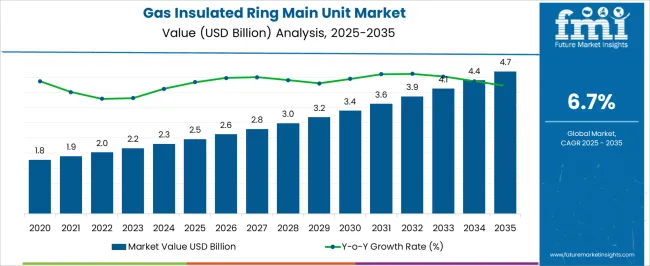

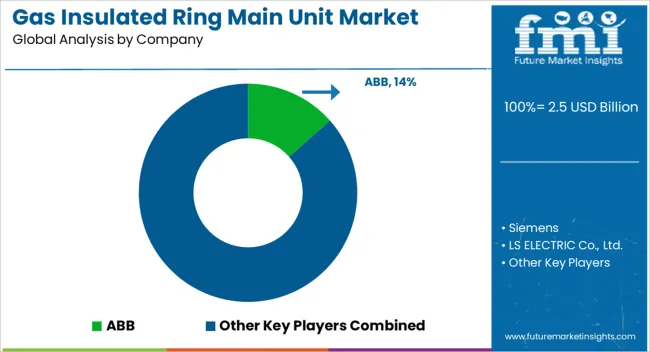

The gas insulated ring main unit market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

The gas insulated ring main unit (GIS RMU) market is valued at USD 2.5 billion in 2025 and is projected to reach USD 4.7 billion by 2035, with a CAGR of 6.7%. From 2021 to 2025, the market grows from USD 1.8 billion to USD 2.5 billion, moving through USD 1.9 billion, 2.0 billion, 2.2 billion, and 2.3 billion. This early growth phase is driven by the increasing adoption of gas-insulated technology in power distribution networks due to its compact design, reliability, and ability to function in harsh environments. The rising demand for efficient, space-saving power distribution systems in both urban and rural areas boosts the market's development.

Between 2026 and 2030, the market continues its growth trajectory, moving from USD 2.5 billion to USD 3.4 billion, with intermediate values of USD 2.6 billion, 2.8 billion, 3.0 billion, and 3.2 billion. The market’s growth contribution during this period is influenced by increasing industrialization, urbanization, and the demand for stable power supplies. As the adoption of renewable energy sources increases, GIS RMUs play a crucial role in ensuring grid reliability and stability.

From 2031 to 2035, the market reaches USD 4.7 billion, with values passing through USD 3.6 billion, 3.9 billion, 4.1 billion, and 4.4 billion. The growth is driven by technological advancements and the growing focus on infrastructure modernization, particularly in emerging economies.

| Metric | Value |

|---|---|

| Gas Insulated Ring Main Unit Market Estimated Value in (2025 E) | USD 2.5 billion |

| Gas Insulated Ring Main Unit Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The electrical equipment market is the largest contributor, accounting for approximately 30-35%, as GIRMs are a fundamental part of electrical distribution systems. The increasing demand for reliable and safe electrical networks in urban, industrial, and commercial areas drives this segment’s growth. The power transmission and distribution market follows with around 25-30%, as GIRMs play a crucial role in protecting and managing power distribution networks. The expansion and modernization of power grids, especially in space-constrained urban areas, boosts the adoption of gas-insulated ring main units. The renewable energy market contributes about 15-18%, as the integration of renewable energy sources such as wind and solar requires efficient and safe distribution solutions.

GIRMs help ensure the reliable connection of renewable energy to the grid. The smart grid market accounts for approximately 12-15%, as the growing adoption of smart grid technologies demands advanced electrical systems with real-time monitoring and control. Gas Insulated Ring Main Units are integral to smart grids, providing essential grid protection and reliability. Finally, the industrial and commercial infrastructure market contributes around 8-10%, as industrial and commercial facilities in dense urban environments require compact and reliable power distribution systems.

The gas insulated ring main unit (RMU) market is gaining traction due to rising demand for compact, safe, and maintenance-free power distribution solutions, particularly in densely populated urban and industrial zones. The integration of RMUs in medium-voltage networks is becoming essential as utilities modernize aging infrastructure and improve grid reliability.

Increased investments in substation automation and smart grid technologies are also bolstering the adoption of gas insulated RMUs for their operational efficiency and space-saving advantages. In developing economies, electrification projects and the expansion of renewable energy installations are creating favorable conditions for market growth.

RMUs’ ability to operate in harsh environments with minimal downtime supports their deployment across commercial, industrial, and residential sectors. As global utilities prioritize network stability, safety, and long-term cost savings, the demand for reliable and adaptable gas insulated RMUs is expected to maintain a strong upward trajectory

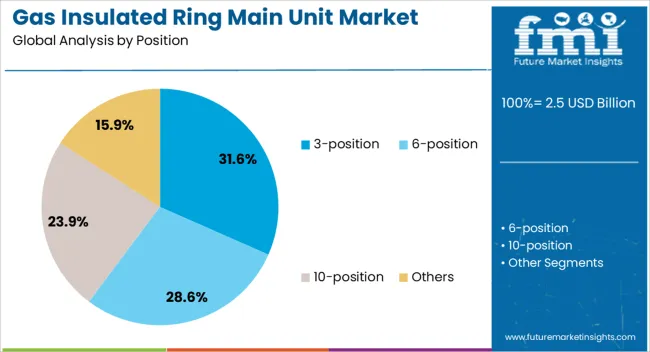

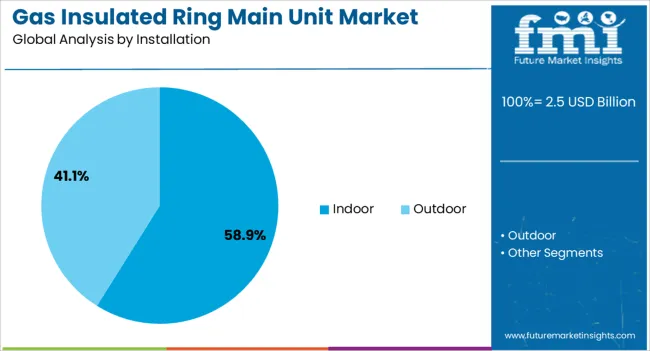

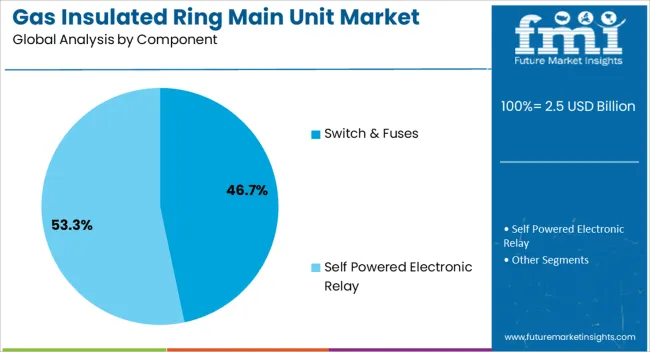

The gas insulated ring main unit market is segmented by position, installation, component, application, and geographic regions. By position, gas insulated ring main unit market is divided into 3-position, 6-position, 10-position, and others. In terms of installation, gas insulated ring main unit market is classified into indoor and outdoor. Based on component, gas insulated ring main unit market is segmented into switch & fuses and self powered electronic relay. By application, gas insulated ring main unit market is segmented into distribution utilities, industries, infrastructure, transportation, and others. Regionally, the gas insulated ring main unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 3-position segment leads the market by position type with a 31.6% share, driven by its operational flexibility and enhanced safety features. These units offer three switching positions—closed, open, and earthed—enabling improved control, isolation, and fault protection in power distribution networks.

Their ability to support uninterrupted power flow during maintenance or fault conditions has made them a preferred choice for utilities and industrial users alike. The compact design and modularity of 3-position RMUs contribute to efficient installation in limited-space environments without compromising on safety or performance.

Growing emphasis on grid automation and increasing urban infrastructure development are further encouraging the use of these units. The segment is expected to retain its lead as utilities continue investing in resilient and reliable medium-voltage systems that can be adapted to both legacy and smart grid frameworks

Indoor installations account for 58.9% of the gas insulated RMU market, underscoring their suitability for environments where space optimization and safety are critical. These units are widely deployed in commercial buildings, residential complexes, and institutional facilities due to their compact footprint and minimal maintenance requirements.

The demand for indoor RMUs is reinforced by the need for aesthetically integrated and weather-protected installations in urban settings. The sealed construction and reduced risk of arc flash or leakage make indoor units particularly appealing for use in confined or populated spaces.

Additionally, indoor installations support faster deployment and offer longer operational lifespans, aligning with current trends in smart urban infrastructure. As cities expand and real estate becomes more constrained, the role of indoor gas insulated RMUs is projected to become increasingly central to power distribution planning and execution

The self-powered electronic relay component segment holds a leading 53.3% share, reflecting its critical role in providing intelligent protection, monitoring, and control within gas insulated RMUs. These relays are essential for detecting faults, enabling selective tripping, and enhancing grid reliability without the need for an external power source.

Their integration into RMUs improves the efficiency, automation, and responsiveness of medium-voltage distribution systems, which is increasingly important for modern utility and industrial networks. Ongoing advancements in microprocessor technology, communication protocols, and real-time data analytics are supporting market expansion.

Demand for smart grid solutions and digital protection systems that align with international safety and efficiency standards is further reinforcing the growth of this segment. As power networks transition toward greater decentralization, renewable integration, and digitalization, the need for adaptive, reliable, and self-sustaining relay systems will continue to strengthen the self-powered electronic relay segment’s dominance in the market.

GIS RMUs are used in medium-voltage electrical networks to ensure the safe and reliable distribution of electricity, particularly in urban areas where space is limited. The market is driven by the ongoing demand for infrastructure upgrades, urbanization, and the growing need for secure and efficient electrical systems. GIS RMUs offer benefits such as compact size, enhanced safety, and reduced maintenance costs, making them ideal for modern power grids. However, high installation costs, complex maintenance procedures, and the need for skilled labor for operation pose challenges to the market. Opportunities exist in the adoption of renewable energy sources, the growing focus on smart grids, and the expansion of electrical networks in emerging markets.

The gas insulated ring main unit market is expanding due to the growing need for reliable and efficient power distribution, particularly in urban and densely populated areas. GIS RMUs provide a compact and secure solution for managing medium-voltage electrical networks, reducing the need for extensive space and minimizing the risk of faults. As urbanization continues and electrical infrastructure ages, there is an increasing demand for grid modernization and upgrading of existing power systems. GIS RMUs play a crucial role in modernizing electrical grids by offering more reliable and compact solutions that ensure uninterrupted power supply and greater protection against faults. This growing demand for power reliability is driving the adoption of GIS RMUs in both new installations and grid upgrade projects.

The GIS RMU market faces several challenges, including high initial investment costs, complex maintenance requirements, and integration difficulties with existing power infrastructure. The cost of manufacturing and installing GIS RMUs can be significantly higher than that of traditional air-insulated switchgear systems, which may limit adoption in price-sensitive markets. Additionally, GIS RMUs require specialized knowledge for installation and maintenance, which can lead to higher operational costs and the need for skilled labor. Integration with legacy systems can also be challenging, as existing electrical networks may not always be compatible with new GIS RMUs. These challenges create barriers to entry for smaller utilities and companies, but also provide opportunities for manufacturers to offer training, support, and cost-effective solutions to reduce the total cost of ownership.

Opportunities in the GIS RMU market are emerging through the integration of renewable energy sources and the adoption of smart grid technologies. As more countries shift towards renewable energy, particularly solar and wind, GIS RMUs are being used to manage the intermittent power generated from these sources and integrate it into the existing electrical grid. These units offer enhanced protection and reliability, making them suitable for the variable nature of renewable energy. Additionally, the rise of smart grids, which require more advanced power management systems and real-time data exchange, is creating new opportunities for GIS RMUs to play a role in grid automation and control. Manufacturers who can provide solutions that are compatible with renewable energy infrastructure and smart grid technologies are well-positioned to benefit from these growing trends.

The GIS RMU market is seeing trends toward more compact designs, enhanced safety features, and greater automation. With the demand for space-efficient power distribution systems increasing, there is a growing focus on developing smaller, more compact GIS RMUs that can be deployed in limited spaces without compromising performance. Safety is a key consideration, with manufacturers focusing on improving fault detection, protection mechanisms, and minimizing the risk of accidents during operation. Additionally, automation trends are pushing for the integration of remote monitoring and control systems in GIS RMUs, enabling utilities to optimize their grid management and respond quickly to faults. These trends are driving innovation in GIS RMUs, making them safer, more efficient, and more versatile for modern electrical infrastructure.

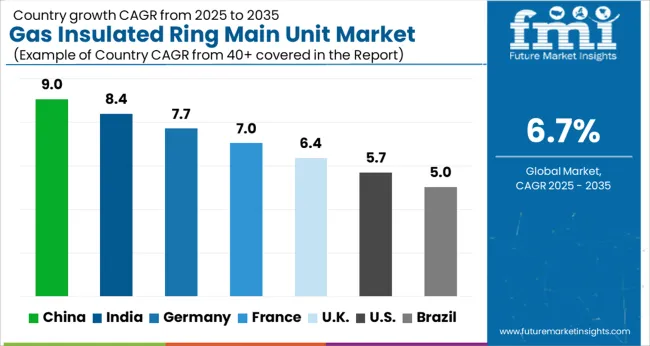

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The global gas insulated ring main unit (GIS RMU) market is expected to grow at a CAGR of 6.7% from 2025 to 2035. China leads the market with a growth rate of 9.0%, followed by India at 8.4% and France at 7.0%. The UK and USA exhibit moderate growth at 6.4% and 5.7%, respectively. The demand for GIS RMUs is driven by the increasing need for reliable and efficient power distribution systems, especially in urban environments with space constraints. Government initiatives focused on infrastructure modernization and the integration of renewable energy sources into national grids further support the market’s expansion. The analysis spans over 40+ countries, with the leading markets shown below.

The gas insulated ring main unit (GIS RMU) market in China is expected to grow at a CAGR of 9.0% from 2025 to 2035. As the country continues to invest heavily in its energy infrastructure, there is a growing demand for advanced electrical distribution systems, such as GIS RMUs, to ensure reliability and safety in power distribution networks. China’s rapid urbanization and industrialization, along with increasing energy consumption, are driving the need for efficient power distribution solutions. GIS RMUs are particularly well-suited for urban environments where space constraints and the need for a compact, reliable solution are key considerations. China’s focus on renewable energy integration and smart grid systems is expected to further increase the demand for GIS RMUs, as they provide enhanced protection and reliability for modern power grids.

The gas insulated ring main unit (GIS RMU) market in India is projected to grow at a CAGR of 8.4% from 2025 to 2035. The Indian government’s focus on expanding and modernizing the country’s power distribution network is a significant driver of this growth. With the increasing demand for reliable electricity in urban and rural areas, GIS RMUs are becoming essential for improving grid stability and reducing power outages. The shift towards renewable energy, especially solar and wind power, is further boosting the demand for GIS RMUs, as these systems offer superior reliability and safety in integrating renewable sources into the grid. India’s commitment to enhancing infrastructure and reducing power distribution losses will also contribute to the market’s growth.

The gas insulated ring main unit (GIS RMU) market in France is expected to grow at a CAGR of 7.0% from 2025 to 2035. The country’s strong focus on modernizing its power infrastructure and enhancing energy efficiency is driving the demand for advanced power distribution technologies like GIS RMUs. As part of its efforts to transition to cleaner energy sources, France is investing in renewable energy projects, which require reliable and efficient electrical distribution systems. GIS RMUs offer a compact and safe solution for integrating renewable energy sources into the power grid, making them essential for meeting the country's energy needs.

The UK’s gas insulated ring main unit (GIS RMU) market is projected to grow at a CAGR of 6.4% from 2025 to 2035. The UK is focused on upgrading its power distribution systems to enhance grid reliability and accommodate the growing demand for electricity. GIS RMUs offer a space-saving, reliable, and efficient solution for urban and industrial applications. The UK government’s commitment to reducing carbon emissions and increasing the use of renewable energy sources is also driving the adoption of GIS RMUs, as they are critical for maintaining grid stability while integrating wind, solar, and other renewable sources.

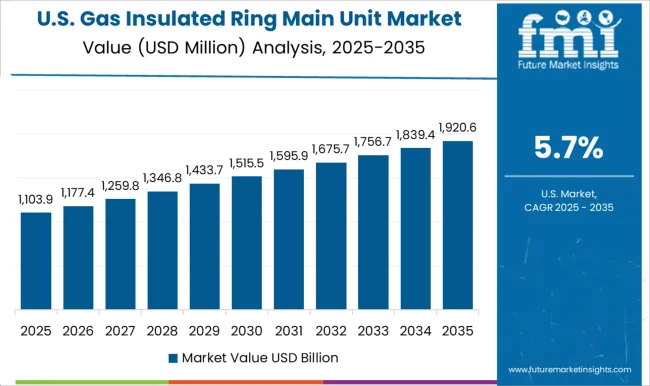

The USA gas insulated ring main unit (GIS RMU) market is expected to grow at a CAGR of 5.7% from 2025 to 2035. The growing focus on modernizing the USA power grid, coupled with the increasing need for reliable power distribution systems, is driving the demand for GIS RMUs. These units offer enhanced reliability, especially in urban environments where space constraints and safety are top priorities. The USA government’s investments in smart grid technologies and renewable energy projects further boost the demand for GIS RMUs. As the country transitions towards cleaner energy sources, the need for more efficient grid solutions will continue to rise.

The gas-insulated ring main unit (GIS RMU) market is highly competitive, driven by the need for safe, reliable, and space-efficient electrical distribution solutions. ABB stands at the forefront, offering GIS RMUs designed for high performance and minimal maintenance. Their solutions emphasize flexibility, energy efficiency, and compactness, ensuring reliable power distribution in both industrial and commercial sectors. Siemens competes with a focus on providing innovative and intelligent GIS systems, integrating advanced monitoring and control features that enhance the reliability and automation of electrical networks. Their emphasis is on efficiency, sustainability, and reduced footprint, making their products ideal for urban infrastructure.

Schneider Electric and LS ELECTRIC Co., Ltd. target different needs in the market. Schneider Electric focuses on smart, connected GIS solutions, enabling real-time data collection and analysis for optimal power management. They highlight eco-friendly and future-proof systems that integrate with digital grid systems. LS ELECTRIC Co., Ltd., on the other hand, specializes in cost-effective GIS RMUs that prioritize durability and ease of installation. Their products are tailored for regions requiring robust, reliable, and easy-to-maintain systems. alfanar Group competes by offering customizable GIS solutions for industrial and power distribution sectors, with an emphasis on long-term performance and safety standards.

Other competitors, such as Eaton, Ormazabal, and CG Power & Industrial Solutions, offer GIS RMUs designed with high-quality materials and innovative protective features, ensuring operation in challenging environments. Product brochures from these companies focus on the compact design, safety, and environmental sustainability of their solutions. Many brochures highlight features like reduced maintenance requirements, enhanced grid resilience, and seamless integration with smart grid applications. Emphasis is placed on operational efficiency, low environmental impact, and advanced automation, positioning GIS RMUs as key enablers of modern, sustainable electrical distribution systems.

| Items | Values |

|---|---|

| Quantitative Units | USD 2.5 billion |

| Position | 3-position, 6-position, 10-position, and Others |

| Installation | Indoor and Outdoor |

| Component | Switch & Fuses and Self Powered Electronic Relay |

| Application | Distribution Utilities, Industries, Infrastructure, Transportation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Siemens, LS ELECTRIC Co., Ltd., alfanar Group, Schneider Electric, Ormazabal, ELECTRIC&ELECTRONIC CO.,LTD., CG Power & Industrial Solutions Ltd., Orecco, Eaton, ElectroPool, Lucy Group Ltd., HD Hyundai Electric Co., Ltd, TGOOD Global Ltd., and Toshiba Energy Systems & Solutions Corporation |

| Additional Attributes | Dollar sales of switchgear cover medium and high voltage for utility, industrial, and commercial use. Growth stems from urbanization, efficiency needs, and smart grids, with strong adoption in Asia-Pacific, North America, and Europe. |

The global gas insulated ring main unit market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the gas insulated ring main unit market is projected to reach USD 4.7 billion by 2035.

The gas insulated ring main unit market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in gas insulated ring main unit market are 3-position, 6-position, 10-position and others.

In terms of installation, indoor segment to command 58.9% share in the gas insulated ring main unit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA