The gas fired real estate generator market has carved a meaningful share across its parent sectors, largely because of the growing reliance on continuous and reliable energy supply in both residential and commercial properties. Within the power generation equipment market, gas fired generators occupy nearly 15-17%, as they are increasingly chosen over diesel sets for cleaner performance and operational efficiency.

In the real estate infrastructure market, they contribute about 10-12%, reflecting their role as essential backup solutions in high-rise apartments, office spaces, and gated communities. Within the backup power solutions market, the segment holds a stronger position with nearly 22-25% share, as real estate installations account for a major portion of demand.

The gas engines market sees close to 14-16% share linked to real estate generator adoption, as developers prefer gas-based models for long-term cost control. In the residential and commercial energy systems market, the share stands around 18-20%, driven by increasing installation in both urban housing clusters and business complexes to ensure uninterrupted power.

While some argue that the operational expenses and natural gas price fluctuations may deter adoption, the market’s trajectory shows otherwise, as real estate developers and end-users continue to prioritize generators that combine reliability with lower emissions. It is my belief that gas fired generators have moved beyond being an optional luxury to becoming an indispensable infrastructure element in modern property developments.

| Metric | Value |

|---|---|

| Gas Fired Real Estate Generator Market Estimated Value in (2025 E) | USD 319.5 million |

| Gas Fired Real Estate Generator Market Forecast Value in (2035 F) | USD 770.4 million |

| Forecast CAGR (2025 to 2035) | 9.2% |

The gas fired real estate generator market is experiencing consistent growth, driven by increasing demand for reliable backup power solutions in residential and commercial properties. Rising incidences of grid instability and extended power outages have encouraged property developers and facility managers to integrate gas-fired generators as part of essential infrastructure. These systems are favored for their lower emissions compared to diesel alternatives, aligning with environmental compliance regulations and sustainability goals.

Advancements in gas engine technology, improved fuel efficiency, and reduced noise levels have further enhanced adoption in urban and suburban developments. Additionally, real estate investment trends indicate heightened integration of standby power systems to increase property value and tenant satisfaction.

The market outlook remains positive, supported by government incentives for cleaner energy solutions and ongoing expansion of natural gas distribution networks.

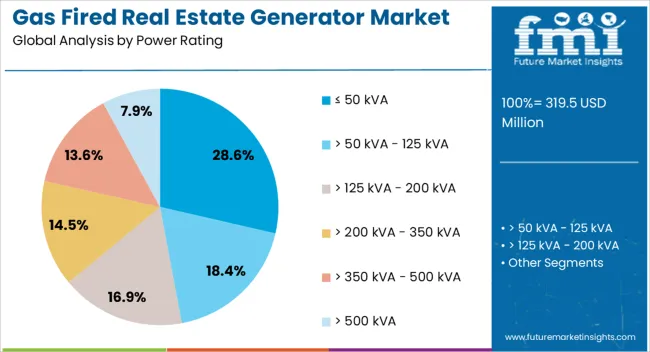

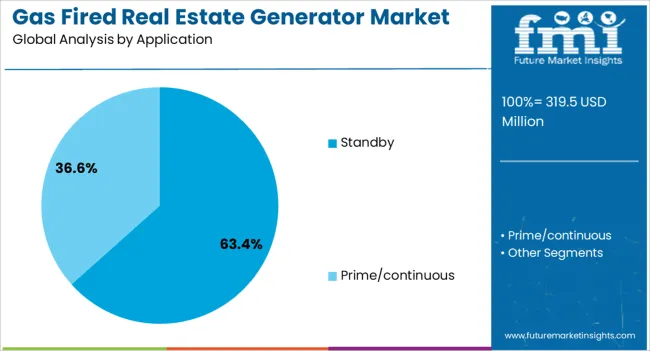

The gas fired real estate generator market is segmented by power rating, application, and geographic regions. By power rating, gas fired real estate generator market is divided into ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 350 kVA, > 350 kVA - 500 kVA, and > 500 kVA. In terms of application, gas fired real estate generator market is classified into Standby and Prime/continuous. Regionally, the gas fired real estate generator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ≤ 50 kVA segment is projected to account for 28.6% of the gas fired real estate generator market revenue in 2025, establishing a significant share in the overall market. Growth in this category has been influenced by its suitability for small to mid-sized residential complexes, retail outlets, and low-load commercial properties. These units offer a cost-effective balance between capacity and operational efficiency, making them attractive for property owners seeking affordable backup solutions.

Their compact design and ease of installation have contributed to adoption in urban projects where space constraints are common.

Furthermore, lower maintenance requirements and compatibility with existing gas supply lines have strengthened their market appeal. With increasing preference for decentralized energy solutions in real estate projects, the ≤ 50 kVA segment is expected to maintain stable demand.

The Standby segment is projected to hold 63.4% of the gas fired real estate generator market revenue in 2025, leading application-based adoption. Demand in this segment has been fueled by the critical need for uninterrupted power in residential communities, commercial complexes, and mixed-use developments. Standby generators provide immediate backup during outages, ensuring minimal disruption to operations and occupant comfort.

Real estate developers have increasingly prioritized standby systems to enhance property resilience and meet tenant expectations, especially in regions with unreliable grid performance.

Technological advancements enabling automated transfer switching and remote monitoring have improved system reliability, further encouraging market uptake. Additionally, the lower operational cost of gas compared to diesel has made standby gas-fired generators a preferred choice for long-term deployment in real estate infrastructure. As energy security becomes a higher priority for property stakeholders, the Standby segment is anticipated to sustain its dominance.

The gas fired real estate generator market is growing as property developers seek dependable, cleaner, and scalable backup power solutions. Opportunities arise from the wave of real estate projects worldwide, while trends emphasize smart and eco-conscious technologies. Yet, infrastructure gaps and higher operating costs remain hurdles for adoption. Overall, the market outlook is optimistic, supported by urban expansion and the increasing need for reliable energy in residential and commercial real estate developments.

The gas fired real estate generator market is witnessing strong demand as property owners and commercial establishments prioritize reliable backup power to counter electricity outages. Urban centers with frequent grid fluctuations and expanding residential complexes increasingly rely on gas-based systems for uninterrupted power. Unlike diesel units, gas-fired generators offer cleaner operation and longer runtimes, making them appealing for modern infrastructure projects. The market demand is further influenced by rising awareness of energy security and property developers positioning reliable power solutions as value-added features for buyers and tenants.

Significant opportunities are being created by the surge in real estate developments across residential, commercial, and mixed-use sectors. Developers prefer gas-fired generators due to their scalability, reduced emissions, and cost-efficiency compared to conventional alternatives. Governments encouraging natural gas infrastructure also create favorable conditions for adoption. In developing economies, urban expansion and housing projects are rapidly generating new prospects. Vendors providing integrated solutions, remote monitoring capabilities, and modular generator sets are positioned to benefit most, catering to property developers seeking efficient, long-term backup solutions aligned with project requirements.

A clear trend is emerging toward the adoption of cleaner and smarter gas-fired generator technologies. Many real estate operators are shifting from diesel to gas units to comply with emissions regulations and meet customer expectations for environmentally conscious solutions. Integration of smart monitoring systems, Internet of Things (IoT) controls, and automated load balancing is becoming commonplace. Compact designs with improved fuel efficiency are gaining traction in high-density real estate spaces. These trends reflect a broader movement toward efficiency-driven, eco-friendly, and technologically advanced generator systems tailored for modern urban developments.

Despite their benefits, gas-fired real estate generators face challenges linked to infrastructure readiness and overall cost of ownership. Areas lacking consistent natural gas supply infrastructure often struggle to adopt these systems, creating dependency on alternative solutions. High upfront installation costs and recurring maintenance requirements can deter smaller property developers. Moreover, navigating diverse regulatory requirements and ensuring compliance with emissions standards remain complex. To overcome these hurdles, industry players must prioritize flexible financing models, cost optimization, and supportive after-sales services that enhance adoption while mitigating long-term operational concerns.

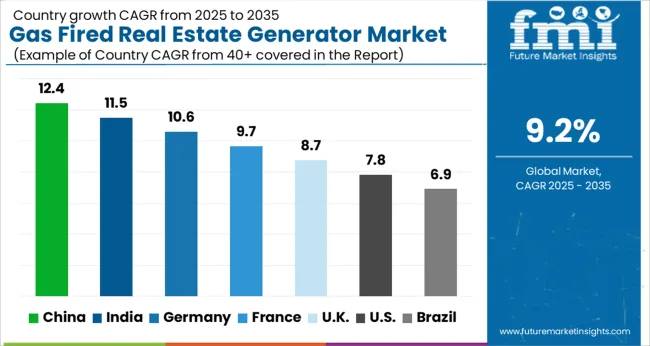

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

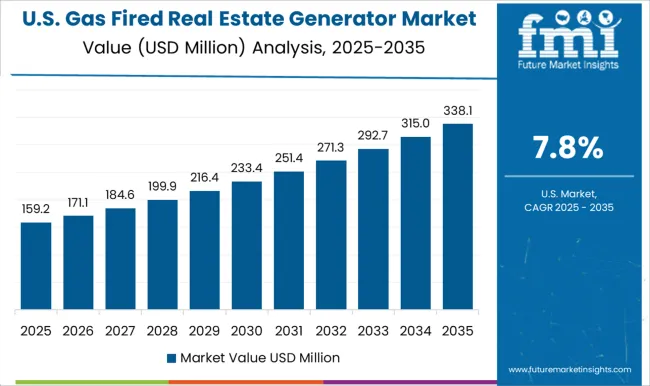

| USA | 7.8% |

| Brazil | 6.9% |

The global gas fired real estate generator market is projected to grow at a CAGR of 9.2% between 2025 and 2035. China leads with a growth rate of 12.4%, followed by India at 11.5%, and France at 9.7%. The United Kingdom records 8.7% growth, while the United States follows at 7.8%. Growth is fueled by rising demand for reliable backup power, urban development, and increasing adoption of natural gas-based systems as a cleaner alternative to diesel.

Emerging economies such as China and India are experiencing rapid growth driven by infrastructure development and frequent power disruptions. Developed regions like France, the UK, and the USA are emphasizing cleaner energy compliance, reduced emissions, and modernization of real estate facilities. This report includes insights on 40+ countries; the top markets are highlighted for reference.

The gas fired real estate generator market in China is forecasted to expand at a CAGR of 12.4%. China’s rising urbanization, combined with a heavy reliance on consistent power supply for high-density residential and commercial developments, is driving generator demand. Real estate projects increasingly prefer gas fired generators due to government policies promoting lower emissions and greater energy efficiency compared to diesel units.

With industrialization creating high energy demand, adoption in real estate ensures reliability during peak consumption. Investment in smart city projects, coupled with stricter emission standards, accelerates the integration of natural gas-based systems across residential complexes, malls, and office hubs.

The gas fired real estate generator market in India is projected to grow at a CAGR of 11.5%. Frequent power shortages and grid instability remain primary drivers of backup power demand in Indian real estate. With the government encouraging natural gas usage to reduce reliance on diesel, adoption of gas fired generators is increasing across commercial and residential projects.

Large-scale housing developments, malls, and IT parks are prioritizing gas-based systems for cleaner, cost-effective, and long-term energy security. Growing awareness of environmental regulations, combined with demand for uninterrupted power during peak load conditions, is further supporting growth. Investments in urban infrastructure and real estate modernization ensure sustained demand in the forecast period.

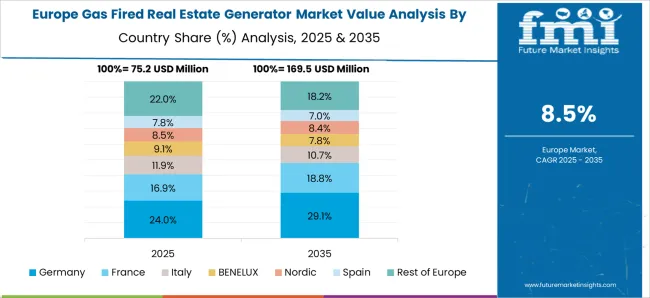

The gas fired real estate generator market in France is set to expand at a CAGR of 9.7%. Growth is driven by the country’s stringent environmental standards and increasing reliance on energy-efficient solutions in real estate. Commercial facilities, residential complexes, and healthcare infrastructure are adopting gas fired generators to meet carbon reduction targets.

The French government’s push for renewable integration creates a complementary role for natural gas systems as reliable backup during intermittent renewable power generation. Strong demand from urban residential projects and compliance-driven modernization of old facilities underpin steady adoption. Manufacturers are also innovating compact and low-emission generators, making them more appealing for urban deployments.

The gas fired real estate generator market in the United Kingdom is expected to grow at a CAGR of 8.7%. With the UK’s transition to cleaner energy sources, real estate developers increasingly adopt gas fired systems as a sustainable alternative to diesel units. The commercial real estate sector, including office spaces, retail chains, and residential complexes, requires reliable standby power due to rising energy consumption.

Regulations targeting emissions from diesel-powered systems push developers to invest in gas-based alternatives. Backup power reliability during grid outages and cost savings on fuel efficiency further strengthen adoption. With real estate modernization and digital infrastructure expansion, gas fired units are expected to play a larger role in the energy landscape.

The gas fired real estate generator market in the United States is forecasted to grow at a CAGR of 7.8%. Growth is supported by the country’s increasing demand for reliable backup power amid grid strain and extreme weather events. Adoption is rising across residential developments, hospitals, data centers, and commercial real estate projects.

The transition from diesel to natural gas systems is driven by stricter EPA regulations and the growing emphasis on sustainability. Developers prioritize generators that reduce emissions and provide long-term cost benefits. Rising investment in urban development, along with a stronger focus on energy security, continues to fuel demand.

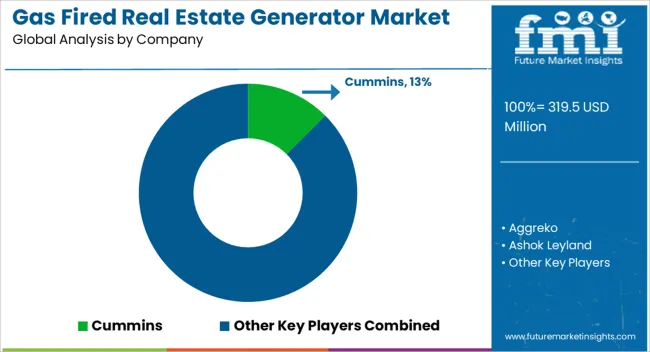

The gas fired real estate generator market is shaped by global manufacturers like Cummins, Caterpillar, and Generac Power Systems, who compete on reliability, energy efficiency, and after-sales support. Their brochures highlight extended runtimes, seamless load management, and low operational costs, resonating with real estate developers seeking dependable backup solutions.

Aggreko and Atlas Copco position themselves strongly in temporary and rental-based solutions, focusing on flexible deployment and reduced downtime. Ashok Leyland, Kirloskar, and Mahindra Powerol emphasize cost-effective power systems for mid-tier real estate projects, promoting brochures that underline localized service networks and simplified maintenance packages.

The differentiation lies in balancing upfront investment with long-term dependability, a factor that drives purchasing decisions in urban property development. Premium players such as Mitsubishi Heavy Industries, Rolls-Royce, and Yanmar Holdings stress high-performance engineering in their brochures, targeting high-capacity real estate complexes and luxury projects.

HIMOINSA and PR Industrial focus on modular systems, stressing adaptability and compliance with varied environmental standards. J.C. Bamford Excavators and Rehlko carve niche spaces with compact generators tailored for specific building requirements, appealing to buyers needing scalable solutions.

Marketing strategies across the industry rely heavily on brochures that highlight energy savings, noise reduction, and automated control systems. As competition intensifies, suppliers are positioning themselves not just on product durability but also on lifecycle support, making brochures a central tool to build trust and influence procurement decisions in a crowded generator market.

| Item | Value |

|---|---|

| Quantitative Units | USD 319.5 Million |

| Power Rating | ≤ 50 kVA, > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 350 kVA, > 350 kVA - 500 kVA, and > 500 kVA |

| Application | Standby and Prime/continuous |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cummins, Aggreko, Ashok Leyland, Atlas Copco, Caterpillar, Generac Power Systems, HIMOINSA, J.C. Bamford Excavators, Kirloskar, Rehlko, Mahindra Powerol, Mitsubishi Heavy Industries, PR Industrial, Rolls-Royce, and Yanmar Holdings |

| Additional Attributes | Dollar sales by generator type (portable, standby) and capacity range (low, medium, high) are key metrics. Trends include rising demand for reliable backup power in residential and commercial properties, preference for cleaner fuel alternatives to diesel, and integration with smart energy systems. Regional adoption, regulatory compliance, and technological advancements are driving market growth. |

The global gas fired real estate generator market is estimated to be valued at USD 319.5 million in 2025.

The market size for the gas fired real estate generator market is projected to reach USD 770.4 million by 2035.

The gas fired real estate generator market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in gas fired real estate generator market are ≤ 50 kva, > 50 kva - 125 kva, > 125 kva - 200 kva, > 200 kva - 350 kva, > 350 kva - 500 kva and > 500 kva.

In terms of application, standby segment to command 63.4% share in the gas fired real estate generator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gas Discharge Tube (GDT) Arresters Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA