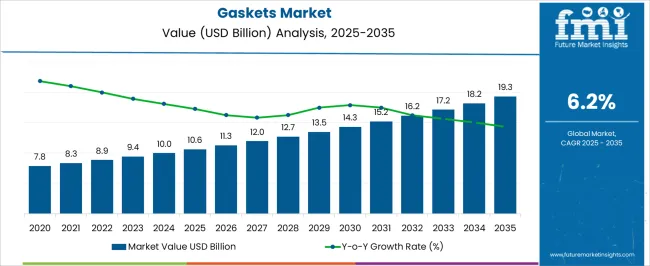

The gaskets market is estimated to be valued at USD 10.6 billion in 2025 and is projected to reach USD 19.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

The absolute dollar opportunity over this period is USD 8.7 billion, representing the additional revenue potential from 2025 to 2035. This growth reflects rising demand for sealing solutions across industrial, automotive, and mechanical applications. Companies can capitalize on this opportunity by expanding production capacity, optimizing distribution networks, and targeting key end-use industries. The incremental market expansion provides a clear financial incentive for strategic investments and long-term business planning throughout the decade. From a business perspective, the USD 8.7 billion absolute dollar opportunity highlights significant potential for revenue growth and market share capture.

With the market gradually increasing from USD 10.6 billion in 2025 to USD 19.3 billion in 2035 at a CAGR of 6.2%, firms can plan phased investments and scale operations strategically. By focusing on high-demand regions and industries, optimizing supply chains, and improving product availability, stakeholders can capture incremental revenue. This predictable growth trajectory allows companies to strengthen market positioning, expand customer base, and achieve sustained profitability over the ten-year period.

| Metric | Value |

|---|---|

| Gaskets Market Estimated Value in (2025 E) | USD 10.6 billion |

| Gaskets Market Forecast Value in (2035 F) | USD 19.3 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

A breakpoint analysis for the gaskets market highlights key thresholds where growth accelerates or strategic adjustments become necessary. With the market valued at USD 10.6 billion in 2025 and projected to reach USD 19.3 billion by 2035 at a CAGR of 6.2%, early breakpoints occur around USD 12.7–13.5 billion. These levels represent the initial phase of notable market expansion, indicating rising demand from industrial, automotive, and mechanical sectors. Recognizing these breakpoints allows companies to allocate resources efficiently, expand production capacity, and optimize distribution channels to capture incremental revenue during periods of accelerated growth. Later-stage breakpoints appear between USD 16.2–18.2 billion as the market approaches maturity and competition intensifies. Surpassing these thresholds may require firms to refine pricing strategies, enhance operational efficiency, and strengthen relationships with key clients to maintain growth momentum. Monitoring these breakpoints enables companies to anticipate shifts in demand and adjust production, marketing, and sales strategies accordingly. By aligning strategic actions with these critical thresholds, stakeholders can maximize revenue potential, reinforce market positioning, and navigate the steady growth trajectory from 2025 to 2035 with informed precision.

The gaskets market is experiencing steady expansion, driven by its critical role in ensuring leak-proof sealing solutions across multiple industries such as automotive, oil and gas, chemical processing, and manufacturing. The current market environment reflects increasing demand for high-performance materials that can withstand extreme temperatures, pressures, and corrosive environments.

Advancements in material science and manufacturing technologies are enabling the production of gaskets that offer enhanced durability, flexibility, and chemical resistance. Growth is also supported by stringent regulations and industry standards mandating reliable sealing to prevent environmental contamination and improve safety.

Furthermore, the rising adoption of automated and electric vehicles is contributing to new gasket designs and applications The market outlook remains positive, with ongoing innovation and the increasing need for customized gasket solutions expected to fuel growth in both established and emerging sectors.

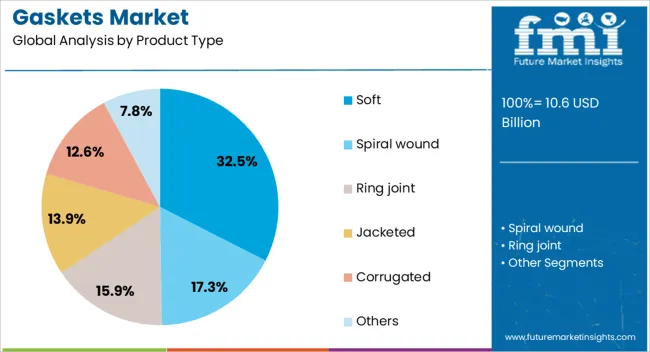

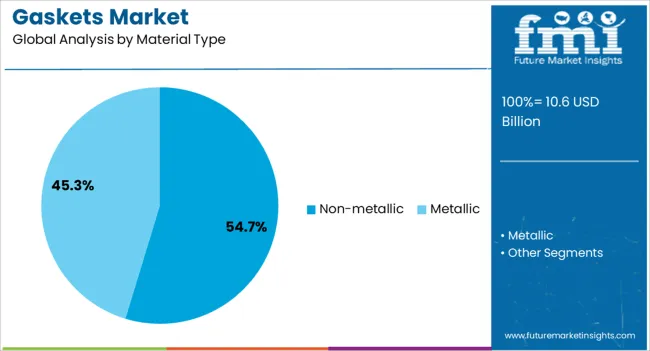

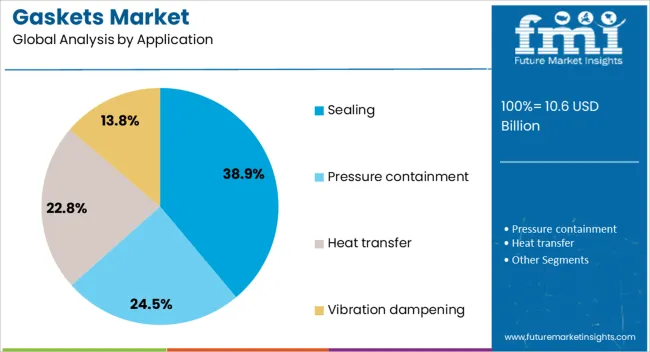

The gaskets market is segmented by product type, material type, application, end user, distribution channel, and geographic regions. By product type, gaskets market is divided into soft, spiral wound, ring joint, jacketed, corrugated, and others. In terms of material type, gaskets market is classified into non-metallic and metallic. Based on application, gaskets market is segmented into sealing, pressure containment, heat transfer, and vibration dampening. By end user, gaskets market is segmented into automotive, aerospace, oil & gas, chemical & petrochemical, power generation, food & beverage, water & wastewater treatment, pharmaceutical, mining, and others (e.g., electronics, marine). By distribution channel, gaskets market is segmented into offline and online. Regionally, the gaskets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The soft product type segment is anticipated to hold 32.5% of the gaskets market revenue share in 2025, establishing it as the leading product type. This position has been driven by the segment’s ability to provide superior flexibility and compressibility, which are essential for achieving effective seals in applications involving uneven surfaces and fluctuating pressures.

The soft gasket materials allow for easier installation and better accommodation of thermal expansion and vibration. Additionally, the versatility of soft gaskets enables their use across diverse industries, including automotive and industrial machinery, where performance under dynamic conditions is critical. The continued development of advanced elastomers and polymer blends has further enhanced the reliability and lifespan of soft gaskets, promoting their preference in many sealing applications.

Non-metallic materials are projected to account for 54.7% of the total gaskets market revenue in 2025, making this the dominant material type. This growth is attributed to the superior chemical resistance, thermal insulation properties, and cost-effectiveness offered by non-metallic materials such as rubber, graphite, and PTFE.

Their wide applicability in corrosive and high-temperature environments has driven their adoption in sectors like chemical processing, power generation, and automotive manufacturing. The ability of non-metallic gaskets to maintain seal integrity under harsh conditions without compromising performance has made them indispensable. Moreover, advancements in composite materials and fabrication techniques have improved their mechanical strength and environmental sustainability, supporting increased market penetration.

The sealing application segment is expected to hold 38.9% of the Gaskets market revenue share in 2025, marking it as the largest application segment. This leadership is credited to the essential role gaskets play in preventing fluid or gas leakage in pipelines, engines, pumps, and valves across multiple industries.

The sealing function is critical for operational safety, efficiency, and compliance with environmental regulations. The growing complexity of mechanical systems and the need for reliable, maintenance-free sealing solutions have fueled demand.

Innovations enabling enhanced resistance to temperature fluctuations, pressure variations, and chemical exposure have further propelled this segment The segment’s growth is also supported by increasing investments in infrastructure, automotive production, and industrial equipment manufacturing where sealing remains a fundamental requirement.

The gaskets market is growing due to rising industrialization, automotive production, and demand for leak-proof sealing solutions. Europe and North America lead with high-performance gaskets for automotive, oil & gas, and chemical industries. Asia-Pacific shows rapid growth driven by expanding manufacturing, infrastructure projects, and automotive assembly lines. Manufacturers differentiate through material innovation, temperature and pressure resistance, and compliance with industry standards. Market expansion is supported by the need for operational safety, regulatory compliance, and increasing equipment reliability requirements. Regional variations influence product adoption, pricing, and supplier strategies globally.

Gaskets vary in material, including rubber, PTFE, metal, and composites, affecting chemical resistance, temperature tolerance, and mechanical durability. Europe and North America prioritize high-performance materials for automotive, chemical, and oil & gas applications, ensuring reliability under extreme conditions. Asia-Pacific often adopts cost-effective materials for general industrial and manufacturing purposes. Differences in material selection affect lifespan, operational safety, and maintenance requirements. Leading global suppliers invest in advanced composites and engineered materials, while regional producers focus on standard, low-cost options. Material performance contrasts shape adoption patterns, product positioning, and competitiveness across premium and volume-driven markets.

Adherence to international standards like ASME, ISO, and ASTM is critical for gaskets used in safety-sensitive applications. North America and Europe emphasize certified, high-precision gaskets for automotive, chemical, and energy sectors, supporting stringent safety and performance requirements. Asia-Pacific markets adopt certified products selectively, balancing compliance with cost considerations. Differences in regulatory adherence affect market access, quality perception, and liability risks. Manufacturers ensuring certified, tested gaskets gain credibility and premium market share, while regional producers target cost-sensitive segments. Compliance contrasts shape adoption rates, buyer trust, and long-term market growth across regions and industries.

Gasket performance is influenced by manufacturing processes, precision cutting, and customization capabilities. Europe and North America prioritize advanced production techniques, CNC cutting, and custom designs for high-pressure, high-temperature applications. Asia-Pacific often relies on standard, mass-produced designs suitable for general industrial uses. Differences in manufacturing sophistication affect product accuracy, durability, and client satisfaction. Global suppliers offering tailored, precision-engineered gaskets gain competitive advantages in specialized markets, while regional manufacturers capture volume-driven, low-cost applications. Production and customization contrasts shape adoption, supplier differentiation, and regional competitiveness in industrial, automotive, and energy sectors.

Gaskets are supplied through distributors, OEMs, industrial suppliers, and e-commerce platforms. Europe and North America emphasize direct sales, specialized distributors, and OEM contracts for automotive and industrial clients. Asia-Pacific relies on wholesale suppliers, local distributors, and online marketplaces for broad accessibility. Differences in distribution impact product availability, pricing, and adoption speed. Leading suppliers leverage multi-channel strategies and technical support for complex applications, while regional producers focus on cost-effective distribution. These contrasts determine market penetration, regional competitiveness, and adoption across specialized and mass-market end-use sectors.

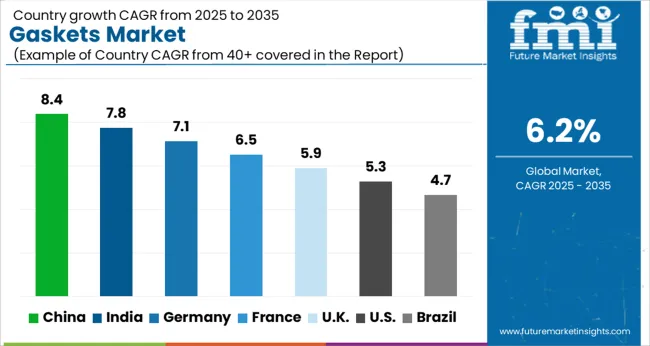

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The global gaskets market was projected to grow at a 6.2% CAGR through 2035, driven by demand in automotive, industrial machinery, and construction applications. Among BRICS nations, China recorded 8.4% growth as large-scale production facilities were commissioned and compliance with quality and safety standards was enforced, while India at 7.8% growth saw expansion of manufacturing units to meet rising regional industrial demand. In the OECD region, Germany at 7.1% maintained substantial output under strict industrial and safety regulations, while the United Kingdom at 5.9% relied on moderate-scale operations for automotive and machinery applications. The USA, expanding at 5.3%, remained a mature market with steady demand across industrial, automotive, and construction segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Gaskets market in China is growing at a CAGR of 8.4%. Between 2020 and 2024, growth was driven by expanding automotive, industrial, and construction sectors. Manufacturers focused on high-performance, durable, and heat- and chemical-resistant gaskets for engines, pipelines, and industrial machinery. Adoption of advanced materials such as PTFE, rubber, and metal composites supported increased reliability and efficiency. In the forecast period 2025 to 2035, growth is expected to accelerate with demand for specialized, lightweight, and environmentally friendly gaskets integrated into automotive and industrial applications. Rising infrastructure development, stringent quality standards, and rapid industrialization will further support market growth. China remains a global leader due to large manufacturing base, automotive industry expansion, and high industrial demand for reliable sealing solutions.

Gaskets market in India is growing at a CAGR of 7.8%. Historical period 2020 to 2024 saw growth supported by rapid industrialization, growth of automotive manufacturing, and infrastructure development. Manufacturers focused on durable, cost-effective, and chemically resistant gaskets for engines, pipelines, and machinery. Expansion of automotive and construction sectors supported widespread adoption. In the forecast period 2025 to 2035, growth is expected to continue with adoption of lightweight, high-performance, and eco-friendly gaskets integrated into industrial and automotive applications. Government initiatives for industrial development, increasing manufacturing capacity, and rising industrial efficiency requirements will further boost demand. India is projected to maintain strong growth due to industrial expansion, automotive sector development, and rising infrastructure projects.

Gaskets market in Germany is growing at a CAGR of 7.1%. Between 2020 and 2024, growth was supported by strong automotive and industrial sectors, high-quality standards, and demand for advanced sealing solutions. Manufacturers focused on durable, high-performance, and temperature- and pressure-resistant gaskets for engines, pipelines, and machinery. In the forecast period 2025 to 2035, market growth is expected to continue steadily with adoption of lightweight, specialized, and eco-friendly gaskets designed for automotive, chemical, and manufacturing applications. Rising industrial efficiency requirements, stringent quality regulations, and demand for sustainable materials will further support adoption. Germany remains a key European market due to advanced industrial base, automotive excellence, and emphasis on product reliability and safety.

Gaskets market in the United Kingdom is growing at a CAGR of 5.9%. During 2020 to 2024, adoption was driven by automotive manufacturing, industrial applications, and construction sector growth. Manufacturers focused on cost-effective, durable, and chemically and thermally resistant gaskets for engines, pipelines, and industrial machinery. In the forecast period 2025 to 2035, market growth is expected to continue moderately with adoption of lightweight, high-performance, and eco-friendly gaskets integrated into automotive and industrial systems. Expansion of manufacturing facilities, regulatory compliance, and emphasis on reliability and efficiency will further support market development. The United Kingdom market demonstrates stable growth with focus on quality, durability, and sustainability.

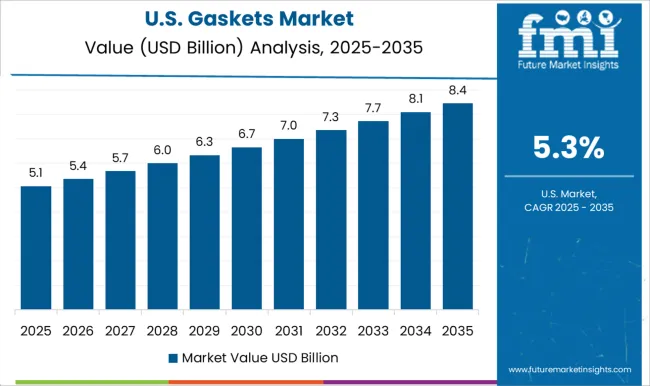

Gaskets market in the United States is growing at a CAGR of 5.3%. Historical period 2020 to 2024 saw growth fueled by industrial, automotive, and construction sector expansion. Manufacturers focused on durable, high-performance, and chemically and thermally resistant gaskets suitable for engines, pipelines, and machinery. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of lightweight, specialized, and eco-friendly gaskets designed for automotive, industrial, and chemical applications. Technological innovation, rising industrial efficiency requirements, and sustainability initiatives will further support market expansion. The United States market demonstrates consistent growth with emphasis on product reliability, performance, and environmentally friendly materials.

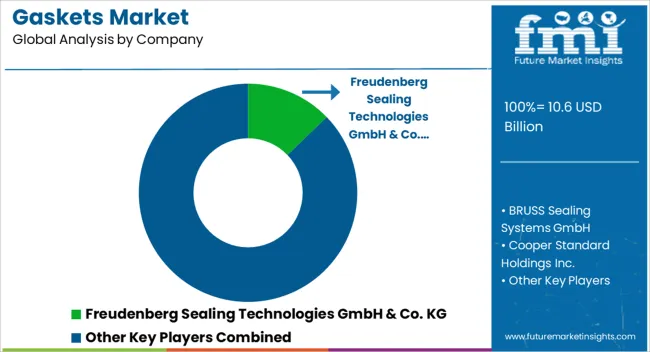

The gaskets market is supplied by Freudenberg Sealing Technologies GmbH & Co. KG, BRUSS Sealing Systems GmbH, Cooper Standard Holdings Inc., Dana Incorporated, Datwyler Holding AG, ElringKlinger AG, Flowserve Corporation, Garlock Sealing Technologies LLC, IGP Engineers Private Limited, John Crane Group Limited, KLINGER Holding GmbH, SKF Group, Smiths Group plc, Tenneco Inc., and Trelleborg AB. Competition is driven by material quality, sealing performance, and compatibility with diverse industrial applications. Freudenberg and Garlock brochures highlight high-performance elastomers, PTFE composites, and metal-reinforced gaskets suitable for automotive, aerospace, and chemical industries. ElringKlinger and Dana datasheets detail precision-molded gaskets, heat-resistant materials, and durability under extreme pressure.

Observed patterns include increasing adoption of multi-layered designs, environmentally resistant coatings, and application-specific customization. Supplier strategies focus on product diversification, industry-specific solutions, and global distribution networks. SKF Group and Trelleborg AB prioritize industrial machinery and rotating equipment with gaskets designed for vibration and wear resistance. Cooper Standard and BRUSS emphasize automotive and transportation applications, offering lightweight, thermally stable, and low-friction options. John Crane and Flowserve target energy, oil, and gas sectors, delivering gaskets compatible with high-pressure, high-temperature environments. Observed practices include R&D investment in advanced elastomers, collaboration with OEMs, and certification for regulatory compliance across regions. Product brochures provide specifications including material composition, dimensional tolerances, pressure ratings, temperature ranges, and installation guidelines.

Freudenberg Sealing Technologies and ElringKlinger highlight chemical resistance, fatigue life, and sealing efficiency under dynamic conditions. Garlock and Dana include cross-sectional designs, surface finishes, and compression set values for industrial use. Trelleborg and SKF datasheets feature multi-layer constructions, flange compatibility, and operational limits for high-performance systems. Verified technical details enable engineers, procurement specialists, and maintenance teams to select gaskets optimized for reliability, longevity, and operational safety.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.6 billion |

| Product Type | Soft, Spiral wound, Ring joint, Jacketed, Corrugated, and Others |

| Material Type | Non-metallic and Metallic |

| Application | Sealing, Pressure containment, Heat transfer, and Vibration dampening |

| End User | Automotive, Aerospace, Oil & Gas, Chemical & petrochemical, Power generation, Food & beverage, Water & wastewater treatment, Pharmaceutical, Mining, and Others (e.g., electronics, marine) |

| Distribution channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Freudenberg Sealing Technologies GmbH & Co. KG, BRUSS Sealing Systems GmbH, Cooper Standard Holdings Inc., Dana Incorporated, Datwyler Holding AG, ElringKlinger AG, Flowserve Corporation, Garlock Sealing Technologies LLC, IGP Engineers Private Limited, John Crane Group Limited, KLINGER Holding GmbH, SKF Group, Smiths Group plc, Tenneco Inc., and Trelleborg AB |

| Additional Attributes | Dollar sales vary by gasket type, including rubber, metal, cork, and composite gaskets; by application, such as automotive, industrial machinery, oil & gas, and HVAC systems; by end-use industry, spanning automotive, manufacturing, oil & gas, and construction; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for leak-proof sealing solutions, industrial expansion, and stringent safety regulations. |

The global gaskets market is estimated to be valued at USD 10.6 billion in 2025.

The market size for the gaskets market is projected to reach USD 19.3 billion by 2035.

The gaskets market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in gaskets market are soft, spiral wound, ring joint, jacketed, corrugated and others.

In terms of material type, non-metallic segment to command 54.7% share in the gaskets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Seals and Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA