive energy policies in several regions promoting the use of cleaner-burning fuels. Additionally, natural gas infrastructure is already well-established in many commercial zones, lowering barriers to adoption and reducing installation costs.

The segment benefits from stable supply chains and price competitiveness, further encouraging its selection for large-scale and long-term heating projects. With ongoing advancements in burner design and controls that enhance performance while minimizing NOx emissions, the natural gas segment is expected to retain its dominant position, particularly as industries and municipalities transition towards greener yet cost-efficient heating solutions.

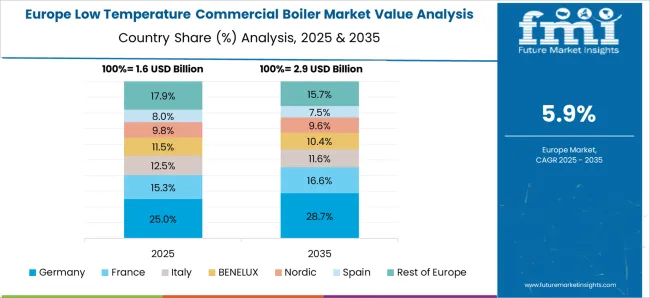

The low temperature commercial boiler market is witnessing steady expansion driven by rising demand for energy-efficient heating systems across offices, educational institutions, healthcare facilities, and retail spaces. Europe leads due to strict efficiency directives and emissions reduction targets, while North America focuses on retrofitting outdated systems. Asia-Pacific growth is supported by urbanization and rapid expansion of commercial infrastructure. Manufacturers differentiate through compact designs, hybrid integration, and advanced digital controls. Regulatory frameworks, fuel price volatility, and lifecycle costs significantly shape adoption.

The push toward greener heating systems is central to the growth of the low temperature commercial boiler market. In Europe, stringent directives such as the Ecodesign and Energy Labelling regulations mandate higher efficiency levels, leading to strong adoption of low temperature units. North America follows suit with energy efficiency programs encouraging replacements of outdated boilers in commercial settings. In Asia-Pacific, demand is influenced less by regulations and more by urban construction activity and infrastructure investments. The differences in regional emphasis—compliance-driven markets in the West versus expansion-driven demand in Asia—shape product specifications and market priorities. Leading manufacturers emphasize condensing technology, smart control integration, and lower emissions, while regional players focus on affordability and basic efficiency upgrades. As efficiency targets tighten globally, the role of low temperature boilers continues to expand within sustainable heating strategies across commercial facilities.

The replacement of outdated and inefficient heating systems remains a dominant factor in shaping low temperature commercial boiler demand. In North America and Europe, a large portion of existing commercial buildings operate with decades-old boiler systems, creating significant opportunities for replacements. Governments and utilities also incentivize retrofitting through subsidies and rebate programs to lower energy consumption. In contrast, Asia-Pacific shows stronger demand from newly constructed commercial spaces, with replacement demand still emerging. This creates a divergence between mature and growing markets: one focused on modernization, the other on new installations. Manufacturers target retrofitting projects with compact, modular, and flexible low temperature boilers that can be installed with minimal disruption. Retrofit-friendly designs are particularly appealing to facility managers in urban areas where downtime is costly. The replacement trend reinforces steady revenue streams in mature economies, while new construction drives parallel growth elsewhere.

Fuel availability and price volatility strongly influence the adoption of low temperature commercial boilers. In Europe, natural gas-based boilers dominate due to widespread gas networks, while fuel oil options are phasing out under emissions restrictions. North America demonstrates similar trends but shows growing interest in hybrid systems combining gas boilers with renewable inputs such as biomass. In Asia-Pacific, cost sensitivity leads to higher demand for affordable systems compatible with local fuels, especially in emerging economies where gas grids are underdeveloped. These contrasts shape the boiler design and technology integration strategies of manufacturers. Global leaders emphasize natural gas condensing boilers with lower carbon footprints, while regional suppliers compete by offering versatile, low-cost alternatives. Fuel-related decisions highlight the divide between cost-conscious, rapidly growing markets and regulation-driven, efficiency-oriented economies, influencing adoption patterns worldwide.

Integration of digital controls and hybrid compatibility is redefining the low temperature commercial boiler market. In advanced regions like Europe and North America, facility managers increasingly prefer boilers with IoT-enabled controls, remote monitoring, and predictive maintenance capabilities. This not only boosts energy efficiency but also reduces operating costs. In Asia-Pacific, where cost remains the primary driver, digital features are adopted gradually, often limited to premium commercial projects. Hybrid systems that combine low temperature boilers with renewable technologies such as solar thermal or heat pumps are also gaining traction, especially in markets pursuing carbon neutrality. The contrast between feature-rich adoption in developed economies and more basic setups in emerging markets creates differentiated growth opportunities. Manufacturers that offer scalable designs—from simple models to advanced hybrid-ready systems—strengthen their global competitiveness, catering to both high-tech and cost-driven customer bases.

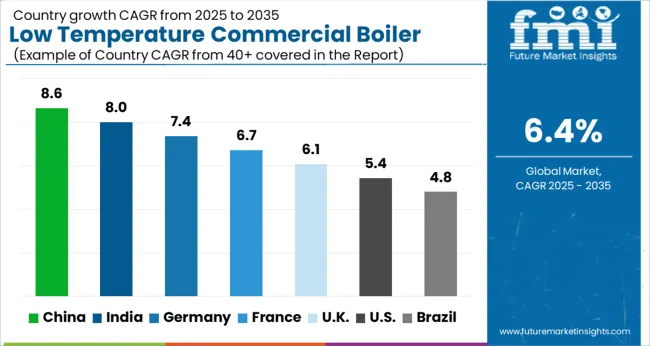

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

The global low temperature commercial boiler market is projected to grow at a 6.4% CAGR through 2035, fueled by demand in commercial buildings, industrial heating, and district energy systems. Among BRICS nations, China led with 8.6% growth as large-scale production and installation facilities were expanded, while India at 8.0% enhanced manufacturing and operational capacity to meet rising efficiency requirements. In the OECD region, Germany at 7.4% maintained stable output under strict emission and safety standards, while the United Kingdom at 6.1% supported moderate deployment across commercial establishments. The USA, growing at 5.4%, advanced steady adoption across heating and industrial applications, complying with federal and state-level efficiency regulations. This report includes insights on 40+ countries; the top countries are shown here for reference.

The low temperature commercial boiler market in China is growing at an 8.6% CAGR, supported by rapid urbanization, expansion of commercial infrastructure, and rising demand for energy-efficient heating solutions. Government initiatives promoting clean and sustainable energy systems are driving the adoption of modern boilers in office complexes, hotels, hospitals, and educational institutions. Domestic manufacturers are investing in research and development to produce high-performance boilers with lower emissions and improved fuel efficiency. Increasing construction of smart buildings and eco-friendly commercial facilities further supports market growth. Distribution through retail networks and e-commerce platforms enhances accessibility. Overall, China’s market expansion is influenced by strong infrastructure investment, regulatory support for efficiency, and rising preference for sustainable heating technologies.

Low temperature commercial boiler market in India is registering an 8.0% CAGR, driven by rising demand for efficient heating in hotels, hospitals, educational institutions, and office complexes. Urbanization and economic development are increasing energy needs across the commercial sector, supporting demand for modern boiler systems. Government policies encouraging energy efficiency and sustainable building solutions further promote market growth. Domestic and international manufacturers are supplying advanced boiler systems that reduce emissions while improving performance. Distribution networks, including specialized equipment suppliers and e-commerce platforms, enhance availability for commercial buyers. The market is shaped by infrastructure growth, rising focus on energy conservation, and increasing adoption of sustainable heating technologies.

Germany’s low temperature commercial boiler market is growing at a 7.4% CAGR, supported by strict energy efficiency regulations and high adoption of environmentally friendly heating systems. Commercial facilities, including offices, hospitals, and educational institutions, are transitioning towards boilers that meet stringent EU energy performance standards. Manufacturers are focusing on compact, high-performance systems designed to reduce emissions and improve cost efficiency. The integration of renewable energy sources such as biomass and solar with boiler systems is further supporting demand. Digital monitoring and smart control features are gaining traction, helping operators optimize energy consumption. Germany’s market reflects a strong emphasis on sustainability, regulatory compliance, and technological sophistication.

The United Kingdom market is expanding at a 6.1% CAGR, driven by modernization of commercial heating systems and regulatory requirements for energy-efficient solutions. Government initiatives promoting carbon reduction and sustainable buildings are encouraging the replacement of outdated boilers with modern low temperature systems. Hotels, hospitals, and office complexes are key adopters of efficient heating technologies. Manufacturers are focusing on systems that combine reliability, cost efficiency, and compliance with evolving standards. Distribution through specialized suppliers and online platforms ensures broad product availability. Overall, the UK market reflects steady adoption of energy-efficient solutions, regulatory influence, and modernization of commercial infrastructure.

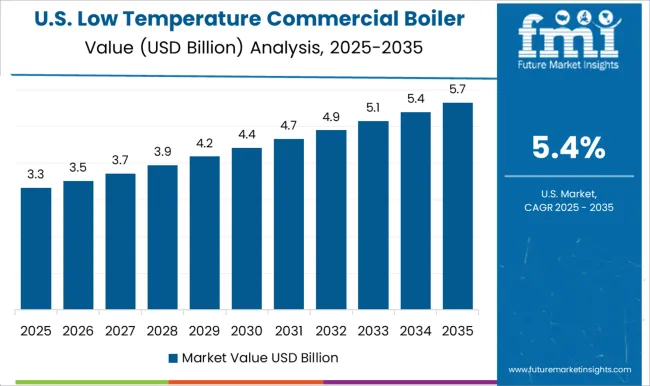

The United States low temperature commercial boiler market is growing at a 5.4% CAGR, supported by increasing demand for energy-efficient heating solutions across commercial facilities. Regulatory frameworks emphasizing sustainability and emission reduction are encouraging adoption of modern boiler systems. Manufacturers are innovating with compact, high-efficiency boilers that offer improved operational performance and lower environmental impact. Commercial sectors such as healthcare, education, and office complexes are driving consistent demand. Integration of smart control features and compatibility with renewable energy sources are gaining importance. Overall, the USA market reflects steady growth supported by infrastructure modernization, sustainability initiatives, and rising preference for cost-efficient heating technologies.

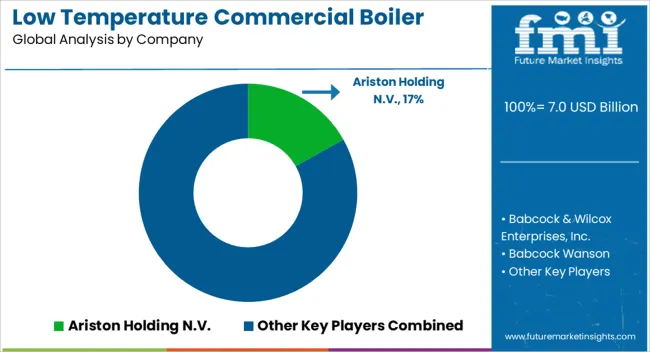

The low temperature commercial boiler market is shaped by several prominent manufacturers that focus on energy-efficient and environmentally sustainable heating solutions. Companies such as Ariston Holding N.V., Babcock & Wilcox Enterprises, Inc., Babcock Wanson, and BURNHAM COMMERCIAL BOILERS have established strong positions by offering advanced boiler systems designed to meet modern efficiency standards and regulatory requirements. These suppliers emphasize durability, innovative combustion technology, and reduced emissions, catering to the growing demand from commercial buildings, institutions, and industrial facilities. Other notable players like Bradford White Corporation, Clayton Industries, Cleaver-Brooks, and FERROLI S.p.A. are recognized for providing a wide range of low temperature boiler systems that integrate compact designs with superior thermal efficiency. Their products are increasingly being adopted in retrofitting projects and new commercial constructions, as building owners prioritize cost savings and compliance with strict energy codes. With rising global concerns over carbon emissions, these companies are also developing boilers that can integrate with renewable energy systems and advanced control technologies. Global manufacturers including FONDITAL S.p.A., Hoval, Hurst Boiler & Welding Co., Inc., Miura America Co., LTD., and Precision Boilers continue to expand their market footprint by focusing on smart solutions and modular systems. These suppliers are investing in innovation to ensure flexible operations, reduced lifecycle costs, and compatibility with future energy transition strategies. As commercial sectors move toward greener and more efficient heating technologies, these leading companies are expected to play a critical role in driving the adoption of low temperature boilers worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.0 Billion |

| Temperature | ≤ 120°F, > 120°F - 140°F, > 140°F - 160°F, and > 160°F - 180°F |

| Capacity | ≤ 0.3 - 2.5 MMBtu/hr, > 2.5 - 10 MMBtu/hr, > 10 - 50 MMBtu/hr, > 50 - 100 MMBtu/hr, and > 100 - 250 MMBtu/hr |

| Fuel | Natural Gas, Oil, Coal, and Others |

| Technology | Condensing and Non-Condensing |

| Application | Offices, Healthcare Facilities, Educational Institutions, Lodgings, Retail Stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ariston Holding N.V., Babcock & Wilcox Enterprises, Inc., Babcock Wanson, BURNHAM COMMERCIAL BOILERS, Bradford White Corporation, Clayton Industries, Cleaver-Brooks, FERROLI S.p.A, FONDITAL S.p.A., Hoval, Hurst Boiler & Welding Co, Inc., Miura America Co., LTD., and Precision Boilers |

| Additional Attributes | Dollar sales vary by fuel type, including natural gas, oil, coal, and biomass boilers; by capacity, such as below 2.5 MMBtu/hr, 2.5–10 MMBtu/hr, and above 10 MMBtu/hr; by application, spanning offices, hospitals, schools, hotels, and retail spaces; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by energy efficiency regulations, sustainable heating demand, and modernization of commercial infrastructure. |

The global low temperature commercial boiler market is estimated to be valued at USD 7.0 billion in 2025.

The market size for the low temperature commercial boiler market is projected to reach USD 13.1 billion by 2035.

The low temperature commercial boiler market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in low temperature commercial boiler market are ≤ 120°f, > 120°f - 140°f, > 140°f - 160°f and > 160°f - 180°f.

In terms of capacity, ≤ 0.3 - 2.5 mmbtu/hr segment to command 28.1% share in the low temperature commercial boiler market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Fired Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Alloy Steels Powder Market Size and Share Forecast Outlook 2025 to 2035

Low Alkali Cement Market Size and Share Forecast Outlook 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Components Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA