The gas fired low temperature commercial boiler market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 6.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

This growth trajectory underscores the continued reliance on efficient heating solutions for commercial buildings such as offices, educational facilities, healthcare centers, and retail complexes. In the period from 2025 to 2030, demand will be driven by replacement of aging boiler systems and heightened regulatory focus on energy efficiency, pushing the market close to USD 4.8 billion.

Between 2030 and 2035, the market is expected to strengthen further as building modernization projects and stricter emission standards encourage the adoption of advanced gas-fired low temperature models. The incremental increase of USD 3.0 billion over the decade signals opportunities for manufacturers offering compact, durable, and digitally controlled systems. Regional momentum will be strongest in Europe, where energy performance regulations are stringent, while Asia-Pacific will witness growth from expanding commercial infrastructure. Competitive intensity will revolve around efficiency enhancements, lifecycle cost reduction, and integration with smart building systems.

Cross-functional coordination between facility engineering teams and energy management departments creates ongoing dialogue about boiler efficiency optimization versus capital investment requirements. Energy managers work with mechanical engineers to evaluate condensing technology benefits against installation costs while managing utility rebate programs and regulatory compliance requirements that may affect both equipment selection and operational procedures across different building types and usage patterns.

Healthcare facility operations experience installation complexity as medical building boiler systems must maintain precise temperature control and reliability standards while coordinating with infection control teams, medical equipment specialists, and emergency backup system requirements. Engineering departments work with clinical operations managers to establish redundancy requirements and maintenance scheduling that addresses both patient care continuity and regulatory compliance for healthcare heating systems.

Educational facility management encounters operational considerations as school and university boiler systems require coordination between academic scheduling, maintenance access, and energy budget management while accommodating seasonal occupancy variations and building usage patterns. Facilities teams coordinate with academic administration to establish maintenance windows during breaks and summer periods while managing energy consumption monitoring and cost allocation across different building zones and departmental budgets.

Office building operations experience tenant coordination challenges as commercial boiler systems must balance individual zone control requirements against central system efficiency while managing lease agreement responsibilities and tenant comfort expectations. Property management teams coordinate with tenant representatives to establish temperature control procedures and maintenance access requirements while managing energy cost allocation and system upgrade decisions that affect both operational expenses and tenant satisfaction.

| Metric | Value |

|---|---|

| Gas Fired Low Temperature Commercial Boiler Market Estimated Value in (2025 E) | USD 3.5 billion |

| Gas Fired Low Temperature Commercial Boiler Market Forecast Value in (2035 F) | USD 6.5 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The gas-fired low-temperature commercial boiler market is expanding steadily due to rising demand for energy-efficient heating systems in commercial and institutional buildings. Growing emphasis on carbon footprint reduction, stricter building energy codes, and the replacement of outdated heating systems are accelerating adoption of high-performance, low-temperature alternatives.

These boilers are valued for their ability to operate efficiently at reduced water temperatures, minimizing fuel consumption and emissions while maintaining consistent heat output. Adoption is increasing across schools, hospitals, offices, and multi-residential complexes, where efficiency, reliability, and lifecycle cost savings are key decision factors.

Recent advancements, such as smart control systems, enhanced heat exchanger materials, and integration with renewable energy technologies, are elevating product value and performance. As sustainability becomes a core priority in HVAC planning and public policy, investment in clean, low-emission heating technologies continues to grow, supporting long-term market expansion.

The gas-fired low-temperature commercial boiler market is segmented by temperature, capacity, technology, application, and geographic regions. The temperature of the gas-fired low temperature commercial boiler market is divided into ≤ 120°F, > 120°F - 140°F, > 140°F - 160°F, and > 160°F - 180°F. In terms of capacity, the gas-fired low-temperature commercial boiler market is classified into ≤ 0.3 - 2.5 MMBTU/hr, > 2.5 - 10 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, and > 100 - 250 MMBTU/hr. The gas-fired low-temperature commercial boiler market is segmented into condensing and non-condensing.

The gas-fired low-temperature commercial boiler market is segmented into offices, healthcare facilities, educational institutions, lodgings, retail stores, and others. Regionally, the gas fired low temperature commercial boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤120°F temperature range is projected to account for 34.6% of total market revenue by 2025, establishing it as a key segment. Its popularity stems from energy savings, lower emissions, and compatibility with low-temperature distribution systems such as radiant floor heating and fan coil units.

Operating at lower temperatures enhances system efficiency, reduces thermal stress, and extends equipment lifespan, which minimizes maintenance needs. This range also aligns with energy conservation standards set by regulators, driving adoption across commercial facilities focused on cost and sustainability performance.

As businesses continue to seek lower lifecycle costs and reduced carbon impact, demand for boilers in this segment is expected to remain strong.

The 0.3–2.5 MMBTU/hr capacity range is forecast to represent 39.2% of total revenue by 2025, making it the largest capacity segment. These systems are ideal for small and medium-sized commercial spaces, including restaurants, retail outlets, offices, and educational facilities.

Their versatility supports both retrofit projects and new installations, particularly in urban areas where space and energy efficiency are critical. The segment’s dominance is reinforced by its suitability for zoned heating systems and distributed energy setups, which balance performance and footprint.

Its cost-effectiveness, compact design, and operational flexibility continue to make it the preferred option for commercial buildings seeking efficient, compliant heating solutions.

The gas-fired low-temperature commercial boiler market is driven by demand for energy-efficient heating, tightening environmental rules, cost-reduction needs, and wide adoption across commercial sectors. These systems deliver reliable, lower-emission heating for a range of buildings and uses.

The demand for gas-fired low-temperature commercial boilers is primarily driven by the growing need for energy-efficient heating solutions. As businesses face increasing energy costs, these boilers offer a cost-effective alternative to traditional heating systems. Their ability to operate at lower temperatures allows for reduced fuel consumption while maintaining optimal heating performance. The market for these boilers is expanding as more industries and commercial establishments seek to lower their operational costs and improve energy efficiency. Governments are implementing regulations to encourage energy-efficient practices, further fueling the demand for these systems. Their efficiency in reducing energy use makes them a preferred choice for commercial heating.

Stricter environmental regulations are pushing commercial sectors to adopt heating solutions with lower emissions. Gas-fired low-temperature commercial boilers meet regulatory standards, as they generate fewer pollutants compared to oil or coal-fired systems. These boilers comply with local and international environmental standards, ensuring that businesses can avoid potential penalties while meeting government requirements. The growing need for compliance with carbon reduction targets and air quality regulations has bolstered the demand for these systems. By adopting gas-fired boilers, businesses can align with these regulations while also reducing their carbon footprint, contributing to a more environmentally friendly operation.

The primary driver for the adoption of gas-fired low-temperature commercial boilers is their cost-effectiveness. These systems provide significant savings on energy bills due to their high efficiency and ability to reduce fuel consumption. By operating at lower temperatures, these boilers utilize less energy to provide the same level of heating, which helps reduce overall operational expenses for commercial buildings. The long-term financial savings, combined with lower maintenance costs, make these systems a viable investment for businesses. The shift towards these systems reflects a growing focus on cost control and energy efficiency in the commercial heating sector.

Gas-fired low-temperature commercial boilers are gaining traction across various industries, including retail, hospitality, education, and healthcare. These sectors require consistent and efficient heating systems to meet the demands of their spaces. As these industries continue to prioritize cost savings and energy efficiency, gas-fired boilers have become the go-to solution. The flexibility of these boilers, which can be adapted for various building sizes and heating needs, contributes to their widespread adoption. Commercial buildings that need reliable and low-cost heating solutions are increasingly turning to gas-fired low-temperature boilers, further expanding the market share of this heating technology.

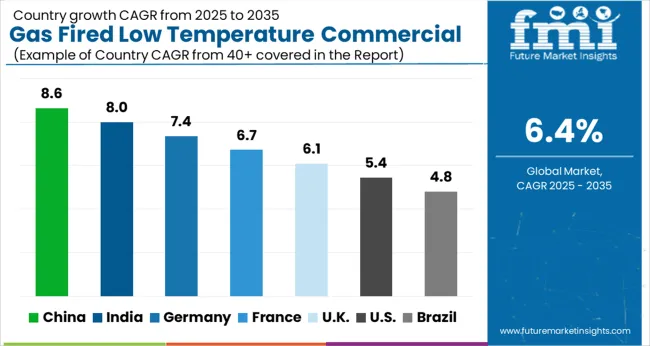

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

| USA | 5.4% |

| Brazil | 4.8% |

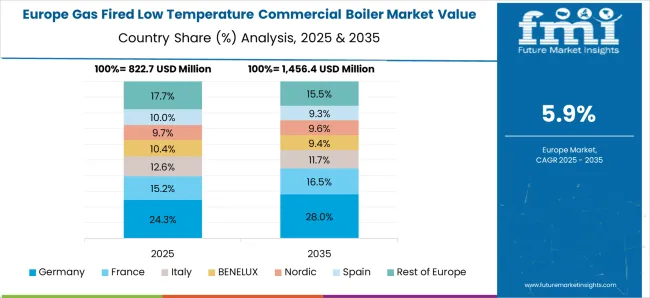

The gas-fired low-temperature commercial boiler market is projected to expand globally at a CAGR of 6.4% from 2025 to 2035, supported by increasing demand for energy-efficient heating solutions, environmental regulations, and cost-effective operation. China leads with a CAGR of 8.6%, driven by the country's push for energy-efficient solutions, rising industrial demand, and government initiatives promoting green technologies. India follows at 8.0%, benefitting from rapid infrastructure development, frequent power outages, and growing commercial construction. France posts 6.7%, driven by its commitment to reducing carbon emissions and its growing commercial building sector. The United Kingdom grows at 6.1%, fueled by rising energy costs and regulatory requirements for energy-efficient heating systems, while the United States shows 5.4%, supported by an expanding demand for low-emission, cost-effective heating solutions in commercial buildings. The analysis spans more than 30 countries, with these five serving as reference points for market expansion, product innovation, and strategic investment in the global gas-fired low-temperature commercial boiler market.

The UK gas-fired low-temperature commercial boiler market is projected to post a CAGR of 6.1% during 2025–2035, up from 4.5% recorded between 2020–2024, reflecting increased adoption driven by stricter energy efficiency regulations and demand for lower operational costs. The earlier period was impacted by slower market uptake and high initial investment costs, but the next phase is expected to benefit from rising commercial building construction, government incentives for energy-efficient solutions, and advancements in low-emission technology. The market growth will also be driven by increased focus on reducing energy consumption in commercial properties.

China is expected to post a CAGR of 8.6% during 2025–2035, up from 5.8% during 2020–2024, reflecting increased demand for energy-efficient and low-emission heating systems. The earlier phase was affected by production slowdowns and limited adoption of new technologies. The upcoming period will gain momentum from the expansion of industrial sectors, government policies supporting cleaner energy, and the rising demand for reliable and cost-effective heating systems in commercial spaces. Additionally, as China's middle class continues to grow, demand for energy-efficient commercial heating solutions is expected to rise.

India is expected to grow at a CAGR of 8.0% from 2025 to 2035, surpassing the 6.2% CAGR between 2020–2024. The earlier phase was shaped by infrastructure constraints and slow adoption of energy-efficient systems. The improved outlook is driven by the rapid expansion of commercial construction, frequent power outages, and government initiatives promoting energy efficiency. As commercial sectors, particularly retail, hospitality, and education, grow, the demand for reliable and cost-effective gas-fired low-temperature boilers is expected to rise. Local manufacturing and government-backed incentives will further fuel adoption.

France is projected to post a CAGR of 6.7% during 2025–2035, up from 5.2% during 2020–2024, as stricter environmental regulations and energy efficiency demands push the market forward. The earlier period saw slower adoption due to higher installation costs and limited awareness of energy-efficient solutions. In the next phase, the market will benefit from increasing focus on reducing carbon emissions across commercial and public sectors, government incentives, and growing demand for low-emission heating systems. France's ongoing commitment to environmental policies will continue to drive the adoption of gas-fired low-temperature boilers.

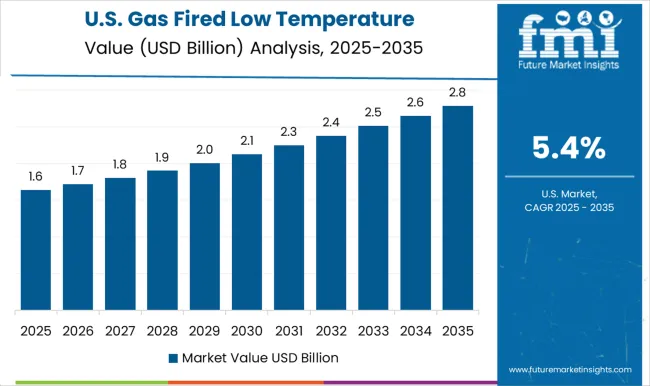

The USA gas-fired low-temperature commercial boiler market is projected to grow at a CAGR of 5.4% during 2025–2035, up from 4.0% recorded between 2020–2024. The earlier phase was influenced by the high initial investment costs and relatively slow adoption of energy-efficient systems in the commercial sector. However, the forecasted growth is driven by increasing demand for cost-effective heating solutions and a stronger push toward energy efficiency in response to stricter environmental regulations. The rise in commercial building projects, along with the growing need for reliable, low-emission heating systems, will fuel market expansion. The USA government’s focus on reducing greenhouse gas emissions is expected to accelerate the shift toward more sustainable and energy-efficient heating technologies.

The gas fired low temperature commercial boiler market is shaped by leading global manufacturers focused on energy-efficient and low-emission heating technologies. Ariston Holding N.V. leads with a broad range of residential and commercial systems emphasizing efficiency and sustainability. Bosch Industriekessel GmbH and Viessmann Climate Solutions SE hold strong positions in Europe, offering advanced condensing and low-temperature boilers that comply with stringent environmental regulations. Cleaver-Brooks, Inc. remains a major North American supplier, specializing in industrial-scale systems with high thermal efficiency and low-NOx performance.

In the United States, Bradford White Corporation and Burnham Commercial Boilers provide reliable, cost-effective solutions for commercial and institutional use. Ferroli S.p.A. and Fondital S.p.A. are key European players offering compact, energy-saving models suited for small and medium facilities. Fulton Boiler Works, Inc. and Precision Boilers, LLC focus on specialized, high-efficiency units for industrial and process applications. Vaillant Group International GmbH and Weil-McLain deliver advanced low-temperature gas-fired boilers for sustainable heating across residential and commercial segments. Wolf GmbH and Immergas S.p.A. continue to innovate with connected, smart control systems that improve energy management.

Across the sector, competition centers on expanding high-efficiency portfolios, reducing emissions, and meeting stricter energy regulations. Manufacturers are increasingly investing in hydrogen-ready boilers, digital monitoring, and hybrid energy systems to align with global sustainability targets. These initiatives collectively strengthen the transition toward cleaner, more efficient heating solutions for commercial buildings worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Temperature | ≤ 120°F, > 120°F - 140°F, > 140°F - 160°F, and > 160°F - 180°F |

| Capacity | ≤ 0.3 - 2.5 MMBTU/hr, > 2.5 - 10 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, and > 100 - 250 MMBTU/hr |

| Technology | Condensing and Non-condensing |

| Application | Offices, Healthcare facilities, Educational institutions, Lodgings, Retail stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ariston Holding N.V.; Babcock & Wilcox Enterprises, Inc.; Bosch Industriekessel GmbH (Bosch Thermotechnology); Bradford White Corporation; Burnham Commercial Boilers; Cleaver-Brooks, Inc.; Ferroli S.p.A.; Fondital S.p.A.; Fulton Boiler Works, Inc.; Hoval AG; Hurst Boiler & Welding Co., Inc.; Immergas S.p.A.; Lochinvar, LLC; Precision Boilers, LLC; Vaillant Group International GmbH; Viessmann Climate Solutions SE; Weil-McLain; Wolf GmbH. |

| Additional Attributes | Dollar sales projections and market share of key players, identifying growth trends and consumer preferences for energy-efficient heating solutions. |

The global gas fired low temperature commercial boiler market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the gas fired low temperature commercial boiler market is projected to reach USD 6.5 billion by 2035.

The gas fired low temperature commercial boiler market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in gas fired low temperature commercial boiler market are ≤ 120°f, > 120°f - 140°f, > 140°f - 160°f and > 160°f - 180°f.

In terms of capacity, ≤ 0.3 - 2.5 mmbtu/hr segment to command 39.2% share in the gas fired low temperature commercial boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Gastrointestinal Stromal Tumor (GIST) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA