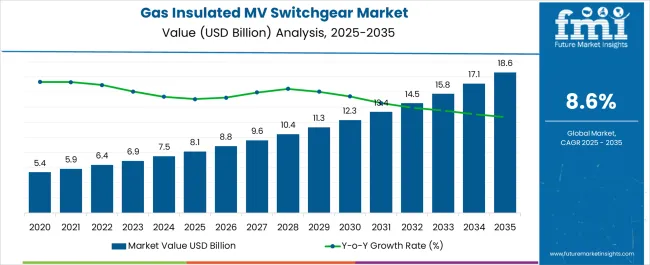

The gas insulated medium-voltage switchgear market is estimated to be valued at USD 8.1 billion in 2025 and is projected to reach USD 18.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period.

The gas insulated medium voltage switchgear market is anticipated to expand from USD 8.1 billion in 2025 to USD 18.6 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.6%. The growth trajectory is driven by the increasing adoption of compact, reliable, and safe switchgear solutions in industrial, commercial, and utility sectors. By 2030, the market is expected to reach approximately USD 12.3 billion, indicating a strong mid-term momentum. This expansion is influenced by rising investments in grid modernization, the need for space-efficient electrical distribution systems, and the ongoing replacement of conventional air-insulated switchgear with gas-insulated alternatives, which are preferred for their enhanced performance and reduced operational footprint.

Year-on-year analysis suggests that growth is consistently compounded, with incremental gains contributing steadily to overall market valuation. From 2025 to 2035, the market demonstrates a clear upward trend, reflecting increasing demand for switchgear that ensures operational reliability and mitigates electrical faults.

Industries prioritizing efficient energy management, minimal maintenance needs, and operational safety are likely to adopt gas insulated medium voltage switchgear at higher rates, reinforcing market expansion. It can be opined that manufacturers focusing on robust designs, long-term performance, and adaptability to diverse electrical environments will capture significant market share, as the market continues to be driven by reliability, compactness, and operational efficiency rather than sporadic demand spikes.

| Metric | Value |

|---|---|

| Gas Insulated Medium Voltage Switchgear Market Estimated Value in (2025 E) | USD 8.1 billion |

| Gas Insulated Medium Voltage Switchgear Market Forecast Value in (2035 F) | USD 18.6 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The gas insulated medium-voltage switchgear market is estimated to hold a significant proportion across its parent markets, representing roughly 18-22% of the medium voltage switchgear market, around 6-7% of the electrical equipment market, close to 4-5% of the power transmission and distribution market, about 3% of the smart grid infrastructure market, and approximately 2-3% within the industrial automation and control systems market. Collectively, the total market share across these parent domains can be observed in the range of 33-40%, indicating a strong positioning and influence of gas insulated solutions in medium voltage applications.

The adoption of compact, reliable, and low-maintenance switchgear solutions has been increasingly emphasized within urban and industrial power networks, which has supported market expansion and deeper penetration into electrical infrastructure segments. Growth in renewable energy projects, coupled with the need for safer and more space-efficient distribution systems, has driven procurement of these switchgear systems across utilities and industrial setups, while regulatory compliance and high reliability standards have further reinforced the market’s prominence.

Market participants are increasingly evaluated based on the efficiency, operational lifespan, and environmental compatibility of the systems, while alternate gas and hybrid solutions are gradually being explored to maintain competitive advantage. As a result, gas insulated medium-voltage switchgear has not only captured a substantial share of its core medium voltage segment but has also begun to influence adjacent electrical and automation markets, reflecting an integrated presence that reinforces the overall ecosystem of power distribution and control.

The gas insulated medium voltage switchgear market is experiencing steady expansion driven by increasing electricity demand, urban infrastructure development, and the need for compact, reliable power distribution solutions. The use of SF6 and alternative insulating gases has enabled high dielectric strength within a smaller footprint, making these systems suitable for urban substations and industrial facilities where space is limited.

Growing emphasis on grid reliability, renewable energy integration, and reduced maintenance requirements is fostering adoption. Technological advancements in monitoring, automation, and eco-friendly gas alternatives are further influencing market growth.

Regulatory initiatives targeting energy efficiency and environmental safety are accelerating the replacement of aging switchgear infrastructure. With rising investments in smart grid projects and modernization of transmission networks, the market is poised for long-term growth, supported by both utility and industrial demand.

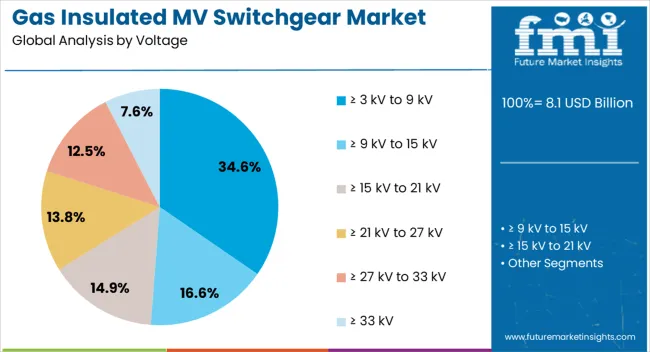

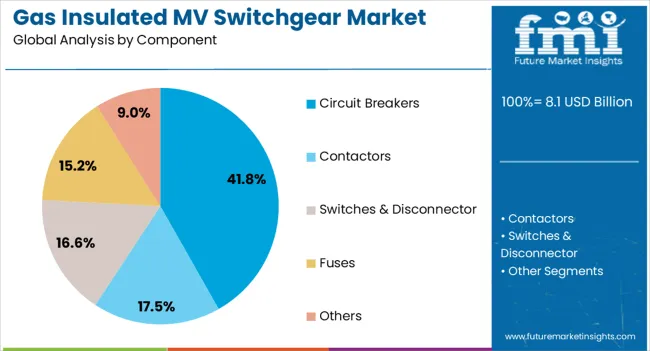

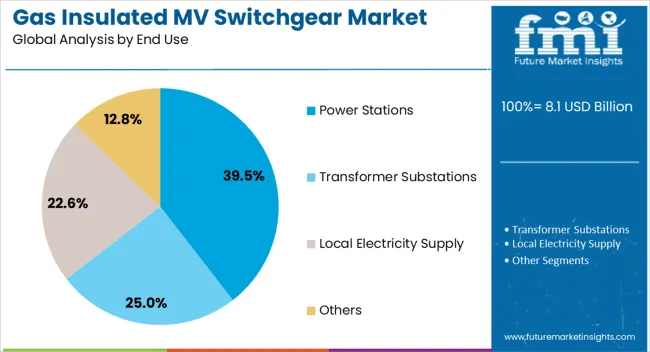

The gas insulated medium voltage switchgear market is segmented by voltage, component, end use, application, and geographic regions. By voltage, gas insulated medium voltage switchgear market is divided into ≥ 3 kV to 9 kV, ≥ 9 kV to 15 kV, ≥ 15 kV to 21 kV, ≥ 21 kV to 27 kV, ≥ 27 kV to 33 kV, and ≥ 33 kV. In terms of component, gas insulated medium voltage switchgear market is classified into circuit breakers, contactors, switches & disconnector, fuses, and others. Based on end use, gas insulated medium voltage switchgear market is segmented into power stations, transformer substations, local electricity supply, and others. By application, gas insulated medium voltage switchgear market is segmented into residential, commercial, industrial, and utility. Regionally, the gas insulated medium voltage switchgear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≥ 3 kV to 9 kV segment is projected to hold 34.6% of the total market revenue by 2025, making it a significant contributor within the voltage category. This dominance is driven by its widespread application in commercial, industrial, and small utility installations requiring medium voltage distribution.

The segment benefits from a balance between performance, cost-effectiveness, and ease of installation in space-constrained environments.

Its compatibility with modular designs and adaptability for renewable integration has further expanded its deployment.

The circuit breakers segment is expected to account for 41.8% of the total market revenue by 2025 within the component category, positioning it as the leading segment.

This growth is being propelled by the critical role circuit breakers play in protecting electrical systems from faults, ensuring operational safety, and maintaining service continuity.

Gas insulated circuit breakers offer high reliability, minimal maintenance, and long operational life, making them the preferred choice in both utility and industrial applications.

The power stations segment is anticipated to capture 39.5% of the market revenue by 2025 under the end use category, establishing it as the dominant application.

This is due to the rising global electricity generation capacity and the need for efficient, compact switchgear to handle high-voltage power distribution in confined environments.

The superior insulation performance, safety features, and operational efficiency of gas insulated systems have made them indispensable in modern power generation facilities.

The gas insulated medium voltage switchgear market is being driven by demand for reliable and compact power distribution solutions. Opportunities are unfolding in renewable energy integration and smart grid projects, while trends emphasize compact designs with digital monitoring. However, challenges such as high installation costs and concerns over SF6 gas emissions are restricting broader adoption. Despite these hurdles, the market remains vital for modern grid infrastructure, with its role in ensuring safety, efficiency, and uninterrupted power supply making it indispensable in today’s energy networks.

The demand for gas insulated medium voltage switchgear has been reinforced by the requirement for reliable and compact power distribution solutions across industrial, commercial, and utility sectors. Increasing electricity consumption and grid expansion projects have pushed utilities to adopt switchgear systems that ensure safety and uninterrupted operations in space-constrained environments. Gas-insulated systems are favored over air-insulated ones due to their durability and ability to withstand harsh conditions. Their rising adoption in renewable energy plants and urban transmission networks has strengthened overall market demand.

Significant opportunities have been created as renewable energy projects and smart grid initiatives increasingly require advanced switchgear systems for efficient power management. Governments and utilities are prioritizing infrastructure that minimizes transmission losses and improves network reliability. Gas insulated medium voltage switchgear is being viewed as an ideal choice for integrating renewable energy into existing grids. The opportunity for suppliers lies in offering compact, modular systems tailored to solar and wind projects, as well as in providing solutions that align with digital monitoring and grid automation requirements.

A notable trend shaping the market has been the preference for compact switchgear designs integrated with digital monitoring features. As electrical infrastructure is modernized, the need for real-time fault detection and predictive maintenance has gained traction. Compact switchgear not only reduces installation space but also enhances operator safety and operational efficiency. Digital integration allows utilities to remotely monitor load conditions and ensure quicker fault response. This trend is transforming gas insulated medium voltage switchgear into a cornerstone of modern, automated, and resilient grid infrastructure.

The gas insulated medium voltage switchgear market has faced challenges related to high upfront installation costs and environmental concerns tied to SF6 gas usage. While the reliability and space-saving benefits are clear, the cost of deployment often discourages smaller utilities and industrial facilities. Furthermore, regulatory pressure regarding SF6 emissions is creating additional hurdles, requiring manufacturers to explore alternatives without compromising performance. These factors have introduced barriers for wider adoption, and managing the balance between cost, compliance, and reliability remains a persistent market challenge.

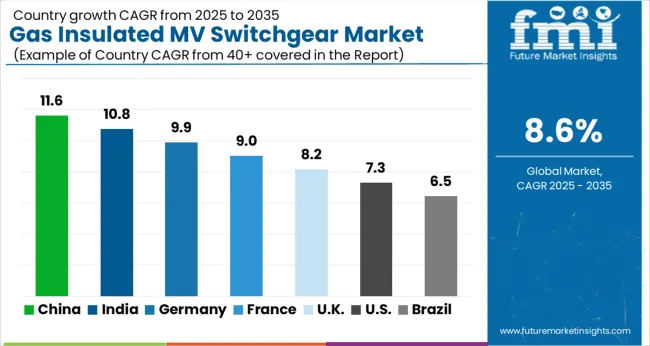

| Country | CAGR |

|---|---|

| China | 11.6% |

| India | 10.8% |

| Germany | 9.9% |

| France | 9.0% |

| UK | 8.2% |

| USA | 7.3% |

| Brazil | 6.5% |

The global gas insulated medium voltage switchgear market is forecasted to expand at a CAGR of 8.6% from 2025 to 2035. China leads the adoption curve with an impressive CAGR of 11.6%, followed by India at 10.8%, and Germany at 9.9%. The United Kingdom shows growth at 8.2%, while the United States demonstrates moderate expansion at 7.3%. Rising electricity demand, grid modernization, and the increasing adoption of renewable energy integration are key drivers. China and India dominate due to large-scale infrastructure projects and urban energy needs, while Germany, the UK, and the USA focus on grid efficiency, renewable integration, and stricter emission regulations. This report includes insights on 40+ countries; the top markets are shown here for reference.

The gas insulated medium voltage switchgear market in China is projected to grow at a CAGR of 11.6%. With its expanding power infrastructure and massive renewable energy deployment, China is driving demand for compact and reliable switchgear solutions. The country’s initiatives to enhance grid reliability and manage high-capacity electricity networks make gas insulated systems highly preferable. Industrial expansion, urban power needs, and large-scale smart grid projects have further accelerated demand. Local manufacturing capabilities and strong policy backing provide China with a competitive edge in global supply and adoption.

The gas insulated medium voltage switchgear market in India is anticipated to grow at a CAGR of 10.8%. India’s rising electricity demand, driven by industrialization and growing urban energy consumption, creates strong opportunities for switchgear deployment. Government-backed programs for rural electrification, smart cities, and renewable integration push adoption further. The compact design of gas insulated switchgear fits well within space-constrained urban centers, making it a preferred choice for metro projects and high-density infrastructure. India’s reliance on energy-efficient equipment also favors long-term market growth.

The gas insulated medium voltage switchgear market in Germany is forecasted to grow at a CAGR of 9.9%. Germany’s emphasis on renewable energy integration, especially wind and solar, fuels the need for reliable and compact switchgear systems. The country’s commitment to decarbonization and energy transition policies has pushed utilities and industries to adopt efficient power distribution solutions. Furthermore, Germany’s robust manufacturing sector and technological expertise strengthen innovation and adoption of advanced switchgear systems. The replacement of aging grid infrastructure is another significant factor supporting demand.

The gas insulated medium voltage switchgear market in the United Kingdom is projected to record a CAGR of 8.2%. The UK’s transition towards low-carbon energy and integration of offshore wind projects are driving demand for compact and high-efficiency switchgear. With grid modernization programs underway, the need for space-saving and reliable solutions is rising. The country’s utilities and industrial users are also investing in grid resilience to handle variable renewable energy flows. Ongoing decarbonization goals and the shift away from conventional power sources further boost market growth.

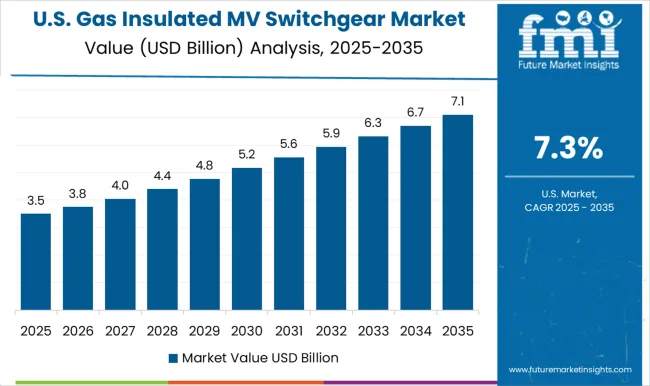

The gas insulated medium voltage switchgear market in the United States is expected to expand at a CAGR of 7.3%. The USA is focusing on strengthening its aging grid, integrating renewable power, and enhancing grid reliability, all of which drive demand for gas insulated solutions. Growing electrification in transportation and industries adds to the requirement for efficient power distribution systems. However, higher initial costs and reliance on traditional switchgear in some regions slow adoption compared to Asian and European counterparts. Despite this, the push for smart grids and energy efficiency ensures steady growth.

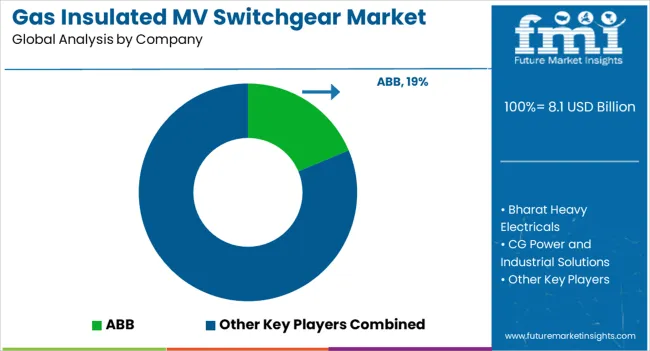

The gas insulated medium voltage switchgear market is defined by the presence of multinational electrical giants alongside regional specialists delivering compact, efficient, and reliable power distribution systems. ABB, Siemens, Schneider Electric, and Eaton have established themselves as dominant forces, supplying advanced GIS solutions with features like reduced footprint, arc-flash safety, and digital monitoring capabilities that appeal to utilities and industrial end-users.

General Electric, Mitsubishi Electric, and Hitachi strengthen their portfolios by integrating eco-friendly gas alternatives and IoT-enabled switchgear to meet regulatory standards while ensuring grid stability. In parallel, Fuji Electric and Toshiba continue to expand in Asian markets, leveraging their regional presence and extensive R&D capabilities to capture growing demand in urban and industrial distribution networks. The competitive space is also shaped by companies focusing on niche strengths and localized expertise. Bharat Heavy Electricals, CG Power and Industrial Solutions, and HD Hyundai Electric emphasize their role in emerging economies, where infrastructural growth fuels medium voltage switchgear adoption.

Hyosung Heavy Industries and Ormazabal highlight customized GIS products, particularly for renewable integration and underground substations. Firms such as Lucy Group, Skema, and E + I Engineering are carving a presence with specialized engineering, modular designs, and turnkey solutions suited for both utility and industrial clients. With electrification projects expanding worldwide, competition is not only based on reliability and cost but also on the ability to deliver compact, environmentally conscious switchgear aligned with modern grid demands.

| Items | Values |

|---|---|

| Quantitative Units | USD 8.1 billion |

| Voltage | ≥ 3 kV to 9 kV, ≥ 9 kV to 15 kV, ≥ 15 kV to 21 kV, ≥ 21 kV to 27 kV, ≥ 27 kV to 33 kV, and ≥ 33 kV |

| Component | Circuit Breakers, Contactors, Switches & Disconnector, Fuses, and Others |

| End Use | Power Stations, Transformer Substations, Local Electricity Supply, and Others |

| Application | Residential, Commercial, Industrial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Bharat Heavy Electricals, CG Power and Industrial Solutions, E + I Engineering, Eaton, Fuji Electric, General Electric, HD Hyundai Electric, Hitachi, Hyosung Heavy Industries, Lucy Group, Mitsubishi Electric, Ormazabal, Schneider Electric, Siemens, Skema, and Toshiba |

| Additional Attributes | Dollar sales by installation type (indoor, outdoor) and voltage class (up to 24kV, 25–36kV, above 36kV) are key indicators. Trends highlight growing grid modernization projects, rising urban electricity demand, and preference for compact switchgear solutions. Regional deployment, regulatory approvals, and replacement of aging infrastructure are fueling market expansion. |

The global gas insulated medium voltage switchgear market is estimated to be valued at USD 8.1 billion in 2025.

The market size for the gas insulated medium voltage switchgear market is projected to reach USD 18.6 billion by 2035.

The gas insulated medium voltage switchgear market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in gas insulated medium voltage switchgear market are ≥ 3 kv to 9 kv, ≥ 9 kv to 15 kv, ≥ 15 kv to 21 kv, ≥ 21 kv to 27 kv, ≥ 27 kv to 33 kv and ≥ 33 kv.

In terms of component, circuit breakers segment to command 41.8% share in the gas insulated medium voltage switchgear market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA