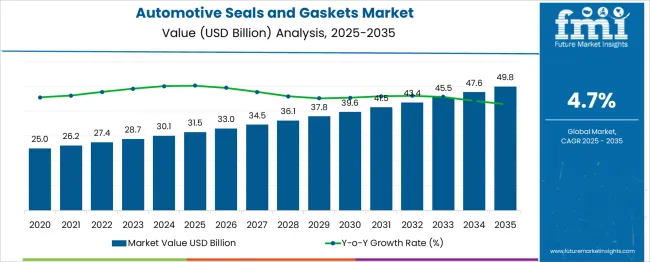

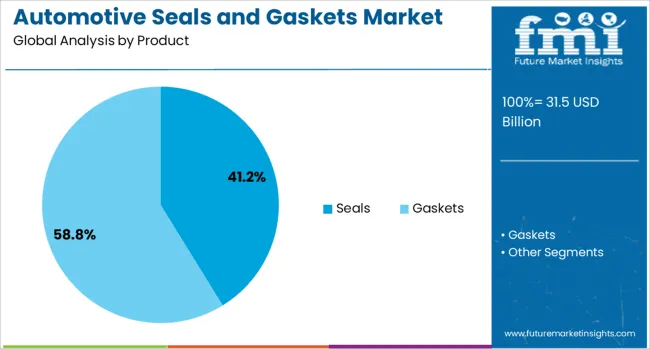

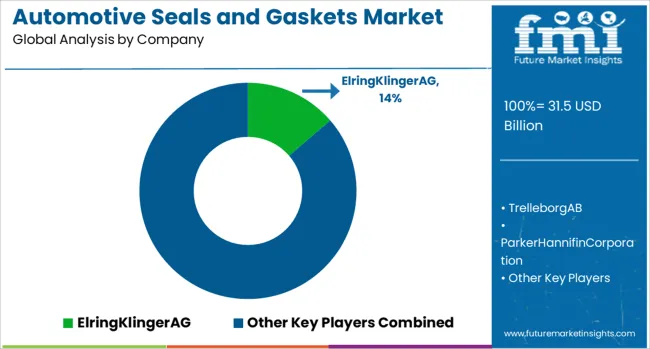

The global automotive seals and gaskets market is estimated at USD 31.5 billion in 2025 and is projected to reach USD 49.8 billion by 2035, expanding at a CAGR of 4.7% during the forecast period. Growth is supported by rising global automotive production, the push for enhanced engine efficiency, and increasingly stringent emission and safety regulations. Seals account for 41.2% of the market share in 2025, reflecting their critical role in powertrain, battery, and fluid system applications. The transition toward electrification and hybridization is accelerating demand for advanced sealing solutions in battery packs, thermal management systems, and lightweight powertrain designs. Material innovations including high-performance elastomers, composites, and recyclable compounds are further driving adoption by offering superior durability, temperature resistance, and sustainability benefits. Regional growth is led by North America, Asia-Pacific, and Europe, where investments in electric and autonomous vehicle development, combined with stricter regulatory standards, are boosting demand for specialized sealing and gasket technologies. Emerging markets are also seeing steady uptake, supported by urbanization and expanding vehicle fleets.

Overall, the automotive seals and gaskets market is poised for steady and sustained growth through 2035, driven by evolving automotive architectures, regulatory pressures, and continued advancements in sealing technologies.

| Metric | Value |

|---|---|

| Automotive Seals And Gaskets Market Estimated Value in (2025 E) | USD 31.5 billion |

| Automotive Seals And Gaskets Market Forecast Value in (2035 F) | USD 49.8 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The automotive seals and gaskets market is witnessing consistent growth, supported by the increasing complexity of vehicle systems and the stringent regulatory landscape surrounding fuel efficiency and emissions control. The rise in demand for lightweight and durable sealing components that can withstand extreme temperatures and chemical exposures is shaping the evolution of product design in both ICE and electric vehicles.

OEMs are focusing on integrating advanced sealing solutions to ensure superior protection against fluid leaks, vibration damping, and environmental contamination. Innovations in material science, especially the use of high-performance elastomers and composites, are driving the long-term reliability and sustainability of seals and gaskets across powertrain and body systems.

Electrification trends are also contributing to the rising application of these components in battery enclosures, EV cooling systems, and thermal management units. As global vehicle production recovers and EV penetration accelerates, demand for optimized, software-integrated, and custom-engineered sealing technologies is expected to define future growth patterns in both mature and emerging markets.

The automotive seals and gaskets market is segmented by product, vehicle type, material, application, sales channel, and region. By product, the market is divided into seals and gaskets. In terms of vehicle type, it is classified into passenger vehicles and commercial vehicles, with the latter further segmented into light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs). Based on material, the market is segmented into rubber (nitrile, EPDM, silicone, etc.), metals (stainless steel, aluminum, etc.), composites (graphite, fiberglass, etc.), and plastics and polymers. By application, it is categorized into engine systems, transmission systems, braking systems, HVAC systems, fuel supply systems, and body sealing systems. In terms of sales channel, the market is divided into OEM and aftermarket. Regionally, the automotive seals and gaskets industry is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Seals are projected to account for 41.2% of the total revenue share in the automotive seals and gaskets market in 2025, making it the dominant product category. This segment's leadership is being supported by the broad application range of seals in dynamic and static systems, including engines, transmissions, brakes, and HVAC units. The demand for high-integrity sealing solutions has been influenced by rising engine downsizing trends, higher system pressures, and thermal fluctuations in modern powertrains.

Seals offer superior performance in preventing leakage, reducing friction, and maintaining pressure stability, which is essential for fuel efficiency and long-term component durability. Advances in seal geometry, surface treatment, and material elasticity have enabled manufacturers to meet the stringent specifications of both traditional and electric drivetrains.

Additionally, increasing demand for turbocharged engines and hybrid architectures has reinforced the critical role of seals in thermal and fluid control systems. Their cost-effectiveness, availability in various sizes, and compliance with environmental standards continue to drive widespread adoption across global manufacturing platforms.

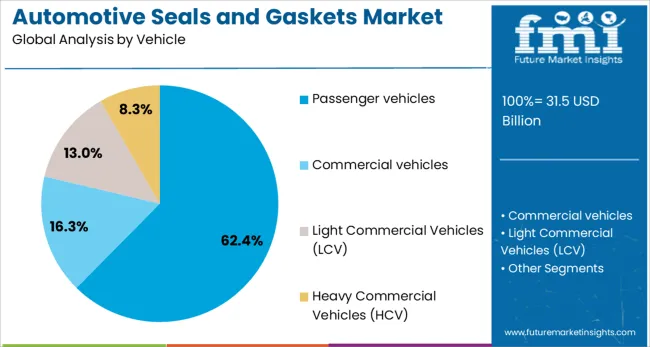

Passenger vehicles are expected to contribute 62.4% to the overall revenue share in the automotive seals and gaskets market in 2025, reflecting their dominant presence across global production volumes. The segment’s growth has been driven by continuous design innovations, rising consumer demand, and the evolution of powertrain technologies. As modern passenger vehicles incorporate more electronic and mechanical subsystems, the need for advanced sealing components has increased to ensure operational efficiency, safety, and environmental compliance.

The use of seals and gaskets in engine blocks, exhaust manifolds, transmission assemblies, and electrical housings is expanding as vehicles become more compact and integrated. Additionally, increasing electrification across the passenger vehicle category has created new requirements for thermal barrier seals, EMI shielding gaskets, and fluid-resistant enclosures.

OEM preferences for cost-effective yet performance-oriented components have also encouraged suppliers to invest in automated production lines and high-precision tooling. The increasing adoption of electric and hybrid passenger cars worldwide is expected to sustain this segment’s leading market share in the foreseeable future.

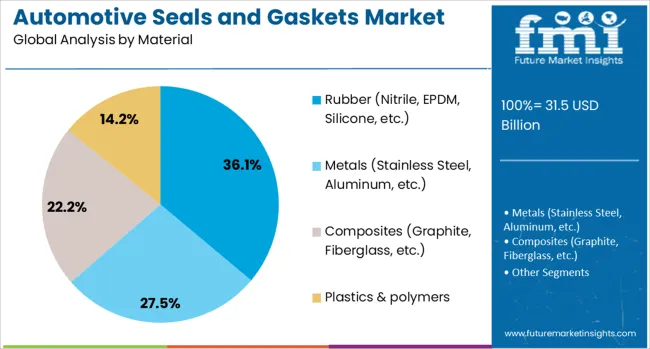

Rubber materials including nitrile, EPDM, and silicone are forecast to represent 36.1% of the automotive seals and gaskets market revenue share in 2025, reflecting their broad utility and adaptability in varied automotive environments. This material category’s leading position is driven by its high thermal stability, flexibility, and chemical resistance, which make it ideal for sealing applications across engine, cooling, fuel, and exhaust systems.

EPDM rubber, in particular, has been widely used due to its resistance to weathering, ozone, and temperature extremes, making it suitable for exterior and under-the-hood components. Nitrile rubber continues to be preferred in oil and fuel contact areas due to its hydrocarbon resistance, while silicone rubber is gaining popularity in electric vehicles for its electrical insulation and heat resistance properties.

The ease of molding, recyclability, and cost-effectiveness of rubber-based seals and gaskets further support their dominance. Continued research in elastomeric compounds and the development of bio-based rubber alternatives are expected to enhance the sustainability and performance profiles of this segment over the forecast period.

The automotive seals and gaskets market is expanding due to EV adoption, high-performance powertrain needs, comfort and safety demands, and cost-effective material innovations. OEM collaboration and precision manufacturing are shaping its competitive future.

Adoption of electric and hybrid vehicles has increased the need for specialized seals and gaskets designed to withstand unique thermal, chemical, and vibration conditions. Battery pack enclosures, coolant circuits, and electronic modules require precision sealing to ensure safety and performance. Manufacturers are investing in advanced elastomers and composite materials to enhance durability under varying temperature ranges. The integration of lightweight sealing solutions that also deliver noise and vibration control is becoming a competitive advantage. Growth in this segment is supported by the rising production volumes of EVs and HEVs, coupled with OEM demands for longer-lasting and maintenance-free sealing components.

Powertrain systems in modern vehicles require seals and gaskets capable of operating under high pressure, elevated temperatures, and increased mechanical loads. Turbocharged engines, advanced transmissions, and direct-injection fuel systems demand enhanced sealing materials with superior chemical resistance. OEMs are collaborating with suppliers to develop custom-fit solutions that reduce energy loss and improve overall system efficiency. The shift toward downsized yet more powerful engines has intensified the performance requirements for sealing components. This trend has encouraged suppliers to adopt precision manufacturing techniques to improve fitment accuracy and reduce operational wear over time.

Seals and gaskets play a crucial role beyond preventing leaks; they contribute to overall safety and comfort in passenger and commercial vehicles. Door, window, and weather seals enhance cabin insulation, reduce wind noise, and protect against water ingress. Brake system seals maintain hydraulic integrity, ensuring consistent performance under variable driving conditions. Airbag module gaskets and seat system seals are designed to perform reliably in emergency situations. With customer preferences leaning toward quieter, more comfortable rides, OEMs are prioritizing premium-grade sealing solutions. This has resulted in higher demand for multi-functional gaskets that combine sealing with vibration and acoustic damping properties.

The automotive seals and gaskets sector is increasingly focused on material efficiency and cost control without compromising performance. Advances in synthetic rubbers, thermoplastics, and composites have enabled longer component life while reducing weight. Suppliers are implementing lean manufacturing techniques and automation to improve productivity and lower production costs. Strategic sourcing of raw materials and the use of recyclable compounds have also contributed to price stability. Global supply chain restructuring has allowed leading players to expand into emerging markets while maintaining quality standards. These strategies ensure that seals and gaskets remain competitive in both OEM and aftermarket channels.

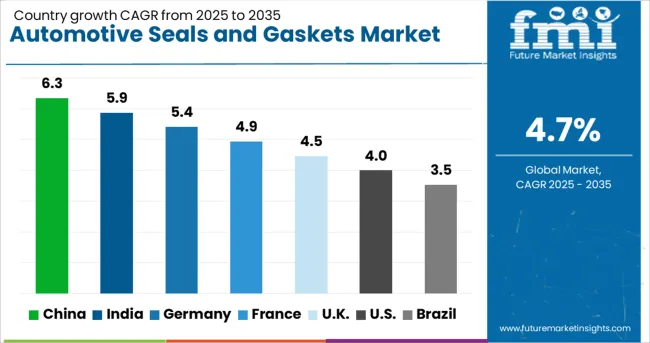

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

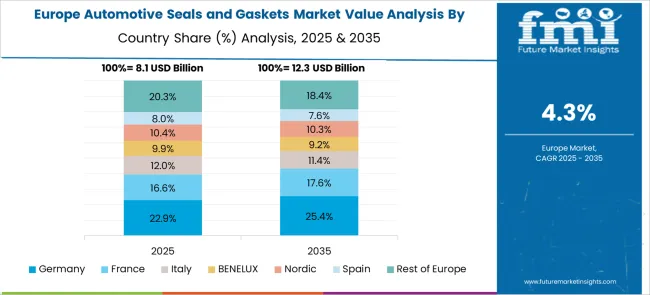

The automotive seals and gaskets market is projected to grow at a global CAGR of 4.7% from 2025 to 2035, supported by rising demand for leak-proof systems, improved NVH (noise, vibration, and harshness) performance, and compliance with evolving emission and safety standards. China leads with a CAGR of 6.3%, driven by strong vehicle production volumes, expansion in electric mobility, and the adoption of advanced sealing materials. India follows at 5.9%, benefiting from rising passenger and commercial vehicle sales, localized manufacturing, and increased demand for performance-enhancing sealing solutions. France records a CAGR of 4.9%, driven by a focus on safety compliance and the integration of seals in comfort-enhancing vehicle features. The United Kingdom achieves 4.5% growth, aided by electric vehicle investments and high-quality aftermarket demand. The United States posts a CAGR of 4.0%, reflecting a mature market where replacement cycles, performance upgrades, and OEM innovation drive sales. This analysis covers over 40 countries, with these markets serving as strategic indicators for investment priorities, competitive positioning, and material innovation in the global automotive seals and gaskets industry.

China is projected to expand at a CAGR of 6.3% during 2025–2035, comfortably ahead of the global 4.7% path. This momentum is expected from high-volume assembly lines, deeper EV penetration, and broader use of sealing in mixed-material bodies where galvanic and thermal interfaces must be protected. Battery pack edge gaskets, vent membranes, inverter housing seals, and coolant loop O-rings are lifting grams per vehicle. Tier suppliers have widened capacity for FKM, HNBR, and PTFE blends, while BIW seam and hem-flange sealants continue to reduce corrosion claims. Glass area growth in SUVs boosts glazing seals, and aftermarket windshield replacement sustains recurring demand. China remains the largest swing market for specification upgrades across powertrain, chassis, and cabin comfort programs.

India is expected to post a 5.9% CAGR in 2025–2035, led by rising volumes in compact SUVs, light trucks, and two-pedal drivetrains. The transition to cleaner fuels and tighter emission norms has increased demands on gasket compression set, blow-out resistance, and oil compatibility. Domestic compounding of EPDM and NBR has lowered input costs, enabling wider adoption of molded profiles for doors, liftgates, and panoramic roof surrounds. Powertrain downsizing with turbocharging requires high-temperature manifold and EGR seals, while CV fleets seek longer-life wheel-end and hub seals to reduce downtime. Consolidation of supplier parks near major OEM plants improves takt-time reliability, and export programs into Africa and the Middle East add scale for Indian converters.

France is projected to grow at 4.9% during 2025–2035. Premium and light commercial platforms emphasize cabin quietness, water-leak prevention, and durable glazing bonds, which elevates door, window, and roof-aperture sealing content. Expansion of domestic EV capacity adds battery module gaskets, coolant circuit seals, and electronics-housing protection, with higher IP ratings specified by OEM programs. Tier suppliers have pushed precision die-cutting and automated bead application to stabilize fit and finish across model refreshes. Import diversification for specialty primers and fluoropolymer sheets has cut supply risk during changeovers. Insurance-linked windshield replacement keeps dealer service bays busy, supporting steady aftermarket flows of adhesives, primers, and molded trim seals.

The United Kingdom is expected to reach a 4.5% CAGR for 2025–2035. For 2020–2024, the CAGR is estimated at 3.9%, derived by benchmarking below the global 4.7% long-term path and aligning with a slower recovery in premium model cycles, customs frictions, and dealership service throughput. The step-up to 4.5% is explained by a firmer cadence of premium exports, broader EV adoption that adds battery, e-axle, and inverter sealing nodes, and rising SUV glass areas boosting glazing and weatherstrip demand. Warranty data shows fewer water-leak incidents, indicating better bead placement and primer use, which supports higher specification rates. Aftermarket e-commerce improved reach for OE-grade kits, lifting replenishment velocity across windscreen and door weatherstrip categories.

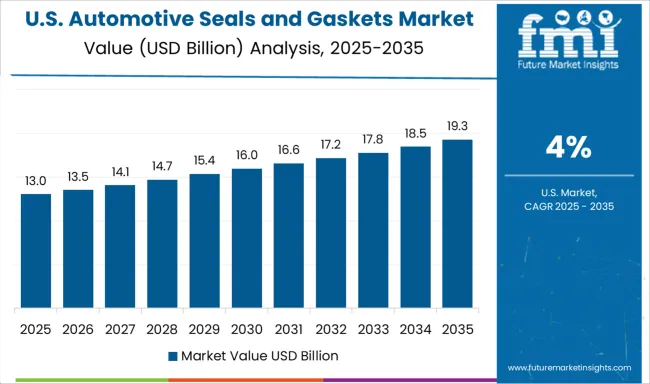

The United States is projected to post a 4.0% CAGR during 2025–2035 in a mature, replacement-heavy environment. Large pickup and SUV platforms command extensive weatherstrip lengths and larger aperture seals, while ADAS expansion increases optical-grade glazing bonding requirements. EV assembly growth adds chemical- and fire-resistant battery pack gasketing, coolant seals, and electronics-housing protection. Salt-belt states favor robust underbody and wheel-end seals to resist brine corrosion. OEMs and Tier-1s have widened use of pumpable and hot-melt paths for hem-flange and underbody areas, improving cycle times. Distribution models emphasize regional DCs, late cut-offs, and zone-skipping to support collision-repair and glass-replacement networks.

The automotive seals and gaskets market features intense competition among global manufacturers offering precision sealing solutions for powertrain, chassis, body, and thermal management systems. ElringKlinger AG is recognized for advanced cylinder head and exhaust gaskets, leveraging lightweight material expertise for efficiency gains. Trelleborg AB delivers engineered polymer seals for dynamic and static applications, targeting both OEM and aftermarket demand.

Parker Hannifin Corporation focuses on high-performance sealing systems for fluid handling and motion control, emphasizing versatility across ICE and EV platforms. NOK Corporation leads in oil seals and O-rings, backed by extensive manufacturing capacity across Asia. Dana Incorporated provides gaskets, thermal management seals, and driveline sealing systems, integrating them into complete module solutions. Sumitomo Riko specializes in anti-vibration components and sealing products optimized for NVH reduction and durability.

Hutchinson SA offers comprehensive sealing systems for body, glazing, and fuel systems, serving both premium and mass-market vehicles. SKF Group excels in wheel-end seals and mechatronic sealing solutions with integrated sensing capabilities. Tenneco Inc supports sealing in exhaust aftertreatment and powertrain modules, focusing on emission compliance. Datwyler Holding Inc delivers precision elastomer components for high-specification automotive sealing, emphasizing chemical resistance and tight tolerance control.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product | Seals and Gaskets |

| Vehicle | Passenger vehicles, Commercial vehicles, Light Commercial Vehicles (LCV), and Heavy Commercial Vehicles (HCV) |

| Material | Rubber (Nitrile, EPDM, Silicone, etc.), Metals (Stainless Steel, Aluminum, etc.), Composites (Graphite, Fiberglass, etc.), and Plastics & polymers |

| Application | Engine systems, Transmission systems, Braking systems, HVAC systems, Fuel supply systems, and Body sealing systems |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ElringKlingerAG, TrelleborgAB, ParkerHannifinCorporation, NOKCorporation, DanaIncorporated, SumitomoRiko, HutchinsonSA, SKFGroup, TennecoInc, and DatwylerHoldingInc |

| Additional Attributes | Dollar sales, share by product type and application, OEM vs aftermarket demand, regional growth hotspots, competitive landscape, pricing trends, and material innovation opportunities. |

The global automotive seals and gaskets market is estimated to be valued at USD 31.5 billion in 2025.

The market size for the automotive seals and gaskets market is projected to reach USD 49.8 billion by 2035.

The automotive seals and gaskets market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in automotive seals and gaskets market are seals, _o-rings, _lip seals, _rotary seals, _others, gaskets, _cylinder head gaskets, _exhaust manifold gaskets, _oil pan gaskets and _others.

In terms of vehicle, passenger vehicles segment to command 62.4% share in the automotive seals and gaskets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA