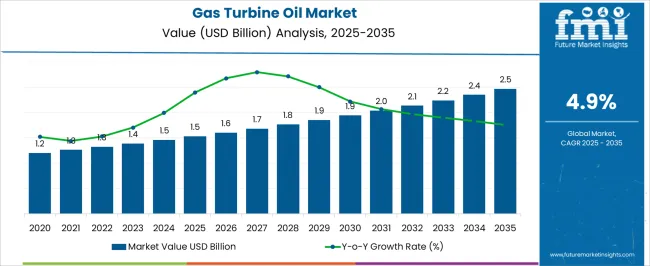

The gas turbine oil market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period. This market is being driven by the increasing use of gas turbines across industries such as power generation, oil & gas, and aviation, which are all looking for reliable and efficient oil solutions to maintain performance and reduce downtime. The demand for gas turbines, especially in emerging markets, is expected to rise due to the need for more sustainable energy solutions and enhanced efficiency in industrial operations.

As the demand for uninterrupted power supply continues to increase, gas turbine oil will play a crucial role in ensuring optimal turbine performance. By 2035, gas turbine oil is likely to see greater demand for higher-performance, longer-lasting oils that can withstand the extreme conditions in turbines, contributing to the growing market.

The expansion of energy infrastructure and industrial capacity in developing regions is also expected to drive market growth. As gas turbines are increasingly relied upon to meet energy demands, advancements in oil formulations that offer better wear protection, improved oxidation stability, and longer operational life will be crucial. As these trends evolve, key players in the market will be positioned to capitalize on this steady demand, driving continued growth and market penetration.

| Metric | Value |

|---|---|

| Gas Turbine Oil Market Estimated Value in (2025 E) | USD 1.5 billion |

| Gas Turbine Oil Market Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The gas turbine oil market is estimated to hold a notable proportion within its parent markets, representing approximately 6-7% of the industrial lubricants market, around 4-5% of the energy and power generation market, close to 15-17% of the gas turbine market, about 3-4% of the oil and gas exploration and production market, and roughly 2-3% of the aerospace and defense lubricants market.

The cumulative share across these parent segments is observed in the range of 30-36%, reflecting a significant role of gas turbine oils in maintaining high-efficiency operations across various industries. The market has been influenced by the growing demand for high-performance, long-lasting lubricants that reduce friction, prevent corrosion, and improve the reliability of turbine engines. Adoption is guided by procurement decisions focused on reducing operational downtime, maximizing turbine efficiency, and ensuring compliance with industry standards for lubricants.

Market participants have focused on enhancing lubricant properties such as thermal stability, oxidation resistance, and wear protection to extend turbine life and improve fuel efficiency. As a result, the gas turbine oil market has not only captured a significant share within the gas turbine and industrial lubricants segments but has also influenced power generation, oil and gas exploration, and aerospace lubricants markets, highlighting its role in improving operational performance, maintenance intervals, and reducing the risk of turbine failures across multiple sectors.

The gas turbine oil market is experiencing consistent growth, supported by increasing demand for efficient lubrication solutions in high-performance power generation and mechanical systems. The rising deployment of gas turbines across energy, aviation, and industrial sectors is fueling the need for specialized oils that can withstand high temperatures, reduce oxidation, and maintain long-term stability under extreme operating conditions. Technological advancements in turbine designs, which now require superior heat resistance and anti-wear characteristics, are accelerating the shift toward high-quality turbine oils.

As governments and utilities push for lower emissions and better energy efficiency, the demand for turbines operating under tighter performance thresholds is increasing, further emphasizing the need for reliable lubricants. The global rise in electricity consumption, especially in developing regions, along with the expansion of distributed power systems, is contributing to this market's momentum.

Growing focus on predictive maintenance and equipment reliability is also driving investments in premium-grade turbine oils. As the energy sector transitions toward cleaner and more efficient technologies, the gas turbine oil market is poised for sustainable long-term expansion.

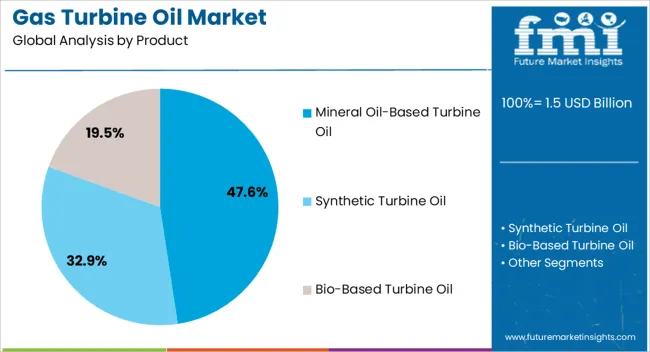

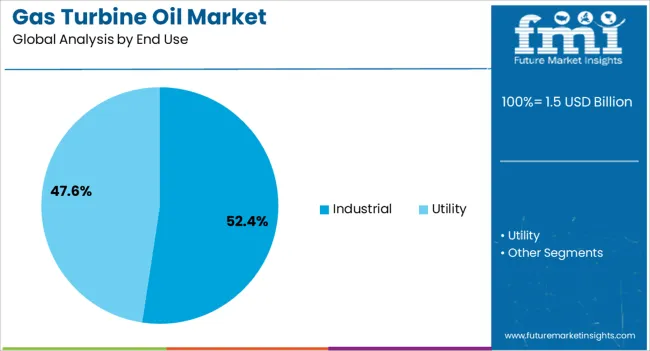

The gas turbine oil market is segmented by product, end use, and geographic regions. By product, gas turbine oil market is divided into Mineral Oil-Based Turbine Oil, Synthetic Turbine Oil, and Bio-Based Turbine Oil. In terms of end use, gas turbine oil market is classified into Industrial and Utility. Regionally, the gas turbine oil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mineral oil-based turbine oil segment is expected to account for 47.6% of the gas turbine oil market revenue share in 2025, making it the leading product category. Its continued dominance is being supported by wide availability, cost-effectiveness, and proven performance across a broad range of turbine applications. Mineral-based formulations offer sufficient thermal stability and oxidation resistance to meet operational demands in many industrial and utility-grade turbines.

Their compatibility with legacy equipment and established supply chains contributes to their ongoing preference among maintenance professionals and procurement teams. In regions with cost-sensitive procurement policies or limited access to advanced synthetics, mineral oil-based products continue to be the lubricant of choice.

Additionally, improvements in additive technologies have enhanced the performance characteristics of mineral oils, allowing them to meet evolving technical standards. As turbine installations increase in emerging markets and mid-range applications expand, the affordability and accessibility of mineral oil-based options are expected to reinforce their leading market position through the forecast period.

The industrial end use segment is projected to hold 52.4% of the gas turbine oil market revenue share in 2025, establishing itself as the largest consumer group. This dominance is being driven by extensive use of gas turbines in sectors such as manufacturing, petrochemicals, metal processing, and district heating. Industrial operations rely on turbines for both primary and backup power generation, often under variable and demanding load conditions that require consistent lubrication performance.

The increasing adoption of combined heat and power systems across industrial facilities is also contributing to sustained demand for high-quality turbine oils. The segment is further supported by rising investments in industrial automation, which require an uninterrupted power supply and reliable mechanical operation.

As maintenance cycles become more data-driven, the role of turbine oil in ensuring operational continuity and asset longevity has become more critical. Regulatory emphasis on emissions control and energy efficiency is also prompting industries to invest in higher-performing lubricants, reinforcing the leading share of the industrial segment in the global market.

The gas turbine oil market is benefiting from rising demand in power generation and industrial sectors that require high-performance oils for efficient turbine operation. The growing shift towards synthetic oils is enhancing the market’s potential, with these oils offering better protection and performance. However, the high costs and limited availability of such oils are posing challenges to broader market growth. With the right focus on overcoming these barriers, the market is poised for growth driven by the increasing need for reliability and efficiency in turbine operation.

The demand for high-performance gas turbine oils is largely driven by the increasing need for efficiency and longevity in gas turbines. As industrial applications, such as power generation and oil and gas production, continue to expand, the demand for turbine oils that offer enhanced protection against wear and oxidation is rising. These oils are essential in ensuring the smooth operation of turbines, which are increasingly used in critical sectors. As industries strive for higher reliability and performance, the need for specialized turbine oils grows.

The growth in the power generation sector presents significant opportunities for the gas turbine oil market. Gas turbines, which are used in combined-cycle power plants, require specialized oils to ensure efficient operation. As many countries continue to focus on increasing energy production capacity, there is potential for increased demand for turbine oils. Moreover, the shift towards more eco-friendly energy generation methods further enhances the demand for oils that help optimize turbine life and reduce operational costs.

The market is seeing a notable shift towards the use of synthetic oils in gas turbines. Synthetic oils offer superior performance compared to mineral oils by providing better resistance to oxidation, corrosion, and thermal degradation. This shift is being observed as industries prioritize operational longevity and cost-efficiency. Synthetic oils also help reduce maintenance requirements and downtime, making them increasingly preferred by turbine operators. The growing adoption of synthetic oils is likely to become a defining trend for the gas turbine oil market moving forward.

A significant challenge facing the gas turbine oil market is the high cost associated with the specialized oils required for efficient turbine operation. The price of synthetic oils, in particular, tends to be higher than that of traditional mineral oils. Additionally, the availability of these specialized oils in certain regions remains an issue, as supply chains continue to face disruption.

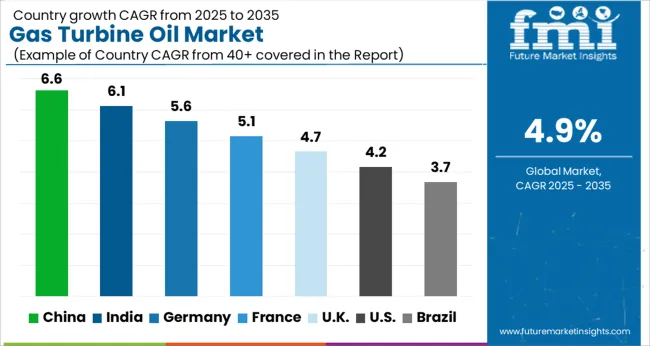

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

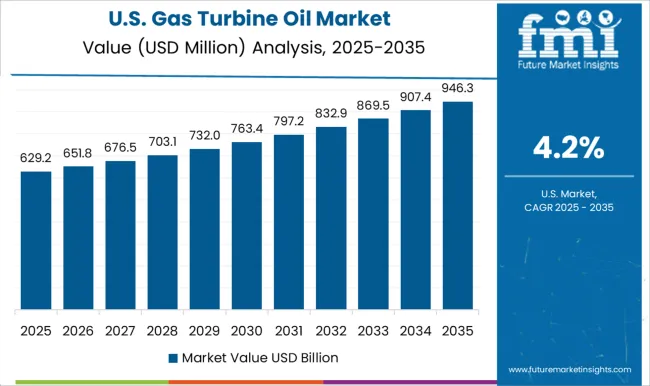

| USA | 4.2% |

| Brazil | 3.7% |

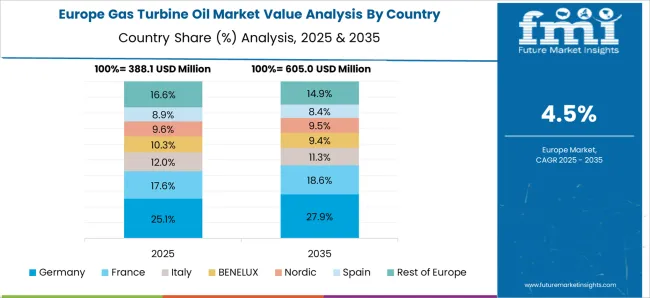

The global gas turbine oil market is projected to grow at a CAGR of 4.9% from 2025 to 2035. China leads with a growth rate of 6.6%, followed by India at 6.1%, and France at 5.1%. The United Kingdom records a growth rate of 4.7%, while the United States shows the slowest growth at 4.2%. This expansion is driven by the increasing demand for power generation and industrial applications, along with a growing need for high-performance lubricants in gas turbines. Emerging markets like China and India are experiencing faster growth due to the rapid industrialization and expansion of the energy sector, while developed markets like the USA and UK focus on technology upgrades and demand for energy efficiency. This report includes insights on 40+ countries; the top markets are shown here for reference.

The gas turbine oil market in China is projected to grow at a rate of 6.6%, driven by the country’s strong demand for power generation and rapid industrialization. With an expanding energy infrastructure and a growing focus on renewable energy sources, China is increasingly relying on gas turbines for efficient power generation. The country’s push toward modernizing its energy sector has led to a higher demand for high-performance turbine oils that can withstand the pressures of continuous operation. Additionally, the shift towards cleaner energy solutions is driving the need for more advanced turbine oils that are capable of reducing emissions and increasing turbine lifespan. China’s commitment to infrastructure growth and the increasing number of gas turbine installations are expected to continue supporting the market’s robust growth.

The gas turbine oil market in India is set to grow at 6.1%, supported by the country’s expanding power generation sector and rising industrial activities. India’s energy needs are growing, with an increasing focus on both renewable energy and natural gas-based power generation. Gas turbines are seen as an efficient means of providing backup power in the country’s growing urban centers. The increasing demand for power and the need for reliable, high-quality turbine oils that enhance engine performance and longevity are key growth drivers. India’s government investments in infrastructure and energy projects are further expected to support the growth of the market by facilitating more gas turbine installations across the country.

The gas turbine oil market France is projected to grow at a rate of 5.1%, driven by the country’s strong commitment to energy security and efficiency. Gas turbines play a significant role in France’s power generation mix, with a growing emphasis on reducing carbon emissions and improving operational efficiency. France’s focus on upgrading its energy infrastructure and increasing renewable energy production has led to a rise in gas turbine usage, particularly in combined-cycle plants. As gas turbine systems become more sophisticated, there is an increasing demand for high-performance turbine oils that can support more demanding operations and ensure longer equipment life. Additionally, France’s advanced industrial sectors are contributing to the continued adoption of high-quality turbine oils to maintain operational reliability.

The gas turbine oil market in the United Kingdom is expected to grow at a CAGR of 4.7%, supported by the country’s focus on reducing carbon emissions and improving energy efficiency. The UK is undergoing an energy transition, with a significant portion of its power generation now coming from natural gas-based turbines. These turbines require specialized oils that can enhance performance while maintaining environmental standards. The government’s push toward greener energy solutions is increasing the demand for turbine oils that can support combined-cycle gas turbine systems. The UK is also investing in technological innovations for more sustainable and efficient turbine operations, which is expected to drive demand for high-quality oils that can withstand the demands of modern turbines.

The gas turbine oil market in the United States is projected to grow at 4.2%, influenced by the growing need for energy efficiency in power generation and industrial applications. As the USA continues to upgrade its energy infrastructure, natural gas-based power plants are seeing more widespread use, and the demand for high-quality turbine oils is rising. Advanced turbine oils that offer superior performance and durability are increasingly necessary to support the growing number of gas turbines in operation. The USA market is focused on reducing emissions and improving fuel efficiency, which drives the demand for advanced turbine oils that meet these environmental and operational demands. The country’s heavy industrial base and energy transition goals are expected to continue supporting the growth of this market.

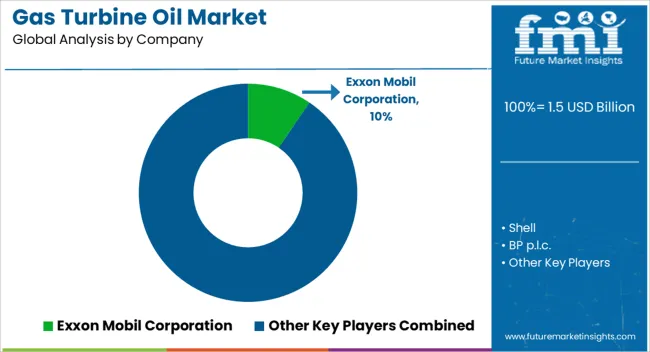

Leading companies such as Exxon Mobil, Shell, and BP dominate the market, providing high-performance oils designed to optimize turbine efficiency, reduce wear, and extend the lifespan of equipment. These oil products are formulated to withstand the extreme operating conditions of gas turbines, including high temperatures, pressures, and stresses. As energy demand increases globally, Chevron, Mobil, and TotalEnergies have developed specialized turbine oils that enhance performance while ensuring sustainability and minimal environmental impact. Companies are also focusing on improving the viscosity, oxidation stability, and corrosion resistance of their products to meet the evolving needs of power plants and industrial facilities. Additionally, with the growing importance of renewable energy sources and more stringent environmental regulations, oil companies are innovating to produce eco-friendly and efficient turbine oils.

The competitive landscape of the gas turbine oil market also includes players like Castrol, PETRONAS, and Lubrizol, who are constantly working on new formulations that improve the operational efficiency and energy output of turbines. FUCHS and Afton Chemical are focusing on enhancing fuel efficiency while minimizing the environmental footprint of turbine operations. As demand for cleaner energy increases, Eastman Chemical Company, Quaker Chemical Corporation, and Lanxess are actively involved in creating more sustainable, high-quality turbine oils. Companies such as Repsol, Kluber Lubrication, and Lukoil Marine Lubricants are expanding their offerings to cater to the marine and offshore sectors, where turbines are subjected to particularly harsh conditions. NYCO, Penrite Oil, and Idemitsu are also seeing an increase in demand for their advanced turbine oil products. As the market grows, there is a clear trend toward innovation and the development of products that enhance performance, reduce operating costs, and meet sustainability goals.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Product | Mineral Oil-Based Turbine Oil, Synthetic Turbine Oil, and Bio-Based Turbine Oil |

| End Use | Industrial and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Exxon Mobil Corporation, Shell, BP p.l.c., TotalEnergies, Chevron USA Inc., Mobil, Valvoline Global, Castrol, PETRONAS, Lubrizol, FUCHS, Afton Chemical, Eastman Chemical Company, Quaker Chemical Corporation, Lanxess, Repsol, Kluber Lubrication, LUKOIL Marine Lubricants, NYCO, Penrite Oil, Idemitsu, and Eastern Petroleum |

| Additional Attributes | Dollar sales by oil type (synthetic, mineral-based, semi-synthetic) and application (power generation, aviation, industrial gas turbines) are key metrics. Trends include rising demand for high-performance oils, growth in renewable energy power plants, and increasing focus on extended operational life and efficiency. Regional adoption, regulatory compliance, and technological advancements are driving market growth. |

The global gas turbine oil market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the gas turbine oil market is projected to reach USD 2.5 billion by 2035.

The gas turbine oil market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in gas turbine oil market are mineral oil-based turbine oil, synthetic turbine oil and bio-based turbine oil.

In terms of end use, industrial segment to command 52.4% share in the gas turbine oil market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA