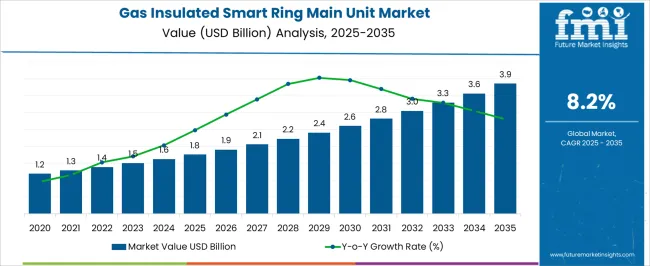

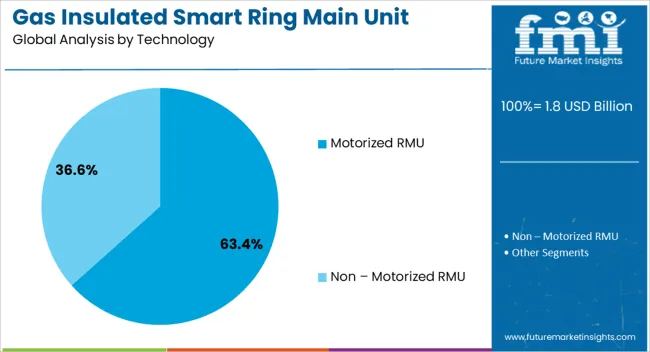

The gas insulated smart ring main unit market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 3.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period. The contribution analysis by technology indicates that the market is primarily segmented into gas-insulated switchgear (GIS) units with digital monitoring, automated protection systems, and remote communication modules. Gas-insulated units constitute the largest technological share due to their compact footprint, enhanced safety, and suitability for urban and industrial deployment where space constraints and reliability are critical.

Their adoption is reinforced by the ability to operate efficiently under harsh environmental conditions and deliver superior insulation performance, reducing maintenance costs and downtime. Digital monitoring technologies, including sensors and data acquisition systems, are progressively contributing to market growth. These technologies enable real-time performance tracking, predictive maintenance, and improved operational efficiency, thereby increasing their share of the overall market. Remote communication and automation modules are also emerging as significant contributors, facilitating integration with smart grids and supporting advanced energy management strategies.

Over the forecast period, the technology mix is expected to shift towards higher digital integration, with smart monitoring and communication systems increasingly complementing traditional gas-insulated configurations.

| Metric | Value |

|---|---|

| Gas Insulated Smart Ring Main Unit Market Estimated Value in (2025 E) | USD 1.8 billion |

| Gas Insulated Smart Ring Main Unit Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The gas insulated smart ring main unit market represents a specialized segment within the global electrical distribution and smart grid industry, emphasizing compact design, reliability, and automated switching for medium-voltage networks. Within the broader switchgear and electrical distribution sector, it accounts for about 3.5%, driven by adoption in urban power distribution, industrial facilities, and renewable energy integration. In the gas-insulated switchgear segment, its share is approximately 4.1%, reflecting demand for space-saving, high-performance, and low-maintenance solutions.

Across the smart grid and automation market, it holds around 3.8%, supporting remote monitoring, fault detection, and real-time network management. Within the industrial electrical solutions category, it represents 3.2%, highlighting its role in reliable and secure power distribution. In the overall energy infrastructure ecosystem, the market contributes about 2.9%, emphasizing operational efficiency, safety, and digital integration. Recent developments in the gas insulated smart ring main unit market have focused on automation, digital monitoring, and eco-efficient designs. Groundbreaking trends include IoT-enabled switchgear, remote control and diagnostics, and predictive maintenance systems to optimize network reliability.

Key players are collaborating with utilities, smart grid developers, and technology providers to implement modular, compact, and scalable solutions. Adoption of SF6-free or low-GWP insulating gas alternatives and enhanced arc-quenching technologies is gaining traction to reduce environmental impact. The integration with energy management platforms and cloud-based analytics is enabling real-time fault detection and load optimization.

The gas insulated smart ring main unit (RMU) market is gaining traction due to rising urbanization, increasing power distribution demands, and the ongoing modernization of electrical infrastructure. Smart RMUs play a pivotal role in ensuring reliable, automated, and compact secondary power distribution, especially in densely populated or space-constrained urban settings.

Utilities and industrial users are increasingly favoring gas-insulated systems for their long service life, low maintenance, and safety advantages over conventional air-insulated alternatives. The integration of IoT and automation technologies into RMUs has further enhanced operational efficiency, fault detection, and grid responsiveness.

With growing investments in renewable energy integration and smart grid development, the market is projected to witness sustained expansion. Regulatory support for grid automation and the emphasis on minimizing power outages and system losses are likely to reinforce the long-term relevance of gas insulated smart RMUs across global markets

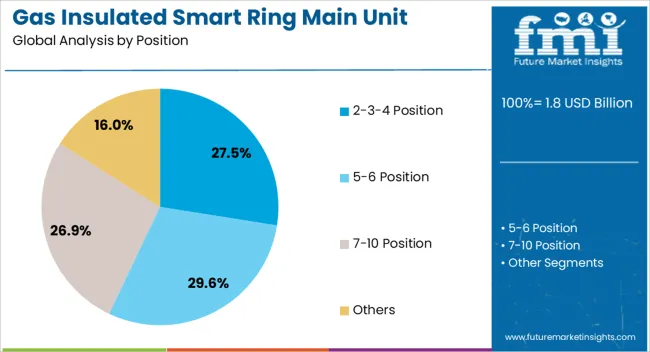

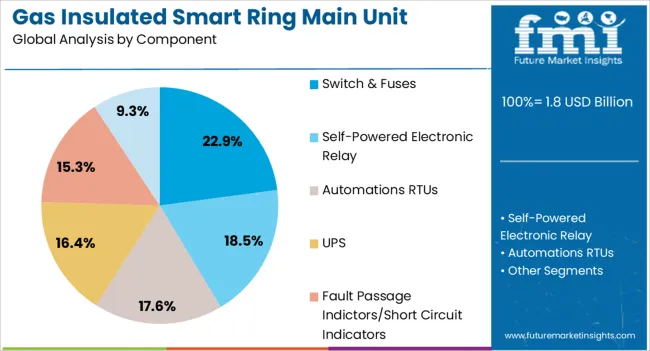

The gas insulated smart ring main unit market is segmented by position, component, technology, application, and geographic regions. By position, gas insulated smart ring main unit market is divided into 2-3-4 Position, 5-6 Position, 7-10 Position, and Others. In terms of component, gas insulated smart ring main unit market is classified into Switch & Fuses, Self-Powered Electronic Relay, Automations RTUs, UPS, Fault Passage Indictors/Short Circuit Indicators, and VDIS.

Based on technology, the gas-insulated smart ring main unit market is segmented into Motorized RMU and non–motorized RMU. By application, gas insulated smart ring main unit market is segmented into Distribution Utilities, Industries, Infrastructure, Transportation, and Others. Regionally, the gas insulated smart ring main unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 2-3-4 position configuration segment leads the position category with a 27.5% market share, driven by its flexibility in managing diverse feeder arrangements within compact substations. This segment caters to varying load requirements and switching operations, making it highly suitable for urban and semi-urban distribution networks.

Its modular design and configurability enhance ease of installation and system scalability, allowing utilities to tailor solutions based on specific grid needs. The demand for these multi-position units is also supported by their capacity to optimize space while maintaining operational reliability and safety.

Utility companies are increasingly opting for these configurations to support growing residential and commercial load demands without extensive infrastructure modifications. The 2-3-4 position segment is expected to maintain its growth due to its practicality, cost efficiency, and compatibility with evolving smart grid architectures.

Switch & fuses account for 22.9% of the gas insulated smart RMU market under the component category, owing to their critical function in protecting circuits and isolating faults in distribution networks. These components offer a balance between simplicity and protection, making them widely adopted in medium-voltage applications where space and reliability are paramount.

Their role in enabling safe disconnection, minimizing damage during overloads, and ensuring personnel safety reinforces their significance in RMU assemblies. Ongoing upgrades in materials and contact technologies have improved the durability and responsiveness of switch & fuse combinations, catering to increasing fault currents and automation needs.

As utilities transition towards more intelligent and modular network components, the continued deployment of robust switch & fuse configurations is anticipated, particularly in regions undergoing grid modernization and urban infrastructure development.

The motorized RMU segment dominates the technology category with a commanding 63.4% market share, highlighting its central role in enhancing automation and remote control in medium-voltage distribution systems. These units enable real-time monitoring, fault isolation, and service restoration without requiring manual intervention, thereby significantly improving operational efficiency and grid uptime.

The growing implementation of smart grid frameworks and the rising need for rapid response to load fluctuations have accelerated the adoption of motorized RMUs. Utilities benefit from reduced maintenance costs, enhanced safety, and improved network reliability, especially in geographically dispersed or hazardous environments.

Continued investments in automation infrastructure and regulatory support for intelligent energy management are expected to drive the expansion of this segment. The motorized RMU’s compatibility with SCADA and IoT platforms further strengthens its position as a future-ready solution in advanced power distribution systems.

The market has gained momentum due to the growing need for compact, reliable, and intelligent electrical distribution systems. Gas insulated RMUs integrate advanced monitoring, control, and protection functionalities, enabling efficient energy distribution in urban, industrial, and utility environments. These units combine space-saving designs with high operational reliability, allowing installation in confined areas while supporting smart grid applications. Increasing investments in power infrastructure modernization, rising adoption of renewable energy sources, and the need for efficient power management have reinforced market growth.

Gas insulated smart RMUs are increasingly deployed in smart grid and digital distribution networks, enabling real-time monitoring, fault detection, and remote control. The integration of IoT-enabled sensors, communication modules, and data analytics allows utilities to optimize load management, prevent outages, and enhance network reliability. These units support automated switching operations and enable predictive maintenance, reducing operational costs and improving power quality. Growing adoption of smart city initiatives, digital substations, and energy-efficient distribution solutions has further accelerated demand. Utilities and industrial facilities are leveraging smart RMUs to achieve operational flexibility, enhanced safety, and better energy management, ensuring that digital distribution networks remain resilient and responsive to dynamic load conditions.

The compactness of gas insulated smart RMUs makes them suitable for dense urban and industrial installations where space is constrained. Their gas-insulated design reduces the footprint compared to traditional air-insulated switchgear while providing superior insulation and safety. Urban distribution networks, high-rise buildings, and industrial complexes increasingly rely on these units for secure power distribution. Reduced maintenance requirements and long operational lifespans further contribute to their adoption. Modular and prefabricated configurations allow seamless integration with existing networks, enhancing installation flexibility. With increasing urbanization and infrastructure development, the demand for compact and reliable medium-voltage distribution solutions has strengthened the deployment of gas insulated smart RMUs globally.

Continuous technological advancements have enhanced the performance, safety, and functionality of gas insulated smart RMUs. Innovations include enhanced gas-insulated insulation systems, integration of intelligent control and communication technologies, and improved fault detection capabilities. Manufacturers are developing units with reduced SF6 gas content, environmentally friendly insulation alternatives, and enhanced digital monitoring capabilities. Modular and scalable designs enable easier maintenance and faster deployment in complex network configurations. These innovations have expanded the application potential of RMUs in industrial, utility, and commercial sectors. As power networks become increasingly digital and automated, gas insulated smart RMUs are positioned as a critical solution for ensuring operational efficiency, reliability, and sustainability.

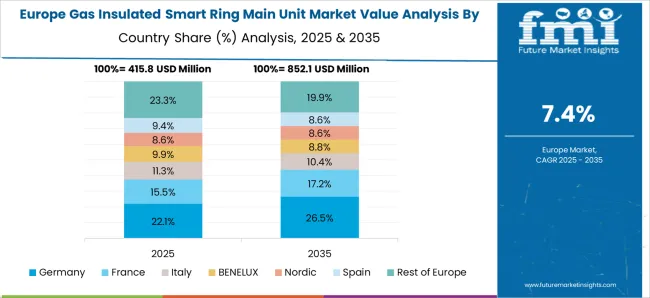

Europe and North America are leading markets for gas insulated smart RMUs due to high investments in smart grid technologies, stringent safety regulations, and mature electrical infrastructure. Asia Pacific is witnessing rapid growth driven by urbanization, industrial expansion, and increasing renewable energy integration. Key market players focus on R&D, strategic partnerships, and regional manufacturing expansions to meet diverse customer requirements. Competition is shaped by technological innovation, cost-effectiveness, and adherence to environmental standards. Rising demand for compact, intelligent, and reliable distribution solutions continues to drive market adoption, with utilities and industrial players emphasizing smart, automated, and sustainable medium-voltage distribution systems worldwide.

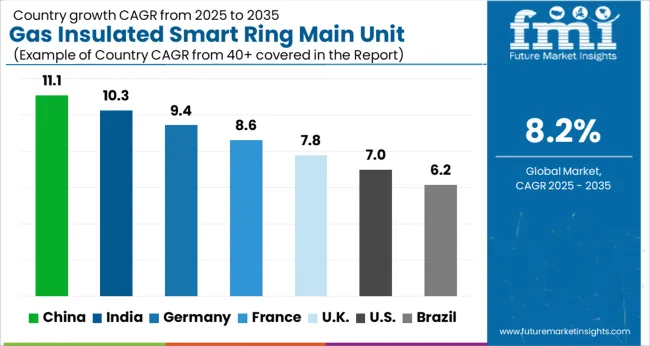

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The market is projected to grow at a CAGR of 8.2% from 2025 to 2035, driven by increasing demand for compact and reliable power distribution systems. China leads with 11.1%, supported by rapid urban infrastructure development and modernization of electrical networks. India follows at 10.3%, as smart grid adoption and industrial electrification expand. Germany records 9.4%, reflecting strong focus on energy efficiency and grid reliability. The UK registers 7.8%, fueled by distribution network upgrades, while the USA stands at 7.0%, driven by investments in resilient and automated power systems. These nations demonstrate the market’s advancement and deployment of innovative ring main unit technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is witnessing a CAGR of 11.1%, driven by rapid urban electrification, expansion of power distribution networks, and adoption of smart grid technologies. GIS RMUs are increasingly deployed in industrial, commercial, and utility applications for enhanced reliability, reduced maintenance, and compact footprint. Domestic manufacturers focus on high-voltage, corrosion-resistant units and smart monitoring integration. Collaboration with international technology providers accelerates innovation in automated switchgear solutions.

India is projected to grow at a CAGR of 10.3%, supported by the modernization of power distribution infrastructure and the integration of smart monitoring systems. GIS RMUs are preferred for industrial plants, urban substations, and renewable energy distribution due to high reliability and safety. Local manufacturers are emphasizing compact designs and automated monitoring for preventive maintenance. Government programs for grid modernization and smart metering further accelerate adoption.

Germany is experiencing a CAGR of 9.4%, supported by modernization of distribution networks, renewable energy integration, and automation in smart grids. GIS RMUs are deployed in industrial plants, urban substations, and renewable energy hubs. Emphasis on safety, compact design, and smart monitoring drives market growth. Manufacturers focus on compliance with European Union electrical standards and integration of advanced diagnostic systems.

The United Kingdom is projected to grow at a CAGR of 7.8%, driven by industrial and urban power distribution modernization initiatives. GIS RMUs are increasingly adopted due to space-saving design, reliability, and integrated monitoring features. Energy utilities and industrial operators focus on reducing downtime and maintenance costs through automated systems. Partnerships with global manufacturers enhance technological adoption and operational efficiency.

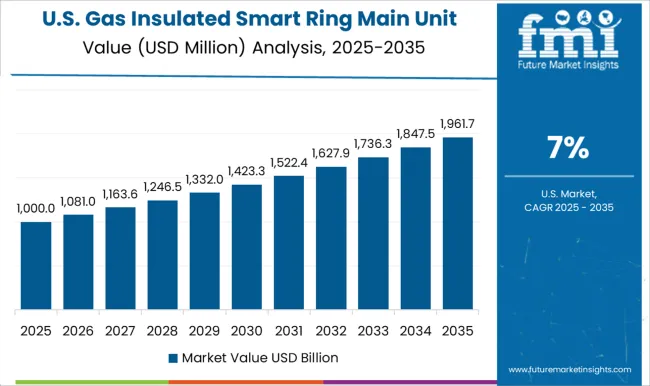

The United States is expanding at a CAGR of 7.0%, driven by infrastructure modernization, adoption of smart grid solutions, and renewable energy integration. GIS RMUs are widely deployed in industrial, utility, and commercial power networks for compact design, safety, and operational efficiency. Manufacturers emphasize high-performance, IoT-enabled monitoring, and compliance with UL and ANSI standards to ensure reliability.

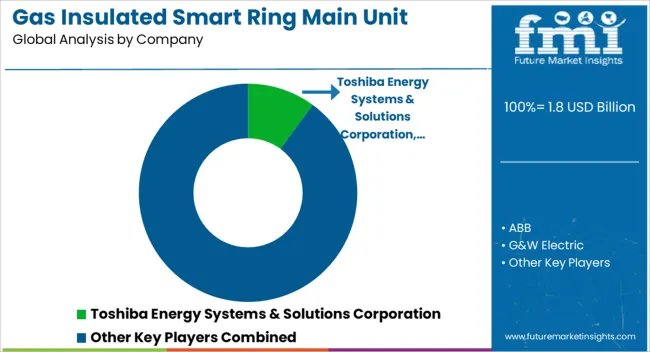

The market is highly competitive, driven by major global players offering advanced, compact, and digitalized distribution solutions for medium-voltage networks. Leading companies such as ABB, Siemens, Schneider Electric, and Toshiba Energy Systems & Solutions Corporation dominate the market with a strong focus on smart grid integration, digital monitoring, and high reliability. Their global reach, extensive product portfolios, and investment in research and development provide a significant competitive advantage.

Regional and specialized players, including Lucy Group Ltd., Ormazabal, LS ELECTRIC Co., Ltd., CG Power & Industrial Solutions Ltd., and Eaton, strengthen their market position by offering customized solutions tailored to local regulations, cost-sensitive projects, and rapid deployment requirements. Their agility in servicing emerging markets and providing technical support enhances adoption rates. Niche manufacturers such as Bonomi Eugenio SpA, alfanar Group, HD HYUNDAI ELECTRIC CO., LTD., Orecco, and BRUSH focus on innovation in compact design, environmentally friendly insulation technology, and integration with IoT-enabled monitoring systems.

The market is influenced by growing urban infrastructure projects, renewable energy integration, and stringent grid safety standards, making product reliability, technological advancement, and service networks the primary differentiators among competitors.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Position | 2-3-4 Position, 5-6 Position, 7-10 Position, and Others |

| Component | Switch & Fuses, Self-Powered Electronic Relay, Automations RTUs, UPS, Fault Passage Indictors/Short Circuit Indicators, and VDIS |

| Technology | Motorized RMU and Non – Motorized RMU |

| Application | Distribution Utilities, Industries, Infrastructure, Transportation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toshiba Energy Systems & Solutions Corporation, ABB, G&W Electric, Lucy Group Ltd., Ormazabal, Siemens, Schneider Electric, LS ELECTRIC Co., Ltd., Electric & Electronic Co., Ltd., Bonomi Eugenio SpA, alfanar Group, BRUSH, HD HYUNDAI ELECTRIC CO., LTD., Orecco, CG Power & Industrial Solutions Ltd., and Eaton |

| Additional Attributes | Dollar sales by unit type and application, demand dynamics across urban distribution, industrial, and renewable integration sectors, regional trends in compact substation adoption, innovation in gas insulation, smart monitoring, and fault detection, environmental impact of SF6 management and energy efficiency, and emerging use cases in smart grids, urban electrification, and decentralized power networks. |

The global gas insulated smart ring main unit market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the gas insulated smart ring main unit market is projected to reach USD 3.9 billion by 2035.

The gas insulated smart ring main unit market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in gas insulated smart ring main unit market are 2-3-4 position, 5-6 position, 7-10 position and others.

In terms of component, switch & fuses segment to command 22.9% share in the gas insulated smart ring main unit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Condensing Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water Tube Chemical Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA