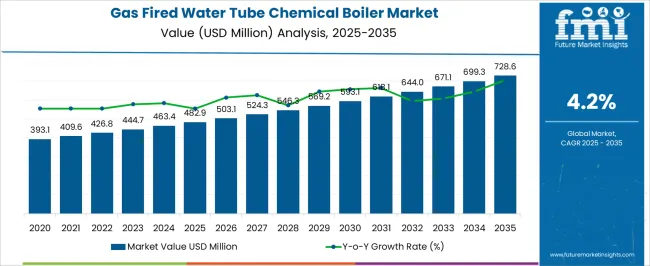

The gas fired water tube chemical boiler market, valued at USD 482.9 million in 2025 and projected to reach USD 728.6 million by 2035 at a CAGR of 4.2%, is significantly shaped by regulatory frameworks that govern emissions, safety standards, and operational efficiency. Environmental regulations, particularly those targeting greenhouse gas emissions and nitrogen oxide outputs, directly influence design specifications, fuel utilization, and combustion efficiency. Manufacturers are compelled to integrate advanced monitoring systems and emission control technologies to comply with evolving standards, which impacts production costs and product pricing. Safety and operational regulations, including mandatory inspections, pressure vessel certifications, and adherence to national and international boiler codes, further define market dynamics.

Compliance with these standards ensures operational reliability but necessitates investment in quality control, certification processes, and workforce training. The chemical industry-specific regulations regarding heat transfer efficiency and process safety introduce technical requirements that dictate boiler design, materials selection, and auxiliary components integration. Energy efficiency mandates and sustainability policies encourage adoption of low-emission, high-efficiency boilers, influencing both R&D investments and end-user purchasing decisions. Regulatory incentives, such as tax credits or subsidies for energy-efficient equipment, can accelerate adoption, particularly in regions with stringent environmental norms. The market’s moderate growth trajectory is closely linked to regulatory adherence, with manufacturers needing to balance compliance costs against technological innovation and market competitiveness to achieve sustainable expansion.

| Metric | Value |

|---|---|

| Gas Fired Water Tube Chemical Boiler Market Estimated Value in (2025 E) | USD 482.9 million |

| Gas Fired Water Tube Chemical Boiler Market Forecast Value in (2035 F) | USD 728.6 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

The gas fired water tube chemical boiler market is regarded as a specialized segment within industrial and process heating equipment. It is estimated to hold 5.4% of the industrial boiler market, driven by applications requiring high efficiency and rapid steam generation. Within chemical processing equipment, a 4.1% share is observed, reflecting use in chemical synthesis, distillation, and reaction control. The power generation equipment sector contributes 3.7%, supporting smaller captive and industrial power plants. Process heating systems account for 4.8% due to the demand for precise temperature control. In oil and gas equipment, a 2.9% share reflects use in upstream, midstream, and refinery operations requiring steam generation and heat integration. Recent industry trends highlight the adoption of low NOx and high efficiency designs, integration with digital control systems, and modular construction for reduced footprint. Groundbreaking developments include automated combustion management, advanced burner technologies, and hybrid fuel systems capable of utilizing biogas or hydrogen blends. Key players are focusing on predictive maintenance and IoT monitoring to improve reliability and reduce downtime. Strategic initiatives involve partnerships with chemical manufacturers for customized solutions, energy efficiency retrofits for existing plants, and compliance with increasingly strict environmental regulations. Regional growth is led by Asia Pacific, while Europe emphasizes emission reduction and energy optimized designs.

The gas fired water tube chemical boiler market is witnessing steady expansion, supported by the growing demand for high-efficiency steam and hot water generation solutions across chemical processing facilities. Current market conditions are shaped by increased emphasis on energy efficiency, operational safety, and compliance with stringent emission regulations, which are encouraging the adoption of advanced boiler designs.

Manufacturers are investing in technology upgrades, optimizing combustion systems, and integrating automation to improve fuel utilization and reduce lifecycle operating costs. Supply chains remain robust, aided by stable access to raw materials and well-established distribution networks.

The future outlook is positive, with anticipated growth driven by industrial capacity expansion, modernization of existing plants, and the transition toward cleaner fuel-based thermal systems. Strategic collaborations, after-sales service optimization, and digital monitoring solutions are expected to further enhance market competitiveness, ensuring sustained revenue growth across both developed and emerging industrial hubs.

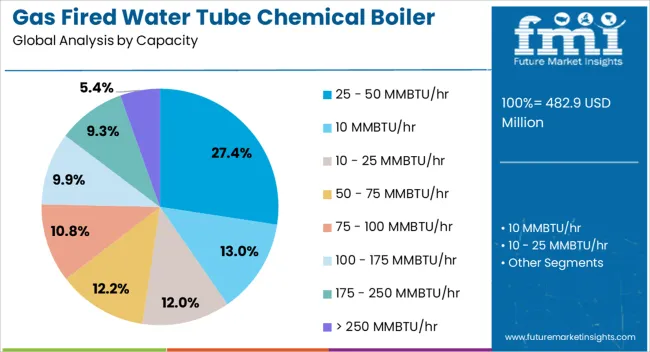

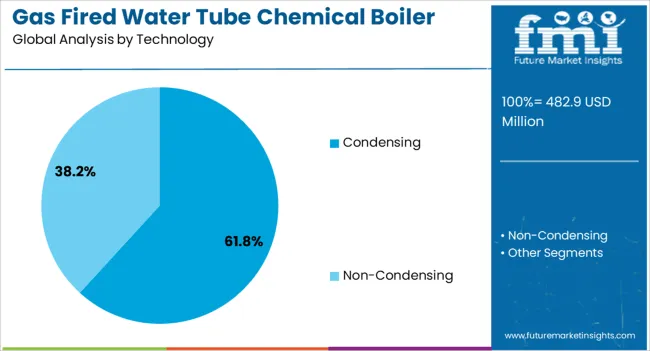

The gas fired water tube chemical boiler market is segmented by capacity, technology, and geographic regions. By capacity, gas fired water tube chemical boiler market is divided into 25 - 50 MMBTU/hr, 10 MMBTU/hr, 10 - 25 MMBTU/hr, 50 - 75 MMBTU/hr, 75 - 100 MMBTU/hr, 100 - 175 MMBTU/hr, 175 - 250 MMBTU/hr, and > 250 MMBTU/hr. In terms of technology, gas fired water tube chemical boiler market is classified into Condensing and Non-Condensing.

Regionally, the gas fired water tube chemical boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 25–50 MMBTU/hr capacity range, representing 27.40% of the capacity category, has maintained a leading position due to its optimal balance between thermal output and operational flexibility in chemical plant environments. This capacity range is well-suited for medium-to-large scale processing units, offering efficiency advantages without the excessive capital and maintenance costs associated with higher-capacity systems.

Adoption has been supported by its compatibility with diverse chemical manufacturing processes requiring consistent steam output, as well as its ability to meet varying load demands. The segment benefits from the reliable availability of standardized designs, ensuring ease of installation and shorter commissioning timelines.

Manufacturers have enhanced competitiveness by incorporating energy recovery solutions and improved burner technologies, further driving uptake. Regulatory alignment with emission norms and the ability to retrofit older installations have reinforced its demand, ensuring it remains a preferred choice for facilities seeking efficiency, compliance, and operational cost control.

The condensing technology segment, accounting for 61.80% of the technology category, dominates due to its superior thermal efficiency and reduced greenhouse gas emissions compared to conventional systems. Rising environmental compliance requirements and the need for cost-effective fuel utilization in energy-intensive chemical processing are reinforcing its market leadership.

Condensing boilers achieve efficiency gains by recovering latent heat from exhaust gases, translating into lower operating expenses and enhanced sustainability performance. Their adoption is being supported by the availability of advanced control systems that optimize performance under variable load conditions.

Manufacturers are focusing on material innovations to improve corrosion resistance, extend service life, and ensure consistent output in demanding industrial environments. This segment’s growth is further driven by industrial modernization programs, government incentives for energy-efficient equipment, and the increasing corporate focus on carbon footprint reduction, positioning it as the preferred technological choice in the gas-fired water tube chemical boiler market.

The market has been growing steadily due to increasing industrialization, energy efficiency demands, and stricter environmental regulations. These boilers are widely used in chemical processing, pharmaceuticals, textiles, and power generation for their ability to provide high-pressure, high-temperature steam efficiently. Gas-fired systems offer cleaner combustion compared to coal or oil, reducing particulate emissions and greenhouse gases. Market growth is influenced by rising demand for continuous, reliable steam production, coupled with technological advancements in automation, control systems, and modular designs.

The chemical, pharmaceutical, and textile industries are major consumers of gas fired water tube chemical boilers. High-pressure steam is essential for process heating, reaction control, sterilization, and drying applications. These sectors demand reliable and continuous boiler operation to maintain production efficiency and quality. In emerging economies, new manufacturing facilities are being commissioned to meet growing domestic and export demands, creating substantial boiler demand. Developed regions focus on retrofitting older systems with gas-fired alternatives to reduce emissions and operating costs. The integration of automated control systems ensures precise temperature and pressure management, further enhancing adoption in complex chemical processes and continuous production lines.

Energy efficiency and emission reduction regulations have been significant drivers in the market. Gas-fired boilers produce lower CO2 and particulate emissions compared to coal or oil-based systems, helping industries comply with strict environmental standards. Advanced combustion technologies, economizers, and flue gas recirculation are being incorporated to optimize fuel consumption and minimize waste. Regulatory frameworks in Europe, North America, and parts of Asia enforce stringent emission standards, encouraging industries to adopt gas-fired water tube systems over conventional boilers. Compliance with these regulations not only reduces environmental impact but also provides operational cost savings, creating incentives for widespread adoption.

Recent innovations in water tube boiler design have enhanced performance, reliability, and safety. Modern systems include modular construction for easier installation, digital monitoring for predictive maintenance, and advanced control systems for precise temperature and pressure regulation. High-quality materials and improved tube configurations enhance heat transfer efficiency, reduce scale formation, and extend equipment lifespan. Automation and remote monitoring allow operators to manage multiple units with minimal intervention, improving plant productivity. These technological improvements have made gas-fired water tube boilers competitive in both new installations and upgrades, ensuring consistent performance in industrial environments where reliability is critical.

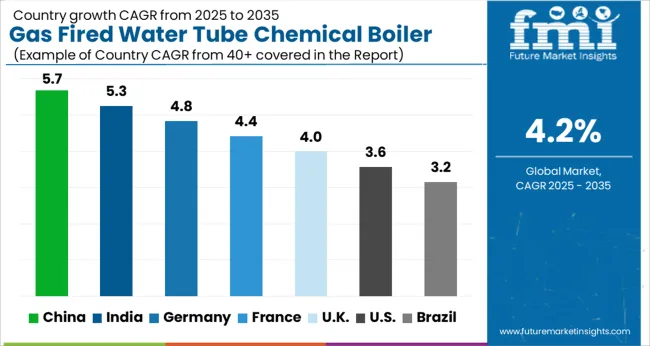

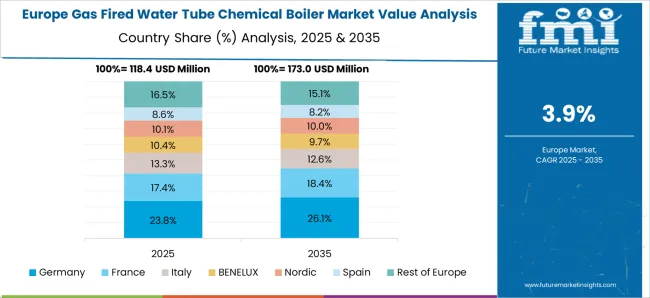

Regional differences in industrial development and natural gas availability influence the market. Asia Pacific, particularly China and India, has seen rapid industrial growth, driving demand for gas-fired water tube chemical boilers in manufacturing and energy-intensive industries.

Europe emphasizes emission reduction and energy efficiency, leading to the modernization of existing boiler infrastructure. North America continues to adopt advanced systems in both new and retrofitted plants. Regions with a reliable natural gas supply benefit from cost-effective fuel availability, encouraging industries to prefer gas-fired systems. These regional trends highlight the interplay of industrial growth, energy policy, and fuel infrastructure in shaping the global market trajectory.

| Country | CAGR |

|---|---|

| China | 5.7% |

| India | 5.3% |

| Germany | 4.8% |

| France | 4.4% |

| UK | 4.0% |

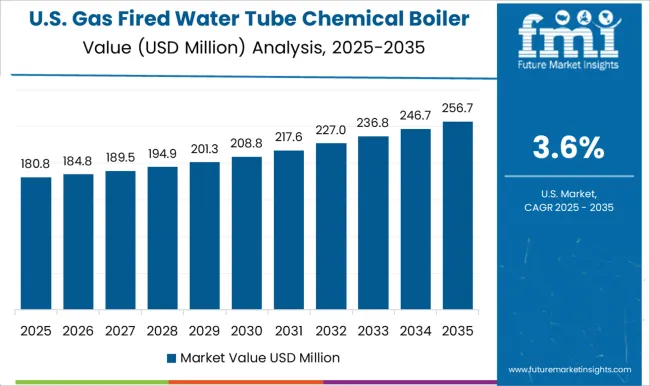

| USA | 3.6% |

| Brazil | 3.2% |

China leads the market with a forecast CAGR of 5.7%, supported by growing chemical processing industries and large-scale industrial boiler installations. India follows at 5.3%, driven by expanding industrial manufacturing and increasing adoption of energy-efficient boiler systems. Germany records 4.8%, where advanced engineering and stringent efficiency regulations contribute to steady market growth. The United Kingdom posts 4.0%, aided by modernization of chemical and pharmaceutical facilities. The United States registers 3.6%, influenced by ongoing replacement of conventional boilers with high-efficiency units in industrial applications. Together, these countries reflect a mix of production capacity, technology adoption, and innovation shaping the global trajectory of the market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to expand at a CAGR of 5.7% in the market, driven by industrial growth and rising chemical processing facilities. The demand is supported by increasing investments in energy-efficient and high-capacity boilers that enhance process efficiency and reduce operational costs. Industrial modernization programs and adoption of advanced water tube boiler technologies are encouraging manufacturers to integrate automation and safety features. Strong government initiatives promoting sustainable energy solutions and regulatory compliance for emissions control further stimulate market adoption. Large-scale chemical plants and expanding manufacturing sectors continue to contribute to the growing preference for reliable and high-performance gas fired water tube boilers in China.

Growth Analysis of Gas Fired Water Tube Chemical Boiler Market in India

India is expected to grow at a CAGR of 5.3% in the market due to increasing chemical production facilities and industrial modernization initiatives. Rising demand for energy-efficient boilers with enhanced safety and automation features encourages adoption among manufacturing units. Government incentives for cleaner and sustainable energy technologies further support the market. Industrial collaborations with technology providers ensure access to high-capacity boilers suitable for varied chemical processes. An increasing focus on cost-effective and reliable heating solutions in chemical, pharmaceutical, and industrial processing sectors across India also influences growth.

Germany is forecasted to expand at a CAGR of 4.8% in the market, propelled by industrial refurbishment and adoption of energy-saving technologies. Strict environmental regulations encourage the use of low-emission and highly efficient water tube boilers. Industrial plants prefer boilers with advanced automation, precise control, and safety systems to improve process reliability. Demand for modern boilers is also influenced by the chemical, pharmaceutical, and manufacturing industries’ need for consistent high-performance solutions. Investments in sustainable energy and low-carbon technologies continue to drive growth in the market across Germany.

The United Kingdom is projected to grow at a CAGR of 4.0% in the market, supported by ongoing industrial renovation projects and a focus on energy efficiency. Manufacturers increasingly prefer boilers that combine reliability with operational efficiency for chemical and process industries. Adoption of sustainable technologies, including low-emission and eco-friendly boilers, is rising due to stringent environmental policies. Supplier partnerships and technology upgrades ensure availability of high-performance boilers capable of meeting evolving industrial demands. The market growth is also influenced by increased awareness of safety standards and maintenance optimization across industrial facilities.

The United States is expected to expand at a CAGR of 3.6% in the market, fueled by chemical plant expansions and modernization of existing industrial infrastructure. The focus on energy-efficient and low-emission boilers supports market adoption. Demand is further driven by the need for high-capacity, automated, and reliable boilers capable of handling diverse industrial processes. Partnerships between manufacturers and technology providers facilitate the introduction of innovative solutions with enhanced safety, durability, and operational efficiency. Adoption is also supported by environmental regulations and rising awareness about sustainable energy solutions within the chemical and manufacturing sectors.

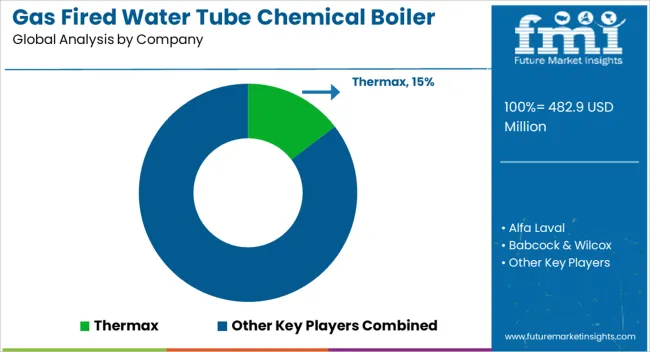

The market is characterized by providers offering highly efficient, reliable, and scalable solutions for industrial and chemical processing applications. Thermodyne Boilers and Thermax lead with technologically advanced designs that optimize heat transfer, fuel efficiency, and operational safety, supporting diverse industrial requirements. Alfa Laval and Babcock & Wilcox focus on modular, high-capacity boilers capable of continuous operation in chemical plants, emphasizing durability and precision engineering. Babcock Wanson, Bosch Industriekessel, and Clayton Industries provide boilers with robust construction and automation features, ensuring consistent performance and compliance with stringent environmental standards.

Cleaver-Brooks, Cochran, Forbes Marshall, and Hoval offer solutions tailored to medium- and large-scale chemical processing, integrating advanced monitoring and control systems for operational reliability. Hurst Boiler & Welding, Kawasaki Thermal Engineering, Miura America, and Rentech Boiler Systems specialize in customizable designs with flexible fuel management systems, supporting process optimization and energy savings. Superior Boiler, Thermodyne Boilers, Victory Energy Operations, and Viessmann deliver cost-efficient, high-performance units that address both conventional and complex industrial process requirements. These providers drive innovation in gas-fired water tube boiler technology, focusing on efficiency, durability, and operational excellence across chemical industry applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 482.9 Million |

| Capacity | 25 - 50 MMBTU/hr, 10 MMBTU/hr, 10 - 25 MMBTU/hr, 50 - 75 MMBTU/hr, 75 - 100 MMBTU/hr, 100 - 175 MMBTU/hr, 175 - 250 MMBTU/hr, and > 250 MMBTU/hr |

| Technology | Condensing and Non-Condensing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thermax, Alfa Laval, Babcock & Wilcox, Babcock Wanson, Bosch Industriekessel, Clayton Industries, Cleaver-Brooks, Cochran, Forbes Marshall, Hoval, Hurst Boiler & Welding, Kawasaki Thermal Engineering, Miura America, Rentech Boiler Systems, SUPERIOR BOILER, Thermodyne Boilers, Victory Energy Operations, and Viessmann |

| Additional Attributes | Dollar sales by boiler type and capacity, demand dynamics across chemical, pharmaceutical, and industrial sectors, regional trends in steam generation adoption, innovation in efficiency, automation, and fuel flexibility, environmental impact of emissions and resource consumption, and emerging use cases in process heating, energy recovery, and sustainable chemical production. |

The global gas fired water tube chemical boiler market is estimated to be valued at USD 482.9 million in 2025.

The market size for the gas fired water tube chemical boiler market is projected to reach USD 728.6 million by 2035.

The gas fired water tube chemical boiler market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in gas fired water tube chemical boiler market are 25 - 50 mmbtu/hr, 10 mmbtu/hr, 10 - 25 mmbtu/hr, 50 - 75 mmbtu/hr, 75 - 100 mmbtu/hr, 100 - 175 mmbtu/hr, 175 - 250 mmbtu/hr and > 250 mmbtu/hr.

In terms of technology, condensing segment to command 61.8% share in the gas fired water tube chemical boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Turbine Oil Market Size and Share Forecast Outlook 2025 to 2035

Gas Telecom Generator Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Gas Commercial Deep Fryers Market Size and Share Forecast Outlook 2025 to 2035

Gastroesophageal Reflux Disease (GERD) Device Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gas Station Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gaskets Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Gastrointestinal Stromal Tumor (GIST) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Gas Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA